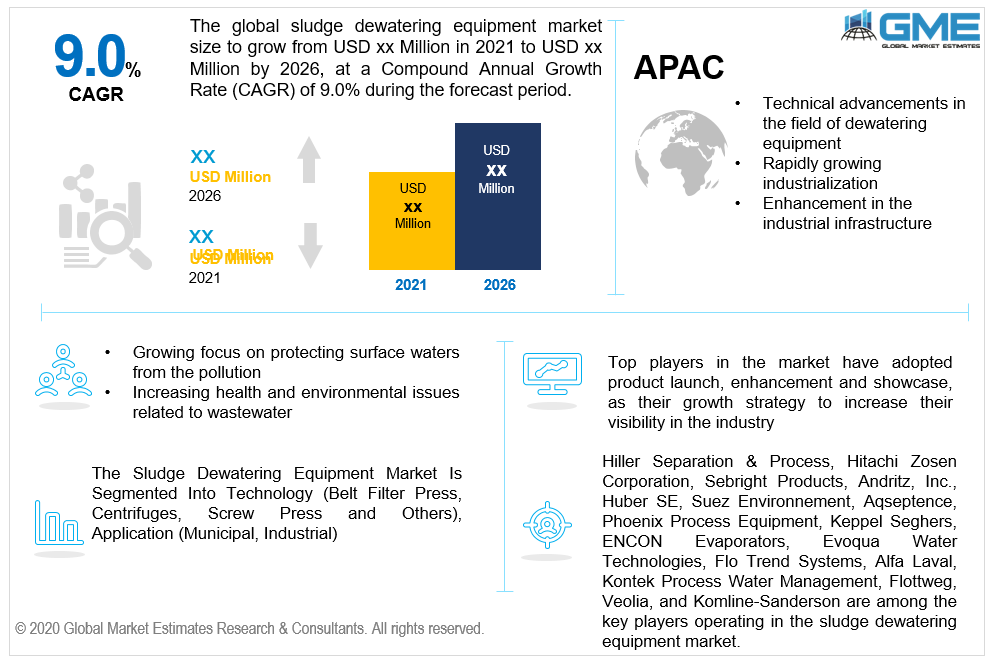

Global Sludge Dewatering Equipment Market Size, Trends, and Analysis- Forecasts To 2026 By Technology (Belt Filter Press, Centrifuges, Screw Press and Others), By Application (Municipal, Industrial), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

Sludge dewatering is the segregation between solid and liquid sludge materials in order to reduce sludge disposal. Dewatering equipment for sludge is used in both the municipal and industrial industries. Its industrial applications include mining, pharmaceuticals, food and beverage refineries, petroleum, and its municipal applications, include the commercial and residential markets. This equipment is a cost-effective and environmentally friendly approach that has a low cost maintenance routine, require lesser skilled forces, and uses less electricity. Sludge dewatering employed both centralized and decentralized approaches to treat sewage created by industrial and municipal infrastructure. The most commonly used decentralized equipment is aerobic treatment systems, biofilters, or septic tanks. Centralized sludge systems, on the other hand, are used in the form of piping systems and sewerage.

The industry measure would be driven by a growing focus on protecting surface waters from the negative effects of wastewater releases, as well as rapid mechanical progressions as part of the circular economy. The implementation of initiatives to limit the adverse consequences that occur from wastewater sources would strengthen the ooze and wastewater treatment frameworks. Moving in the direction of green economy, which involves eco-productivity, emission reduction, and closed-loop development based on enhanced asset proficiency, the market will grow rapidly. The demand is growing due to increasing health and environmental issues around wastewater, as well as changing patterns toward the circular economy.

Growing mining activity in emerging nations such as Mexico, Peru, Chile, and South Africa, due to government funding for investment promotion, is projected to play a significant role in growing sewage and sludge market. As a consequence, sludge treatment equipment in mining applications is projected to grow over the forecast period.

Many policymakers have enacted strict wastewater emission regulations for both industrial and municipal industries, which is anticipated to fuel the sludge treatment equipment demand over the estimated timeframe. The Environmental Protection Agency (EPA), the Central Pollution Control Board (CPCB), and the European Environment Agency (EEA), are all playing important roles in improving water quality and preventing pollution.

The complexity of the system design necessitates the use of a professional technician to manage and control the equipment. This could serve as a demand constraint in the coming years, restricting the market growth. Furthermore, the increased cost of dewatering equipment, as well as the operating cost and maintenance, stymies the global dewatering equipment market's expansion.

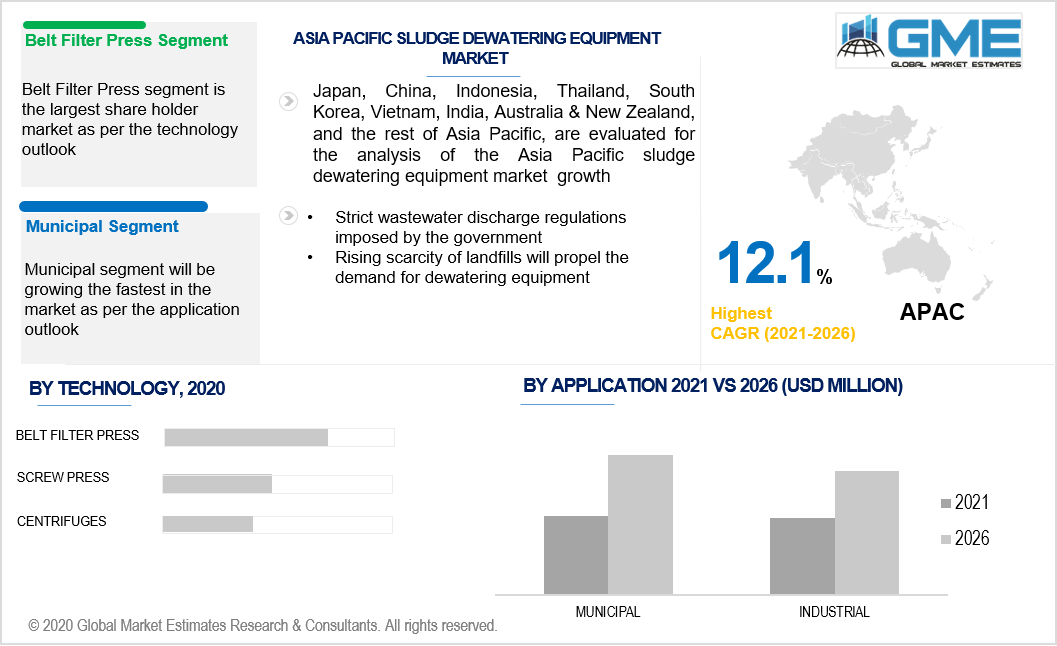

The industry is divided into screw press, centrifuges, belt filter press, and others based on technology. Because of its high-capacity performance, lower installation costs, continuous feed operation, and reduced energy running cost, the belt press filter technology segment is anticipated to expand significantly over the forecast period. The industry development would be aided by regulatory measures to minimize the effects of untreated industrial and municipal waste, as well as the reduced supply of land for landfills. The implementation of strict wastewater generation and discharge regulations, as well as an increasing emphasis on reducing the environmental effects of municipal and industrial waste, would fuel product demand even further.

In 2020, the screw press held the major share of the sludge dewatering equipment market. Fully automated operation, a simple design, and low operating costs have all led to an improvement in product acceptance. Furthermore, rapid product deployment will be accelerated by strong industrial sector development and effective regulatory initiatives to alleviate the negative effects of industrial wastewater. The pulp and paper industry and municipal wastewater treatment plants have both adopted this technology.

During the forecast period, municipal applications are expected to grow rapidly. Owing to a shortage of available land for waste disposal around metropolitan areas, wastewater treatment facilities have been built, which would raise demand for these systems. Increased emphasis on reducing the harmful environmental effects of undisposed waste would enhance product penetration even more. The sector will gain even more traction as municipal waste recycling patterns change. Refineries, chemicals, pharmaceuticals, mining, paper & pulp, and food & beverage are only a few of the industries that use processed and raw water for industrial applications. Technological advances, rapid urbanization, and the expansion of production units have resulted in increased demand for processed water, which will be a major driving force for the market during the forecast period. Increased discharges of untreated wastewater, combined with investments in the construction of new manufacturing plants, would improve product adoption in industrial settings. Innovative sludge management strategies, along with strict regulatory legislation prohibiting the dumping of untreated sludge, would boost business growth.

During the forecast period, Asia Pacific is predicted to be the fastest growing market for sludge dewatering equipment. Technical advancements, increasing industrialization, and infrastructure development are key drivers of increasing demand for fresh and processed water, resulting in rapid industry growth. Strict wastewater discharge and sludge disposal regulations, as well as a scarcity of landfills, would bolster business expansion.

The number of legislations enforced by regulatory agencies across Europe and North America has helped the regions gain a dominant position in the market. In the overall sludge dewatering equipment industry, the European market is analyzed to be a potential market for growth. Improving technological advancements in the region in order to achieve market share and sustain competition would be a key driver of market growth.

Hiller Separation & Process, Hitachi Zosen Corporation, Sebright Products, Andritz, Inc., Huber SE, Suez Environnement, Aqseptence, Phoenix Process Equipment, Keppel Seghers, ENCON Evaporators, Evoqua Water Technologies, Flo Trend Systems, Alfa Laval, Kontek Process Water Management, Flottweg, Veolia, and Komline-Sanderson are among the key players operating in the sludge dewatering equipment market.

Please note: This is not an exhaustive list of companies profiled in the report.

In July 2020, ALFA LAVAL declared that it won the contract to supply Framo pumping systems to a Chinese-built FPSO (Floating Production, Storage, and Offloading) vessel. The order was worth SEK 130 million and was planned to delivery in 2021.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Sludge Dewatering Equipment Industry Overview, 2016-2026

2.1.1 Industry Overview

2.1.2 Technology Overview

2.1.3 Application Overview

2.1.4 Regional Overview

Chapter 3 Sludge Dewatering Equipment Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Technology Advancement in Sludge Dewatering Equipment

3.3.1.2 The Rising Water Pollution in Developing Countries

3.3.2 Industry Challenges

3.3.2.1 High Cost Associated With Sludge Dewatering Equipment

3.4 Prospective Growth Scenario

3.4.1 Technology Growth Scenario

3.4.2 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Sludge Dewatering Equipment Market, By Technology

4.1 Technology Outlook

4.2 Belt Filter Press

4.2.1 Market Size, By Region, 2016-2026 (USD Million)

4.3 Centrifuges

4.3.1 Market Size, By Region, 2016-2026 (USD Million)

4.4 Screw Press

4.4.1 Market Size, By Region, 2016-2026 (USD Million)

4.5 Others

4.5.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 5 Sludge Dewatering Equipment Market, By Application

5.1 Application Outlook

5.2 Municipal

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

5.3 Industrial

5.3.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 6 Sludge Dewatering Equipment Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2016-2026 (USD Million)

6.2.2 Market Size, By Technology, 2016-2026 (USD Million)

6.2.3 Market Size, By Application, 2016-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Technology, 2016-2026 (USD Million)

6.2.4.2 Market Size, By Application, 2016-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Technology, 2016-2026 (USD Million)

6.2.5.2 Market Size, By Application, 2016-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2016-2026 (USD Million)

6.3.2 Market Size, By Technology, 2016-2026 (USD Million)

6.3.3 Market Size, By Application, 2016-2026 (USD Million)

6.3.4 Germany

6.3.4.1 Market Size, By Technology, 2016-2026 (USD Million)

6.3.4.2 Market Size, By Application, 2016-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Technology, 2016-2026 (USD Million)

6.3.5.2 Market Size, By Application, 2016-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Technology, 2016-2026 (USD Million)

6.3.6.2 Market Size, By Application, 2016-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Technology, 2016-2026 (USD Million)

6.3.7.2 Market Size, By Application, 2016-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Technology, 2016-2026 (USD Million)

6.3.8.2 Market Size, By Application, 2016-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Technology, 2016-2026 (USD Million)

6.3.9.2 Market Size, By Application, 2016-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2016-2026 (USD Million)

6.4.2 Market Size, By Technology, 2016-2026 (USD Million)

6.4.3 Market Size, By Application, 2016-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Technology, 2016-2026 (USD Million)

6.4.4.2 Market Size, By Application, 2016-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Technology, 2016-2026 (USD Million)

6.4.5.2 Market Size, By Application, 2016-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Technology, 2016-2026 (USD Million)

6.4.6.2 Market Size, By Application, 2016-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Technology, 2016-2026 (USD Million)

6.4.7.2 Market size, By Application, 2016-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Technology, 2016-2026 (USD Million)

6.4.8.2 Market Size, By Application, 2016-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2016-2026 (USD Million)

6.5.2 Market Size, By Technology, 2016-2026 (USD Million)

6.5.3 Market Size, By Application, 2016-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Technology, 2016-2026 (USD Million)

6.5.4.2 Market Size, By Application, 2016-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Technology, 2016-2026 (USD Million)

6.5.5.2 Market Size, By Application, 2016-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Technology, 2016-2026 (USD Million)

6.5.6.2 Market Size, By Application, 2016-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2016-2026 (USD Million)

6.6.2 Market Size, By Technology, 2016-2026 (USD Million)

6.6.3 Market Size, By Application, 2016-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Technology, 2016-2026 (USD Million)

6.6.4.2 Market Size, By Application, 2016-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Technology, 2016-2026 (USD Million)

6.6.5.2 Market Size, By Application, 2016-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Technology, 2016-2026 (USD Million)

6.6.6.2 Market Size, By Application, 2016-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Hiller Separation & Process

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Hitachi Zosen Corporation

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 Sebright Products

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Andritz, Inc.

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Huber SE

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Suez Environment

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Aqseptence

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Phoenix Process Equipment

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Keppel Seghers

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

7.11 Other Companies

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info Graphic Analysis

The Global Sludge Dewatering Equipment Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Sludge Dewatering Equipment Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS