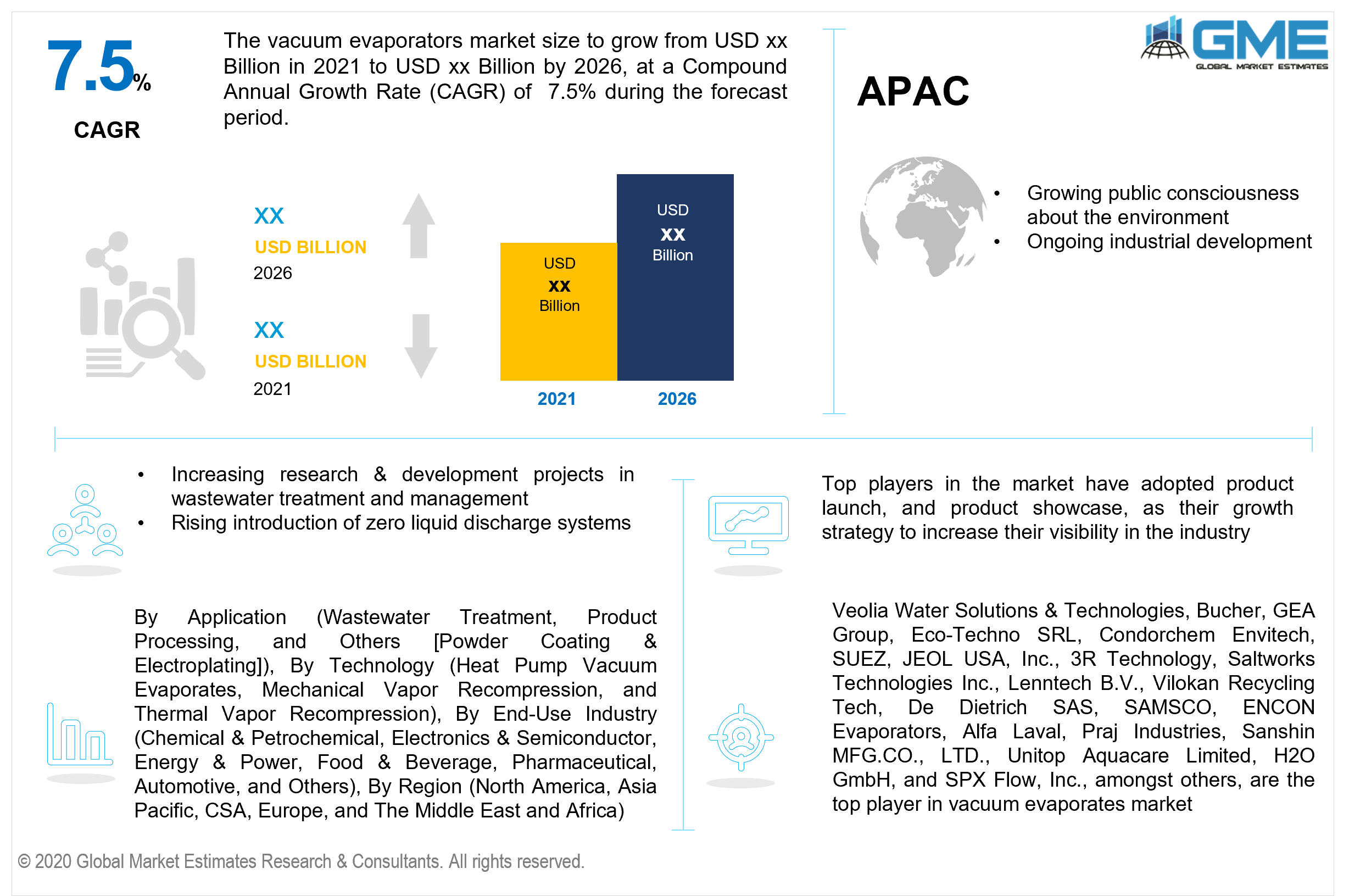

Global Vacuum Evaporators Market Size, Trends & Analysis - Forecasts to 2026 By Application (Wastewater Treatment, Product Processing, and Others [Powder Coating & Electroplating]), By Technology (Heat Pump Vacuum Evaporates, Mechanical Vapor Recompression, and Thermal Vapor Recompression), By End-Use Industry (Chemical & Petrochemical, Electronics & Semiconductor, Energy & Power, Food & Beverage, Pharmaceutical, Automotive, and Others), By Region (North America, Asia Pacific, CSA, Europe, and The Middle East and Africa); Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

Vacuum evaporators, often regarded as wastewater evaporators, are the most effective systems for reducing and managing municipal wastewater. This equipment is considered sterile, secure, and has a low treatment cost. It can also contribute to a maintenance system with zero discharge. It is one of the most efficient techniques for treating ionic pollutants. As per the World Health Organization, more than 2 billion individuals lack access to clean drinking water facilities, while more than half of the global population lacks accessibility to healthy sewage facilities. Furthermore, without disposal, 80 percent of wastewater spills back into the environment. Thus, it is presumed that the demand for vacuum evaporators will expand in the global markets.

The implementation of stringent environmental legislation, as well as global water shortages, have had a significant impact on the development of the vacuum evaporators market. In conjunction with this, insufficient freshwater supply is also a primary determinant favoring the development of the vacuum evaporators market throughout the forecast period. The widespread use of zero liquid discharge devices (ZLD), as well as the steadily developing global manufacturing sector, are both boosting the development of the vacuum evaporators market. The growing demand for wastewater treatment from multiple end-users is the primary driver of global market development.

Nevertheless, the high construction and maintenance costs of vacuum evaporators may serve as a major constraint on the vacuum evaporator market growth rate throughout the forecast period. Although a lack of knowledge regarding the disposal of wastewater focuses in certain regions may pose a conundrum to the vacuum evaporators market growth throughout the forecast period. Moreover, growing worries about brine concentrate drainage into oceans, as well as growing population and rapid urbanization in developing economies, would provide a range of growth prospects for the vacuum evaporators market throughout the forecast period.

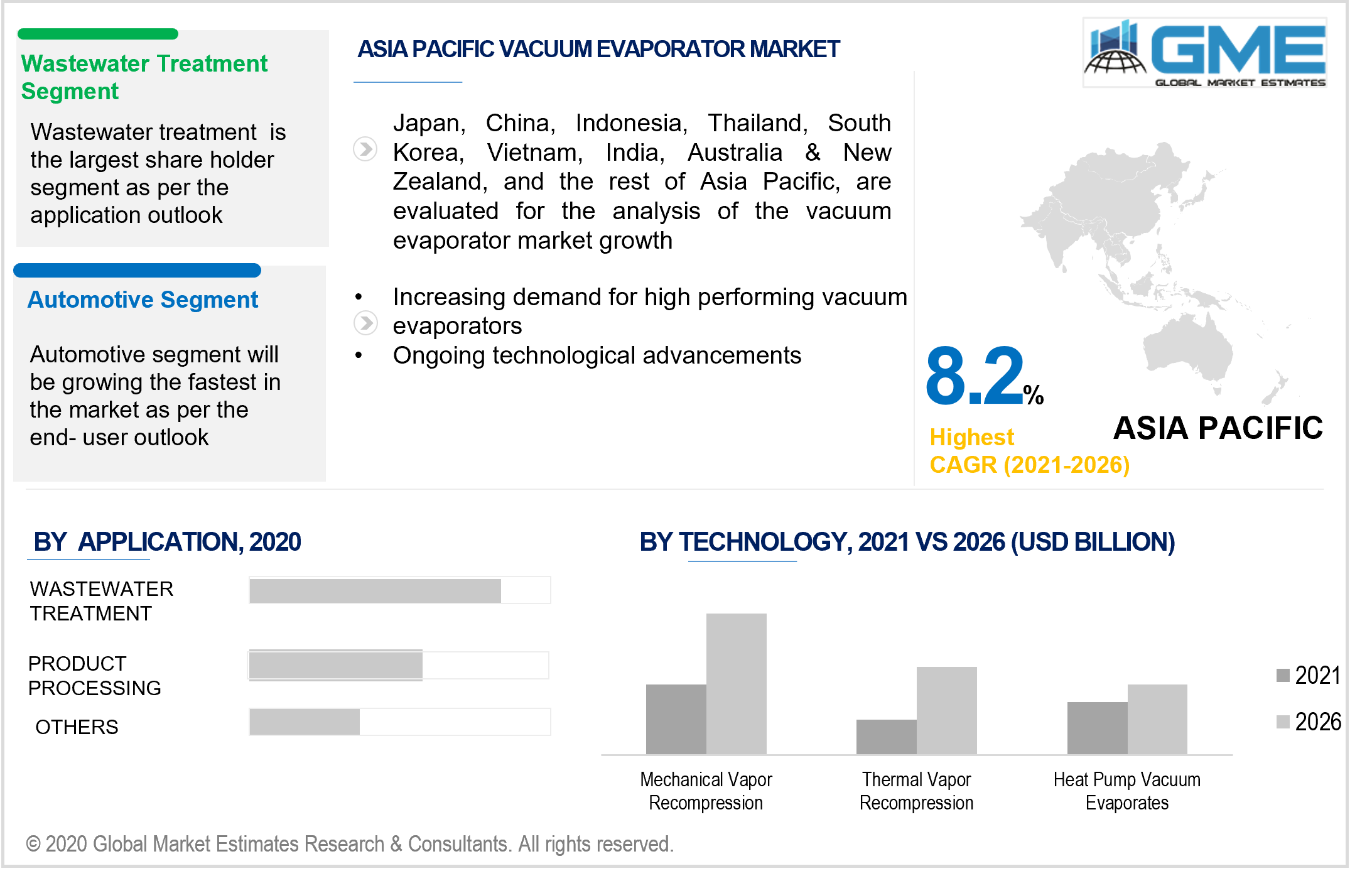

Depending on the application, the market is classified as wastewater treatment, product processing, and others. The other segment includes powder coating & electroplating. Due to the growing need for wastewater treatment from extensive end-use industries, the wastewater treatment segment dominated the market. Stringent ecological laws governing wastewater pollution of freshwater waterways, as well as global water shortages, have resulted in the expanded deployment of zero liquid discharge (ZLD) systems by various industries. Since vacuum evaporators are an essential component of modern ZLD systems, their market in wastewater treatment applications is presumed to rise.

Depending on the technology, the market can be categorized as heat pump vacuum evaporates, mechanical vapor recompression vacuum evaporates, and thermal vacuum evaporates. The MVR (mechanical vapor recompression) vacuum evaporators segment is expected to lead and expand at the fastest pace throughout the forecast period, pertaining to the demand for a more efficient technology as electricity prices rise, freshwater supplies become scarcer, and consumers become more concerned about the ecological effects of industrial management activities. MVR technology, which is relatively new to thermal vapor recompression (TVR) and is quickly eliminating TVR in European and North American economies, meets this requirement.

Depending on the end-use industry, the market can be segmented into chemical & petrochemicals, electronics & semiconductors, energy & power, food & beverage, pharmaceuticals, automotive, and others. A major share of the vacuum evaporator market was accountable to the automotive segment. The global automotive industry necessitates water for its different manufacturing operations, which is indeed termed to be a significant customer of vacuum evaporators. It is estimated that the manufacturing of a car needs more than 50,000 tons of water, regardless of vehicle tires. The main uses of water in the automobile industry involve chemical treatment & topcoat, paint spray coating, washing, scrubbing, bogging, and air conditioning. There are also many liquid processes in the production component section and every one of these contributes more amounts of high-strength synthetic and greasy wastes with an increased metal concentration that needs effective treatment. Thus, these aforementioned factors led to the supremacy of the automotive industry.

As per the geographical analysis, the market of vacuum evaporators can be classified into North America (the US, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa and Central & South America. The North American region is presumed to be dominant in the global markets of vacuum evaporators. This supremacy is attributed to the enhanced environmental concerns amongst the majority of the regional population and the strenuous enforcement of numerous regulatory laws concerning pollutants emitted by factories. The rise of the vacuum evaporators market throughout this region is primarily fuelled by increasing research & development projects in wastewater treatment and management. Moreover, production activity growth and the rising introduction of zero liquid discharge systems are estimated to augment market growth prospects in the area throughout the forecast period.

The Asia Pacific market is presumed to grow the fastest. This region is home to many of the world's fastest-growing countries. China, India, and Japan are experiencing massive development in their industrial, retail, and infrastructure sectors. Multiple Asia Pacific countries have enormous demand opportunities due to increasing population, favorable governmental policies, industrial development, and other factors. China and India are the two fastest-growing countries in this region. Economic development in these economies is presumed to enhance economic operations, resulting in expanded demand for treated water. As a result, the APAC demand for vacuum evaporators is assumed to be augmented.

Veolia Water Solutions & Technologies, Bucher, GEA Group, Eco-Techno SRL, Condorchem Envitech, SUEZ, JEOL USA, Inc., 3R Technology, Saltworks Technologies Inc., Lenntech B.V., Vilokan Recycling Tech, De Dietrich SAS, SAMSCO, ENCON Evaporators, Alfa Laval, Praj Industries, Sanshin MFG.CO., LTD., Unitop Aquacare Limited, H2O GmbH, and SPX Flow, Inc., among others, are the top player in vacuum evaporates market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Applications

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Vacuum Evaporators Market Overview, 2016-2026

2.1.1 Industry Overview

2.1.2 Application Overview

2.1.3 Technology Overview

2.1.4 End-Use Industry Overview

2.1.5 Regional Overview

Chapter 3 Vacuum Evaporators Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rapidly Expanding Global Manufacturing Industry

3.3.1.2 Increasing Demand for The Treatment of Wastewater from Various End Use Industries

3.3.2 Industry Challenges

3.3.2.1 Lack of Awareness About the Disposal of Wastewater Concentrates in Some Regions

3.4 Prospective Growth Scenario

3.4.1 Application Growth Scenario

3.4.2 Technology Growth Scenario

3.4.3 End-Use Industry Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Vacuum Evaporators Market, By Application

4.1 Application Outlook

4.2 Wastewater Treatment

4.2.1 Market Size, By Region, 2016-2026 (USD Million)

4.3 Product Processing

4.3.1 Market Size, By Region, 2016-2026 (USD Million)

4.4 Others

4.4.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 5 Vacuum Evaporators Market, By Technology

5.1 Technology Outlook

5.2 Heat Pump Vacuum Evaporates

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

5.3 Mechanical Vapor Recompression

5.3.1 Market Size, By Region, 2016-2026 (USD Million)

5.3 Thermal Vapor Recompression

5.3.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 6 Vacuum Evaporators Market, By End-Use Industry

6.1 End-Use Industry Outlook

6.2 Chemical & Petrochemical

6.2.1 Market Size, By Region, 2016-2026 (USD Million)

6.3 Electronics & Semiconductor

6.3.1 Market Size, By Region, 2016-2026 (USD Million)

6.4 Energy & Power

6.4.1 Market Size, By Region, 2016-2026 (USD Million)

6.5 Food & Beverage

6.5.1 Market Size, By Region, 2016-2026 (USD Million)

6.6 Pharmaceutical

6.6.1 Market Size, By Region, 2016-2026 (USD Million)

6.7 Automotive

6.7.1 Market Size, By Region, 2016-2026 (USD Million)

6.8 Others

6.8.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 7 Vacuum Evaporators Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2016-2026 (USD Million)

7.2.2 Market Size, By Application, 2016-2026 (USD Million)

7.2.3 Market Size, By Technology, 2016-2026 (USD Million)

7.2.4 Market Size, By End-Use Industry, 2016-2026 (USD Million)

7.2.5 U.S.

7.2.5.1 Market Size, By Application, 2016-2026 (USD Million)

7.2.5.2 Market Size, By Technology, 2016-2026 (USD Million)

7.2.5.3 Market Size, By End-Use Industry, 2016-2026 (USD Million)

7.2.6 Canada

7.2.6.1 Market Size, By Application, 2016-2026 (USD Million)

7.2.6.2 Market Size, By Technology, 2016-2026 (USD Million)

7.2.6.3 Market Size, By End-Use Industry, 2016-2026 (USD Million)

7.3 Europe

7.3.1 Market Size, By Country 2016-2026 (USD Million)

7.3.2 Market Size, By Application, 2016-2026 (USD Million)

7.3.3 Market Size, By End-Use Industry, 2016-2026 (USD Million)

7.3.4 Market Size, By End-Use Industry, 2016-2026 (USD Million)

7.3.5 Germany

7.3.5.1 Market Size, By Application, 2016-2026 (USD Million)

7.3.5.2 Market Size, By Technology, 2016-2026 (USD Million)

7.3.5.3 Market Size, By End-Use Industry, 2016-2026 (USD Million)

7.3.6 UK

7.3.6.1 Market Size, By Application, 2016-2026 (USD Million)

7.3.6.2 Market Size, By Technology, 2016-2026 (USD Million)

7.3.6.3 Market Size, By End-Use Industry, 2016-2026 (USD Million)

7.3.7 France

7.3.7.1 Market Size, By Application, 2016-2026 (USD Million)

7.3.7.2 Market Size, By Technology, 2016-2026 (USD Million)

7.3.7.3 Market Size, By End-Use Industry, 2016-2026 (USD Million)

7.3.8 Italy

7.3.8.1 Market Size, By Application, 2016-2026 (USD Million)

7.3.8.2 Market Size, By Technology, 2016-2026 (USD Million)

7.3.8.3 Market Size, By End-Use Industry, 2016-2026 (USD Million)

7.3.9 Spain

7.3.9.1 Market Size, By Application, 2016-2026 (USD Million)

7.3.9.2 Market Size, By Technology, 2016-2026 (USD Million)

7.3.9.3 Market Size, By End-Use Industry, 2016-2026 (USD Million)

7.3.10 Russia

7.3.10.1 Market Size, By Application, 2016-2026 (USD Million)

7.3.10.2 Market Size, By Technology, 2016-2026 (USD Million)

7.3.10.3 Market Size, By End-Use Industry, 2016-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2016-2026 (USD Million)

7.4.2 Market Size, By Application, 2016-2026 (USD Million)

7.4.3 Market Size, By Technology, 2016-2026 (USD Million)

7.4.4 Market Size, By End-Use Industry, 2016-2026 (USD Million)

7.4.5 China

7.4.5.1 Market Size, By Application, 2016-2026 (USD Million)

7.4.5.2 Market Size, By Technology, 2016-2026 (USD Million)

7.4.5.3 Market Size, By End-Use Industry, 2016-2026 (USD Million)

7.4.6 India

7.4.6.1 Market Size, By Application, 2016-2026 (USD Million)

7.4.6.2 Market Size, By Technology, 2016-2026 (USD Million)

7.4.6.3 Market Size, By End-Use Industry, 2016-2026 (USD Million)

7.4.7 Japan

7.4.7.1 Market Size, By Application, 2016-2026 (USD Million)

7.4.7.2 Market Size, By Technology, 2016-2026 (USD Million)

7.4.7.3 Market Size, By End-Use Industry, 2016-2026 (USD Million)

7.4.8 Australia

7.4.8.1 Market Size, By Application, 2016-2026 (USD Million)

7.4.8.2 Market size, By Technology, 2016-2026 (USD Million)

7.4.8.3 Market Size, By End-Use Industry, 2016-2026 (USD Million)

7.4.9 South Korea

7.4.9.1 Market Size, By Application, 2016-2026 (USD Million)

7.4.9.2 Market Size, By Technology, 2016-2026 (USD Million)

7.4.9.3 Market Size, By End-Use Industry, 2016-2026 (USD Million)

7.5 Latin America

7.5.1 Market Size, By Country 2016-2026 (USD Million)

7.5.2 Market Size, By Application, 2016-2026 (USD Million)

7.5.3 Market Size, By Technology, 2016-2026 (USD Million)

7.5.4 Market Size, By End-Use Industry, 2016-2026 (USD Million)

7.5.5 Brazil

7.5.5.1 Market Size, By Application, 2016-2026 (USD Million)

7.5.5.2 Market Size, By Technology, 2016-2026 (USD Million)

7.5.5.3 Market Size, By End-Use Industry, 2016-2026 (USD Million)

7.5.6 Mexico

7.5.6.1 Market Size, By Application, 2016-2026 (USD Million)

7.5.6.2 Market Size, By Technology, 2016-2026 (USD Million)

7.5.6.3 Market Size, By End-Use Industry, 2016-2026 (USD Million)

7.5.7 Argentina

7.5.7.1 Market Size, By Application, 2016-2026 (USD Million)

7.5.7.2 Market Size, By Technology, 2016-2026 (USD Million)

7.5.7.3 Market Size, By End-Use Industry, 2016-2026 (USD Million)

7.6 MEA

7.6.1 Market Size, By Country 2016-2026 (USD Million)

7.6.2 Market Size, By Application, 2016-2026 (USD Million)

7.6.3 Market Size, By Technology, 2016-2026 (USD Million)

7.6.4 Market Size, By End-Use Industry, 2016-2026 (USD Million)

7.6.5 Saudi Arabia

7.6.5.1 Market Size, By Application, 2016-2026 (USD Million)

7.6.5.2 Market Size, By Technology, 2016-2026 (USD Million)

7.6.5.3 Market Size, By End-Use Industry, 2016-2026 (USD Million)

7.6.6 UAE

7.6.6.1 Market Size, By Application, 2016-2026 (USD Million)

7.6.6.2 Market Size, By Technology, 2016-2026 (USD Million)

7.6.6.3 Market Size, By End-Use Industry, 2016-2026 (USD Million)

7.6.7 South Africa

7.6.7.1 Market Size, By Application, 2016-2026 (USD Million)

7.6.7.2 Market Size, By Technology, 2016-2026 (USD Million)

7.6.7.3 Market Size, By End-Use Industry, 2016-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Veolia Water Solutions & Technologies

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 Bucher

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 GEA Group

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Eco-Techno SRL

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Condorchem Envitech

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 SUEZ

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 JEOL USA, Inc.

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 3R Technology

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info Graphic Analysis

8.10 Saltworks Technologies Inc.

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Bolton Surgical Ltd.

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

8.12 Lenntech B.V.

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info Graphic Analysis

8.13 Vilokan Recycling Tech

8.13.1 Company Overview

8.13.2 Financial Analysis

8.13.3 Strategic Positioning

8.13.4 Info Graphic Analysis

8.14 De Dietrich SAS

8.14.1 Company Overview

8.14.2 Financial Analysis

8.14.3 Strategic Positioning

8.14.4 Info Graphic Analysis

8.15 SAMSCO

8.15.1 Company Overview

8.15.2 Financial Analysis

8.15.3 Strategic Positioning

8.15.4 Info Graphic Analysis

8.16 ENCON Evaporators

8.16.1 Company Overview

8.16.2 Financial Analysis

8.16.3 Strategic Positioning

8.16.4 Info Graphic Analysis

8.17 Alfa Laval

8.17.1 Company Overview

8.17.2 Financial Analysis

8.17.3 Strategic Positioning

8.17.4 Info Graphic Analysis

8.18 Praj Industries

8.18.1 Company Overview

8.18.2 Financial Analysis

8.18.3 Strategic Positioning

8.18.4 Info Graphic Analysis

8.19 Sanshin MFG.CO., LTD.

8.19.1 Company Overview

8.19.2 Financial Analysis

8.19.3 Strategic Positioning

8.19.4 Info Graphic Analysis

8.20 Unitop Aquacare Limited,

8.20.1 Company Overview

8.20.2 Financial Analysis

8.20.3 Strategic Positioning

8.20.4 Info Graphic Analysis

8.21 H2O GmbH

8.21.1 Company Overview

8.21.2 Financial Analysis

8.21.3 Strategic Positioning

8.21.4 Info Graphic Analysis

8.22 SPX Flow, Inc.

8.22.1 Company Overview

8.22.2 Financial Analysis

8.22.3 Strategic Positioning

8.22.4 Info Graphic Analysis

8.23 Other Companies

8.23.1 Company Overview

8.23.2 Financial Analysis

8.23.3 Strategic Positioning

8.23.4 Info Graphic Analysis

The Global Vacuum Evaporators Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Vacuum Evaporators Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS