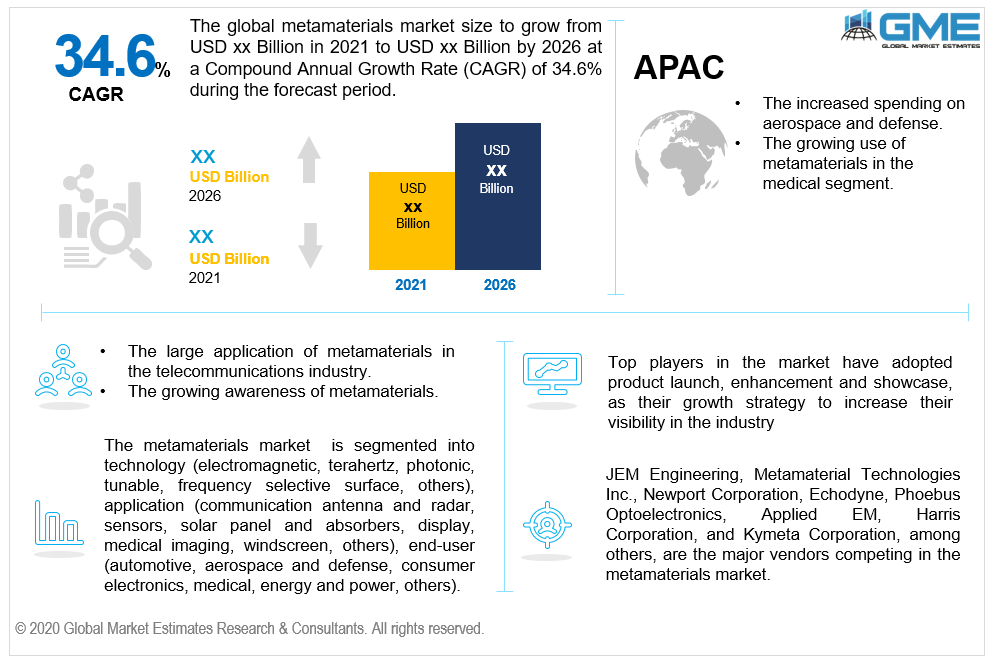

Global Metamaterial Market Size, Trends, and Analysis - Forecasts To 2026 By Technology (Electromagnetic, Terahertz, Photonic (Optical), Tunable, Frequency Selective Surface, Others), By Application (Communication Antenna and Radar, Sensors, Solar Panel and Absorbers, Display, Medical Imaging, Windscreen, Others), By End-User (Automotive, Aerospace and Defense, Consumer Electronics, Medical, Energy and Power, Others), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

Metamaterials are synthetically created materials that can have properties that are not naturally present in materials like having a negative refractive index or electromagnetic cloaking. Metamaterials are used in the manufacture of radomes, radars, antennas, and absorbers which will drive the growth of this market. Metamaterials are being used in various industries like aerospace and defense, consumer electronics, automotive, and telecommunications devices. Increased application of metamaterials in these industries will initiate the increase in the demand for this product. The growing implementation of 5G and the development of 5G networks will also act as a catalyst for the rising demand for metamaterials in the global market. Metamaterials are manufactured through expensive and time-consuming processes as the manufacturing process is highly controlled to ensure the right amount and combination of constituent materials used. These processes are not suitable to be reproduced for mass production which will impact the growth of the metamaterials market.

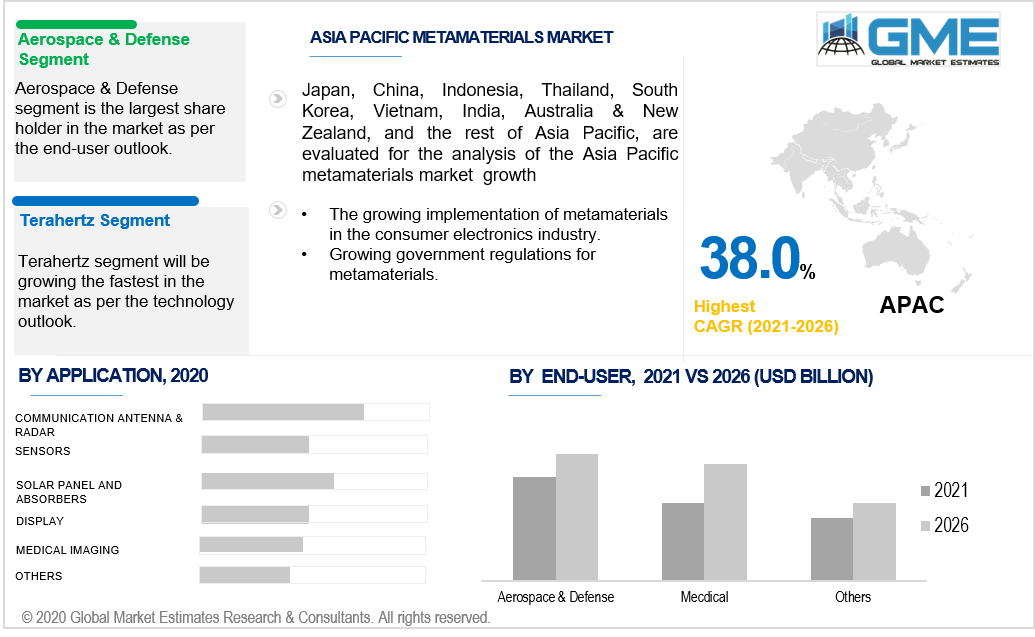

Based on technology, the metamaterial market can be segmented into electromagnetic, terahertz, photonic (optical), tunable, frequency selective surface, and others. The electromagnetic segment is expected to hold the dominant share of the market during the forecast period. The extensive research being carried out to develop electromagnetic metamaterials is one of the major drivers of the electromagnetic segment. The growing market demand for electromagnetic metamaterials in the Asia Pacific and the Middle East has resulted in the dominance of the electromagnetic segment in the metamaterials market. Electromagnetic metamaterials are used extensively for microwave and optical applications. They are used to create novel futuristic products like electromagnetic invisibility cloaks, beam steerers, and microwave couplers. The electromagnetic properties of these metamaterials have increased their application in various industries. They are being used in the manufacturing of radomes, band-pass filters, beam steerers, microwave couplers, and antennas. The terahertz segment is expected to grow at the fastest rate during the forecast period. Terahertz metamaterials are specially manufactured to function at terahertz frequencies.

Based on the various applications of metamaterials, the metamaterials market can be segmented into communication antenna and radar, sensors, solar panel and absorbers, display, medical imaging, windscreen, and others. The communication antenna and radar segment is expected to hold the lion’s share of the revenue during the forecast period. The large demand for antenna and communication devices, in general, has resulted in the dominance of the communication antenna and radar segment. Metamaterials have better properties compared to traditional materials used in communication and radar devices. The solar panel and absorbers segment is expected to register the fastest growth rate during the forecast period. Solar energy is slowly becoming widely implemented and is expected to grow significantly in the coming years. Metamaterials can improve the efficiency of solar panels and are being increasingly used in creating novel solar panels. Absorbers are also used in the production of cloaking devices, superlenses, and radars. The increasing awareness of metamaterials and the benefits from their use is expected to result in an increase in the solar panels and absorbers segment during the forecast period.

Based on the various end-users of metamaterials, the metamaterials market can be segmented into automotive, aerospace and defense, consumer electronics, medical, energy and power, and others. The aerospace and defense segment is expected to hold the dominant share of the revenues during the forecast period. Military and defense sectors have a large demand for antennas and radars for various communications devices that are used to protect the nation. Metamaterials are used to create new and improved antennas and radars that are more efficient and have better range. Metamaterials can be used to make antennas smaller which reduces the space required and allows them to be fit into smaller areas while performing better than traditional antennas. The medical segment is expected to grow at the fastest rate during the forecast period. Medical applications of metamaterials are increasing, they are being used in creating novel sensors and diagnostic imaging devices. Electromagnetic metamaterials can influence electromagnetic waves which can be used to improve the images generated. The medical industry is expected to grow as the population increases and increases health hazards. Medical growth in countries like China, India, and Japan are expected to be major drivers of the medical segment of the metamaterials market.

The North American region is expected to hold the largest share of the market during the forecast period. The region spends heavily on its aerospace and defense sector who are increasingly implementing metamaterials for improved communications and radar devices. Increasing investments in the research and development of metamaterials for various applications have also had an impact on the demand for metamaterials in the region. The region has also seen large installations of solar panels and other energy and power installations that use metamaterials. Heavy investments in healthcare are also expected to have a positive impact on the metamaterials market as metamaterials are used in novel imaging systems. The APAC region is expected to register the fastest growth rate among all regions during the forecast period. The growing consumer electronics industry and medical industries in the region are expected to increase the demand for metamaterials. Increased spending on military and defense by the governments in the region is also expected to increase the demand for metamaterials in the region.

Metamaterial Technologies Inc., JEM Engineering, Newport Corporation, Phoebus Optoelectronics, Echodyne, Applied EM, Kymeta Corporation, and Harris Corporation, among others, are the major vendors competing in the metamaterial market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Metamaterials Industry Overview, 2016-2026

2.1.1 Industry Overview

2.1.2 Technology Overview

2.1.3 End-User Overview

2.1.4 Application Overview

2.1.5 Regional Overview

Chapter 3 Metamaterials Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Technology Advancement in Radar and LiDAR for Autonomous Vehicles

3.3.1.2 Increasing Use of Metamaterials in Solar Power Systems

3.3.2 Industry Challenges

3.3.2.1 Unavailability of Technology for Mass Production of Metamaterials

3.4 Prospective Growth Scenario

3.4.1 Technology Growth Scenario

3.4.2 End-User Growth Scenario

3.4.3 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Metamaterials Market, By Technology

4.1 Technology Outlook

4.2 Electromagnetic

4.2.1 Market Size, By Region, 2016-2026 (USD Million)

4.3 Terahertz

4.3.1 Market Size, By Region, 2016-2026 (USD Million)

4.4 Photonic (Optical)

4.4.1 Market Size, By Region, 2016-2026 (USD Million)

4.5 Tunable

4.5.1 Market Size, By Region, 2016-2026 (USD Million)

4.6 Frequency Selective Surface

4.6.1 Market Size, By Region, 2016-2026 (USD Million)

4.7 Others

4.7.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 5 Metamaterials Market, By End-User

5.1 End-User Outlook

5.2 Automotive

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

5.3 Aerospace & Defence

5.3.1 Market Size, By Region, 2016-2026 (USD Million)

5.4 Consumer Electronics

5.4.1 Market Size, By Region, 2016-2026 (USD Million)

5.5 Medical

5.5.1 Market Size, By Region, 2016-2026 (USD Million)

5.6 Energy & Power

5.6.1 Market Size, By Region, 2016-2026 (USD Million)

5.7 Others

5.7.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 6 Metamaterials Market, By Application

6.1 Communication Antenna and Radar

6.1.1 Market Size, By Region, 2016-2026 (USD Million)

6.2 Sensors

6.2.1 Market Size, By Region, 2016-2026 (USD Million)

6.3 Solar Panel and Absorbers

6.3.1 Market Size, By Region, 2016-2026 (USD Million)

6.4 Display

6.4.1 Market Size, By Region, 2016-2026 (USD Million)

6.5 Medical Imaging

6.5.1 Market Size, By Region, 2016-2026 (USD Million)

6.6 Windscreen

6.6.1 Market Size, By Region, 2016-2026 (USD Million)

6.7 Others

6.7.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 6 Metamaterials Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2016-2026 (USD Million)

6.2.2 Market Size, By Technology, 2016-2026 (USD Million)

6.2.3 Market Size, By End-User, 2016-2026 (USD Million)

6.2.4 Market Size, By Application, 2016-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Technology, 2016-2026 (USD Million)

6.2.4.2 Market Size, By End-User, 2016-2026 (USD Million)

6.2.4.3 Market Size, By Application, 2016-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Technology, 2016-2026 (USD Million)

6.2.5.2 Market Size, By End-User, 2016-2026 (USD Million)

6.2.5.3 Market Size, By Application, 2016-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2016-2026 (USD Million)

6.3.2 Market Size, By Technology, 2016-2026 (USD Million)

6.3.3 Market Size, By End-User, 2016-2026 (USD Million)

6.3.4 Market Size, By Application, 2016-2026 (USD Million)

6.3.4 Germany

6.3.4.1 Market Size, By Technology, 2016-2026 (USD Million)

6.3.4.2 Market Size, By End-User, 2016-2026 (USD Million)

6.3.4.3 Market Size, By Application, 2016-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Technology, 2016-2026 (USD Million)

6.3.5.2 Market Size, By End-User, 2016-2026 (USD Million)

6.3.5.3 Market Size, By Application, 2016-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Technology, 2016-2026 (USD Million)

6.3.6.2 Market Size, By End-User, 2016-2026 (USD Million)

6.3.6.3 Market Size, By Application, 2016-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Technology, 2016-2026 (USD Million)

6.3.7.2 Market Size, By End-User, 2016-2026 (USD Million)

6.3.7.3 Market Size, By Application, 2016-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Technology, 2016-2026 (USD Million)

6.3.8.2 Market Size, By End-User, 2016-2026 (USD Million)

6.3.8.3 Market Size, By Application, 2016-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Technology, 2016-2026 (USD Million)

6.3.9.2 Market Size, By End-User, 2016-2026 (USD Million)

6.3.9.3 Market Size, By Application, 2016-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2016-2026 (USD Million)

6.4.2 Market Size, By Technology, 2016-2026 (USD Million)

6.4.3 Market Size, By End-User, 2016-2026 (USD Million)

6.4.4 Market Size, By Application, 2016-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Technology, 2016-2026 (USD Million)

6.4.4.2 Market Size, By End-User, 2016-2026 (USD Million)

6.4.4.3 Market Size, By Application, 2016-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Technology, 2016-2026 (USD Million)

6.4.5.2 Market Size, By End-User, 2016-2026 (USD Million)

6.4.5.3 Market Size, By Application, 2016-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Technology, 2016-2026 (USD Million)

6.4.6.2 Market Size, By End-User, 2016-2026 (USD Million)

6.4.6.3 Market Size, By Application, 2016-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Technology, 2016-2026 (USD Million)

6.4.7.2 Market size, By End-User, 2016-2026 (USD Million)

6.4.7.3 Market Size, By Application, 2016-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Technology, 2016-2026 (USD Million)

6.4.8.2 Market Size, By End-User, 2016-2026 (USD Million)

6.4.8.3 Market Size, By Application, 2016-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2016-2026 (USD Million)

6.5.2 Market Size, By Technology, 2016-2026 (USD Million)

6.5.3 Market Size, By End-User, 2016-2026 (USD Million)

6.5.4 Market Size, By Application, 2016-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Technology, 2016-2026 (USD Million)

6.5.4.2 Market Size, By End-User, 2016-2026 (USD Million)

6.5.4.3 Market Size, By Application, 2016-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Technology, 2016-2026 (USD Million)

6.5.5.2 Market Size, By End-User, 2016-2026 (USD Million)

6.5.5.3 Market Size, By Application, 2016-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Technology, 2016-2026 (USD Million)

6.5.6.2 Market Size, By End-User, 2016-2026 (USD Million)

6.5.6.3 Market Size, By Application, 2016-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2016-2026 (USD Million)

6.6.2 Market Size, By Technology, 2016-2026 (USD Million)

6.6.3 Market Size, By End-User, 2016-2026 (USD Million)

6.6.4 Market Size, By Application, 2016-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Technology, 2016-2026 (USD Million)

6.6.4.2 Market Size, By End-User, 2016-2026 (USD Million)

6.6.4.3 Market Size, By Application, 2016-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Technology, 2016-2026 (USD Million)

6.6.5.2 Market Size, By End-User, 2016-2026 (USD Million)

6.6.5.3 Market Size, By Application, 2016-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Technology, 2016-2026 (USD Million)

6.6.6.2 Market Size, By End-User, 2016-2026 (USD Million)

6.6.6.3 Market Size, By Application, 2016-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Metamaterial Technologies Inc.

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 JEM Engineering

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 Newport Corporation

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Phoebus Optoelectronics

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Echodyne

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Applied EM

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Kymeta Corporation

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Harris Corporation

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Others

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

The Global Metamaterial Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Metamaterial Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS