Global Sugar Substitutes Market Size, Trends & Analysis - Forecasts to 2029 By Manufacturing Technology (Precision Fermentation, Enzymatic Conversion, Chemical Synthesis, and Others), By Type (High Fructose Corn Syrup, High-intensity Sweeteners, and Low-intensity Sweeteners), By Application (Food, Beverages, Health & Personal Care Products, Pharmaceuticals, and Others), By Source (Natural and Artificial), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

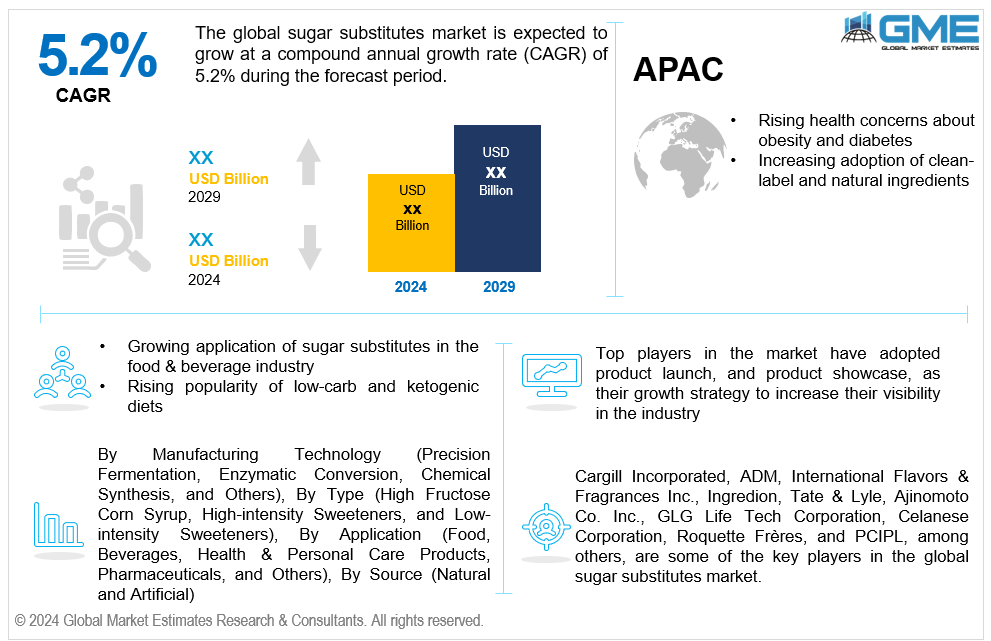

The global sugar substitutes market is estimated to exhibit a CAGR of 5.2% from 2024 to 2029.

The primary factors propelling the market growth are the rising health concerns about obesity and diabetes and the increasing adoption of clean-label and natural ingredients. With global rates of obesity and diabetes climbing, awareness about the harmful effects of excessive sugar consumption has intensified. This shift has led to increased demand for low-calorie and low-glycemic sweeteners, including stevia, sucralose, and monk fruit, which offer a similar sweetness profile without impacting blood sugar levels. Health-conscious consumers are looking for products that support weight management and help control glucose levels, particularly as diet-related health conditions have been linked to serious health risks. Food and beverage manufacturers are responding by innovating and expanding product lines with sugar substitutes, helping meet consumer demand for healthier, sugar-free, or low-sugar options. For instance, The National Diabetes Statistics Report from the Centers for Disease Control (CDC) estimates that 37.3 million Americans had diabetes in 2022.

The growing application of sugar substitutes in the food & beverage industry and the rising popularity of low-carb and ketogenic diets are expected to support the market growth. Low-carb and keto diets rely on maintaining low blood sugar and insulin levels to promote fat-burning, making sugar substitutes a staple for individuals following these regimens. Sweeteners like erythritol, stevia, and monk fruit, which have low or zero glycemic impacts, offer keto dieters a way to satisfy sweet cravings without spiking blood sugar or exceeding carb limits. As more consumers adopt these diets for weight loss, energy stability, and health benefits, demand for sugar-free and low-carb products has surged across the food and beverage sector. Manufacturers are increasingly formulating keto-friendly options—such as desserts, snacks, and drinks—using sugar substitutes to meet this demand, further fueling market growth.

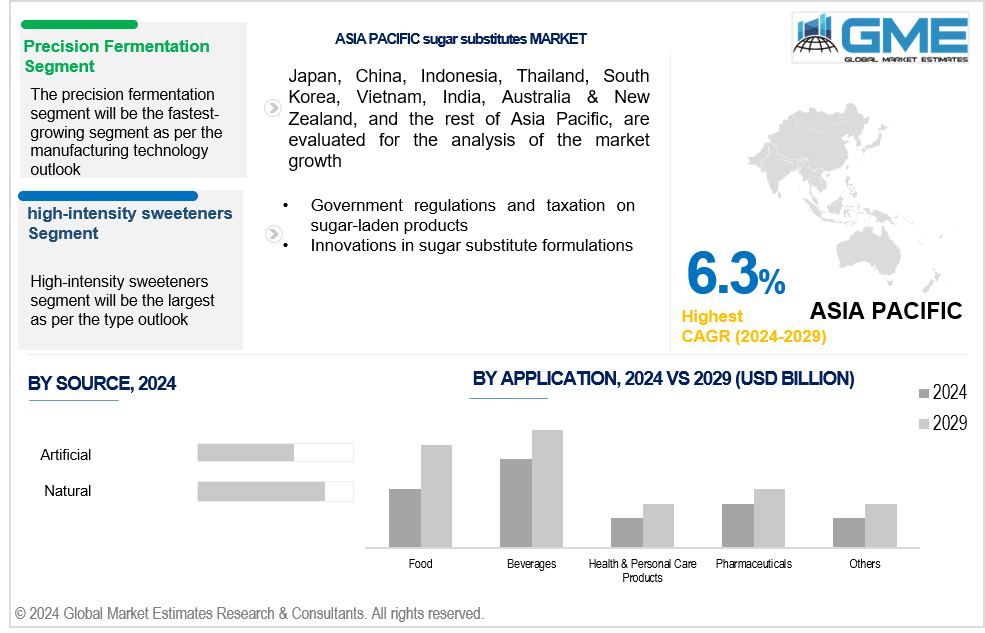

Government regulations and taxation on sugar-laden products, coupled with innovations in sugar substitute formulations that enhance taste and texture, propel market growth. Traditional sugar substitutes sometimes have an aftertaste or lack the full-bodied texture of sugar, which has historically limited their appeal. However, advancements in formulation techniques have led to sugar alternatives that closely mimic sugar’s sweetness profile and texture, making them more palatable in a wider range of food and beverage applications. Manufacturers are combining different sweeteners and using advanced processing methods to create products that replicate sugar’s sensory experience while reducing calories and glycemic impact. These improvements are driving higher consumer acceptance and encouraging food producers to incorporate enhanced sugar substitutes into their products.

Consumers are gravitating towards natural ingredients, creating a strong opportunity for plant-based sweeteners like stevia and monk fruit. Their low-calorie content and "natural" label appeal to health-conscious consumers looking to avoid synthetic additives. Additionally, sugar substitutes have potential in functional foods and nutraceuticals that target health benefits like energy balance or immunity. As consumers look for health-focused products, sugar substitutes with added benefits can cater to this expanding niche.

However, high production costs and low adoption among traditional consumers impede market growth.

The chemical synthesis segment is expected to hold the largest share of the market over the forecast period. This traditional technology, used to produce artificial sweeteners like aspartame and saccharin, has long dominated due to established production methods, lower costs, and scalability. Chemical synthesis’s wide application in low-calorie sweeteners contributes significantly to its market size.

The precision fermentation segment is expected to be the fastest-growing segment in the market from 2024 to 2029. This method, which uses microorganisms to create natural-tasting sweeteners (e.g., rebaudioside M from stevia or allulose), is becoming increasingly popular as consumers prefer natural and plant-based options. Precision fermentation aligns well with clean-label trends, driving rapid growth as companies scale up production and refine cost efficiency.

The high-intensity sweeteners segment is expected to hold the largest share of the market over the forecast period. High-intensity sweeteners are increasingly used in pharmaceuticals for sugar-free formulations, especially for products targeting diabetic and health-conscious consumers, expanding their market share beyond traditional food uses.

The low-intensity sweeteners segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. Advances in production technology for low-intensity sweeteners, including precision fermentation and enzymatic processes, enhance the efficiency and scalability of their production. These innovations contribute to lower costs, improving market access and driving consumer adoption of these sweeteners.

The beverages segment is expected to hold the largest share of the market over the forecast period. Beverage manufacturers are increasingly experimenting with new formulations and flavors that incorporate sugar substitutes, leading to the introduction of innovative products in the market. This innovation attracts consumer interest and promotes growth in the beverages segment.

The food segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. The versatility of sugar substitutes enables their incorporation into a wide array of food products, including baked goods, sauces, dressings, and snacks. This broad applicability contributes to significant growth opportunities within the food segment as manufacturers explore innovative formulations.

The natural segment is expected to hold the largest share of the market over the forecast period. Increasing health consciousness among consumers is driving the demand for natural ingredients. Natural sugar substitutes, such as stevia, monk fruit, and agave syrup, align with consumer desires for healthier, minimally processed food options, leading to their dominance in the market.

The artificial segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. Many artificial sweeteners have longer shelf lives compared to natural alternatives, making them ideal for food and beverage products with extended storage requirements. This stability enhances their appeal to manufacturers looking for reliable ingredients that can withstand varying conditions.

North America is expected to be the largest region in the global market. Governments and health organizations in North America actively promote the reduction of sugar consumption due to its association with obesity and diabetes. Such initiatives encourage food and beverage manufacturers to explore and adopt sugar substitutes, enhancing market growth in the region.

Asia Pacific is anticipated to witness rapid growth during the forecast period. The growing interest in functional foods that offer health benefits is driving demand for sugar substitutes. Consumers are increasingly looking for products that contribute to their overall health and well-being, leading manufacturers to incorporate sugar alternatives into their formulations.

Cargill Incorporated, ADM, International Flavors & Fragrances Inc., Ingredion, Tate & Lyle, Ajinomoto Co. Inc., GLG Life Tech Corporation, Celanese Corporation, Roquette Frères, and PCIPL, among others, are some of the key players in the global sugar substitutes market.

Please note: This is not an exhaustive list of companies profiled in the report.

In January 2024, to increase the usage of its sugar-reducing technology in the United States, Ingredion teamed up with Better Juice, a company that aims to lower the amount of sugar in juice-based drinks.

In July 2023, Tate & Lyle introduced OPTIMIZER STEVIA 8.10, a cutting-edge stevia blend that is more affordable than other premium sweeteners while maintaining a premium, sugar-like flavor even at high sugar replacement levels.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Type Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL PEPTIDE SEQUENCING MARKET, BY TYPE

4.1 Introduction

4.2 Peptide Sequencing Market: Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 High Fructose Corn Syrup

4.4.1 High Fructose Corn Syrup Market Estimates and Forecast, 2021-2029 (USD Billion)

4.5 High-intensity Sweeteners

4.5.1 High-intensity Sweeteners Market Estimates and Forecast, 2021-2029 (USD Billion)

4.6 Low-intensity Sweeteners

4.6.1 Low-intensity Sweeteners Market Estimates and Forecast, 2021-2029 (USD Billion)

5 GLOBAL PEPTIDE SEQUENCING MARKET, BY APPLICATION

5.1 Introduction

5.2 Peptide Sequencing Market: Application Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Food

5.4.1 Food Market Estimates and Forecast, 2021-2029 (USD Billion)

5.5 Beverages

5.5.1 Beverages Market Estimates and Forecast, 2021-2029 (USD Billion)

5.6 Health & Personal Care Products

5.6.1 Health & Personal Care Products Market Estimates and Forecast, 2021-2029 (USD Billion)

5.7 Pharmaceuticals

5.7.1 Pharmaceuticals Market Estimates and Forecast, 2021-2029 (USD Billion)

5.8 Others

5.8.1 Others Market Estimates and Forecast, 2021-2029 (USD Billion)

6 GLOBAL PEPTIDE SEQUENCING MARKET, BY SOURCE

6.1 Introduction

6.2 Peptide Sequencing Market: Source Scope Key Takeaways

6.3 Revenue Growth Analysis, 2023 & 2029

6.4 Natural

6.4.1 Natural Market Estimates and Forecast, 2021-2029 (USD Billion)

6.5 Artificial

6.5.1 Artificial Market Estimates and Forecast, 2021-2029 (USD Billion)

7 GLOBAL PEPTIDE SEQUENCING MARKET, BY MANUFACTURING TECHNOLOGY

7.1 Introduction

7.2 Peptide Sequencing Market: Manufacturing Technology Scope Key Takeaways

7.3 Revenue Growth Analysis, 2023 & 2029

7.4 Precision Fermentation

7.4.1 Precision Fermentation Market Estimates and Forecast, 2021-2029 (USD Billion)

7.5 Enzymatic Conversion

7.5.1 Enzymatic Conversion Market Estimates and Forecast, 2021-2029 (USD Billion)

7.6 Chemical Synthesis

7.6.1 Chemical Synthesis Market Estimates and Forecast, 2021-2029 (USD Billion)

7.7 Others

7.7.1 Others Market Estimates and Forecast, 2021-2029 (USD Billion)

8 GLOBAL PEPTIDE SEQUENCING MARKET, BY REGION

8.1 Introduction

8.2 North America Peptide Sequencing Market Estimates and Forecast, 2021-2029 (USD Billion)

8.2.1 By Type

8.2.2 By Application

8.2.3 By Source

8.2.4 By Manufacturing Technology

8.2.5 By Country

8.2.5.1 U.S. Peptide Sequencing Market Estimates and Forecast, 2021-2029 (USD Billion)

8.2.5.1.1 By Type

8.2.5.1.2 By Application

8.2.5.1.3 By Source

8.2.5.1.4 By Manufacturing Technology

8.2.5.2 Canada Peptide Sequencing Market Estimates and Forecast, 2021-2029 (USD Billion)

8.2.5.2.1 By Type

8.2.5.2.2 By Application

8.2.5.2.3 By Source

8.2.5.2.4 By Manufacturing Technology

8.2.5.3 Mexico Peptide Sequencing Market Estimates and Forecast, 2021-2029 (USD Billion)

8.2.5.3.1 By Type

8.2.5.3.2 By Application

8.2.5.3.3 By Source

8.2.5.3.4 By Manufacturing Technology

8.3 Europe Peptide Sequencing Market Estimates and Forecast, 2021-2029 (USD Billion)

8.3.1 By Type

8.3.2 By Application

8.3.3 By Source

8.3.4 By Manufacturing Technology

8.3.5 By Country

8.3.5.1 Germany Peptide Sequencing Market Estimates and Forecast, 2021-2029 (USD Billion)

8.3.5.1.1 By Type

8.3.5.1.2 By Application

8.3.5.1.3 By Source

8.3.5.1.4 By Manufacturing Technology

8.3.5.2 U.K. Presered Flowers Market Estimates and Forecast, 2021-2029 (USD Billion)

8.3.5.2.1 By Type

8.3.5.2.2 By Application

8.3.5.2.3 By Source

8.3.5.2.4 By Manufacturing Technology

8.3.5.3 France Peptide Sequencing Market Estimates and Forecast, 2021-2029 (USD Billion)

8.3.5.3.1 By Type

8.3.5.3.2 By Application

8.3.5.3.3 By Source

8.3.5.3.4 By Manufacturing Technology

8.3.5.4 Italy Peptide Sequencing Market Estimates and Forecast, 2021-2029 (USD Billion)

8.3.5.4.1 By Type

8.3.5.4.2 By Application

8.3.5.4.3 By Source

8.3.5.4.4 By Manufacturing Technology

8.3.5.5 Spain Peptide Sequencing Market Estimates and Forecast, 2021-2029 (USD Billion)

8.3.5.5.1 By Type

8.3.5.5.2 By Application

8.3.5.5.3 By Source

8.3.5.5.4 By Manufacturing Technology

8.3.5.6 Netherlands Peptide Sequencing Market Estimates and Forecast, 2021-2029 (USD Billion)

8.3.5.6.1 By Type

8.3.5.6.2 By Application

8.3.5.6.3 By Source

8.3.5.6.4 By Manufacturing Technology

8.3.5.7 Rest of Europe Peptide Sequencing Market Estimates and Forecast, 2021-2029 (USD Billion)

8.3.5.7.1 By Type

8.3.5.7.2 By Application

8.3.5.7.3 By Source

8.3.5.7.4 By Manufacturing Technology

8.4 Asia Pacific Peptide Sequencing Market Estimates and Forecast, 2021-2029 (USD Billion)

8.4.1 By Type

8.4.2 By Application

8.4.3 By Source

8.4.4 By Manufacturing Technology

8.4.5 By Country

8.4.5.1 China Peptide Sequencing Market Estimates and Forecast, 2021-2029 (USD Billion)

8.4.5.1.1 By Type

8.4.5.1.2 By Application

8.4.5.1.3 By Source

8.4.5.1.4 By Manufacturing Technology

8.4.5.2 Japan Peptide Sequencing Market Estimates and Forecast, 2021-2029 (USD Billion)

8.4.5.2.1 By Type

8.4.5.2.2 By Application

8.4.5.2.3 By Source

8.4.5.2.4 By Manufacturing Technology

8.4.5.3 India Peptide Sequencing Market Estimates and Forecast, 2021-2029 (USD Billion)

8.4.5.3.1 By Type

8.4.5.3.2 By Application

8.4.5.3.3 By Source

8.4.5.3.4 By Manufacturing Technology

8.4.5.4 South Korea Peptide Sequencing Market Estimates and Forecast, 2021-2029 (USD Billion)

8.4.5.4.1 By Type

8.4.5.4.2 By Application

8.4.5.4.3 By Source

8.4.5.4.4 By Manufacturing Technology

8.4.5.5 Singapore Peptide Sequencing Market Estimates and Forecast, 2021-2029 (USD Billion)

8.4.5.5.1 By Type

8.4.5.5.2 By Application

8.4.5.5.3 By Source

8.4.5.5.4 By Manufacturing Technology

8.4.5.6 Malaysia Peptide Sequencing Market Estimates and Forecast, 2021-2029 (USD Billion)

8.4.5.6.1 By Type

8.4.5.6.2 By Application

8.4.5.6.3 By Source

8.4.5.6.4 By Manufacturing Technology

8.4.5.7 Thailand Peptide Sequencing Market Estimates and Forecast, 2021-2029 (USD Billion)

8.4.5.7.1 By Type

8.4.5.7.2 By Application

8.4.5.7.3 By Source

8.4.5.7.4 By Manufacturing Technology

8.4.5.8 Indonesia Peptide Sequencing Market Estimates and Forecast, 2021-2029 (USD Billion)

8.4.5.8.1 By Type

8.4.5.8.2 By Application

8.4.5.8.3 By Source

8.4.5.8.4 By Manufacturing Technology

8.4.5.9 Vietnam Peptide Sequencing Market Estimates and Forecast, 2021-2029 (USD Billion)

8.4.5.9.1 By Type

8.4.5.9.2 By Application

8.4.5.9.3 By Source

8.4.5.9.4 By Manufacturing Technology

8.4.5.10 Taiwan Peptide Sequencing Market Estimates and Forecast, 2021-2029 (USD Billion)

8.4.5.10.1 By Type

8.4.5.10.2 By Application

8.4.5.10.3 By Source

8.4.5.10.4 By Manufacturing Technology

8.4.5.11 Rest of Asia Pacific Peptide Sequencing Market Estimates and Forecast, 2021-2029 (USD Billion)

8.4.5.11.1 By Type

8.4.5.11.2 By Application

8.4.5.11.3 By Source

8.4.5.11.4 By Manufacturing Technology

8.5 Middle East and Africa Peptide Sequencing Market Estimates and Forecast, 2021-2029 (USD Billion)

8.5.1 By Type

8.5.2 By Application

8.5.3 By Source

8.5.4 By Manufacturing Technology

8.5.5 By Country

8.5.5.1 Saudi Arabia Peptide Sequencing Market Estimates and Forecast, 2021-2029 (USD Billion)

8.5.5.1.1 By Type

8.5.5.1.2 By Application

8.5.5.1.3 By Source

8.5.5.1.4 By Manufacturing Technology

8.5.5.2 U.A.E. Peptide Sequencing Market Estimates and Forecast, 2021-2029 (USD Billion)

8.5.5.2.1 By Type

8.5.5.2.2 By Application

8.5.5.2.3 By Source

8.5.5.2.4 By Manufacturing Technology

8.5.5.3 Israel Peptide Sequencing Market Estimates and Forecast, 2021-2029 (USD Billion)

8.5.4.3.1 By Type

8.5.4.3.2 By Application

8.5.4.3.3 By Source

8.5.5.3.4 By Manufacturing Technology

8.5.5.4 South Africa Peptide Sequencing Market Estimates and Forecast, 2021-2029 (USD Billion)

8.5.5.4.1 By Type

8.5.5.4.2 By Application

8.5.5.4.3 By Source

8.5.5.4.4 By Manufacturing Technology

8.5.5.5 Rest of Middle East and Africa Peptide Sequencing Market Estimates and Forecast, 2021-2029 (USD Billion)

8.5.5.5.1 By Type

8.5.5.5.2 By Application

8.5.5.5.2 By Source

8.5.5.5.4 By Manufacturing Technology

8.6 Central & South America Peptide Sequencing Market Estimates and Forecast, 2021-2029 (USD Billion)

8.6.1 By Type

8.6.2 By Application

8.6.3 By Source

8.6.4 By Manufacturing Technology

8.6.5 By Country

8.6.5.1 Brazil Peptide Sequencing Market Estimates and Forecast, 2021-2029 (USD Billion)

8.6.5.1.1 By Type

8.6.5.1.2 By Application

8.6.5.1.3 By Source

8.6.5.1.4 By Manufacturing Technology

8.6.5.2 Argentina Peptide Sequencing Market Estimates and Forecast, 2021-2029 (USD Billion)

8.6.5.2.1 By Type

8.6.5.2.2 By Application

8.6.5.2.3 By Source

8.6.5.2.4 By Manufacturing Technology

8.6.5.3 Chile Peptide Sequencing Market Estimates and Forecast, 2021-2029 (USD Billion)

8.6.5.3.1 By Type

8.6.5.3.2 By Application

8.6.5.3.3 By Source

8.6.5.5.4 By Manufacturing Technology

8.6.5.4 Rest of Central & South America Peptide Sequencing Market Estimates and Forecast, 2021-2029 (USD Billion)

8.6.5.4.1 By Type

8.6.5.4.2 By Application

8.6.5.4.3 By Source

8.6.5.4.4 By Manufacturing Technology

9 COMPETITIVE LANDCAPE

9.1 Company Market Share Analysis

9.2 Four Quadrant Positioning Matrix

9.2.1 Market Leaders

9.2.2 Market Visionaries

9.2.3 Market Challengers

9.2.4 Niche Market Players

9.3 Vendor Landscape

9.3.1 North America

9.3.2 Europe

9.3.3 Asia Pacific

9.3.4 Rest of the World

9.4 Company Profiles

9.4.1 Cargill Incorporated

9.4.1.1 Business Description & Financial Analysis

9.4.1.2 SWOT Analysis

9.4.1.3 Products & Services Offered

9.4.1.4 Strategic Alliances between Business Partners

9.4.2 ADM

9.4.2.1 Business Description & Financial Analysis

9.4.2.2 SWOT Analysis

9.4.2.3 Products & Services Offered

9.4.2.4 Strategic Alliances between Business Partners

9.4.3 International Flavors & Fragrances Inc.

9.4.3.1 Business Description & Financial Analysis

9.4.3.2 SWOT Analysis

9.4.3.3 Products & Services Offered

9.4.3.4 Strategic Alliances between Business Partners

9.4.4 Ingredion

9.4.4.1 Business Description & Financial Analysis

9.4.4.2 SWOT Analysis

9.4.4.3 Products & Services Offered

9.4.4.4 Strategic Alliances between Business Partners

9.4.5 Tate & Lyle

9.4.5.1 Business Description & Financial Analysis

9.4.5.2 SWOT Analysis

9.4.5.3 Products & Services Offered

9.4.5.4 Strategic Alliances between Business Partners

9.4.6 AJINOMOTO CO. INC.

9.4.6.1 Business Description & Financial Analysis

9.4.6.2 SWOT Analysis

9.4.6.3 Products & Services Offered

9.4.6.4 Strategic Alliances between Business Partners

9.4.7 GLG Life Tech Corporation

9.4.7.1 Business Description & Financial Analysis

9.4.7.2 SWOT Analysis

9.4.7.3 Products & Services Offered

9.4.8.4 Strategic Alliances between Business Partners

9.4.8 Celanese Corporation

9.4.8.1 Business Description & Financial Analysis

9.4.8.2 SWOT Analysis

9.4.8.3 Products & Services Offered

9.4.8.4 Strategic Alliances between Business Partners

9.4.9 Roquette Frères

9.4.9.1 Business Description & Financial Analysis

9.4.9.2 SWOT Analysis

9.4.9.3 Products & Services Offered

9.4.9.4 Strategic Alliances between Business Partners

9.4.10 PCIPL

9.4.10.1 Business Description & Financial Analysis

9.4.10.2 SWOT Analysis

9.4.10.3 Products & Services Offered

9.4.10.4 Strategic Alliances between Business Partners

9.4.11 Other Companies

9.4.11.1 Business Description & Financial Analysis

9.4.11.2 SWOT Analysis

9.4.11.3 Products & Services Offered

9.4.11.4 Strategic Alliances between Business Partners

10 RESEARCH METHODOLOGY

10.1 Market Introduction

10.1.1 Market Definition

10.1.2 Market Scope & Segmentation

10.2 Information Procurement

10.2.1 Secondary Research

10.2.1.1 Purchased Databases

10.2.1.2 GMEs Internal Data Repository

10.2.1.3 Secondary Resources & Third Party Perspectives

10.2.1.4 Company Information Sources

10.2.2 Primary Research

10.2.2.1 Various Types of Respondents for Primary Interviews

10.2.2.2 Number of Interviews Conducted throughout the Research Process

10.2.2.3 Primary Stakeholders

10.2.2.4 Discussion Guide for Primary Participants

10.2.3 Expert Panels

10.2.3.1 Expert Panels Across 30+ Industry

10.2.4 Paid Local Experts

10.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

10.3 Market Estimation

10.3.1 Top-Down Approach

10.3.1.1 Macro-Economic Indicators Considered

10.3.1.2 Micro-Economic Indicators Considered

10.3.2 Bottom Up Approach

10.3.2.1 Company Share Analysis Approach

10.3.2.2 Estimation of Potential Product Sales

10.4 Data Triangulation

10.4.1 Data Collection

10.4.2 Time Series, Cross Sectional & Panel Data Analysis

10.4.3 Cluster Analysis

10.5 Analysis and Output

10.5.1 Inhouse AI Based Real Time Analytics Tool

10.5.2 Output From Desk & Primary Research

10.6 Research Assumptions & Limitations

10.7.1 Research Assumptions

10.7.2 Research Limitations

LIST OF TABLES

1 Global Peptide Sequencing Market, By Type, 2021-2029 (USD Billion)

2 High Fructose Corn Syrup Market, By Region, 2021-2029 (USD Billion)

3 High-intensity Sweeteners Market, By Region, 2021-2029 (USD Billion)

4 Low-intensity Sweeteners Market, By Region, 2021-2029 (USD Billion)

5 Global Peptide Sequencing Market, By Application, 2021-2029 (USD Billion)

6 Food Market, By Region, 2021-2029 (USD Billion)

7 Beverages Market, By Region, 2021-2029 (USD Billion)

8 Health & Personal Care Products Market, By Region, 2021-2029 (USD Billion)

9 Pharmaceuticals Market, By Region, 2021-2029 (USD Billion)

10 Others Market, By Region, 2021-2029 (USD Billion)

11 Global Peptide Sequencing Market, By Source, 2021-2029 (USD Billion)

12 Natural Market, By Region, 2021-2029 (USD Billion)

13 Artificial Market, By Region, 2021-2029 (USD Billion)

14 Global Peptide Sequencing Market, By MANUFACTURING TECHNOLOGY, 2021-2029 (USD Billion)

15 Precision Fermentation Market, By Region, 2021-2029 (USD Billion)

16 Enzymatic Conversion Market, By Region, 2021-2029 (USD Billion)

17 Chemical Synthesis Market, By Region, 2021-2029 (USD Billion)

18 Others Market, By Region, 2021-2029 (USD Billion)

19 Regional Analysis, 2021-2029 (USD Billion)

20 North America Peptide Sequencing Market, By Type, 2021-2029 (USD Billion)

21 North America Peptide Sequencing Market, By Application, 2021-2029 (USD Billion)

22 North America Peptide Sequencing Market, By Source, 2021-2029 (USD Billion)

23 North America Peptide Sequencing Market, By Manufacturing Technology, 2021-2029 (USD Billion)

24 North America Peptide Sequencing Market, By Country, 2021-2029 (USD Billion)

25 U.S Peptide Sequencing Market, By Type, 2021-2029 (USD Billion)

26 U.S Peptide Sequencing Market, By Application, 2021-2029 (USD Billion)

27 U.S Peptide Sequencing Market, By Source, 2021-2029 (USD Billion)

28 U.S Peptide Sequencing Market, By Manufacturing Technology, 2021-2029 (USD Billion)

29 Canada Peptide Sequencing Market, By Type, 2021-2029 (USD Billion)

30 Canada Peptide Sequencing Market, By Application, 2021-2029 (USD Billion)

31 Canada Peptide Sequencing Market, By Source, 2021-2029 (USD Billion)

32 CANADA Peptide Sequencing Market, By Manufacturing Technology, 2021-2029 (USD Billion)

33 Mexico Peptide Sequencing Market, By Type, 2021-2029 (USD Billion)

34 Mexico Peptide Sequencing Market, By Application, 2021-2029 (USD Billion)

35 Mexico Peptide Sequencing Market, By Source, 2021-2029 (USD Billion)

36 mexico Peptide Sequencing Market, By Manufacturing Technology, 2021-2029 (USD Billion)

37 Europe Peptide Sequencing Market, By Type, 2021-2029 (USD Billion)

38 Europe Peptide Sequencing Market, By Application, 2021-2029 (USD Billion)

39 Europe Peptide Sequencing Market, By Source, 2021-2029 (USD Billion)

40 europe Peptide Sequencing Market, By Manufacturing Technology, 2021-2029 (USD Billion)

41 europe Peptide Sequencing Market, By COUNTRY, 2021-2029 (USD Billion)

42 Germany Peptide Sequencing Market, By Type, 2021-2029 (USD Billion)

43 Germany Peptide Sequencing Market, By Application, 2021-2029 (USD Billion)

44 Germany Peptide Sequencing Market, By Source, 2021-2029 (USD Billion)

45 germany Peptide Sequencing Market, By Manufacturing Technology, 2021-2029 (USD Billion)

46 UK Peptide Sequencing Market, By Type, 2021-2029 (USD Billion)

47 UK Peptide Sequencing Market, By Application, 2021-2029 (USD Billion)

48 UK Peptide Sequencing Market, By Source, 2021-2029 (USD Billion)

49 U.kPeptide Sequencing Market, By Manufacturing Technology, 2021-2029 (USD Billion)

50 France Peptide Sequencing Market, By Type, 2021-2029 (USD Billion)

51 France Peptide Sequencing Market, By Application, 2021-2029 (USD Billion)

52 France Peptide Sequencing Market, By Source, 2021-2029 (USD Billion)

53 france Peptide Sequencing Market, By Manufacturing Technology, 2021-2029 (USD Billion)

54 Italy Peptide Sequencing Market, By Type, 2021-2029 (USD Billion)

55 Italy Peptide Sequencing Market, By T Application Type, 2021-2029 (USD Billion)

56 Italy Peptide Sequencing Market, By Source, 2021-2029 (USD Billion)

57 italy Peptide Sequencing Market, By Manufacturing Technology, 2021-2029 (USD Billion)

58 Spain Peptide Sequencing Market, By Type, 2021-2029 (USD Billion)

59 Spain Peptide Sequencing Market, By Application, 2021-2029 (USD Billion)

60 Spain Peptide Sequencing Market, By Source, 2021-2029 (USD Billion)

61 spain Peptide Sequencing Market, By Manufacturing Technology, 2021-2029 (USD Billion)

62 Netherlands Peptide Sequencing Market, By Type, 2021-2029 (USD Billion)

63 Netherlands Peptide Sequencing Market, By Application, 2021-2029 (USD Billion)

64 Netherlands Peptide Sequencing Market, By Source, 2021-2029 (USD Billion)

65 Netherlands Peptide Sequencing Market, By MANUFACTURING TECHNOLOGY, 2021-2029 (USD Billion)

66 Rest Of Europe Peptide Sequencing Market, By Type, 2021-2029 (USD Billion)

67 Rest Of Europe Peptide Sequencing Market, By Application, 2021-2029 (USD Billion)

68 Rest of Europe Peptide Sequencing Market, By Source, 2021-2029 (USD Billion)

69 REST OF EUROPE Peptide Sequencing Market, By Manufacturing Technology, 2021-2029 (USD Billion)

70 Asia Pacific Peptide Sequencing Market, By Type, 2021-2029 (USD Billion)

71 Asia Pacific Peptide Sequencing Market, By Application, 2021-2029 (USD Billion)

72 Asia Pacific Peptide Sequencing Market, By Source, 2021-2029 (USD Billion)

73 asia Peptide Sequencing Market, By Manufacturing Technology, 2021-2029 (USD Billion)

74 Asia Pacific Peptide Sequencing Market, By Country, 2021-2029 (USD Billion)

75 China Peptide Sequencing Market, By Type, 2021-2029 (USD Billion)

76 China Peptide Sequencing Market, By Application, 2021-2029 (USD Billion)

77 China Peptide Sequencing Market, By Source, 2021-2029 (USD Billion)

78 china Peptide Sequencing Market, By Manufacturing Technology, 2021-2029 (USD Billion)

79 India Peptide Sequencing Market, By Type, 2021-2029 (USD Billion)

80 India Peptide Sequencing Market, By Application, 2021-2029 (USD Billion)

81 India Peptide Sequencing Market, By Source, 2021-2029 (USD Billion)

82 india Peptide Sequencing Market, By Manufacturing Technology, 2021-2029 (USD Billion)

83 Japan Peptide Sequencing Market, By Type, 2021-2029 (USD Billion)

84 Japan Peptide Sequencing Market, By Application, 2021-2029 (USD Billion)

85 Japan Peptide Sequencing Market, By Source, 2021-2029 (USD Billion)

86 japan Peptide Sequencing Market, By Manufacturing Technology, 2021-2029 (USD Billion)

87 South Korea Peptide Sequencing Market, By Type, 2021-2029 (USD Billion)

88 South Korea Peptide Sequencing Market, By Application, 2021-2029 (USD Billion)

89 South Korea Peptide Sequencing Market, By Source, 2021-2029 (USD Billion)

90 south korea Peptide Sequencing Market, By Manufacturing Technology, 2021-2029 (USD Billion)

91 Singapore Peptide Sequencing Market, By Type, 2021-2029 (USD Billion)

92 Singapore Peptide Sequencing Market, By Application, 2021-2029 (USD Billion)

93 Singapore Peptide Sequencing Market, By Source, 2021-2029 (USD Billion)

94 Singapore Peptide Sequencing Market, By Manufacturing Technology, 2021-2029 (USD Billion)

95 Thailand Peptide Sequencing Market, By Type, 2021-2029 (USD Billion)

96 Thailand Peptide Sequencing Market, By Application, 2021-2029 (USD Billion)

97 Thailand Peptide Sequencing Market, By Source, 2021-2029 (USD Billion)

98 Thailand Peptide Sequencing Market, By Manufacturing Technology, 2021-2029 (USD Billion)

99 MALAYSIA Peptide Sequencing Market, By Type, 2021-2029 (USD Billion)

100 MALAYSIA Peptide Sequencing Market, By Application, 2021-2029 (USD Billion)

101 MALAYSIA Peptide Sequencing Market, By Source, 2021-2029 (USD Billion)

102 MALAYSIA Peptide Sequencing Market, By Manufacturing Technology, 2021-2029 (USD Billion)

103 Vietnam Peptide Sequencing Market, By Type, 2021-2029 (USD Billion)

104 Vietnam Peptide Sequencing Market, By Application, 2021-2029 (USD Billion)

105 Vietnam Peptide Sequencing Market, By Source, 2021-2029 (USD Billion)

106 Taiwan Peptide Sequencing Market, By Type, 2021-2029 (USD Billion)

107 Taiwan Peptide Sequencing Market, By Application, 2021-2029 (USD Billion)

108 Taiwan Peptide Sequencing Market, By Source, 2021-2029 (USD Billion)

109 Taiwan Peptide Sequencing Market, By Manufacturing Technology, 2021-2029 (USD Billion)

110 REST OF APAC Peptide Sequencing Market, By Type, 2021-2029 (USD Billion)

111 REST OF APAC Peptide Sequencing Market, By Application, 2021-2029 (USD Billion)

112 REST OF APAC Peptide Sequencing Market, By Source, 2021-2029 (USD Billion)

113 Rest of APAC Peptide Sequencing Market, By Manufacturing Technology, 2021-2029 (USD Billion)

114 Middle East and Africa Peptide Sequencing Market, By Type, 2021-2029 (USD Billion)

115 Middle East and Africa Peptide Sequencing Market, By Application, 2021-2029 (USD Billion)

116 Middle East and Africa Peptide Sequencing Market, By Source, 2021-2029 (USD Billion)

117 MIDDLE EAST AND AFRICA Peptide Sequencing Market, By Manufacturing Technology, 2021-2029 (USD Billion)

118 Middle East and Africa Peptide Sequencing Market, By Country, 2021-2029 (USD Billion)

119 Saudi Arabia Peptide Sequencing Market, By Type, 2021-2029 (USD Billion)

120 Saudi Arabia Peptide Sequencing Market, By Application, 2021-2029 (USD Billion)

121 Saudi Arabia Peptide Sequencing Market, By Source, 2021-2029 (USD Billion)

122 saudi arabia Peptide Sequencing Market, By Manufacturing Technology, 2021-2029 (USD Billion)

123 UAE Peptide Sequencing Market, By Type, 2021-2029 (USD Billion)

124 UAE Peptide Sequencing Market, By Application, 2021-2029 (USD Billion)

125 UAE Peptide Sequencing Market, By Source, 2021-2029 (USD Billion)

126 uae Peptide Sequencing Market, By Manufacturing Technology, 2021-2029 (USD Billion)

127 Israel Peptide Sequencing Market, By Type, 2021-2029 (USD Billion)

128 Israel Peptide Sequencing Market, By Application, 2021-2029 (USD Billion)

129 Israel Peptide Sequencing Market, By Source, 2021-2029 (USD Billion)

130 Israel Peptide Sequencing Market, By Manufacturing Technology, 2021-2029 (USD Billion)

131 South Africa Peptide Sequencing Market, By Type, 2021-2029 (USD Billion)

132 South Africa Peptide Sequencing Market, By Application, 2021-2029 (USD Billion)

133 South Africa Peptide Sequencing Market, By Source, 2021-2029 (USD Billion)

134 South Africa Peptide Sequencing Market, By Manufacturing Technology, 2021-2029 (USD Billion)

135 REST OF MIDDLE EAST AND AFRICA Peptide Sequencing Market, By Type, 2021-2029 (USD Billion)

136 REST OF MIDDLE EAST AND AFRICA Peptide Sequencing Market, By Application, 2021-2029 (USD Billion)

137 REST OF MIDDLE EAST AND AFRICA Peptide Sequencing Market, By Source, 2021-2029 (USD Billion)

138 REST OF MIDDLE EAST AND AFRICA Peptide Sequencing Market, By Manufacturing Technology, 2021-2029 (USD Billion)

139 Central & South America Peptide Sequencing Market, By Type, 2021-2029 (USD Billion)

140 Central & South America Peptide Sequencing Market, By Application, 2021-2029 (USD Billion)

141 Central & South America Peptide Sequencing Market, By Source, 2021-2029 (USD Billion)

142 CENTRAL & SOUTH AMERICA Peptide Sequencing Market, By Manufacturing Technology, 2021-2029 (USD Billion)

143 Central & South America Peptide Sequencing Market, By Country, 2021-2029 (USD Billion)

144 Brazil Peptide Sequencing Market, By Type, 2021-2029 (USD Billion)

145 Brazil Peptide Sequencing Market, By Application, 2021-2029 (USD Billion)

146 Brazil Peptide Sequencing Market, By Source, 2021-2029 (USD Billion)

147 brazil Peptide Sequencing Market, By Manufacturing Technology, 2021-2029 (USD Billion)

148 Chile Peptide Sequencing Market, By Type, 2021-2029 (USD Billion)

149 Chile Peptide Sequencing Market, By Application, 2021-2029 (USD Billion)

150 Chile Peptide Sequencing Market, By Source, 2021-2029 (USD Billion)

151 Chile Peptide Sequencing Market, By Manufacturing Technology, 2021-2029 (USD Billion)

152 Argentina Peptide Sequencing Market, By Type, 2021-2029 (USD Billion)

153 Argentina Peptide Sequencing Market, By Application, 2021-2029 (USD Billion)

154 Argentina Peptide Sequencing Market, By Source, 2021-2029 (USD Billion)

155 Argentina Peptide Sequencing Market, By Manufacturing Technology, 2021-2029 (USD Billion)

156 REST OF CENTRAL AND SOUTH AMERICA Peptide Sequencing Market, By Type, 2021-2029 (USD Billion)

157 REST OF CENTRAL AND SOUTH AMERICA Peptide Sequencing Market, By Application, 2021-2029 (USD Billion)

158 REST OF CENTRAL AND SOUTH AMERICA Peptide Sequencing Market, By Source, 2021-2029 (USD Billion)

159 REST OF CENTRAL AND SOUTH AMERICA Peptide Sequencing Market, By Manufacturing Technology, 2021-2029 (USD Billion)

160 Cargill Incorporated: Products & Services Offering

161 ADM: Products & Services Offering

162 International Flavors & Fragrances Inc.: Products & Services Offering

163 Ingredion: Products & Services Offering

164 Tate & Lyle: Products & Services Offering

165 AJINOMOTO CO. INC.: Products & Services Offering

166 GLG Life Tech Corporation: Products & Services Offering

167 Celanese Corporation: Products & Services Offering

168 Roquette Frères, Inc: Products & Services Offering

169 PCIPL: Products & Services Offering

170 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Peptide Sequencing Market Overview

2 Global Peptide Sequencing Market Value From 2021-2029 (USD Billion)

3 Global Peptide Sequencing Market Share, By Type (2023)

4 Global Peptide Sequencing Market Share, By Application (2023)

5 Global Peptide Sequencing Market Share, By Source (2023)

6 Global Peptide Sequencing Market Share, By Manufacturing Technology (2023)

7 Global Peptide Sequencing Market, By Region (Asia Pacific Market)

8 Technological Trends In Global Peptide Sequencing Market

9 Four Quadrant Competitor Positioning Matrix

10 Impact Of Macro & Micro Indicators On The Market

11 Impact Of Key Drivers On The Global Peptide Sequencing Market

12 Impact Of Challenges On The Global Peptide Sequencing Market

13 Porter’s Five Forces Analysis

14 Global Peptide Sequencing Market: By Type Scope Key Takeaways

15 Global Peptide Sequencing Market, By Type Segment: Revenue Growth Analysis

16 High Fructose Corn Syrup Market, By Region, 2021-2029 (USD Billion)

17 High-intensity Sweeteners Market, By Region, 2021-2029 (USD Billion)

18 Low-intensity Sweeteners Market, By Region, 2021-2029 (USD Billion)

19 Global Peptide Sequencing Market: By Application Scope Key Takeaways

20 Global Peptide Sequencing Market, By Application Segment: Revenue Growth Analysis

21 Food Market, By Region, 2021-2029 (USD Billion)

22 Beverages Market, By Region, 2021-2029 (USD Billion)

23 Health & Personal Care Products Market, By Region, 2021-2029 (USD Billion)

24 Pharmaceuticals Market, By Region, 2021-2029 (USD Billion)

25 Others Market, By Region, 2021-2029 (USD Billion)

26 Global Peptide Sequencing Market: By Source Scope Key Takeaways

27 Global Peptide Sequencing Market, By Source Segment: Revenue Growth Analysis

28 Natural Market, By Region, 2021-2029 (USD Billion)

29 Artificial Market, By Region, 2021-2029 (USD Billion)

30 Global Peptide Sequencing Market: By Manufacturing Technology Scope Key Takeaways

31 Global Peptide Sequencing Market, By Manufacturing Technology Segment: Revenue Growth Analysis

32 Precision Fermentation Market, By Region, 2021-2029 (USD Billion)

33 Enzymatic Conversion Market, By Region, 2021-2029 (USD Billion)

34 Chemical Synthesis Market, By Region, 2021-2029 (USD Billion)

35 Others Market, By Region, 2021-2029 (USD Billion)

36 Regional Segment: Revenue Growth Analysis

37 Global Peptide Sequencing Market: Regional Analysis

38 North America Peptide Sequencing Market Overview

39 North America Peptide Sequencing Market, By Type

40 North America Peptide Sequencing Market, By Application

41 North America Peptide Sequencing Market, By Source

42 North America Peptide Sequencing Market, By Manufacturing Technology

43 North America Peptide Sequencing Market, By Country

44 U.S. Peptide Sequencing Market, By Type

45 U.S. Peptide Sequencing Market, By Application

46 U.S. Peptide Sequencing Market, By Source

47 U.S. Peptide Sequencing Market, By Manufacturing Technology

48 Canada Peptide Sequencing Market, By Type

49 Canada Peptide Sequencing Market, By Application

50 Canada Peptide Sequencing Market, By Source

51 Canada Peptide Sequencing Market, By Manufacturing Technology

52 Mexico Peptide Sequencing Market, By Type

53 Mexico Peptide Sequencing Market, By Application

54 Mexico Peptide Sequencing Market, By Source

55 Mexico Peptide Sequencing Market, By Manufacturing Technology

56 Four Quadrant Positioning Matrix

57 Company Market Share Analysis

58 Cargill Incorporated: Company Snapshot

59 Cargill Incorporated: SWOT Analysis

60 Cargill Incorporated: Geographic Presence

61 ADM: Company Snapshot

62 ADM: SWOT Analysis

63 ADM: Geographic Presence

64 International Flavors & Fragrances Inc.: Company Snapshot

65 International Flavors & Fragrances Inc.: SWOT Analysis

66 International Flavors & Fragrances Inc.: Geographic Presence

67 Ingredion: Company Snapshot

68 Ingredion: Swot Analysis

69 Ingredion: Geographic Presence

70 Tate & Lyle: Company Snapshot

71 Tate & Lyle: SWOT Analysis

72 Tate & Lyle: Geographic Presence

73 AJINOMOTO CO. INC.: Company Snapshot

74 AJINOMOTO CO. INC.: SWOT Analysis

75 AJINOMOTO CO. INC.: Geographic Presence

76 GLG Life Tech Corporation : Company Snapshot

77 GLG Life Tech Corporation : SWOT Analysis

78 GLG Life Tech Corporation : Geographic Presence

79 Celanese Corporation: Company Snapshot

80 Celanese Corporation: SWOT Analysis

81 Celanese Corporation: Geographic Presence

82 Roquette Frères, Inc.: Company Snapshot

83 Roquette Frères, Inc.: SWOT Analysis

84 Roquette Frères, Inc.: Geographic Presence

85 PCIPL: Company Snapshot

86 PCIPL: SWOT Analysis

87 PCIPL: Geographic Presence

88 Other Companies: Company Snapshot

89 Other Companies: SWOT Analysis

90 Other Companies: Geographic Presence

The Global Sugar Substitutes Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Sugar Substitutes Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS