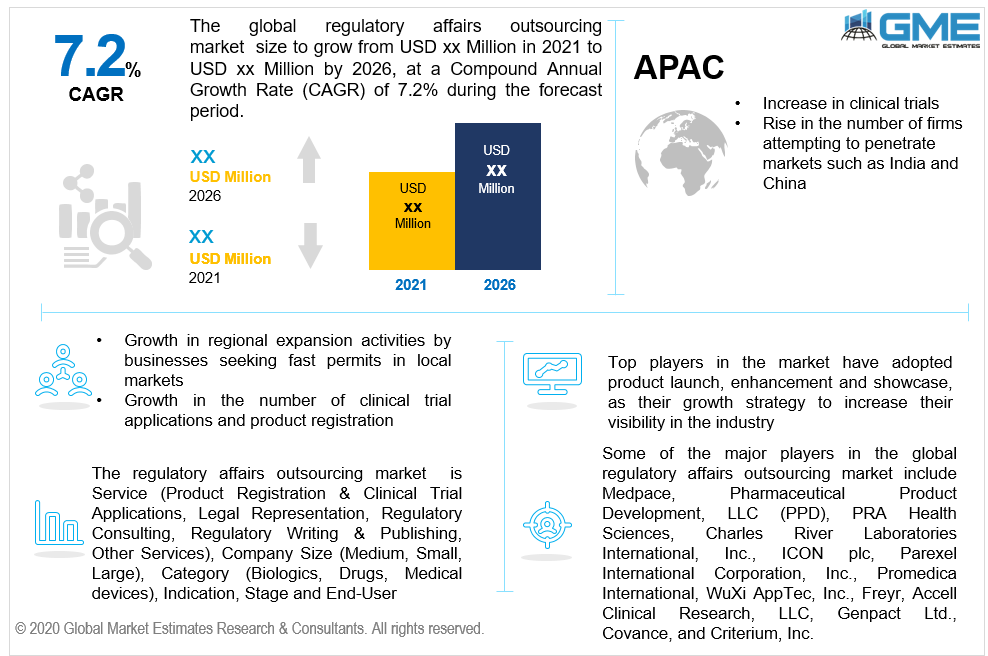

Global Regulatory Affairs Outsourcing Market Size, Trends, and Analysis- Forecasts To 2026 By Service (Product Registration & Clinical Trial Applications, Legal Representation, Regulatory Consulting, Regulatory Writing & Publishing, Other Services), By Company Size (Medium, Small, Large), By Category (Biologics, Drugs, Medical devices), By Indication (Cardiology, Neurology, Immunology, Oncology, Others), By Stage (Clinical, PMA (Post Market Authorization), Preclinical), By End-User (Pharmaceutical Companies, Biotechnology Companies, Medical Device Companies), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

Regulatory affairs also called government affairs is a profession that analyses and monitors the quality and effectiveness of products in fields such as agrochemicals, cosmetics, pesticides, medical devices, veterinary medicines, pharmaceuticals, and complementary medicines in order to ensure public health. The medical device, biotech, and pharmaceutical manufacturing companies have regulatory affairs outsourcing services. Regulatory affairs outsourcing companies assist with obtaining regulatory permits in a timely manner. Regulatory affairs outsourcing companies aid in the acceptance of new products, the preparation of protocols for clinical trials, and the publication of reports, among other things.

Regulatory affairs outsourcing is becoming more popular in the healthcare sector. The introduction of regulatory outsourcing frameworks is projected to be aided by a growth in regional expansion activities by businesses seeking fast permits in local markets. Because of the rise in Research & Development operations, as well as a growth in the number of clinical trial applications and product registration, the regulatory affairs outsourcing industry is continuously growing. Firms are constantly under pressure from authorities in various regions to obtain clinical approvals in a timely manner.

Regulatory affairs functions are difficult to perform. Over the last decades, the need to secure approval for new goods, ensure conformity, and do more with less has intensified. At the same time, investments in regulatory information systems have risen significantly in order to keep up with the need to automate processes such as publication and regulatory operations.

In the regulatory affairs outsourcing industry, there is a rise in the number of cases where service rates are not explicitly stated, which is posing a threat to the industry. Furthermore, with the increased usage of image magnification such as applications for database & information management, content management, and clinical data processing, extra charges are said to be associated with facilities. While technological advancements enhance the overall operation, they also increase overall cost, limiting market growth during the forecast period.

During the forecast period, the regulatory writing and publishing sector would have the largest profit share. Due to higher outsourcing of these products by mid-size and large medical device and biopharmaceutical firms, the sector is expected to lead the regulatory affairs outsourcing industry during the forecast period.

Over the forecast period, the legal representation segment is expected to grow at the highest CAGR. This may be attributed to the proliferation of medical device firms, which has increased the demand for legal representation across the world. Companies that do not have a physical presence in Europe, for example, must appoint legal representatives in order to obtain business authorization.

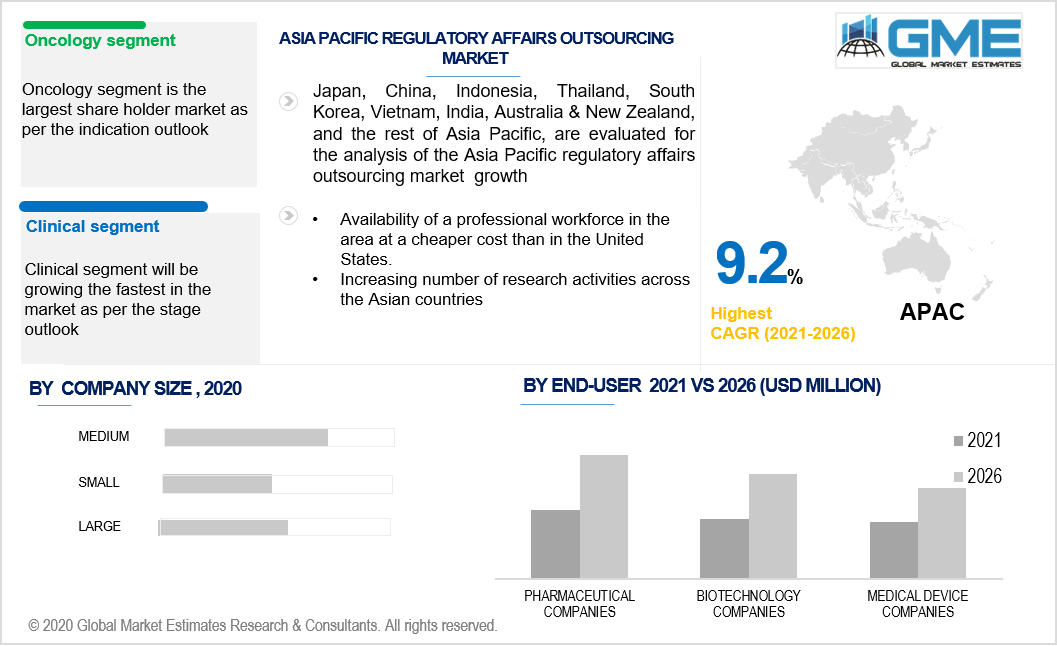

In 2020, medium-sized businesses accounted for the majority of the market. The involvement of several existing midsized companies, especially privately owned ones, is expected to help the segment expand. These businesses have a wide presence in selected or several markets around the world.

Over the forecast period, large companies are expected to expand at the highest pace. The top biotechnology, medical device, and pharma companies favor large service providers. The availability of a huge range of services and the involvement of these providers in different geographical areas will make doing business easier, which is one of the main reasons for their popularity, especially among larger businesses.

Medical devices lead the industry by category during the forecast period with the largest share of the market. This may be due to medical device firms relying on their core competencies while outsourcing non-core functions to boost competitiveness and operating performance.

During the forecast period, the biologics segment is expected to expand exponentially. Small molecule drug research & development productivity is decreasing, so the emphasis is turning to biologics, which are projected to increase productivity in the near future. To catch up with industry trends and retain their marketplace, various pharmaceutical companies are concentrating on the production of several biopharmaceutical products, thus leading to segment development.

During the forecast period, the oncology division had the highest market share. Latest developments in cancer biology, as well as the use of modern methods for genome analysis, have opened up a clinical outlook in oncology, resulting in personalized medicine. Scientific advancements are causing a rise in the number of personalized medicine services and products that are subject to regulatory scrutiny, resulting in market development.

Over the forecast period, the neurology segment is anticipated to grow at a fast rate. Neurological diseases are a leading cause of death worldwide. The sector is being driven by effective government policies and an expansion in external funding for research & development. Besides that, rapid advancements in the fields of technology and neurology have created opportunities for innovative product development for start-ups.

During the forecast period, the clinical segment had the highest share. This is due to an increase in the number of clinical trial registrations in recent times. Furthermore, the coronavirus pandemic has raised the demand for regulatory services even more. The global necessity to discover and commercialize an appropriate treatment and/or vaccination for COVID-19 has resulted in a surge in clinical trials all over the world. Additionally, supportive regulatory measures such as reducing the time it takes to approve a trial, releasing market guidance documents, waiving the waiting period, and financing clinical trials initiated by regulatory agencies are expected to fuel the segment's progress.

The Pharmaceutical Companies market generated the most revenue and is expected to rise at the fastest CAGR over the anticipated timeframe, attributed to the growing need for effective pharmaceutical product manufacturing and production, which is driving the implementation of full-time regulatory affairs outsourcing systems to reduce overall production costs. To keep up with the segment's intense competitiveness, pharmaceutical firms are aggressively working to increase production and performance, fulfill stringent quality assurance and healthcare regulatory outsourcing standards and streamline clinical trials.

During the forecast period, Asia Pacific dominated the industry with the highest CAGR rate. Over the forthcoming years, the region is expected to expand at a healthy rate. This can be due to the availability of a professional workforce in the area at a cheaper cost than in the United States.

Because of the growing number of research & development activities in the field of drug development carried out in the area, North America recorded the highest profit and is expected dominate the market from 2021 to 2026. It is home to a vast number of international biotech and pharmaceutical firms that conduct several clinical trials, as well as has an established and well-developed healthcare infrastructure.

However, due to health care requirements and government funds for scientific efforts, Europe is expected to surpass all other regions with the highest CAGR over the forecast period. Furthermore, several biotech and pharmaceutical firms have begun outsourcing their drug production services to nations such as France, Germany, and Italy, which is propelling the healthcare regulatory affairs outsourcing industry forward.

Some of the major players in the global regulatory affairs outsourcing market include Parexel International Corporation, Inc., Medpace, Pharmaceutical Product Development, LLC (PPD), ICON plc, Promedica International, WuXi AppTec, Charles River Laboratories International, Genpact Ltd., Covance, and Criterium, Inc.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Regulatory Affairs Outsourcing Industry Overview, 2016-2026

2.1.1 Industry Overview

2.1.2 Service Overview

2.1.3 Company Size Overview

2.1.4 Category Overview

2.1.5 Stage Overview

2.1.6 Indication Overview

2.1.6 End-User Overview

2.1.6 Regional Overview

Chapter 3 Regulatory Affairs Outsourcing Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Company expansion to developing regions seeking quick market permits

3.3.2 Industry Challenges

3.3.2.1 Impact of COVID-19 on outsourcing business

3.4 Prospective Growth Scenario

3.4.1 Service Growth Scenario

3.4.2 Company Size Growth Scenario

3.4.3 Category Growth Scenario

3.4.4 Stage Growth Scenario

3.4.5 Indication Scenario

3.4.6 End-User Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Stage Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Regulatory Affairs Outsourcing Market, By Service

4.1 Service Outlook

4.2 Product Registration & Clinical Trial Applications

4.2.1 Market Size, By Region, 2016-2026 (USD Million)

4.3 Legal Representation

4.3.1 Market Size, By Region, 2016-2026 (USD Million)

4.4 Regulatory Consulting

4.4.1 Market Size, By Region, 2016-2026 (USD Million)

4.5 Regulatory Writing & Publishing

4.5.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 5 Regulatory Affairs Outsourcing Market, By Company Size

5.1 Company Size Outlook

5.2 Medium

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

5.3 Small

5.3.1 Market Size, By Region, 2016-2026 (USD Million)

5.4 Large

5.4.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 6 Regulatory Affairs Outsourcing Market, By Category

6.1 Biologics

6.1.1 Market Size, By Region, 2016-2026 (USD Million)

6.2 Drugs

6.2.1 Market Size, By Region, 2016-2026 (USD Million)

6.3 Medical Devices

6.3.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 7 Regulatory Affairs Outsourcing Market, By Stage

7.1 Clinical

7.1.1 Market Size, By Region, 2016-2026 (USD Million)

7.2 PMA (Post Market Authorization)

7.2.1 Market Size, By Region, 2016-2026 (USD Million)

7.3 Preclinical

7.3.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 8 Regulatory Affairs Outsourcing Market, By End-User

8.1 Pharmaceutical Companies

8.1.1 Market Size, By Region, 2016-2026 (USD Million)

8.2 Biotechnology Companies

8.2.1 Market Size, By Region, 2016-2026 (USD Million)

8.3 Medical Device Companies

8.3.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 9 Regulatory Affairs Outsourcing Market, By Indication

9.1 Cardiology

9.1.1 Market Size, By Region, 2016-2026 (USD Million)

9.2 Neurology

9.2.1 Market Size, By Region, 2016-2026 (USD Million)

9.3 Immunology

9.4.1 Market Size, By Region, 2016-2026 (USD Million)

9.4 Oncology

9.4.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 10 Regulatory Affairs Outsourcing Market, By Region

10.1 Regional outlook

10.2 North America

10.2.1 Market Size, By Country 2016-2026 (USD Million)

10.2.2 Market Size, By Service, 2016-2026 (USD Million)

10.2.3 Market Size, By Company Size, 2016-2026 (USD Million)

10.2.4 Market Size, By Category, 2016-2026 (USD Million)

10.2.5 Market Size, By Stage, 2016-2026 (USD Million)

10.2.6 Market Size, By End-User, 2016-2026 (USD Million)

10.2.7 Market Size, By Indication, 2016-2026 (USD Million)

10.2.8 U.S.

10.2.8.1 Market Size, By Service, 2016-2026 (USD Million)

10.2.8.2 Market Size, By Company Size, 2016-2026 (USD Million)

10.2.8.3 Market Size, By Category, 2016-2026 (USD Million)

10.2.8.4 Market Size, By Stage, 2016-2026 (USD Million)

10.2.8.5 Market Size, By End-User, 2016-2026 (USD Million)

10.2.8.6 Market Size, By Indication, 2016-2026 (USD Million)

10.2.9 Canada

10.2.9.1 Market Size, By Service, 2016-2026 (USD Million)

10.2.9.2 Market Size, By Company Size, 2016-2026 (USD Million)

10.2.9.3 Market Size, By Category, 2016-2026 (USD Million)

10.2.9.4 Market Size, By Stage, 2016-2026 (USD Million)

10.2.9.5 Market Size, By End-User, 2016-2026 (USD Million)

10.2.9.6 Market Size, By Indication, 2016-2026 (USD Million)

10.2.10 Mexico

10.2.10.1 Market Size, By Service, 2016-2026 (USD Million)

10.2.10.2 Market Size, By Company Size, 2016-2026 (USD Million)

10.2.10.3 Market Size, By Category, 2016-2026 (USD Million)

10.2.10.4 Market Size, By Stage, 2016-2026 (USD Million)

10.2.10.5 Market Size, By End-User, 2016-2026 (USD Million)

10.2.10.6 Market Size, By Indication, 2016-2026 (USD Million)

10.3 Europe

10.3.1 Market Size, By Country 2016-2026 (USD Million)

10.3.2 Market Size, By Service, 2016-2026 (USD Million)

10.3.3 Market Size, By Company Size, 2016-2026 (USD Million)

10.3.4 Market Size, By Category, 2016-2026 (USD Million)

10.3.5 Market Size, By Stage, 2016-2026 (USD Million)

10.3.6 Market Size, By End-User, 2016-2026 (USD Million)

10.3.7 Market Size, By Indication, 2016-2026 (USD Million)

10.3.8 Germany

10.3.8.1 Market Size, By Service, 2016-2026 (USD Million)

10.3.8.2 Market Size, By Company Size, 2016-2026 (USD Million)

10.3.8.3 Market Size, By Category, 2016-2026 (USD Million)

10.3.8.4 Market Size, By Stage, 2016-2026 (USD Million)

10.3.8.5 Market Size, By End-User, 2016-2026 (USD Million)

10.3.8.6 Market Size, By Indication, 2016-2026 (USD Million)

10.3.9 UK

10.3.9.1 Market Size, By Service, 2016-2026 (USD Million)

10.3.9.2 Market Size, By Company Size, 2016-2026 (USD Million)

10.3.9.3 Market Size, By Category, 2016-2026 (USD Million)

10.3.9.4 Market Size, By Stage, 2016-2026 (USD Million)

10.3.9.5 Market Size, By End-User, 2016-2026 (USD Million)

10.3.9.6 Market Size, By Indication, 2016-2026 (USD Million)

10.3.10 France

10.3.10.1 Market Size, By Service, 2016-2026 (USD Million)

10.3.10.2 Market Size, By Company Size, 2016-2026 (USD Million)

10.3.10.3 Market Size, By Category, 2016-2026 (USD Million)

10.3.10.4 Market Size, By Stage, 2016-2026 (USD Million)

10.3.10.5 Market Size, By End-User, 2016-2026 (USD Million)

10.3.10.6 Market Size, By Indication, 2016-2026 (USD Million)

10.3.11 Italy

10.3.11.1 Market Size, By Service, 2016-2026 (USD Million)

10.3.11.2 Market Size, By Company Size, 2016-2026 (USD Million)

10.3.11.3 Market Size, By Category, 2016-2026 (USD Million)

10.3.11.4 Market Size, By Stage, 2016-2026 (USD Million)

10.3.11.5 Market Size, By End-User, 2016-2026 (USD Million)

10.3.11.6 Market Size, By Indication, 2016-2026 (USD Million)

10.4 Asia Pacific

10.4.1 Market Size, By Country 2016-2026 (USD Million)

10.4.2 Market Size, By Service, 2016-2026 (USD Million)

10.4.3 Market Size, By Company Size, 2016-2026 (USD Million)

10.4.4 Market Size, By Category, 2016-2026 (USD Million)

10.4.5 Market Size, By Stage, 2016-2026 (USD Million)

10.4.6 Market Size, By End-User, 2016-2026 (USD Million)

10.4.7 Market Size, By Indication, 2016-2026 (USD Million)

10.4.8 China

10.4.8.1 Market Size, By Service, 2016-2026 (USD Million)

10.4.8.2 Market Size, By Company Size, 2016-2026 (USD Million)

10.4.8.3 Market Size, By Category, 2016-2026 (USD Million)

10.4.8.4 Market Size, By Stage, 2016-2026 (USD Million)

10.4.8.5 Market Size, By End-User, 2016-2026 (USD Million)

10.4.8.6 Market Size, By Indication, 2016-2026 (USD Million)

10.4.9 India

10.4.9.1 Market Size, By Service, 2016-2026 (USD Million)

10.4.9.2 Market Size, By Company Size, 2016-2026 (USD Million)

10.4.9.3 Market Size, By Category, 2016-2026 (USD Million)

10.4.9.4 Market Size, By Stage, 2016-2026 (USD Million)

10.4.9.5 Market Size, By End-User, 2016-2026 (USD Million)

10.4.9.6 Market Size, By Indication, 2016-2026 (USD Million)

10.4.10 Japan

10.4.8.1 Market Size, By Service, 2016-2026 (USD Million)

10.4.8.2 Market Size, By Company Size, 2016-2026 (USD Million)

10.4.8.3 Market Size, By Category, 2016-2026 (USD Million)

10.4.8.4 Market Size, By Stage, 2016-2026 (USD Million)

10.4.8.5 Market Size, By End-User, 2016-2026 (USD Million)

10.4.8.6 Market Size, By Indication, 2016-2026 (USD Million)

10.5 MEA

10.5.1 Market Size, By Country 2016-2026 (USD Million)

10.5.2 Market Size, By Service, 2016-2026 (USD Million)

10.5.3 Market Size, By Company Size, 2016-2026 (USD Million)

10.5.4 Market Size, By Category, 2016-2026 (USD Million)

10.5.5 Market Size, By Stage, 2016-2026 (USD Million)

10.5.6 Market Size, By End-User, 2016-2026 (USD Million)

10.5.7 Market Size, By Indication, 2016-2026 (USD Million)

10.5.8 Saudi Arabia

10.5.8.1 Market Size, By Service, 2016-2026 (USD Million)

10.5.8.2 Market Size, By Company Size, 2016-2026 (USD Million)

10.5.8.3 Market Size, By Category, 2016-2026 (USD Million)

10.5.8.4 Market Size, By Stage, 2016-2026 (USD Million)

10.5.8.5 Market Size, By End-User, 2016-2026 (USD Million)

10.5.8.6 Market Size, By Indication, 2016-2026 (USD Million)

10.5.9 UAE

10.5.9.1 Market Size, By Service, 2016-2026 (USD Million)

10.5.9.2 Market Size, By Company Size, 2016-2026 (USD Million)

10.5.9.3 Market Size, By Category, 2016-2026 (USD Million)

10.5.9.4 Market Size, By Stage, 2016-2026 (USD Million)

10.5.9.5 Market Size, By End-User, 2016-2026 (USD Million)

10.5.9.6 Market Size, By Indication, 2016-2026 (USD Million)

10.5.10 South Africa

10.5.10.1 Market Size, By Service, 2016-2026 (USD Million)

10.5.10.2 Market Size, By Company Size, 2016-2026 (USD Million)

10.5.10.3 Market Size, By Category, 2016-2026 (USD Million)

10.5.10.4 Market Size, By Stage, 2016-2026 (USD Million)

10.5.10.5 Market Size, By End-User, 2016-2026 (USD Million)

10.5.10.6 Market Size, By Indication, 2016-2026 (USD Million)

Chapter 11 Company Landscape

11.1 Competitive Analysis, 2020

11.2 ICON plc

11.2.1 Company Overview

11.2.2 Financial Analysis

11.2.3 Strategic Positioning

11.2.4 Info Graphic Analysis

11.3 Promedica

11.3.1 Company Overview

11.3.2 Financial Analysis

11.3.3 Strategic Positioning

11.3.4 Info Graphic Analysis

11.4 Parexel

11.4.1 Company Overview

11.4.2 Financial Analysis

11.4.3 Strategic Positioning

11.4.4 Info Graphic Analysis

11.5 Medpace

11.5.1 Company Overview

11.5.2 Financial Analysis

11.5.3 Strategic Positioning

11.5.4 Info Graphic Analysis

11.6 PPD LLC

11.6.1 Company Overview

11.6.2 Financial Analysis

11.6.3 Strategic Positioning

11.6.4 Info Graphic Analysis

11.7 WuXi

11.7.1 Company Overview

11.7.2 Financial Analysis

11.7.3 Strategic Positioning

11.7.4 Info Graphic Analysis

11.8 Charles River Laboratories

11.10.1 Company Overview

11.10.2 Financial Analysis

11.10.3 Strategic Positioning

11.10.4 Info Graphic Analysis

11.11 Genpact

11.11.1 Company Overview

11.11.2 Financial Analysis

11.11.3 Strategic Positioning

11.11.4 Info Graphic Analysis

11.10 Others

11.10.1 Company Overview

11.10.2 Financial Analysis

11.10.3 Strategic Positioning

11.10.4 Info Graphic Analysis

The Global Regulatory Affairs Outsourcing Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Regulatory Affairs Outsourcing Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS