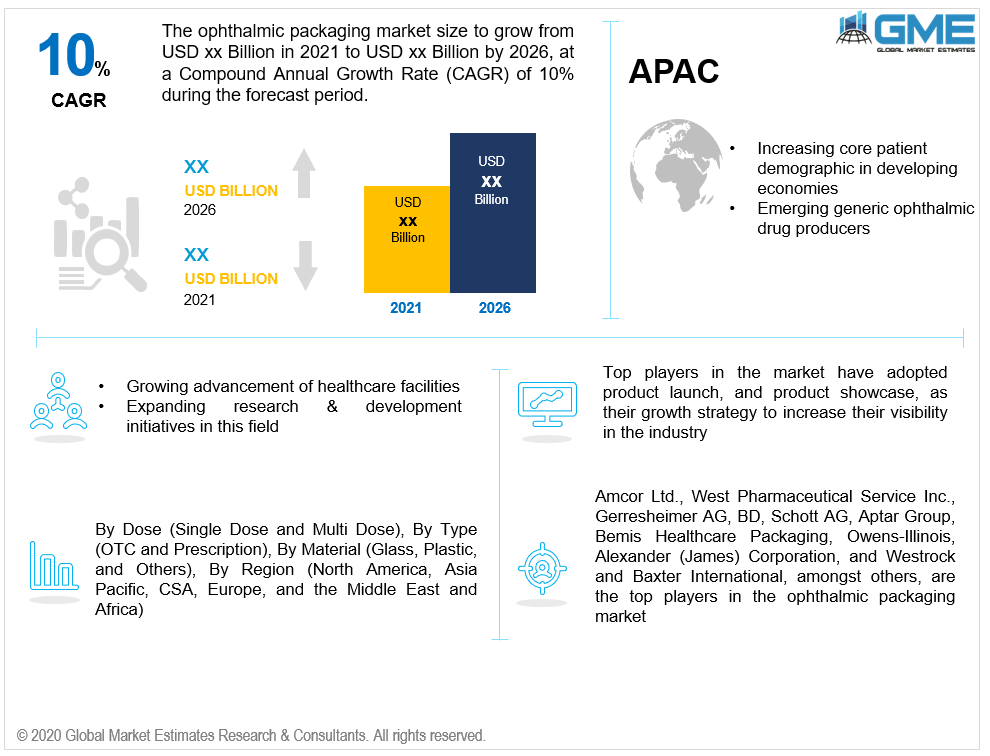

Global Ophthalmic Packaging Market Size, Trends & Analysis - Forecasts to 2026 By Dose (Single Dose and Multi Dose), By Type (OTC and Prescription), By Material (Glass, Plastic, and Others), By Region (North America, Europe, Asia-Pacific, CSA, MEA), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

Topically applied medications are used to cure a variety of ophthalmic conditions and eye irritations. These medications, which are intended for the care of acute or chronic illnesses, are kept in bottles with a prescription dispensing tip to help with dosing the correct volume of medication. This packaging protects the drug's purity, ensures its sterility, ensures correct dosing & delivery, and reduces chemical leakage by keeping the drug from coming into interaction with the atmosphere. As a result, when opposed to the packaging used for solid oral goods, ophthalmic drug label packaging is known to be more critical for the drug's performance and safety.

Ophthalmic drugs are sterile formulations that provide specific dosage types for external application to the eye's surface. The protection of ophthalmic packaged goods guarantees that all ophthalmic products must comply with strict legislation relating to sterility checks following pharmaceutical production and packaging requirements. Thus, companies are making investments in research and development activities to create innovative products to meet the growing need for successful packaging techniques.

One of the most essential and receptive organs of the human body is the eyes. The tiniest irritation can cause excruciating pain and nausea, as well as swelling, drainage, infection, and allergies, which can harm the eyes permanently. Therefore, effective packaging that is both approved and sterile is extremely important. As a result, global pharmaceutical companies are ensuring to avoid any errors or omissions in the manufacturing, distribution, and application of the ophthalmic packaging over the drugs.

The key market force that is accelerating the ophthalmic packaging market is the rising prevalence of eye disorders globally. Apart from that, the market is being driven by a growing need for a renowned brand with a distinctive ophthalmic packing product portfolio, a robust ophthalmic drug distribution system, a substantial increase in core population, and an emphasis on increased medication life expectancy. Moreover, rising disposable income, the market for flexible and streamlined packaging, drug distribution technology advances, and a large growth in the pharmaceutical sector are some of the major factors contributing to the growth in the global markets of ophthalmic packaging.

Based on the dose, the ophthalmic packaging market can be segmented as single and multidose doses. Over the projected period, the multiple-dose segment is presumed to predominate and rise at a substantial pace. Throughout the forecast period, this segment is anticipated to expand due to the introduction of the best quality, patient-friendly, and safer multi-dose packaging. The decision to use multiple doses is influenced by several factors, including the drug's potency, formulation, stability, and treatment duration.

The strong demand for the safest ophthalmic drugs with limited to no additives is driving the growth of the multiple-dose market. The demand is due to the increase in the use of multiple dosage packaging systems in OTC preparations, as well as an increase in the incidence of common ocular disorders like red eyes, dry eyes, and conjunctivitis.

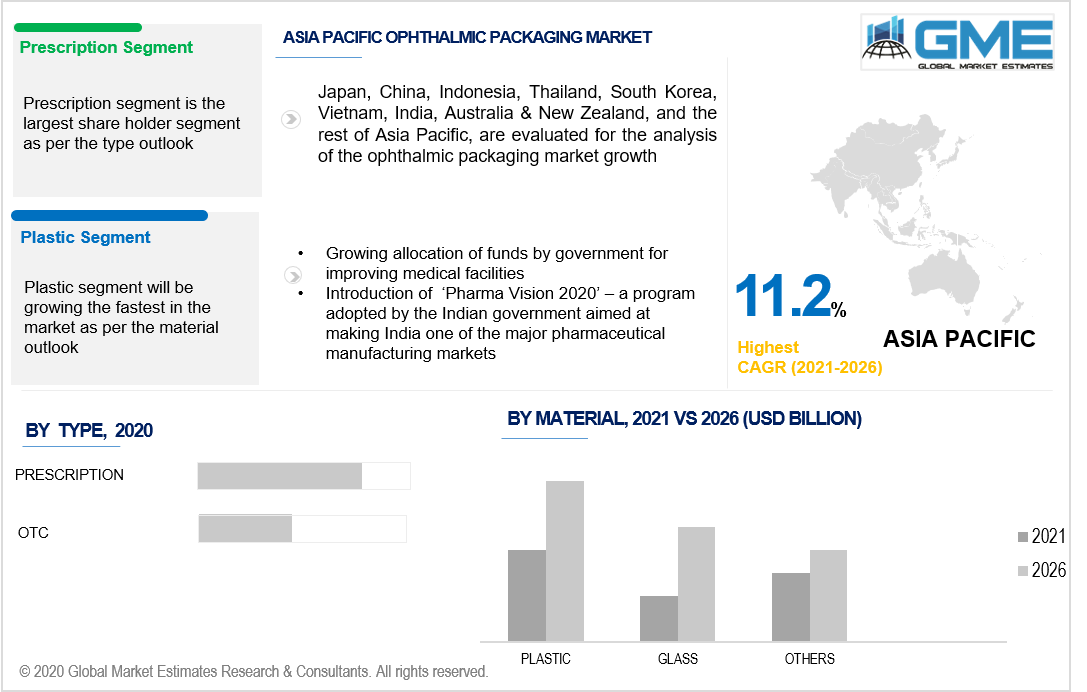

Depending on type, the ophthalmic packaging market is divided into OTC and prescription. The prescription form has the largest market share and is projected to expand rapidly throughout the forecast period. Variables such as the increased proportion of ophthalmic diseases and the growing number of ophthalmic clinics, hospitals, & ambulatory treatment centers account for the substantial growth of the prescription segment in the global markets.

Moreover, the expansion of prescription-style ophthalmic packaging is expected to be fuelled by increased access to ophthalmic healthcare clinics and the development of advanced drug delivery systems. Besides that, patients are hesitant to use OTC medications for ophthalmic conditions and are only preferring to consult an ophthalmologist to avoid the infection getting further deteriorated. As a result, the discretionary income rises, and people become more conscious of the importance of preventive treatment, more individuals will consider consulting a doctor, thus, fuelling the segment’s development.

Based on material, the ophthalmic packaging market is classified as glass, plastic, and others. The market for plastic packaging materials has the largest share and is anticipated to expand significantly throughout the forecast period. The benefits associated with plastic content, like complacency, cost-effectiveness, low weight, and ease of use, have contributed significantly to the segment's development. Due to its stability and low risk of pollution, low-density polyethylene is the most used form of resin. Furthermore, since this content is conveniently recycled, it is suitable for all forms of ophthalmic packaging.

As per the geographical analysis, the market can be classified into North America (the US, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa and Central & South America. Due to the enhanced use of ophthalmic packaging products, the demand in North America is envisioned to contribute to the majority of the market revenue throughout the forecast period. This can be due to a myriad of reasons, such as the advancement of healthcare facilities and expanded research & development initiatives in this field, the rising elderly population, a surge in the volume of cases involving eye-related conditions, and the myriad regulations enacted by strict regulatory bodies. Additionally, The American Academy of Ophthalmology is implementing a consistent color-coding scheme for all ophthalmologic drug labeling and covers. This, in addition, is likely to lead to the expansion of the demand in this area. Throughout the forecast period, the Asia Pacific area is likely to see the highest growth rate. The emergence of a broad patient demographic in developing economies is presumed to empower market momentum, particularly in India, Japan, and China. Furthermore, the policymakers of a multitude of APAC nations, namely India, Australia, Japan, and Singapore, have been carrying out projects for the growth of healthcare facilities. The emergence of a strong generic ophthalmic drug sector in India will further support the Asia Pacific ophthalmic packaging market's expansion.

Amcor Ltd., West Pharmaceutical Service Inc., Gerresheimer AG, BD, Schott AG, Aptar Group, Bemis Healthcare Packaging, Owens-Illinois, Alexander (James) Corporation, and Westrock and Baxter International, among others, are the top players in the ophthalmic packaging market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Ophthalmic Packaging Industry Overview, 2016-2026

2.1.1 Industry Overview

2.1.2 Dose Overview

2.1.3 Type Overview

2.1.4 Material Overview

2.1.5 Regional Overview

Chapter 3 Ophthalmic Packaging Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increased population

3.3.1.2 Rising prevalence of eye disorders

3.3.2 Industry Challenges

3.3.2.1 Limited Study and Industry Participants

3.4 Prospective Growth Scenario

3.4.1 Dose Growth Scenario

3.4.2 Type Growth Scenario

3.4.3 Material Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Ophthalmic Packaging Market, By Dose

4.1 Dose Outlook

4.2 Single-Dose

4.2.1 Market Size, By Region, 2016-2026 (USD Million)

4.3 Multiple-Dose

4.3.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 5 Ophthalmic Packaging Market, By Type

5.1 Type Outlook

5.2 OTC

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

5.3 Prescription

5.3.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 6 Ophthalmic Packaging Market, By Material

6.1 Material Outlook

6.2 Glass

6.2.1 Market Size, By Region, 2016-2026 (USD Million)

6.3 Plastic

6.3.1 Market Size, By Region, 2016-2026 (USD Million)

6.4 Others

6.3.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 7 Ophthalmic Packaging Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2016-2026 (USD Million)

7.2.2 Market Size, By Dose, 2016-2026 (USD Million)

7.2.3 Market Size, By Type, 2016-2026 (USD Million)

7.2.4 Market Size, By Material, 2016-2026 (USD Million)

7.2.5 U.S.

7.2.5.1 Market Size, By Dose, 2016-2026 (USD Million)

7.2.5.2 Market Size, By Type, 2016-2026 (USD Million)

7.2.5.3 Market Size, By Material, 2016-2026 (USD Million)

7.2.6 Canada

7.2.6.1 Market Size, By Dose, 2016-2026 (USD Million)

7.2.6.2 Market Size, By Type, 2016-2026 (USD Million)

7.2.6.3 Market Size, By Material, 2016-2026 (USD Million)

7.3 Europe

7.3.1 Market Size, By Country 2016-2026 (USD Million)

7.3.2 Market Size, By Dose, 2016-2026 (USD Million)

7.3.3 Market Size, By Type, 2016-2026 (USD Million)

7.3.4 Market Size, By Material, 2016-2026 (USD Million)

7.3.5 Germany

7.3.5.1 Market Size, By Dose, 2016-2026 (USD Million)

7.3.5.2 Market Size, By Type, 2016-2026 (USD Million)

7.3.5.3 Market Size, By Material, 2016-2026 (USD Million)

7.3.6 UK

7.3.6.1 Market Size, By Dose, 2016-2026 (USD Million)

7.3.6.2 Market Size, By Type, 2016-2026 (USD Million)

7.3.6.3 Market Size, By Material, 2016-2026 (USD Million)

7.3.7 France

7.3.7.1 Market Size, By Dose, 2016-2026 (USD Million)

7.3.7.2 Market Size, By Type, 2016-2026 (USD Million)

7.3.7.3 Market Size, By Material, 2016-2026 (USD Million)

7.3.8 Italy

7.3.8.1 Market Size, By Dose, 2016-2026 (USD Million)

7.3.8.2 Market Size, By Type, 2016-2026 (USD Million)

7.3.8.3 Market Size, By Material, 2016-2026 (USD Million)

7.3.9 Spain

7.3.9.1 Market Size, By Dose, 2016-2026 (USD Million)

7.3.9.2 Market Size, By Type, 2016-2026 (USD Million)

7.3.9.2 Market Size, By Material, 2016-2026 (USD Million)

7.3.10 Russia

7.3.10.1 Market Size, By Dose, 2016-2026 (USD Million)

7.3.10.2 Market Size, By Type, 2016-2026 (USD Million)

7.3.10.3 Market Size, By Material, 2016-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2016-2026 (USD Million)

7.4.2 Market Size, By Dose, 2016-2026 (USD Million)

7.4.3 Market Size, By Type, 2016-2026 (USD Million)

7.4.4 Market Size, By Material, 2016-2026 (USD Million)

7.4.5 China

7.4.5.1 Market Size, By Dose, 2016-2026 (USD Million)

7.4.5.2 Market Size, By Type, 2016-2026 (USD Million)

7.4.5.3 Market Size, By Material, 2016-2026 (USD Million)

7.4.6 India

7.4.6.1 Market Size, By Dose, 2016-2026 (USD Million)

7.4.6.2 Market Size, By Type, 2016-2026 (USD Million)

7.4.6.3 Market Size, By Material, 2016-2026 (USD Million)

7.4.7 Japan

7.4.7.1 Market Size, By Dose, 2016-2026 (USD Million)

7.4.7.2 Market Size, By Type, 2016-2026 (USD Million)

7.4.7.3 Market Size, By Material, 2016-2026 (USD Million)

7.4.8 Australia

7.4.8.1 Market Size, By Dose, 2016-2026 (USD Million)

7.4.8.2 Market size, By Type, 2016-2026 (USD Million)

7.4.8.3 Market size, By Material, 2016-2026 (USD Million)

7.4.9 South Korea

7.4.9.1 Market Size, By Dose, 2016-2026 (USD Million)

7.4.9.2 Market Size, By Type, 2016-2026 (USD Million)

7.4.9.3 Market Size, By Material, 2016-2026 (USD Million)

7.5 Latin America

7.5.1 Market Size, By Country 2016-2026 (USD Million)

7.5.2 Market Size, By Dose, 2016-2026 (USD Million)

7.5.3 Market Size, By Type, 2016-2026 (USD Million)

7.5.4 Market Size, By Material, 2016-2026 (USD Million)

7.5.4 Brazil

7.5.5.1 Market Size, By Dose, 2016-2026 (USD Million)

7.5.5.2 Market Size, By Type, 2016-2026 (USD Million)

7.5.5.3 Market Size, By Material, 2016-2026 (USD Million)

7.5.6 Mexico

7.5.6.1 Market Size, By Dose, 2016-2026 (USD Million)

7.5.6.2 Market Size, By Type, 2016-2026 (USD Million)

7.5.6.3 Market Size, By Material, 2016-2026 (USD Million)

7.5.7 Argentina

7.5.7.1 Market Size, By Dose, 2016-2026 (USD Million)

7.5.7.2 Market Size, By Type, 2016-2026 (USD Million)

7.5.7.3 Market Size, By Material, 2016-2026 (USD Million)

7.6 MEA

7.6.1 Market Size, By Country 2016-2026 (USD Million)

7.6.2 Market Size, By Dose, 2016-2026 (USD Million)

7.6.3 Market Size, By Type, 2016-2026 (USD Million)

7.6.4 Market Size, By Material, 2016-2026 (USD Million)

7.6.5 Saudi Arabia

7.6.5.1 Market Size, By Dose, 2016-2026 (USD Million)

7.6.5.2 Market Size, By Type, 2016-2026 (USD Million)

7.6.5.3 Market Size, By Material, 2016-2026 (USD Million)

7.6.6 UAE

7.6.6.1 Market Size, By Dose, 2016-2026 (USD Million)

7.6.6.2 Market Size, By Type, 2016-2026 (USD Million)

7.6.6.3 Market Size, By Material, 2016-2026 (USD Million)

7.6.7 South Africa

7.6.7.1 Market Size, By Dose, 2016-2026 (USD Million)

7.6.7.2 Market Size, By Type, 2016-2026 (USD Million)

7.6.7.3 Market Size, By Material, 2016-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Amcor Ltd.

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 West Pharmaceutical Service Inc.

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Gerresheimer AG

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 BD

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Schott AG

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Aptar Group

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Bemis Healthcare Packaging

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Owens-Illinois

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info Graphic Analysis

8.10 Alexander (James) Corporation

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Westrock and Baxter International

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

8.12 Other Companies

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info Graphic Analysis

The Global Ophthalmic Packaging Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Ophthalmic Packaging Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS