Global Urinalysis Market Size, Trends, and Analysis - Forecasts To 2026 By Product (Consumables (Pregnancy Kits, Fertility Kits, Dipsticks, Reagents, Disposables), Instruments (Automated Biochemical Urine Analyzers, Semi-Automated Urine Analyzers, Urine Sediment Analyzers, Microscopic Urine Analyzers)), By Application (Disease Screening, Pregnancy, Fertility), By End-User (Hospitals, Clinical Laboratories, Home Healthcare, Research and Academics, Others), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

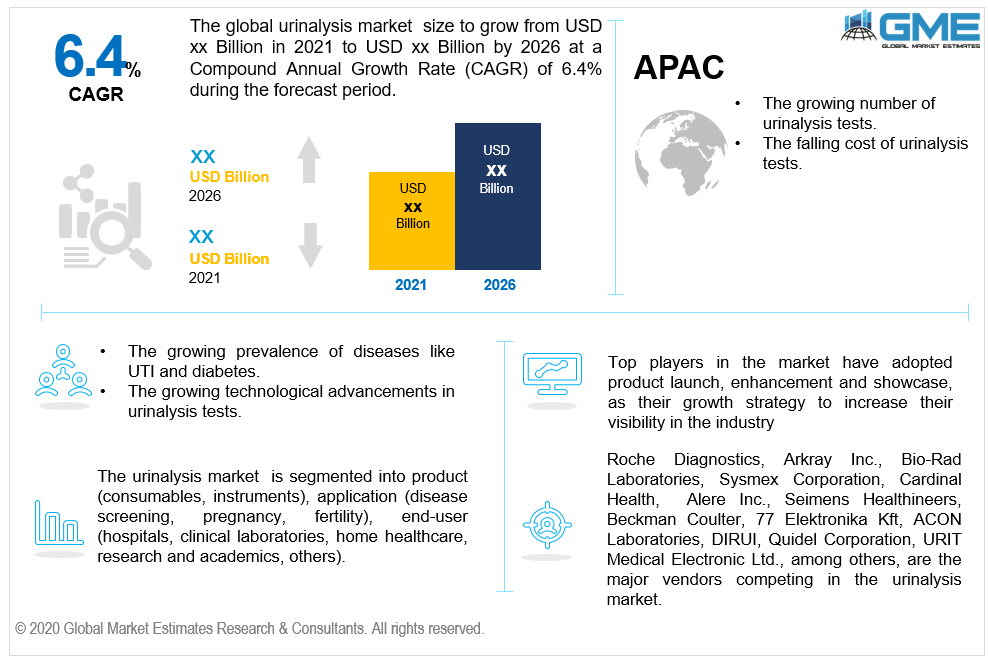

A urinalysis is a diagnostic tool used to identify the diseases and conditions of the body by checking the appearance, concentration, and composition of the urine. Urinalysis is conducted mainly through instruments and consumables, instruments like urine analyzers and urine sediment analyzers are commonly used in diagnostic facilities. Consumables like pregnancy and fertility kits are used in homes. Urinalysis tests can allow patients to effectively manage chronic diseases like urinary bladder cancer and diabetes. The growing incidences of diseases like urinary tract infections, diabetes, and kidney diseases are expected to result in the growth of the urinalysis market. Due to lifestyle changes as people become more sedentary, the above-mentioned diseases are rapidly becoming heavily prevalent. Because of technological advancements made to the urinalysis systems, the market is witnessing the launch of faster, efficient, and compact analysis tools. The growing investments in the research and development of such technologies are expected to result in the growth of the urinalysis market. The diagnostic tools are becoming increasingly cheaper which allows diagnostic services to be provided at affordable rates. This is extremely important in underdeveloped countries with large unmet medical needs among their population. The market is restrained by the lack of adequate infrastructure and lack of skilled labor.

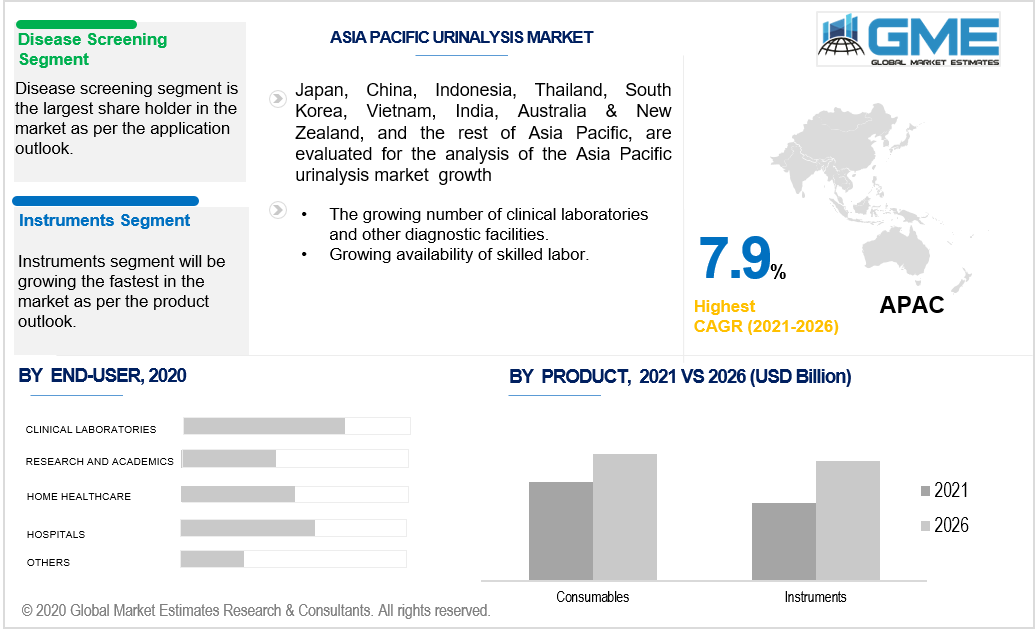

Based on the urinalysis products available in the market, the urinalysis market can be segmented into instruments and consumables. The consumables segment is expected to hold the dominant share of the market during the forecast period. Urinalysis consumables include pregnancy kits, fertility kits, reagents, dipsticks, and disposables. Pregnancy and fertility kits are expected to hold the lion’s share of the revenues among all consumables as their use has become widespread. Pregnancy and fertility kits provide accurate results at the comfort of one’s home. These kits are cost-effective and have been extensively used, thereby enjoying high market penetration. The consumables segment has therefore enjoyed a dominant share of the urinalysis market products. The instruments segment is expected to register the fastest growth rate during the forecast period. The instruments segment includes various urinalysis instruments like urine sediment analyzers, automated biochemical urine analyzers, semi-automated biochemical urine analyzers, and microscopic urine analyzers. Technological advancements like automated urine sediment analyzers, and automated urine strip readers are expected to facilitate the growth of this segment during the forecast period. With advancements in communications technology, wireless and miniaturized urine analyzers are also expected to impact the growth of the instruments segment.

Based on applications of urinalysis, the urinalysis market can be segmented into disease screening, pregnancy, and fertility. The disease screening segment is expected to hold the lion’s share of the revenue during the forecast period. Urinalysis has become one of the common diagnostic tools used to diagnose various metabolic abnormalities and infections like urinary tract infections. Urinalysis tools are used to effectively manage chronic diseases like chronic kidney disease and diabetes. The growing prevalence of diseases like diabetes, urinary tract infections, kidney diseases, and urinary bladder cancers is one of the major drivers of the disease screening segment. Technological advancements have resulted in faster, non-invasive, and user-friendly diagnostic tools available in the market. These technological advancements have also contributed to the dominance of the disease screening segment. The urinary tract infections screening is the major contributor to the dominance of the disease screening segment among other applications like pregnancy and fertility.

Based on the various end-users of urinalysis products, the urinalysis market can be segmented into hospitals, clinical laboratories, home healthcare, research and academics, and others. The clinical laboratories segment is expected to hold the dominant share of the market during the forecast period. The clinical laboratories segment is expected to register the fastest growth rate during the forecast period as well. Clinical laboratories conduct various diagnostic tests and procedures which has been the major driver of the clinical laboratories segment. Increased use of automated laboratory instruments will enhance the sample volume on daily basis. This trend will help the segment grow the fastest during the forecast period.

The North American region is expected to hold the largest share of the urinalysis market. The presence of various urinalysis product vendors in the region has contributed to the awareness of urinalysis products within the region. The increased awareness and heavy spending on healthcare have contributed to the dominance of the North American region in the urinalysis market. Increased adoption of technological advancements like automation and miniaturization has also contributed to the growth of the urinalysis market in the North American region. The Asia Pacific region is expected to register the fastest growth rate among all regions. The growing number of clinical laboratories and increased spending on healthcare facilities by governments and private entities are expected to contribute to the growth of the urinalysis market in the Asia Pacific region. The increasing number of local urinalysis product vendors in the region and growing awareness of urinalysis products are expected to result in the growth of the urinalysis market in the region. The region has a large population who have unmet clinical diagnostic needs. The growing prevalence of urinary tract infections and urinary bladder cancer in the region are also expected to contribute to the growth of the urinalysis market in the Asia Pacific region.

Arkray Inc., URIT Medical Electronic Ltd., Roche Diagnostics, Bio-Rad Laboratories, Cardinal Health, Sysmex Corporation, Alere Inc., Beckman Coulter, Seimens Healthineers, 77 Elektronika Kft, DIRUI, ACON Laboratories, Quidel Corporation, among others, are the major vendors competing in the urinalysis market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Urinalysis Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Product Type Overview

2.1.3 Application Overview

2.1.4 End-User Overview

2.1.5 Regional Overview

Chapter 3 Urinalysis Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Technology Advancement in Urinalysis Tools

3.3.1.2 Rising Prevalence of Urine Issues and Diabetes Associated Complications

3.3.2 Industry Challenges

3.3.2.1 Lack of Adequate Infrastructure and Lack of Skilled Labor

3.4 Prospective Growth Scenario

3.4.1 Product Type Growth Scenario

3.4.2 Application Growth Scenario

3.4.3 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Urinalysis Market, By Product Type

4.1 Product Type Outlook

4.2 Instruments

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Consumables

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Urinalysis Market, By Application

5.1 Application Outlook

5.2 Disease Screening

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 Pregnancy

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

5.4 Fertility

5.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Urinalysis Market, By End-User

6.1 Hospitals

6.1.1 Market Size, By Region, 2019-2026 (USD Million)

6.2 Clinic Laboratories

6.2.1 Market Size, By Region, 2019-2026 (USD Million)

6.3 Home Healthcare

6.3.1 Market Size, By Region, 2019-2026 (USD Million)

6.4 Research & Academia

6.4.1 Market Size, By Region, 2019-2026 (USD Million)

6.5 Others

6.5.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Urinalysis Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2019-2026 (USD Million)

6.2.2 Market Size, By Product Type, 2019-2026 (USD Million)

6.2.3 Market Size, By Application, 2019-2026 (USD Million)

6.2.4 Market Size, By End-User, 2019-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Product Type, 2019-2026 (USD Million)

6.2.4.2 Market Size, By Application, 2019-2026 (USD Million)

6.2.4.3 Market Size, By End-User, 2019-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Product Type, 2019-2026 (USD Million)

6.2.5.2 Market Size, By Application, 2019-2026 (USD Million)

6.2.5.3 Market Size, By End-User, 2019-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2019-2026 (USD Million)

6.3.2 Market Size, By Product Type, 2019-2026 (USD Million)

6.3.3 Market Size, By Application, 2019-2026 (USD Million)

6.3.4 Market Size, By End-User, 2019-2026 (USD Million)

6.3.4 Germany

6.3.4.1 Market Size, By Product Type, 2019-2026 (USD Million)

6.3.4.2 Market Size, By Application, 2019-2026 (USD Million)

6.3.4.3 Market Size, By End-User, 2019-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Product Type, 2019-2026 (USD Million)

6.3.5.2 Market Size, By Application, 2019-2026 (USD Million)

6.3.5.3 Market Size, By End-User, 2019-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Product Type, 2019-2026 (USD Million)

6.3.6.2 Market Size, By Application, 2019-2026 (USD Million)

6.3.6.3 Market Size, By End-User, 2019-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Product Type, 2019-2026 (USD Million)

6.3.7.2 Market Size, By Application, 2019-2026 (USD Million)

6.3.7.3 Market Size, By End-User, 2019-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Product Type, 2019-2026 (USD Million)

6.3.8.2 Market Size, By Application, 2019-2026 (USD Million)

6.3.8.3 Market Size, By End-User, 2019-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Product Type, 2019-2026 (USD Million)

6.3.9.2 Market Size, By Application, 2019-2026 (USD Million)

6.3.9.3 Market Size, By End-User, 2019-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2019-2026 (USD Million)

6.4.2 Market Size, By Product Type, 2019-2026 (USD Million)

6.4.3 Market Size, By Application, 2019-2026 (USD Million)

6.4.4 Market Size, By End-User, 2019-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Product Type, 2019-2026 (USD Million)

6.4.4.2 Market Size, By Application, 2019-2026 (USD Million)

6.4.4.3 Market Size, By End-User, 2019-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Product Type, 2019-2026 (USD Million)

6.4.5.2 Market Size, By Application, 2019-2026 (USD Million)

6.4.5.3 Market Size, By End-User, 2019-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Product Type, 2019-2026 (USD Million)

6.4.6.2 Market Size, By Application, 2019-2026 (USD Million)

6.4.6.3 Market Size, By End-User, 2019-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Product Type, 2019-2026 (USD Million)

6.4.7.2 Market size, By Application, 2019-2026 (USD Million)

6.4.7.3 Market Size, By End-User, 2019-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Product Type, 2019-2026 (USD Million)

6.4.8.2 Market Size, By Application, 2019-2026 (USD Million)

6.4.8.3 Market Size, By End-User, 2019-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2019-2026 (USD Million)

6.5.2 Market Size, By Product Type, 2019-2026 (USD Million)

6.5.3 Market Size, By Application, 2019-2026 (USD Million)

6.5.4 Market Size, By End-User, 2019-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Product Type, 2019-2026 (USD Million)

6.5.4.2 Market Size, By Application, 2019-2026 (USD Million)

6.5.4.3 Market Size, By End-User, 2019-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Product Type, 2019-2026 (USD Million)

6.5.5.2 Market Size, By Application, 2019-2026 (USD Million)

6.5.5.3 Market Size, By End-User, 2019-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Product Type, 2019-2026 (USD Million)

6.5.6.2 Market Size, By Application, 2019-2026 (USD Million)

6.5.6.3 Market Size, By End-User, 2019-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2019-2026 (USD Million)

6.6.2 Market Size, By Product Type, 2019-2026 (USD Million)

6.6.3 Market Size, By Application, 2019-2026 (USD Million)

6.6.4 Market Size, By End-User, 2019-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Product Type, 2019-2026 (USD Million)

6.6.4.2 Market Size, By Application, 2019-2026 (USD Million)

6.6.4.3 Market Size, By End-User, 2019-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Product Type, 2019-2026 (USD Million)

6.6.5.2 Market Size, By Application, 2019-2026 (USD Million)

6.6.5.3 Market Size, By End-User, 2019-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Product Type, 2019-2026 (USD Million)

6.6.6.2 Market Size, By Application, 2019-2026 (USD Million)

6.6.6.3 Market Size, By End-User, 2019-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 ACON Laboratories

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Arkay

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 Cardinal Health

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Siemens

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 URIT Medical Electronics

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Roche Diagnostics

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Bio-Rad Laboratories

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Sysmex Corporation

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Beckman Coulter

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

The Global Urinalysis Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Urinalysis Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS