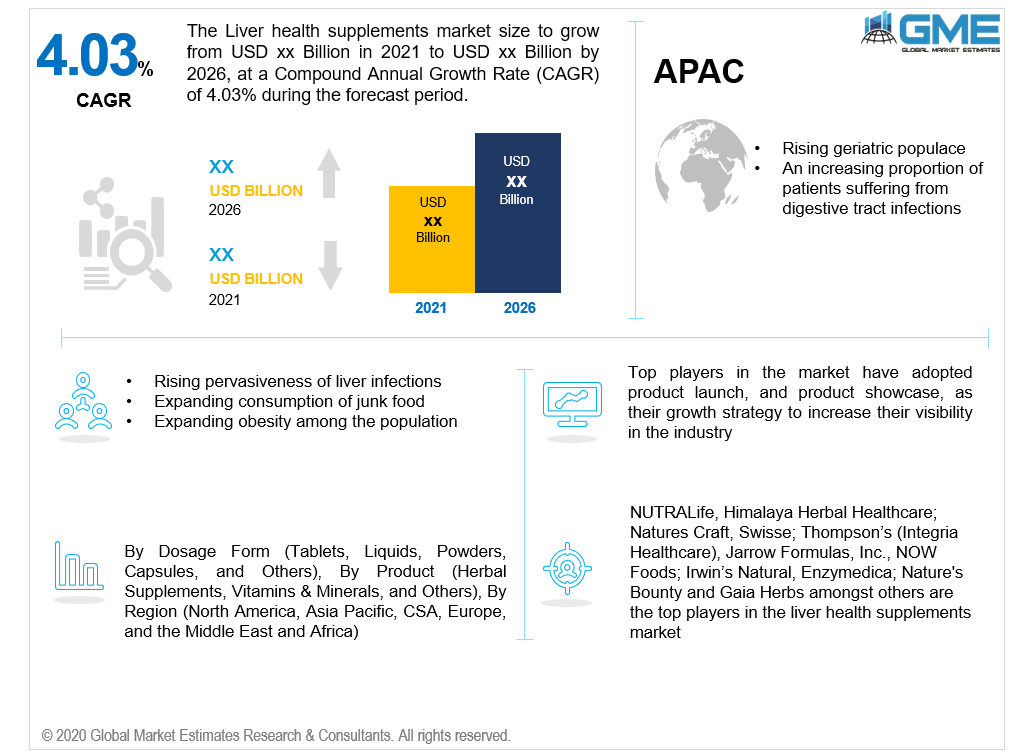

Global Liver Health Supplements Market Size, Trends & Analysis - Forecasts to 2026 By Dosage Form (Tablets, Liquids, Powders, Capsules, and Others), By Product (Herbal Supplements, Vitamins & Minerals, and Others), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

The liver is the largest internal organ in the body and its active functionality is to act as a collector of garbage. At the end of the day, it gathers all the poisons or toxins present and separates them to deliver them out of the body. The liver's wellbeing and smooth operation are important for a healthier body. Due to the diminished food quality, and expanded consumption of fast food & liquor, chronic liver diseases like liver cirrhosis, liver hepatitis, non-alcoholic fatty liver diseases, and so forth are becoming prevalent in the global population. Among all health supplements, liver health supplement consumption is witnessing a steady growth rate because it directs a coherent blood supply while supporting the smooth functioning of the circulatory system. Also, they could offer consumers more stamina, protect their liver cells from injury, boost their immune systems, and also their mood.

Nutritional liver health supplements help improve liver well-being and uplift its ability to complete different vital functions. Governments and private associations are highly focused on liver health advancement, which may expand the global demand for liver health supplements throughout the forecast period. The rising pervasiveness of liver infections globally and developing companies in this domain are boosting the demand for liver health supplements. Due to the uptick in the prevalence of liver-related diseases like liver cancer, liver cirrhosis, fatty liver disease, growing consumption of junk food, high liquor intake, and a surge in obese populaces, there is a skyrocketing demand for liver health supplements in the global markets. Moreover, rising mindfulness amongst the core demographics about the availability and benefits of different nutritional liver supplements is driving growth in the liver health supplements market.

Furthermore, legislative measures to encourage balanced nutrition and raise consciousness about the importance of healthy liver function are projected to drive the growth in the global liver health supplements market throughout the forecast period. The overall liver health supplements market is projected to expand due to a growing elderly populace, a rising proclivity to follow a sedentary lifestyle, and notable developments in liver wellbeing. Governments and private organizations are focusing heavily on liver health education, which may boost the potential of liver nutritional supplements in the national and international liver health supplements market throughout the forecast period.

The uptick in customer knowledge regarding the widespread and efficient supply of liver health supplement products and their complementary health benefits are acting as the key factors for the upsurge in the global demand for these products. Furthermore, the advent of new channels for accessing nutritional supplements such as web applications, online stores, and other e-commerce platforms, has contributed to a growth in the consumption of liver health supplements. Additionally, growing GDP-PPP in developing countries, namely, India and China, has resulted in increased customers' buying power within these nations. As a result of this, the middle-class populations of such countries have begun to accept high-quality wellness products, particularly health supplements. These are some of the prominent trends that will lead to skyrocketing sales of liver health supplements throughout the forecast period.

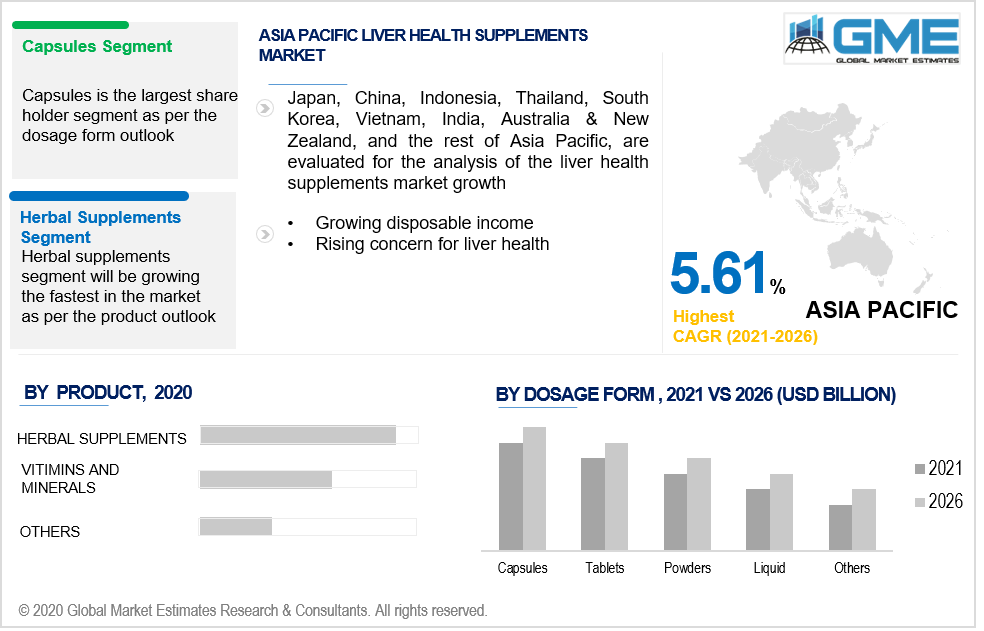

Based on the dosage form, the market can be segmented into tablets, liquids, powders, capsules, and others. The capsules segment is dominating in this segment. The capsule is a broadly acknowledged dosage form as it empowers the formulations and active ingredients to perfectly blend in a single dose form. Moreover, capsules give protection from sensitive health disorders related to the disturbance in the stomach lining and lessen gastrointestinally. Furthermore, developing mindfulness amongst consumers about the upside benefits like easy consumption procedure with the correct proportion of nutritional content in the capsule formulations is further increasing the demand for nutritional supplements in this form, thus, boosting the overall development of this segment.

Liver health supplements are classified into four product forms, namely, herbal supplements, vitamins & minerals, and others. The herbal supplements segment predominates in this segment. Herbal formulations-based supplements are broadly embraced by shoppers as this has ended up being advantageous for the proper functioning of the liver. Also, expanding mindfulness amongst the core demographics of developed and developing nations, namely, the U.S and India about the various advantages of natural ingredients in nutritional supplements is boosting the demand in this segment. Furthermore, different herbal formulations-based supplements are likewise expected to keep acquiring momentum in terms of the demand amongst the global consumers of natural nutritional supplements.

As per the geographical analysis, the market of Liver Health Supplements can be classified into North America (the US, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa and Central & South America. Europe is presumed to predominate in the global market for liver health supplements. This growth is attributable to the rising occurrence of persistent liver diseases and the surge in the consumption of fast food & liquor. Additionally, the development of the market in the European region is further fuelled by the expansion in governmental healthcare expenses and growing mindfulness amongst the core demographics about the nutritional benefits of liver health supplements. North America is presumed to hold the second position in the market because of the ascent in the prevalence of chronic diseases, growing public comprehension of health items containing significant nutritional content In conjunction, the region's increasing interest in customized high nutrition level products is also a contributing factor. Asia-Pacific has the highest market growth potential because of the rising geriatric populace, the growing inclination of core demographics towards healthy food & nutritional supplements, and expansion in disposable income. In addition, the severity of digestive tract infections is an increasing concern for liver health, and the availability of such nutritional supplements is additionally driving the development in the APAC market.

NUTRALife, Himalaya Herbal Healthcare; Natures Craft, Swisse; Thompson’s (Integria Healthcare), Jarrow Formulas, Inc., NOW Foods; Irwin’s Natural, Enzymedica; Nature's Bounty and Gaia Herbs among others are the top players in the liver health supplements market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Liver Health Supplements Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Dosage Form Overview

2.1.3 Product Overview

2.1.5 Regional Overview

Chapter 3 Liver Health Supplements Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Technology Advancement in Healthcare Industry

3.3.1.2 Increasing Expenditure in Healthcare Sector by government

3.3.2 Industry Challenges

3.3.2.1 Limited Study and Industry Participants

3.4 Prospective Growth Scenario

3.4.1 Dosage Form Growth Scenario

3.4.2 Product Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Liver Health Supplements Market, By Dosage Form

4.1 Dosage Form Outlook

4.2 Tablets

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Liquids

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

4.4 Powders

4.4.1 Market Size, By Region, 2019-2026 (USD Million)

4.5 Capsules

4.5.1 Market Size, By Region, 2019-2026 (USD Million)

4.6 Others

4.6.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Liver Health Supplements Market, By Product

5.1 Product Outlook

5.2 Herbal Supplements

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 Vitamins & Minerals

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

5.4 Others

5.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Liver Health Supplements Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2019-2026 (USD Million)

6.2.2 Market Size, By Dosage Form, 2019-2026 (USD Million)

6.2.3 Market Size, By Product, 2019-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Dosage Form, 2019-2026 (USD Million)

6.2.4.2 Market Size, By Product, 2019-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Dosage Form, 2019-2026 (USD Million)

6.2.5.2 Market Size, By Product, 2019-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2019-2026 (USD Million)

6.3.2 Market Size, By Dosage Form, 2019-2026 (USD Million)

6.3.3 Market Size, By Product, 2019-2026 (USD Million)

6.3.4 Germany

6.3.4.1 Market Size, By Dosage Form, 2019-2026 (USD Million)

6.3.4.2 Market Size, By Product, 2019-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Dosage Form, 2019-2026 (USD Million)

6.3.5.2 Market Size, By Product, 2019-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Dosage Form, 2019-2026 (USD Million)

6.3.6.2 Market Size, By Product, 2019-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Dosage Form, 2019-2026 (USD Million)

6.3.7.2 Market Size, By Product, 2019-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Dosage Form, 2019-2026 (USD Million)

6.3.8.2 Market Size, By Product, 2019-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Dosage Form, 2019-2026 (USD Million)

6.3.9.2 Market Size, By Product, 2019-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2019-2026 (USD Million)

6.4.2 Market Size, By Dosage Form, 2019-2026 (USD Million)

6.4.3 Market Size, By Product, 2019-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Dosage Form, 2019-2026 (USD Million)

6.4.4.2 Market Size, By Product, 2019-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Dosage Form, 2019-2026 (USD Million)

6.4.5.2 Market Size, By Product, 2019-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Dosage Form, 2019-2026 (USD Million)

6.4.6.2 Market Size, By Product, 2019-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Dosage Form, 2019-2026 (USD Million)

6.4.7.2 Market size, By Product, 2019-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Dosage Form, 2019-2026 (USD Million)

6.4.8.2 Market Size, By Product, 2019-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2019-2026 (USD Million)

6.5.2 Market Size, By Dosage Form, 2019-2026 (USD Million)

6.5.3 Market Size, By Product, 2019-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Dosage Form, 2019-2026 (USD Million)

6.5.4.2 Market Size, By Product, 2019-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Dosage Form, 2019-2026 (USD Million)

6.5.5.2 Market Size, By Product, 2019-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Dosage Form, 2019-2026 (USD Million)

6.5.6.2 Market Size, By Product, 2019-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2019-2026 (USD Million)

6.6.2 Market Size, By Dosage Form, 2019-2026 (USD Million)

6.6.3 Market Size, By Product, 2019-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Dosage Form, 2019-2026 (USD Million)

6.6.4.2 Market Size, By Product, 2019-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Dosage Form, 2019-2026 (USD Million)

6.6.5.2 Market Size, By Product, 2019-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Dosage Form, 2019-2026 (USD Million)

6.6.6.2 Market Size, By Product, 2019-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 NUTRALife

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Himalaya Herbal Healthcare

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 Natures Craft

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Swisse

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Thompson’s (Integria Healthcare)

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Jarrow Formulas, Inc.

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 NOW Foods

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Irwin’s Natural

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Enzymedica

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

7.11 Nature's Bounty

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info Graphic Analysis

7.12 Gaia Herbs

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 Info Graphic Analysis

7.13 Other Companies

7.13.1 Company Overview

7.13.2 Financial Analysis

7.13.3 Strategic Positioning

7.13.4 Info Graphic Analysis

The Global Liver Health Supplements Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Liver Health Supplements Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS