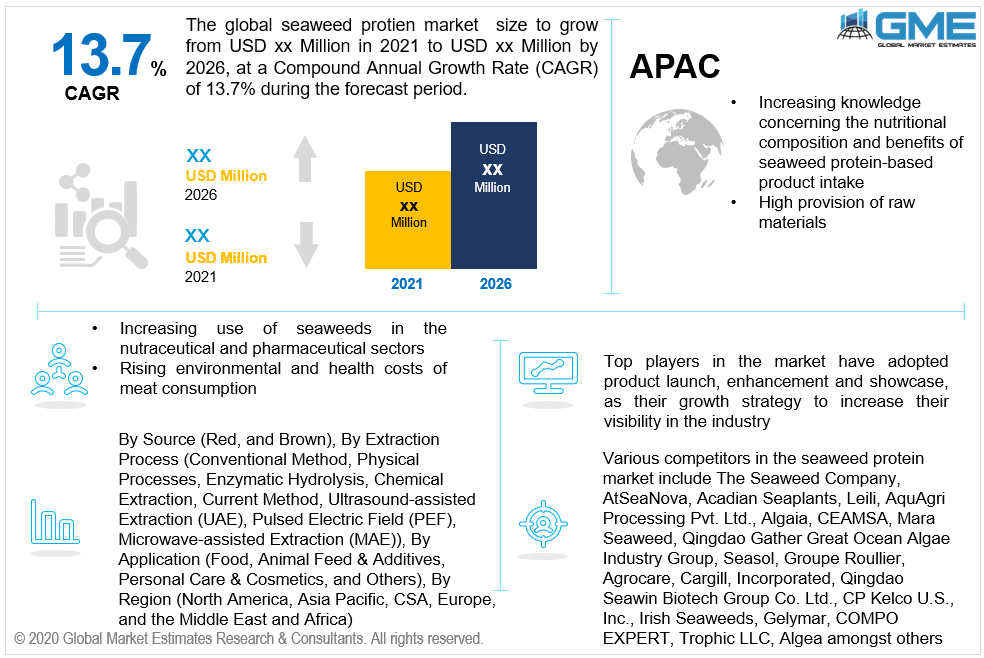

Global Seaweed Protein Market Size, Trends, and Analysis - Forecasts To 2026 By Source (Red, and Brown), By Extraction Process (Conventional Method, Physical Processes, Enzymatic Hydrolysis, Chemical Extraction, Current Method, Ultrasound-assisted Extraction (UAE), Pulsed Electric Field (PEF), Microwave-assisted Extraction (MAE)), By Application (Food, Animal Feed & Additives, Personal Care & Cosmetics, and Others), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

Aspects, including increased consumer consciousness of the nutritional advantages of seaweed protein-based items, expanding industrial and feed-related applications, and developing demand for alternative protein sources, are slated to fuel the expansion of the seaweed protein market during the forecast period. The increasing popularity of plant-based proteins in foodstuff owing to their numerous health advantages is boosting the global seaweed protein market. Moreover, rising seaweed protein use in nutraceuticals is likely to open up an attractive potential for market expansion throughout the forecast period. Increased popularity for vegan/vegetarian protein substitutes to meat and dairy, increased consumer acknowledgment of the therapeutic properties of seaweed protein-based goods, and elevated industrial feed-related implementations are anticipated to propel the growth of the seaweed protein market during the forecast period.

Nonetheless, the increased cost of seaweed farming is expected to stymie market growth. Frequent usage of seaweed protein-based goods, on the other hand, might be harmful to consumers' health owing to hazardous substances, including heavy metal deposits. This has resulted in increased worldwide health concerns, and, in response, contributed to a stifling factor in the expansion of the seaweed protein market. Recently, the consumer food market has seen a shift in preference from meat and its by-products to vegetable-based products. Seaweed serves as a great alternative to animal protein because of its benefits. This shift has been especially observed among millennials, as they are more aware of their muscle health and veganism. Attributable to its high protein concentration, the demand for seaweed has also seen an uprise in the nutraceutical industry.

The growing use of seaweed compounds in calorie restriction may open up new commercial prospects in the future. Individuals nowadays are embracing a healthy lifestyle by eating extremely nutritious foods with minimal fat and sugar content. Furthermore, seaweed is regarded as one of the most effective weight-loss foods. Furthermore, folks who exercise at the gym utilize seaweed proteins as protein supplements. All of these considerations amongst young people are predicted to increase the demand for seaweed protein.

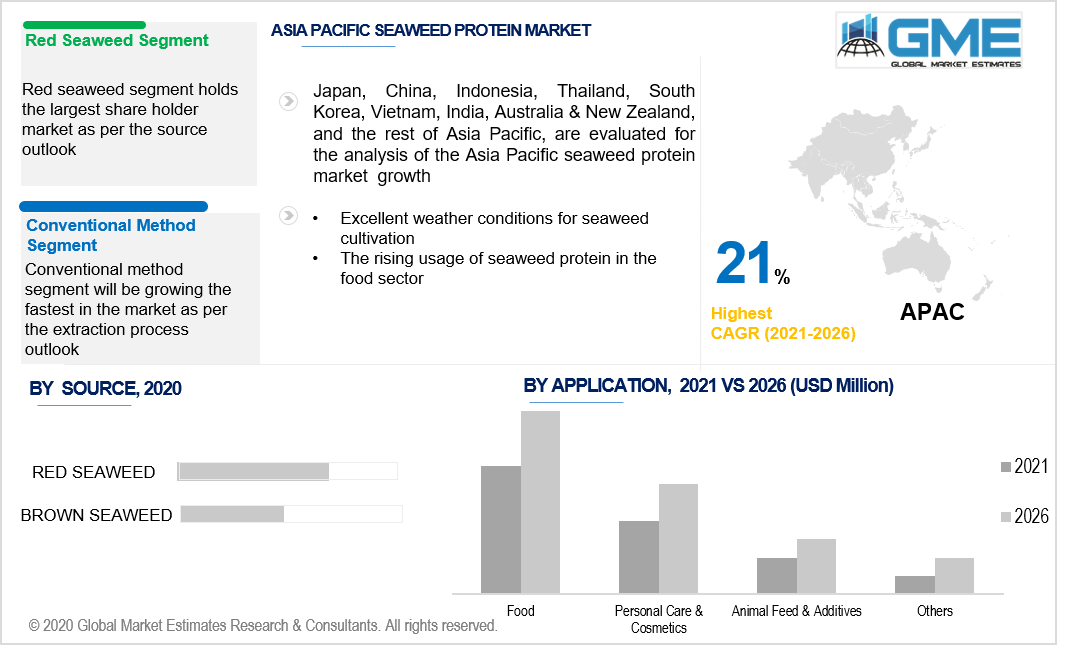

The market for seaweed protein is bifurcated into red and brown. The red seaweed segment is further divided into Eucheuma spp., Gracilaria spp., Porphyra spp., Kappaphycus alvarezii, Porphyra tenera, Eucheuma denticulatum. The Brown Seaweed segment is further divided into Laminaria Japonica, Undaria pinnatifida, Sargassum fusiforme, green seaweeds, Enteromorpha spp., Ulva spp. Red seaweed dominates the market share, according to the source's analysis. Because of their substantial protein concentration red seaweeds are the most common type of seaweed ingested primarily as food. Red seaweeds are chosen over brown and green seaweeds because of their nutritional and protein-rich qualities.

According to the NCBI, red seaweeds contain around 47 percent dry matter by weight. In this sense, the crude protein level of Pyropia (dulse) and Porphyra (nori) genera is equivalent to that of protein-rich plant sources like soy. Red seaweed is likely to be in considerable demand internationally as a result of these causes. With the rise in the use of superfoods like spirulina and chlorella in the pet food industry and nutraceuticals, companies have started producing red seaweed in high quantities.

Depending on the extraction process, the market for seaweed protein is bifurcated into conventional methods, physical processes, enzymatic hydrolysis, chemical extraction, the current method, ultrasound-assisted extraction (UAE), pulsed electric field (PEF), Microwave-assisted extraction (MAE). The conventional methods hold the highest market revenue share during the forecast period. Conventional mechanical and chemical protein extraction procedures potentially compromise the stability of retrieved seaweed proteins owing to protease activation from cytosolic vacuoles. Moreover, these approaches are time-consuming and labor-intensive. As a result, better cell disintegration and extraction approaches are necessary. Pre-treatment using cell-disruption procedures aids in the breaking of the strong seaweed cell membrane, enhancing the presence of proteins and other high-value constituents for subsequent protein extraction.

The application analysis bifurcates the seaweed protein market into food, animal feed & additives, personal care & cosmetics, and others. The largest market share, according to application analysis, is led by the food segment. This supremacy is mostly attributable to the increased use of seaweed for biological nutrition. Furthermore, compounds isolated from seaweeds, including carrageenan, are employed as thickening agents in the food sector. With the rise in veganism, the worldwide usage of seaweed as a meat alternative has seen a significant hike, especially in the usage of superfoods like spirulina and chlorella for nutraceuticals.

The Asia Pacific market is likely to contribute to the majority of the market share. This is mostly due to aspects including the area's large-scale production and domestic intake of edible seaweeds, which is fuelled by the processed food sector. Furthermore, the growth of the seaweed protein business in Asian nations due to reasons including provision of raw materials, excellent weather conditions for seaweed cultivation, and the accessibility of inexpensive labor. The rising usage of seaweed protein in the food sector, as well as expanding endeavors by companies to develop cheaper seaweed proteins in this area, are driving the expansion of this area market.

Europe is expected to be the fastest-growing market for seaweed protein over the forecast period. In Europe, customers are more oriented towards healthy meals, and seaweed is considered as a nutritious superfood that is utilized in a wide variety of food preparations, spices, and beverage items, boosting the rise of seaweed protein in the area. The use of seaweeds in the nutraceutical and pharmaceutical sectors has lately begun to grow as a result of increased knowledge concerning the nutritional composition and benefits of seaweed protein-based product intake. The rising environmental and health costs of meat consumption are likely to stimulate the demand for seaweed protein in the area.

Various competitors in the seaweed protein market include The Seaweed Company, AtSeaNova, Acadian Seaplants, Leili, AquAgri Processing Pvt. Ltd., Algaia, CEAMSA, Mara Seaweed, Qingdao Gather Great Ocean Algae Industry Group, Seasol, Groupe Roullier, Agrocare, Cargill, Incorporated, Qingdao Seawin Biotech Group Co. Ltd., CP Kelco U.S., Inc., Irish Seaweeds, Gelymar, COMPO EXPERT, Trophic LLC, Algea among others.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Seaweed Protein Industry Overview, 2016-2026

2.1.1 Industry Overview

2.1.2 Source Overview

2.1.3 Extraction Process Overview

2.1.4 Application Overview

2.1.5 Regional Overview

Chapter 3 Global Seaweed Protein Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Growing Popularity of Plant-Based Protein in Food

3.3.1.2 Growing Seaweed Protein Applications in Nutraceuticals

3.3.2 Industry Challenges

3.3.2.1 High Cost Involved in Seaweed Production

3.4 Prospective Growth Scenario

3.4.1 Source Growth Scenario

3.4.2 Extraction Process Growth Scenario

3.4.3 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Seaweed Protein Market, By Source

4.1 Source Outlook

4.2 Red

4.2.1 Market Size, By Region, 2016-2026 (USD Million)

4.3 Brown

4.3.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 5 Global Seaweed Protein Market, By Extraction Process

5.1 Extraction Process Outlook

5.2 Conventional Method

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

5.3 Physical Processes

5.3.1 Market Size, By Region, 2016-2026 (USD Million)

5.4 Enzymatic Hydrolysis

5.4.1 Market Size, By Region, 2016-2026 (USD Million)

5.5 Chemical Extraction

5.5.1 Market Size, By Region, 2016-2026 (USD Million)

5.6 Current Method

5.6.1 Market Size, By Region, 2016-2026 (USD Million)

5.7 Ultrasound-assisted Extraction (UAE)

5.7.1 Market Size, By Region, 2016-2026 (USD Million)

5.8 Pulsed Electric Field (PEF)

5.8.1 Market Size, By Region, 2016-2026 (USD Million)

5.9 Microwave-assisted Extraction (MAE)

5.9.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 6 Global Seaweed Protein Market, By Application

6.1 Application Outlook

6.2 Food

6.2.1 Market Size, By Region, 2016-2026 (USD Million)

6.3 Animal Feed & Additives

6.3.1 Market Size, By Region, 2016-2026 (USD Million)

6.4 Personal Care & Cosmetics

6.4.1 Market Size, By Region, 2016-2026 (USD Million)

6.5 Others

6.5.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 7 Global Seaweed Protein Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country, 2016-2026 (USD Million)

7.2.2 Market Size, By Source, 2016-2026 (USD Million)

7.2.3 Market Size, By Extraction Process, 2016-2026 (USD Million)

7.2.4 Market Size, By Application, 2016-2026 (USD Million)

7.2.5 U.S.

7.2.5.1 Market Size, By Source, 2016-2026 (USD Million)

7.2.5.2 Market Size, By Extraction Process, 2016-2026 (USD Million)

7.2.5.3 Market Size, By Application, 2016-2026 (USD Million)

7.2.6 Canada

7.2.6.1 Market Size, By Source, 2016-2026 (USD Million)

7.2.6.2 Market Size, By Extraction Process, 2016-2026 (USD Million)

7.2.6.3 Market Size, By Application, 2016-2026 (USD Million)

7.3 Europe

7.3.1 Market Size, By Country, 2016-2026 (USD Million)

7.3.2 Market Size, By Source, 2016-2026 (USD Million)

7.3.3 Market Size, By Extraction Process, 2016-2026 (USD Million)

7.3.4 Market Size, By Application, 2016-2026 (USD Million)

7.3.5 Germany

7.3.5.1 Market Size, By Source, 2016-2026 (USD Million)

7.3.5.2 Market Size, By Extraction Process, 2016-2026 (USD Million)

7.3.5.3 Market Size, By Application, 2016-2026 (USD Million)

7.3.6 UK

7.3.6.1 Market Size, By Source, 2016-2026 (USD Million)

7.3.6.2 Market Size, By Extraction Process, 2016-2026 (USD Million)

7.3.6.3 Market Size, By Application, 2016-2026 (USD Million)

7.3.7 France

7.3.7.1 Market Size, By Source, 2016-2026 (USD Million)

7.3.7.2 Market Size, By Extraction Process, 2016-2026 (USD Million)

7.3.7.3 Market Size, By Application, 2016-2026 (USD Million)

7.3.8 Italy

7.3.8.1 Market Size, By Source, 2016-2026 (USD Million)

7.3.8.2 Market Size, By Extraction Process, 2016-2026 (USD Million)

7.3.8.3 Market Size, By Application, 2016-2026 (USD Million)

7.3.9 Spain

7.3.9.1 Market Size, By Source, 2016-2026 (USD Million)

7.3.9.2 Market Size, By Extraction Process, 2016-2026 (USD Million)

7.3.9.3 Market Size, By Application, 2016-2026 (USD Million)

7.3.10 Russia

7.3.10.1 Market Size, By Source, 2016-2026 (USD Million)

7.3.10.2 Market Size, By Extraction Process, 2016-2026 (USD Million)

7.3.10.3 Market Size, By Application, 2016-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market Size, By Country, 2016-2026 (USD Million)

7.4.2 Market Size, By Source, 2016-2026 (USD Million)

7.4.3 Market Size, By Extraction Process, 2016-2026 (USD Million)

7.4.4 Market Size, By Application, 2016-2026 (USD Million)

7.4.5 China

7.4.5.1 Market Size, By Source, 2016-2026 (USD Million)

7.4.5.2 Market Size, By Extraction Process, 2016-2026 (USD Million)

7.4.5.3 Market Size, By Application, 2016-2026 (USD Million)

7.4.6 India

7.4.6.1 Market Size, By Source, 2016-2026 (USD Million)

7.4.6.2 Market Size, By Extraction Process, 2016-2026 (USD Million)

7.4.6.3 Market Size, By Application, 2016-2026 (USD Million)

7.4.7 Japan

7.4.7.1 Market Size, By Source, 2016-2026 (USD Million)

7.4.7.2 Market Size, By Extraction Process, 2016-2026 (USD Million)

7.4.7.3 Market Size, By Application, 2016-2026 (USD Million)

7.4.8 Australia

7.4.8.1 Market Size, By Source, 2016-2026 (USD Million)

7.4.8.2 Market size, By Extraction Process, 2016-2026 (USD Million)

7.4.8.3 Market Size, By Application, 2016-2026 (USD Million)

7.4.9 South Korea

7.4.9.1 Market Size, By Source, 2016-2026 (USD Million)

7.4.9.2 Market Size, By Extraction Process, 2016-2026 (USD Million)

7.4.9.3 Market Size, By Application, 2016-2026 (USD Million)

7.5 Latin America

7.5.1 Market Size, By Country, 2016-2026 (USD Million)

7.5.2 Market Size, By Source, 2016-2026 (USD Million)

7.5.3 Market Size, By Extraction Process, 2016-2026 (USD Million)

7.5.4 Market Size, By Application, 2016-2026 (USD Million)

7.5.5 Brazil

7.5.5.1 Market Size, By Source, 2016-2026 (USD Million)

7.5.5.2 Market Size, By Extraction Process, 2016-2026 (USD Million)

7.5.5.3 Market Size, By Application, 2016-2026 (USD Million)

7.5.6 Mexico

7.5.6.1 Market Size, By Source, 2016-2026 (USD Million)

7.5.6.2 Market Size, By Extraction Process, 2016-2026 (USD Million)

7.5.6.3 Market Size, By Application, 2016-2026 (USD Million)

7.5.7 Argentina

7.5.7.1 Market Size, By Source, 2016-2026 (USD Million)

7.5.7.2 Market Size, By Extraction Process, 2016-2026 (USD Million)

7.5.7.3 Market Size, By Application, 2016-2026 (USD Million)

7.6 MEA

7.6.1 Market Size, By Country, 2016-2026 (USD Million)

7.6.2 Market Size, By Source, 2016-2026 (USD Million)

7.6.3 Market Size, By Extraction Process, 2016-2026 (USD Million)

7.6.4 Market Size, By Application, 2016-2026 (USD Million)

7.6.5 Saudi Arabia

7.6.5.1 Market Size, By Source, 2016-2026 (USD Million)

7.6.5.2 Market Size, By Extraction Process, 2016-2026 (USD Million)

7.6.5.3 Market Size, By Application, 2016-2026 (USD Million)

7.6.6 UAE

7.6.6.1 Market Size, By Source, 2016-2026 (USD Million)

7.6.6.2 Market Size, By Extraction Process, 2016-2026 (USD Million)

7.6.6.3 Market Size, By Application, 2016-2026 (USD Million)

7.6.7 South Africa

7.6.7.1 Market Size, By Source, 2016-2026 (USD Million)

7.6.7.2 Market Size, By Extraction Process, 2016-2026 (USD Million)

7.6.7.3 Market Size, By Application, 2016-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 AtSeaNova

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 Acadian Seaplants

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 AquAgri Processing Pvt. Ltd.

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Leili

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Algaia

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 CEAMSA

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Mara Seaweed

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Seasol

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info Graphic Analysis

8.10 Qingdao Gather Great Ocean Algae Industry Group

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Groupe Roullier

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

8.12 Agrocare

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info Graphic Analysis

8.13 Cargill, Incorporated

8.13.1 Company Overview

8.13.2 Financial Analysis

8.13.3 Strategic Positioning

8.13.4 Info Graphic Analysis

8.14 Qingdao Seawin Biotech Group Co. Ltd.

8.14.1 Company Overview

8.14.2 Financial Analysis

8.14.3 Strategic Positioning

8.14.4 Info Graphic Analysis

8.15 CP Kelco U.S., Inc.

8.15.1 Company Overview

8.15.2 Financial Analysis

8.15.3 Strategic Positioning

8.15.4 Info Graphic Analysis

8.16 Irish Seaweeds

8.16.1 Company Overview

8.16.2 Financial Analysis

8.16.3 Strategic Positioning

8.16.4 Info Graphic Analysis

8.17 Gelymar

8.17.1 Company Overview

8.17.2 Financial Analysis

8.17.3 Strategic Positioning

8.17.4 Info Graphic Analysis

8.18 COMPO EXPERT

8.18.1 Company Overview

8.18.2 Financial Analysis

8.18.3 Strategic Positioning

8.18.4 Info Graphic Analysis

8.19 Trophic LLC

8.19.1 Company Overview

8.19.2 Financial Analysis

8.19.3 Strategic Positioning

8.19.4 Info Graphic Analysis

8.20 Algea

8.20.1 Company Overview

8.20.2 Financial Analysis

8.20.3 Strategic Positioning

8.20.4 Info Graphic Analysis

8.21 Other Companies

8.21.1 Company Overview

8.21.2 Financial Analysis

8.21.3 Strategic Positioning

8.21.4 Info Graphic Analysis

The Global Seaweed Protein Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Seaweed Protein Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS