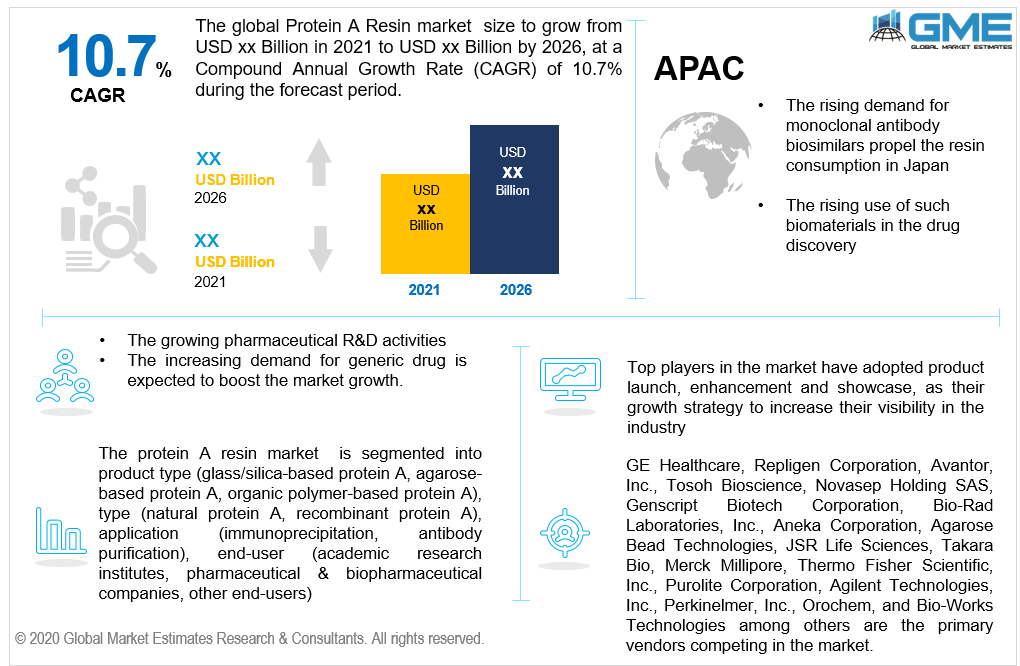

Global Protein A Resin Market Size, Trends, and Analysis - Forecasts To 2026 By Product Type (Glass/Silica-based protein A, Agarose-based protein A, Organic polymer-based protein A), By Type (Natural protein A, Recombinant protein A), By Application (Immunoprecipitation, Antibody Purification), By End-User (Academic Research Institutes, Pharmaceutical & Biopharmaceutical Companies, Other End-Users), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

Protein A resin chromatography is used for the processing of large quantities of pure materials for trace detection of the products contaminants. In recent years, chromatography is often used as an option to increase the efficiency of the chromatography purification process's resin ability. It removes antigen-antibody, receptor-nucleic acid interaction, and enzyme-substrate-based biochemical mixtures. The increasing production of therapeutic antibodies and increasing demand for biosimilars are fuelling the market growth for protein A resin. To enhance therapeutic approaches, several public and private agencies are funding protein-based research projects. The growing funding and investments for protein-based research are some of the significant factors likely to propel the protein resin market. Furthermore, growing pharmaceutical research & development expenditure and the demand for generic drugs during the expected timeline is fuelling the market growth.

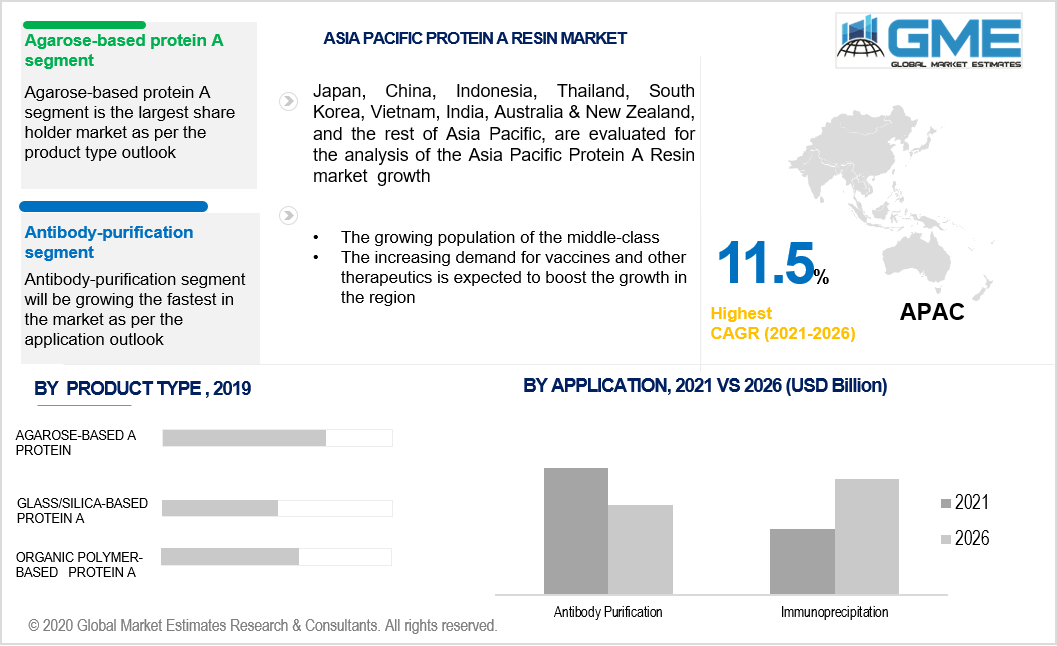

The various types of products available in the market are glass/silica-based protein A, agarose-based protein A and organic polymer-based protein A. It is expected that the revenue of agarose-based protein A will increase over the expected timeframe to hold the largest market shareholder by 2026. Resins based on agarose contain ionic and hydrophobic groups that connect with the compound of interest. Many antibody manufacturers, therefore, tend to use agarose-based resins, the most commonly used matrix resin for attaching protein-binding ligands.

Recombinant protein A is mostly used to enhance the solubility and to standardize alkaline solution sensitivity and prepare nanoparticles for protein drug carriers. The growth of the pharmaceutical industry and with growing technical developments in novel drug production would continue at a substantial pace. Therefore, the leading segment recombinant protein A is estimated to expand in 2021 at a substantial CAGR.

Over the estimated period, antibody purification is expected to increase in value to maintain the largest market shareholder in 2021. It can be due to the rising need for monoclonal antibodies for both therapeutic and research purposes, which has contributed to the need for protein A resins used in the downstream treatment of these antibodies. Moreover, the growing demand for the development of drugs will stimulate market growth in the coming years.

Academic research institutes, and pharmaceutical & biopharmaceutical companies, among others, are the various end-users of the market. Over the projected timeframe, the pharmaceutical & biopharmaceutical companies’ segment is expected to lead the market in 2021. Due to the rising occurrence of multiple chronic diseases and the increasing demand for effective treatment methods, a high demand for protein A resins is anticipated in the biopharmaceutical industry. Growing chromatography applications in the biopharmaceutical industry would also generate significant growth in the market.

In terms of market share, due to rising investments in R&D initiatives, increasing drug delivery and production, and the growing demand for technologically advanced goods, the market-leading segment is dominated by the North American region. Furthermore, Asia-Pacific is anticipated to boost at a high CAGR pace. The growth of this market is mainly driven by a growing middle-class population and the increasing demand for vaccines and other therapeutics has also led to a range of key factors leading to the growth of the market. Moreover, the increasing use of such biomaterials in drug discovery and the rising pharmaceutical industry have also been major factors contributing to the APAC sector's growth.

GE Healthcare, Repligen Corporation, Avantor, Inc., Tosoh Bioscience, Novasep Holding SAS, Genscript Biotech Corporation, Bio-Rad Laboratories, Inc., Aneka Corporation, Agarose Bead Technologies, JSR Life Sciences, Takara Bio, Merck Millipore, Thermo Fisher Scientific, Inc., Purolite Corporation, Agilent Technologies, Inc., Perkinelmer, Inc., Orochem, and Bio-Works Technologies among others are the primary vendors competing in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

In March 2018, Merck Millipore established its new distribution and manufacturing center in India for its Life Science business.

We value your investment and offer free customization with every report to fulfil your exact research needs.

The Global Protein A Resin Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply side analysis for the Protein A Resin Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the companies and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS