Global Tokenization Market Size, Trends & Analysis - Forecasts to 2026 By Type of Component (Software and Services [Professional Services and Managed Services]), By Type of Application Area (Payment Security, User Authentication, and Compliance Management), By Type of Tokenization Technique (Application Programming Interface [API] and Gateway-Based), By Type of Deployment Model (On-premises and Cloud), By Type of Organization Size (Small & Medium-Sized Enterprises and Large Enterprises), By Type of Vertical (Banking, Finance Services and Insurance, Government, Retail, Healthcare, IT & Telecom, Energy & Utilities, Automotive, Education, and Others), By Type of Region (NA [North America], Europe, APAC [Asia Pacific], MEA [the Middle East & Africa], and CSA [Central & South America]), End-User Landscape, Vendor Landscape, Company Market Share Analysis & Competitor Analysis

Tokenization Market Insights

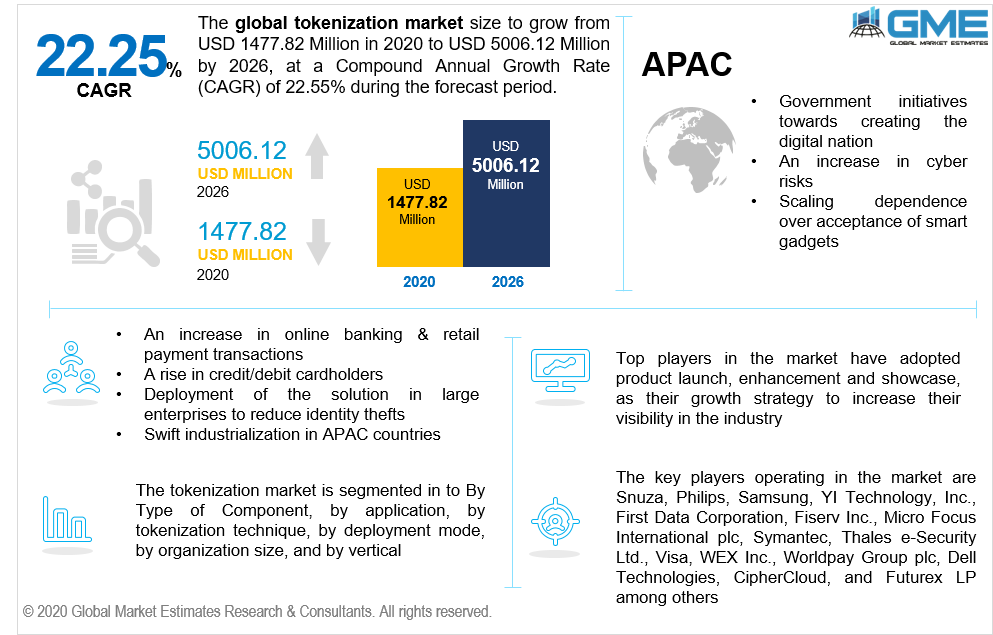

The tokenization market will register a high growth rate during the prediction period (2020-2026). A Tokenization is a process of forming a “token” that concocts sensitive data. It is also termed as a solution providing real-time payment data security based on all transactions. The purpose of tokenization is to reduce processing risks of the information and can be an alternative for the isolated and data segmentation in the database. An increase in online banking & retail payment transactions, a rise in credit/debit cardholders, deployment of the solution in large enterprises to reduce identity thefts, and swift industrialization in APAC countries are a few factors propelling the global tokenization market.

Tokenization Market: By Type of Component

The market sectioning based on components can be reviewed as solutions and services, where professional services and managed services are the subdivisions of the service segment. The services segment is set to hold the largest share in the market. An increase in illegal payment transactions, quick adoption of digitization, and cloud security applications aid to the blooming of the tokenization market.

Tokenization Market: By Type of Application Area

Payment security, user authentication, compliance management are the areas of application for tokenization. payment security involves providing regulations for securing consumers data and sensitive information, user authentication is allowing to identify the particular individual to connect to the essential services, and compliance management revolves around managing, planning, & organize activities to ensure docility with laws and standards. Payment security is associated with the fastest-growing segment in the tokenization market. An increase in online payment applications and SaaS-based security services are the factors correlated to the magnification of the market.

Tokenization Market: By Type of Tokenization Technique

Application Programming Interface (API) and gateway-based are the techniques applied to tokenization. API is a software application that interacts with multiple applications for data acquisition whereas gateway associates with card payment data and proffering for remuneration & authorization. API is predicted to control the market in the subsequent years where an increase in mobile banking applications, low-cost internet convenience, and improved awareness of cyber-attacks are the chauffers leading towards the burgeoning of the market.

Tokenization Market: By Type of Deployment Mode

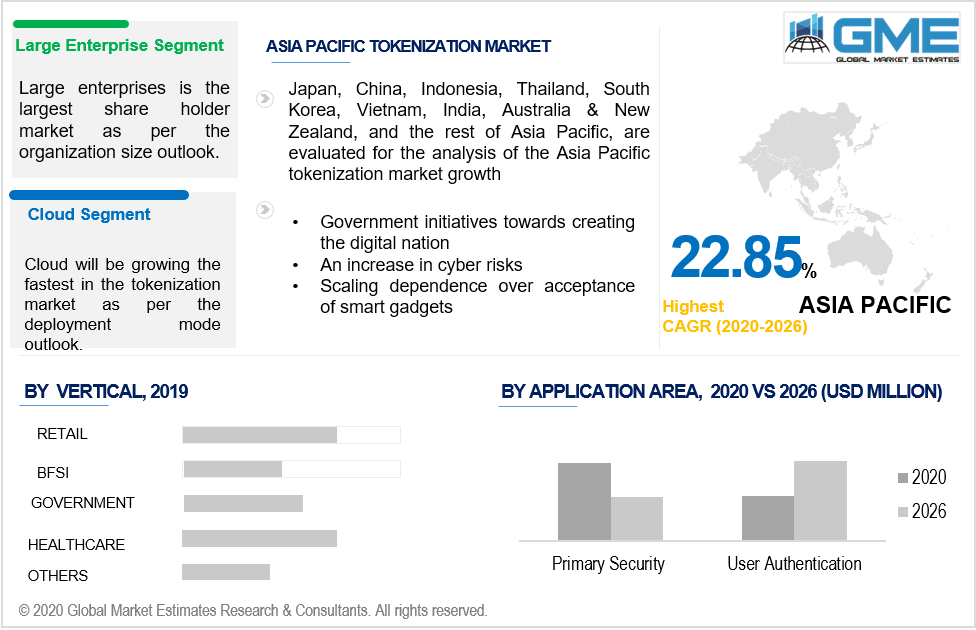

Based on the operating system, market segmentation can be portrayed as cloud and on-premises. Mode of cloud deployment will be accounting for the highest CAGR in the global market due to the rise in credit and debit cardholders, an accession in fraudulent activities, and higher operation efficiency enacting as the propellors sailing through the advancement of the market.

Tokenization Market: By Type of Organization Size

The various organization for size can be seen as small & medium-sized enterprises and large enterprises respectively. Large enterprises are the prospect segment that accounts for the largest share in the market. An increase in industrialization, demand for data protection, and a rise in the regulation of payment processing companies are some of the factors pointing onward the global market.

Tokenization Market: By Type of Vertical

Based on the type of vertical, market diversification can be listed as banking, finance services & insurance, government, retail, healthcare, IT & telecom, energy & utilities, automotive, education, and others. The retail segment is termed to grow in an exponential range due to the elements such as an improving change in lifestyle, expansion in payment solutions industries, and forbearing data management appending to the development of the market.

Tokenization Market: By Region

North America has been on top of the game for the precedent years as many companies are based in the US, Canada, and Mexico, yet APAC will present a stunning swelling within the forecast period. Government initiatives towards creating the digital nation, an increase in cyber risks, and scaling dependence over smart gadgets are the drivers reshaping the expansion of the market.

Tokenization Market Share and Competitor Analysis

First Data Corporation, Fiserv Inc., Micro Focus International plc, Symantec, Thales e-Security Ltd., Visa, WEX Inc., Worldpay Group plc, Dell Technologies, CipherCloud, Futurex LP, Liaison Technologies Inc., Protegrity USA, Inc., TokenEx, Sequent Software Inc., Discover Financial Services, Carta Worldwide, Merchant Link LLC, Ingenico ePayments and other industries are the dominant players in the global tokenization market

Please note: This is not an exhaustive list of companies profiled in the report.

In May 2017, First Data Corporation joined hands with Flywire to improve consumer cross-border transactions.

Check the Press Release on Global Tokenization Market Report

We value your investment and offer free customization with every report to fulfil your exact research needs.

The Global Tokenization Market has been studied from the year 2017 till 2026. However, the CAGR provided in the report is from the year 2018 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply side analysis for the Tokenization Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the companies and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS