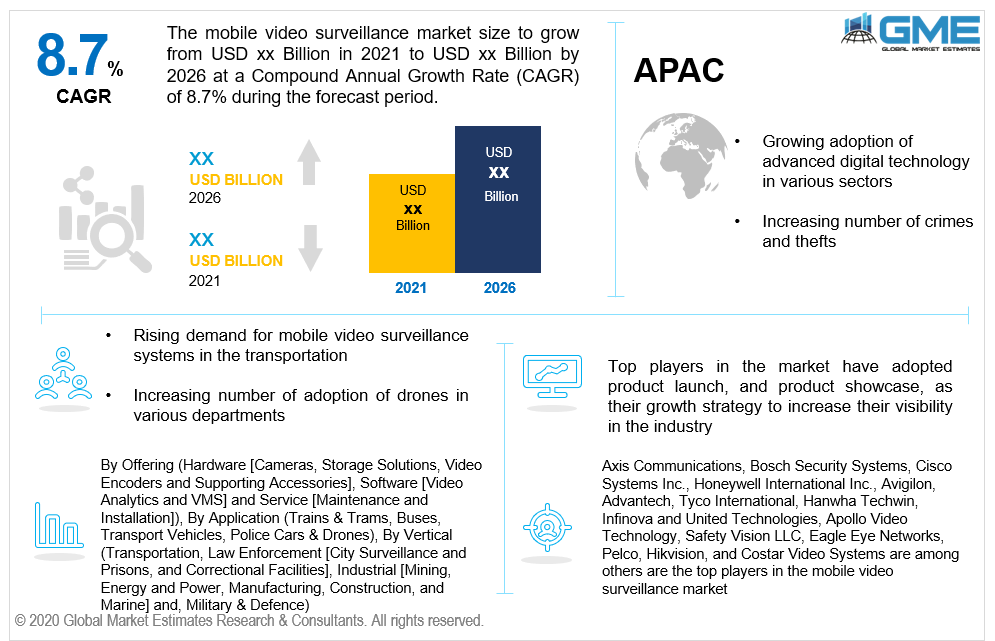

Global Mobile Video Surveillance Market Size, Trends & Analysis - Forecasts to 2026 By Offering (Hardware [Cameras, Storage Solutions, Video Encoders, and Supporting Accessories], Software [Video Analytics and VMS], and Service [Maintenance and Installation]), By Application (Trains & Trams, Buses, Transport Vehicles, and Police Cars & Drones), By Vertical (Transportation, Law Enforcement [City Surveillance and Prisons, and Correctional Facilities], Industrial [Mining, Energy and Power, Manufacturing, Construction, and Marine], and Military & Defence), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

Mobile video surveillance helps users to access their data, remotely store, manage, record, play, and monitor CCTV footage in the cloud from a remote area. For example, CCTV footage is stored on the spot and users do not have to save files on a computer hard drive. The data that is stored on the cloud can be accessed quickly and securely from any part of the world. In other words, it is a monitoring site surveillance technology with some advanced features for optimum performance. This process is done in such a way, wherein a mobile record the video, and the Wi-Fi present in the system sends the footage to the main control system room or place from where the entire process is being executed.

Mobile video surveillance is operator independent system. These video observation applications give a concurrent review and multi-site alternatives so that users can investigate as per their convenience and such surveillance cameras can be deployed at both business or home. Observing off-site is likewise very advantageous for clients as it allows them to go back and forth. They are applied to stop any kind of loss or theft in the manufacturing industry, monitor operations in the industry, security purposes, traffic monitoring, to prevent any kind of fight or mishappening at crowded places, event video surveillance, web monitoring, and monitoring parking lots.

Relatively high initial costs and privacy concerns associated with the use of information presented by these devices are expected to limit the development of the mobile video surveillance market. The high operational cost of such devices, which involves deployment and servicing, may be a deterrent to widespread acceptance. These networks are often sensitive to hacker attacks, posing a barrier to the market of mobile video surveillance development.

The rising potential for remote video surveillance technology and services for real-time tracking and protection at airports, office spaces, transport infrastructure automobiles, factories, and homes may be a major driver of the industry. The growing need for flexible and intelligent mobile video monitoring applications in a wide range of application domains may be a noticeable trend in fuelling the market in various regions. A progressively increasing number of commercial institutions and government offices are installing mobile video monitoring devices to protect themselves from fraud and extremism, which is driving the market growth. The growing security problem, due to increasing terrorist activity, in police vehicles, trams, school buses, and drones around the world is also driving up demand for sophisticated mobile video monitoring systems.

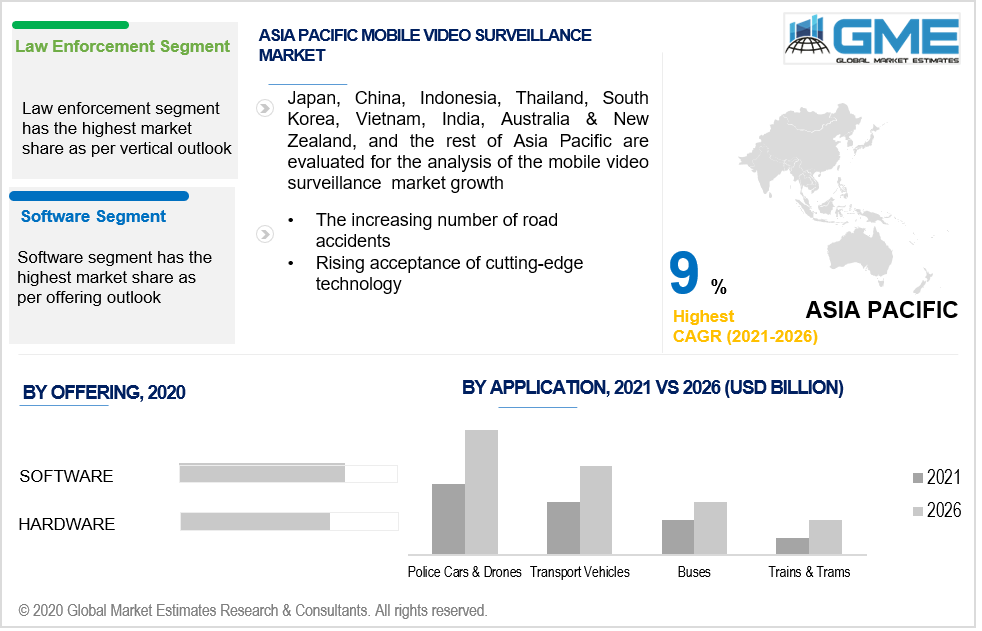

Mobile video surveillance can be divided into, buses, police cars & drones, transport vehicles, and trains & trams, depending on the application. Police cars & drones have the highest market share because of the steps taken to stop theft and crimes in a particular place. Increasing safety and protection issues because of the surge in crime levels and terror threats are key factors driving global demand for this segment. Implementation of IP cameras and cloud-based monitoring is supposed to drive market growth throughout the forecast period.

Based on vertical, the mobile video surveillance market can be segregated into transportation, law enforcement (city surveillance and prisons, and correctional facilities), industrial (mining, energy and power, manufacturing, construction, and marine), and military and defence. Law enforcement has the highest share in the market. It can be attributed to the growing implementation of such systems by law enforcement organizations to minimize the ever-growing crime levels due to benefits such as improved efficiency, effectiveness, and simplifying numerous activities.

As per the geographical analysis, the market of Mobile Video Surveillance can be classified into North America (the US, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa and Central South America. North America is the market leader in the mobile video surveillance market owing to the number of key players in the field of the surveillance business. Also, the number of crimes occurring in the region is another important reason for the adoption of mobile video surveillance which is eventually leading to the growth in the North American region. North America is then followed by Europe due to the advancement in technology in the surveillance market. Moreover, Asia Pacific is the fastest-growing market because of the intensified terrorist and criminal activity, the government has increased investments in surveillance devices, and efforts to install security cameras in public places are to be the key factors for the market's growth in this area.

Axis Communications, Bosch Security Systems, Cisco Systems Inc., Honeywell International Inc., Avigilon, Advantech, Tyco International, Hanwha Techwin, Infinova and United Technologies, Apollo Video Technology, Safety Vision LLC, Eagle Eye Networks, Pelco, Hikvision, and Costar Video Systems among others are the top players in the mobile video surveillance market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Mobile Video Surveillance Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Offering Overview

2.1.3 Vertical Overview

2.1.4 Regional Overview

Chapter 3 Mobile Video Surveillance Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising demand for mobile video surveillance systems in

the transportation

3.3.1.2 Increasing number of adoption of drones in various

departments

3.3.2 Industry Challenges

3.3.2.1 Involves high cost at initial stage

3.4 Prospective Growth Scenario

3.4.1 Offering Overview

3.4.2 Vertical Overview

3.4.3 Vertical Overview

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Mobile Video Surveillance Market, By Offering

4.1 Offering Outlook

4.2 Hardware

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Software

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

4.4 Service

4.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Mobile Video Surveillance Market, By Vertical

5.1 Vertical Outlook

5.2 Trains & Trams

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 Buses

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 Transport Vehicles

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

5.4 Police Cars & Drones

5.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Mobile Video Surveillance Market, By Vertical

6.1 Vertical Outlook

6.2 Transportation

6.2.1 Market Size, By Region, 2019-2026 (USD Million)

6.3 Law Enforcement

6.3.1 Market Size, By Region, 2019-2026 (USD Million)

6.4 Industrial

6.4.1 Market Size, By Region, 2019-2026 (USD Million)

6.5 Military & Defence

6.5.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 7 Mobile Video Surveillance Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2019-2026 (USD Million)

7.2.2 Market Size, By Offering, 2019-2026 (USD Million)

7.2.3 Market Size, By Application, 2019-2026 (USD Million)

7.2.4 Market Size, By Vertical, 2019-2026 (USD Million)

7.2.5 U.S.

7.2.5.1 Market Size, By Offering, 2019-2026 (USD Million)

7.2.5.2 Market Size, By Application, 2019-2026 (USD Million)

7.2.5.3 Market Size, By Vertical, 2019-2026 (USD Million)

7.2.6 Canada

7.2.6.1 Market Size, By Offering, 2019-2026 (USD Million)

7.2.6.2 Market Size, By Application, 2019-2026 (USD Million)

7.2.6.3 Market Size, By Vertical, 2019-2026 (USD Million)

7.3 Europe

7.3.1 Market Size, By Country 2019-2026 (USD Million)

7.3.2 Market Size, By Offering, 2019-2026 (USD Million)

7.3.3 Market Size, By Application, 2019-2026 (USD Million)

7.3.4 Market Size, By Vertical, 2019-2026 (USD Million)

7.3.5 Germany

7.3.5.1 Market Size, By Offering, 2019-2026 (USD Million)

7.3.5.2 Market Size, By Application, 2019-2026 (USD Million)

7.3.5.3 Market Size, By Vertical, 2019-2026 (USD Million)

7.3.6 UK

7.3.6.1 Market Size, By Offering, 2019-2026 (USD Million)

7.3.6.2 Market Size, By Application, 2019-2026 (USD Million)

7.3.6.3 Market Size, By Vertical, 2019-2026 (USD Million)

7.3.7 France

7.3.7.1 Market Size, By Offering, 2019-2026 (USD Million)

7.3.7.2 Market Size, By Application, 2019-2026 (USD Million)

7.3.7.3 Market Size, By Vertical, 2019-2026 (USD Million)

7.3.8 Italy

7.3.8.1 Market Size, By Offering, 2019-2026 (USD Million)

7.3.8.2 Market Size, By Application, 2019-2026 (USD Million)

7.3.8.3 Market Size, By Vertical, 2019-2026 (USD Million)

7.3.9 Spain

7.3.9.1 Market Size, By Offering, 2019-2026 (USD Million)

7.3.9.2 Market Size, By Application, 2019-2026 (USD Million)

7.3.9.2 Market Size, By Vertical, 2019-2026 (USD Million)

7.3.10 Russia

7.3.10.1 Market Size, By Offering, 2019-2026 (USD Million)

7.3.10.2 Market Size, By Application, 2019-2026 (USD Million)

7.3.10.3 Market Size, By Vertical, 2019-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2019-2026 (USD Million)

7.4.2 Market Size, By Offering, 2019-2026 (USD Million)

7.4.3 Market Size, By Application, 2019-2026 (USD Million)

7.4.4 Market Size, By Vertical, 2019-2026 (USD Million)

7.4.5 China

7.4.5.1 Market Size, By Offering, 2019-2026 (USD Million)

7.4.5.2 Market Size, By Application, 2019-2026 (USD Million)

7.4.5.3 Market Size, By Vertical, 2019-2026 (USD Million)

7.4.6 India

7.4.6.1 Market Size, By Offering, 2019-2026 (USD Million)

7.4.6.2 Market Size, By Application, 2019-2026 (USD Million)

7.4.6.3 Market Size, By Vertical, 2019-2026 (USD Million)

7.4.7 Japan

7.4.7.1 Market Size, By Offering, 2019-2026 (USD Million)

7.4.7.2 Market Size, By Application, 2019-2026 (USD Million)

7.4.7.3 Market Size, By Vertical, 2019-2026 (USD Million)

7.4.8 Australia

7.4.8.1 Market Size, By Offering, 2019-2026 (USD Million)

7.4.8.2 Market size, By Application, 2019-2026 (USD Million)

7.4.8.3 Market size, By Vertical, 2019-2026 (USD Million)

7.4.9 South Korea

7.4.9.1 Market Size, By Offering, 2019-2026 (USD Million)

7.4.9.2 Market Size, By Application, 2019-2026 (USD Million)

7.4.9.3 Market Size, By Vertical, 2019-2026 (USD Million)

7.5 Latin America

7.5.1 Market Size, By Country 2019-2026 (USD Million)

7.5.2 Market Size, By Offering, 2019-2026 (USD Million)

7.5.3 Market Size, By Application, 2019-2026 (USD Million)

7.5.4 Market Size, By Vertical, 2019-2026 (USD Million)

7.5.4 Brazil

7.5.5.1 Market Size, By Offering, 2019-2026 (USD Million)

7.5.5.2 Market Size, By Application, 2019-2026 (USD Million)

7.5.5.3 Market Size, By Vertical, 2019-2026 (USD Million)

7.5.6 Mexico

7.5.6.1 Market Size, By Offering, 2019-2026 (USD Million)

7.5.6.2 Market Size, By Application, 2019-2026 (USD Million)

7.5.6.3 Market Size, By Vertical, 2019-2026 (USD Million)

7.5.7 Argentina

7.5.7.1 Market Size, By Offering, 2019-2026 (USD Million)

7.5.7.2 Market Size, By Application, 2019-2026 (USD Million)

7.5.7.3 Market Size, By Vertical, 2019-2026 (USD Million)

7.6 MEA

7.6.1 Market Size, By Country 2019-2026 (USD Million)

7.6.2 Market Size, By Offering, 2019-2026 (USD Million)

7.6.3 Market Size, By Application, 2019-2026 (USD Million)

7.6.4 Market Size, By Vertical, 2019-2026 (USD Million)

7.6.5 Saudi Arabia

7.6.5.1 Market Size, By Offering, 2019-2026 (USD Million)

7.6.5.2 Market Size, By Application, 2019-2026 (USD Million)

7.6.5.3 Market Size, By Vertical, 2019-2026 (USD Million)

7.6.6 UAE

7.6.6.1 Market Size, By Offering, 2019-2026 (USD Million)

7.6.6.2 Market Size, By Application, 2019-2026 (USD Million)

7.6.6.3 Market Size, By Vertical, 2019-2026 (USD Million)

7.6.7 South Africa

7.6.7.1 Market Size, By Offering, 2019-2026 (USD Million)

7.6.7.2 Market Size, By Application, 2019-2026 (USD Million)

7.6.7.3 Market Size, By Vertical, 2019-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Axis Communications

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 Bosch Security Systems

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Cisco Systems Inc.

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Honeywell International Inc.

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Avigilon

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Laser Components

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Advantech

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Tyco International

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info Graphic Analysis

8.10 Hanwha Techwin Unlimited

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Infinova and United Technologies

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

8.12 Apollo Video Technology

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info Graphic Analysis

8.13 Safety Vision LLC

8.13.1 Company Overview

8.13.2 Financial Analysis

8.13.3 Strategic Positioning

8.13.4 Info Graphic Analysis

8.14 Eagle Eye Networks

8.14.1 Company Overview

8.14.2 Financial Analysis

8.14.3 Strategic Positioning

8.14.4 Info Graphic Analysis

8.15 Pelco

8.15.1 Company Overview

8.15.2 Financial Analysis

8.15.3 Strategic Positioning

8.15.4 Info Graphic Analysis

8.16 Hikvision

8.16.1 Company Overview

8.16.2 Financial Analysis

8.16.3 Strategic Positioning

8.16.4 Info Graphic Analysis

8.17 Costar Video Systems

8.16.1 Company Overview

8.16.2 Financial Analysis

8.16.3 Strategic Positioning

8.16.4 Info Graphic Analysis

The Global Mobile Video Surveillance Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Mobile Video Surveillance Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS