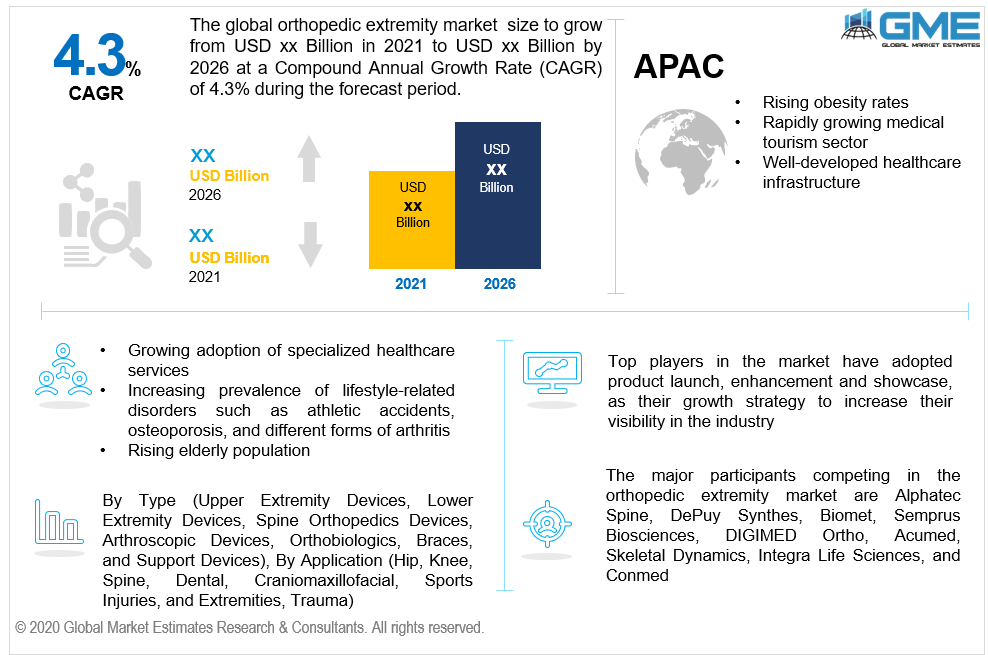

Global Orthopedic Extremity Market Size, Trends, and Analysis - Forecasts To 2026 By Type (Upper Extremity Devices, Lower Extremity Devices, Spine Orthopedics Devices, Arthroscopic Devices, Orthobiologics, Braces, and Support Devices), By Application (Hip, Knee, Spine, Dental, Craniomaxillofacial, Sports Injuries, and Extremities, Trauma), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

Orthopedics is a medical specialty that specializes in injuries and disorders in the body's musculoskeletal system, which includes ligaments, bones, muscles, tendons, nerves, and joints that helps the human body to move. These are treated non-operatively or operatively using methods such as exercise, drugs, alternative treatments, and physical therapy, among others, or surgical operations performed by orthopedic surgeons. These devices are used to substitute a missing bone or joint as well as to protect a damaged bone. They are typically made up of titanium alloy or stainless steel for toughness.

Moreover, the increased cost of the devices and the precautionary protocols linked with the usage of metal implants are anticipated to stifle the orthopedic extremity devices industry's development. The orthopedic extremity devices industry is expected to be challenged in the future by healthcare practitioners who choose stem cell-based therapies and tissue engineering over other therapeutic procedures.

The demand for orthopedic extremity implants is being driven by a rise in average lifespan, adoption of specialized healthcare services, and increasing prevalence of lifestyle-related disorders such as athletic accidents, osteoporosis, and different forms of arthritis. The growing need for orthopedic surgical operations, as well as the need for effective and sophisticated implants such as poly, metal, and ceramic, are driving the orthopedic extremity devices market forward. The orthopedic extremity devices market is influenced by the rise in the incidence of bone-related disorders such as avascular necrosis, osteoarthritis, osteoporosis, and fractures, as well as the increasing demand for surgical operations like revision surgeries, minimally invasive procedures, and shoulder replacements to prolong the durability of implants, healthier and active lifestyle for patients.

Furthermore, the growing prevalence of hip-based lower extremities, rising elderly population, increasing public awareness, increased healthcare spending, and the advent of sophisticated and fully integrated orthopedic devices have a significant impact on the orthopedic extremity devices industry. In addition, advancements in device functionality generate lucrative prospects for orthopedic extremity devices industry participants over the forecast period.

Upper extremity devices, spine orthopedic devices, arthroscopic devices, lower extremity devices, orthobiologics, and braces & support devices are among the product types that make up the global orthopedic extremity market.

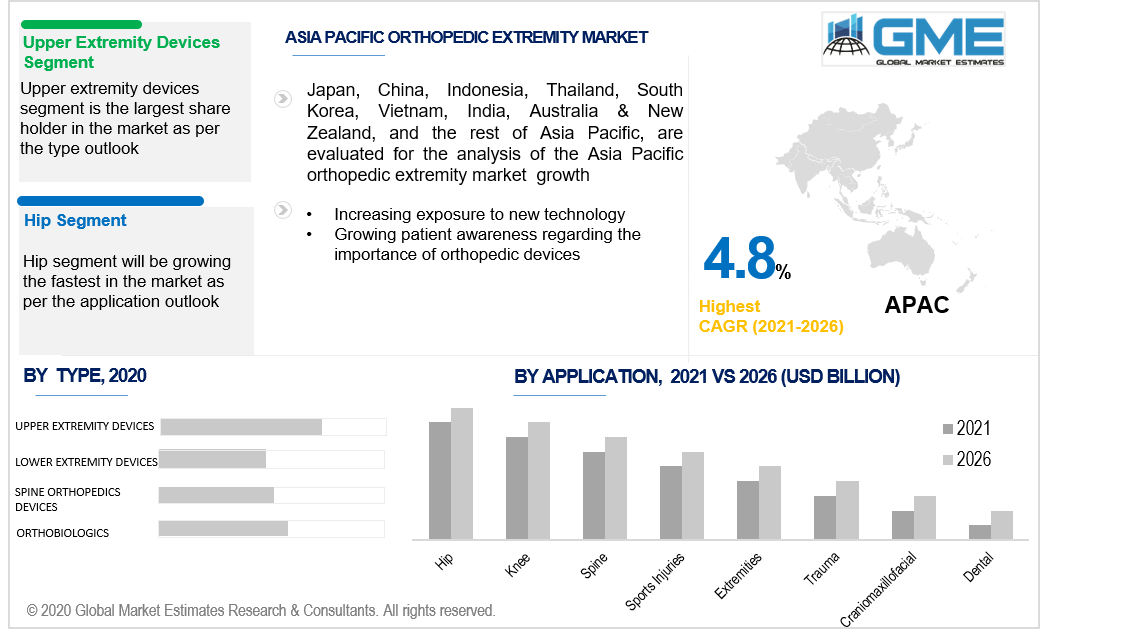

Upper extremity devices, which are divided into elbow, shoulder, and radius, had the highest market share proportion, and are projected to rise at a healthy rate over the forecast period. The growing market for shoulder replacement surgery, as well as medical advancements such as increased implant durability, enhanced patient outcomes, and far less invasive procedures, are contributing to the market's supremacy.

Based on the lower extremities of the body, the segment is further divided into the knee, hip, ankle, and foot. Over the forecast period, the hip-based category is predicted to expand significantly. The rise in the hip replacement sub-segment is due to the rising prevalence of bone-related diseases such as fractures, osteoarthritis, osteonecrosis, and osteoporosis.

Artificial discs, fixation screws, fixation rods/nails, fixation plates, and fixation wires make up the spine orthopedic devices category.

Bone graft and bone cement are the major growth factors that drive up the orthobiologic segment.

The market has been divided into craniomaxillofacial, hip, trauma, knee, dental, sports injury, spine, and extremities based on the application. During the forecast period, hip orthopedic devices is expected to be a rapidly developing market. This is due to an increase in osteoarthritis, which is usual in hips for patients who do not respond to conventional therapy.

Over the forecast period, knee replacement is projected to hold a significant market share. This can be attributed to the rise in the elderly population. In addition, emerging nations are becoming more conscious about joint replacement surgery, which will fuel the market of hip orthopedic during the forecast period.

As per the geographical analysis, the market can be classified into North America (the US, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa and Central South America. North America is presumed to lead this market. Increasing sports injury rates, rising elderly population, and increased health consciousness are some of the main factors contributing to its significant growth. Improvements in orthopedic devices such as anatomic plates and screws in trauma procedures and all-suture anchors and bio composite anchors in soft tissue healing and sports medicine therapies are some of the key drivers. Other reasons, such as enhanced orthopedic surgeon expertise, would further fuel the demand. The key players in this area are concentrating on expanding their extremities portfolio by expanding in a variety of anatomic locations and developing a specialist sales team.

The Asia Pacific market is projected to expand steadily over the forecast period, attributed to rising obesity rates, a large elderly population, well-developed infrastructure, and a rapidly growing medical tourism sector, as well as bone-related diseases like musculoskeletal diseases. Furthermore, rising spending power, an expanding population base, and growing patient awareness regarding the importance of orthopedic devices are driving the APAC orthopedic extremity market development. India and China are expected to have the world's biggest geriatric communities in the upcoming years due to population growth.

The major participants competing in the orthopedic extremity market are Alphatec Spine, DePuy Synthes, Biomet, Semprus Biosciences, DIGIMED Ortho, Acumed, Skeletal Dynamics, Integra Life Sciences, and Conmed.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Orthopedic Extremity Industry Overview, 2016-2026

2.1.1 Industry Overview

2.1.2 Application Overview

2.1.3 Application Overview

2.1.4 Regional Overview

Chapter 3 Orthopedic Extremity Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Technology Advancement in Healthcare Industry

3.3.1.2 Increasing Lifestyle Related Diseases

3.3.2 Industry Challenges

3.3.2.1 Limited Study and Industry Participants

3.4 Prospective Growth Scenario

3.4.1 Application Growth Scenario

3.4.2 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Orthopedic Extremity Market, By Application

4.1 Application Outlook

4.2 Upper Extremity Devices

4.2.1 Market Size, By Region, 2016-2026 (USD Million)

4.3 Lower Extremity Devices

4.3.1 Market Size, By Region, 2016-2026 (USD Million)

4.4 Spine Orthopedics Devices

4.4.1 Market Size, By Region, 2016-2026 (USD Million)

4.5 Arthroscopic Devices

4.5.1 Market Size, By Region, 2016-2026 (USD Million)

4.6 Orthobiologics, Braces

4.6.1 Market Size, By Region, 2016-2026 (USD Million)

4.7 Support Devices

4.7.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 5 Orthopedic Extremity Market, By Application

5.1 Application Outlook

5.2 Hip

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

5.3 Knee

5.3.1 Market Size, By Region, 2016-2026 (USD Million)

5.4 Spine

5.4.1 Market Size, By Region, 2016-2026 (USD Million)

5.5 Dental

5.5.1 Market Size, By Region, 2016-2026 (USD Million)

5.6 Craniomaxillofacial

5.6.1 Market Size, By Region, 2016-2026 (USD Million)

5.7 Sports Injuries

5.7.1 Market Size, By Region, 2016-2026 (USD Million)

5.8 Extremities

5.8.1 Market Size, By Region, 2016-2026 (USD Million)

5.9 Trauma

5.9.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 6 Orthopedic Extremity Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2016-2026 (USD Million)

6.2.2 Market Size, By Type, 2016-2026 (USD Million)

6.2.3 Market Size, By Application, 2016-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Type, 2016-2026 (USD Million)

6.2.4.2 Market Size, By Application, 2016-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Type, 2016-2026 (USD Million)

6.2.5.2 Market Size, By Application, 2016-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2016-2026 (USD Million)

6.3.2 Market Size, By Type, 2016-2026 (USD Million)

6.3.3 Market Size, By Application, 2016-2026 (USD Million)

6.3.4 Germany

6.2.4.1 Market Size, By Type, 2016-2026 (USD Million)

6.2.4.2 Market Size, By Application, 2016-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Type, 2016-2026 (USD Million)

6.3.5.2 Market Size, By Application, 2016-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Type, 2016-2026 (USD Million)

6.3.6.2 Market Size, By Application, 2016-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Type, 2016-2026 (USD Million)

6.3.7.2 Market Size, By Application, 2016-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Type, 2016-2026 (USD Million)

6.3.8.2 Market Size, By Application, 2016-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Type, 2016-2026 (USD Million)

6.3.9.2 Market Size, By Application, 2016-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2016-2026 (USD Million)

6.4.2 Market Size, By Type, 2016-2026 (USD Million)

6.4.3 Market Size, By Application, 2016-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Type, 2016-2026 (USD Million)

6.4.4.2 Market Size, By Application, 2016-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Type, 2016-2026 (USD Million)

6.4.5.2 Market Size, By Application, 2016-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Type, 2016-2026 (USD Million)

6.4.6.2 Market Size, By Application, 2016-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Type, 2016-2026 (USD Million)

6.4.7.2 Market size, By Application, 2016-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Type, 2016-2026 (USD Million)

6.4.8.2 Market Size, By Application, 2016-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2016-2026 (USD Million)

6.5.2 Market Size, By Type, 2016-2026 (USD Million)

6.5.3 Market Size, By Application, 2016-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Type, 2016-2026 (USD Million)

6.5.4.2 Market Size, By Application, 2016-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Type, 2016-2026 (USD Million)

6.5.5.2 Market Size, By Application, 2016-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Type, 2016-2026 (USD Million)

6.5.6.2 Market Size, By Application, 2016-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2016-2026 (USD Million)

6.6.2 Market Size, By Type, 2016-2026 (USD Million)

6.6.3 Market Size, By Application, 2016-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Type, 2016-2026 (USD Million)

6.6.4.2 Market Size, By Application, 2016-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Type, 2016-2026 (USD Million)

6.6.5.2 Market Size, By Application, 2016-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Type, 2016-2026 (USD Million)

6.6.6.2 Market Size, By Application, 2016-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Alphatec Spine

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 DePuy Synthes

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 Biomet

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Semprus Biosciences

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 DIGIMED Ortho

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Acumed

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Skeletal Dynamics

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Integra Life Sciences

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Conmed

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

The Global Orthopedic Extremity Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Orthopedic Extremity Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS