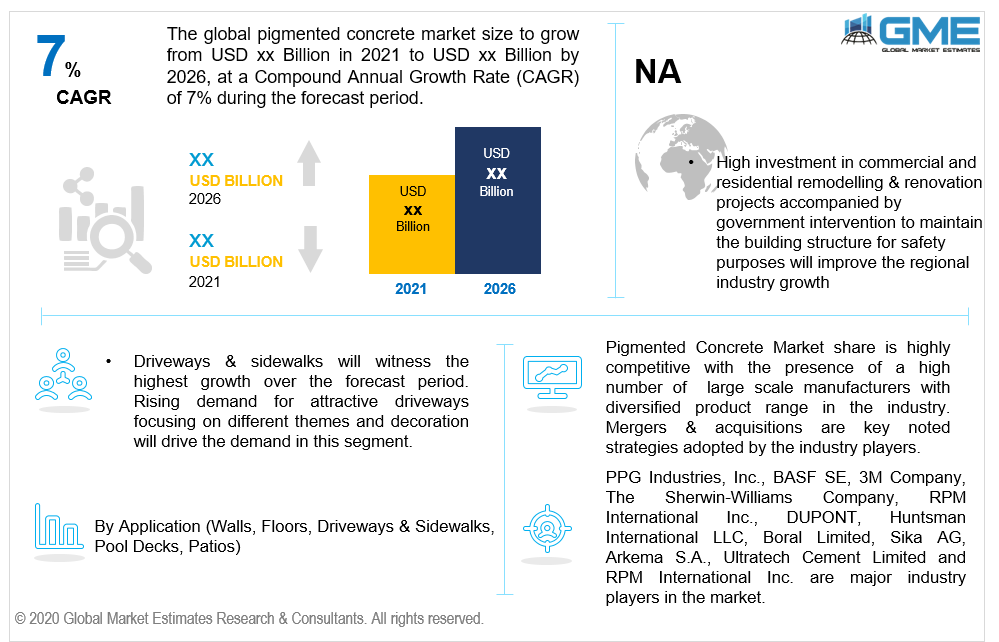

Global Pigmented Concrete Market Size, Trends & Analysis - Forecasts to 2026 By Type (Stained, Dyed, Paint, Tinted Sealers, Integral Colour, Dry Shake Colour Hardener), By Application (Walls, Floors, Driveways & Sidewalks, Pool Decks, Patios), By End-Use (Residential, Non-Residential), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa); End-User Landscape, Company Market Share Analysis, and Competitor Analysis

Increasing remodeling and renovation trends in the construction industry to improve the overall infrastructure aesthetics will drive the pigmented concrete market growth. Structure appearance enhancements along with better cost-effectiveness are among the major factors stimulating product demand in residential and non-residential sectors.

Previously, the pigmented concrete was solely used by the companies who were into precast structure supplies for building facades. However, changes in customer needs to improve the building exterior by offering a unique touch will promote the product demand. Providing unique designs, highlighting paved areas and different interior coloring in the same space are key factors influencing the pigmented concrete market growth.

Pigments for cement are extracted from the ground or manufactured through chemical processes. Mostly these colored pigments are derived from minute iron oxide particles, which are later mixed with the wet cement mix and cover up the entire cement particles, and end-up by producing a tint. Decisions on the color ratio are dependent on the cement mixture measure and wish for color need. Powder, granular, and liquid are three forms in which these colors can be obtained depending on the user requirement.

Rising trends to give an aesthetic touch to the houses, hotels, restaurants, and other institutional buildings have positively influenced the pigmented concrete demand. These unique types of cement give an ample amount of creativity to the user to enhance the construction in a more artistic and presentable way. For instance, coloured cement can be used to divide a large patio area or long driveway. Coloring them with different themes enriches the overall infrastructure appearance. The product has wide acceptance due to its multiple coloring and texture style to suit different customers. With the increasing focus on ecology and green campus, many designers are applying nature-friendly coloring walls and patios to replicate the outside nature.

An increase in investment in building renovation and development of smart cities will open new opportunities to instigate pigmented concrete demand. The product has high potential due to its large applicability in different construction areas such as floors, walls, pool decks, patios, galleries, and driveways.

Concrete surface renovation can restore damaged slabs in a more cost-effective and time-saving manner. These surfaces do not necessitate the four-week preservation timeline to cure the cement. Thus, makes them the best suitable alternative to replace or demolish the existing structure.

Stains, dyes, paint, tint, integral color, and dry shake color hardener are major product types. With the presence of various color and texture cement types, it gives ample opportunity to the user to create different interiors and exteriors in the building. The rising demand for diversified building appearances depending on the facility type such as restaurants, hotels, hospitals, malls, and colleges will reinforce the pigmented concrete industry growth.

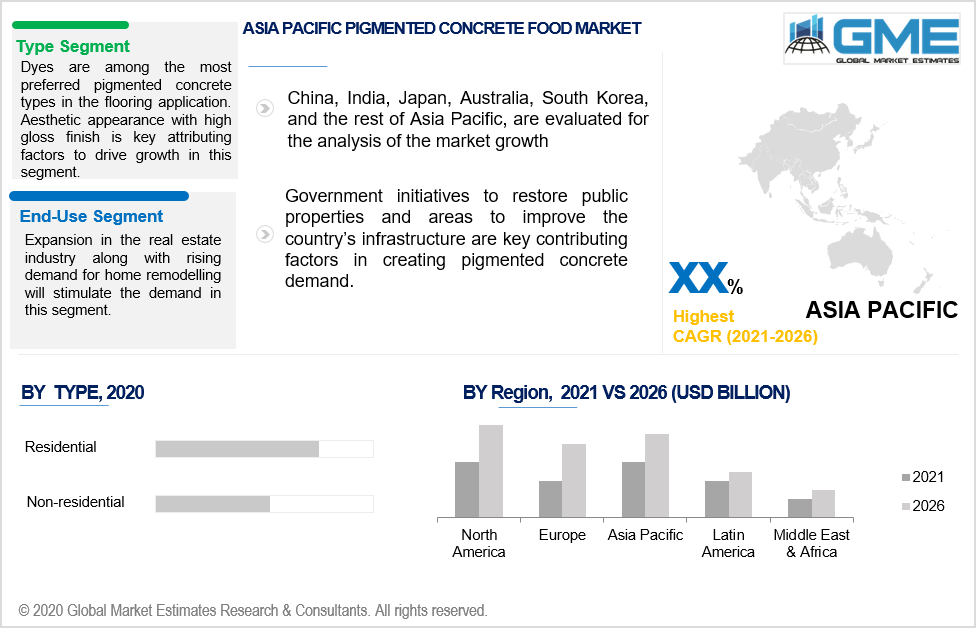

Dyes are among the most preferred pigmented concrete types in the flooring application. Aesthetic appearance with a high gloss finish is a key attributing factor to drive growth in this segment. Pigmented concrete dyes are penetrating and translucent coloring solutions. Unlike stains, this cement does not give chemical reactions to the cement. In its place, they provide a fine coloring agent that penetrates the surface to offer a glossy finish. The product holds high potential as an alternative to granite, marble, linoleum, flooring due to high cost-effectiveness and ability to sustain more foot pressure. Less maintenance and high moisture resistance make them the best for hotels & restaurants, malls, and retail store applications.

Pigmented concrete applications are segmented into walls, floors, driveways & sidewalks, pool decks, and patios. Driveways & sidewalks will witness the highest growth over the forecast period. The rising demand for attractive driveways focusing on different themes and decorations will drive the demand in this segment. Stained pigmented concrete is noted to be the most preferred choice in the driveways & sidewalks. Minimal maintenance to conserve the texture and color of the walkway along with its applicability on the existing surface without any additional cost are major benefits offered by the stained concrete.

By end-use, the market is segmented into residential and non-residential segments. The residential sector is expected to witness the fastest growth in the coming years. Expansion in the real estate industry along with rising demand for home remodeling will stimulate the demand in this segment. An increase in preference for township homes among the consumers while investing in properties has influenced the construction companies to improvise the overall home experience. Moreover, the growing trend to remodel the pre-owned houses and sell them at a higher price has resulted in more investment in decorative walls and flooring.

Asia Pacific pigmented concrete market is projected to account for significant market share by 2026. An increase in infrastructure spending along with growing demand for remodeling structures in the residential & non-residential sectors will fuel the regional growth. Government initiatives to restore public properties and areas to improve the country’s infrastructure are key contributing factors in creating pigmented concrete demand.

North America will witness around 6.5% growth during the forecast period. Factors such as high investment in commercial and residential remodeling & renovation projects accompanied by government intervention to maintain the building structure for safety purposes will improve the regional industry growth.

Pigmented Concrete Market share is highly competitive with the presence of a high number of large-scale manufacturers with diversified product range in the industry. PPG Industries, Inc., BASF SE, 3M Company, The Sherwin-Williams Company, RPM International Inc., DUPONT, Huntsman International LLC, Boral Limited, Sika AG, Arkema S.A., Ultratech Cement Limited and RPM International Inc. are major industry players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

Mergers & acquisitions are keynoted strategies adopted by the industry players. For instance, in December 2020, PPG Industries initiated the acquisition process of Tikkurila, a Finland-based paint & coating manufacturer. The deal will be finalized by the 2nd quarter of 2021. The Finnish company has a stronghold in European countries for its decorative paint brands. The acquisition will benefit the PPG by cross-selling the products in new areas.

CEMEX, Heidelbergcement AG, Covestro AG, Dex-O-Tex, Elite Crete Systems, MAPEI Corporation, Neocrete Technologies Pvt Ltd, and Parchem Construction Supplies are other notable industry participants.

Chapter 1 Methodology

1.1 Market scope & definitions

1.2 Estimates & forecast calculation

1.3 Historical data overview and validation

1.4 Data sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Pigmented concrete industry overview, 2016-2026

2.1.1 Industry overview

2.1.2 Type overview

2.1.3 Application overview

2.1.4 End-Use overview

2.1.5 Regional overview

Chapter 3 Pigmented Concrete Market Trends

3.1 Market segmentation

3.2 Industry background, 2016-2026

3.3 Market key trends

3.3.1 Positive trends

3.3.2 Industry challenges

3.4 Prospective growth scenario

3.4.1 Material growth scenario

3.4.2 Type growth scenario

3.5 COVID-19 influence over industry growth

3.6 Porter’s analysis

3.7 PESTEL analysis

3.8 Value chain & supply chain analysis

3.9 Regulatory framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology overview

3.10.1 Material

3.10.2 Process

3.11 Market share analysis, 2020

3.11.1 Company positioning overview, 2020

Chapter 4 Pigmented Concrete Market, By Type

4.1 Type Outlook

4.2 Stained

4.2.1 Market size, by region, 2016-2026 (USD Million)

4.3 Dyed

4.3.1 Market size, by region, 2016-2026 (USD Million)

4.4 Paint

4.4.1 Market size, by region, 2016-2026 (USD Million)

4.5 Tinted sealers

4.5.1 Market size, by region, 2016-2026 (USD Million)

4.6 Integral colour

4.6.1 Market size, by region, 2016-2026 (USD Million)

4.7 Dry shake colour hardener

4.7.1 Market size, by region, 2016-2026 (USD Million)

Chapter 5 Pigmented Concrete Market, By Application

5.1 Application Outlook

5.2 Walls

5.2.1 Market size, by region, 2016-2026 (USD Million)

5.3 Floors

5.3.1 Market size, by region, 2016-2026 (USD Million)

5.4 Driveways & Sidewalks

5.3.1 Market size, by region, 2016-2026 (USD Million)

5.5 Pool Decks

5.5.1 Market size, by region, 2016-2026 (USD Million)

5.6 Patios

5.6.1 Market size, by region, 2016-2026 (USD Million)

5.7 Others

5.7.1 Market size, by region, 2016-2026 (USD Million)

Chapter 6 Pigmented Concrete Market, By End-Use

6.1 End-Use Outlook

6.2 Residential

6.2.1 Market size, by region, 2016-2026 (USD Million)

6.3 Non-residential

6.3.1 Market size, by region, 2016-2026 (USD Million)

Chapter 7 Pigmented Concrete Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market size, by country 2016-2026 (USD Million)

7.2.2 Market size, by type, 2016-2026 (USD Million)

7.2.3 Market size, by application, 2016-2026 (USD Million)

7.2.4 Market size, by end-use, 2016-2026 (USD Million)

7.2.5 U.S.

7.2.5.1 Market size, by type, 2016-2026 (USD Million)

7.2.5.2 Market size, by application, 2016-2026 (USD Million)

7.2.5.3 Market size, by end-use, 2016-2026 (USD Million)

7.2.6 Canada

7.2.6.1 Market size, by type, 2016-2026 (USD Million)

7.2.6.2 Market size, by application, 2016-2026 (USD Million)

7.2.6.3 Market size, by end-use, 2016-2026 (USD Million)

7.3 Europe

7.3.1 Market size, by country 2016-2026 (USD Million)

7.3.2 Market size, by type, 2016-2026 (USD Million)

7.3.3 Market size, by application, 2016-2026 (USD Million)

7.3.4 Market size, by end-use, 2016-2026 (USD Million)

7.3.5 Germany

7.2.5.1 Market size, by type, 2016-2026 (USD Million)

7.2.5.2 Market size, by application, 2016-2026 (USD Million)

7.2.5.3 Market size, by end-use, 2016-2026 (USD Million)

7.3.6 UK

7.3.6.1 Market size, by type, 2016-2026 (USD Million)

7.3.6.2 Market size, by application, 2016-2026 (USD Million)

7.3.6.3 Market size, by end-use, 2016-2026 (USD Million)

7.3.7 France

7.3.7.1 Market size, by type, 2016-2026 (USD Million)

7.3.7.2 Market size, by application, 2016-2026 (USD Million)

7.3.7.3 Market size, by end-use, 2016-2026 (USD Million)

7.3.8 Italy

7.3.8.1 Market size, by type, 2016-2026 (USD Million)

7.3.8.2 Market size, by application, 2016-2026 (USD Million)

7.3.8.3 Market size, by end-use, 2016-2026 (USD Million)

7.3.9 Spain

7.3.9.1 Market size, by type, 2016-2026 (USD Million)

7.3.9.2 Market size, by application, 2016-2026 (USD Million)

7.3.9.3 Market size, by end-use, 2016-2026 (USD Million)

7.3.10 Russia

7.3.10.1 Market size, by type, 2016-2026 (USD Million)

7.3.10.2 Market size, by application, 2016-2026 (USD Million)

7.3.10.3 Market size, by end-use, 2016-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market size, by country 2016-2026 (USD Million)

7.4.2 Market size, by type, 2016-2026 (USD Million)

7.4.3 Market size, by application, 2016-2026 (USD Million)

7.4.4 Market size, by end-use, 2016-2026 (USD Million)

7.4.5 China

7.4.5.1 Market size, by type, 2016-2026 (USD Million)

7.4.5.2 Market size, by application, 2016-2026 (USD Million)

7.4.5.3 Market size, by end-use, 2016-2026 (USD Million)

7.4.6 India

7.4.6.1 Market size, by type, 2016-2026 (USD Million)

7.4.6.2 Market size, by application, 2016-2026 (USD Million)

7.4.6.3 Market size, by end-use, 2016-2026 (USD Million)

7.4.7 Japan

7.4.7.1 Market size, by type, 2016-2026 (USD Million)

7.4.7.2 Market size, by application, 2016-2026 (USD Million)

7.4.7.3 Market size, by end-use, 2016-2026 (USD Million)

7.4.8 Australia

7.4.8.1 Market size, by type, 2016-2026 (USD Million)

7.4.8.2 Market size, by application, 2016-2026 (USD Million)

7.4.8.3 Market size, by end-use, 2016-2026 (USD Million)

7.4.9 South Korea

7.4.9.1 Market size, by type, 2016-2026 (USD Million)

7.4.9.2 Market size, by application, 2016-2026 (USD Million)

7.4.9.3 Market size, by end-use, 2016-2026 (USD Million)

7.5 Latin America

7.5.1 Market size, by country 2016-2026 (USD Million)

7.5.2 Market size, by type, 2016-2026 (USD Million)

7.5.3 Market size, by application, 2016-2026 (USD Million)

7.5.4 Market size, by end-use, 2016-2026 (USD Million)

7.5.5 Brazil

7.5.5.1 Market size, by type, 2016-2026 (USD Million)

7.5.5.2 Market size, by application, 2016-2026 (USD Million)

7.5.5.3 Market size, by end-use, 2016-2026 (USD Million)

7.5.6 Mexico

7.5.6.1 Market size, by type, 2016-2026 (USD Million)

7.5.6.2 Market size, by application, 2016-2026 (USD Million)

7.5.6.3 Market size, by end-use, 2016-2026 (USD Million)

7.5.7 Argentina

7.5.7.1 Market size, by type, 2016-2026 (USD Million)

7.5.7.2 Market size, by application, 2016-2026 (USD Million)

7.5.7.3 Market size, by end-use, 2016-2026 (USD Million)

7.6 MEA

7.6.1 Market size, by country 2016-2026 (USD Million)

7.6.2 Market size, by type, 2016-2026 (USD Million)

7.6.3 Market size, by application, 2016-2026 (USD Million)

7.6.4 Market size, by end-use, 2016-2026 (USD Million)

7.6.5 Saudi Arabia

7.6.5.1 Market size, by type, 2016-2026 (USD Million)

7.6.5.2 Market size, by application, 2016-2026 (USD Million)

7.6.5.3 Market size, by end-use, 2016-2026 (USD Million)

7.6.6 UAE

7.6.6.1 Market size, by type, 2016-2026 (USD Million)

7.6.6.2 Market size, by application, 2016-2026 (USD Million)

7.6.6.3 Market size, by end-use, 2016-2026 (USD Million)

7.6.7 South Africa

7.6.7.1 Market size, by type, 2016-2026 (USD Million)

7.6.7.2 Market size, by application, 2016-2026 (USD Million)

7.6.7.3 Market size, by end-use, 2016-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive analysis, 2020

8.2 PPG Industries, Inc.

8.2.1 Company overview

8.2.2 Financial analysis

8.2.3 Strategic positioning

8.2.4 Info graphic analysis

8.3 BASF SE

8.3.1 Company overview

8.3.2 Financial analysis

8.3.3 Strategic positioning

8.3.4 Info graphic analysis

8.4 3M Company

8.4.1 Company overview

8.4.2 Financial analysis

8.4.3 Strategic positioning

8.4.4 Info graphic analysis

8.5 The Sherwin-Williams Company

8.5.1 Company overview

8.5.2 Financial analysis

8.5.3 Strategic positioning

8.5.4 Info graphic analysis

8.6 RPM International Inc.

8.6.1 Company overview

8.6.2 Financial analysis

8.6.3 Strategic positioning

8.6.4 Info graphic analysis

8.7 DUPONT

8.7.1 Company overview

8.7.2 Financial analysis

8.7.3 Strategic positioning

8.7.4 Info graphic analysis

8.8 Huntsman International LLC

8.8.1 Company overview

8.8.2 Financial analysis

8.8.3 Strategic positioning

8.8.4 Info graphic analysis

8.9 Boral Limited

8.9.1 Company overview

8.9.2 Financial analysis

8.9.3 Strategic positioning

8.9.4 Info graphic analysis

8.10 SIKA AG

8.10.1 Company overview

8.10.2 Financial analysis

8.10.3 Strategic positioning

8.10.4 Info graphic analysis

8.11 Ultratech Cement Limited

8.11.1 Company overview

8.11.2 Financial analysis

8.11.3 Strategic positioning

8.11.4 Info graphic analysis

8.12 CEMEX, S.A.B. DE C.V.

8.12.1 Company overview

8.12.2 Financial analysis

8.12.3 Strategic positioning

8.12.4 Info graphic analysis

8.13 Arkema S.A.

8.13.1 Company overview

8.13.2 Financial analysis

8.13.3 Strategic positioning

8.13.4 Info graphic analysis

8.14 Heidelbergcement AG

8.14.1 Company overview

8.14.2 Financial analysis

8.14.3 Strategic positioning

8.14.4 Info graphic analysis

8.15 Covestro AG

8.15.1 Company overview

8.15.2 Financial analysis

8.15.3 Strategic positioning

8.15.4 Info graphic analysis

8.16 Dex-O-Tex

8.16.1 Company overview

8.16.2 Financial analysis

8.16.3 Strategic positioning

8.16.4 Info graphic analysis

8.17 Elite Crete Systems

8.17.1 Company overview

8.17.2 Financial analysis

8.17.3 Strategic positioning

8.17.4 Info graphic analysis

8.18 LafargeHolcim

8.18.1 Company overview

8.18.2 Financial analysis

8.18.3 Strategic positioning

8.18.4 Info graphic analysis

8.19 MAPEI Corporation

8.19.1 Company overview

8.19.2 Financial analysis

8.19.3 Strategic positioning

8.19.4 Info graphic analysis

8.20 Neocrete Technologies Pvt Ltd

8.20.1 Company overview

8.20.2 Financial analysis

8.20.3 Strategic positioning

8.20.4 Info graphic analysis

8.21 Palermo Concrete Inc.

8.21.1 Company overview

8.21.2 Financial analysis

8.21.3 Strategic positioning

8.21.4 Info graphic analysis

8.22 Parchem Construction Supplies (Avista)

8.22.1 Company overview

8.22.2 Financial analysis

8.22.3 Strategic positioning

8.22.4 Info graphic analysis

8.23 RPM International Inc. (Increte Systems Inc.)

8.23.1 Company overview

8.23.2 Financial analysis

8.23.3 Strategic positioning

8.23.4 Info graphic analysis

8.24 Tarmac

8.24.1 Company overview

8.24.2 Financial analysis

8.24.3 Strategic positioning

8.24.4 Info graphic analysis

8.25 The Euclid Chemical Company

8.25.1 Company overview

8.25.2 Financial analysis

8.25.3 Strategic positioning

8.25.4 Info graphic analysis

8.26 W. R. Grace & Co.

8.26.1 Company overview

8.26.2 Financial analysis

8.26.3 Strategic positioning

8.26.4 Info graphic analysis

The Global Pigmented Concrete Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Pigmented Concrete Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS