Global Steam Sanitization and Sterilization Market Size, Trends & Analysis - Forecasts to 2026 By Type (Gravity, SFPP, Pre-Vac), By Application (Surface Sanitization, Equipment Sterilization), By End-User (Hospital, Clinics, Laboratories), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa); End-User Landscape, Company Market Share Analysis, and Competitor Analysis

Dynamic changes in the healthcare industry owing to the covid-19 pandemic have led towards some drastic changes in the activities. One such drastic change that has been witnessed is the adoption of different techniques and methods to make the healthcare premise and products virus-free. Steam sterilization of medical products and instruments is not a novel practice. However, the adoption of steam-based sanitization methods to decontaminate the surface and building has gained high popularity in recent years. The technique is effective and time-saving which will induce the penetration of steam sanitization and sterilization.

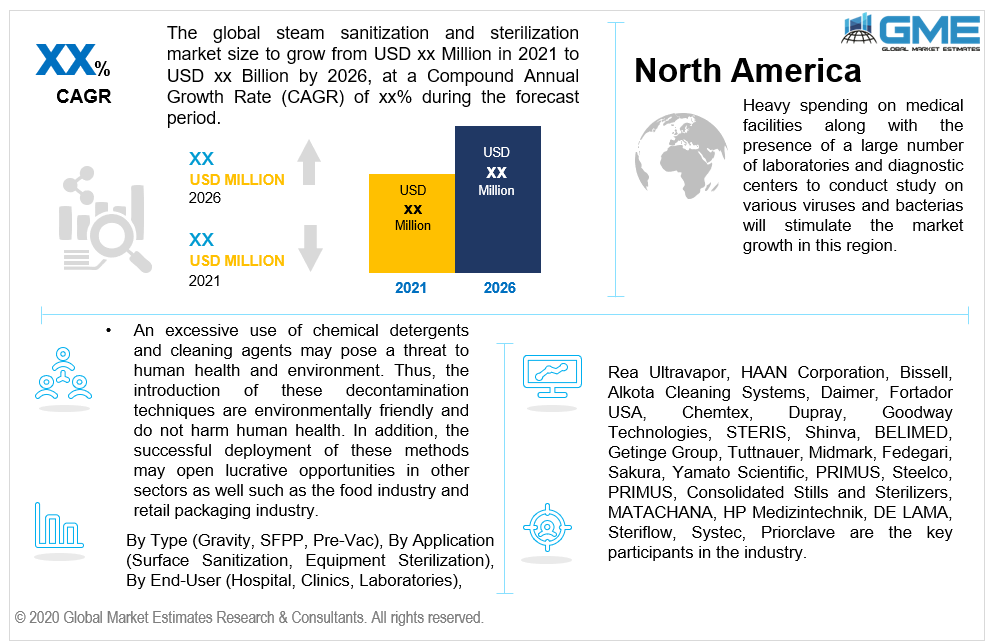

Also, excessive use of chemical detergents and cleaning agents may pose a threat to human health and the environment. Thus, the introduction of these decontamination techniques is environmentally friendly and does not harm human health. In addition, the successful deployment of these methods may open lucrative opportunities in other sectors as well such as the food industry and retail packaging industry.

Gravity, SFPP, and Pre-vac are key recognized types in the steam sanitization and sterilization market. Periodically, healthcare systems spend a large sum of money on decontamination of surfaces and instruments to keep the premises virus-free. The industry uses different products and types as per their requirement. The aforementioned product types are proven as the highly effective and efficient treatment to sterilize the instruments and surfaces. Gravity is among the highly adopted method to sterilize. The method is simple and proven to be highly effective.

By application, the market is categorized into surface sanitization and equipment sterilization. The equipment sterilization is projected to lead the market revenue owing to its high penetration and requirement. The concept is not new for medical instruments to undergo steam sterilization. However, steam surface sanitization is a new concept that came into consideration after the coronavirus breakout. The process is proven to be more productive in terms of making the premises virus-free. The segment will foresee the fastest growth and highest adoption as many developed countries have started the implementation of these decontamination techniques and methods.

By end-user, the market is segmented into hospitals, clinics, and laboratories. Hospitals are likely to dominate the end-user segment in the coming years. Increasing patient traffic in the hospitals due to covid-19 has induced the high requirement of decontamination products as hospitals are one of the major hotspots for virus transmission. Thus, it makes it necessary to opt for cleaning products with maximum probability to eradicate the virus.

Laboratories will observe the highest CAGR by the end of 2026. The increasing need to regularly sterilize the equipment and surfaces due to over usage of the medical instruments will support the growth in this segment.

Clinics are the second-degree hotspot for the virus spread after the hospitals. Asymptomatic patients are much more likely to visit clinics rather than hospitals. These patients do not need any additional medical care and also may not be aware that they are exposed to viruses. Thus, clinics also need regular steam sanitization to eradicate the virus.

Steam Sanitization and Sterilization Market: By Region

Europe Steam Sanitization and Sterilization market will dominate the global revenue during the forecast period. The region is highly influenced by the strict regulatory requirement pertaining to the cleaning of medical equipment and premises. Moreover, consistent efforts to keep the healthcare facility virus-free to combat the covid-19 will positively induce regional industry growth. France, Germany, Italy, and the UK, are major contributing countries to implement these cleaning methods.

North America Steam Sanitization and Sterilization market will observe high growth up to 2026. Heavy spending on medical facilities along with the presence of a large number of laboratories and diagnostic centers to conduct a study on various viruses and bacterias will stimulate market growth in this region. Stringent regulations by FDA to keep the vicinity sterilized and use the correctly labeled products will result in high product penetration.

Asia Pacific is expected to foresee notable growth up to 2026, with China, Japan, South Korea, Australia, and India being the key contributors in the region. The necessity to reduce the high transmission rate of covid-19 in highly populated countries such as India and China by breaking the chain through proper decontamination will induce product adoption in the region.

Steam Sanitization and Sterilization Company Market Share and Competitor Analysis

Global Steam Sanitization and Sterilization Company Market Share is partially consolidated and competitive in nature. Mostly large-scale companies with wider reach dominated the industry share. However, the impact of covid-19 is likely to make room for new entrants due to the high demand for clinical-grade cleaning products. Technology development to enhance product performance along with the need to meet the rising demand of consistent sterilization in the healthcare industry will offer lucrative opportunities to the existing as well as new market players.

Rea Ultravapor, HAAN Corporation, Bissell, Alkota Cleaning Systems, Daimer, Fortador USA, Chemtex, Dupray, Goodway Technologies, STERIS, Shinva, BELIMED, Getinge Group, Tuttnauer, Midmark, Fedegari, Sakura, Yamato Scientific, PRIMUS, Steelco, PRIMUS, Consolidated Stills and Sterilizers, MATACHANA, HP Medizintechnik, DE LAMA, Steriflow, Systec, Priorclave are the key participants in the industry.

Please note: This is not an exhaustive list of companies profiled in the report.

Strategic collaborations with the end-users to build long term partnerships with the customers accompanied by the product advancement to align with the new requirements are prime priorities witnessed in the industry.

Chapter 1 Methodology

1.1 Market scope & definitions

1.2 Estimates & forecast calculation

1.3 Historical data overview and validation

1.4 Data sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Steam sanitization and sterilization industry overview, 2019-2026

2.1.1 Industry overview

2.1.2 Type overview

2.1.3 Application overview

2.1.4 End-Use overview

2.1.5 Regional overview

Chapter 3 Steam Sanitization and Sterilization Market Trends

3.1 Market segmentation

3.2 Industry background, 2019-2026

3.3 Market key trends

3.3.1 Positive trends

3.3.2 Industry challenges

3.4 Prospective growth scenario

3.5 COVID-19 influence over industry growth

3.6 Porter’s analysis

3.7 PESTEL analysis

3.8 Value chain & supply chain analysis

3.9 Regulatory framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology overview

3.11 Market share analysis, 2020

3.11.1 Company positioning overview, 2020

Chapter 4 Steam Sanitization and Sterilization Market, By Type

4.1 Type Outlook

4.2 Gravity

4.2.1 Market size, by region, 2019-2026 (USD Million)

4.3 SFPP

4.3.1 Market size, by region, 2019-2026 (USD Million)

4.4 Pre-Vac

4.4.1 Market size, by region, 2019-2026 (USD Million)

Chapter 5 Steam Sanitization and Sterilization Market, By Application

5.1 Application Outlook

5.2 Surface sanitization

5.2.1 Market size, by region, 2019-2026 (USD Million)

5.3 Equipment sterilization

5.3.1 Market size, by region, 2019-2026 (USD Million)

Chapter 6 Steam Sanitization and Sterilization Market, By End-User

6.1 End-User Outlook

6.2 Hospitals

6.2.1 Market size, by region, 2019-2026 (USD Million)

6.3 Clinics

6.3.1 Market size, by region, 2019-2026 (USD Million)

6.4 Laboratories

6.4.1 Market size, by region, 2019-2026 (USD Million)

6.5 Others

6.5.1 Market size, by region, 2019-2026 (USD Million)

Chapter 7 Steam Sanitization and Sterilization Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market size, by country 2019-2026 (USD Million)

7.2.2 Market size, by type, 2019-2026 (USD Million)

7.2.3 Market size, by application, 2019-2026 (USD Million)

7.2.4 Market size, by end-user, 2019-2026 (USD Million)

7.2.5 U.S.

7.2.5.1 Market size, by type, 2019-2026 (USD Million)

7.2.5.2 Market size, by application, 2019-2026 (USD Million)

7.2.5.3 Market size, by end-user, 2019-2026 (USD Million)

7.2.6 Canada

7.2.6.1 Market size, by type, 2019-2026 (USD Million)

7.2.6.2 Market size, by application, 2019-2026 (USD Million)

7.2.6.3 Market size, by end-user, 2019-2026 (USD Million)

7.3 Europe

7.3.1 Market size, by country 2019-2026 (USD Million)

7.3.2 Market size, by type, 2019-2026 (USD Million)

7.3.3 Market size, by application, 2019-2026 (USD Million)

7.3.4 Market size, by end-user, 2019-2026 (USD Million)

7.3.5 Germany

7.2.5.1 Market size, by type, 2019-2026 (USD Million)

7.2.5.2 Market size, by application, 2019-2026 (USD Million)

7.2.5.3 Market size, by end-user, 2019-2026 (USD Million)

7.3.6 UK

7.3.6.1 Market size, by type, 2019-2026 (USD Million)

7.3.6.2 Market size, by application, 2019-2026 (USD Million)

7.3.6.3 Market size, by end-user, 2019-2026 (USD Million)

7.3.7 France

7.3.7.1 Market size, by type, 2019-2026 (USD Million)

7.3.7.2 Market size, by application, 2019-2026 (USD Million)

7.3.7.3 Market size, by end-user, 2019-2026 (USD Million)

7.3.8 Italy

7.3.8.1 Market size, by type, 2019-2026 (USD Million)

7.3.8.2 Market size, by application, 2019-2026 (USD Million)

7.3.8.3 Market size, by end-user, 2019-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market size, by country 2019-2026 (USD Million)

7.4.2 Market size, by type, 2019-2026 (USD Million)

7.4.3 Market size, by application, 2019-2026 (USD Million)

7.4.4 Market size, by end-user, 2019-2026 (USD Million)

7.4.5 China

7.4.5.1 Market size, by type, 2019-2026 (USD Million)

7.4.5.2 Market size, by application, 2019-2026 (USD Million)

7.4.5.3 Market size, by end-user, 2019-2026 (USD Million)

7.4.6 India

7.4.6.1 Market size, by type, 2019-2026 (USD Million)

7.4.6.2 Market size, by application, 2019-2026 (USD Million)

7.4.6.3 Market size, by end-user, 2019-2026 (USD Million)

7.4.7 Japan

7.4.7.1 Market size, by type, 2019-2026 (USD Million)

7.4.7.2 Market size, by application, 2019-2026 (USD Million)

7.4.7.3 Market size, by end-user, 2019-2026 (USD Million)

7.4.8 Australia

7.4.8.1 Market size, by type, 2019-2026 (USD Million)

7.4.8.2 Market size, by application, 2019-2026 (USD Million)

7.4.8.3 Market size, by end-user, 2019-2026 (USD Million)

7.4.9 South Korea

7.4.9.1 Market size, by type, 2019-2026 (USD Million)

7.4.9.2 Market size, by application, 2019-2026 (USD Million)

7.4.9.3 Market size, by end-user, 2019-2026 (USD Million)

7.5 Latin America

7.5.1 Market size, by country 2019-2026 (USD Million)

7.5.2 Market size, by type, 2019-2026 (USD Million)

7.5.3 Market size, by application, 2019-2026 (USD Million)

7.5.4 Market size, by end-user, 2019-2026 (USD Million)

7.5.5 Brazil

7.5.5.1 Market size, by type, 2019-2026 (USD Million)

7.5.5.2 Market size, by application, 2019-2026 (USD Million)

7.5.5.3 Market size, by end-user, 2019-2026 (USD Million)

7.5.6 Mexico

7.5.6.1 Market size, by type, 2019-2026 (USD Million)

7.5.6.2 Market size, by application, 2019-2026 (USD Million)

7.5.6.3 Market size, by end-user, 2019-2026 (USD Million)

7.6 MEA

7.6.1 Market size, by country 2019-2026 (USD Million)

7.6.2 Market size, by type, 2019-2026 (USD Million)

7.6.3 Market size, by application, 2019-2026 (USD Million)

7.6.4 Market size, by end-user, 2019-2026 (USD Million)

7.6.5 Saudi Arabia

7.6.5.1 Market size, by type, 2019-2026 (USD Million)

7.6.5.2 Market size, by application, 2019-2026 (USD Million)

7.6.5.3 Market size, by end-user, 2019-2026 (USD Million)

7.6.6 UAE

7.6.6.1 Market size, by type, 2019-2026 (USD Million)

7.6.6.2 Market size, by application, 2019-2026 (USD Million)

7.6.6.3 Market size, by end-user, 2019-2026 (USD Million)

7.6.7 South Africa

7.6.7.1 Market size, by type, 2019-2026 (USD Million)

7.6.7.2 Market size, by application, 2019-2026 (USD Million)

7.6.7.3 Market size, by end-user, 2019-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive analysis, 2020

8.2 Rea Ultravapor

8.2.1 Company overview

8.2.2 Financial analysis

8.2.3 Strategic positioning

8.2.4 Info graphic analysis

8.3 Bissell

8.3.1 Company overview

8.3.2 Financial analysis

8.3.3 Strategic positioning

8.3.4 Info graphic analysis

8.4 HAAN Corporation

8.4.1 Company overview

8.4.2 Financial analysis

8.4.3 Strategic positioning

8.4.4 Info graphic analysis

8.5 Alkota Cleaning Systems

8.5.1 Company overview

8.5.2 Financial analysis

8.5.3 Strategic positioning

8.5.4 Info graphic analysis

8.6 Fortador USA

8.6.1 Company overview

8.6.2 Financial analysis

8.6.3 Strategic positioning

8.6.4 Info graphic analysis

8.7 Daimer

8.7.1 Company overview

8.7.2 Financial analysis

8.7.3 Strategic positioning

8.7.4 Info graphic analysis

8.8 Chemtex

8.8.1 Company overview

8.8.2 Financial analysis

8.8.3 Strategic positioning

8.8.4 Info graphic analysis

8.9 Goodway Technologies

8.9.1 Company overview

8.9.2 Financial analysis

8.9.3 Strategic positioning

8.9.4 Info graphic analysis

8.10 Dupray

8.10.1 Company overview

8.10.2 Financial analysis

8.10.3 Strategic positioning

8.10.4 Info graphic analysis

8.11 STERIS

8.11.1 Company overview

8.11.2 Financial analysis

8.11.3 Strategic positioning

8.11.4 Info graphic analysis

8.12 Shinva

8.12.1 Company overview

8.12.2 Financial analysis

8.12.3 Strategic positioning

8.12.4 Info graphic analysis

8.13 Getinge Group

8.13.1 Company overview

8.13.2 Financial analysis

8.13.3 Strategic positioning

8.13.4 Info graphic analysis

8.14 BELIMED

8.14.1 Company overview

8.14.2 Financial analysis

8.14.3 Strategic positioning

8.14.4 Info graphic analysis

8.15 Tuttnauer

8.15.1 Company overview

8.15.2 Financial analysis

8.15.3 Strategic positioning

8.15.4 Info graphic analysis

8.16 Fedegari

8.16.1 Company overview

8.16.2 Financial analysis

8.16.3 Strategic positioning

8.16.4 Info graphic analysis

8.17 Midmark

8.17.1 Company overview

8.17.2 Financial analysis

8.17.3 Strategic positioning

8.17.4 Info graphic analysis

8.18 Sakura

8.18.1 Company overview

8.18.2 Financial analysis

8.18.3 Strategic positioning

8.18.4 Info graphic analysis

8.19 Yamato Scientific

8.19.1 Company overview

8.19.2 Financial analysis

8.19.3 Strategic positioning

8.19.4 Info graphic analysis

8.20 Steelco

8.20.1 Company overview

8.20.2 Financial analysis

8.20.3 Strategic positioning

8.20.4 Info graphic analysis

8.21 PRIMUS

8.21.1 Company overview

8.21.2 Financial analysis

8.21.3 Strategic positioning

8.21.4 Info graphic analysis

8.22 Consolidated Stills and Sterilizers

8.22.1 Company overview

8.22.2 Financial analysis

8.22.3 Strategic positioning

8.22.4 Info graphic analysis

8.23 MATACHANA

8.23.1 Company overview

8.23.2 Financial analysis

8.23.3 Strategic positioning

8.23.4 Info graphic analysis

8.24 DE LAMA

8.24.1 Company overview

8.24.2 Financial analysis

8.24.3 Strategic positioning

8.24.4 Info graphic analysis

8.25 HP Medizintechnik

8.25.1 Company overview

8.25.2 Financial analysis

8.25.3 Strategic positioning

8.25.4 Info graphic analysis

8.26 Steriflow

8.26.1 Company overview

8.26.2 Financial analysis

8.26.3 Strategic positioning

8.26.4 Info graphic analysis

8.27 Priorclave

8.27.1 Company overview

8.27.2 Financial analysis

8.27.3 Strategic positioning

8.27.4 Info graphic analysis

8.28 Systec

8.28.1 Company overview

8.28.2 Financial analysis

8.28.3 Strategic positioning

8.28.4 Info graphic analysis

The Global Steam Sanitization and Sterilization Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Global Steam Sanitization and Sterilization Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS