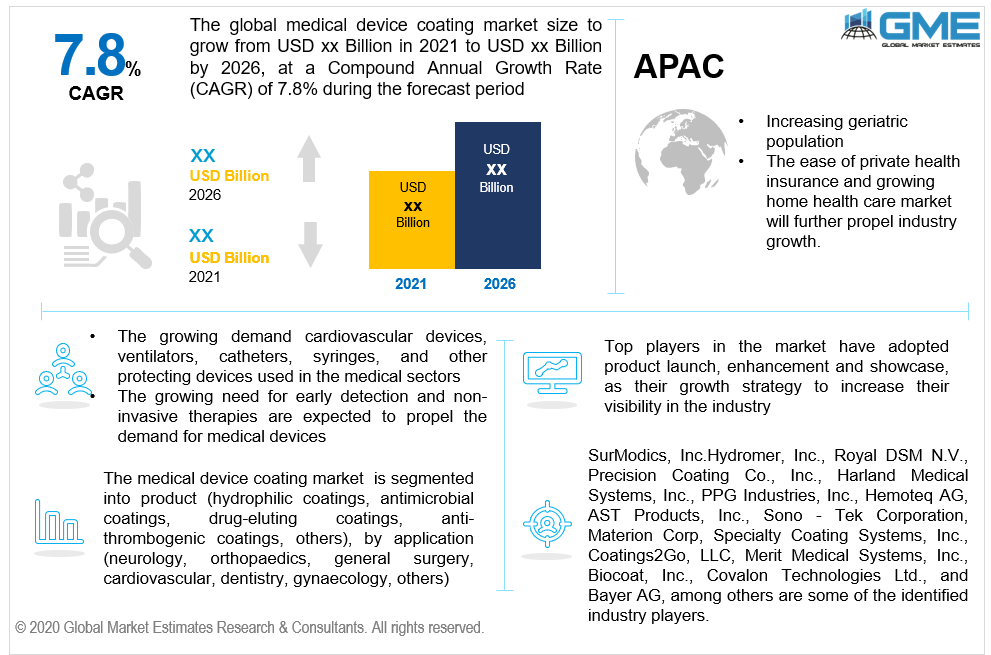

Global Medical Device Coating Market Size, Trends & Analysis - Forecast to 2026 By Product (Hydrophilic Coatings, Antimicrobial Coatings, Drug-eluting Coatings, Anti-thrombogenic Coatings, Others), By Application (Neurology, Orthopaedics, General Surgery, Cardiovascular, Dentistry, Gynaecology, Others), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa); End-User Landscape, Company Market Share Analysis, and Competitor Analysis

Medical device coatings are components that improve the performance and maneuver ability of medical devices. Their usage results in decreased trauma and thrombogenicity to blood vessels. Medical device coatings (MDCs) are used to cover the surfaces of a variety of medical devices, including neurovascular, gynecology, and cardiovascular applications, among others.

The global populations increased disposable income, increased demand for implantable products, tendency & innovation for minimally invasive procedures, and increased understanding of hospital-acquired infections (HAI)are driving the market growth. The untapped potential of emerging markets such as China and India, as well as the expansion of the multifunctional coatings industry, is expected to offer numerical opportunities.Strict regulatory policies concerning medical device coatings (MDCs) and time-consuming regulative approvals are anticipated to hinder the market growth.

The innovation in the design of medical instruments such as guide wires, catheters, and stents has greatly increased the quality of medical treatment.Nevertheless, these devices are made up of substances that can cause unwanted complications such as blood clots, bacterial infection, and tissue trauma when coming in contact with the external atmosphere. To address such flaws, medical equipment coatings are used. Medical device coatings (MDCs) technology utilizes a UV curing or organic solvent to coat the medical device. As a coating technology, water-based or dry formulations are used, allowing for solvent-free handling.

Medical device coatings (MDCs) help reduce the friction between tissues and medical devices, provide wear-resistance, wetting, surface coverage, uniform adhesion, and coating homogeneity. The dry lubricant coating has the highest market share for medical device coatings (MDCs). The super-hydrophilic layer will anticipate the highest growth in the forecast period owing to its growing demand for medical devices that need excellent optical clarity and water attraction.

The rising awareness regarding minimally invasive surgeries among patients runs the global medical device coatings (MDCs) market. Furthermore, the global market is expected to be driven to some extent by the medical industries' growth prospects in developing economies.The increasing concern of people towards health & well-being is further likely to boost the demand for more skilled medical facilities in the coming years. Nevertheless, the changing government laws for medical devices across various countries may hinder the growth of the medical device coatings (MDCs) market to some extent.

The global medical device coatings market is divided due to the participation of small and large-scale suppliers.Medical device coatings (MDCs) manufacturers strive to strengthen market positions by broadening their customer base. Moreover, these manufacturers concentrate on new product launches, mergers &acquisitions, distribution, contract manufacturing, technology licensing, and partnerships to measure existing and future demand trends from multiple application sectors. Major players focus on the research & development (R&D) of numerous coating technologies and new nanotechnology-based coatings, such as UV radiation cured and waterborne, due to various volatile organic compounds (VOC) emissions laws.

Based on the product, the market is segmented intofive segments: hydrophilic coatings, antimicrobial coatings, drug-eluting coatings, and anti-thrombogenic coatings, amongothers.Based on revenue, the antimicrobial coatings segment will dominate the market during the forecast period. This can be attributed to their high compatibility and low cost with different device materials, including plastic, metal, composite materials, carbon fiber, and stainless steel. Moreover, the increasing research & development (R&D) activities, and the growing usage of implantable devices, will thrust the segment growth.

The hydrophilic coatings are anticipated to develop at the fastest CAGR based on revenue during the forecast period due to extensive medical device usage, including high lubrication and cardiac pacemakers. Furthermore, the benefits, including optical precision and the capacity to withstand maintenance methods, such as sterilization, storage, and cleaning, will accelerate the product demand.

Based on the application, the market is segregated into seven segments namely;neurology, orthopedics, general surgery, cardiovascular, dentistry, gynecology, and others.

The cardiovascular application segment will hold the largest revenue share during the forecast period due to the increasing preference for cardiac pacemakers and implants. Moreover, the rising demand for drug-eluting coatings on coronary stents would drive segment expansion.With the rising usage of these medical devices in light of the ever-increasing unhealthy dietary practices, the geriatric population and an inactive lifestyle will increase the prevalence of cardiovascular diseases. Furthermore, beneficial government schemes, including increasing healthcare expenditure and reimbursement coverage, will increase the cardiovascular segment's growth over the forecast period.

North America has the largest market share for medical device coatings (MDCs) technology, trailed by Europe and the Asia Pacific.The U.S. is likely to sustain its dominance in the global medical device coatings (MDCs) market. This is due to increased healthcare availability and the rising prevalence of cardiometabolic conditions such as Deep Vein Thrombosis (DVT) and Pulmonary Embolism (PE). Furthermore, the increasing COVID- 19 positive cases, widespread acceptance of high-level surgical therapies, and thriving healthcare system in the United States are expected to drive demand for medical device coatings in the coming years.

The Asia Pacific is anticipated to witness the highest CAGR in the forecast period. China and India's developing markets are likely to boost the Asian medical device coatings (MDCs) demand. The stronger growth opportunities of the medical care sector have influenced many foreign companies to spend further in Asia Pacific's developing market. The increased demand for more professional healthcare services, high obesity rates, a growing number of hospitals, and an aging population are all projected to increase the prevalence of cardiac diseases.The efficiency of private health insurance and the expanding home health care market will further accelerate industry growth.

SurModics, Inc., Hydromer, Inc., Royal DSM N.V., Precision Coating Co., Inc., Harland Medical Systems, Inc., PPG Industries, Inc., Hemoteq AG, AST Products, Inc., Sono - Tek Corporation, Materion Corp, Specialty Coating Systems, Inc., Coatings2Go, LLC, Merit Medical Systems, Inc.,Biocoat, Inc., Covalon Technologies Ltd., and Bayer AG, among other sare some of the identified industry players.

Please note: This is not an exhaustive list of companies profiled in the report.

In April 2020, Hydromer collaborated with N8 Medical to provide coatings for CeraShield endotracheal tubing. These tubes are essential in the treatment of COVID-19 patients

In February 2020, Biocat introduced its new product HYDAK UV. UV light is used to cure the current version of the previous HYDAK coating. This coating enables adaptability for industry-standard UV coating systems.

We value your investment and offer free customization with every report to fulfil your exact research needs.

The Global Medical Device Coating Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Medical Device Coating Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS