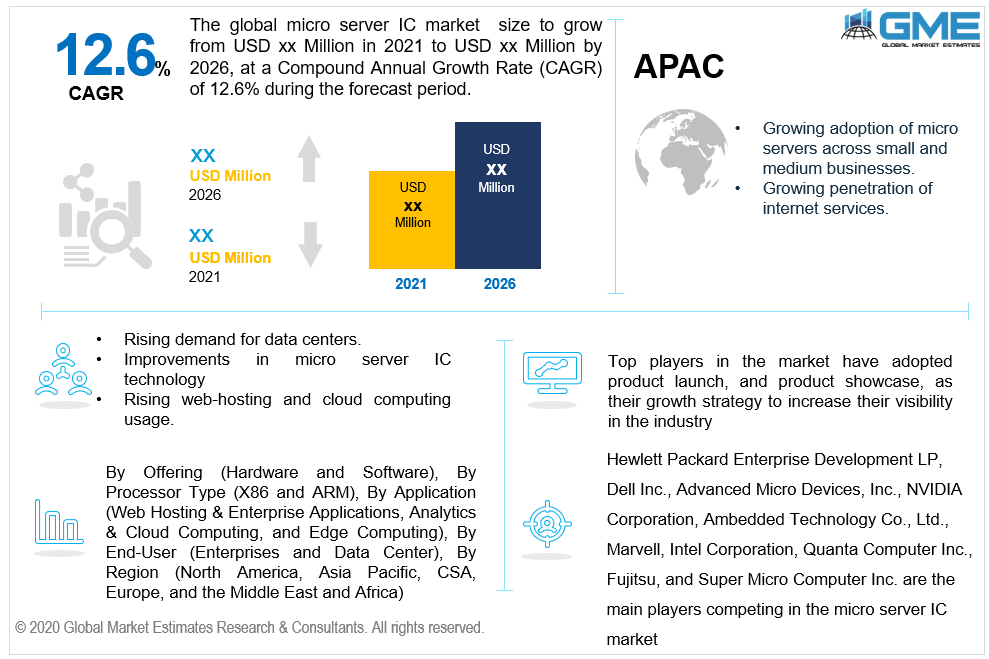

Global Micro Server IC Market Size, Trends, and Analysis - Forecasts To 2026 By Offering (Hardware and Software), By Processor Type (X86 and ARM), By Application (Web Hosting & Enterprise Applications, Analytics & Cloud Computing, and Edge Computing), By End-User (Enterprises and Data Center), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

A crucial boosting factor for the global micro server IC market is the proliferating demand for data centers in developed and developing nations because micro server ICs are exclusively needed in the data centers. The need for additional data centers is generated by rising internet traffic. The additional main factor driving the global micro server IC market is improvements in micro server IC technology.

The volume of transistors employed in micro server integrated circuits has shrunk in recent years, rendering them to be smaller and smarter. To maximize energy economy, computing capability, and minimize heat emitted through micro server ICs, some micro server IC users substitute their existing micro server ICs. Because of the developments in micro server IC technology, industries manufacture more efficient micro server ICs at a reduced cost compared to the same company's previous micro server IC architectures.

In addition, rising web-hosting and cloud computing usage would also propel the demand over the forecast period. This is due to the decline in cloud computing and web hosting costs in the last three years. The cloud is expected to generate demand for security, data processing, and storage for cloud service providers. For the micro server IC market, restricted storage space is the main constraint. Many big companies have a huge amount of data to store and process. Because of their limited data storage capabilities, micro server ICs are not ideal for processing massive volumes of data. Instead of micro server ICs, many large organizations are likely to opt for conventional enterprise-class servers, as they are more suited for processing large amounts of data.

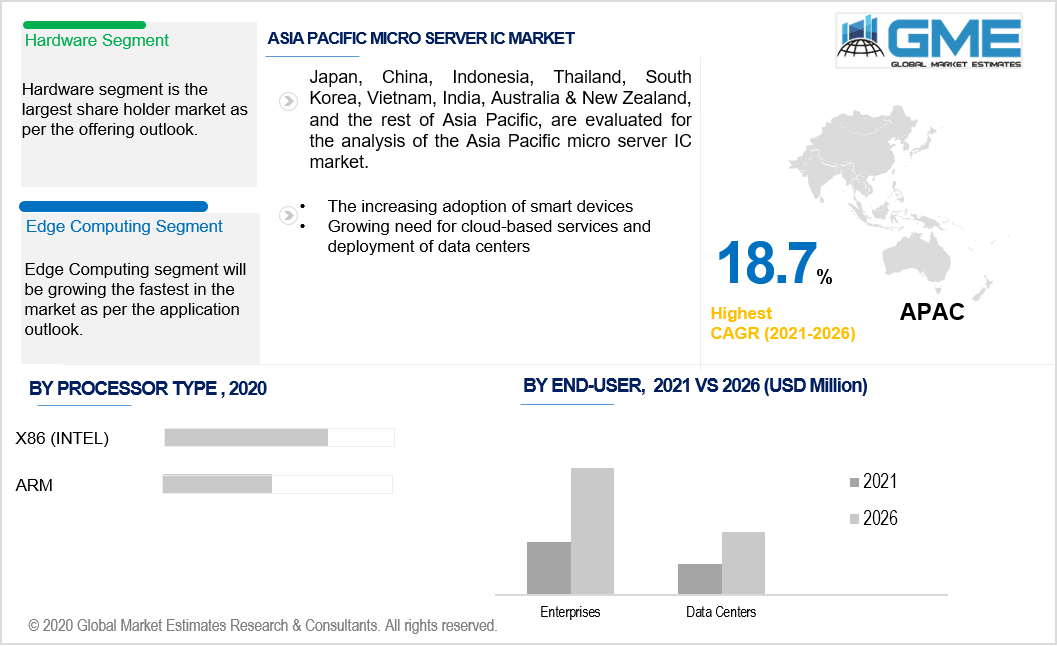

Based on offerings, the micro server IC market is divided into software and hardware. Hardware is projected to have the highest market share of the micro server IC market during the forecast period. Because hardware is the key section of an SoC, organizations including Intel and ARM are attempting to improve the functionality of their integrated circuits by making the design leaner and increasingly efficient. Furthermore, expansion in the market is propelled by the increasingly high usage of micro servers for specialized web hosting, front-end services, large data operations, content distribution networks, and low-space & application-specific capabilities. In addition, it is anticipated that the evolving edge computing environment, namely the provision of storage, advanced computing, and networking capabilities near data sources to achieve both high-throughput analytical processing and low-latency event processing, will boost the micro server hardware segment.

Based on processor type, the market is categorized as X86 and ARM. The Intel-based (X86) segment is foreseen to lead the global market. Intel (X86) is one of the leading companies to step early on into the market for micro servers. Intel has a significant number of clients and partners coupled with high availability of improved technical support. This surges the install rate of Intel-based micro server ICs. The growth of the segment is due to the enormous accessibility of a diverse variety of ICs and CPUs, as well as increased usage of 14 nm process technology to make ICs, which are enabling low-power, high-flexibility micro servers for compact scale-out operations in small enterprises. The market growth is further driven by the standardization of computing technologies and the growing momentum of industries for Intel-based micro servers.

Based on application, the market is categorized as web hosting & enterprise applications, analytics & cloud computing, and edge computing. One of the emerging applications for micro server ICs is edge computing, and during the forecast period, it is anticipated to hold the largest market share. Edge computing has been pushed into further focus with the rising investments in IoT and the advent of the hyper-scale cloud. Edge computing is a potential accelerator of consumer insights and loyalty as companies aim to stay competitive in the digital corporate age, notably in a post-pandemic environment. Independent suppliers of software, device integrators, and businesses will aim to construct cloud-independent solutions that push edge computing applications.

The increasing implementation of 5G technologies would also provide lower throughput and a medium to integrate with a large proportion of edge devices, notably in the consumer arena. For applications such as connected and automated cars, intelligent manufacturing and the Internet of Things, and smart cities, the requirement for edge computing has been growing. It has encouraged the development of edge data centers, and micro servers are given opportunities by the growing significance of advanced servers to tackle capacity limitations.

Based on end-user, the market is categorized as enterprises and data centers. The enterprise end-user segment is projected to hold the largest market share. The quantity and diversity of data have been immense with the rise of social platforms, smartphones, IoT, and big data. Ramping up security and data storage, legacy systems upgrades, dense task management, and technological adaptation require a mobile workforce. Henceforth, to render straightforward management which has exclusive protection, it is particularly necessary to upgrade IT infrastructure, notably servers, regardless of sensitive applications and data being stored on-site or in the cloud. Small to medium-sized companies require server platforms that meet not only existing demands, but also manage potential workloads seamlessly, thus reducing costs. Micro servers use lower power per node, reduce costs and improve operating performance, making them the preferred choice for medium-sized companies.

North America is expected to have the major proportion of the micro server IC market. Expanding research & development in the realm of IoT and cloud-based services is fostering demand for new and enhanced ICs for smarter, swifter computing to process the massive volumes of data generated. North America has the most data centers in the world. The burgeoning demand for elevated data transmission levels, an improved market for communication devices including smartphones and tablet devices as a result of 5G network connectivity, the booming market for wearable technology, and the expanding data center universality are propelling the development of the North American micro server IC market.

Due to the involvement of countries with a large population and the growing adoption of micro servers across small and medium businesses, APAC is projected to expand at the fastest pace for the micro server IC market. Data generation has been fueled by the growing penetration of internet services, along with the introduction of smart devices. This further drives the growth of data centers in APAC countries. Owing to its cost-effective solutions and minimal energy usage, micro server ICs could be employed for light-load operations in data centers in the APAC region.

Hewlett Packard Enterprise Development LP, Dell Inc., Advanced Micro Devices, Inc., NVIDIA Corporation, Ambedded Technology Co., Ltd., Marvell, Intel Corporation, Quanta Computer Inc., Fujitsu, and Super Micro Computer Inc. are the main players competing in the micro server IC market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Micro Server IC Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Offering Overview

2.1.3 Processor Type Overview

2.1.4 Application Overview

2.1.5 End-User Overview

2.1.6 Regional Overview

Chapter 3 Global Micro Server IC Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing Demand For Cloud Computing And Web Hosting

3.3.1.2 Growing Advancements in Micro Server IC Technology

3.3.2 Industry Challenges

3.3.2.1 Limited Storage Capacity

3.4 Prospective Growth Scenario

3.4.1 Offering Growth Scenario

3.4.2 Processor Type Growth Scenario

3.4.3 Application Growth Scenario

3.4.4 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Micro Server IC Market, By Offering

4.1 Offering Outlook

4.2 Hardware

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Software

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Global Micro Server IC Market, By Processor Type

5.1 Processor Type Outlook

5.2 X86

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 ARM

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Global Micro Server IC Market, By Application

6.1 Application Outlook

6.2 Web Hosting & Enterprise Applications

6.2.1 Market Size, By Region, 2019-2026 (USD Million)

6.3 Analytics & Cloud Computing

6.3.1 Market Size, By Region, 2019-2026 (USD Million)

6.4 Edge Computing

6.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 7 Global Micro Server IC Market, By End-User

7.1 End-User Outlook

7.2 Enterprises

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

7.4 Data Center

7.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 8 Global Micro Server IC Market, By Region

8.1 Regional Outlook

8.2 North America

8.2.1 Market Size, By Country, 2019-2026 (USD Million)

8.2.2 Market Size, By Offering, 2019-2026 (USD Million)

8.2.3 Market Size, By Processor Type, 2019-2026 (USD Million)

8.2.4 Market Size, By Application, 2019-2026 (USD Million)

8.2.5 Market Size, By End-User, 2019-2026 (USD Million)

8.2.6 U.S.

8.2.6.1 Market Size, By Offering, 2019-2026 (USD Million)

8.2.6.2 Market Size, By Processor Type, 2019-2026 (USD Million)

8.2.6.3 Market Size, By Application, 2019-2026 (USD Million)

8.2.6.4 Market Size, By End-User, 2019-2026 (USD Million)

8.2.7 Canada

8.2.7.1 Market Size, By Offering, 2019-2026 (USD Million)

8.2.7.2 Market Size, By Processor Type, 2019-2026 (USD Million)

8.2.7.3 Market Size, By Application, 2019-2026 (USD Million)

8.2.7.4 Market Size, By End-User, 2019-2026 (USD Million)

8.3 Europe

8.3.1 Market Size, By Country, 2019-2026 (USD Million)

8.3.2 Market Size, By Offering, 2019-2026 (USD Million)

8.3.3 Market Size, By Processor Type, 2019-2026 (USD Million)

8.3.4 Market Size, By Application, 2019-2026 (USD Million)

8.3.5 Market Size, By End-User, 2019-2026 (USD Million)

8.3.6 Germany

8.3.6.1 Market Size, By Offering, 2019-2026 (USD Million)

8.3.6.2 Market Size, By Processor Type, 2019-2026 (USD Million)

8.3.6.3 Market Size, By Application, 2019-2026 (USD Million)

8.3.6.4 Market Size, By End-User, 2019-2026 (USD Million)

8.3.7 UK

8.3.7.1 Market Size, By Offering, 2019-2026 (USD Million)

8.3.7.2 Market Size, By Processor Type, 2019-2026 (USD Million)

8.3.7.3 Market Size, By Application, 2019-2026 (USD Million)

8.3.7.4 Market Size, By End-User, 2019-2026 (USD Million)

8.3.8 France

8.3.8.1 Market Size, By Offering, 2019-2026 (USD Million)

8.3.8.2 Market Size, By Processor Type, 2019-2026 (USD Million)

8.3.8.3 Market Size, By Application, 2019-2026 (USD Million)

8.3.8.4 Market Size, By End-User, 2019-2026 (USD Million)

8.3.9 Italy

8.3.9.1 Market Size, By Offering, 2019-2026 (USD Million)

8.3.9.2 Market Size, By Processor Type, 2019-2026 (USD Million)

8.3.9.3 Market Size, By Application, 2019-2026 (USD Million)

8.3.9.4 Market Size, By End-User, 2019-2026 (USD Million)

8.3.10 Spain

8.3.10.1 Market Size, By Offering, 2019-2026 (USD Million)

8.3.10.2 Market Size, By Processor Type, 2019-2026 (USD Million)

8.3.10.3 Market Size, By Application, 2019-2026 (USD Million)

8.3.10.4 Market Size, By End-User, 2019-2026 (USD Million)

8.3.11 Russia

8.3.11.1 Market Size, By Offering, 2019-2026 (USD Million)

8.3.11.2 Market Size, By Processor Type, 2019-2026 (USD Million)

8.3.11.3 Market Size, By Application, 2019-2026 (USD Million)

8.3.11.4 Market Size, By End-User, 2019-2026 (USD Million)

8.4 Asia Pacific

8.4.1 Market Size, By Country, 2019-2026 (USD Million)

8.4.2 Market Size, By Offering, 2019-2026 (USD Million)

8.4.3 Market Size, By Processor Type, 2019-2026 (USD Million)

8.4.4 Market Size, By Application, 2019-2026 (USD Million)

8.4.5 Market Size, By End-User, 2019-2026 (USD Million)

8.4.6 China

8.4.6.1 Market Size, By Offering, 2019-2026 (USD Million)

8.4.6.2 Market Size, By Processor Type, 2019-2026 (USD Million)

8.4.6.3 Market Size, By Application, 2019-2026 (USD Million)

8.4.6.4 Market Size, By End-User, 2019-2026 (USD Million)

8.4.7 India

8.4.7.1 Market Size, By Offering, 2019-2026 (USD Million)

8.4.7.2 Market Size, By Processor Type, 2019-2026 (USD Million)

8.4.7.3 Market Size, By Application, 2019-2026 (USD Million)

8.4.7.4 Market Size, By End-User, 2019-2026 (USD Million)

8.4.8 Japan

8.4.8.1 Market Size, By Offering, 2019-2026 (USD Million)

8.4.8.2 Market Size, By Processor Type, 2019-2026 (USD Million)

8.4.8.3 Market Size, By Application, 2019-2026 (USD Million)

8.4.8.4 Market Size, By End-User, 2019-2026 (USD Million)

8.4.9 Australia

8.4.9.1 Market Size, By Offering, 2019-2026 (USD Million)

8.4.9.2 Market size, By Processor Type, 2019-2026 (USD Million)

8.4.9.3 Market size, By Application, 2019-2026 (USD Million)

8.4.9.4 Market size, By End-User, 2019-2026 (USD Million)

8.4.10 South Korea

8.4.10.1 Market Size, By Offering, 2019-2026 (USD Million)

8.4.10.2 Market Size, By Processor Type, 2019-2026 (USD Million)

8.4.10.3 Market Size, By Application, 2019-2026 (USD Million)

8.4.10.4 Market Size, By End-User, 2019-2026 (USD Million)

8.5 Latin America

8.5.1 Market Size, By Country, 2019-2026 (USD Million)

8.5.2 Market Size, By Offering, 2019-2026 (USD Million)

8.5.3 Market Size, By Processor Type, 2019-2026 (USD Million)

8.5.4 Market Size, By Application, 2019-2026 (USD Million)

8.5.5 Market Size, By End-User, 2019-2026 (USD Million)

8.5.6 Brazil

8.5.6.1 Market Size, By Offering, 2019-2026 (USD Million)

8.5.6.2 Market Size, By Processor Type, 2019-2026 (USD Million)

8.5.6.3 Market Size, By Application, 2019-2026 (USD Million)

8.5.6.4 Market Size, By End-User, 2019-2026 (USD Million)

8.5.7 Mexico

8.5.7.1 Market Size, By Offering, 2019-2026 (USD Million)

8.5.7.2 Market Size, By Processor Type, 2019-2026 (USD Million)

8.5.7.3 Market Size, By Application, 2019-2026 (USD Million)

8.5.7.4 Market Size, By End-User, 2019-2026 (USD Million)

8.5.8 Argentina

8.5.8.1 Market Size, By Offering, 2019-2026 (USD Million)

8.5.8.2 Market Size, By Processor Type, 2019-2026 (USD Million)

8.5.8.3 Market Size, By Application, 2019-2026 (USD Million)

8.5.8.4 Market Size, By End-User, 2019-2026 (USD Million)

8.6 MEA

8.6.1 Market Size, By Country, 2019-2026 (USD Million)

8.6.2 Market Size, By Offering, 2019-2026 (USD Million)

8.6.3 Market Size, By Processor Type, 2019-2026 (USD Million)

8.6.4 Market Size, By Application, 2019-2026 (USD Million)

8.6.5 Market Size, By End-User, 2019-2026 (USD Million)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Offering, 2019-2026 (USD Million)

8.6.6.2 Market Size, By Processor Type, 2019-2026 (USD Million)

8.6.6.3 Market Size, By Application, 2019-2026 (USD Million)

8.6.6.4 Market Size, By End-User, 2019-2026 (USD Million)

8.6.7 UAE

8.6.7.1 Market Size, By Offering, 2019-2026 (USD Million)

8.6.7.2 Market Size, By Processor Type, 2019-2026 (USD Million)

8.6.7.3 Market Size, By Application, 2019-2026 (USD Million)

8.6.7.4 Market Size, By End-User, 2019-2026 (USD Million)

8.6.8 South Africa

8.6.8.1 Market Size, By Offering, 2019-2026 (USD Million)

8.6.8.2 Market Size, By Processor Type, 2019-2026 (USD Million)

8.6.8.3 Market Size, By Application, 2019-2026 (USD Million)

8.6.8.4 Market Size, By End-User, 2019-2026 (USD Million)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 Hewlett Packard Enterprise Development LP

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 Dell Inc.

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 Advanced Micro Devices, Inc.

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 NVIDIA Corporation

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 Ambedded Technology Co., Ltd.

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 Marvell

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 Intel Corporation

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 Quanta Computer Inc.

7.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

9.10 Fujitsu

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info Graphic Analysis

9.11 Super Micro Computer Inc.

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info Graphic Analysis

9.12 Other Companies

9.12.1 Company Overview

9.12.2 Financial Analysis

9.12.3 Strategic Positioning

9.12.4 Info Graphic Analysis

The Global Micro Server IC Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Micro Server IC Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS