Global Methanol Market Size, Trends & Analysis - Forecasts to 2029 By Feedstock (Natural Gas, Coal, and Biomass & Renewables), By Application (Construction, Automotive, Electronics, and Others), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

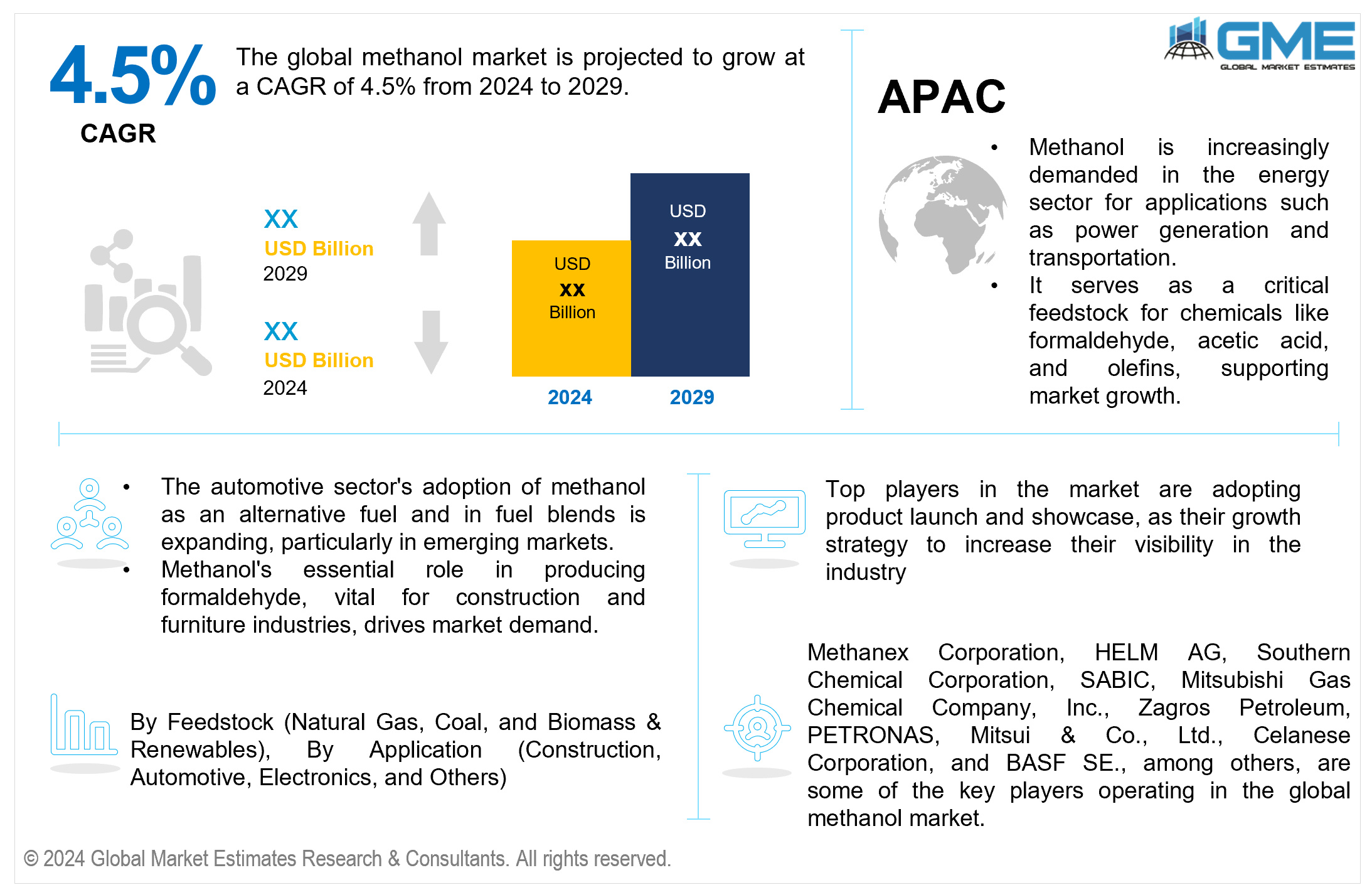

The global methanol market is projected to grow at a CAGR of 4.5% from 2024 to 2029.

The methanol market is expanding due to several factors, such as its wide range of uses and methanol derivatives. A common feedstock for the synthesis of acetic acid, formaldehyde, and other compounds is methanol. Technological developments in the methanol production process involving converting coal or natural gas have increased efficiency and decreased costs, driving the market's expansion. Methanol's relevance in the energy industry is further underscored by its potential as an alternative fuel source and its use in emerging technologies like fuel cells, which further propels its use.

Developments in the supply chain and the dynamics of international trade also have an impact on the methanol market. The Middle East, China, and the United States have large amounts of methanol manufacturing process, and the market for methanol shows strong trade activity. The dynamics of Methanol export-import are vital to maintaining supply and demand equilibrium among various geographical areas. Increases in methanol plant capacity help to maintain a consistent supply of methanol to satisfy rising demand, particularly in nations with natural gas reserves that are readily available. Favorable methanol pricing trends, which are fueled by changes in the price of methanol raw materials and improvements in manufacturing techniques that maximize production efficiency, also contribute to the market's growth.

The methanol industry trends is also influenced by regulatory frameworks and methanol environmental impact. Methanol consumption is more attractive than conventional fossil fuels because of its comparatively smaller carbon footprint, which is a factor that governments and industry are prioritizing. A growing number of methanol end-use sectors, including the automotive, construction, and pharmaceutical sectors, are using more methanol, which is in line with efforts to cut greenhouse gas emissions and switch to cleaner energy sources. Methanol market forecast and methanol market analysis point to a promising future, with ongoing expenditures being made in R&D to investigate novel methanol applications and enhance production processes. Due to a combination of environmental concerns, trade and methanol supply chain dynamics, and technological improvements, the methanol global market is expected to grow significantly over the forecast period.

One restraint for the global methanol market is its reliance on feedstock prices, notably natural gas and coal, which can change dramatically, affecting production costs and profitability throughout the industry.

The natural gas segment is expected to hold the largest share of the market. The growth of the segment is due to its cost-effectiveness and abundance. Compared to coal, natural gas is a more cost-effective and efficient feedstock for synthesizing methanol. Furthermore, availability has expanded due to developments in natural gas extraction technologies such as fracking, which makes it a more appealing alternative for methanol manufacturers to maximize production costs and satisfy rising methanol demand.

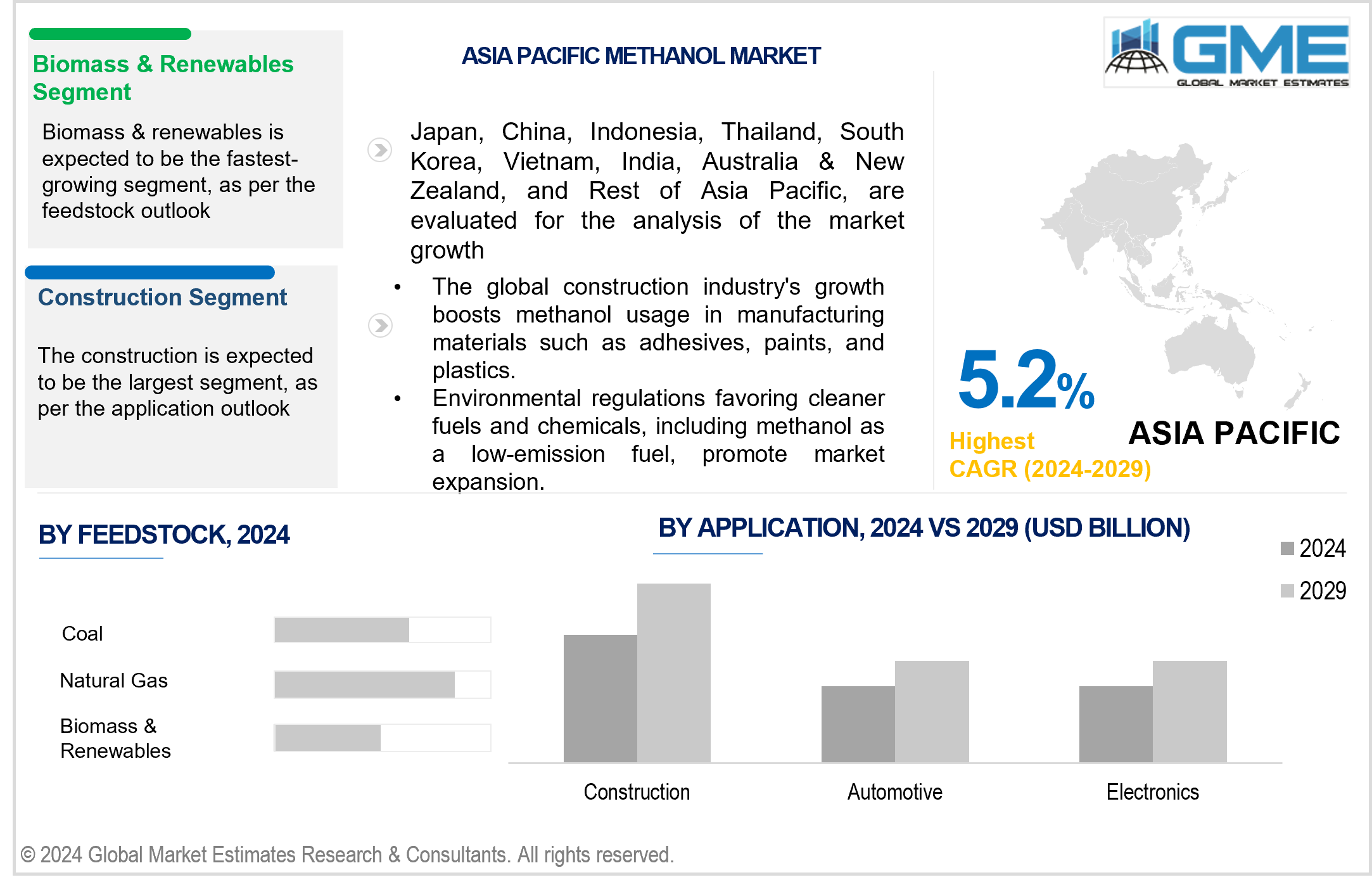

The biomass & renewables segment is expected to be the fastest-growing segment in the market from 2024 to 2029. The growth is due to increasing environmental concerns and regulatory pressures to reduce carbon emissions. Advancements in renewable energy technologies and government incentives for sustainable practices are driving the transition to biomass-based methanol production. This change aligns with global sustainability goals and offers a more environmentally friendly alternative to methanol obtained from fossil fuels.

The automotive segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. This growth is due to the increased need for cleaner fuels and stringent emission laws. The growth is due to the potential of methanol as an alternative fuel and its increasing usage in the production of gasoline additives and biodiesel. Its rapid rise in the automotive sector is also attributed to improvements in methanol-powered vehicle technologies and growing methanol fuel cell use.

The construction segment is expected to hold the largest share of the market. The segment's growth is due to its extensive use in producing formaldehyde, a key ingredient in construction materials such as plywood, insulation, and adhesives. The demand for these materials is driven by increasing infrastructural development and urbanization. Methanol's dominance in this market segment is further contributed by its use in the production of resins and other chemicals related to construction.

North America is expected to be the largest region in the market. Natural gas reserves, which provide a cost-effective feedstock for methanol production, are the primary reasons for boosting methanol market growth in this region. The region's highly developed industrial infrastructure, strong demand for methanol in construction and automotive applications, and kind regulatory framework also contribute to the market's expansion.

Asia Pacific is predicted to witness rapid growth during the forecast period. The regional market growth is due to its expanding industrial base and increasing demand for methanol in the automotive, construction, and chemical sectors. This demand is driven by the rapidly growing urbanization, infrastructural development, and consumer expenditure in nations like China and India.

Methanex Corporation, HELM AG, Southern Chemical Corporation, SABIC, Mitsubishi Gas Chemical Company, Inc., Zagros Petroleum, PETRONAS, Mitsui & Co., Ltd., Celanese Corporation, and BASF SE., among others, are some of the key players operating in the global methanol market.

Please note: This is not an exhaustive list of companies profiled in the report.

In February 2024, Consolidated Energy Limited (CEL), a leading global methanol producer, acquired a majority 60% stake in Oman Methanol Company LLC (OMC), increasing its ownership from 26.1% to USD 347 million. OMC, operating a major methanol plant in Sohar Port, Oman, was initially a joint venture between Methanol Holdings International Limited (MHIL) and Oman Methanol Holding Company LLC.

In December 2023, Mitsubishi Gas Chemical Company, Inc. (MGC) signed a Memorandum of Understanding (MOU) with the City of Yokohama and Maersk AS to promote the use of green methanol at the Port of Yokohama. This initiative aims to decarbonize international marine transportation, support Japan's International Container Strategic Port and Harbour Policies, and contribute to the port's carbon neutrality goals.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL METHANOL MARKET, BY APPLICATION

4.1 Introduction

4.2 Methanol Market: Application Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Construction

4.4.1 Construction Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Automotive

4.5.1 Automotive Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Electronics

4.6.1 Electronics Market Estimates and Forecast, 2021-2029 (USD Million)

4.7 Others

4.7.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL METHANOL MARKET, BY FEEDSTOCK

5.1 Introduction

5.2 Methanol Market: Feedstock Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Natural Gas

5.4.1 Natural Gas Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Coal

5.5.1 Coal Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Biomass & Renewables

5.6.1 Biomass & Renewables Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL METHANOL MARKET, BY REGION

6.1 Introduction

6.2 North America Methanol Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.1 By Application

6.2.2 By Feedstock

6.2.3 By Country

6.2.3.1 U.S. Methanol Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.1.1 By Application

6.2.3.1.2 By Feedstock

6.2.3.2 Canada Methanol Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.2.1 By Application

6.2.3.2.2 By Feedstock

6.2.3.3 Mexico Methanol Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.3.1 By Application

6.2.3.3.2 By Feedstock

6.3 Europe Methanol Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.1 By Application

6.3.2 By Feedstock

6.3.3 By Country

6.3.3.1 Germany Methanol Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.1.1 By Application

6.3.3.1.2 By Feedstock

6.3.3.2 U.K. Methanol Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.2.1 By Application

6.3.3.2.2 By Feedstock

6.3.3.3 France Methanol Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.3.1 By Application

6.3.3.3.2 By Feedstock

6.3.3.4 Italy Methanol Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.4.1 By Application

6.3.3.4.2 By Feedstock

6.3.3.5 Spain Methanol Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.5.1 By Application

6.3.3.5.2 By Feedstock

6.3.3.6 Netherlands Methanol Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Application

6.3.3.6.2 By Feedstock

6.3.3.7 Rest of Europe Methanol Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Application

6.3.3.6.2 By Feedstock

6.4 Asia Pacific Methanol Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.1 By Application

6.4.2 By Feedstock

6.4.3 By Country

6.4.3.1 China Methanol Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.1.1 By Application

6.4.3.1.2 By Feedstock

6.4.3.2 Japan Methanol Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.2.1 By Application

6.4.3.2.2 By Feedstock

6.4.3.3 India Methanol Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.3.1 By Application

6.4.3.3.2 By Feedstock

6.4.3.4 South Korea Methanol Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.4.1 By Application

6.4.3.4.2 By Feedstock

6.4.3.5 Singapore Methanol Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.5.1 By Application

6.4.3.5.2 By Feedstock

6.4.3.6 Malaysia Methanol Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Application

6.4.3.6.2 By Feedstock

6.4.3.7 Thailand Methanol Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Application

6.4.3.6.2 By Feedstock

6.4.3.8 Indonesia Methanol Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.7.1 By Application

6.4.3.7.2 By Feedstock

6.4.3.9 Vietnam Methanol Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.8.1 By Application

6.4.3.8.2 By Feedstock

6.4.3.10 Taiwan Methanol Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.10.1 By Application

6.4.3.10.2 By Feedstock

6.4.3.11 Rest of Asia Pacific Methanol Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.11.1 By Application

6.4.3.11.2 By Feedstock

6.5 Middle East and Africa Methanol Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.1 By Application

6.5.2 By Feedstock

6.5.3 By Country

6.5.3.1 Saudi Arabia Methanol Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.1.1 By Application

6.5.3.1.2 By Feedstock

6.5.3.2 U.A.E. Methanol Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.2.1 By Application

6.5.3.2.2 By Feedstock

6.5.3.3 Israel Methanol Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.3.1 By Application

6.5.3.3.2 By Feedstock

6.5.3.4 South Africa Methanol Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.4.1 By Application

6.5.3.4.2 By Feedstock

6.5.3.5 Rest of Middle East and Africa Methanol Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.5.1 By Application

6.5.3.5.2 By Feedstock

6.6 Central and South America Methanol Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.1 By Application

6.6.2 By Feedstock

6.6.3 By Country

6.6.3.1 Brazil Methanol Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.1.1 By Application

6.6.3.1.2 By Feedstock

6.6.3.2 Argentina Methanol Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.2.1 By Application

6.6.3.2.2 By Feedstock

6.6.3.3 Chile Methanol Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Application

6.6.3.3.2 By Feedstock

6.6.3.3 Rest of Central and South America Methanol Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Application

6.6.3.3.2 By Feedstock

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 North America

7.3.2 Europe

7.3.3 Asia Pacific

7.3.4 Rest of the World

7.4 Company Profiles

7.4.1 Methanex Corporation

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Southern Chemical Corporation

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 HELM AG

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 SABIC

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 Mitsubishi Gas Chemical Company, Inc.

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 PETRONAS

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 Zagros Petroleum

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 Mitsui & Co., Ltd.

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 Celanese Corporation

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 BASF SE

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 Global Methanol Market, By Application, 2021-2029 (USD Million)

2 Construction Market, By Region, 2021-2029 (USD Million)

3 Automotive Market, By Region, 2021-2029 (USD Million)

4 Electronics Market, By Region, 2021-2029 (USD Million)

5 Others Market, By Region, 2021-2029 (USD Million)

6 Global Methanol Market, By Feedstock, 2021-2029 (USD Million)

7 Natural Gas Market, By Region, 2021-2029 (USD Million)

8 Coal Market, By Region, 2021-2029 (USD Million)

9 Biomass & Renewables Market, By Region, 2021-2029 (USD Million)

10 Regional Analysis, 2021-2029 (USD Million)

11 North America Methanol Market, By Application, 2021-2029 (USD Million)

12 North America Methanol Market, By Feedstock, 2021-2029 (USD Million)

13 North America Methanol Market, By COUNTRY, 2021-2029 (USD Million)

14 U.S. Methanol Market, By Application, 2021-2029 (USD Million)

15 U.S. Methanol Market, By Feedstock, 2021-2029 (USD Million)

16 Canada Methanol Market, By Application, 2021-2029 (USD Million)

17 Canada Methanol Market, By Feedstock, 2021-2029 (USD Million)

18 Mexico Methanol Market, By Application, 2021-2029 (USD Million)

19 Mexico Methanol Market, By Feedstock, 2021-2029 (USD Million)

20 Europe Methanol Market, By Application, 2021-2029 (USD Million)

21 Europe Methanol Market, By Feedstock, 2021-2029 (USD Million)

22 Europe Methanol Market, By Country, 2021-2029 (USD Million)

23 Germany Methanol Market, By Application, 2021-2029 (USD Million)

24 Germany Methanol Market, By Feedstock, 2021-2029 (USD Million)

25 U.K. Methanol Market, By Application, 2021-2029 (USD Million)

26 U.K. Methanol Market, By Feedstock, 2021-2029 (USD Million)

27 France Methanol Market, By Application, 2021-2029 (USD Million)

28 France Methanol Market, By Feedstock, 2021-2029 (USD Million)

29 Italy Methanol Market, By Application, 2021-2029 (USD Million)

30 Italy Methanol Market, By Feedstock, 2021-2029 (USD Million)

31 Spain Methanol Market, By Application, 2021-2029 (USD Million)

32 Spain Methanol Market, By Feedstock, 2021-2029 (USD Million)

33 Netherlands Methanol Market, By Application, 2021-2029 (USD Million)

34 Netherlands Methanol Market, By Feedstock, 2021-2029 (USD Million)

35 Rest Of Europe Methanol Market, By Application, 2021-2029 (USD Million)

36 Rest Of Europe Methanol Market, By Feedstock, 2021-2029 (USD Million)

37 Asia Pacific Methanol Market, By Application, 2021-2029 (USD Million)

38 Asia Pacific Methanol Market, By Feedstock, 2021-2029 (USD Million)

39 Asia Pacific Methanol Market, By Country, 2021-2029 (USD Million)

40 China Methanol Market, By Application, 2021-2029 (USD Million)

41 China Methanol Market, By Feedstock, 2021-2029 (USD Million)

42 Japan Methanol Market, By Application, 2021-2029 (USD Million)

43 Japan Methanol Market, By Feedstock, 2021-2029 (USD Million)

44 India Methanol Market, By Application, 2021-2029 (USD Million)

45 India Methanol Market, By Feedstock, 2021-2029 (USD Million)

46 South Korea Methanol Market, By Application, 2021-2029 (USD Million)

47 South Korea Methanol Market, By Feedstock, 2021-2029 (USD Million)

48 Singapore Methanol Market, By Application, 2021-2029 (USD Million)

49 Singapore Methanol Market, By Feedstock, 2021-2029 (USD Million)

50 Thailand Methanol Market, By Application, 2021-2029 (USD Million)

51 Thailand Methanol Market, By Feedstock, 2021-2029 (USD Million)

52 Malaysia Methanol Market, By Application, 2021-2029 (USD Million)

53 Malaysia Methanol Market, By Feedstock, 2021-2029 (USD Million)

54 Indonesia Methanol Market, By Application, 2021-2029 (USD Million)

55 Indonesia Methanol Market, By Feedstock, 2021-2029 (USD Million)

56 Vietnam Methanol Market, By Application, 2021-2029 (USD Million)

57 Vietnam Methanol Market, By Feedstock, 2021-2029 (USD Million)

58 Taiwan Methanol Market, By Application, 2021-2029 (USD Million)

59 Taiwan Methanol Market, By Feedstock, 2021-2029 (USD Million)

60 Rest of APAC Methanol Market, By Application, 2021-2029 (USD Million)

61 Rest of APAC Methanol Market, By Feedstock, 2021-2029 (USD Million)

62 Middle East and Africa Methanol Market, By Application, 2021-2029 (USD Million)

63 Middle East and Africa Methanol Market, By Feedstock, 2021-2029 (USD Million)

64 Middle East and Africa Methanol Market, By Country, 2021-2029 (USD Million)

65 Saudi Arabia Methanol Market, By Application, 2021-2029 (USD Million)

66 Saudi Arabia Methanol Market, By Feedstock, 2021-2029 (USD Million)

67 UAE Methanol Market, By Application, 2021-2029 (USD Million)

68 UAE Methanol Market, By Feedstock, 2021-2029 (USD Million)

69 Israel Methanol Market, By Application, 2021-2029 (USD Million)

70 Israel Methanol Market, By Feedstock, 2021-2029 (USD Million)

71 South Africa Methanol Market, By Application, 2021-2029 (USD Million)

72 South Africa Methanol Market, By Feedstock, 2021-2029 (USD Million)

73 Rest Of Middle East and Africa Methanol Market, By Application, 2021-2029 (USD Million)

74 Rest Of Middle East and Africa Methanol Market, By Feedstock, 2021-2029 (USD Million)

75 Central and South America Methanol Market, By Application, 2021-2029 (USD Million)

76 Central and South America Methanol Market, By Feedstock, 2021-2029 (USD Million)

77 Central and South America Methanol Market, By Country, 2021-2029 (USD Million)

78 Brazil Methanol Market, By Application, 2021-2029 (USD Million)

79 Brazil Methanol Market, By Feedstock, 2021-2029 (USD Million)

80 Chile Methanol Market, By Application, 2021-2029 (USD Million)

81 Chile Methanol Market, By Feedstock, 2021-2029 (USD Million)

82 Argentina Methanol Market, By Application, 2021-2029 (USD Million)

83 Argentina Methanol Market, By Feedstock, 2021-2029 (USD Million)

84 Rest Of Central and South America Methanol Market, By Application, 2021-2029 (USD Million)

85 Rest Of Central and South America Methanol Market, By Feedstock, 2021-2029 (USD Million)

86 Methanex Corporation: Products & Services Offering

87 Southern Chemical Corporation: Products & Services Offering

88 HELM AG : Products & Services Offering

89 SABIC: Products & Services Offering

90 Mitsubishi Gas Chemical Company, Inc.: Products & Services Offering

91 PETRONAS: Products & Services Offering

92 Zagros Petroleum : Products & Services Offering

93 Mitsui & Co., Ltd.: Products & Services Offering

94 Celanese Corporation, Inc: Products & Services Offering

95 BASF SE: Products & Services Offering

96 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Methanol Market Overview

2 Global Methanol Market Value From 2021-2029 (USD Million)

3 Global Methanol Market Share, By Application (2023)

4 Global Methanol Market Share, By Feedstock (2023)

5 Global Methanol Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Methanol Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Methanol Market

10 Impact Of Challenges On The Global Methanol Market

11 Porter’s Five Forces Analysis

12 Global Methanol Market: By Application Scope Key Takeaways

13 Global Methanol Market, By Application Segment: Revenue Growth Analysis

14 Construction Market, By Region, 2021-2029 (USD Million)

15 Automotive Market, By Region, 2021-2029 (USD Million)

16 Electronics Market, By Region, 2021-2029 (USD Million)

17 Others Market, By Region, 2021-2029 (USD Million)

18 Global Methanol Market: By Feedstock Scope Key Takeaways

19 Global Methanol Market, By Feedstock Segment: Revenue Growth Analysis

20 Natural Gas Market, By Region, 2021-2029 (USD Million)

21 Coal Market, By Region, 2021-2029 (USD Million)

22 Biomass & Renewables Market, By Region, 2021-2029 (USD Million)

23 Regional Segment: Revenue Growth Analysis

24 Global Methanol Market: Regional Analysis

25 North America Methanol Market Overview

26 North America Methanol Market, By Application

27 North America Methanol Market, By Feedstock

28 North America Methanol Market, By Country

29 U.S. Methanol Market, By Application

30 U.S. Methanol Market, By Feedstock

31 Canada Methanol Market, By Application

32 Canada Methanol Market, By Feedstock

33 Mexico Methanol Market, By Application

34 Mexico Methanol Market, By Feedstock

35 Four Quadrant Positioning Matrix

36 Company Market Share Analysis

37 Methanex Corporation: Company Snapshot

38 Methanex Corporation: SWOT Analysis

39 Methanex Corporation: Geographic Presence

40 Southern Chemical Corporation: Company Snapshot

41 Southern Chemical Corporation: SWOT Analysis

42 Southern Chemical Corporation: Geographic Presence

43 HELM AG : Company Snapshot

44 HELM AG : SWOT Analysis

45 HELM AG : Geographic Presence

46 SABIC: Company Snapshot

47 SABIC: Swot Analysis

48 SABIC: Geographic Presence

49 Mitsubishi Gas Chemical Company, Inc.: Company Snapshot

50 Mitsubishi Gas Chemical Company, Inc.: SWOT Analysis

51 Mitsubishi Gas Chemical Company, Inc.: Geographic Presence

52 PETRONAS: Company Snapshot

53 PETRONAS: SWOT Analysis

54 PETRONAS: Geographic Presence

55 Zagros Petroleum : Company Snapshot

56 Zagros Petroleum : SWOT Analysis

57 Zagros Petroleum : Geographic Presence

58 Mitsui & Co., Ltd.: Company Snapshot

59 Mitsui & Co., Ltd.: SWOT Analysis

60 Mitsui & Co., Ltd.: Geographic Presence

61 Celanese Corporation, Inc.: Company Snapshot

62 Celanese Corporation, Inc.: SWOT Analysis

63 Celanese Corporation, Inc.: Geographic Presence

64 BASF SE: Company Snapshot

65 BASF SE: SWOT Analysis

66 BASF SE: Geographic Presence

67 Other Companies: Company Snapshot

68 Other Companies: SWOT Analysis

69 Other Companies: Geographic Presence

The Global Methanol Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Methanol Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS