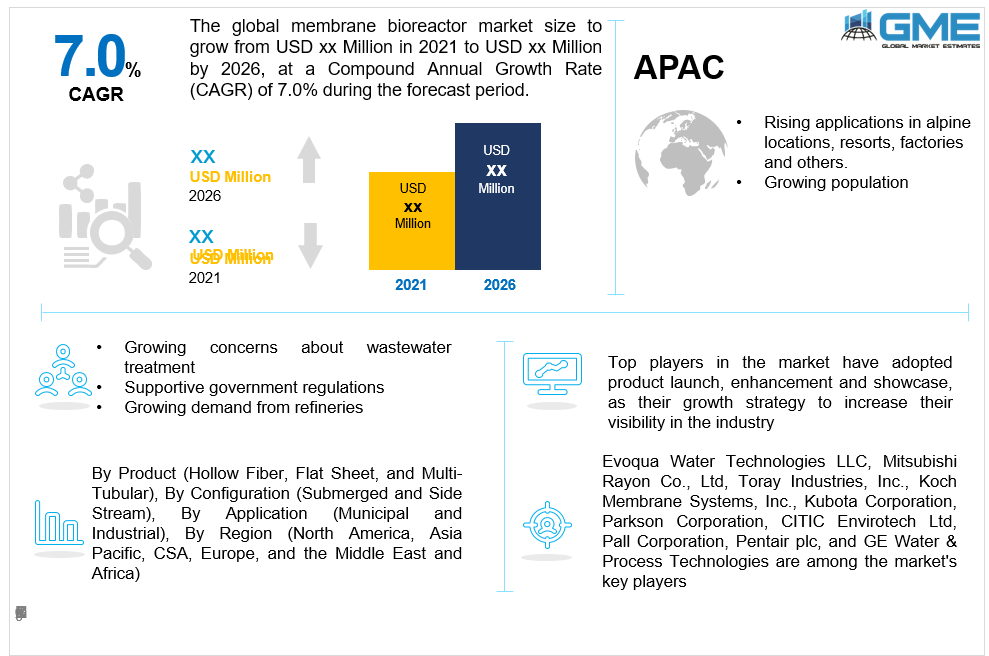

Global Membrane Bioreactor Market Size, Trends, and Analysis - Forecasts To 2026 By Product (Hollow Fibre, Flat Sheet, and Multi-Tubular), By Configuration (Submerged and Side Stream), By Application (Municipal and Industrial), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

The expanding need for water treatment technologies around the world is driving the market. This can be linked to diminishing freshwater supplies and a continually rising demand from the domestic segment for chemical-free and clean water supply. Additionally, growing sustainability considerations about effective sewage and drainage systems are boosting market expansion. The amount of wastewater produced in residential, commercial, and industrial establishments has increased significantly, and it is now processed by Membrane Bioreactor (MBR). Aside from that, the growing use of environmentally friendly water and wastewater administration solutions amongst sectors is fuelling market expansion. Other reasons, such as rising industrialization and favourable government regulations for renovating existing wastewater treatment facilities with MBRs, are expected to boost the market even further.

Rapid urbanization and infrastructural improvement in emerging economies, increased need for cost-effective and long-lasting goods, severe environmental laws, and supportive regulatory programs and regulations are some of the drivers that will likely boost the expansion of the MBR systems market throughout the forecast period. Expanding demands for the high standard and effluent products will create additional chances for the expansion of the MBR systems market throughout the forecast period. Because of growing concerns about wastewater treatment, the demand for MBR is anticipated to expand significantly. Globally, the MBR market is projected to be driven by several factors, including water scarcity and increasing environmental concerns about industrial sludge disposal over the forthcoming years.

Increased deployment of environmentally sustainable water management technologies in the industrial and sewage sectors would drive market development. Growing industrial waste from the oil & gas, pulp & paper, textile, food & beverage, pharmaceutical, and construction industries is estimated to accelerate business demand. The pharmaceutical sector's strong industrial base in the United States, which includes companies like Johnson & Johnson, Merck & Co., and Pfizer, is anticipated to enhance the medical sector, which will, in turn, accelerate market growth. One of the key drivers for the water treatment industry has been high demand from refineries, which is projected to generate tremendous business opportunities for the membrane bioreactor (MBR) systems market. The increasing requirement for significant capital expenditure, as well as escalating operational costs, are limiting the market growth of membrane bioreactor (MBR) systems. Furthermore, the increased incidence of fouling in membrane bioreactors is expected to limit market growth. Technological advances that improve productivity, minimize sludge formation, and limit footprint would open up a huge market.

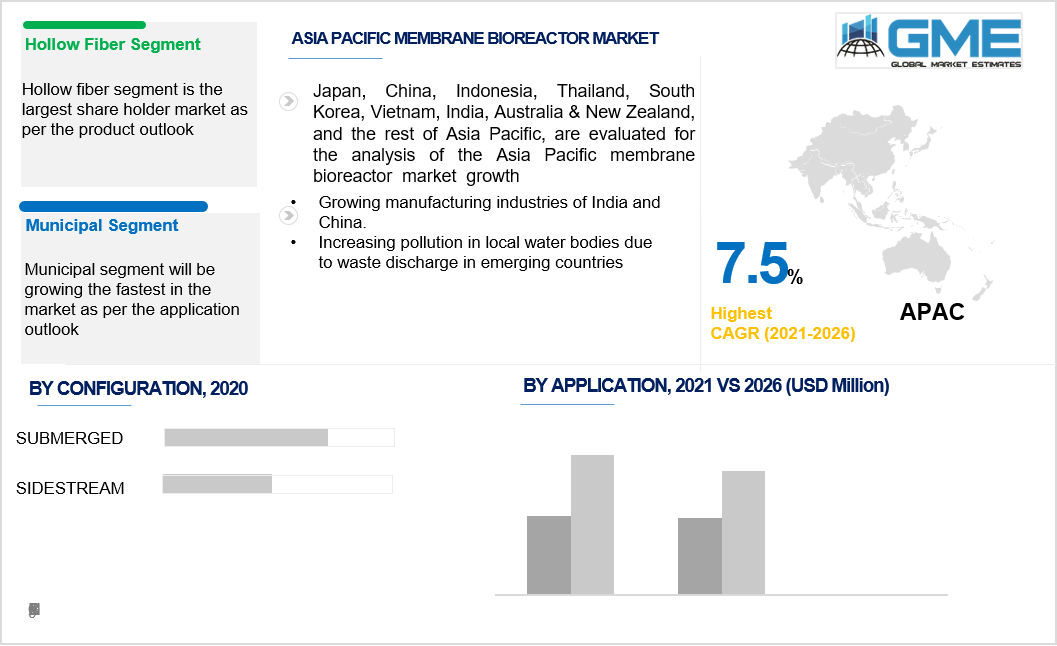

Depending on the product the market is categorized as hollow fiber, flat sheet, and multi-tubular. Hollow fiber is predicted to lead in this market. In comparison to a multi-tubular and flat sheet, the product is projected to see substantial growth due to its lower maintenance and operating costs. The escalating use of hollow fiber membranes in municipal applications due to their high output per unit volume and packing density will drive demand throughout the forecast period. Furthermore, the growing population and urbanization in Turkey, Bangladesh, Mexico, China, India, and Thailand are projected to rise municipal applications, resulting in increased demand.

Depending on the configuration the market is categorized as a submerged and side stream. The submerged segment held the major portion of the market. This segment is being driven by lower energy requirements and improved biodegradation performance of submerged membrane bioreactors. The market for membrane bioreactors for treating industrial wastewater is growing as involvement in submerged anaerobic membrane bioreactors increases among different sectors, including food and beverage, textiles, pulp and paper, mining, oil, and gas, and power generation. Innovative submerged membranes have been developed as a result of increased research and development efforts and favorable government policies for wastewater treatment development.

Depending on the application the market is categorized as municipal and industrial. The membrane bioreactor market is foreseen to be regulated by the municipal wastewater treatment segment. Municipalities are gradually turning to membrane bioreactors to meet the strict requirements set by regulatory authorities on wastewater discharge. The use of membrane bioreactors by municipal authorities in advanced economies is being driven by population growth and dwindling freshwater supplies. Furthermore, since the overall flow of sewage in municipal wastewater treatment plants is greater than that of commercial sewage, membrane bioreactors are being used more often. Municipalities are increasingly utilizing membrane bioreactors to extract dissolved solids, micropollutants, pathogenic bacteria, and organic matter from municipal wastewaters. The market for membrane bioreactors has grown as the expense of traditional water treatment processes has increased, as they are considered commercially feasible for municipal wastewater treatment.

North America is foreseen to predominate in the market, due to the existence of automobile manufacturing facilities, food and beverage, pharmaceutical, and chemical in the Mexico and United States which is likely to boost demand for water treatment facilities. Furthermore, in 2012, the Mexican government approved a new Public-Private Partnership (PPP) bill with the consent of the Mexican Congress, which aims to promote domestic investments in the form of upgrading and new construction of water purification plants and desalination facilities. The MBR sector is projected to benefit from this initiative for encouraging investments in the water treatment sector.

Asia Pacific is foreseen to dominate this market in terms of CAGR. The market for membrane bioreactors in the Asia Pacific region has been led by the fast growth of the manufacturing sector and the region's growing population. Furthermore, the region's acceptance of membrane bioreactors is boosted by diminishing freshwater supplies and growing pollution of local water bodies due to waste discharge in emerging countries.

Evoqua Water Technologies LLC, Mitsubishi Rayon Co., Ltd, Toray Industries, Inc., Koch Membrane Systems, Inc., Kubota Corporation, Parkson Corporation, CITIC Envirotech Ltd, Pall Corporation, Pentair plc, and GE Water & Process Technologies are among the market's key players.

Please note: This is not an exhaustive list of companies profiled in the report.

Toray Industries, China Water Affairs Group (China), and ORIX Corporation (Japan) formed a strategic alliance in June 2018 to collaborate on water treatment and aquatic environment programs in the region. China Water Affairs Group will be able to use Toray Industries' superior membrane filtration techniques, such as UF, NF, MF, RO, and MBR solutions, as a result of this collaboration. By analyzing the content of projects allowed by this collaboration, this agreement will assist each organization in maximizing its capital.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Membrane Bioreactor Industry Overview, 2016-2026

2.1.1 Industry Overview

2.1.2 Product Overview

2.1.3 Configuration Overview

2.1.4 Application Overview

2.1.5 Regional Overview

Chapter 3 Global Membrane Bioreactor Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rapid Urbanization and Development of the Infrastructure in Developing Economies

3.3.1.2 Favourable Initiatives and Policies of the Government

3.3.1.3 Rising Preferences Towards High Quality and Effluent Product

3.3.2 Industry Challenges

3.3.2.1 Increasing Need of High Capital Investment Along with Rising Operational Cost

3.4 Prospective Growth Scenario

3.4.1 Product Growth Scenario

3.4.2 Configuration Growth Scenario

3.4.3 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Membrane Bioreactor Market, By Product

4.1 Product Outlook

4.2 Hollow Fibre

4.2.1 Market Size, By Region, 2016-2026 (USD Million)

4.3 Flat Sheet

4.3.1 Market Size, By Region, 2016-2026 (USD Million)

4.4 Multi-Tubular

4.4.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 5 Global Membrane Bioreactor Market, By Configuration

5.1 Configuration Outlook

5.2 Submerged

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

5.3 Side Stream

5.3.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 6 Global Membrane Bioreactor Market, By Configuration

6.1 Configuration Outlook

6.2 Municipal

6.2.1 Market Size, By Region, 2016-2026 (USD Million)

6.3 Industrial

6.3.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 7 Global Membrane Bioreactor Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2016-2026 (USD Million)

7.2.2 Market Size, By Product, 2016-2026 (USD Million)

7.2.3 Market Size, By Configuration, 2016-2026 (USD Million)

7.2.4 Market Size, By Application, 2016-2026 (USD Million)

7.2.5 U.S.

7.2.5.1 Market Size, By Product, 2016-2026 (USD Million)

7.2.5.2 Market Size, By Configuration, 2016-2026 (USD Million)

7.2.5.3 Market Size, By Application, 2016-2026 (USD Million)

7.2.6 Canada

7.2.6.1 Market Size, By Product, 2016-2026 (USD Million)

7.2.6.2 Market Size, By Configuration, 2016-2026 (USD Million)

7.2.6.2 Market Size, By Application, 2016-2026 (USD Million)

7.3 Europe

7.3.1 Market Size, By Country 2016-2026 (USD Million)

7.3.2 Market Size, By Product, 2016-2026 (USD Million)

7.3.3 Market Size, By Configuration, 2016-2026 (USD Million)

7.3.4 Market Size, By Application, 2016-2026 (USD Million)

7.3.5 Germany

7.2.5.1 Market Size, By Product, 2016-2026 (USD Million)

7.2.5.2 Market Size, By Configuration, 2016-2026 (USD Million)

7.2.5.3 Market Size, By Application, 2016-2026 (USD Million)

7.3.6 UK

7.3.6.1 Market Size, By Product, 2016-2026 (USD Million)

7.3.6.2 Market Size, By Configuration, 2016-2026 (USD Million)

7.3.6.2 Market Size, By Application, 2016-2026 (USD Million)

7.3.7 France

7.3.7.1 Market Size, By Product, 2016-2026 (USD Million)

7.3.7.2 Market Size, By Configuration, 2016-2026 (USD Million)

7.3.7.3 Market Size, By Application, 2016-2026 (USD Million)

7.3.8 Italy

7.3.8.1 Market Size, By Product, 2016-2026 (USD Million)

7.3.8.2 Market Size, By Configuration, 2016-2026 (USD Million)

7.3.8.3 Market Size, By Application, 2016-2026 (USD Million)

7.3.9 Spain

7.3.9.1 Market Size, By Product, 2016-2026 (USD Million)

7.3.9.2 Market Size, By Configuration, 2016-2026 (USD Million)

7.3.9.2 Market Size, By Application, 2016-2026 (USD Million)

7.3.10 Russia

7.3.10.1 Market Size, By Product, 2016-2026 (USD Million)

7.3.10.2 Market Size, By Configuration, 2016-2026 (USD Million)

7.3.10.2 Market Size, By Application, 2016-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2016-2026 (USD Million)

7.4.2 Market Size, By Product, 2016-2026 (USD Million)

7.4.3 Market Size, By Configuration, 2016-2026 (USD Million)

7.4.4 Market Size, By Application, 2016-2026 (USD Million)

7.4.5 China

7.4.5.1 Market Size, By Product, 2016-2026 (USD Million)

7.4.5.2 Market Size, By Configuration, 2016-2026 (USD Million)

7.4.5.2 Market Size, By Application, 2016-2026 (USD Million)

7.4.6 India

7.4.6.1 Market Size, By Product, 2016-2026 (USD Million)

7.4.6.2 Market Size, By Configuration, 2016-2026 (USD Million)

7.4.6.3 Market Size, By Application, 2016-2026 (USD Million)

7.4.7 Japan

7.4.7.1 Market Size, By Product, 2016-2026 (USD Million)

7.4.7.2 Market Size, By Configuration, 2016-2026 (USD Million)

7.4.7.3 Market Size, By Application, 2016-2026 (USD Million)

7.4.8 Australia

7.4.8.1 Market Size, By Product, 2016-2026 (USD Million)

7.4.8.2 Market size, By Configuration, 2016-2026 (USD Million)

7.4.8.2 Market size, By Application, 2016-2026 (USD Million)

7.4.9 South Korea

7.4.9.1 Market Size, By Product, 2016-2026 (USD Million)

7.4.9.2 Market Size, By Configuration, 2016-2026 (USD Million)

7.4.9.2 Market Size, By Application, 2016-2026 (USD Million)

7.5 Latin America

7.5.1 Market Size, By Country 2016-2026 (USD Million)

7.5.2 Market Size, By Product, 2016-2026 (USD Million)

7.5.3 Market Size, By Configuration, 2016-2026 (USD Million)

7.5.4 Market Size, By Application, 2016-2026 (USD Million)

7.5.5 Brazil

7.5.5.1 Market Size, By Product, 2016-2026 (USD Million)

7.5.5.2 Market Size, By Configuration, 2016-2026 (USD Million)

7.5.5.2 Market Size, By Application, 2016-2026 (USD Million)

7.5.6 Mexico

7.5.6.1 Market Size, By Product, 2016-2026 (USD Million)

7.5.6.2 Market Size, By Configuration, 2016-2026 (USD Million)

7.5.6.2 Market Size, By Application, 2016-2026 (USD Million)

7.5.7 Argentina

7.5.7.1 Market Size, By Product, 2016-2026 (USD Million)

7.5.7.2 Market Size, By Configuration, 2016-2026 (USD Million)

7.5.7.2 Market Size, By Application, 2016-2026 (USD Million)

7.6 MEA

7.6.1 Market Size, By Country 2016-2026 (USD Million)

7.6.2 Market Size, By Product, 2016-2026 (USD Million)

7.6.3 Market Size, By Configuration, 2016-2026 (USD Million)

7.6.4 Market Size, By Application, 2016-2026 (USD Million)

7.6.5 Saudi Arabia

7.6.5.1 Market Size, By Product, 2016-2026 (USD Million)

7.6.5.2 Market Size, By Configuration, 2016-2026 (USD Million)

7.6.5.3 Market Size, By Application, 2016-2026 (USD Million)

7.6.6 UAE

7.6.6.1 Market Size, By Product, 2016-2026 (USD Million)

7.6.6.2 Market Size, By Configuration, 2016-2026 (USD Million)

7.6.6.3 Market Size, By Application, 2016-2026 (USD Million)

7.6.7 South Africa

7.6.7.1 Market Size, By Product, 2016-2026 (USD Million)

7.6.7.2 Market Size, By Configuration, 2016-2026 (USD Million)

7.6.7.2 Market Size, By Application, 2016-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Evoqua Water Technologies LLC

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 Mitsubishi Rayon Co., Ltd

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Toray Industries, Inc.

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Koch Membrane Systems, Inc.

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Kubota Corporation

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Parkson Corporation

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 CITIC Envirotech Ltd

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Pall Corporation

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info Graphic Analysis

8.10 Pentair plc

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 GE Water & Process Technologies

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

8.12 Other Companies

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info Graphic Analysis

The Global Membrane Bioreactor Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Membrane Bioreactor Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS