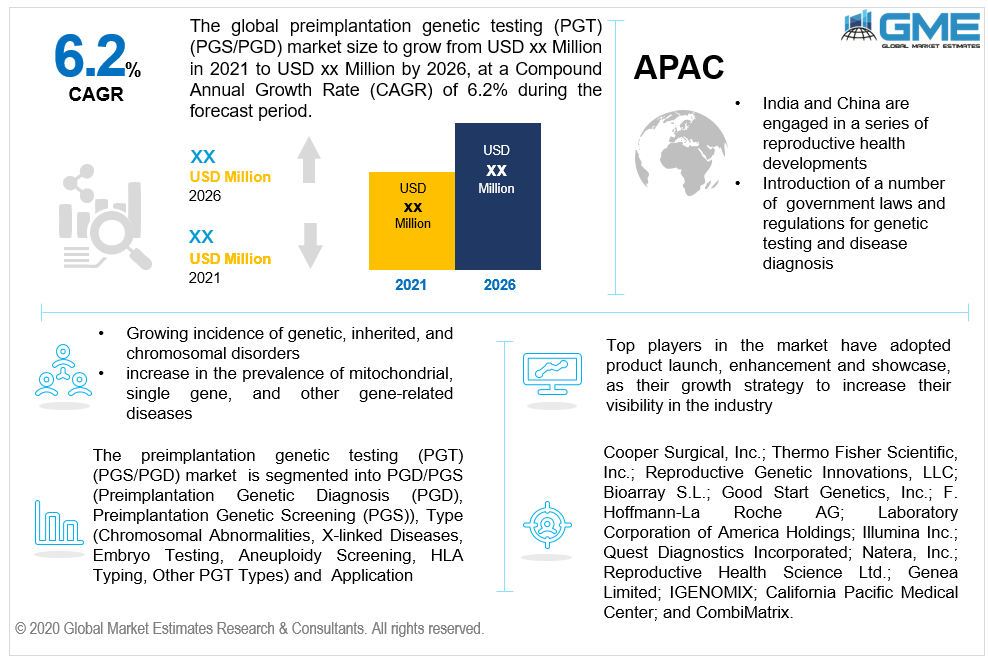

Global Preimplantation Genetic Testing (PGT) Market Size, Trends, and Analysis - Forecasts To 2026 By PGD/PGS (Preimplantation Genetic Diagnosis (PGD), Preimplantation Genetic Screening (PGS)), By Type (Chromosomal Abnormalities, X-linked Diseases, Embryo Testing, Aneuploidy Screening, HLA Typing, Other PGT Types), By Application (Embryo HLA Typing for Stem Cell Therapy, IVF Prognosis, Late-Onset Genetic Disorders, Inherited Genetic Disease, Others), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

Preimplantation genetic testing is the process of genetically profiling embryos and, in some cases, oocytes before fertilization to ensure a healthy pregnancy. By predicting the existence of disease over the process of gestation, these studies assist partners who are at risk of genetic abnormalities in making the best choice on whether or not to end the pregnancy. These examinations are also beneficial to women in IVF phases who have had previous miscarriages or have had a previous pregnancy with chromosome abnormalities.

Because of the growing incidence of genetic, inherited, and chromosomal disorders, the global PGT industry is projected to expand significantly during the projected timeline. Prenatal screening and early diagnosis of chromosomal defects in an embryo have improved dramatically as a result of recent scientific advances. In vitro fertilization (IVF) processing has been effective owing to the expansion of non-invasive cell-free foetal DNA-based identification processes along with carrier screening panels across prenatal treatment. This has fueled the demand for preimplantation genetic testing (PGT) by encouraging early diagnosis of congenital defects in the early phases of the IVF process, which reduces the risk of hereditary chromosomal disorders in the foetus.

Increased demand for screening procedures and preimplantation testing is due to an increase in the prevalence of mitochondrial, single gene, and other gene-related diseases. For a healthy pregnancy, preimplantation genetic diagnosis (PGD) is used before IVF. IVF techniques have been improved by the notion of aneuploidy screening during PGD. Aneuploidy testing in IVF clinics also helped to identify defective embryos and has resulted in a higher incidence of a healthy pregnancy.

Furthermore, recent advances in genetic therapy, such as the introduction of PGT monogenic disease diagnosis (PGT-M), spur industrialization. PGT-M focuses on identifying Mendelian genetic disorders in embryos to resolve prenatal diagnosis issues and eliminate the possibility of elective abortion.

The sector is also driven by the number of supporting policies undertaken by government agencies to improve reproductive health. For example, the Switzerland government accepted the pre-implantation genetic testing of an in-vitro embryo in June 2017. Such programs are aimed at identifying and mitigating genetic abnormalities of embryos prior to implantation.

Public agencies' regulatory measures and ethical acceptability stifle the acceptance of PGT services, stifling development. However, the awareness of foetal wellbeing among couples, as well as increasing applications of PGD and Preimplantation Genetic Screening (PGS), both contribute to industry growth.

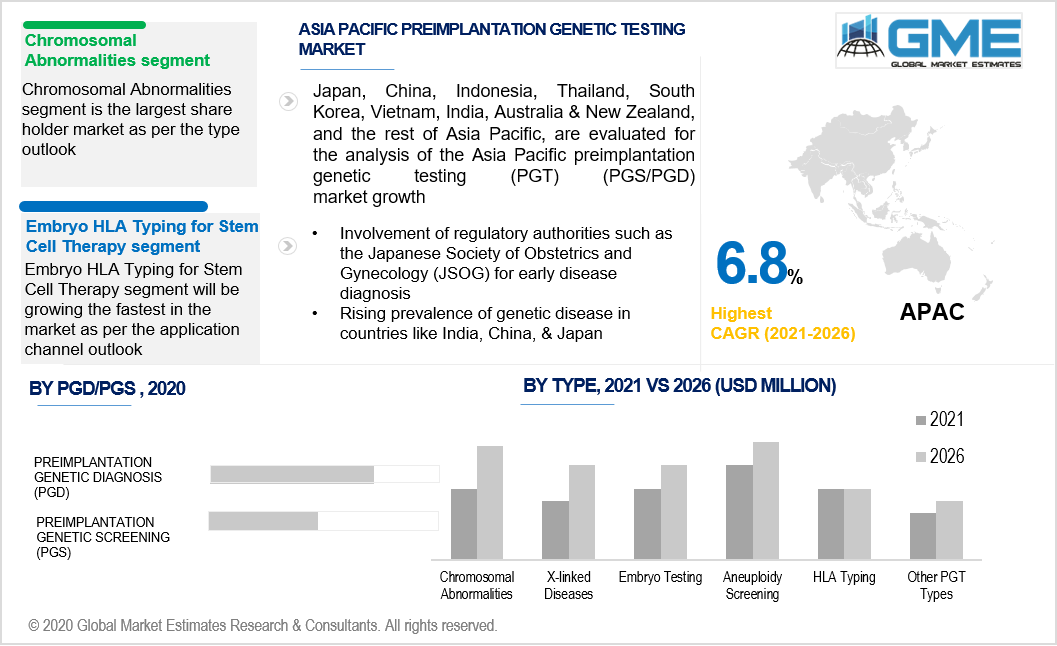

Due to rising understanding among medical professionals and consumers about genetic testing with a particular gene mutation, the PGD category generated the highest revenue in 2020. The rise is fuelled by the increasing occurrence of translocation events and single-gene disorders, as well as industrial organizations' successful delivery of NGS technology for genetic testing.

PGS facilities, on the other hand, provide for the detection of chromosomal defects in embryos. These programs are recommended for partners who are beyond reproductive age, have undergone multiple IVF phases, and have experienced repeated miscarriage. The PGS services category is expected to rise at a healthy rate over the projected timeframe, owing to increasing demand and the effective development of IVF treatment. Furthermore, because of great infrastructure, a significant number of IVF procedures are performed in high-capacity labs, which improves the efficiency of PGS services and thus drives development.

In terms of revenue growth, PGT for identifying chromosomal defects led the industry in 2020. This is attributed to the relentless advancement of aneuploidy detection techniques, which is very common in advanced maternal age.

During the projected timeframe, the Human Leukocyte Antigen (HLA) typing category is expected to grow at a massive rate. The category's development is expected to be fueled by the increased success rate of hematopoietic reconstitution in infants due to stem cell transplant surgery obtained from HLA-matched offspring.

In 2020, the most revenue was generated by the function of preimplantation genetic testing in embryo HLA typing for stem cell therapy. This is due to transplanting hematopoietic stem cells from associated donors has a better rate of survival than transplanting stem cells from different donors. However, in the coming years, the use of PGT in the analysis of hereditary genetic disorders is predicted to have the highest CAGR. The growing instances of hereditary genetic conditions in infants, such as hemoglobin diseases, cystic fibrosis, and others, as well as generations to come inheriting these disorders, are driving up the market.

In terms of revenue generation in 2020, North America dominated the preimplantation genetic testing industry, owing to a massive number of late pregnancy instances, which resulted in an increased acceptance of IVF treatments. Furthermore, the European PGT industry is bolstered by liberal aneuploidy screening legislation.

During the projected timeframe, Asia Pacific is expected to have the highest CAGR. Developing countries like India and China are engaged in a series of reproductive health developments, which have been followed by the introduction of a number of encouraging government laws and regulations. The involvement of regulatory authorities like the Japanese Society of Obstetrics and Gynecology (JSOG), which accepts and oversees the problems related to reproductive health in Japan, is expected to help the area expand. Moreover, improved IVF techniques use translates to higher PGT process acceptance, which stimulates the Asia Pacific PGT industry.

Some of the major participants competing in the preimplantation genetic testing (PGT) (PGS/PGD) are Thermo Fisher Scientific, Inc.; Cooper Surgical, Inc.; Reproductive Genetic Innovations, LLC; Good Start Genetics, Inc.; Bioarray S.L.; F. Hoffmann-La Roche AG; Illumina Inc.; Reproductive Health Science Ltd.; Natera, Inc.; Genea Limited; California Pacific Medical Center; IGENOMIX; and CombiMatrix.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Preimplantation Genetic Testing Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 PGD/PGS Overview

2.1.3 Application Overview

2.1.4 Type Overview

2.1.6 Regional Overview

Chapter 3 Preimplantation Genetic Testing Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Technology Advancement in Genetic Test

3.3.1.2 Rising Prevalence of Gene Specific Diseases

3.3.2 Industry Challenges

3.3.2.1 Lack of Adequate Infrastructure and Automated Laboratory Systems in Developing Nations

3.4 Prospective Growth Scenario

3.4.1 PGD/PGS Growth Scenario

3.4.2 Application Growth Scenario

3.4.3 Type Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Preimplantation Genetic Testing Market, By PGD/PGS

4.1 PGD/PGS Outlook

4.2 Preimplantation Genetic Diagnosis (PGD)

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Preimplantation Genetic Screening (PGS)

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Preimplantation Genetic Testing Market, By Application

5.1 Application Outlook

5.2 Embryo HLA Typing for Stem Cell Therapy

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 IVF Prognosis

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

5.4 Late Onset Genetic Disorders

5.4.1 Market Size, By Region, 2019-2026 (USD Million)

5.5 Inherited Genetic Disease

5.5.1 Market Size, By Region, 2019-2026 (USD Million)

5.6 Other Applications

5.6.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Preimplantation Genetic Testing Market, By Type

6.1 Chromosomal Abnormalities

6.1.1 Market Size, By Region, 2019-2026 (USD Million)

6.2 X-linked Diseases

6.2.1 Market Size, By Region, 2019-2026 (USD Million)

6.3 Embryo Testing

6.3.1 Market Size, By Region, 2019-2026 (USD Million)

6.4 Aneuploidy Screening

6.4.1 Market Size, By Region, 2019-2026 (USD Million)

6.5 HLA Typing

6.5.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 8 Preimplantation Genetic Testing Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2019-2026 (USD Million)

8.2.2 Market Size, By PGD/PGS, 2019-2026 (USD Million)

8.2.3 Market Size, By Application, 2019-2026 (USD Million)

8.2.4 Market Size, By Type, 2019-2026 (USD Million)

8.2.6 U.S.

8.2.6.1 Market Size, By PGD/PGS, 2019-2026 (USD Million)

8.2.4.2 Market Size, By Application, 2019-2026 (USD Million)

8.2.4.3 Market Size, By Type, 2019-2026 (USD Million)

8.2.7 Canada

8.2.7.1 Market Size, By PGD/PGS, 2019-2026 (USD Million)

8.2.7.2 Market Size, By Application, 2019-2026 (USD Million)

8.2.7.3 Market Size, By Type, 2019-2026 (USD Million)

8.3 Europe

8.3.1 Market Size, By Country 2019-2026 (USD Million)

8.3.2 Market Size, By PGD/PGS, 2019-2026 (USD Million)

8.3.3 Market Size, By Application, 2019-2026 (USD Million)

8.3.4 Market Size, By Type, 2019-2026 (USD Million)

8.3.6 Germany

8.3.6.1 Market Size, By PGD/PGS, 2019-2026 (USD Million)

8.3.6.2 Market Size, By Application, 2019-2026 (USD Million)

8.3.6.3 Market Size, By Type, 2019-2026 (USD Million)

8.3.7 UK

8.3.7.1 Market Size, By PGD/PGS, 2019-2026 (USD Million)

8.3.7.2 Market Size, By Application, 2019-2026 (USD Million)

8.3.7.3 Market Size, By Type, 2019-2026 (USD Million)

8.3.8 France

8.3.8.1 Market Size, By PGD/PGS, 2019-2026 (USD Million)

8.3.8.2 Market Size, By Application, 2019-2026 (USD Million)

8.3.8.3 Market Size, By Type, 2019-2026 (USD Million)

8.3.9 Italy

8.3.9.1 Market Size, By PGD/PGS, 2019-2026 (USD Million)

8.3.9.2 Market Size, By Application, 2019-2026 (USD Million)

8.3.9.3 Market Size, By Type, 2019-2026 (USD Million)

8.3.10 Spain

8.3.10.1 Market Size, By PGD/PGS, 2019-2026 (USD Million)

8.3.10.2 Market Size, By Application, 2019-2026 (USD Million)

8.3.10.3 Market Size, By Type, 2019-2026 (USD Million)

8.3.11 Russia

8.3.11.1 Market Size, By PGD/PGS, 2019-2026 (USD Million)

8.3.11.2 Market Size, By Application, 2019-2026 (USD Million)

8.3.11.3 Market Size, By Type, 2019-2026 (USD Million)

8.4 Asia Pacific

8.4.1 Market Size, By Country 2019-2026 (USD Million)

8.4.2 Market Size, By PGD/PGS, 2019-2026 (USD Million)

8.4.3 Market Size, By Application, 2019-2026 (USD Million)

8.4.4 Market Size, By Type, 2019-2026 (USD Million)

8.4.6 China

8.4.6.1 Market Size, By PGD/PGS, 2019-2026 (USD Million)

8.4.6.2 Market Size, By Application, 2019-2026 (USD Million)

8.4.6.3 Market Size, By Type, 2019-2026 (USD Million)

8.4.7 India

8.4.7.1 Market Size, By PGD/PGS, 2019-2026 (USD Million)

8.4.7.2 Market Size, By Application, 2019-2026 (USD Million)

8.4.7.3 Market Size, By Type, 2019-2026 (USD Million)

8.4.8 Japan

8.4.8.1 Market Size, By PGD/PGS, 2019-2026 (USD Million)

8.4.8.2 Market Size, By Application, 2019-2026 (USD Million)

8.4.8.3 Market Size, By Type, 2019-2026 (USD Million)

8.4.9 Australia

8.4.9.1 Market Size, By PGD/PGS, 2019-2026 (USD Million)

8.4.9.2 Market size, By Application, 2019-2026 (USD Million)

8.4.9.3 Market Size, By Type, 2019-2026 (USD Million)

8.4.10 South Korea

8.4.10.1 Market Size, By PGD/PGS, 2019-2026 (USD Million)

8.4.10.2 Market Size, By Application, 2019-2026 (USD Million)

8.4.10.3 Market Size, By Type, 2019-2026 (USD Million)

8.5 Latin America

8.5.1 Market Size, By Country 2019-2026 (USD Million)

8.5.2 Market Size, By PGD/PGS, 2019-2026 (USD Million)

8.5.3 Market Size, By Application, 2019-2026 (USD Million)

8.5.4 Market Size, By Type, 2019-2026 (USD Million)

8.5.6 Brazil

8.5.6.1 Market Size, By PGD/PGS, 2019-2026 (USD Million)

8.5.6.2 Market Size, By Application, 2019-2026 (USD Million)

8.5.6.3 Market Size, By Type, 2019-2026 (USD Million)

8.5.7 Mexico

8.5.7.1 Market Size, By PGD/PGS, 2019-2026 (USD Million)

8.5.7.2 Market Size, By Application, 2019-2026 (USD Million)

8.5.7.3 Market Size, By Type, 2019-2026 (USD Million)

8.5.8 Argentina

8.5.8.1 Market Size, By PGD/PGS, 2019-2026 (USD Million)

8.5.8.2 Market Size, By Application, 2019-2026 (USD Million)

8.5.8.3 Market Size, By Type, 2019-2026 (USD Million)

8.6 MEA

8.6.1 Market Size, By Country 2019-2026 (USD Million)

8.6.2 Market Size, By PGD/PGS, 2019-2026 (USD Million)

8.6.3 Market Size, By Application, 2019-2026 (USD Million)

8.6.4 Market Size, By Type, 2019-2026 (USD Million)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By PGD/PGS, 2019-2026 (USD Million)

8.6.6.2 Market Size, By Application, 2019-2026 (USD Million)

8.6.6.3 Market Size, By Type, 2019-2026 (USD Million)

8.6.7 UAE

8.6.7.1 Market Size, By PGD/PGS, 2019-2026 (USD Million)

8.6.7.2 Market Size, By Application, 2019-2026 (USD Million)

8.6.7.3 Market Size, By Type, 2019-2026 (USD Million)

8.6.8 South Africa

8.6.8.1 Market Size, By PGD/PGS, 2019-2026 (USD Million)

8.6.8.2 Market Size, By Application, 2019-2026 (USD Million)

8.6.8.3 Market Size, By Type, 2019-2026 (USD Million)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 Thermo Fisher Scientific

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 Cooper Surgical

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 Reproductive Genetic Innovations

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 Good Start Genetics

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 Bioarray S.L

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 F. Hoffmann-La Roche AG

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 Illumina

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 Reproductive Health Science Ltd

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

9.10 Natera

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info Graphic Analysis

9.11 Other Companies

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info Graphic Analysis

The Global Preimplantation Genetic Testing (PGT) Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Preimplantation Genetic Testing (PGT) Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS