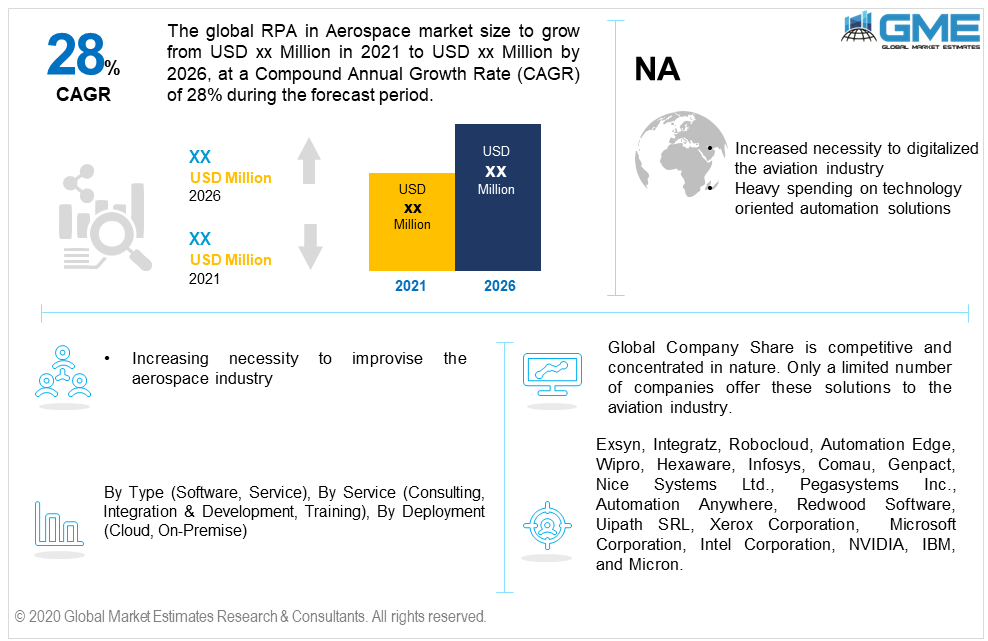

Global Robotic Process Automation In Aerospace Market Size, Trends & Analysis - Forecasts to 2026 By Type (Software, Service), By Service (Consulting, Integration & Development, Training), By Deployment (Cloud, On-Premise), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa); End-User Landscape, Company Market Share Analysis, and Competitor Analysis

Increasing need to streamline the aviation industry in terms of data collection, analysing, and management of the information are major factors to drive the Robotic Process Automation in Aerospace Market growth. The Global Robotic Process Automation in Aerospace Market will witness over 28% CAGR up to 2026. Shifting business needs towards more computerized and digitalized solutions to reduce the manual and time-consuming tasks along with the need to assess and analyse the data are key success factors to induce RPA adoption in the aviation industry. Data migration, system integration, inventory management, KYC, and MRO software are the major implemented tools in the aviation industry.

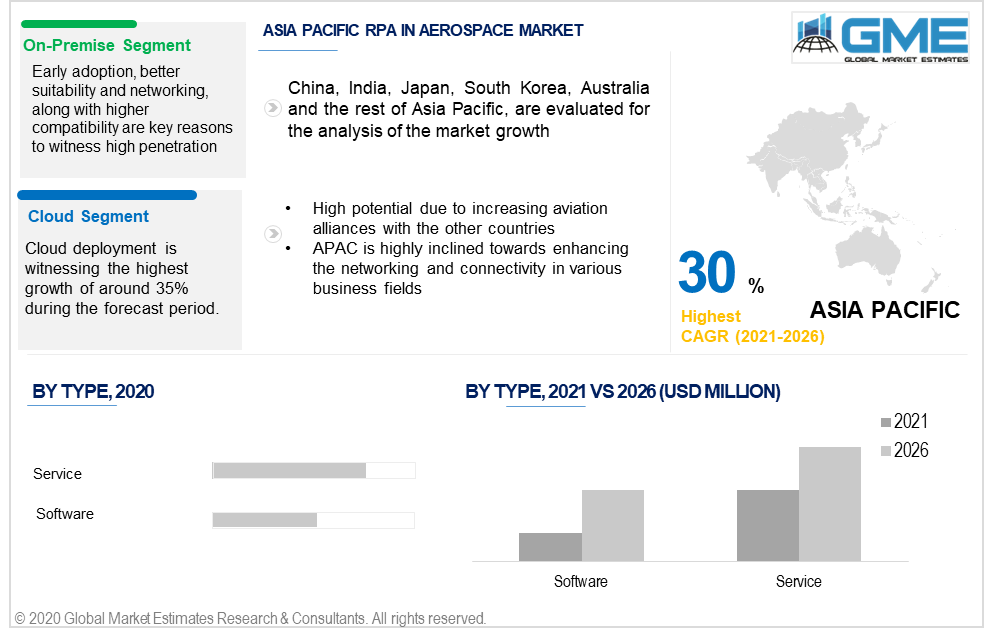

Software and service are the key identified types in the RPA market. Yearly, airline companies and other business organizations spend large sums of money on digital infrastructure. Internal networking, policy implementations, customer KPI, connectivity, and system computerization solutions are the major agenda to implement these RPA tools. The basic purpose of these organizations is to achieve the enhancement of business experience and streamline their activities with the help of the latest technological tools.

The service segment dominated the industry and accounted for over 58% of the revenue share in 2019. The major service components are integration & maintenance, consulting, support and training. Software segment will observe steady growth up to 2026.

By service, the industry is segmented into consulting, integration & development, and training. The consulting segment dominated the overall RPA in the aviation industry. The segment led the market due to its wide and early implementation as an IT infrastructure solution tool. The aviation industry is still witnessing the high adoption of consulting services in developing countries. Increased dependence on the network incorporated business environment and necessity to improve the connectivity resultant in high penetration of integration & development services. Airlines owners have started financing these smart organisation infrastructures to improvise the overall business experience will fuel the industrial growth.

Other key segments i.e. training will witness significant growth in the coming years. The rising necessity to improve the internal business practice and appropriate training in the organization are the key reasons to drive growth in this segment.

By deployment, the industry is segregated into on-premise and cloud. As of now, the on-premise deployment method led the overall industry revenue in 2019. Early adoption, better suitability and networking, along with higher compatibility are key reasons to witness high penetration in this segment. Data safety, credibility, and strict policies & protocols were the initial factors to adopt the on-premise deployment method. However, changing business requirements along with shifting large industry’s interest towards cloud computing infrastructure will result in high growth in cloud deployment.

Cloud deployment is witnessing the highest growth of around 35% during the forecast period. Improved reach, compatibility, and suitability with the user along with lesser maintenance cost as compared to the on-premise deployment are major success factors to induce demand. Other factors such as economical, flexibility, automatic upgrades, and real time data analytics will support cloud computing implementation in the aviation industry.

The North America Robotic Process Automation in Aerospace market will dominate the overall revenue share and accounts for over 37% of the market by 2026. High spending on digitalization along with heavy aviation traffic in both passenger and cargo will result in a high adoption rate. Also, presence of various providers in the region along with government support to promote RPA tools in diversified businesses will support the regional industry growth.

The European market will witness significant gains during the forecast period. Rising penetration among the aviation industry to enhance the overall procedure by adopting RPA tools will benefit the regional industry growth. Improved business activity execution, standardization, and policy implementation are the key influencing factors to induce the RPA adoption in the region.

The Asia Pacific RPA Market will witness over 30% CAGR up to 2026. High potential due to increasing aviation alliances with the other countries along with heavy airline traffic within the region will proliferate the industry growth. China, India, Singapore, and Australia are the key contributing countries in this industry owing to their vast aviation industry. The aforementioned nations are spending and investing heavily in IT Infrastructure and smart computerization processes. APAC is highly inclined towards enhancing the networking and connectivity in various business fields.

Global Company Share is competitive and concentrated in nature. Only a limited number of companies offer these solutions to the aviation industry. However, changing IT infrastructure accompanied by the development of more advanced and updated solutions by the tech startup companies will result in new market entrants in the coming years.

Key identified providers in the company includes but not limited to Exsyn, Integratz, Robocloud, Automation Edge, Wipro, Hexaware, Infosys, Comau, Genpact, Nice Systems Ltd., Pegasystems Inc., Automation Anywhere, Redwood Software, Uipath SRL, Xerox Corporation, Microsoft Corporation, Intel Corporation, NVIDIA, IBM, and Micron.

Please note: This is not an exhaustive list of companies profiled in the report.

Collaboration with the end-users along with the technological development in product offerings are the key strategies observed in the industry.

Chapter 1 Methodology

1.1 Market scope & definitions

1.2 Estimates & forecast calculation

1.3 Historical data overview and validation

1.4 Data sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Robotic process automation in aerospace industry overview, 2019-2026

2.1.1 Industry overview

2.1.2 Type overview

2.1.3 Service overview

2.1.4 Deployment overview

2.1.5 Regional overview

Chapter 3 Robotic Process Automation Market Trends

3.1 Market segmentation

3.2 Industry background, 2019-2026

3.3 Market key trends

3.3.1 Positive trends

3.3.2 Industry challenges

3.4 Prospective growth scenario

3.5 COVID-19 influence over industry growth

3.6 Porter’s analysis

3.7 PESTEL analysis

3.8 Value chain & supply chain analysis

3.9 Regulatory framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology overview

3.11 Market share analysis, 2020

3.11.1 Company positioning overview, 2020

Chapter 4 Robotic Process Automation Market, By Type

4.1 Type Outlook

4.2 Software

4.2.1 Market size, by region, 2019-2026 (USD Million)

4.3 Service

4.3.1 Market size, by region, 2019-2026 (USD Million)

Chapter 5 Robotic Process Automation Market, By Service

5.1 Service Outlook

5.2 Consulting

5.2.1 Market size, by region, 2019-2026 (USD Million)

5.3 Integration & development

5.3.1 Market size, by region, 2019-2026 (USD Million)

5.4 Training

5.4.1 Market size, by region, 2019-2026 (USD Million)

Chapter 6 Robotic Process Automation Market, By Deployment

6.1 Deployment Outlook

6.2 Cloud

6.2.1 Market size, by region, 2019-2026 (USD Million)

6.3 On premise

6.3.1 Market size, by region, 2019-2026 (USD Million)

Chapter 7 Robotic Process Automation Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market size, by country 2019-2026 (USD Million)

7.2.2 Market size, by type, 2019-2026 (USD Million)

7.2.3 Market size, by service, 2019-2026 (USD Million)

7.2.4 Market size, by deployment, 2019-2026 (USD Million)

7.2.5 U.S.

7.2.5.1 Market size, by type, 2019-2026 (USD Million)

7.2.5.2 Market size, by service, 2019-2026 (USD Million)

7.2.5.3 Market size, by deployment, 2019-2026 (USD Million)

7.2.6 Canada

7.2.6.1 Market size, by type, 2019-2026 (USD Million)

7.2.6.2 Market size, by service, 2019-2026 (USD Million)

7.2.6.3 Market size, by deployment, 2019-2026 (USD Million)

7.3 Europe

7.3.1 Market size, by country 2019-2026 (USD Million)

7.3.2 Market size, by type, 2019-2026 (USD Million)

7.3.3 Market size, by service, 2019-2026 (USD Million)

7.3.4 Market size, by deployment, 2019-2026 (USD Million)

7.3.5 Germany

7.2.5.1 Market size, by type, 2019-2026 (USD Million)

7.2.5.2 Market size, by service, 2019-2026 (USD Million)

7.2.5.3 Market size, by deployment, 2019-2026 (USD Million)

7.3.6 UK

7.3.6.1 Market size, by type, 2019-2026 (USD Million)

7.3.6.2 Market size, by service, 2019-2026 (USD Million)

7.3.6.3 Market size, by deployment, 2019-2026 (USD Million)

7.3.7 France

7.3.7.1 Market size, by type, 2019-2026 (USD Million)

7.3.7.2 Market size, by service, 2019-2026 (USD Million)

7.3.7.3 Market size, by deployment, 2019-2026 (USD Million)

7.3.8 Italy

7.3.8.1 Market size, by type, 2019-2026 (USD Million)

7.3.8.2 Market size, by service, 2019-2026 (USD Million)

7.3.8.3 Market size, by deployment, 2019-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market size, by country 2019-2026 (USD Million)

7.4.2 Market size, by type, 2019-2026 (USD Million)

7.4.3 Market size, by service, 2019-2026 (USD Million)

7.4.4 Market size, by deployment, 2019-2026 (USD Million)

7.4.5 China

7.4.5.1 Market size, by type, 2019-2026 (USD Million)

7.4.5.2 Market size, by service, 2019-2026 (USD Million)

7.4.5.3 Market size, by deployment, 2019-2026 (USD Million)

7.4.6 India

7.4.6.1 Market size, by type, 2019-2026 (USD Million)

7.4.6.2 Market size, by service, 2019-2026 (USD Million)

7.4.6.3 Market size, by deployment, 2019-2026 (USD Million)

7.4.7 Japan

7.4.7.1 Market size, by type, 2019-2026 (USD Million)

7.4.7.2 Market size, by service, 2019-2026 (USD Million)

7.4.7.3 Market size, by deployment, 2019-2026 (USD Million)

7.4.8 Australia

7.4.8.1 Market size, by type, 2019-2026 (USD Million)

7.4.8.2 Market size, by service, 2019-2026 (USD Million)

7.4.8.3 Market size, by deployment, 2019-2026 (USD Million)

7.4.9 South Korea

7.4.9.1 Market size, by type, 2019-2026 (USD Million)

7.4.9.2 Market size, by service, 2019-2026 (USD Million)

7.4.9.3 Market size, by deployment, 2019-2026 (USD Million)

7.5 Latin America

7.5.1 Market size, by country 2019-2026 (USD Million)

7.5.2 Market size, by type, 2019-2026 (USD Million)

7.5.3 Market size, by service, 2019-2026 (USD Million)

7.5.4 Market size, by deployment, 2019-2026 (USD Million)

7.5.5 Brazil

7.5.5.1 Market size, by type, 2019-2026 (USD Million)

7.5.5.2 Market size, by service, 2019-2026 (USD Million)

7.5.5.3 Market size, by deployment, 2019-2026 (USD Million)

7.5.6 Mexico

7.5.6.1 Market size, by type, 2019-2026 (USD Million)

7.5.6.2 Market size, by service, 2019-2026 (USD Million)

7.5.6.3 Market size, by deployment, 2019-2026 (USD Million)

7.6 MEA

7.6.1 Market size, by country 2019-2026 (USD Million)

7.6.2 Market size, by type, 2019-2026 (USD Million)

7.6.3 Market size, by service, 2019-2026 (USD Million)

7.6.4 Market size, by deployment, 2019-2026 (USD Million)

7.6.5 Saudi Arabia

7.6.5.1 Market size, by type, 2019-2026 (USD Million)

7.6.5.2 Market size, by service, 2019-2026 (USD Million)

7.6.5.3 Market size, by deployment, 2019-2026 (USD Million)

7.6.6 UAE

7.6.6.1 Market size, by type, 2019-2026 (USD Million)

7.6.6.2 Market size, by service, 2019-2026 (USD Million)

7.6.6.3 Market size, by deployment, 2019-2026 (USD Million)

7.6.7 South Africa

7.6.7.1 Market size, by type, 2019-2026 (USD Million)

7.6.7.2 Market size, by service, 2019-2026 (USD Million)

7.6.7.3 Market size, by deployment, 2019-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive analysis, 2020

8.2 Exsyn

8.2.1 Company overview

8.2.2 Financial analysis

8.2.3 Strategic positioning

8.2.4 Info graphic analysis

8.3 Integratz

8.3.1 Company overview

8.3.2 Financial analysis

8.3.3 Strategic positioning

8.3.4 Info graphic analysis

8.4 Robocloud

8.4.1 Company overview

8.4.2 Financial analysis

8.4.3 Strategic positioning

8.4.4 Info graphic analysis

8.5 Automation Edge

8.5.1 Company overview

8.5.2 Financial analysis

8.5.3 Strategic positioning

8.5.4 Info graphic analysis

8.6 Wipro

8.6.1 Company overview

8.6.2 Financial analysis

8.6.3 Strategic positioning

8.6.4 Info graphic analysis

8.7 Hexaware

8.7.1 Company overview

8.7.2 Financial analysis

8.7.3 Strategic positioning

8.7.4 Info graphic analysis

8.8 Infosys

8.8.1 Company overview

8.8.2 Financial analysis

8.8.3 Strategic positioning

8.8.4 Info graphic analysis

8.9 Comau

8.9.1 Company overview

8.9.2 Financial analysis

8.9.3 Strategic positioning

8.9.4 Info graphic analysis

8.10 Genpact

8.10.1 Company overview

8.10.2 Financial analysis

8.10.3 Strategic positioning

8.10.4 Info graphic analysis

8.11 Nice Systems Ltd.

8.11.1 Company overview

8.11.2 Financial analysis

8.11.3 Strategic positioning

8.11.4 Info graphic analysis

8.12 Pegasystems Inc.

8.12.1 Company overview

8.12.2 Financial analysis

8.12.3 Strategic positioning

8.12.4 Info graphic analysis

8.13 Automation Anywhere

8.13.1 Company overview

8.13.2 Financial analysis

8.13.3 Strategic positioning

8.13.4 Info graphic analysis

8.14 Redwood Software

8.14.1 Company overview

8.14.2 Financial analysis

8.14.3 Strategic positioning

8.14.4 Info graphic analysis

8.15 Uipath SRL

8.15.1 Company overview

8.15.2 Financial analysis

8.15.3 Strategic positioning

8.15.4 Info graphic analysis

8.16 Xerox Corporation

8.16.1 Company overview

8.16.2 Financial analysis

8.16.3 Strategic positioning

8.16.4 Info graphic analysis

8.17 Microsoft Corporation

8.17.1 Company overview

8.17.2 Financial analysis

8.17.3 Strategic positioning

8.17.4 Info graphic analysis

8.18 Intel Corporation

8.18.1 Company overview

8.18.2 Financial analysis

8.18.3 Strategic positioning

8.18.4 Info graphic analysis

8.19 NVIDIA

8.19.1 Company overview

8.19.2 Financial analysis

8.19.3 Strategic positioning

8.19.4 Info graphic analysis

8.20 IBM

8.20.1 Company overview

8.20.2 Financial analysis

8.20.3 Strategic positioning

8.20.4 Info graphic analysis

8.21 Micron

8.21.1 Company overview

8.21.2 Financial analysis

8.21.3 Strategic positioning

8.21.4 Info graphic analysis

The Global Robotic Process Automation In Aerospace Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Robotic Process Automation In Aerospace Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS