Global Tugger Train Market Size, Trends & Analysis - Forecasts to 2026 By Type (Trailer Concept, Taxi Concept, Push Concept), By End-Use (Automotive & Transportation, Electro Technology & Mechanics, Mechanical & Plant Engineering, FMCG, Healthcare, Construction, Plastic Industry), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa); End-User Landscape, Company Market Share Analysis, and Competitor Analysis

Manufacturing facilities such as automotive use conveyor systems for transportation of various large sized components to achieve in ease in operation. A conveyor system is a reliable and faster solution than a forklift due to its efficient material handling capability. However, in small and medium-size tools transportation another excellent system is available i.e. Tugger Train. These are excellent solutions for the small components transportation across workstations.

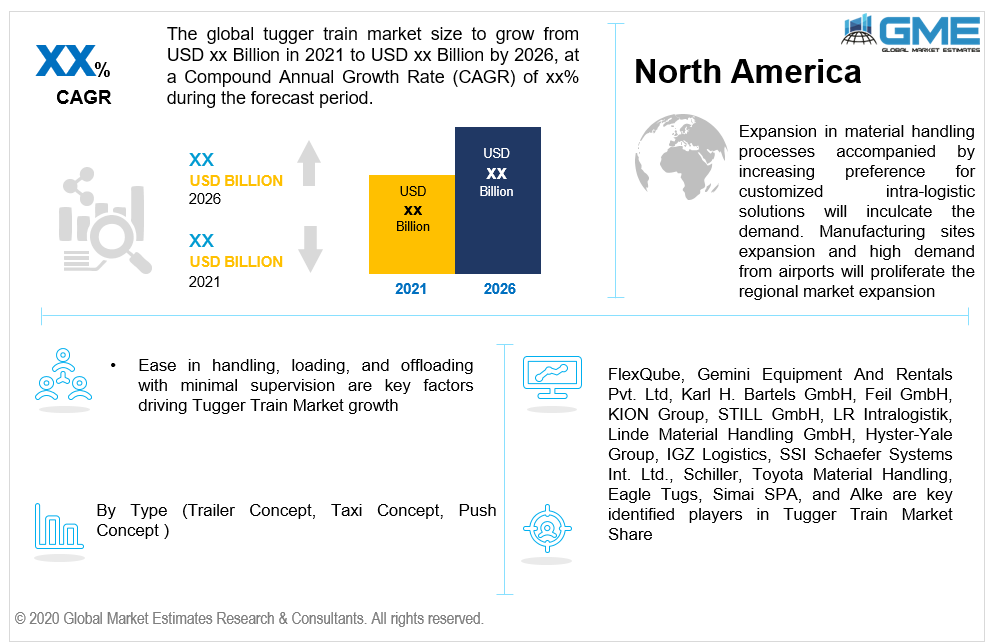

These systems can be customized as per the operator requirement and also involves fewer personnel to run. From transporting the small components to transferring weightier components such as tires can be carried by the Tugger Train easily. Ease in handling, loading, and offloading with minimal supervision are key factors driving Tugger Train Market growth.

Tugger train systems installation is a complex procedure that needs a broad analysis of logistics structure. To achieve efficient lean production, the company goes through various logistic schemes. Thus, the increasing importance of intralogistics and adopting customized solutions will influence the Tugger Train demand in various end-use industries.

These systems are designed or can be customized in such a way to provide an enhanced material handling experience by offering delivery speed, no product damage, and smooth transitioning. It has been noticed that the manufacturing floors are always congested due to continuous operation in the facility, which makes the floor unnecessarily busy and creates confusion. Thus, the Tugger Train integration can effectively reduce the congestion as only two persons are required to load, unload, and operate the system.

In a current trade scenario, unmanned or self-driven vehicles are becoming popular in the intralogistics undertakings of various factories such as Alibaba and Amazon. Hence, the industry demand will be influenced due to their automated functionality to follow pre-defined routes while delivering the material. Customization, flexibility, and ease in handling are key attributing factors fuelling the market growth.

Trailer, Taxi, and Push are three concepts involved in the tugger train systems. Each type has its usage and advantage depending on the application for the end-use industry. Different tugger train types also involve different technicalities, operating methods, and costs. The choice of the system completely depends on the customer's requirement. Thus, deep scrutiny is required by both parties before finalizing the tugger train type.

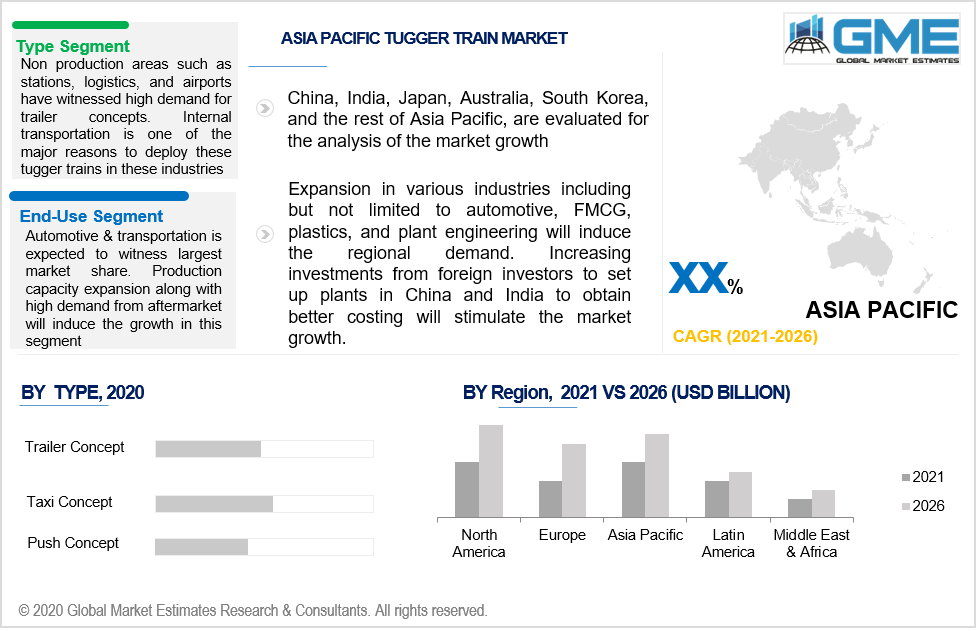

Non-production areas such as stations, logistics, and airports have witnessed high demand for trailer concepts. Internal transportation is one of the major reasons to deploy these tugger trains in these industries. Trailers are the foremost step in intralogistics but may become challenging in later stages if the company switches to push concepts. They are comparatively less flexible and cannot be compatible with digital information systems. On the contrary, push systems are flexible and digital-friendly which makes the functioning more smooth and efficient.

Automotive & transportation, electrotechnology& mechanics, plant engineering, FMCG, healthcare, construction, and plastics are major industries where the tugger train are high in demand. These vehicles are typically deployed in production facilities where goods are in continuous supply. Also, they are in high demand from non-production facilities such as airports.

Automotive & transportation is expected to witness the largest market share. Production capacity expansion along with high demand from the aftermarket will induce growth in this segment. In FMCG, these vehicle helps in efficient loading retail shelves that are systematically occupied with specific goods. The pre-defined process of these systems ensures the proper collection and transference of goods to the specific place.

The Asia Pacific will witness the highest gains due to the presence of a large number of factories in the region. Expansion in various industries including but not limited to automotive, FMCG, plastics, and plant engineering will induce the regional demand. Increasing investments from foreign investors to set up plants in China and India to obtain better costing will stimulate market growth.

North America will observe significant demand during the forecast period. Expansion in material handling processes accompanied by increasing preference for customized intra-logistic solutions will inculcate the demand. Manufacturing site expansion and high demand from airports will proliferate the regional market expansion.

The presence of large-scale chemical and oil & gas factories has encouraged product adoption in Middle East & Africa. Technology and process up-gradation is another key attributing factors in the region.

FlexQube, Gemini Equipment And Rentals Pvt. Ltd, Karl H. Bartels GmbH, Feil GmbH, KION Group, STILL GmbH, LR Intralogistik, Linde Material Handling GmbH, Hyster-Yale Group, IGZ Logistics, SSI Schaefer Systems Int. Ltd., Schiller, Toyota Material Handling, Eagle Tugs, Simai SPA, and Alke are key identified players in Tugger Train Market Share.

Please note: This is not an exhaustive list of companies profiled in the report.

The industry share is competitive in nature owing to the presence of various companies with multiple product variety. Mergers & acquisition to take advantage of forward and backward integration is among the key strategies adopted by the industry leaders.

Other industry participants areRäder-Busch GmbH, Schneider Leichtbau GmbH, GÜTHLE PressenSpannen GmbH, HORGES GmbH Lagertechnik, StöcklinLogistik AG, Padberg + Palatec Logistic GmbH, E&L Lagertechnik GmbH, SMI Handling Systeme GmbH, AczentLagertechnik GmbH & Co. KG, K. Hartwall Oy Ab, Manuline Intralogistics Solutions, Jungheinrich AG, Bradshaw Electric Vehicles, Motrec International Inc, The Raymond Corporation, and JBT.

Chapter 1 Methodology

1.1 Market scope & definitions

1.2 Estimates & forecast calculation

1.3 Historical data overview and validation

1.4 Data sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Tugger Train Market industry overview, 2016-2026

2.1.1 Industry overview

2.1.2 Type overview

2.1.3 End-Use overview

2.1.4 Regional overview

Chapter 3 Tugger Train Market Trends

3.1 Market segmentation

3.2 Industry background, 2016-2026

3.3 Market key trends

3.3.1 Positive trends

3.3.2 Industry challenges

3.4 Prospective growth scenario

3.4.1 Product growth scenario

3.4.2 Distribution channel growth scenario

3.5 COVID-19 influence over industry growth

3.6 Porter’s analysis

3.7 PESTEL analysis

3.8 Value chain & supply chain analysis

3.9 Regulatory framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Product innovation

3.11 Market share analysis, 2020

3.11.1 Company positioning overview, 2020

Chapter 4 Tugger Train Market, By Type

4.1 Type Outlook

4.2 Trailer Concept

4.2.1 Market size, by region, 2016-2026 (USD Million)

4.3 Taxi Concept

4.3.1 Market size, by region, 2016-2026 (USD Million)

4.4 Push Concept

4.4.1 Market size, by region, 2016-2026 (USD Million)

Chapter 5 Tugger Train Market, By End-Use

5.1 End-Use Outlook

5.2 Automotive & Transportation

5.2.1 Market size, by region, 2016-2026 (USD Million)

5.3 Electro Technology & Mechanics

5.3.1 Market size, by region, 2016-2026 (USD Million)

5.4 Mechanical & Plant Engineering

5.4.1 Market size, by region, 2016-2026 (USD Million)

5.5 FMCG

5.5.1 Market size, by region, 2016-2026 (USD Million)

5.6 Healthcare

5.6.1 Market size, by region, 2016-2026 (USD Million)

5.67 Construction

5.7.1 Market size, by region, 2016-2026 (USD Million)

5.8 Plastic Industry

5.8.1 Market size, by region, 2016-2026 (USD Million)

5.9 Others

5.9.1 Market size, by region, 2016-2026 (USD Million)

Chapter 6 Tugger Train Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market size, by country 2016-2026 (USD Million)

6.2.2 Market size, by type, 2016-2026 (USD Million)

6.2.3 Market size, by end-use, 2016-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market size, by type, 2016-2026 (USD Million)

6.2.4.2 Market size, by end-use, 2016-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market size, by type, 2016-2026 (USD Million)

6.2.5.2 Market size, by end-use, 2016-2026 (USD Million)

6.3 Europe

6.3.1 Market size, by country 2016-2026 (USD Million)

6.3.2 Market size, by type, 2016-2026 (USD Million)

6.3.3 Market size, by end-use, 2016-2026 (USD Million)

6.3.4 Germany

6.2.4.1 Market size, by type, 2016-2026 (USD Million)

6.2.4.2 Market size, by end-use, 2016-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market size, by type, 2016-2026 (USD Million)

6.3.5.2 Market size, by end-use, 2016-2026 (USD Million)

6.3.6 France

6.3.6.1 Market size, by type, 2016-2026 (USD Million)

6.3.6.2 Market size, by end-use, 2016-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market size, by type, 2016-2026 (USD Million)

6.3.7.2 Market size, by end-use, 2016-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market size, by type, 2016-2026 (USD Million)

6.3.8.2 Market size, by end-use, 2016-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market size, by type, 2016-2026 (USD Million)

6.3.9.2 Market size, by end-use, 2016-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market size, by country 2016-2026 (USD Million)

6.4.2 Market size, by type, 2016-2026 (USD Million)

6.4.3 Market size, by end-use, 2016-2026 (USD Million)

6.4.4 China

6.4.4.1 Market size, by type, 2016-2026 (USD Million)

6.4.4.2 Market size, by end-use, 2016-2026 (USD Million)

6.4.5 India

6.4.5.1 Market size, by type, 2016-2026 (USD Million)

6.4.5.2 Market size, by end-use, 2016-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market size, by type, 2016-2026 (USD Million)

6.4.6.2 Market size, by end-use, 2016-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market size, by type, 2016-2026 (USD Million)

6.4.7.2 Market size, by end-use, 2016-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market size, by type, 2016-2026 (USD Million)

6.4.8.2 Market size, by end-use, 2016-2026 (USD Million)

6.5 Latin America

6.5.1 Market size, by country 2016-2026 (USD Million)

6.5.2 Market size, by type, 2016-2026 (USD Million)

6.5.3 Market size, by end-use, 2016-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market size, by type, 2016-2026 (USD Million)

6.5.4.2 Market size, by end-use, 2016-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market size, by type, 2016-2026 (USD Million)

6.5.5.2 Market size, by end-use, 2016-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market size, by type, 2016-2026 (USD Million)

6.5.6.2 Market size, by end-use, 2016-2026 (USD Million)

6.6 MEA

6.6.1 Market size, by country 2016-2026 (USD Million)

6.6.2 Market size, by type, 2016-2026 (USD Million)

6.6.3 Market size, by end-use, 2016-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market size, by type, 2016-2026 (USD Million)

6.6.4.2 Market size, by end-use, 2016-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market size, by type, 2016-2026 (USD Million)

6.6.5.2 Market size, by end-use, 2016-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market size, by type, 2016-2026 (USD Million)

6.6.6.2 Market size, by end-use, 2016-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive analysis, 2020

7.2 FlexQube

7.2.1 Company overview

7.2.2 Financial analysis

7.2.3 Strategic positioning

7.2.4 Info graphic analysis

7.3 Gemini Equipment And Rentals Pvt. Ltd

7.3.1 Company overview

7.3.2 Financial analysis

7.3.3 Strategic positioning

7.3.4 Info graphic analysis

7.4 Karl H. Bartels GmbH

7.4.1 Company overview

7.4.2 Financial analysis

7.4.3 Strategic positioning

7.4.4 Info graphic analysis

7.5 Feil GmbH

7.5.1 Company overview

7.5.2 Financial analysis

7.5.3 Strategic positioning

7.5.4 Info graphic analysis

7.6 KION Group

7.6.1 Company overview

7.6.2 Financial analysis

7.6.3 Strategic positioning

7.6.4 Info graphic analysis

7.7 Räder-Busch GmbH

7.7.1 Company overview

7.7.2 Financial analysis

7.7.3 Strategic positioning

7.7.4 Info graphic analysis

7.8 Schneider Leichtbau GmbH

7.8.1 Company overview

7.8.2 Financial analysis

7.8.3 Strategic positioning

7.8.4 Info graphic analysis

7.9 GÜTHLE Pressen Spannen GmbH

7.9.1 Company overview

7.9.2 Financial analysis

7.9.3 Strategic positioning

7.9.4 Info graphic analysis

7.10 HORGES GmbH Lagertechnik

7.10.1 Company overview

7.10.2 Financial analysis

7.10.3 Strategic positioning

7.10.4 Info graphic analysis

7.11 Stöcklin Logistik AG

7.11.1 Company overview

7.11.2 Financial analysis

7.11.3 Strategic positioning

7.11.4 Info graphic analysis

7.12 STILL GmbH

7.12.1 Company overview

7.12.2 Financial analysis

7.12.3 Strategic positioning

7.12.4 Info graphic analysis

7.13 LR Intralogistik

7.13.1 Company overview

7.13.2 Financial analysis

7.13.3 Strategic positioning

7.13.4 Info graphic analysis

7.14 Padberg + Palatec Logistic GmbH

7.14.1 Company overview

7.14.2 Financial analysis

7.14.3 Strategic positioning

7.14.4 Info graphic analysis

7.15 E&L Lagertechnik GmbH

7.15.1 Company overview

7.15.2 Financial analysis

7.15.3 Strategic positioning

7.15.4 Info graphic analysis

7.16 Linde Material Handling GmbH

7.16.1 Company overview

7.16.2 Financial analysis

7.16.3 Strategic positioning

7.16.4 Info graphic analysis

7.17 SMI Handling Systeme GmbH

7.17.1 Company overview

7.17.2 Financial analysis

7.17.3 Strategic positioning

7.17.4 Info graphic analysis

7.18 Aczent Lagertechnik GmbH & Co. KG

7.18.1 Company overview

7.18.2 Financial analysis

7.18.3 Strategic positioning

7.18.4 Info graphic analysis

7.19 Hyster-Yale Group

7.19.1 Company overview

7.19.2 Financial analysis

7.19.3 Strategic positioning

7.19.4 Info graphic analysis

7.20 IGZ Logistics

7.20.1 Company overview

7.20.2 Financial analysis

7.20.3 Strategic positioning

7.20.4 Info graphic analysis

7.21 K. Hartwall Oy Ab

7.21.1 Company overview

7.21.2 Financial analysis

7.21.3 Strategic positioning

7.21.4 Info graphic analysis

7.22 Manuline Intralogistics Solutions

7.22.1 Company overview

7.22.2 Financial analysis

7.22.3 Strategic positioning

7.22.4 Info graphic analysis

7.23 SSI Schaefer Systems Int. Ltd.

7.23.1 Company overview

7.23.2 Financial analysis

7.23.3 Strategic positioning

7.23.4 Info graphic analysis

7.24 Schiller

7.24.1 Company overview

7.24.2 Financial analysis

7.24.3 Strategic positioning

7.24.4 Info graphic analysis

7.25 Jungheinrich AG

7.25.1 Company overview

7.25.2 Financial analysis

7.25.3 Strategic positioning

7.25.4 Info graphic analysis

7.26 Toyota Material Handling

7.26.1 Company overview

7.26.2 Financial analysis

7.26.3 Strategic positioning

7.26.4 Info graphic analysis

7.27 Bradshaw Electric Vehicles

7.27.1 Company overview

7.27.2 Financial analysis

7.27.3 Strategic positioning

7.27.4 Info graphic analysis

7.28 Motrec International Inc.

7.28.1 Company overview

7.28.2 Financial analysis

7.28.3 Strategic positioning

7.28.4 Info graphic analysis

7.29 The Raymond Corporation

7.29.1 Company overview

7.29.2 Financial analysis

7.29.3 Strategic positioning

7.29.4 Info graphic analysis

7.30 JBT

7.30.1 Company overview

7.30.2 Financial analysis

7.30.3 Strategic positioning

7.30.4 Info graphic analysis

7.31 Alke

7.31.1 Company overview

7.31.2 Financial analysis

7.31.3 Strategic positioning

7.31.4 Info graphic analysis

7.32 Eagle Tugs

7.32.1 Company overview

7.32.2 Financial analysis

7.32.3 Strategic positioning

7.32.4 Info graphic analysis

7.33 Simai SPA

7.33.1 Company overview

7.33.2 Financial analysis

7.33.3 Strategic positioning

7.33.4 Info graphic analysis

The Global Tugger Train Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Tugger Train Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS