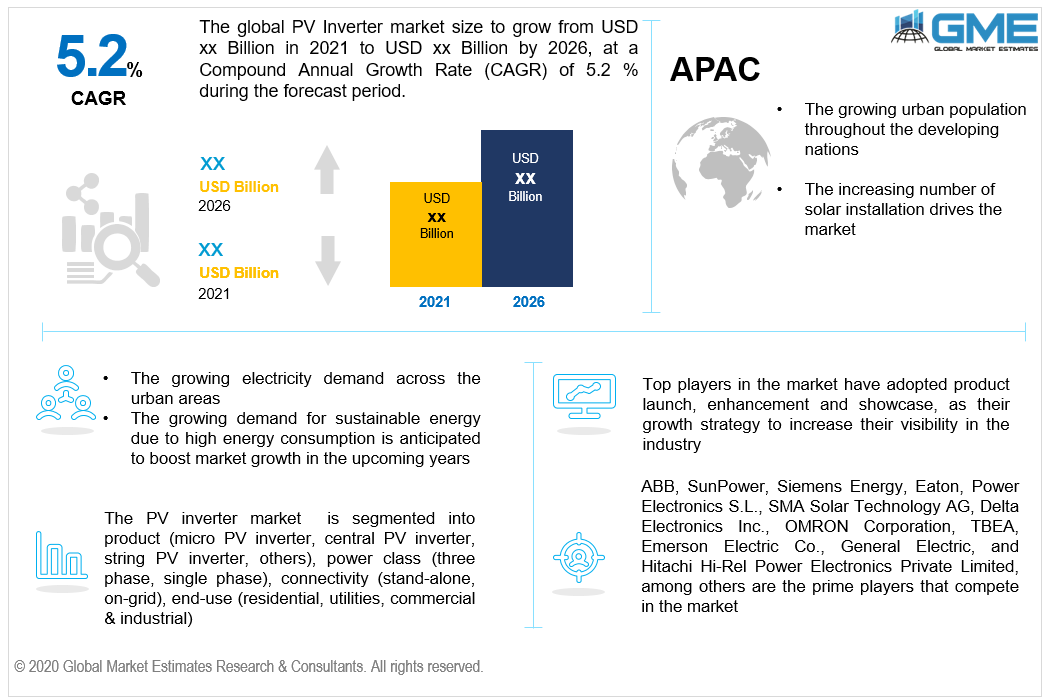

Global PV Inverter Market Size, Trends, and Analysis - Forecasts To 2026 By Product (Micro PV Inverter, Central PV Inverter, String PV Inverter, Others), By Power Class (Three Phase, Single Phase), By Connectivity (Stand-alone, On-Grid), By End-Use (Residential, Utilities, Commercial & Industrial), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

The output of the photovoltaic (PV) solar panel differential direct current (DC) is transformed by a PV inverter into an alternating current (AC) utility frequency that can be integrated into a commercial power grid or used by a central, off-grid electric grid. The special functions of solar power inverters are modified for use with photovoltaic arrays, like maximum power point monitoring and anti-island defense.

In the upcoming years the rising demand for renewable power due to high energy use, along with a decrease in the cost of generating renewable energy, is expected to boost the market growth. The relatively recent applications of solar inverters are PV plants. The number of solar panels installed in PV plants is high, and the special integration of solar inverters for each panel may not be convenient and cost-efficient.

Furthermore, growing investment in the production of large-scale solar PV infrastructure will boost the outlook for the industry. In addition to regulatory steps to ensure energy stability and the availability of stable and uninterruptible power supplies, the optimistic market outlook would stimulate the potential of the industry. Growing concerns about the environmental effects of the production of energy from traditional sources such as coal and natural gas are expected to serve as a possibility for the demand for solar photovoltaic inverters.

The photovoltaic inverter supply chain is significantly complex and involves part manufacturers, inverter producers, dealers, distributors, and end-users. Multiple components of the solar supply chain account for various generations of sales, such as the large portion of panels accompanied by batteries and inverters. Solar energy has gained prominence rapidly. It generates energy without emissions, without fluctuations in fuel prices, and without gas costs.

Various safety certifications, production, and grid integration certifications are protected by PV inverters. Regulatory compliance is reflected in all of the Photovoltaic industry's equipment segments, particularly in the U.S. Industry of PVs.

To ensure inverter protection and keep pace with technological developments, the increasing demand for solar equipment has placed tremendous strain on testing organizations, such as Underwriters Laboratories.

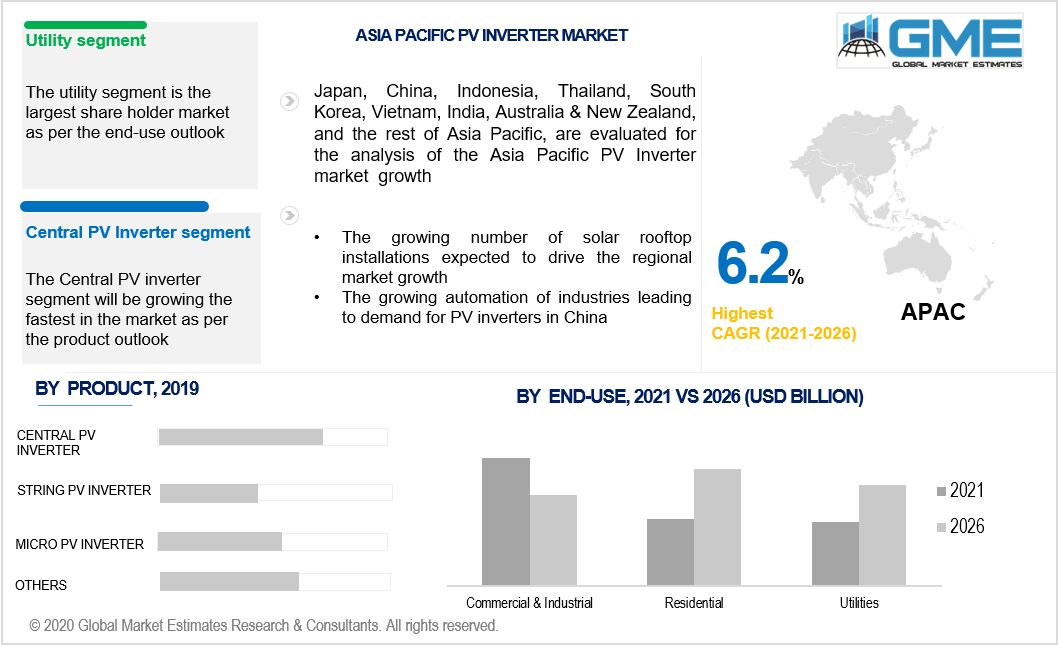

In 2019, the central PV inverter sector accounted for the largest revenue share due to the wide use of these systems in large-scale industrial applications. These inverters are extremely robust with appropriate maintenance. They are combined with wide arrays mounted on field facilities, manufacturing facilities, and homes, taking DC power from all PV panels and transforming it into AC power to become a single distribution point for power.

The micro-PV inverter segment is anticipated to witness considerable growth over the forecast timeline. These systems are electronics at the module level and have become a common option for the industrial and commercial industries. These products are economical, easy to install, have the benefit of high reliability and deliver improved performance and efficiency through the Maximum Power Point Tracker (MPPT).

The single-phase inverter segment is anticipated to boost market share during the forecast era. It will stimulate product demand by rising the operating potential of such systems through residential and commercial facilities. Moreover, the rising tendency to incorporate advanced inverter units throughout the developing economies will further fuel the market scenario.

The three-phase PV inverter market will experience significant growth, owing to robust product requirements and the ability to integrate across the low and high-power utility and industrial sectors. Product adoption will be powered by the growing implementation of enhanced solar PV systems, accompanied by an increasing number of solar farms throughout emerging markets. Furthermore, the deployment of these systems through on-grid and isolated grid networks providing monitoring & control and IoT-based solutions will promote the demand for technology.

The utility segment is anticipated to boost market share as well as grow during the expected timeframe at a high CAGR pace. This is primarily attributed to the rising government subsidies, the decline in solar power & equipment prices, and the increasing demand for renewable solar energy. With their pre-integrated power plants, some prominent players provide customers with industry-leading utility-scale activities to achieve higher performance and minimized device balance costs.

The residential segment is expected to see substantial growth throughout the forecast period, owing to the high demand for solar renewable energy among customers for household appliances, electricity, and other applications.

The industrial segment is expected to spur the market growth over the forecast due to the increasing number of government policies to strengthen the use of renewable energy sources for power generation. Moreover, the rapid increase in investment in the renewable energy industry across several industries will continue to pave the way for market growth.

In terms of sales, the Asia-Pacific region holds the leading market position as well as demonstrates a substantial CAGR rate over the projected timeframe. It is driven by factors that led to the market growth due to the growing number of solar installations and increasing investments for the clean energy network. A favorable market scenario has been implemented by strict regulatory measures followed by subsidized solar deployment with a consequent decrease in component prices. Moreover, rapid urban development throughout developing nations along with rising demand for energy are some of the factors driving the Asia-Pacific region's market during the forecast era.

Furthermore, numerous initiatives, like the Indian National Solar Mission, will push the demand of this region's solar inverter market further. NABARD, for example, provides a 40% subsidy for all those who buy solar inverters. All these aspects are reinforcing market demand throughout other Asian countries.

ABB, SunPower, Siemens Energy, Eaton, Power Electronics S.L., SMA Solar Technology AG, Delta Electronics Inc., OMRON Corporation, TBEA, Emerson Electric Co., General Electric, and Hitachi Hi-Rel Power Electronics Private Limited, among others are the prime players that compete in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

In August 2019, High-voltage ABB PV inverters selected for European development of renewable energy within the Netherlands, Spain, and Italy to increase GW capacity on large-scale PV installations.

We value your investment and offer free customization with every report to fulfil your exact research needs.

The Global PV Inverter Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the PV Inverter Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS