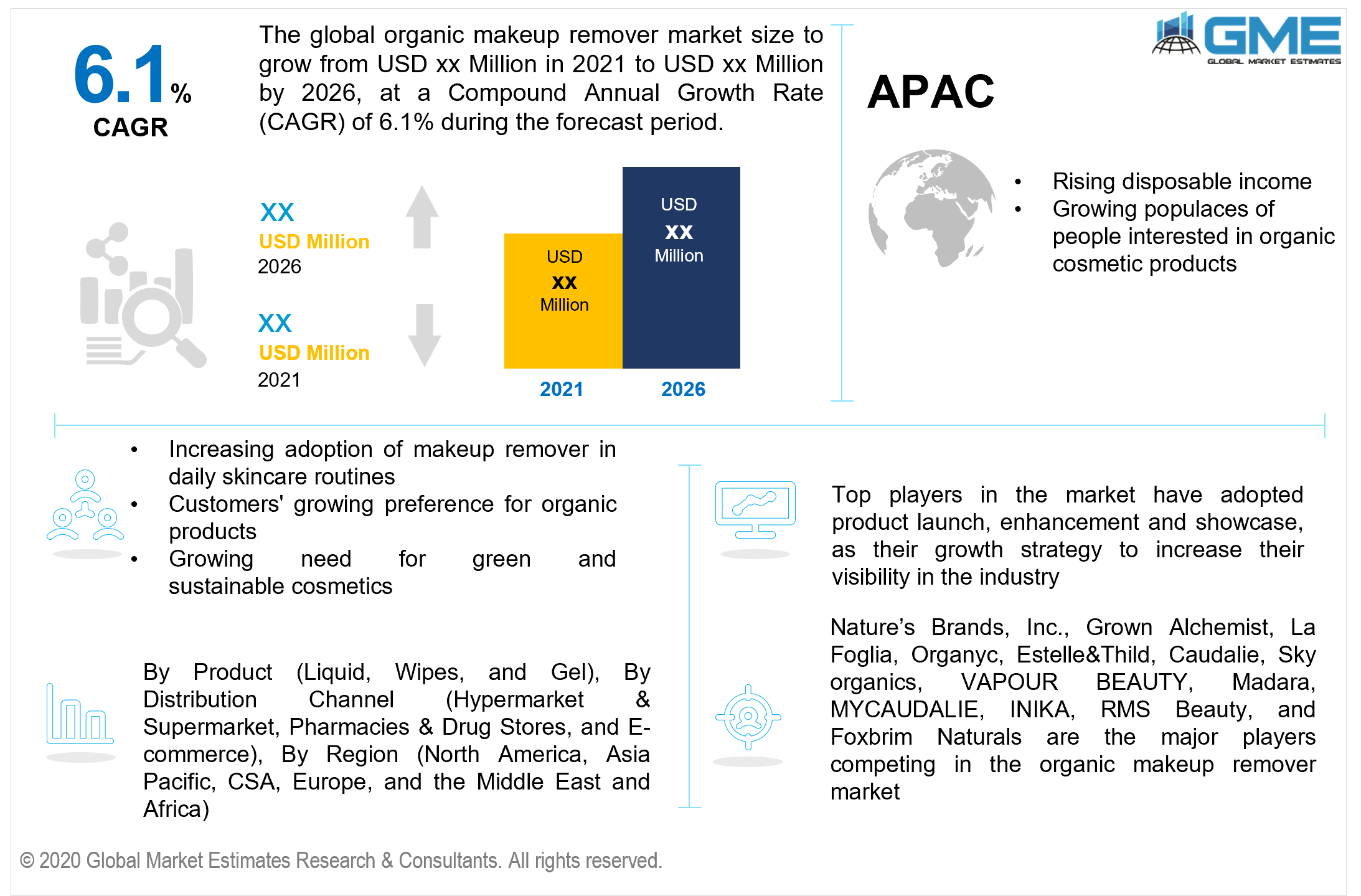

Global Organic Makeup Remover Market Size, Trends, and Analysis - Forecasts To 2026 By Product (Liquid, Wipes, and Gel), By Distribution Channel (Hypermarket & Supermarket, Pharmacies & Drug Stores, and E-commerce), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

Due to the extreme increasing acceptance of appealing aesthetics and immaculate lives across the world, the usage of organic makeup remover is becoming a vogue. The different benefits of using makeup remover include lowering the chance of undesirable skin blemishes, removing dead skin build-up, encouraging cellular regeneration, and others. The abrasive character of the chemicals employed in numerous cosmetics on the market has increased the organic product's use. Moreover, the product's widespread usage, particularly in the modeling and fashion industries, has a beneficial influence on product growth. Furthermore, the increasing demand for the product at skincare and cosmetic salons are expected to develop momentum for the organic makeup remover.

The increased global usage of cosmetic items has also played a significant impact on the increasing need for organic makeup removal solutions. Furthermore, people's awareness of pre-mature aging caused by incorrect makeup removal or prolonged use of makeup for extended durations has produced impetus for the increasing use of organic makeup remover. Moreover, the rising expansion of the global cosmetics sector, as well as the development of appealing goods that assist improve appearance, protect the skin from different issues and increase the use of organic components, all promote the usage of cosmetic products. As a result, there is an exceptional necessitate for organic makeup removal products.

The absence of widespread awareness about such products, as well as the often-increased cost of organic makeup removers, can stymie market development. The market has been driven by the increasing adoption of makeup remover in daily skincare routines, as well as customers' growing preference for organic products. Organic makeup removers that quickly erase dirt, cosmetics, and impurities without harming the skin are in high demand. Rising concerns about the skin irritants and emulsifiers found in typical organic makeup removers, such as phenoxyethanol, phthalates, polysorbates, mineral oils, denatured alcohols, formaldehyde, parabens, and other kinds of emulsifiers, solubilize, and surfactants, which can cause burning sensations around the face and eyes, has persuaded customers to shift to organic makeup removers that are both safe and efficient. The growing notoriety of sustainable and plant-based makeup removers is allowing market participants to diversify their product range in the personal care sector.

Market participants are known to add minerals and vitamins which have antioxidant properties are good for sensitive skin, enhances conditioning, and entails moisturizing effects to maximize sales revenue of organic makeup removers. Bioactive extracts and essential oils are being added to organic makeup removers that provide nutrition to the skin by some of the leading companies. This leads to wider acceptance of organic makeup remover. Another factor that drives the organic makeup remover market is the need for green and sustainable cosmetics. Consumers show a preference for cruelty-free and vegan products, which is prompting market participants to spend more on manufacturing goods that are green-labeled and made from natural ingredients.

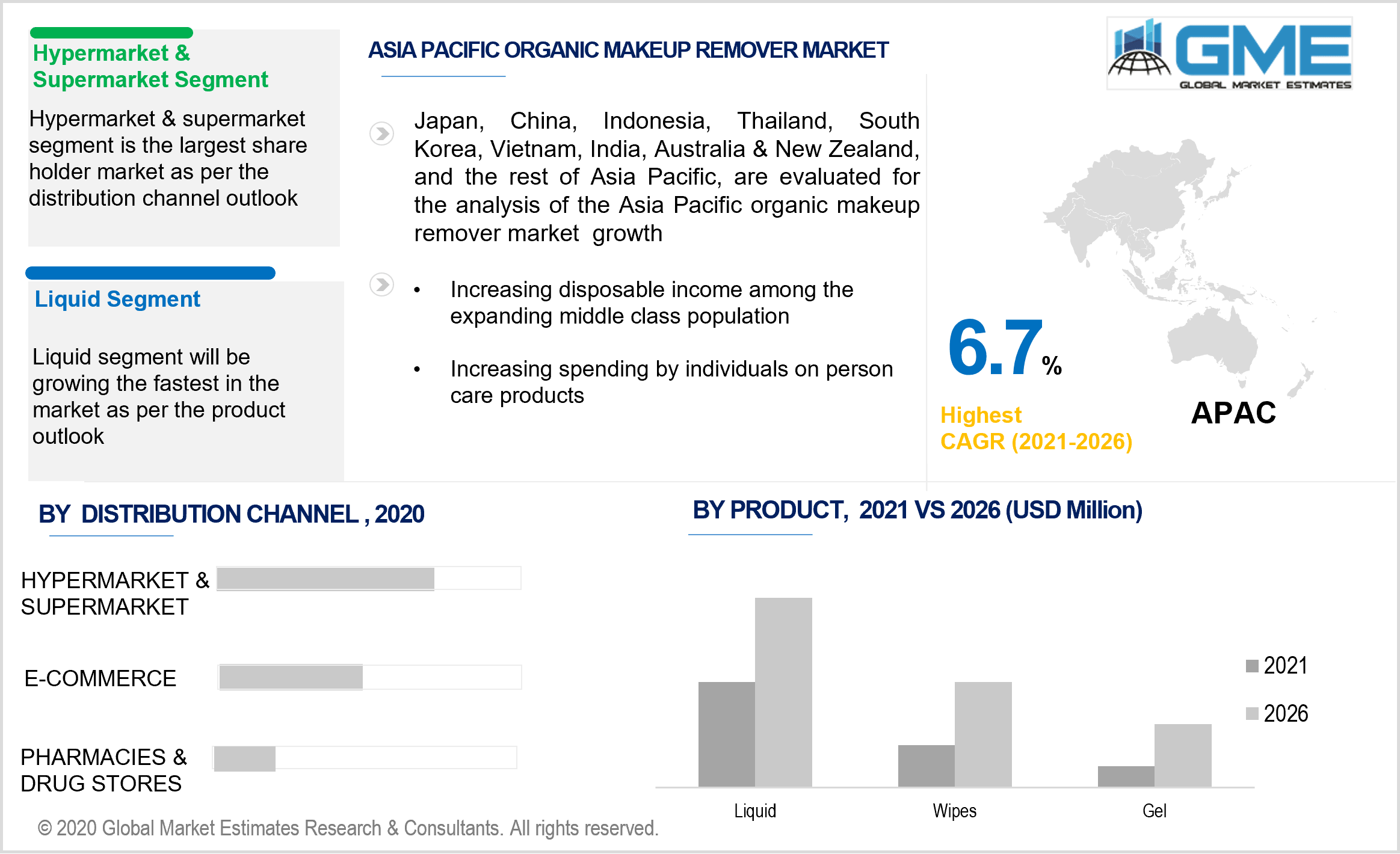

As per the product, the market is categorized as liquid, wipes, and gels. Essential oils, microemulsion, and micellar water are some of the more well-known and often used ingredients in liquid organic makeup cleansers. Moreover, liquid organic makeup removers clean the makeup in one swipe with minimal side effects. Expanding manufacturing of skin-friendly, efficacious liquid base makeup removers formulated from natural ingredients that leave the skin smooth and nourished has led to segment supremacy.

As per the distribution channel, the market is categorized as hypermarkets & supermarkets, pharmacies & drug stores, and e-commerce. The supermarket segment is foreseen to lead in the global market. When it comes to cosmetic products, a sizable portion of the population prefers to visit physical stores, speak with product professionals, and make a purchase. These supermarkets have focused on providing organic and chemical-free products to attract shoppers and give them the option of selecting from a variety of brands before making purchases.

The e-commerce distribution channel segment is estimated to expand at the fastest rate. Numerous online beauty product promotion efforts have made this a profitable market growth channel. This segment's demand is projected to be fueled by expanding internet penetration and firms' focusing on marketing to reach all customer touchpoints.

North America is foreseen to hold the largest share of the organic makeup remover market. The beauty and cosmetics sector in the United States is tightly regulated, and there are several certification programs in place to ensure that products meet environmental standards and perform as promised. Furthermore, the region has several market participants who have been in the industry for a long time. These companies had more time to extend their product portfolios and spend more in R&D to bring innovative products to market, boosting the organic makeup remover market in North America.

Due to rising environmental consciousness and understanding about the impact of toxic chemicals on the skin, the organic makeup remover business has grown significantly in Europe. Organic ingredients have gained ground into a variety of products in upcoming years and have now established themselves as a favored cosmetic ingredient. The organic makeup remover market is driven by European clients who are ready to pay extra for such items because organic makeup removers are better for the skin as well as for the environment.

The Asia Pacific region is anticipated to witness the fastest growth rate. The market's expansion has been aided by a rising middle-class demographic with more discretionary income. Organic product demand is anticipated to rise, particularly in emerging nations like China and India, as consumers become more interested in organic products. Many companies are focusing on organic skincare, which is anticipated to boost the popularity of many green skincare products, including organic makeup removers.

Nature’s Brands, Inc., Grown Alchemist, La Foglia, Organyc, Estelle&Thild, Caudalie, Sky organics, VAPOUR BEAUTY, Madara, MYCAUDALIE, INIKA, RMS Beauty, and Foxbrim Naturals are the major vendors competing in the organic makeup remover market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Products

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Organic Makeup Remover Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Product Overview

2.1.3 Distribution Channel Overview

2.1.4 Regional Overview

Chapter 3 Global Organic Makeup Remover Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing Eco-Consciousness And Awareness About The Effects of Harmful Chemicals

3.3.1.2 Increasing Spending by Individuals on Person Care Products

3.3.2 Industry Challenges

3.3.2.1 Limited availability of Product

3.4 Prospective Growth Scenario

3.4.1 Product Growth Scenario

3.4.2 Distribution Channel Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Organic Makeup Remover Market, By Product

4.1 Product Outlook

4.2 Liquid

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Wipes

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

4.4 Gel

4.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Global Organic Makeup Remover Market, By Distribution Channel

5.1 Distribution Channel Outlook

5.2 Hypermarket & Supermarket

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 Pharmacies & Drug Stores

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

5.4 E-commerce

5.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Global Organic Makeup Remover Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2019-2026 (USD Million)

6.2.2 Market Size, By Product, 2019-2026 (USD Million)

6.2.3 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Product, 2019-2026 (USD Million)

6.2.4.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Product, 2019-2026 (USD Million)

6.2.5.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2019-2026 (USD Million)

6.3.2 Market Size, By Product, 2019-2026 (USD Million)

6.3.3 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.3.4 Germany

6.3.4.1 Market Size, By Product, 2019-2026 (USD Million)

6.3.4.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Product, 2019-2026 (USD Million)

6.3.5.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Product, 2019-2026 (USD Million)

6.3.6.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Product, 2019-2026 (USD Million)

6.3.7.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Product, 2019-2026 (USD Million)

6.3.8.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Product, 2019-2026 (USD Million)

6.3.9.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2019-2026 (USD Million)

6.4.2 Market Size, By Product, 2019-2026 (USD Million)

6.4.3 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Product, 2019-2026 (USD Million)

6.4.4.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Product, 2019-2026 (USD Million)

6.4.5.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Product, 2019-2026 (USD Million)

6.4.6.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Product, 2019-2026 (USD Million)

6.4.7.2 Market size, By Distribution Channel, 2019-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Product, 2019-2026 (USD Million)

6.4.8.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2019-2026 (USD Million)

6.5.2 Market Size, By Product, 2019-2026 (USD Million)

6.5.3 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Product, 2019-2026 (USD Million)

6.5.4.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Product, 2019-2026 (USD Million)

6.5.5.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Product, 2019-2026 (USD Million)

6.5.6.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2019-2026 (USD Million)

6.6.2 Market Size, By Product, 2019-2026 (USD Million)

6.6.3 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Product, 2019-2026 (USD Million)

6.6.4.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Product, 2019-2026 (USD Million)

6.6.5.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Product, 2019-2026 (USD Million)

6.6.6.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Nature’s Brands, Inc.

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Grown Alchemist

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 La Foglia

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Organyc

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Estelle&Thild

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Caudalie

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Sky organics

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 VAPOUR BEAUTY

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Madara

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

7.11 MYCAUDALIE

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info Graphic Analysis

7.12 INIKA

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 Info Graphic Analysis

7.13 RMS Beauty

7.13.1 Company Overview

7.13.2 Financial Analysis

7.13.3 Strategic Positioning

7.13.4 Info Graphic Analysis

7.14 Foxbrim Naturals

7.14.1 Company Overview

7.14.2 Financial Analysis

7.14.3 Strategic Positioning

7.14.4 Info Graphic Analysis

7.15 Other Companies

7.15.1 Company Overview

7.15.2 Financial Analysis

7.15.3 Strategic Positioning

7.15.4 Info Graphic Analysis

The Global Organic Makeup Remover Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Organic Makeup Remover Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS