Global Succinic Acid Market Size, Trends & Analysis - Forecasts to 2026 By Type (Petro-based, Bio-based), By Applications (Food & Beverages, Pharmaceutical, Personal Care, Coatings, Industrial, and Others), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis; By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Company Market Share Analysis & Competitor Analysis

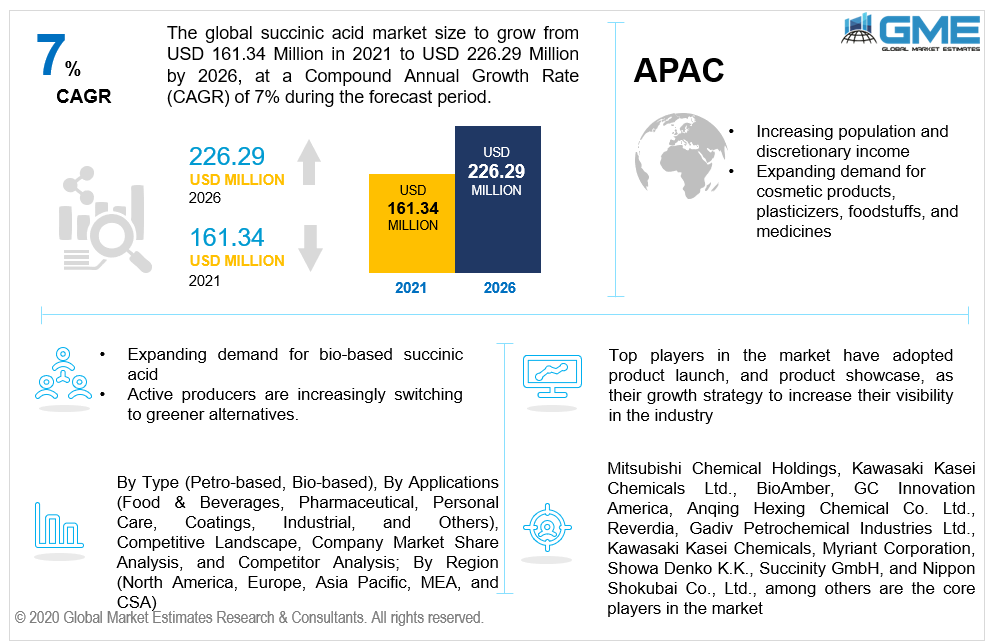

The succinic acid market is estimated to be valued at USD 161.34 Million in 2021 and is projected to reach USD 226.29 Million by 2026 at a CAGR of 7%. One of the primary drivers propelling the market is its use as a core component for polyurethanes, polybutylene succinate (PBS), and plasticizers, as well as a substrate for compounds including 1,4 butanediol (BDO). The expansion of the succinic acid market share has been accelerated by expanding demand for bio-based compounds, increased usage of succinic acid as a core ingredient for the manufacturing of chemical substances & consumer goods, and technological advancements for bio-based succinic acid manufacturing. The predilection for succinic acid over butane-based maleic anhydride in the production of chemicals including succinic anhydride, fumaric acid, diethylmaleate, glyoxylic acid, and other plastics, as well as its use in the production of polymers that are traditionally made from butane, all have an impact on the market. Furthermore, rising requirements for ecological integrity, the rise of industrial businesses, ecological considerations, and a spike in manufacturing expenditure have all increased the succinic acid market size. Moreover, in the forecast period, expanding prospective succinic acid market applications, as well as research and development efforts, provide lucrative prospects for market participants.

Succinic acid is extensively utilised in the pharmaceutical, chemical, and food sectors. The majority of succinic acid now comes from petroleum feedstock. The fermentation process produces a little proportion of succinic acid. One of the most important raw materials utilised in the synthesis of succinic acid is N-butane. Because traditional succinic acid is reliant on petroleum sources for manufacturing, petroleum prices have a significant impact on its pricing. Succinic acid generated from plants must also be manufactured at a low cost. In order to compete with its alternatives, it must also adhere to enhanced fermentation procedures. This leads to a surge in demand for succinic acid.

Covid 19 impact on the succinic acid market has been significant because of the volatility in crude oil prices which stymie overall expansion. In the forecast period, the rising manufacturing of bio-succinic acid attributable to the growing acceptance of sustainable practices amongst chemical producers is foreseen to pose a threat to the market. Nevertheless, in food and drinks, succinic acid is commonly used as a flavouring ingredient. It's used to make chemical substances, fragrances, coatings, photographic compounds, adhesive polymers, emulsifiers, metallic processing solvents and paints, among others. It's also used to make opioids, antispasmers, antiplegm, antiphlogistic, anrhoeic, and contraceptive medications. The overall food succinic acid market is expected to increase primarily due to rising requirements in the food and beverage sector. Government regulations in developed countries that encourage growth in the overall market are a major factor. The notion of green chemicals has been supported by the government. Thus, the overall market could expand significantly, attributable to the approval from numerous regulatory organisations.

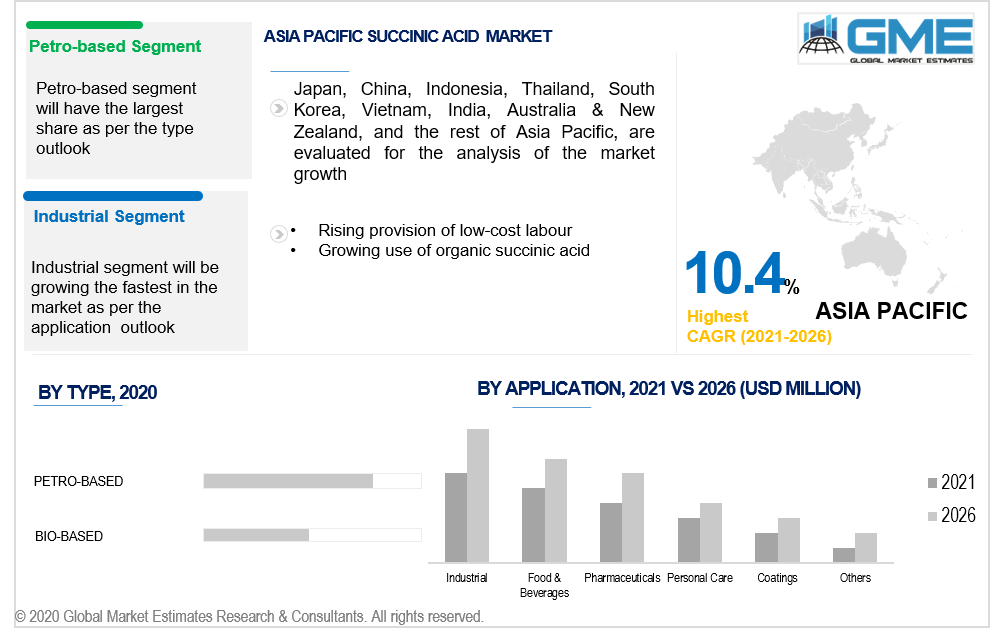

Depending on the type, the market is categorized as petro-based and bio-based. Throughout the forecast period, the petro-based category is presumed to contribute the most to market growth. The chemical industry's requirement for PBS/PBST and polyurethane is primarily responsible for the segment's rise. In comparison to bio-based succinic acid, petro-based succinic acid is more cost-effective and efficient. It's also commonly utilised as a flavour booster in the food and beverage sector, as well as in the chemical sector for the production of PBS.

Bio-based succinic acid, manufactured through fermentation of sugars, is progressively replacing phthalic anhydride and maleic anhydride (including crude-oil based products) as a cost-competitive alternative. As a consequence, producers are switching to bio-based succinic acid, which performs similarly to phthalic anhydride in compositions. Companies like Myriant, for example, have produced bio-based succinic acid with structural similarities to maleic anhydride and phthalic anhydride, thereby improving efficiency and reducing productivity fluctuations. As a result, the bio-based chemical section of the market analysed has grown.

Depending on the application, the market is categorized as food & beverages, pharmaceuticals, personal care, coatings, industrials, and others. Industrial application is foreseen to predominate. The usage of succinic acid for industrial purposes drives this segment. Novel uses including 1,4-Butanediol (BDO), PBS, plasticizers, and polyester polyols will fuel the market's growth prospects. Reduced crude oil prices, more green chemical manufacturing, the need for sustainable chemicals, and higher government support will all contribute to the market's expansion.

PBS, polyester polyols, resins, plasticizers, coatings, and pigments, alkyd resins, solvents & lubricants, BDO, and deicer solutions are all key growth catalysts in the industrial application market. The highest revenue was generated by the demand for resins, coatings, and pigments. The largest application group is projected to be BDO. These are mostly owing to the growing usage of succinic acid as a substitute for maleic anhydride in BDO synthesis.

As per the geographical analysis, the market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central South America (Brazil, Argentina, and Rest of Central and South America). The Asia Pacific is foreseen to predominate. The market is driven by industrial development, flexible investment regulations, rising per capita spending, and inexpensive manufacturing. Furthermore, the provision of low-cost labour is encouraging manufacturing facilities in the Asia-Pacific, with China, amongst all economies in the area, having the biggest manufacturing capability. The spike in demand for polyurethane-based goods, as well as expansion in the construction and automotive sectors, are expected to increase the market's profitability in the Asia Pacific. In the area, China is the leading producer and user of succinic acid. Moreover, the APAC market is predicted to grow due to increased demand for cosmetic products, plasticizers, foodstuffs, and medicines.

Due to the extreme involvement of large end-use sectors, including food & beverages, pharmaceuticals, petrochemicals, and cosmetics, North America and Europe are also prominent markets for succinic acid. Environmental rules are having a beneficial impact on the demand for bio-based succinic acid in certain countries in these areas. Europe is the major revenue-generating market for succinic acid, owing to stringent regulations prohibiting the employment of some dangerous chemicals that endanger the ecosystem and humans. As a result, producers are switching to greener equivalents, such as bio-succinic acid, to meet the standards. Throughout the forecast period, the strict regulatory environment in the EU, as a result of the activation of the REACH law, is likely to favour bio-based replacements.

Mitsubishi Chemical Holdings, Kawasaki Kasei Chemicals Ltd., BioAmber, GC Innovation America, Anqing Hexing Chemical Co. Ltd., Reverdia, Gadiv Petrochemical Industries Ltd., Myriant Corporation, Showa Denko K.K., Succinity GmbH, and Nippon Shokubai Co., Ltd., among others are the core players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Succinic Acid Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Applications Overview

2.1.4 Regional Overview

Chapter 3 Global Succinic Acid Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Stringent Environmental Regulations in Developed Regions Supporting the Use of Bio-Based Succinic Acid

3.3.1.2 Increasing Demand for Bio-Based Chemicals

3.3.2 Industry Challenges

3.3.2.1 Raw Material Costs Fluctuation and Significant Production Costs

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Applications Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Succinic Acid Market, By Type

4.1 Type Outlook

4.2 Petro-based

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Bio-based

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Global Succinic Acid Market, By Applications

5.1 Applications Outlook

5.2 Food & Beverages

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 Pharmaceutical

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

5.4 Personal Care

5.4.1 Market Size, By Region, 2019-2026 (USD Million)

5.5 Coatings

5.5.1 Market Size, By Region, 2019-2026 (USD Million)

5.6 Industrial

5.6.1 Market Size, By Region, 2019-2026 (USD Million)

5.7 Others

5.7.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Global Succinic Acid Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2019-2026 (USD Million)

6.2.2 Market Size, By Type, 2019-2026 (USD Million)

6.2.3 Market Size, By Applications, 2019-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Type, 2019-2026 (USD Million)

6.2.4.2 Market Size, By Applications, 2019-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Type, 2019-2026 (USD Million)

6.2.5.2 Market Size, By Applications, 2019-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2019-2026 (USD Million)

6.3.2 Market Size, By Type, 2019-2026 (USD Million)

6.3.3 Market Size, By Applications, 2019-2026 (USD Million)

6.3.4 Germany

6.2.4.1 Market Size, By Type, 2019-2026 (USD Million)

6.2.4.2 Market Size, By Applications, 2019-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Type, 2019-2026 (USD Million)

6.3.5.2 Market Size, By Applications, 2019-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Type, 2019-2026 (USD Million)

6.3.6.2 Market Size, By Applications, 2019-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Type, 2019-2026 (USD Million)

6.3.7.2 Market Size, By Applications, 2019-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Type, 2019-2026 (USD Million)

6.3.8.2 Market Size, By Applications, 2019-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Type, 2019-2026 (USD Million)

6.3.9.2 Market Size, By Applications, 2019-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2019-2026 (USD Million)

6.4.2 Market Size, By Type, 2019-2026 (USD Million)

6.4.3 Market Size, By Applications, 2019-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Type, 2019-2026 (USD Million)

6.4.4.2 Market Size, By Applications, 2019-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Type, 2019-2026 (USD Million)

6.4.5.2 Market Size, By Applications, 2019-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Type, 2019-2026 (USD Million)

6.4.6.2 Market Size, By Applications, 2019-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Type, 2019-2026 (USD Million)

6.4.7.2 Market size, By Applications, 2019-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Type, 2019-2026 (USD Million)

6.4.8.2 Market Size, By Applications, 2019-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2019-2026 (USD Million)

6.5.2 Market Size, By Type, 2019-2026 (USD Million)

6.5.3 Market Size, By Applications, 2019-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Type, 2019-2026 (USD Million)

6.5.4.2 Market Size, By Applications, 2019-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Type, 2019-2026 (USD Million)

6.5.5.2 Market Size, By Applications, 2019-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Type, 2019-2026 (USD Million)

6.5.6.2 Market Size, By Applications, 2019-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2019-2026 (USD Million)

6.6.2 Market Size, By Type, 2019-2026 (USD Million)

6.6.3 Market Size, By Applications, 2019-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Type, 2019-2026 (USD Million)

6.6.4.2 Market Size, By Applications, 2019-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Type, 2019-2026 (USD Million)

6.6.5.2 Market Size, By Applications, 2019-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Type, 2019-2026 (USD Million)

6.6.6.2 Market Size, By Applications, 2019-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Mitsubishi Chemical Holdings

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Kawasaki Kasei Chemicals Ltd.

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 BioAmber

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 GC Innovation America

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Anqing Hexing Chemical Co. Ltd.

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Reverdia

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Gadiv Petrochemical Industries Ltd.

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Kawasaki Kasei Chemicals

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Myriant Corporation

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

7.11 Showa Denko K.K.

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info Graphic Analysis

7.12 Succinity GmbH

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 Info Graphic Analysis

7.13 Nippon Shokubai Co., Ltd.

7.13.1 Company Overview

7.13.2 Financial Analysis

7.13.3 Strategic Positioning

7.13.4 Info Graphic Analysis

7.14 Other Companies

7.14.1 Company Overview

7.14.2 Financial Analysis

7.14.3 Strategic Positioning

7.14.4 Info Graphic Analysis

The Global Succinic Acid Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Succinic Acid Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS