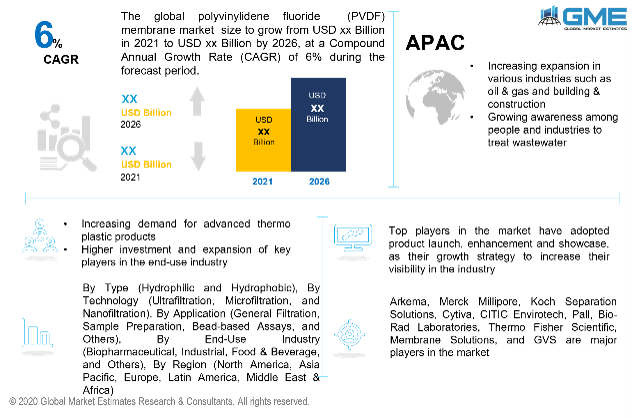

Global Polyvinylidene Fluoride (PVDF) Membrane Market Size, Trends & Analysis - Forecasts to 2026 By Type (Hydrophilic and Hydrophobic), By Technology (Ultrafiltration, Microfiltration, and Nanofiltration), By Application (General Filtration, Sample Preparation, Bead-based Assays, and Others), By End-Use Industry (Biopharmaceutical, Industrial, Food & Beverage, and Others), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa); Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

Polyvinylidene fluoride (PVDF), often regarded as polyvinylidene difluoride (PVDF), is a fluoropolymer composite content. It is a non-reactive thermoplastic fluoropolymer produced by the polymerization of vinylidene difluoride. Membrane distillation (MD) is used to create PVDF flat-sheet membranes. PVDF membrane is predominantly utilized in implementations that involve endurance, high resistance to chemicals, bases, acids, and temperature, as well as sensitivity to these substances. Because of their similarity to amino acids, PVDF membranes are commonly considered for protein immobilization. PVDF is a granulated category of polyvinylidene fluoride, which is employed in high-end metal paints.

These are some of the significant factors advancing the need for the Polyvinylidene fluoride (PVDF) membrane market globally. The budding usage of Polyvinylidene fluoride (PVDF) membrane in venting applications, microfiltration, and medical accessories is the fuelling the market growth. Also, growing demand for treated water in developing economies offers growth opportunities for the Polyvinylidene fluoride (PVDF) membrane manufacturers.

Polyvinylidene fluoride (PVDF) membranes are also used for protein sequencing of small quantities of proteins and amino acid analysis. They are preferred over nitrocellulose due to their high protein binding property. Protein molecules bind to Polyvinylidene fluoride (PVDF) membranes through dipole and hydrophobic interactions, supporting the consumers’ preference for the Polyvinylidene fluoride (PVDF) membrane over the nitrocellulose membrane. The demand for Polyvinylidene fluoride (PVDF) membranes has considerably risen over the past few years for this reason. There has been rapid utilization of Polyvinylidene fluoride (PVDF) membrane in the field of nanofiltration. Expanding demand from technical, biopharmaceutical, and food & beverage applications has positively influenced the Polyvinylidene fluoride (PVDF) membrane market.

Development in end-user industries including coatings, photovoltaic films, oil & gas, and electronics is driving the PVDF membrane market. The main variable accelerating the demand is an improvement in research and development projects. Numerous organizations, end-user suppliers, and PVDF packaging firms want to spend heavily on PVDF membrane processing advances to substitute other metals and plastics. This opens up exciting prospects for the PVDF membrane market. Conversely, considerations such as growing environmental and health issues, as well as unpredictable markets, are likely to stymie demand development throughout the forecast period.

Nevertheless, due to its low protein binding characteristics and reduced association behavior with specimen elements, the PVDF membrane is also used for filtering applications in the pharmaceutical sector, namely confirmation, and sterilization of protein-containing formulations throughout drug processing as well as other applications. The ongoing epidemic has raised the need for multiple drugs, which has enhanced the use of the PVDF membrane.

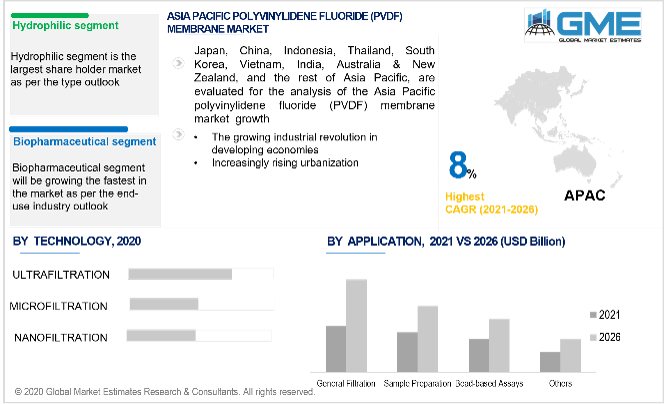

By type, there are two segments, namely, hydrophilic and hydrophobic. The hydrophilic segment is presumed to dominate this market. This is attributed to its various physical properties, like chemical & abrasion resistance, high porosity, convenience in handling, particle retention, high flow rates, and high filtration efficiency. This is why hydrophilic polyvinylidene fluoride (PVDF) is extensively used in filtration applications, which involves exposure to gasses and aqueous solutions. It is also used in aqueous and gas solution filtration applications like chemical & petrochemical, food & beverage, processing, biopharmaceutical, and other industries.

By technology, there are three segments, namely, ultrafiltration, microfiltration, and nanofiltration. The ultrafiltration segment is expected to lead the market. The factor responsible for this is its property to separate colloids and macromolecules from micro solutes and water through finely porous membranes. Moreover, a few advantages, namely, lower energy consumption, which reduces maintenance costs; reduced chemical contaminants used to eliminate impurities (e.g., wastewater treatment); and increased processing reliability and quality management are leading to segment supremacy.

By application, there are four segments, namely, general filtration, sample preparation, bead-based assays, and others. The general filtration segment is presumed to dominate the market. It provides the ability to sustain high temperatures, chemical inertness, high filtration efficiency, and good mechanical properties. This makes Polyvinylidene fluoride (PVDF) membranes better suited for industrial filtration applications, where they encounter acids, gasses, alkaline solutions, and solvents and are exposed to corrosive environments. General filtration is used in a wide range of industries, hence driving up the segment’s demand.

By end-use industry, there are four segments, namely, biopharmaceutical, industrial, food & beverage, and others. The biopharmaceutical segment is likely to lead. Factors like increasing outlay in R&D of the medical and biotechnology industry propel the market’s growth. Because of their low protein bonding characteristics, hydrophilic PVDF membranes are utilized in activities such as biological specimen processing, sample press, safe vaccine filtering, and natural mobile phase filtering. Moreover, hydrophobic PVDF membranes are employed as a transition membrane for polymer staining activities and as biosensing carrier media.

The polyvinylidene fluoride (PVDF) membrane market by region can be classified into North America (the US, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa and Central & South America. The Asia Pacific region is presumed to be leading, driven by acceleration in industries including energy and gas and engineering and construction. This is likely to maximize the utilization of PVDF membrane in a variety of implementations. With the growth of the chemical and pharmaceutical industries, as well as a rising consciousness amongst citizens and businesses about the need to handle wastewater, the market for PVDF membranes in the area has been growing. Countries including, China, India, and Japan are presumed to dominate the PVDF membrane market in the Asia Pacific throughout the forecast period, with China accounting for a large volume share in the area. After the Asia Pacific region, North America is predicted to take the lead. One of the primary forces influencing development in the polyvinylidene fluoride (PVDF) market is increasing investment and advancement by prominent players in the end-use sector. This is mostly due to the region's increasingly rising urbanization and enhanced demand for advanced thermoplastic materials. Furthermore, the United States has a well-established source of raw resources used by the plastics industry. Numerous polyvinylidene fluoride producers have set up shop in this area as a result of this. This pattern is predicted to continue throughout the forecast period.

Arkema, Merck Millipore, Koch Separation Solutions, Cytiva, CITIC Envirotech, Pall, Bio-Rad Laboratories, Thermo Fisher Scientific, Membrane Solutions, and GVS are major players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Polyvinylidene Fluoride (PVDF) Membrane Industry Overview, 2016-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Application Overview

2.1.4 End-Use Industry Overview

2.1.5 Technology Overview

2.1.6 Regional Overview

Chapter 3 Polyvinylidene Fluoride (PVDF) Membrane Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Higher Investment And Expansion Of Key Players In The End-Use Industry Industry

3.3.1.2 Increasing Research And Development For More Advanced And Highly Efficient PVDF Membranes

3.3.2 Industry Challenges

3.3.2.1 Growing Environmental And Health Issues

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Application Growth Scenario

3.4.3 End-Use Industry Growth Scenario

3.4.4 Technology Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Polyvinylidene Fluoride (PVDF) Membrane Market, By Type

4.1 Type Outlook

4.2 Hydrophilic

4.2.1 Market Size, By Region, 2016-2026 (USD Million)

4.3 Hydrophobic

4.3.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 5 Polyvinylidene Fluoride (PVDF) Membrane Market, By Application

5.1 Application Outlook

5.2 General Filtration

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

5.3 Sample Preparation

5.3.1 Market Size, By Region, 2016-2026 (USD Million)

5.4 Bead-based Assays

5.4.1 Market Size, By Region, 2016-2026 (USD Million)

5.5 Others

5.5.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 6 Polyvinylidene Fluoride (PVDF) Membrane Market, By End-Use Industry

6.1 End-Use Industry Outlook

6.2 Biopharmaceutical

6.2.1 Market Size, By Region, 2016-2026 (USD Million)

6.3 Industrial

6.3.1 Market Size, By Region, 2016-2026 (USD Million)

6.3 Industrial

6.3.1 Market Size, By Region, 2016-2026 (USD Million)

6.4 Food & Beverage

6.4.1 Market Size, By Region, 2016-2026 (USD Million)

6.5 Others

6.5.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 7 Polyvinylidene Fluoride (PVDF) Membrane Market, By Technology

7.1 Technology Outlook

7.2 Ultrafiltration

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

7.3 Microfiltration

7.3.1 Market Size, By Region, 2016-2026 (USD Million)

7.4 Nanofiltration

7.4.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 8 Polyvinylidene Fluoride (PVDF) Membrane Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country, 2016-2026 (USD Million)

8.2.2 Market Size, By Type, 2016-2026 (USD Million)

8.2.3 Market Size, By Application, 2016-2026 (USD Million)

8.2.4 Market Size, By End-Use Industry, 2016-2026 (USD Million)

8.2.5 Market Size, By Technology, 2016-2026 (USD Million)

8.2.6 U.S.

8.2.6.1 Market Size, By Type, 2016-2026 (USD Million)

8.2.6.2 Market Size, By Application, 2016-2026 (USD Million)

8.2.6.3 Market Size, By End-Use Industry, 2016-2026 (USD Million)

8.2.6.4 Market Size, By Technology, 2016-2026 (USD Million)

8.2.7 Canada

8.2.7.1 Market Size, By Type, 2016-2026 (USD Million)

8.2.7.2 Market Size, By Application, 2016-2026 (USD Million)

8.2.7.3 Market Size, By End-Use Industry, 2016-2026 (USD Million)

8.2.7.4 Market Size, By Technology, 2016-2026 (USD Million)

8.3 Europe

8.3.1 Market Size, By Country, 2016-2026 (USD Million)

8.3.2 Market Size, By Type, 2016-2026 (USD Million)

8.3.3 Market Size, By Application, 2016-2026 (USD Million)

8.3.4 Market Size, By End-Use Industry, 2016-2026 (USD Million)

8.3.5 Market Size, By Technology, 2016-2026 (USD Million)

8.3.6 Germany

8.3.6.1 Market Size, By Type, 2016-2026 (USD Million)

8.3.6.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.6.3 Market Size, By End-Use Industry, 2016-2026 (USD Million)

8.3.6.4 Market Size, By Technology, 2016-2026 (USD Million)

8.3.7 UK

8.3.7.1 Market Size, By Type, 2016-2026 (USD Million)

8.3.7.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.7.3 Market Size, By End-Use Industry, 2016-2026 (USD Million)

8.3.7.4 Market Size, By Technology, 2016-2026 (USD Million)

8.3.8 France

8.3.8.1 Market Size, By Type, 2016-2026 (USD Million)

8.3.8.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.8.3 Market Size, By End-Use Industry, 2016-2026 (USD Million)

8.3.8.4 Market Size, By Technology, 2016-2026 (USD Million)

8.3.9 Italy

8.3.9.1 Market Size, By Type, 2016-2026 (USD Million)

8.3.9.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.9.3 Market Size, By End-Use Industry, 2016-2026 (USD Million)

8.3.9.4 Market Size, By Technology, 2016-2026 (USD Million)

8.3.10 Spain

8.3.10.1 Market Size, By Type, 2016-2026 (USD Million)

8.3.10.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.10.3 Market Size, By End-Use Industry, 2016-2026 (USD Million)

8.3.10.4 Market Size, By Technology, 2016-2026 (USD Million)

8.3.11 Russia

8.3.11.1 Market Size, By Type, 2016-2026 (USD Million)

8.3.11.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.11.3 Market Size, By End-Use Industry, 2016-2026 (USD Million)

8.3.11.4 Market Size, By Technology, 2016-2026 (USD Million)

8.4 Asia Pacific

8.4.1 Market Size, By Country, 2016-2026 (USD Million)

8.4.2 Market Size, By Type, 2016-2026 (USD Million)

8.4.3 Market Size, By Application, 2016-2026 (USD Million)

8.4.4 Market Size, By End-Use Industry, 2016-2026 (USD Million)

8.4.5 Market Size, By Technology, 2016-2026 (USD Million)

8.4.6 China

8.4.6.1 Market Size, By Type, 2016-2026 (USD Million)

8.4.6.2 Market Size, By Application, 2016-2026 (USD Million)

8.4.6.3 Market Size, By End-Use Industry, 2016-2026 (USD Million)

8.4.6.4 Market Size, By Technology, 2016-2026 (USD Million)

8.4.7 India

8.4.7.1 Market Size, By Type, 2016-2026 (USD Million)

8.4.7.2 Market Size, By Application, 2016-2026 (USD Million)

8.4.7.3 Market Size, By End-Use Industry, 2016-2026 (USD Million)

8.4.7.4 Market Size, By Technology, 2016-2026 (USD Million)

8.4.8 Japan

8.4.8.1 Market Size, By Type, 2016-2026 (USD Million)

8.4.8.2 Market Size, By Application, 2016-2026 (USD Million)

8.4.8.3 Market Size, By End-Use Industry, 2016-2026 (USD Million)

8.4.8.4 Market Size, By Technology, 2016-2026 (USD Million)

8.4.9 Australia

8.4.9.1 Market Size, By Type, 2016-2026 (USD Million)

8.4.9.2 Market size, By Application, 2016-2026 (USD Million)

8.4.9.3 Market size, By End-Use Industry, 2016-2026 (USD Million)

8.4.9.4 Market size, By Technology, 2016-2026 (USD Million)

8.4.10 South Korea

8.4.10.1 Market Size, By Type, 2016-2026 (USD Million)

8.4.10.2 Market Size, By Application, 2016-2026 (USD Million)

8.4.10.3 Market Size, By End-Use Industry, 2016-2026 (USD Million)

8.4.10.4 Market Size, By Technology, 2016-2026 (USD Million)

8.5 Latin America

8.5.1 Market Size, By Country, 2016-2026 (USD Million)

8.5.2 Market Size, By Type, 2016-2026 (USD Million)

8.5.3 Market Size, By Application, 2016-2026 (USD Million)

8.5.4 Market Size, By End-Use Industry, 2016-2026 (USD Million)

8.5.5 Market Size, By Technology, 2016-2026 (USD Million)

8.5.6 Brazil

8.5.6.1 Market Size, By Type, 2016-2026 (USD Million)

8.5.6.2 Market Size, By Application, 2016-2026 (USD Million)

8.5.6.3 Market Size, By End-Use Industry, 2016-2026 (USD Million)

8.5.6.4 Market Size, By Technology, 2016-2026 (USD Million)

8.5.7 Mexico

8.5.7.1 Market Size, By Type, 2016-2026 (USD Million)

8.5.7.2 Market Size, By Application, 2016-2026 (USD Million)

8.5.7.3 Market Size, By End-Use Industry, 2016-2026 (USD Million)

8.5.7.4 Market Size, By Technology, 2016-2026 (USD Million)

8.5.8 Argentina

8.5.8.1 Market Size, By Type, 2016-2026 (USD Million)

8.5.8.2 Market Size, By Application, 2016-2026 (USD Million)

8.5.8.3 Market Size, By End-Use Industry, 2016-2026 (USD Million)

8.5.8.4 Market Size, By Technology, 2016-2026 (USD Million)

8.6 MEA

8.6.1 Market Size, By Country, 2016-2026 (USD Million)

8.6.2 Market Size, By Type, 2016-2026 (USD Million)

8.6.3 Market Size, By Application, 2016-2026 (USD Million)

8.6.4 Market Size, By End-Use Industry, 2016-2026 (USD Million)

8.6.5 Market Size, By Technology, 2016-2026 (USD Million)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Type, 2016-2026 (USD Million)

8.6.6.2 Market Size, By Application, 2016-2026 (USD Million)

8.6.6.3 Market Size, By End-Use Industry, 2016-2026 (USD Million)

8.6.6.4 Market Size, By Technology, 2016-2026 (USD Million)

8.6.7 UAE

8.6.7.1 Market Size, By Type, 2016-2026 (USD Million)

8.6.7.2 Market Size, By Application, 2016-2026 (USD Million)

8.6.7.3 Market Size, By End-Use Industry, 2016-2026 (USD Million)

8.6.7.4 Market Size, By Technology, 2016-2026 (USD Million)

8.6.8 South Africa

8.6.8.1 Market Size, By Type, 2016-2026 (USD Million)

8.6.8.2 Market Size, By Application, 2016-2026 (USD Million)

8.6.8.3 Market Size, By End-Use Industry, 2016-2026 (USD Million)

8.6.8.4 Market Size, By Technology, 2016-2026 (USD Million)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 Arkema

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 Merck Millipore

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 Koch Separation Solutions

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 Cytiva

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 CITIC Envirotech

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 Pall

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 Bio-Rad Laboratories

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 Thermo Fisher Scientific

7.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

9.10 Membrane Solutions

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info Graphic Analysis

9.11 GVS

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info Graphic Analysis

9.12 Other Companies

9.12.1 Company Overview

9.12.2 Financial Analysis

9.12.3 Strategic Positioning

9.12.4 Info Graphic Analysis

The Global Polyvinylidene Fluoride (PVDF) Membrane Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Polyvinylidene Fluoride (PVDF) Membrane Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS