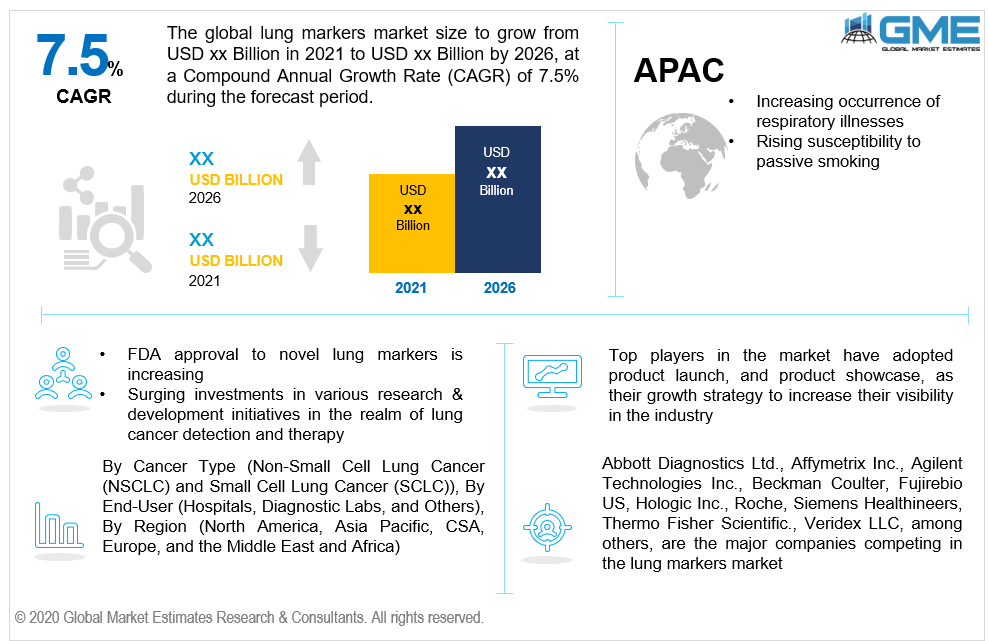

Global Lung Markers Market Size, Trends, and Analysis - Forecasts To 2026 By Cancer Type (Non-Small Cell Lung Cancer (NSCLC) and Small Cell Lung Cancer (SCLC)), By End-User (Hospitals, Diagnostic Labs, and Others), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

The escalating need for lung markers can be ascribed to the increased occurrence of respiratory illnesses, including pleural effusion, pleural mesothelioma, pleural plaque, and many more, as a result of global pollutant concentrations. Furthermore, increased susceptibility to passive smoking, as well as a family medical history of lung cancer, the volume of individuals afflicted with lung cancer, hence increasing the need for lung indicators. Likewise, the growing veteran demographic, along with stressful consumer lives that contribute to a high smoking prevalence, increases the chances of numerous respiratory ailments. Aside from that, mounting medical spending by government bodies for timely identification and pre-treatment of life-threatening illnesses, including lung cancer, is accelerating the global use of lung markers. Similarly, increased investments in various research & development initiatives in the realm of lung cancer detection and therapy are accelerating demand for lung markers. In addition, the growing use of lung markers in hospitals, surgical centers, and clinics, as well as their many therapeutic uses, has fueled product demand. Novel innovations are the prime growth catalyst. For instance, In April 2021, Wake Forest Baptist Health researchers have uncovered a collection of new genetic markers that might lead to new customized therapies for lung cancer. Their paper was titled "Recruitment of KMT2C/MLL3 to DNA damage sites causes DNA damage responses and modulates PARP inhibitor sensitivity in cancer."

Public and private groups are working together to raise awareness of lung cancer. In addition, the rising occurrence of lung cancer is fueling the growth of the lung cancer diagnostic market. As per the American Cancer Society, there have been around 235,760 new cases of lung cancer reported. Among individuals, 84% have non-small cell lung cancer and 13% have small cell lung cancer. The mortality toll among lung cancer patients is steadily growing due to the startling increase in incidence. The inability to conduct adequate screening on time is causing problems all around the world. Medical professionals recognize this load and are striving for the discovery of enhanced bio-markers for comprehensive, precise, and fast detection, resulting in the expansion of the lung cancer diagnostic market.

Lung markers are chemicals generated by tumor cells that are employed to localize tumor cells in the lung. These are created in the body in reaction to cancer and may be identified in patients' urine, blood, and feces. They are utilized to provide data on the kind and stage of cancer during lung intervention operations. They also help in the diagnosis, prediction, and tracking of tumors in order to determine the sort of therapy necessary to address the ailment. Aside from that, they are employed in a variety of hospitals and other healthcare institutions to identify and manage pleural effusion and mesothelioma. Several projects and programs have been undertaken by governmental and commercial organizations to enhance screening rates of people at elevated risk of diverse forms of lung cancer. These activities also assist in raising awareness regarding lung cancer detection, hence offering market development prospects.

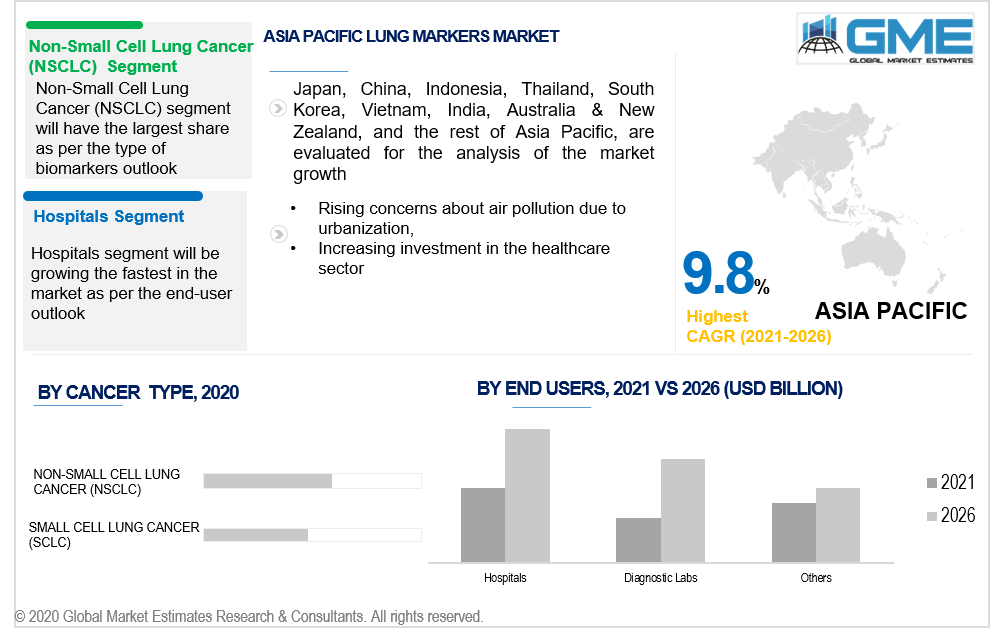

According to the cancer type segment, the two categories include non-small cell lung cancer (NSCLC) and small cell lung cancer (SCLC). The category of non-small cell lung cancer is the largest shareholder over the forecast period. Non-small cell lung cancer is a group of lung cancers that behaves similarly and its major symptoms are coughing, shortage of breath, and weight loss. It has acquired the largest share of the market due to factors like a wide range of applications in the pharmaceutical and biopharmaceutical industries, the rising number of passive smokers, the soaring volume of people being infected by lung cancer, an increasing proportion of healthcare institutions providing cancer treatment, rising incidences of chronic diseases, the availability of a diversity of applications, rising venture funding, the hectic schedule of people, rapid urbanization, a drastically challenging lifestyle, and burgeoning health concerns.

According to the end-user analysis, the three segments are hospitals, diagnostic labs, and others. The hospital segment is predicted to acquire the largest share in the market in terms of revenue growth due to the rising investments in healthcare infrastructure, quality care treatment, developed medical sector, the soaring volume of multi-specialty hospitals, initiatives for education & social support for people undergoing cancer treatment, availability of personalized care by experts, the introduction of user-friendly products, advancements in diagnostics technology, increasing healthcare expenditure in addition to being highly preferred by people due to inclusion of non-invasive techniques.

As per the geographical analysis, the market of depth filtration can be classified into North America (the US, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa and Central South America. The market for North America will be dominant due to the active participation of a large number of core market players and industries, robust healthcare infrastructure, well-established medical facilities, increasing investments to set up diagnostics centers, rising number of passive smokers, quick adoption of latest technologies and devices, well-developed healthcare sector, presence of adequate reimbursement policies, growing concerns about health and fitness, favorable government initiatives, advancement in medical technology, presence of skilled professionals, higher adoption amongst core demographics, the comprehensive focus on research for launching advanced lung markers.

The Asia Pacific region will grow the fastest due to the rising geriatric population, increasing research and development of respiratory disorders, improvements in healthcare facilities, rising concerns about air pollution due to urbanization, increasing investment in the healthcare sector, rising disposable income, increasing awareness, and the adoption of advanced cancer diagnosis technology.

Abbott Diagnostics Ltd., Affymetrix Inc., Agilent Technologies Inc., Beckman Coulter, Fujirebio US, Hologic Inc., Roche, Siemens Healthineers, Thermo Fisher Scientific., Veridex LLC, among others, are the major companies competing in the lung markers market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Lung Markers Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Cancer Type Overview

2.1.3 End-User Overview

2.1.4 Regional Overview

Chapter 3 Global Lung Markers Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Technology Advancement in Healthcare Industry

3.3.1.2 High Prevalence of Respiratory Disorders

3.3.2 Industry Challenges

3.3.2.1 Limited Study and Industry Participants

3.4 Prospective Growth Scenario

3.4.1 Cancer Type Growth Scenario

3.4.2 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Lung Markers Market, By Cancer Type

4.1 Cancer Type Outlook

4.2 Non-Small Cell Lung Cancer (NSCLC)

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Small Cell Lung Cancer (SCLC)

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Global Lung Markers Market, By End-User

5.1 End-User Outlook

5.2 Hospitals

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 Diagnostic Labs

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

5.4 Others

5.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Global Lung Markers Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2019-2026 (USD Million)

6.2.2 Market Size, By Cancer Type, 2019-2026 (USD Million)

6.2.3 Market Size, By End-User, 2019-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Cancer Type, 2019-2026 (USD Million)

6.2.4.2 Market Size, By End-User, 2019-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Cancer Type, 2019-2026 (USD Million)

6.2.5.2 Market Size, By End-User, 2019-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2019-2026 (USD Million)

6.3.2 Market Size, By Cancer Type, 2019-2026 (USD Million)

6.3.3 Market Size, By End-User, 2019-2026 (USD Million)

6.3.4 Germany

6.2.4.1 Market Size, By Cancer Type, 2019-2026 (USD Million)

6.2.4.2 Market Size, By End-User, 2019-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Cancer Type, 2019-2026 (USD Million)

6.3.5.2 Market Size, By End-User, 2019-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Cancer Type, 2019-2026 (USD Million)

6.3.6.2 Market Size, By End-User, 2019-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Cancer Type, 2019-2026 (USD Million)

6.3.7.2 Market Size, By End-User, 2019-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Cancer Type, 2019-2026 (USD Million)

6.3.8.2 Market Size, By End-User, 2019-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Cancer Type, 2019-2026 (USD Million)

6.3.9.2 Market Size, By End-User, 2019-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2019-2026 (USD Million)

6.4.2 Market Size, By Cancer Type, 2019-2026 (USD Million)

6.4.3 Market Size, By End-User, 2019-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Cancer Type, 2019-2026 (USD Million)

6.4.4.2 Market Size, By End-User, 2019-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Cancer Type, 2019-2026 (USD Million)

6.4.5.2 Market Size, By End-User, 2019-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Cancer Type, 2019-2026 (USD Million)

6.4.6.2 Market Size, By End-User, 2019-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Cancer Type, 2019-2026 (USD Million)

6.4.7.2 Market size, By End-User, 2019-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Cancer Type, 2019-2026 (USD Million)

6.4.8.2 Market Size, By End-User, 2019-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2019-2026 (USD Million)

6.5.2 Market Size, By Cancer Type, 2019-2026 (USD Million)

6.5.3 Market Size, By End-User, 2019-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Cancer Type, 2019-2026 (USD Million)

6.5.4.2 Market Size, By End-User, 2019-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Cancer Type, 2019-2026 (USD Million)

6.5.5.2 Market Size, By End-User, 2019-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Cancer Type, 2019-2026 (USD Million)

6.5.6.2 Market Size, By End-User, 2019-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2019-2026 (USD Million)

6.6.2 Market Size, By Cancer Type, 2019-2026 (USD Million)

6.6.3 Market Size, By End-User, 2019-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Cancer Type, 2019-2026 (USD Million)

6.6.4.2 Market Size, By End-User, 2019-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Cancer Type, 2019-2026 (USD Million)

6.6.5.2 Market Size, By End-User, 2019-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Cancer Type, 2019-2026 (USD Million)

6.6.6.2 Market Size, By End-User, 2019-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Abbott Diagnostics Ltd.

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Affymetrix Inc.

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 Agilent Technologies Inc.

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Beckman Coulter

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Fujirebio US

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Hologic Inc.

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Roche

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Siemens Healthineers

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Thermo Fisher Scientific

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

7.11 Veridex LLC

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info Graphic Analysis

7.12 Other Companies

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 Info Graphic Analysis

The Global Lung Markers Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Lung Markers Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS