Global Predictive Maintenance Market Size, Trends & Analysis - Forecasts to 2027 By Component (Solutions and Service), By Deployment Mode (On-premises and Cloud), By Stakeholders (MRO, OEM/ODM and Technology Integrator), By Vertical (Government and Defense, Manufacturing, Energy and Utilities, Transportation and Logistics, Healthcare and Life Sciences and Others), By Technique (Vibration Monitoring, Electrical Testing, Oil Analysis, Ultrasonic Leak Detectors, Shock Pulse, Infrared and Others), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Company Market Share Analysis, and Competitor Analysis

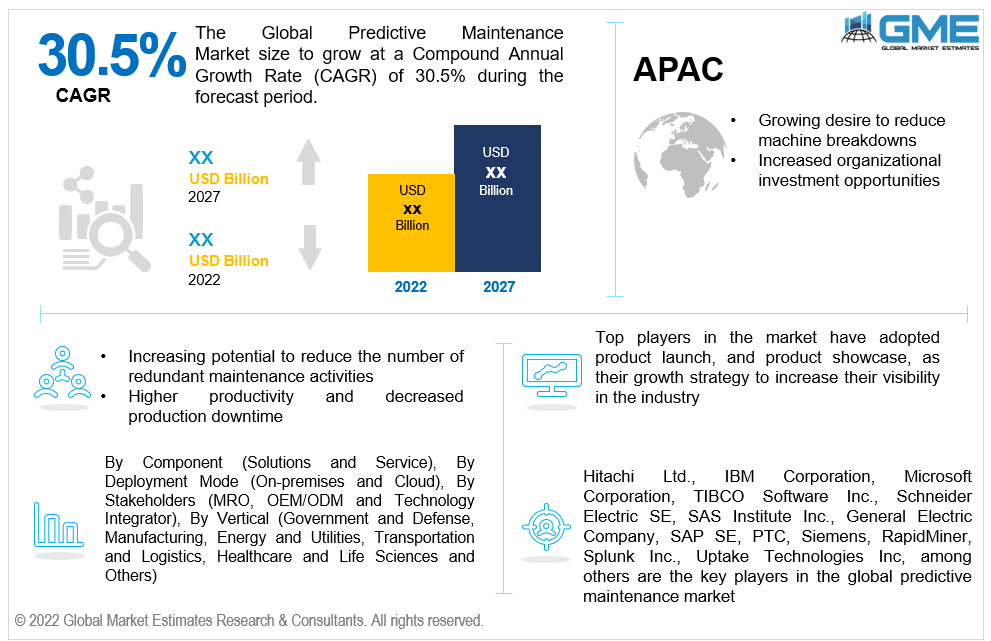

The Global Predictive Maintenance Market is projected to grow at a CAGR value of 30.5% from 2022 to 2027.

Predictive maintenance (PdM) is a technique that is used to optimize asset maintenance programs by using data-driven strategies to predict asset breakdowns. Companies may benefit from the use of PdM by reducing downtimes and improving product quality, among other benefits, particularly in the automotive industry. The increased potential of predictive maintenance technology reduces the number of redundant maintenance activities since it is not based on periodic maintenance intervals, as well as the decline of fatal breakdowns, which leads to higher productivity and decreased production downtime, are all contributing to market growth during the forecast period.

According to studies, maintenance operations account for anywhere between 15% and 70% of overall production costs, depending on the industry. This so-called predictive maintenance program is particularly interesting in the context of Industry 4.0 because it significantly improves the efficiency of modern manufacturing facilities. The use of PdM methods for strategizing repair parts inventories and keeping at least as much inventory as is predicted necessary, as well as their utility in the sector of remote sensing techniques, allow for Remote Condition Monitoring (RCM) and their ability to successfully gather information regarding merchandise use, missteps, and deterioration, are propelling the market growth.

The rapid growth of Industry 4.0 and wireless communication technologies along with the growing deployment of machine learning and IoT adoption will boost the market during the forecast period. Additionally, the expanding utilization of predictive maintenance in the logistics and transportation industries to ensure maintenance decisions and avoid supply chain risk along with advantages such as increased dependability and security, lower operating costs, lower spare part inventory, and shorter refurbishment periods, are some of the factors contributing to market growth.

The surge in investments in predictive maintenance as a result of IoT adoption, as well as the necessity to extend the lifespan of aged industrial gear, are all driving the predictive maintenance industry forward. Furthermore, due to the sheer increased requirement to get additional insight from the implementation of new technologies, the desire for predictive maintenance is on the upswing. Market development, nevertheless, is limited by implementation constraints, data security threats, and a scarcity of experienced labor.

The COVID-19 pandemic imposed various lockdowns and limitations around the world, leading to a greater reliance on digitalization. Firms all over the world adopted new technologies such as cloud, AI, and IoT, among others, and the need for remote asset management grew, propelling the predictive maintenance market forward.

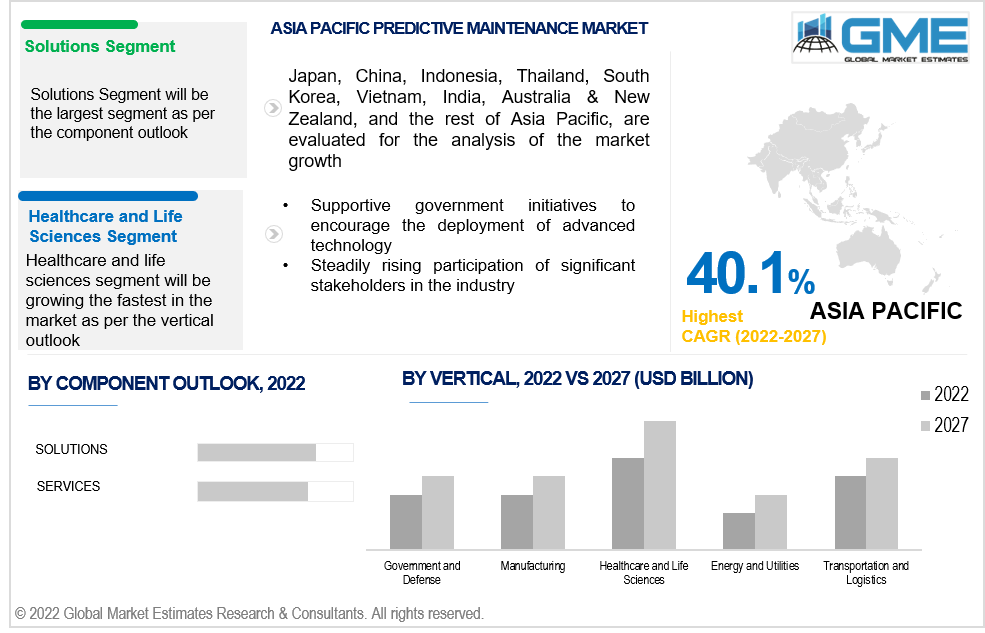

Based on the component, the global predictive maintenance market is divided into solutions and services. The service segment is expected to grow the fastest in the predictive maintenance market from 2022 to 2027. Owing to the sheer growing need for IoT-based predictive maintenance solutions and the increasing awareness among enterprises to deploy cost-effective alternatives, the solution segment is expected to grow at a rapid rate.

Based on the deployment model, the predictive maintenance market is divided into on-premises and cloud. The cloud segment is expected to grow the fastest in the predictive maintenance market from 2022 to 2027. The advantages of cloud-based predictive maintenance solutions include remote connectivity, effective IT management, rapid data interpretation, and cost-effectiveness, all of which contribute to segment growth.

MRO, OEM/ODM, and technology integrator are the segmentations based on stakeholders. The MRO segment is expected to grow the fastest in the predictive maintenance market from 2022 to 2027. Some of the drivers driving segment growth include better inventory management, reduced component expenditure and utilization, and improved upkeep personnel engagement.

As per the vertical segmentation, the predictive maintenance market can be classified into government and defense, manufacturing, energy and utilities, transportation and logistics, healthcare and life sciences, and others. The healthcare and life sciences segments are expected to grow the fastest in the predictive maintenance market from 2022 to 2027. This is because the demand for predictive maintenance is high for medical equipment like X-rays, MR, and mammography and has a significantly positive impact on general hospital productivity.

Based on the technique, the market is divided into vibration monitoring, electrical testing, oil analysis, ultrasonic leak detectors, shock pulse, infrared, and others. The vibration monitoring segment is expected to grow the fastest during the forecast period among other segments. Some of the causes driving growth include early detection of possible faults, lower maintenance costs, data organization for data-driven decisions, and lower equipment prices.

As per the geographical analysis, the Global Predictive Maintenance Market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico) will have a dominant share in the global predictive maintenance market from 2022 to 2027. The major factor driving the growth of the market in the North American region is the growing number of investments in advanced technologies as well as a high number of solution and service component-based predictive maintenance providers present in the region.

Moreover, the Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific) region is expected to be the fastest-growing segment in the global predictive maintenance market during the forecast period. Some of the factors driving regional market growth include an upsurge for more cost-effective predictive maintenance alternatives, a growing desire to reduce machine breakdowns, increased organizational investment opportunities, and enhanced knowledge about the importance of predictive maintenance innovations.

Hitachi, Ltd., IBM Corporation, Microsoft Corporation, TIBCO Software Inc., Schneider Electric SE, SAS Institute Inc., General Electric Company, SAP SE, PTC, Siemens, RapidMiner, Splunk Inc., Uptake Technologies Inc, among others are the key players in the global predictive maintenance market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Predictive Maintenance Market Overview, 2022-2027

2.1.1 Industry Overview

2.1.2 Component Overview

2.1.3 Deployment Mode Overview

2.1.4 Stakeholders Overview

2.1.5 Vertical Overview

2.1.6 Technique Overview

2.1.7 Regional Overview

Chapter 3 Global Predictive Maintenance Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2022-2027

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising adoption of advanced technologies

3.3.2 Industry Challenges

3.3.2.1 High installation costs

3.4 Prospective Growth Scenario

3.4.1 Component Growth Scenario

3.4.2 Deployment Mode Growth Scenario

3.4.3 Stakeholders Growth Scenario

3.4.4 Vertical Growth Scenario

3.4.5 Technique Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2021

3.11.1 Company Positioning Overview, 2021

Chapter 4 Global Predictive Maintenance Market, By Component

4.1 Component Type Outlook

4.2 Solutions

4.2.1 Market Size, By Region, 2022-2027 (USD Billion)

4.3 Service

4.3.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 5 Global Predictive Maintenance Market, By Deployment Mode

5.1 Deployment Mode Outlook

5.2 On-premises

5.2.1 Market Size, By Region, 2022-2027 (USD Billion)

5.3 Cloud

5.3.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 6 Global Predictive Maintenance Market, By Stakeholders

6.1 MRO

6.1.1 Market Size, By Region, 2022-2027 (USD Billion)

6.2 OEM/ODM

6.2.1 Market Size, By Region, 2022-2027 (USD Billion)

6.3 Technology Integrator

6.3.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 7 Global Predictive Maintenance Market, By Vertical

7.1 Government and Defense

7.1.1 Market Size, By Region, 2022-2027 (USD Billion)

7.2 Manufacturing

7.2.1 Market Size, By Region, 2022-2027 (USD Billion)

7.2 Energy and Utilities

7.2.1 Market Size, By Region, 2022-2027 (USD Billion)

7.2 Transportation and Logistics

7.2.1 Market Size, By Region, 2022-2027 (USD Billion)

7.2 Healthcare and Life Sciences

7.2.1 Market Size, By Region, 2022-2027 (USD Billion)

7.2 Others

7.2.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 8 Global Predictive Maintenance Market, By Technique

8.1 Vibration Monitoring

8.1.1 Market Size, By Region, 2022-2027 (USD Billion)

8.2 Electrical Testing

8.2.1 Market Size, By Region, 2022-2027 (USD Billion)

8.2 Oil Analysis

8.2.1 Market Size, By Region, 2022-2027 (USD Billion)

8.2 Ultrasonic Leak Detectors

8.2.1 Market Size, By Region, 2022-2027 (USD Billion)

8.2 Shock Pulse

8.2.1 Market Size, By Region, 2022-2027 (USD Billion)

8.2 Infrared

8.2.1 Market Size, By Region, 2022-2027 (USD Billion)

8.2 Others

8.2.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 9 Global Predictive Maintenance Market, By Region

9.1 Regional outlook

9.2 North America

9.2.1 Market Size, By Country 2022-2027 (USD Billion)

9.2.2 Market Size, By Component, 2022-2027 (USD Billion)

9.2.3 Market Size, By Deployment Mode, 2022-2027 (USD Billion)

9.2.4 Market Size, By Stakeholders, 2022-2027 (USD Billion)

9.2.5 Market Size, By Vertical, 2022-2027 (USD Billion)

9.2.6 Market Size, By Technique, 2022-2027 (USD Billion)

9.2.7 U.S.

9.2.7.1 Market Size, By Component, 2022-2027 (USD Billion)

9.2.7.2 Market Size, By Deployment Mode, 2022-2027 (USD Billion)

9.2.7.3 Market Size, By Stakeholders, 2022-2027 (USD Billion)

9.2.7.4 Market Size, By Vertical, 2022-2027 (USD Billion)

9.2.7.5 Market Size, By Technique, 2022-2027 (USD Billion)

9.2.8 Canada

9.2.8.1 Market Size, By Component, 2022-2027 (USD Billion)

9.2.8.2 Market Size, By Deployment Mode, 2022-2027 (USD Billion)

9.2.8.3 Market Size, By Stakeholders, 2022-2027 (USD Billion)

9.2.8.4 Market Size, By Vertical, 2022-2027 (USD Billion)

9.2.8.5 Market Size, By Technique, 2022-2027 (USD Billion)

9.2.9 Mexico

9.2.9.1 Market Size, By Component, 2022-2027 (USD Billion)

9.2.9.2 Market Size, By Deployment Mode, 2022-2027 (USD Billion)

9.2.9.3 Market Size, By Stakeholders, 2022-2027 (USD Billion)

9.2.9.4 Market Size, By Vertical, 2022-2027 (USD Billion)

9.2.9.5 Market Size, By Technique, 2022-2027 (USD Billion)

9.3 Europe

9.3.1 Market Size, By Country 2022-2027 (USD Billion)

9.3.2 Market Size, By Component, 2022-2027 (USD Billion)

9.3.3 Market Size, By Deployment Mode, 2022-2027 (USD Billion)

9.3.4 Market Size, By Stakeholders, 2022-2027 (USD Billion)

9.3.5 Market Size, By Vertical, 2022-2027 (USD Billion)

9.3.6 Market Size, By Technique, 2022-2027 (USD Billion)

9.3.7 Germany

9.3.7.1 Market Size, By Component, 2022-2027 (USD Billion)

9.3.7.2 Market Size, By Deployment Mode, 2022-2027 (USD Billion)

9.3.7.3 Market Size, By Stakeholders, 2022-2027 (USD Billion)

9.3.7.4 Market Size, By Vertical, 2022-2027 (USD Billion)

9.3.7.5 Market Size, By Technique, 2022-2027 (USD Billion)

9.3.8 UK

9.3.8.1 Market Size, By Component, 2022-2027 (USD Billion)

9.3.8.2 Market Size, By Deployment Mode, 2022-2027 (USD Billion)

9.3.8.3 Market Size, By Stakeholders, 2022-2027 (USD Billion)

9.3.8.4 Market Size, By Vertical, 2022-2027 (USD Billion)

9.3.8.5 Market Size, By Technique, 2022-2027 (USD Billion)

9.3.9 France

9.3.9.1 Market Size, By Component, 2022-2027 (USD Billion)

9.3.9.2 Market Size, By Deployment Mode, 2022-2027 (USD Billion)

9.3.9.3 Market Size, By Stakeholders, 2022-2027 (USD Billion)

9.3.9.4 Market Size, By Vertical, 2022-2027 (USD Billion)

9.3.9.5 Market Size, By Technique, 2022-2027 (USD Billion)

9.3.10 Italy

9.3.10.1 Market Size, By Component, 2022-2027 (USD Billion)

9.3.10.2 Market Size, By Deployment Mode, 2022-2027 (USD Billion)

9.3.10.3 Market Size, By Stakeholders, 2022-2027 (USD Billion)

9.3.10.4 Market Size, By Vertical, 2022-2027 (USD Billion)

9.3.10.5 Market Size, By Technique, 2022-2027 (USD Billion)

9.4 Asia Pacific

9.4.1 Market Size, By Country 2022-2027 (USD Billion)

9.4.2 Market Size, By Component, 2022-2027 (USD Billion)

9.4.3 Market Size, By Deployment Mode, 2022-2027 (USD Billion)

9.4.4 Market Size, By Stakeholders, 2022-2027 (USD Billion)

9.4.5 Market Size, By Vertical, 2022-2027 (USD Billion)

9.4.6 Market Size, By Technique, 2022-2027 (USD Billion)

9.4.7 China

9.4.7.1 Market Size, By Component, 2022-2027 (USD Billion)

9.4.7.2 Market Size, By Deployment Mode, 2022-2027 (USD Billion)

9.4.7.3 Market Size, By Stakeholders, 2022-2027 (USD Billion)

9.4.7.4 Market Size, By Vertical, 2022-2027 (USD Billion)

9.4.7.5 Market Size, By Technique, 2022-2027 (USD Billion)

9.4.8 India

9.4.8.1 Market Size, By Component, 2022-2027 (USD Billion)

9.4.8.2 Market Size, By Deployment Mode, 2022-2027 (USD Billion)

9.4.8.3 Market Size, By Stakeholders, 2022-2027 (USD Billion)

9.4.8.4 Market Size, By Vertical, 2022-2027 (USD Billion)

9.4.8.5 Market Size, By Technique, 2022-2027 (USD Billion)

9.4.9 Japan

9.4.9.1 Market Size, By Component, 2022-2027 (USD Billion)

9.4.9.2 Market Size, By Deployment Mode, 2022-2027 (USD Billion)

9.4.9.3 Market Size, By Stakeholders, 2022-2027 (USD Billion)

9.4.9.4 Market Size, By Vertical, 2022-2027 (USD Billion)

9.4.9.5 Market Size, By Technique, 2022-2027 (USD Billion)

9.5 MEA

9.5.1 Market Size, By Country 2022-2027 (USD Billion)

9.5.2 Market Size, By Component, 2022-2027 (USD Billion)

9.5.3 Market Size, By Deployment Mode, 2022-2027 (USD Billion)

9.5.4 Market Size, By Stakeholders, 2022-2027 (USD Billion)

9.5.5 Market Size, By Vertical, 2022-2027 (USD Billion)

9.5.6 Market Size, By Technique, 2022-2027 (USD Billion)

9.5.7 Saudi Arabia

9.5.7.1 Market Size, By Component, 2022-2027 (USD Billion)

9.5.7.2 Market Size, By Deployment Mode, 2022-2027 (USD Billion)

9.5.7.3 Market Size, By Stakeholders, 2022-2027 (USD Billion)

9.5.7.4 Market Size, By Vertical, 2022-2027 (USD Billion)

9.5.7.5 Market Size, By Technique, 2022-2027 (USD Billion)

9.5.8 UAE

9.5.8.1 Market Size, By Component, 2022-2027 (USD Billion)

9.5.8.2 Market Size, By Deployment Mode, 2022-2027 (USD Billion)

9.5.8.3 Market Size, By Stakeholders, 2022-2027 (USD Billion)

9.5.8.4 Market Size, By Vertical, 2022-2027 (USD Billion)

9.5.8.5 Market Size, By Technique, 2022-2027 (USD Billion)

9.5.9 South Africa

9.5.9.1 Market Size, By Component, 2022-2027 (USD Billion)

9.5.9.2 Market Size, By Deployment Mode, 2022-2027 (USD Billion)

9.5.9.3 Market Size, By Stakeholders, 2022-2027 (USD Billion)

9.5.9.4 Market Size, By Vertical, 2022-2027 (USD Billion)

9.5.9.5 Market Size, By Technique, 2022-2027 (USD Billion)

Chapter 10 Company Landscape

10.1 Competitive Analysis, 2020

10.2 Hitachi, Ltd.

10.2.1 Company Overview

10.2.2 Financial Analysis

10.2.3 Strategic Positioning

10.2.4 Info Graphic Analysis

10.3 IBM Corporation

10.3.1 Company Overview

10.3.2 Financial Analysis

10.3.3 Strategic Positioning

10.3.4 Info Graphic Analysis

10.4 Microsoft Corporation

10.4.1 Company Overview

10.4.2 Financial Analysis

10.4.3 Strategic Positioning

10.4.4 Info Graphic Analysis

10.5 TIBCO Software Inc.

10.5.1 Company Overview

10.5.2 Financial Analysis

10.5.3 Strategic Positioning

10.5.4 Info Graphic Analysis

10.6 Schneider Electric SE

10.6.1 Company Overview

10.6.2 Financial Analysis

10.6.3 Strategic Positioning

10.6.4 Info Graphic Analysis

10.7 SAS Institute Inc.

10.7.1 Company Overview

10.7.2 Financial Analysis

10.7.3 Strategic Positioning

10.7.4 Info Graphic Analysis

10.8 General Electric Company

10.10.1 Company Overview

10.10.2 Financial Analysis

10.10.3 Strategic Positioning

10.10.4 Info Graphic Analysis

10.9 SAP SE

10.9.1 Company Overview

10.9.2 Financial Analysis

10.9.3 Strategic Positioning

10.9.4 Info Graphic Analysis

10.10 PTC

10.10.1 Company Overview

10.10.2 Financial Analysis

10.10.3 Strategic Positioning

10.10.4 Info Graphic Analysis

10.11 Siemens

10.11.1 Company Overview

10.11.2 Financial Analysis

10.11.3 Strategic Positioning

10.11.4 Info Graphic Analysis

10.12 RapidMiner

10.12.1 Company Overview

10.12.2 Financial Analysis

10.12.3 Strategic Positioning

10.12.4 Info Graphic Analysis

10.13 Other Companies

10.13.1 Company Overview

10.13.2 Financial Analysis

10.13.3 Strategic Positioning

10.13.4 Info Graphic Analysis

The Global Predictive Maintenance market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply side analysis for the Predictive Maintenance market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the companies, and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS