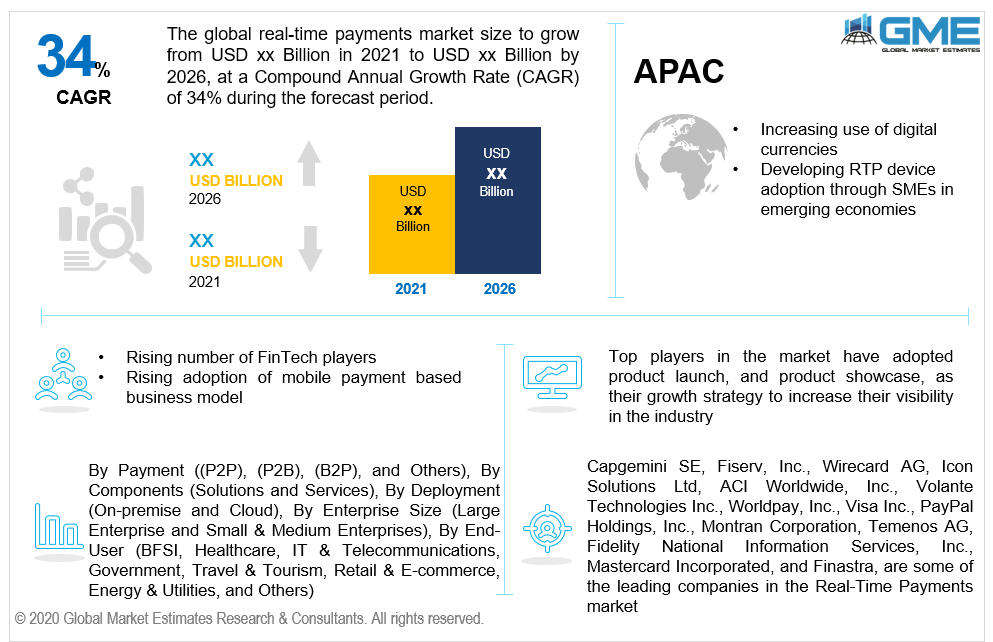

Global Real-Time Payments Market Size, Trends & Analysis - Forecasts to 2026 By Payment (Person-to-Person (P2P), Person-to-Business (P2B), Business-to-Person (B2P), and Others), By Components (Solutions and Services), By Deployment (On-premise and Cloud), By Enterprise Size (Large Enterprise and Small & Medium Enterprises), By End-User (BFSI, Healthcare, IT & Telecommunications, Government, Travel & Tourism, Retail & E-commerce, Energy & Utilities, and Others), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

Real-time payments are electronic/digital transactions that allow for rapid funds transfer via a stable payment gateway. The increasing pervasiveness of mobile devices and the brisk growth of online retail shopping in global markets are driving the accelerated acceptance of real-time transactions. The emergence of digital commerce, advancements in payment technologies, and the advent of smartphone point of sale (POS) systems have all pledged to drive market growth. Demanding buyers are gradually moving to their smartphones to pay retailers, billers, peer groups, and many others. Although the private sector has traditionally led innovation as a strategy to encourage online trade, policymakers have lagged; however, expanded use of real-time payments may enable the government to improve tax collection ratesand strengthen anti-fraud schemes.

Real-time payments can support financial institutions (FIs), retailers, customers, and the economy by enhancing transaction transparency, enabling better cash management, and assisting companies in efficiently managing day-to-day activities through improved liquidity.The liquidity boost will be particularly beneficial for small retailers who are accustomed to waiting for days to get their dues to be settled, potentially improving their cash balance and regular sales outstanding.Real-time payment systems are widely used in a variety of fields, including retail and internet businesses, BFSI, and IT and telecommunications, owing to their advantages in terms of efficiency, privacy, and transparency.

Consumers, retailers, and policymakers in developing markets see real-time payments as a road to a 24/7 fund transfer service that is extremely convenient and capable to provide financial stability. The increasing number of mobile users worldwide, as well as higher transfer speeds compared to conventional payment options, are driving overall growth.The growing acceptance of real-time payment solutions by retailers and online shopping shop owners is expected to drive market growth during the forecast timeframe.

Threats about cybersecurity and the difficulties encountered during payment transactions, on the other hand, are some of the reasons that could have an impact on the overall market development. To overcome such challenges, merchants are reconfiguring their payment systemsthrough integrating with high-end analytics software working on advanced technologies like ArtificialIntelligence (AI), Blockchain, Internet of Things (IoT), etc to provide a unique user experience for online real-time payment scenarios and toreduce overall fraudulent activity. This creates a hostile payment ecosystem which is beneficial for all the parties involved in financial transactions thus boosting the real-time payment market's expansion.

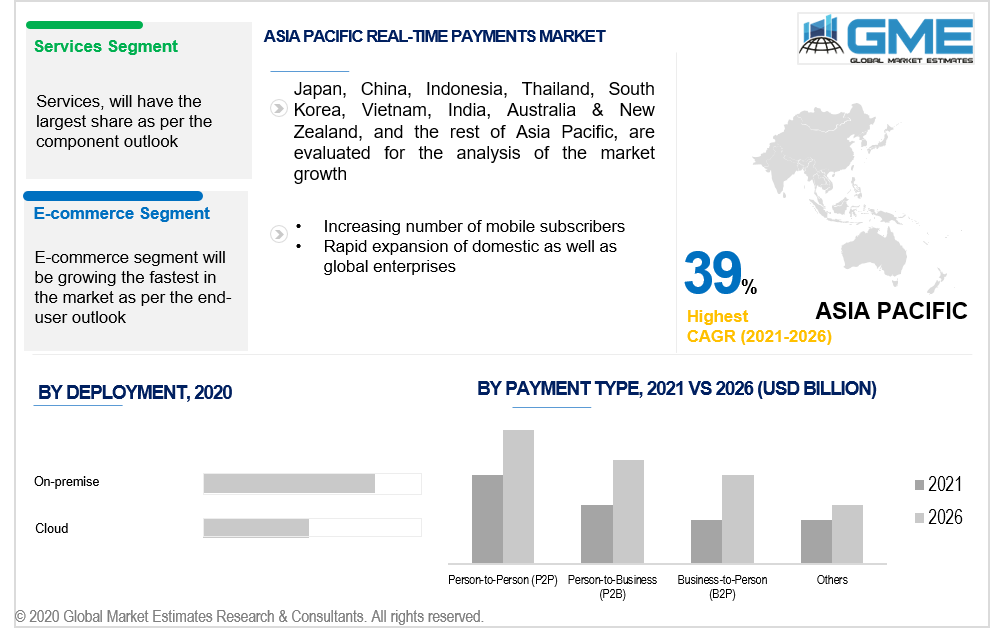

The market can be split into person-to-person (P2P), person-to-business (P2B), business-to-person (B2P), and others depending on payment form.The market for person-to-person (P2P)will be the largest owing to the rise in the prevalence of cell phones with fintech applications like Samsung Pay, Google Pay, Apple Pay,etc that allow easy money transfer options.

Based on the component segment, the market is classified into solutions and services.The market segment ofsolutions will be the largest because payment gateway service providers are witnessing skyrocketed demand for online payments as a result of an increase in the numberof reputed banks and financial institutions providing secure IoT-baseddigital payment services.

The market is divided into two segments based on deployment type: on-premise and cloud.The demand for the On-premise segment will rise the fastest from 2021 to 2026 because it is simple to install, manage and configure. The continual launch of smart city initiatives, as well as the growing number of autonomous retail outlets, are some of the major factors driving the segment's development.

Based on the scale of the enterprise, the market is categorized into large businesses and small and medium enterprises.The market for small & medium enterprises will be the largest.These companies are expected to expand rapidly in the future, due to the advent of cost-cutting technology such as cloud-based platforms and the increasing proliferation of the internet.

BFSI, healthcare, IT& telecommunications, government, travel & tourism, retail & e-commerce, energy & utilities, and others are the end-user segments of the market.During the forecast period, the retail & e-commerce segment is projected to expand at a rapid pace because it provides retail and e-commerce companies and consumers a strategic advantage like hostile ecosystemsecureddigital payments.

As per the geographical analysis, the market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central South America (Brazil, Argentina, and Rest of Central and South America).Over the projected timeframe, the North America region is expected to develop at a rapid pace. Several market leaders do have a footprint throughout North America.The growing level of immigration in North American countries such as the United States and Canada is expected to increase the number of cross-border payments. Furthermore, domestic and international players are making major investments to facilitate real-time payments, thus boosting the regional market's expansion.During the projection timeframe, APAC is predicted to have the maximum CAGR value. The APAC region's rate of growth can be attributed to a variety of reasons, such as the introduction of emerging technology, economic growth, a growing rate of digital transformation, large population, which correlates to the number of transactions, as well as domestic and foreign companies investing in this region, and substantial investment by real-time payment brands.

Capgemini SE, Fiserv, Inc., Wirecard AG, Icon Solutions Ltd, ACI Worldwide, Inc., Volante Technologies Inc., Worldpay, Inc., Visa Inc., PayPal Holdings, Inc., Montran Corporation, Temenos AG, Fidelity National Information Services, Inc., Mastercard Incorporated, and Finastra, are some of the leading companies in the Real-Time Payments market.

Please note: This is not an exhaustive list of companies profiled in the report.

We value your investment and offer free customization with every report to fulfil your exact research needs.

The Global Real-Time Payments Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Real-Time Payments Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS