Global Therapeutic Drug Monitoring Market Size, Trends, and Analysis - Forecasts to 2026 By Product (Consumables, Equipment), By Technology (Immunoassays & Chromatography-MS) By Class of Drug (Antiepileptic Drugs, Antiarrhythmic Drugs, Immunosuppressant Drugs, Antibiotic Drugs, Bronchodilator Drugs, Psychoactive Drugs, and Other Drug Classes) By End- User (Hospital Laboratories, Commercial/Private Laboratories, Other End Users) By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); Company Market Share Analysis & Competitor Analysis

Therapeutic drug monitoring is the clinical method of measuring the concentration of a particular drug in a patients blood at distinct intervals. The monitoring of therapeutic drugs (TDM) helps to maintain a constant volume of drugs in the bloodstream needed to demonstrate therapeutic effects without toxic effects, thus optimizing individual dosage regimens.

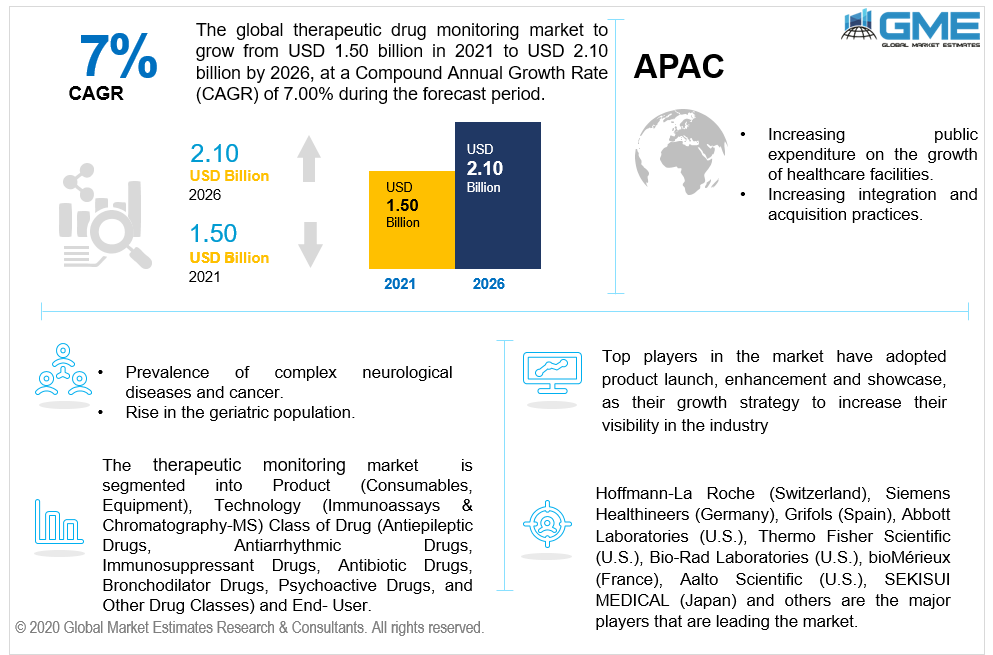

The therapeutic drug monitoring (TDM) will register high growth between 2021-2026 due to the growing demand for better healthcare among urban population. Increased knowledge of drug pharmacogenetics and pharmacokinetics inclines clinicians to monitor certain medications for therapeutic drugs (TDM). The growing incidence of neurological diseases and the increased number of cancer patients are boosting the market growth. The growing need for high-end diagnostic strategies including genetic testing is supporting the market growth. Moreover, growing spending by private and government entities in the research and development of new medicines and vaccines is also anticipated in the near future to fuel demand for the Therapeutic Drug Monitoring (TDM) industry. In addition, this demand is further driven by the rise in the geriatric population, especially in emerging geographies, and by the emergence of innovative medication management tools.

Low R&D returns, high infrastructure costs, a strict regulatory framework,and a lack of qualified personnel, however, are some of the constraints on the demand for therapeutic drug monitoring (TDM).

Based on the product type, the market is segregated and explained into consumables and equipment. The consumable segment will be the prominent segment and occupying maximum share in the global market. The repetitive use of consumables such as kits and reagents is driving this segments development. In addition, the growing number of diseases, such as infectious and chronic diseases, is contributing to the increasing demand for immunoassay tests, which, in turn, is driving the demand for consumables.

The increasing incidence of chronic and infectious diseases is boosting the market for Immunoassays. The immunoassay category holds the highest share in the technology segment. Also, immunoassays are simple to carry out and do not need advanced training. Technological advances have made the analyzers more user-friendly and automated which is accelerating the growth of the immunoassay segment.

Antibiotics, psychoactive, immunosuppressants, anti-epileptics,bronchodilator drugs, and anti-arrhythmic drugs are part of the drug-class segmentation. Owing to the high demand for frequent screening of antiepileptic medications such as carbamazepine, ethosuximide, and phenobarbital, the antiepileptic segment is projected to hold a leading position. The complicated pharmacokinetics associated with antiepileptic drugs have generated a need for continuous antiepileptic screening, thus boosting demand from this category. Also, as a consequence of the growing prevalence of epilepsy and seizures and the resulting exponential increase in the number of anti-epileptic drugs, the anti-epileptic group has the largest market share.

Hospital labs, private labs, and others (research institutes, academic institutes, and pharmaceutical companies) are included in the end-user segment. Hospital labs are fully equipped with technology and provide patients monetary assistance by insurance policies. These factors make these facilities widely recommended places for treatment, which in turn increases hospital laboratory demand which is projected to continue throughout the predicted timeframe. Due to the availability of accurate patient information, such as ethnicity, metabolism, age, and drug performance history, over 50 percent of therapeutic drug monitoring is performed in hospitals. The growing incidence of healthcare-associated infections (HAIs), the increasing surgical operations, and growing number of hospitals are boosting the market growth.

The North Americanregion will dominate the global market in terms of revenue between 2021-2026. The presence of leading healthcare providers, rising healthcare expenditure and investments,are driving the regional market. The European region will also register decent growth between 2021-2026.

Asia-Pacific is projected to expand steadily, due to the increasing public expenditure on the growth of healthcare facilities and increasing integration and acquisition practices in developing economies of the region. Owing to the high prevalence of health problems due to lifestyle diseases, Asia Pacific is expected to rise at a substantial CAGR during the forecast period. In the near future, countries such as India, Japan, and China in the Asia-Pacific region are expected to become the most lucrative therapeutic drug monitoring (TDM) markets. The rapid growth in healthcare sector and updating healthcare facilities in developing economies are supporting the regional growth.

F. Hoffmann-La Roche (Switzerland), UTAK (U.S.), Siemens Healthineers (Germany), JASEM Laboratory Systems and Solutions A.S (Turkey), Eagle Biosciences Inc. (U.S.), Grifols (Spain), BÜHLMANN Laboratories (Switzerland), Abbott Laboratories, apDia Group, BioTeZ Berlin-Buch GmbH, Thermo Fisher Scientific, R-Biopharm AG, Bio-Rad Laboratories, Exagen Inc., bioMérieux (France), Danaher Corporation, Aalto Scientific (U.S.), Immundiagnostik AG, Cambridge Life Sciences Limited, Chromsystems Instruments & Chemicals GmbH, DiaSystem Scandinavia AB (Sweden), SEKISUI MEDICAL (Japan), ARK Diagnostics, Inc. (U.S.), and Randox Laboratories (Ireland) are the key palyers involved in developing Therapeutic Drug Monitoring systems.

Please note: This is not an exhaustive list of companies profiled in the report.

Abbott released a new test in April 2020 that will show whether youve ever had the coronavirus, with the aim to pump millions out.

Hoffmann-La Roche partnered with Blueprint Drugs in July 2020 to introduce new therapies to people with RET-altered cancers.

We value your investment and offer free customization with every report to fulfil your exact research needs.

The Global Therapeutic Drug Monitoring Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Therapeutic Drug Monitoring Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS