Global Payment as a Service Market Size, Trends & Analysis - Forecasts to 2029 By Services (Managed Services and Professional Services), By End-use Industry (Retail & E-commerce, Healthcare, Travel & Hospitality, BFSI, and Others), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

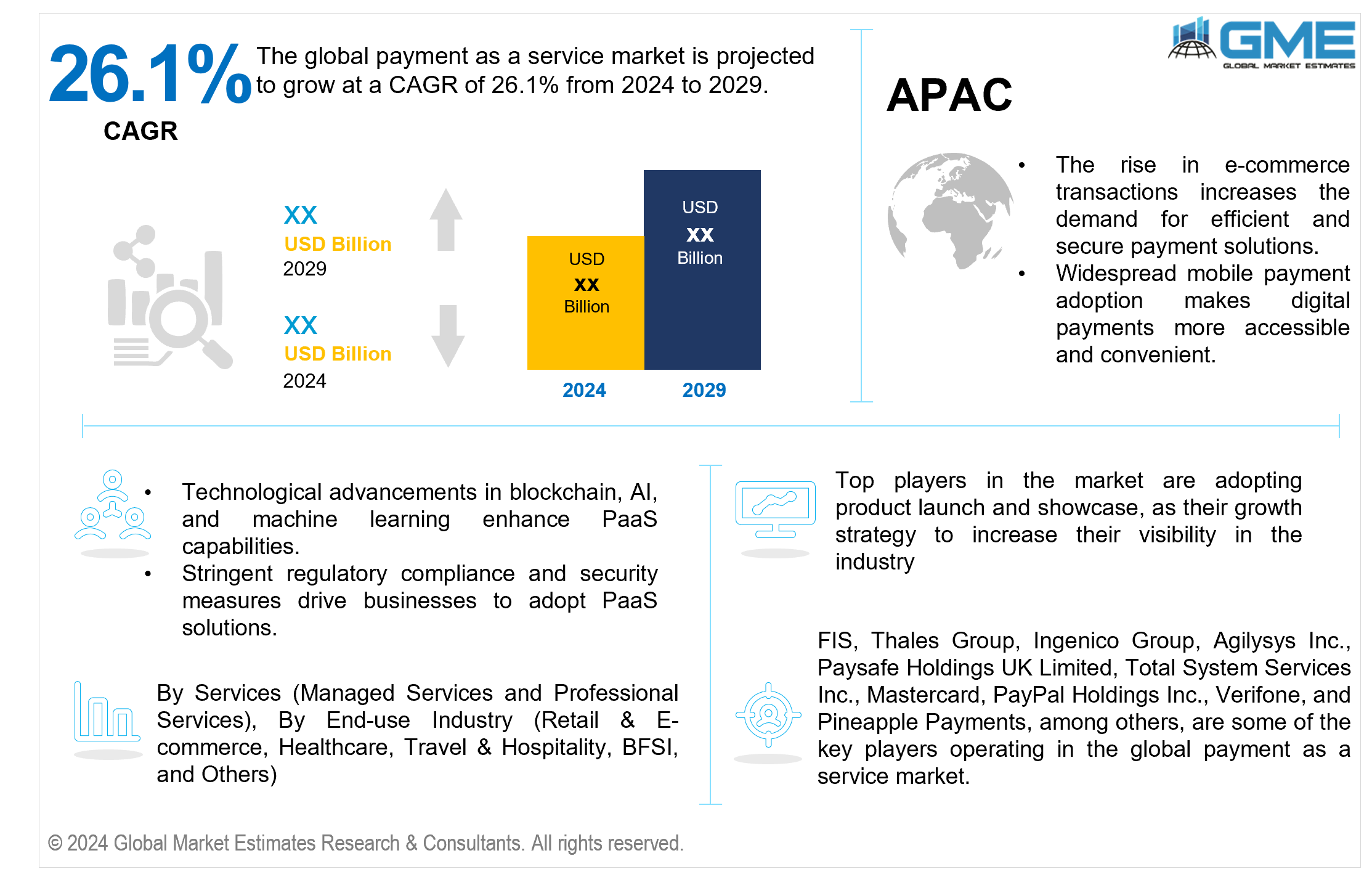

The global payment as a service market is projected to grow at a CAGR of 26.1% from 2024 to 2029.

The global payment as a service (PaaS) market is experiencing growth due to the convergence of modern financial technology (FinTech) developments and rising consumer demand for smooth, efficient, and secure payment processing solutions. One of the key elements driving this rise is the growing adoption of digital payment platforms, which simplify transaction processing and improve the overall user experience. Payment gateway services are important to this ecosystem since they provide the infrastructure required to handle online payment services, ensuring that transactions go smoothly and efficiently. The integration of payment gateway APIs with e-commerce payment solutions has expedited payment processing, making it more accessible and simpler for both businesses and customers.

Furthermore, the advancement of mobile payment technology and contactless payment solutions have transformed how customers interact with payment systems. The proliferation of smartphones and improvements in mobile technology have enabled the development of robust mobile payment platforms, allowing customers to conduct transactions directly from their devices. Contactless payment solutions add to this ease by enabling rapid and secure payments without physical contact, which has become increasingly critical in the wake of health and safety concerns. These technologies are supported by secure payment processing methods and strong payment security measures, ensuring that consumer data is safeguarded and transactions are fraud-free.

Payment APIs (Application Programming Interfaces) and payment integration solutions play an extremely important part in the expansion of the PaaS market. Payment APIs allow developers to integrate payment processing capabilities directly into their applications, resulting in a smooth payment experience for end users. This ease of connectivity has been especially useful for e-commerce payment systems, allowing online merchants to provide numerous and flexible payment alternatives to their customers. Payment service providers (PSPs) are at the forefront of this innovation, providing extensive payment processing networks that accept a variety of payment methods and currencies, thereby catering to a global audience.

The growing payment ecosystem, which includes payment processing networks and payment authorization services, has resulted in a strong infrastructure that enables payment systems to scale and be reliable. Payment infrastructure developments, such as upgraded payment processing networks, have allowed for faster and more reliable transaction processing systems, which is crucial for preserving consumer trust and satisfaction. Additionally, the concept of Payment as a Platform (PaaS) is gaining ground, providing organizations with a scalable and configurable solution for managing their payment processes. This comprehensive approach to payment services simplifies payment processing while also providing useful insights through data analytics, allowing businesses to manage their operations and better serve their consumers.

One constraint for the global payment as a service market is regulatory complexity across regions, as varying compliance requirements and legal frameworks can pose significant challenges to providers, limiting their ability to provide consistent and seamless payment services on a global scale.

The professional services segment is expected to hold the largest share of the market. The segment's growth is due to its critical role in offering expert advice, customization, and support for payment systems. Businesses increasingly rely on professional services to design, manage, and optimize complex payment infrastructures, ensure regulatory compliance, and improve security. The need for specialist knowledge and modified solutions is driving the rise of the professional services segment.

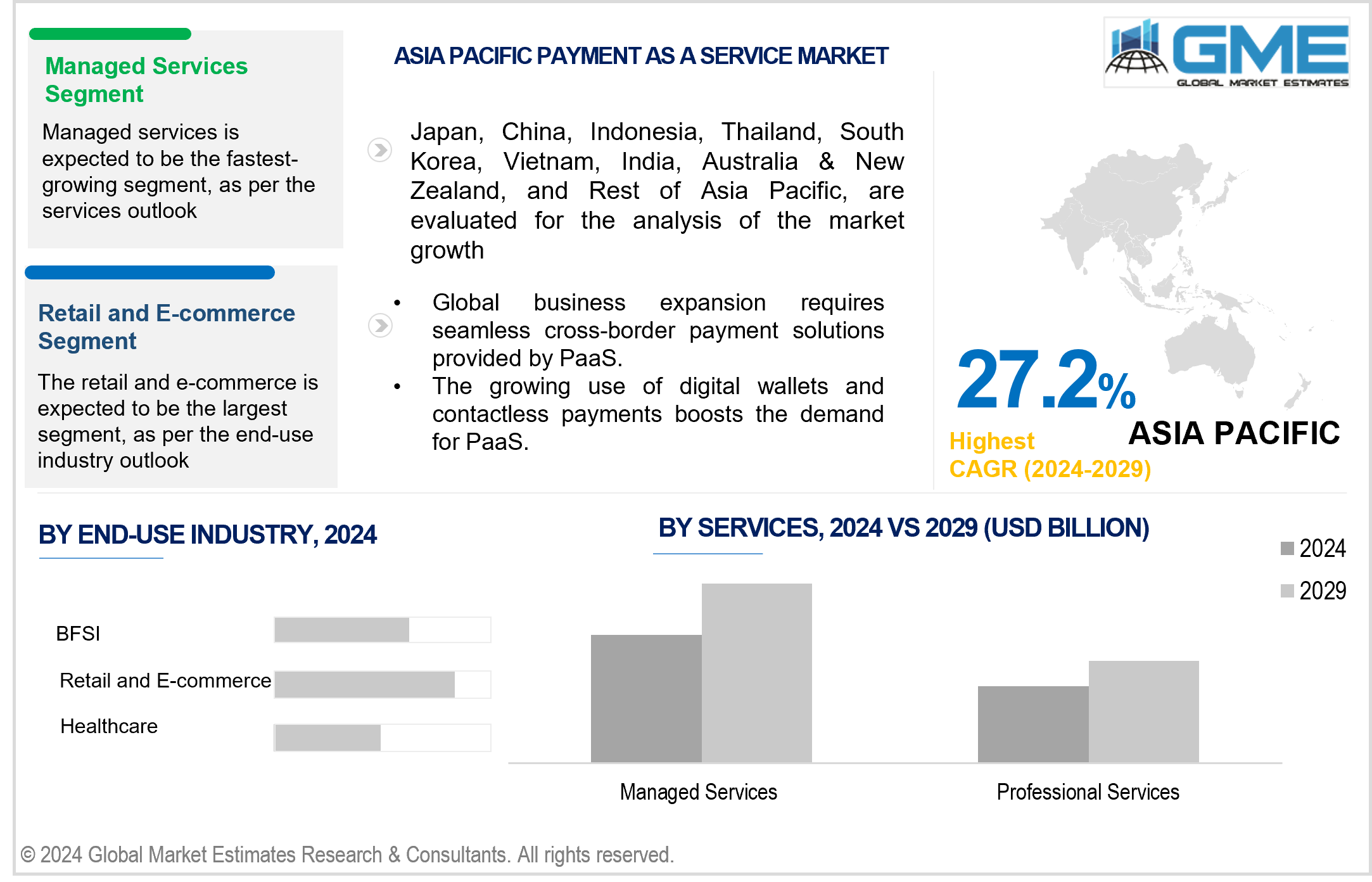

The managed services segment is expected to be the fastest-growing segment in the market from 2024 to 2029. As businesses increasingly outsource their payment processing needs to specialist providers, there is a growing need for managed services. This method enables businesses to focus on core activities while benefiting from sophisticated technologies, scalability, and increased security provided by managed service providers. The increasing complexity of payment systems, as well as the need for ongoing innovation, are driving demand for managed services.

The healthcare segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. The anticipated growth of the segment is owing to increased digitalization and the implementation of electronic health records (EHR). Healthcare providers are integrating payment processing technologies to improve invoicing and patient payments, hence increasing operational efficiency and patient satisfaction. Furthermore, severe data security and compliance requirements in healthcare fuel the demand for secure payment systems, which accelerates the rise of healthcare-specific payment services.

The retail and e-commerce segment is expected to hold the largest share of the market. The expected dominance of the segment is due to increasing transaction volumes and the crucial need for efficient, secure, and seamless payment solutions. The development of online shopping, as well as the demand for different payment methods, drive the adoption of advanced payment technologies, positioning retail and e-commerce as the market's major end-use industries.

North America is expected to be the largest region in the global market. The primary reasons boosting the market growth in this region include robust technological infrastructure, high internet penetration rates, and extensive acceptance of digital payment solutions across industries. The region's strong regulatory environment, as well as the presence of significant firms in FinTech and payment processing, drives its dominance. Furthermore, growing innovation and investments in payment technologies strengthen North America's industry leadership.

Asia Pacific is predicted to witness rapid growth during the forecast period. The regional market growth is attributed to expanding internet and smartphone penetration, a thriving e-commerce sector, and increased usage of digital payment methods. Government attempts to promote cashless economies, as well as the quick proliferation of FinTech firms, all contribute to this trend, establishing Asia Pacific future industry expansion.

FIS, Thales Group, Ingenico Group, Agilysys Inc., Paysafe Holdings UK Limited, Total System Services Inc., Mastercard, PayPal Holdings Inc., Verifone, and Pineapple Payments, among others, are some of the key players operating in the global payment as a service market.

Please note: This is not an exhaustive list of companies profiled in the report.

In January 2024, Ingenico, a global leader in payment acceptance, announced a strategic partnership with Cybersource, Visa's global payment and fraud management platform, to create a unified commerce solution. This partnership will first launch in the Asia Pacific region and later expand globally. It integrates Ingenico's AXIUM application on Cybersource's open payment platform, offering a ready-to-use solution for authorizing in-store card transactions across various geographies.

On June 4, 2024, Temenos, a global banking software company, partnered with Mastercard to enhance cross-border payment capabilities through Mastercard Move. This collaboration integrates Mastercard Move's comprehensive money transfer solutions into the Temenos Payments Hub, enabling banks to offer a variety of international payment options, including transfers to cards, bank accounts, cash pick-up locations, and mobile wallets.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL PAYMENT AS A SERVICE MARKET, BY SERVICES

4.1 Introduction

4.2 Payment as a Service Market: Services Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Managed Services

4.4.1 Managed Services Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Professional Services

4.5.1 Professional Services Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL PAYMENT AS A SERVICE MARKET, BY END-USE INDUSTRY

5.1 Introduction

5.2 Payment as a Service Market: End-use Industry Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Retail and E-commerce

5.4.1 Retail and E-commerce Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 BFSI

5.5.1 BFSI Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Travel & Hospitality

5.6.1 Travel & Hospitality Market Estimates and Forecast, 2021-2029 (USD Million)

5.7 Healthcare

5.7.1 Healthcare Market Estimates and Forecast, 2021-2029 (USD Million)

5.8 Others

5.8.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL PAYMENT AS A SERVICE MARKET, BY REGION

6.1 Introduction

6.2 North America Payment as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.1 By Services

6.2.2 By End-use Industry

6.2.3 By Country

6.2.3.1 U.S. Payment as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.1.1 By Services

6.2.3.1.2 By End-use Industry

6.2.3.2 Canada Payment as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.2.1 By Services

6.2.3.2.2 By End-use Industry

6.2.3.3 Mexico Payment as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.3.1 By Services

6.2.3.3.2 By End-use Industry

6.3 Europe Payment as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.1 By Services

6.3.2 By End-use Industry

6.3.3 By Country

6.3.3.1 Germany Payment as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.1.1 By Services

6.3.3.1.2 By End-use Industry

6.3.3.2 U.K. Payment as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.2.1 By Services

6.3.3.2.2 By End-use Industry

6.3.3.3 France Payment as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.3.1 By Services

6.3.3.3.2 By End-use Industry

6.3.3.4 Italy Payment as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.4.1 By Services

6.3.3.4.2 By End-use Industry

6.3.3.5 Spain Payment as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.5.1 By Services

6.3.3.5.2 By End-use Industry

6.3.3.6 Netherlands Payment as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Services

6.3.3.6.2 By End-use Industry

6.3.3.7 Rest of Europe Payment as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Services

6.3.3.6.2 By End-use Industry

6.4 Asia Pacific Payment as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.1 By Services

6.4.2 By End-use Industry

6.4.3 By Country

6.4.3.1 China Payment as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.1.1 By Services

6.4.3.1.2 By End-use Industry

6.4.3.2 Japan Payment as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.2.1 By Services

6.4.3.2.2 By End-use Industry

6.4.3.3 India Payment as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.3.1 By Services

6.4.3.3.2 By End-use Industry

6.4.3.4 South Korea Payment as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.4.1 By Services

6.4.3.4.2 By End-use Industry

6.4.3.5 Singapore Payment as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.5.1 By Services

6.4.3.5.2 By End-use Industry

6.4.3.6 Malaysia Payment as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Services

6.4.3.6.2 By End-use Industry

6.4.3.7 Thailand Payment as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Services

6.4.3.6.2 By End-use Industry

6.4.3.8 Indonesia Payment as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.7.1 By Services

6.4.3.7.2 By End-use Industry

6.4.3.9 Vietnam Payment as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.8.1 By Services

6.4.3.8.2 By End-use Industry

6.4.3.10 Taiwan Payment as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.10.1 By Services

6.4.3.10.2 By End-use Industry

6.4.3.11 Rest of Asia Pacific Payment as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.11.1 By Services

6.4.3.11.2 By End-use Industry

6.5 Middle East and Africa Payment as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.1 By Services

6.5.2 By End-use Industry

6.5.3 By Country

6.5.3.1 Saudi Arabia Payment as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.1.1 By Services

6.5.3.1.2 By End-use Industry

6.5.3.2 U.A.E. Payment as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.2.1 By Services

6.5.3.2.2 By End-use Industry

6.5.3.3 Israel Payment as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.3.1 By Services

6.5.3.3.2 By End-use Industry

6.5.3.4 South Africa Payment as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.4.1 By Services

6.5.3.4.2 By End-use Industry

6.5.3.5 Rest of Middle East and Africa Payment as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.5.1 By Services

6.5.3.5.2 By End-use Industry

6.6 Central and South America Payment as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.1 By Services

6.6.2 By End-use Industry

6.6.3 By Country

6.6.3.1 Brazil Payment as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.1.1 By Services

6.6.3.1.2 By End-use Industry

6.6.3.2 Argentina Payment as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.2.1 By Services

6.6.3.2.2 By End-use Industry

6.6.3.3 Chile Payment as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Services

6.6.3.3.2 By End-use Industry

6.6.3.3 Rest of Central and South America Payment as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Services

6.6.3.3.2 By End-use Industry

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 North America

7.3.2 Europe

7.3.3 Asia Pacific

7.3.4 Rest of the World

7.4 Company Profiles

7.4.1 Thales Group

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Ingenico Group

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 Agilysys Inc.

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 Paysafe Holdings UK Limited

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 Total System Services Inc.

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 FIS

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 Mastercard

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 PayPal Holdings Inc.

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 Verifone

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 Pineapple Payments

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 Global Payment as a Service Market, By Services, 2021-2029 (USD Mllion)

2 Managed Services Market, By Region, 2021-2029 (USD Mllion)

3 Professional Services Market, By Region, 2021-2029 (USD Mllion)

4 Payment Applications and Gateways Market, By Region, 2021-2029 (USD Mllion)

5 Security and Fraud Protection Market, By Region, 2021-2029 (USD Mllion)

6 Other Services Market, By Region, 2021-2029 (USD Mllion)

7 Global Payment as a Service Market, By End-use Industry, 2021-2029 (USD Mllion)

8 Retail and E-commerce Market, By Region, 2021-2029 (USD Mllion)

9 BFSI Market, By Region, 2021-2029 (USD Mllion)

10 Travel & Hospitality Market, By Region, 2021-2029 (USD Mllion)

11 Healthcare Market, By Region, 2021-2029 (USD Mllion)

12 Others Market, By Region, 2021-2029 (USD Mllion)

13 Regional Analysis, 2021-2029 (USD Mllion)

14 North America Payment as a Service Market, By Services, 2021-2029 (USD Mllion)

15 North America Payment as a Service Market, By End-use Industry, 2021-2029 (USD Mllion)

16 North America Payment as a Service Market, By COUNTRY, 2021-2029 (USD Mllion)

17 U.S. Payment as a Service Market, By Services, 2021-2029 (USD Mllion)

18 U.S. Payment as a Service Market, By End-use Industry, 2021-2029 (USD Mllion)

19 Canada Payment as a Service Market, By Services, 2021-2029 (USD Mllion)

20 Canada Payment as a Service Market, By End-use Industry, 2021-2029 (USD Mllion)

21 Mexico Payment as a Service Market, By Services, 2021-2029 (USD Mllion)

22 Mexico Payment as a Service Market, By End-use Industry, 2021-2029 (USD Mllion)

23 Europe Payment as a Service Market, By Services, 2021-2029 (USD Mllion)

24 Europe Payment as a Service Market, By End-use Industry, 2021-2029 (USD Mllion)

25 Europe Payment as a Service Market, By Country, 2021-2029 (USD Mllion)

26 Germany Payment as a Service Market, By Services, 2021-2029 (USD Mllion)

27 Germany Payment as a Service Market, By End-use Industry, 2021-2029 (USD Mllion)

28 U.K. Payment as a Service Market, By Services, 2021-2029 (USD Mllion)

29 U.K. Payment as a Service Market, By End-use Industry, 2021-2029 (USD Mllion)

30 France Payment as a Service Market, By Services, 2021-2029 (USD Mllion)

31 France Payment as a Service Market, By End-use Industry, 2021-2029 (USD Mllion)

32 Italy Payment as a Service Market, By Services, 2021-2029 (USD Mllion)

33 Italy Payment as a Service Market, By End-use Industry, 2021-2029 (USD Mllion)

34 Spain Payment as a Service Market, By Services, 2021-2029 (USD Mllion)

35 Spain Payment as a Service Market, By End-use Industry, 2021-2029 (USD Mllion)

36 Netherlands Payment as a Service Market, By Services, 2021-2029 (USD Mllion)

37 Netherlands Payment as a Service Market, By End-use Industry, 2021-2029 (USD Mllion)

38 Rest Of Europe Payment as a Service Market, By Services, 2021-2029 (USD Mllion)

39 Rest Of Europe Payment as a Service Market, By End-use Industry, 2021-2029 (USD Mllion)

40 Asia Pacific Payment as a Service Market, By Services, 2021-2029 (USD Mllion)

41 Asia Pacific Payment as a Service Market, By End-use Industry, 2021-2029 (USD Mllion)

42 Asia Pacific Payment as a Service Market, By Country, 2021-2029 (USD Mllion)

43 China Payment as a Service Market, By Services, 2021-2029 (USD Mllion)

44 China Payment as a Service Market, By End-use Industry, 2021-2029 (USD Mllion)

45 Japan Payment as a Service Market, By Services, 2021-2029 (USD Mllion)

46 Japan Payment as a Service Market, By End-use Industry, 2021-2029 (USD Mllion)

47 India Payment as a Service Market, By Services, 2021-2029 (USD Mllion)

48 India Payment as a Service Market, By End-use Industry, 2021-2029 (USD Mllion)

49 South Korea Payment as a Service Market, By Services, 2021-2029 (USD Mllion)

50 South Korea Payment as a Service Market, By End-use Industry, 2021-2029 (USD Mllion)

51 Singapore Payment as a Service Market, By Services, 2021-2029 (USD Mllion)

52 Singapore Payment as a Service Market, By End-use Industry, 2021-2029 (USD Mllion)

53 Thailand Payment as a Service Market, By Services, 2021-2029 (USD Mllion)

54 Thailand Payment as a Service Market, By End-use Industry, 2021-2029 (USD Mllion)

55 Malaysia Payment as a Service Market, By Services, 2021-2029 (USD Mllion)

56 Malaysia Payment as a Service Market, By End-use Industry, 2021-2029 (USD Mllion)

57 Indonesia Payment as a Service Market, By Services, 2021-2029 (USD Mllion)

58 Indonesia Payment as a Service Market, By End-use Industry, 2021-2029 (USD Mllion)

59 Vietnam Payment as a Service Market, By Services, 2021-2029 (USD Mllion)

60 Vietnam Payment as a Service Market, By End-use Industry, 2021-2029 (USD Mllion)

61 Taiwan Payment as a Service Market, By Services, 2021-2029 (USD Mllion)

62 Taiwan Payment as a Service Market, By End-use Industry, 2021-2029 (USD Mllion)

63 Rest of APAC Payment as a Service Market, By Services, 2021-2029 (USD Mllion)

64 Rest of APAC Payment as a Service Market, By End-use Industry, 2021-2029 (USD Mllion)

65 Middle East and Africa Payment as a Service Market, By Services, 2021-2029 (USD Mllion)

66 Middle East and Africa Payment as a Service Market, By End-use Industry, 2021-2029 (USD Mllion)

67 Middle East and Africa Payment as a Service Market, By Country, 2021-2029 (USD Mllion)

68 Saudi Arabia Payment as a Service Market, By Services, 2021-2029 (USD Mllion)

69 Saudi Arabia Payment as a Service Market, By End-use Industry, 2021-2029 (USD Mllion)

70 UAE Payment as a Service Market, By Services, 2021-2029 (USD Mllion)

71 UAE Payment as a Service Market, By End-use Industry, 2021-2029 (USD Mllion)

72 Israel Payment as a Service Market, By Services, 2021-2029 (USD Mllion)

73 Israel Payment as a Service Market, By End-use Industry, 2021-2029 (USD Mllion)

74 South Africa Payment as a Service Market, By Services, 2021-2029 (USD Mllion)

75 South Africa Payment as a Service Market, By End-use Industry, 2021-2029 (USD Mllion)

76 Rest Of Middle East and Africa Payment as a Service Market, By Services, 2021-2029 (USD Mllion)

77 Rest Of Middle East and Africa Payment as a Service Market, By End-use Industry, 2021-2029 (USD Mllion)

78 Central and South America Payment as a Service Market, By Services, 2021-2029 (USD Mllion)

79 Central and South America Payment as a Service Market, By End-use Industry, 2021-2029 (USD Mllion)

80 Central and South America Payment as a Service Market, By Country, 2021-2029 (USD Mllion)

81 Brazil Payment as a Service Market, By Services, 2021-2029 (USD Mllion)

82 Brazil Payment as a Service Market, By End-use Industry, 2021-2029 (USD Mllion)

83 Chile Payment as a Service Market, By Services, 2021-2029 (USD Mllion)

84 Chile Payment as a Service Market, By End-use Industry, 2021-2029 (USD Mllion)

85 Argentina Payment as a Service Market, By Services, 2021-2029 (USD Mllion)

86 Argentina Payment as a Service Market, By End-use Industry, 2021-2029 (USD Mllion)

87 Rest Of Central and South America Payment as a Service Market, By Services, 2021-2029 (USD Mllion)

88 Rest Of Central and South America Payment as a Service Market, By End-use Industry, 2021-2029 (USD Mllion)

89 Thales Group: Products & Services Offering

90 Ingenico Group: Products & Services Offering

91 Agilysys Inc.: Products & Services Offering

92 Paysafe Holdings UK Limited: Products & Services Offering

93 Total System Services Inc.: Products & Services Offering

94 FIS: Products & Services Offering

95 Mastercard : Products & Services Offering

96 PayPal Holdings Inc.: Products & Services Offering

97 Verifone, Inc: Products & Services Offering

98 Pineapple Payments: Products & Services Offering

99 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Payment as a Service Market Overview

2 Global Payment as a Service Market Value From 2021-2029 (USD Mllion)

3 Global Payment as a Service Market Share, By Services (2023)

4 Global Payment as a Service Market Share, By End-use Industry (2023)

5 Global Payment as a Service Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Payment as a Service Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Payment as a Service Market

10 Impact Of Challenges On The Global Payment as a Service Market

11 Porter’s Five Forces Analysis

12 Global Payment as a Service Market: By Services Scope Key Takeaways

13 Global Payment as a Service Market, By Services Segment: Revenue Growth Analysis

14 Managed Services Market, By Region, 2021-2029 (USD Mllion)

15 Professional Services Market, By Region, 2021-2029 (USD Mllion)

16 Security and Fraud Protection Market, By Region, 2021-2029 (USD Mllion)

17 Payment Applications and GatewaysMarket, By Region, 2021-2029 (USD Mllion)

18 Other Services Market, By Region, 2021-2029 (USD Mllion)

19 Global Payment as a Service Market: By End-use Industry Scope Key Takeaways

20 Global Payment as a Service Market, By End-use Industry Segment: Revenue Growth Analysis

21 Retail and E-commerce Market, By Region, 2021-2029 (USD Mllion

22 BFSI Market, By Region, 2021-2029 (USD Mllion)

23 Travel & Hospitality Market, By Region, 2021-2029 (USD Mllion)

24 Healthcare Market, By Region, 2021-2029 (USD Mllion)

25 Others Market, By Region, 2021-2029 (USD Mllion)

26 Regional Segment: Revenue Growth Analysis

27 Global Payment as a Service Market: Regional Analysis

28 North America Payment as a Service Market Overview

29 North America Payment as a Service Market, By Services

30 North America Payment as a Service Market, By End-use Industry

31 North America Payment as a Service Market, By Country

32 U.S. Payment as a Service Market, By Services

33 U.S. Payment as a Service Market, By End-use Industry

34 Canada Payment as a Service Market, By Services

35 Canada Payment as a Service Market, By End-use Industry

36 Mexico Payment as a Service Market, By Services

37 Mexico Payment as a Service Market, By End-use Industry

38 Four Quadrant Positioning Matrix

39 Company Market Share Analysis

40 Thales Group: Company Snapshot

41 Thales Group: SWOT Analysis

42 Thales Group: Geographic Presence

43 Ingenico Group: Company Snapshot

44 Ingenico Group: SWOT Analysis

45 Ingenico Group: Geographic Presence

46 Agilysys Inc.: Company Snapshot

47 Agilysys Inc.: SWOT Analysis

48 Agilysys Inc.: Geographic Presence

49 Paysafe Holdings UK Limited: Company Snapshot

50 Paysafe Holdings UK Limited: Swot Analysis

51 Paysafe Holdings UK Limited: Geographic Presence

52 Total System Services Inc.: Company Snapshot

53 Total System Services Inc.: SWOT Analysis

54 Total System Services Inc.: Geographic Presence

55 FIS: Company Snapshot

56 FIS: SWOT Analysis

57 FIS: Geographic Presence

58 Mastercard : Company Snapshot

59 Mastercard : SWOT Analysis

60 Mastercard : Geographic Presence

61 PayPal Holdings Inc.: Company Snapshot

62 PayPal Holdings Inc.: SWOT Analysis

63 PayPal Holdings Inc.: Geographic Presence

64 Verifone, Inc.: Company Snapshot

65 Verifone, Inc.: SWOT Analysis

66 Verifone, Inc.: Geographic Presence

67 Pineapple Payments: Company Snapshot

68 Pineapple Payments: SWOT Analysis

69 Pineapple Payments: Geographic Presence

70 Other Companies: Company Snapshot

71 Other Companies: SWOT Analysis

72 Other Companies: Geographic Presence

The Global Payment as a Service Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Payment as a Service Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS