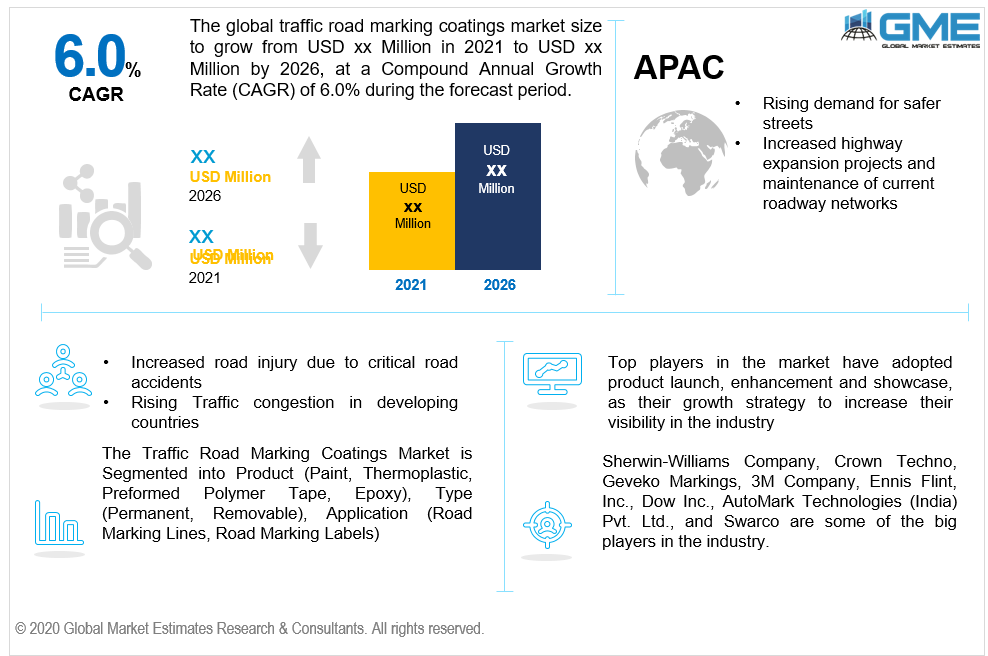

Global Traffic Road Marking Coatings Market Size, Trends, and Analysis- Forecasts To 2026 By Product (Paint, Thermoplastic, Preformed Polymer Tape, Epoxy), By Type (Permanent, Removable), By Application (Road Marking Lines, Road Marking Labels), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

Lines, patterns, phrases, or other devices added to or connected to the kerb or carriageway, or to items inside and adjacent to the carriageway, for monitoring, directing, warning, and informing road users, are referred to as road markings. The application of traffic road marking coating is critical for maintaining road protection, particularly on four- and six-lane highways. Coating aids in the seamless flow of traffic, reducing the incidence of traffic collisions. Coating material is non-toxic, convenient, corrosion-resistant, UV-resistant, and environmentally safe. Traffic road marking coatings also serve as a means for monitoring, advising, and informing drivers about road direction and speed limits, in addition to directing traffic. Epoxy, thermoplastic, preformed polymer tape, and paint are some of the different forms of road marking coatings present in the market.

Increased road accidents and traffic congestion are two main factors moving the global traffic road marking coatings industry forward. In the coming years, the global traffic road marking coatings market is anticipated to rise due to increasing demand for traffic flow management and enhanced road infrastructure, particularly in developing markets. Increased government initiatives for the construction of secure highways also contributes to the market's expansion. Increased highway expansion and maintenance of current roadway networks are other factors boosting business demand.

Despite the fact that the traffic road marking coatings industry is rising at a fast pace, the market is projected to be hindered by a few factors worldwide. Raw material shortage is a big stumbling block to the market's global expansion. Furthermore, the inaccessibility of resins used as binders in thermoplastics and cold plastics road marking materials, as well as titanium dioxide used to blanch road marking, has a significant effect on all shareholders. Term repair contractors and staff, individual road users, central government departments, road marking contractors, material suppliers, or local authorities are among the shareholders.

In the coming years, the main market participants are projected to benefit from the growth of developed organizations in emerging nations as well as the increased use of environmentally sustainable and organic road marking materials.

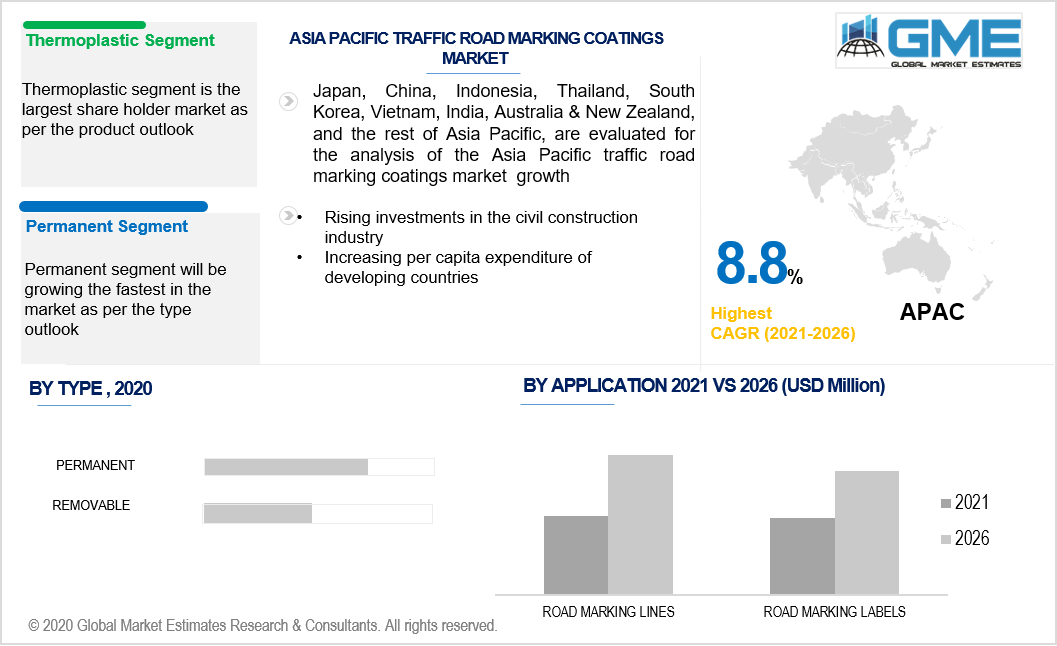

Over the forecast period, thermoplastic coating is predicted to be the fastest-growing product category. For markers on private settings and city sidewalks, traditional paint is best. These paints come in a number of colours, each of which represents a unique function. Red markings, for example, express vital details, while yellow and orange colours are synonymous with transient cautions. To avoid collisions, reflectors are used in places where forklift traffic is common. To make rumble strips, thick/built-up layers of thermoplastic marking coatings are used. This coating hardens easily and conforms to the surface tightly. Additional additives may be applied to the coating to help it maintain its colour and enhance its reflective properties over time. This coating is wear-resistant due to its high resistance and strength.

During the hardening process, preformed polymer tape coatings, also known as cold or tape plastic, are applied to the surface of the asphalt concrete or pavement. It comes in sheets from which distinctive forms, shapes, or letters can be crafted, in addition to its use for crosswalks and stop bars.

The traffic road marking coatings market is categorised into removable and permanent traffic road marking coatings based on type. Paints and pavement tapes are examples of permanent traffic road marking coatings. For traffic line labelling, aerosol permanent paints are commonly utilized. They have a high proportion of solid and resin content, which helps with exterior longevity and resistance to water, abrasion, and climate. Aerosol paints come in a multitude of colours, but yellow and white are commonly seen in streets, parking garages, highways, crosswalks, and airport runways, among other places. In comparison to traditional colours, these paints have a longer lifespan.

Removable traffic road marking coatings are mostly used for identification numbers, paint signs, and direction arrows for synthetic turf fields, road construction areas, and factory floors, among other things. These paints are tough and long-lasting, but they can be quickly discarded and will gradually disappear if exposed to the environment.

In 2020, road marking lines is analyzed to be the most common application category, with highest share. The use of road marking lines to direct vehicles on the road is common. The marking delineates the traffic direction which provides lateral clearance from traffic hazards for secure and seamless road travel. It can also be used to provide details, monitor traffic, and issue warnings to road users.

Because of its vast use for roads, public highways, and on-site installations, road marking labels are anticipated to witness the fastest growing application market. Both road users, including bicyclists and pedestrians, benefit from traffic road marking labels because they encourage traffic safety, warn drivers of speed limits, and include directions and other valuable information. Regulatory notices, roadwork signals, and informative signs are all examples of basic road labelling. All road marking labels must adhere to the rules of the road.

North America was the largest region, while Asia Pacific is expected to rise the fastest over the forecast period. To achieve its target of eliminating highway deaths, the government is undertaking research to create uniform guidelines. In the near future, high-quality construction materials, safety controls, training, and improved contractor monitoring are likely to fuel product demand.

The US government has launched programmes to improve road infrastructure and promote the manufacturing of long-lasting, high-performance coatings that improve skid resistance and visibility. Vertical industry integration could be facilitated by establishing production units for highway marking and traffic paints, giving suppliers and applicators more leverage over product quality and cost.

During the forecast period, Asia Pacific is predicted to be the quickest growing market for road marking coatings. During the forecasting period, factors such as rising demand for safer streets and rising investments in the civil construction industry would promote the usage of road marking coatings in the Asia Pacific region.

Sherwin-Williams Company, Crown Techno, Geveko Markings, 3M Company, Ennis Flint, Inc., Dow Inc., AutoMark Technologies (India) Pvt. Ltd., and Swarco are some of the big players in the industry.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Road Marking Coatings Industry Overview, 2016-2026

2.1.1 Industry Overview

2.1.2 Product Overview

2.1.3 Type Overview

2.1.4 Application Overview

2.1.6 Regional Overview

Chapter 3 Road Marking Coatings Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising cases of road accidents and traffic congestion

3.3.2 Industry Challenges

3.3.2.1 Lack of adequate infrastructure and automated road marking systems in developing nations

3.4 Prospective Growth Scenario

3.4.1 Product Growth Scenario

3.4.2 Type Growth Scenario

3.4.3 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Application Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Road Marking Coatings Market, By Product

4.1 Product Outlook

4.2 Paint

4.2.1 Market Size, By Region, 2016-2026 (USD Million)

4.3 Thermoplastic

4.3.1 Market Size, By Region, 2016-2026 (USD Million)

4.4 Preformed Polymer Tape

4.4.1 Market Size, By Region, 2016-2026 (USD Million)

4.5 Epoxy

4.5.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 5 Road Marking Coatings Market, By Type

5.1 Type Outlook

5.2 Permanent

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

5.3 Removable

5.3.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 6 Road Marking Coatings Market, By Application

6.1 Road Marking Lines

6.1.1 Market Size, By Region, 2016-2026 (USD Million)

6.2 Road Marking Labels

6.2.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 7 Road Marking Coatings Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2016-2026 (USD Million)

7.2.2 Market Size, By Product, 2016-2026 (USD Million)

7.2.3 Market Size, By Type, 2016-2026 (USD Million)

7.2.4 Market Size, By Application, 2016-2026 (USD Million)

7.2.6 U.S.

7.2.6.1 Market Size, By Product, 2016-2026 (USD Million)

7.2.4.2 Market Size, By Type, 2016-2026 (USD Million)

7.2.4.3 Market Size, By Application, 2016-2026 (USD Million)

7.2.7 Canada

7.2.7.1 Market Size, By Product, 2016-2026 (USD Million)

7.2.7.2 Market Size, By Type, 2016-2026 (USD Million)

7.2.7.3 Market Size, By Application, 2016-2026 (USD Million)

7.3 Europe

7.3.1 Market Size, By Country 2016-2026 (USD Million)

7.3.2 Market Size, By Product, 2016-2026 (USD Million)

7.3.3 Market Size, By Type, 2016-2026 (USD Million)

7.3.4 Market Size, By Application, 2016-2026 (USD Million)

7.3.6 Germany

7.3.6.1 Market Size, By Product, 2016-2026 (USD Million)

7.3.6.2 Market Size, By Type, 2016-2026 (USD Million)

7.3.6.3 Market Size, By Application, 2016-2026 (USD Million)

7.3.7 UK

7.3.7.1 Market Size, By Product, 2016-2026 (USD Million)

7.3.7.2 Market Size, By Type, 2016-2026 (USD Million)

7.3.7.3 Market Size, By Application, 2016-2026 (USD Million)

7.3.8 France

7.3.7.1 Market Size, By Product, 2016-2026 (USD Million)

7.3.7.2 Market Size, By Type, 2016-2026 (USD Million)

7.3.7.3 Market Size, By Application, 2016-2026 (USD Million)

7.3.9 Italy

7.3.9.1 Market Size, By Product, 2016-2026 (USD Million)

7.3.9.2 Market Size, By Type, 2016-2026 (USD Million)

7.3.9.3 Market Size, By Application, 2016-2026 (USD Million)

7.3.10 Spain

7.3.10.1 Market Size, By Product, 2016-2026 (USD Million)

7.3.10.2 Market Size, By Type, 2016-2026 (USD Million)

7.3.10.3 Market Size, By Application, 2016-2026 (USD Million)

7.3.11 Russia

7.3.11.1 Market Size, By Product, 2016-2026 (USD Million)

7.3.11.2 Market Size, By Type, 2016-2026 (USD Million)

7.3.11.3 Market Size, By Application, 2016-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2016-2026 (USD Million)

7.4.2 Market Size, By Product, 2016-2026 (USD Million)

7.4.3 Market Size, By Type, 2016-2026 (USD Million)

7.4.4 Market Size, By Application, 2016-2026 (USD Million)

7.4.6 China

7.4.6.1 Market Size, By Product, 2016-2026 (USD Million)

7.4.6.2 Market Size, By Type, 2016-2026 (USD Million)

7.4.6.3 Market Size, By Application, 2016-2026 (USD Million)

7.4.7 India

7.4.7.1 Market Size, By Product, 2016-2026 (USD Million)

7.4.7.2 Market Size, By Type, 2016-2026 (USD Million)

7.4.7.3 Market Size, By Application, 2016-2026 (USD Million)

7.4.8 Japan

7.4.7.1 Market Size, By Product, 2016-2026 (USD Million)

7.4.7.2 Market Size, By Type, 2016-2026 (USD Million)

7.4.7.3 Market Size, By Application, 2016-2026 (USD Million)

7.4.9 Australia

7.4.9.1 Market Size, By Product, 2016-2026 (USD Million)

7.4.9.2 Market size, By Type, 2016-2026 (USD Million)

7.4.9.3 Market Size, By Application, 2016-2026 (USD Million)

7.4.10 South Korea

7.4.10.1 Market Size, By Product, 2016-2026 (USD Million)

7.4.10.2 Market Size, By Type, 2016-2026 (USD Million)

7.4.10.3 Market Size, By Application, 2016-2026 (USD Million)

7.5 Latin America

7.5.1 Market Size, By Country 2016-2026 (USD Million)

7.5.2 Market Size, By Product, 2016-2026 (USD Million)

7.5.3 Market Size, By Type, 2016-2026 (USD Million)

7.5.4 Market Size, By Application, 2016-2026 (USD Million)

7.5.6 Brazil

7.5.6.1 Market Size, By Product, 2016-2026 (USD Million)

7.5.6.2 Market Size, By Type, 2016-2026 (USD Million)

7.5.6.3 Market Size, By Application, 2016-2026 (USD Million)

7.5.7 Mexico

7.5.7.1 Market Size, By Product, 2016-2026 (USD Million)

7.5.7.2 Market Size, By Type, 2016-2026 (USD Million)

7.5.7.3 Market Size, By Application, 2016-2026 (USD Million)

7.5.8 Argentina

7.5.7.1 Market Size, By Product, 2016-2026 (USD Million)

7.5.7.2 Market Size, By Type, 2016-2026 (USD Million)

7.5.7.3 Market Size, By Application, 2016-2026 (USD Million)

7.6 MEA

7.6.1 Market Size, By Country 2016-2026 (USD Million)

7.6.2 Market Size, By Product, 2016-2026 (USD Million)

7.6.3 Market Size, By Type, 2016-2026 (USD Million)

7.6.4 Market Size, By Application, 2016-2026 (USD Million)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Product, 2016-2026 (USD Million)

7.6.6.2 Market Size, By Type, 2016-2026 (USD Million)

7.6.6.3 Market Size, By Application, 2016-2026 (USD Million)

7.6.7 UAE

7.6.7.1 Market Size, By Product, 2016-2026 (USD Million)

7.6.7.2 Market Size, By Type, 2016-2026 (USD Million)

7.6.7.3 Market Size, By Application, 2016-2026 (USD Million)

7.6.8 South Africa

7.6.7.1 Market Size, By Product, 2016-2026 (USD Million)

7.6.7.2 Market Size, By Type, 2016-2026 (USD Million)

7.6.7.3 Market Size, By Application, 2016-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Sherwin-Williams Company

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 Crown Techno

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Geveko Markings

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 3M Company

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Ennis Flint, Inc.

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Dow Inc.

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 AutoMark Technologies

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Swarco

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.10 Other Companies

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

The Global Traffic Road Marking Coatings Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Traffic Road Marking Coatings Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS