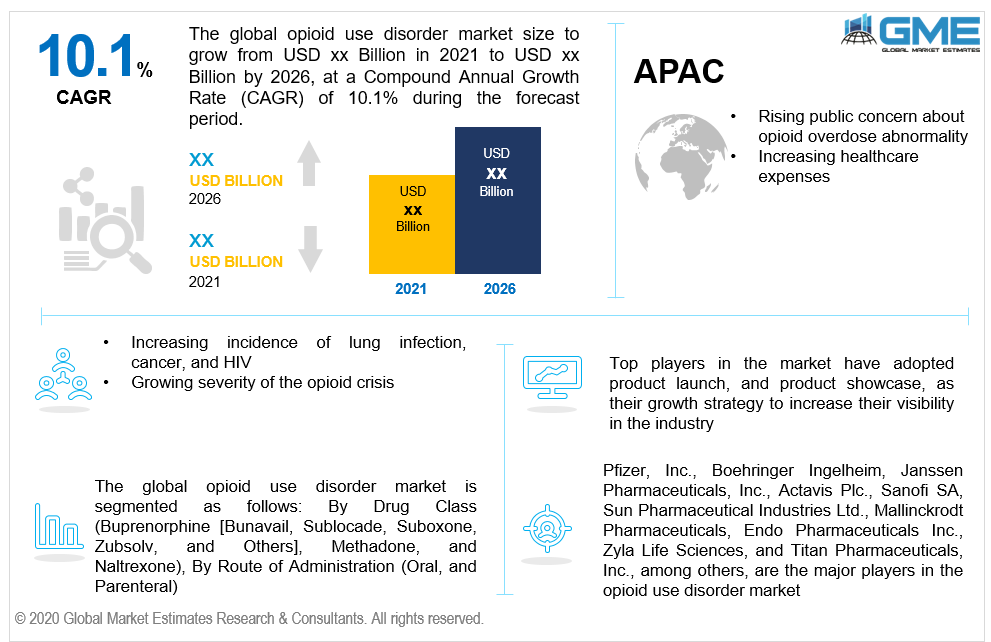

Global Opioid Use Disorder Market Size, Trends & Analysis - Forecasts to 2026 By Drug Class (Buprenorphine [Bunavail, Sublocade, Suboxone, Zubsolv, and Others], Methadone, and Naltrexone), By Route of Administration (Oral, and Parenteral), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis.

Opioids have a sedative impact on the core neurological system which can induce euphoria. Opioid use disorder (OUD) may develop as a result of the overdose or addiction of such opioid drugs. Opioid use disorder (OUD) is a chronic, recurring condition that is associated with considerably higher morbidity and mortality rates. Moreover, opioid use disorder (OUD) is characterised by the abuse of prescription opioid medications, the use of diverted opioid drugs, or the use of illegally acquired heroin. Additionally, due to the number of people suffering from chronic pain increasing globally, the number of prescriptions for painkillers containing opioids is also rising. This leads to the skyrocketing growth scenario in the global opioid use disorder market.

Opioid-based painkillers are used to relieve the patient's pain. However, over time, the patient's over-dependence or addiction to these drugs grows. This addiction can be lethal since an opioid overdose can result in death or lifelong disruption to the individual's natural psychological and physiological functions. To reduce the harm, policymakers around the world, including the United States, have put in place measures to combat this situation effectively. The growing use of buprenorphine prescription patches as a successful medication is one of the upcoming developments in the worldwide market for treating opioid addiction. Buprenorphine patches are thought to be a novel alternative to treating opioid use disorder. Also, transdermal patches have many benefits over other treatment methods such as injections since they are the most convenient mode of opioid administration. They easily relieve discomfort and can be self-administered by the patient. Furthermore, these aforementioned patches could be a viable option for patients that need round-the-clock drug treatment for OUD and would drive growth in the global opioid use disorder market.

Globally, the core demographics are currently suffering from a wide range of acute and chronic illnesses, including cancer, respiratory disease, trauma, and other ailments. These disorders also cause chronic pain in people, who are treated with the use of painkillers, containing opioids. Although the suffering subsides, the patient is more likely to become addicted to these medications. Withdrawal syndrome may arise as a consequence of the patient's growing reliance on these medications and their abrupt discontinuation. As a result, patients tend to consume these opioids, raising the risk of catastrophic outcomes, including opioid overdose mortality. As a result, rising opioid dependence is expected to drive demand growth throughout the forecast period.

Moreover, the growing participation of governmental and non-governmental organisations is another crucial driving force that is expected to fuel the overall demand growth during the forecast period. Additionally, the global opioid use disorder market is being driven by an uptick in the heroin epidemic, as well as the implementation of government measures to combat the problem.

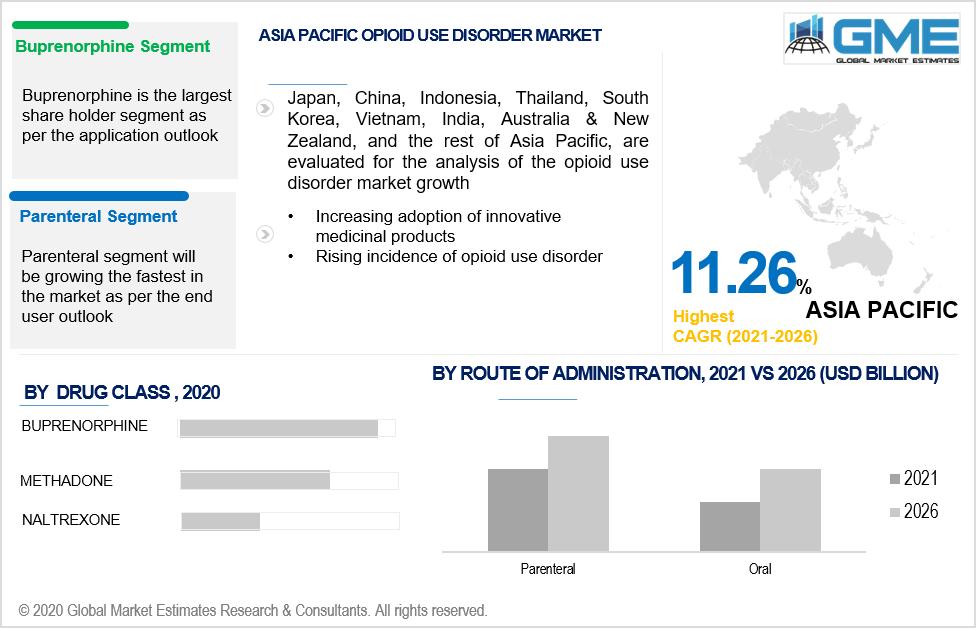

The opioid use disorder market is divided into three categories based on drug class: buprenorphine, methadone, and naltrexone. Buprenorphine is further classified as bunavail, sublocade, suboxone, zubsolv, and others. In conjunction with counselling and behavioural therapy, all the three aforementioned drug categories are FDA approved and successful. The market leader in this segment is buprenorphine. The most commonly used buprenorphine drugs for OUD are buprenorphine/naloxone sublingual pills, buprenorphine sublingual tablets, and branded suboxone. Due to its outstanding clinical profile, buprenorphine is the most widely used medication globally. This medication's extensive acceptance in the global OUD market can be attributed to its high effectiveness in treating addiction, low risk of misuse, relatively minor adverse effects, and favourable formulary scope.

The opioid use disorder market is divided into two categories based on the route of administration: oral and parenteral. Owing to the variety of OUD drugs available in various dosages in the intravenous form, the parenteral segment is presumed to hold the largest market share during the forecast period. The obvious benefits of parenteral injection are the consistency and accuracy of administration, as well as the drug's comparatively swift induction of operation. Parenteral medications have the potential to increase medication adherence. They often allow doctors and nurses to prescribe medications to patients who are intoxicated or otherwise incapable of doing so on their own. Another key benefit of parenteral medications is that they function faster than oral medications. As a result, this method of drug administration continues its global market domination.

As per the geographical analysis, the market can be classified into North America (the US, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa and Central South America. The North American region is presumed to be predominant over the forecast period due to the large number of people in the United States recovering from drug addiction, the role of powerful market leaders in the region, and the government's growing participation in combating the crisis. Due to the rising public concern about opioid overdose abnormality, the Asia Pacific market is presumed to grow at the fastest rate. Furthermore, the large patient demographic pool and the increasing healthcare expenses are expected to favour opioid use disorder market growth in the APAC region.

Pfizer, Inc., Boehringer Ingelheim, Janssen Pharmaceuticals, Inc., Actavis Plc., Sanofi SA, Sun Pharmaceutical Industries Ltd., Mallinckrodt Pharmaceuticals, Endo Pharmaceuticals Inc., Zyla Life Sciences, and Titan Pharmaceuticals, Inc., among others, are the major players in the opioid use disorder market.

Please note: This is not an exhaustive list of companies profiled in the report.

Titan Pharmaceuticals, Inc. revealed in February 2019 that they had entered into a partnership with AllianceRx Walgreens Prime to expand consumer accessibility to Titan's opioid use disorder implant known as "Probuphine Implant." This arrangement was reached after the corporation recognised the fields where the majority of revenue for these drugs is expected to be produced, namely pharmacology distribution. This would improve patients' access to highly appropriate recovery options for opioid use disorder.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Opioid Use Disorder Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Drug Class Overview

2.1.3 Route of Administration Overview

2.1.4 Regional Overview

Chapter 3 Opioid Use Disorder Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 The opioid epidemic's ferocity is growing in North America

3.3.1.2 Pharmaceuticals with a compelling pipeline and drugs that are scheduled to be commercialised

3.3.2 Industry Challenges

3.3.2.1 Issues involved with the insurance schemes for addiction treatments

3.4 Prospective Growth Scenario

3.4.1 Drug Class Growth Scenario

3.4.2 Route of Administration Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Opioid Use Disorder Market, By Drug Class

4.1 Drug Class Outlook

4.2 Buprenorphine

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.2.2 Market Size, By Bunavail, 2019-2026 (USD Million)

4.2.3 Market Size, By Sublocade, 2019-2026 (USD Million)

4.2.4 Market Size, By Suboxone, 2019-2026 (USD Million)

4.2.5 Market Size, By Zubsolv, 2019-2026 (USD Million)

4.2.6 Market Size, By Others, 2019-2026 (USD Million)

4.3 Methadone

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

4.4 Naltrexone

4.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Opioid Use Disorder Market, By Route of Administration

5.1 Route of Administration Outlook

5.2 Oral

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 Parenteral

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Opioid Use Disorder Market, By Region

6.1 Regional Outlook

6.2 North America

6.2.1 Market Size, By Country 2019-2026 (USD Million)

6.2.2 Market Size, By Drug Class, 2019-2026 (USD Million)

6.2.3 Market Size, By Route of Administration, 2019-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Drug Class, 2019-2026 (USD Million)

6.2.4.2 Market Size, By Route of Administration, 2019-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Drug Class, 2019-2026 (USD Million)

6.2.5.2 Market Size, By Route of Administration, 2019-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2019-2026 (USD Million)

6.3.2 Market Size, By Drug Class, 2019-2026 (USD Million)

6.3.3 Market Size, By Route of Administration, 2019-2026 (USD Million)

6.3.4 Germany

6.2.4.1 Market Size, By Drug Class, 2019-2026 (USD Million)

6.2.4.2 Market Size, By Route of Administration, 2019-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Drug Class, 2019-2026 (USD Million)

6.3.5.2 Market Size, By Route of Administration, 2019-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Drug Class, 2019-2026 (USD Million)

6.3.6.2 Market Size, By Route of Administration, 2019-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Drug Class, 2019-2026 (USD Million)

6.3.7.2 Market Size, By Route of Administration, 2019-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Drug Class, 2019-2026 (USD Million)

6.3.8.2 Market Size, By Route of Administration, 2019-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Drug Class, 2019-2026 (USD Million)

6.3.9.2 Market Size, By Route of Administration, 2019-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2019-2026 (USD Million)

6.4.2 Market Size, By Drug Class, 2019-2026 (USD Million)

6.4.3 Market Size, By Route of Administration, 2019-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Drug Class, 2019-2026 (USD Million)

6.4.4.2 Market Size, By Route of Administration, 2019-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Drug Class, 2019-2026 (USD Million)

6.4.5.2 Market Size, By Route of Administration, 2019-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Drug Class, 2019-2026 (USD Million)

6.4.6.2 Market Size, By Route of Administration, 2019-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Drug Class, 2019-2026 (USD Million)

6.4.7.2 Market size, By Route of Administration, 2019-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Drug Class, 2019-2026 (USD Million)

6.4.8.2 Market Size, By Route of Administration, 2019-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2019-2026 (USD Million)

6.5.2 Market Size, By Drug Class, 2019-2026 (USD Million)

6.5.3 Market Size, By Route of Administration, 2019-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Drug Class, 2019-2026 (USD Million)

6.5.4.2 Market Size, By Route of Administration, 2019-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Drug Class, 2019-2026 (USD Million)

6.5.5.2 Market Size, By Route of Administration, 2019-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Drug Class, 2019-2026 (USD Million)

6.5.6.2 Market Size, By Route of Administration, 2019-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2019-2026 (USD Million)

6.6.2 Market Size, By Drug Class, 2019-2026 (USD Million)

6.6.3 Market Size, By Route of Administration, 2019-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Drug Class, 2019-2026 (USD Million)

6.6.4.2 Market Size, By Route of Administration, 2019-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Drug Class, 2019-2026 (USD Million)

6.6.5.2 Market Size, By Route of Administration, 2019-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Drug Class, 2019-2026 (USD Million)

6.6.6.2 Market Size, By Route of Administration, 2019-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Pfizer, Inc.

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Boehringer Ingelheim

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 Janssen Pharmaceuticals, Inc.

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Actavis Plc.

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Sanofi SA

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Sun Pharmaceutical Industries Ltd.

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Mallinckrodt Pharmaceuticals

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Endo Pharmaceuticals Inc.

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Zyla Life Sciences

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

7.11 Titan Pharmaceuticals, Inc.

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info Graphic Analysis

7.12 Other Companies

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 Info Graphic Analysis

The Global Opioid Use Disorder Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Opioid Use Disorder Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS