Global Veterinary Equipment and Disposables Market Size, Trends, and Analysis- Forecasts to 2026 By Product (Critical Care Consumables [Wound Management Consumables, Airway Management Consumables, Gastroenterology Consumables, Needles, Fluid Administration and Therapy Consumables, Accessories, Others], Anesthesia Equipment [Complete Anesthesia Machines, Ventilators, Vaporizers, Waste Gas Management Systems, Gas Delivery Management Systems, Accessories], Fluid Management Equipment [Large-Volume Infusion Pumps, Syringe Pumps], Temperature Management Equipment [Patient Warming Systems {Convection Warming Systems, Conduction Warming Systems}, Fluid Warmers], Rescue & Resuscitation Equipment [Resuscitation Bags, Oxygen Masks], Research Equipment [Lab Evacuation Systems, Induction Chambers], Patient Monitoring Equipment), By Animal Type (Companion Animal [Dogs, Cats, Horses, Others], Livestock Animal), By End-use Outlook (Veterinary Hospitals/Clinics, Research Institutes), By Region (North America, Europe, Asia Pacific, MEA, and CSA).

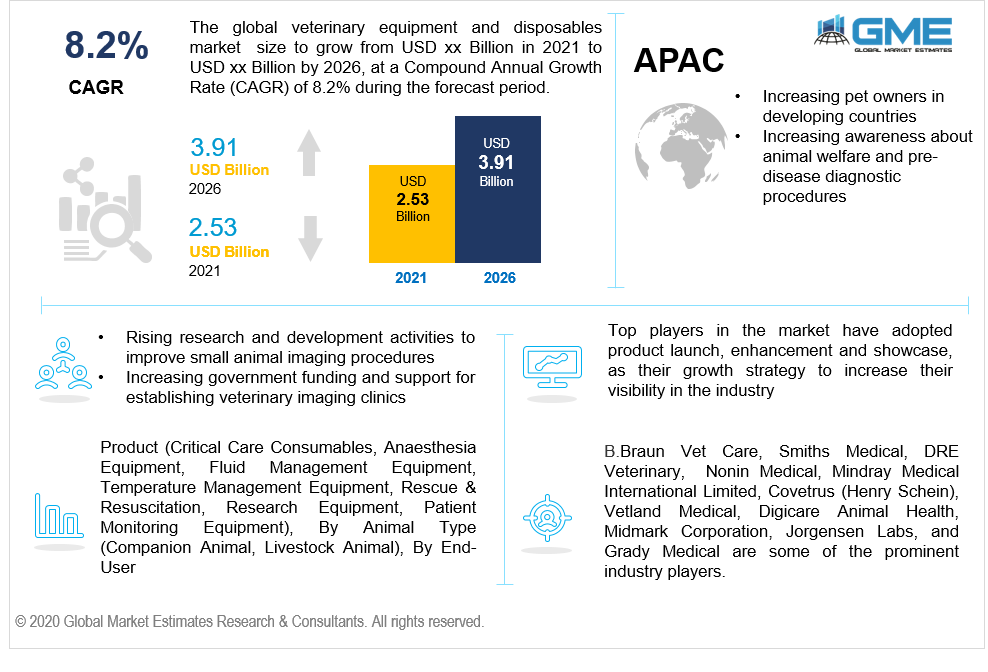

The veterinary equipment and disposables market is estimated to be valued at USD 2.53 billion in 2021 and is projected to reach USD 3.91 billion by 2026 at a CAGR of 8.2%. These equipment and disposables are special apparatuses that are used to conduct medical procedures on small and large sized animals. With the changing lifestyles and increasing per capita incomes, the market is witnessing rising trend of pet adoption, which is indirectly increasing the demand for medical support for pet animals.

Rising animal health expenditure and growing demand for pet insurance, increasing number of veterinary practitioners in developed regions, and growth in the companion animals market are the primary drivers for the market during the forecast period of 2021 to 2026. Moreover, increasing organic activities such as launch of technically advanced products in the developed market, and rising number of companies in the developing region will help the market grow rapidly.

These equipment help the professionals to detect any malfunctions in the body, keep a check on the surgery procedures, assist in carrying out regular check-ups, and efficiently manage any small or complex disease or wound in the animals. Research and surveys show that there are approximately 480 million dogs who are adopted as pets by families around the world and require medical assistance atleast once a year. Also, approximately 370 million cats are adopted as pets by people globally. Besides dogs, which are adopted in the majority, various other animal species are adopted by families as pets as per their preferences.

The veterinary industry has also witnessed an increase in the chronic diseases among various animal species. Pets and rescued animals commonly face extreme allergies, diabetes, cancer, inflammatory bowel diseases, and hepatitis, among others. With every passing year, the American Veterinary Medical Association has observed that the number of veterinary schools and colleges is increasing nationally and internationally. This increasing number is rising the number of veterinary graduates every year, thus raising the number of independent practitioners across the world. Besides the rescued or adopted animals, the livestock sector has always been a victim of various infectious diseases and flu, which call for more veterinary equipment and practitioners.

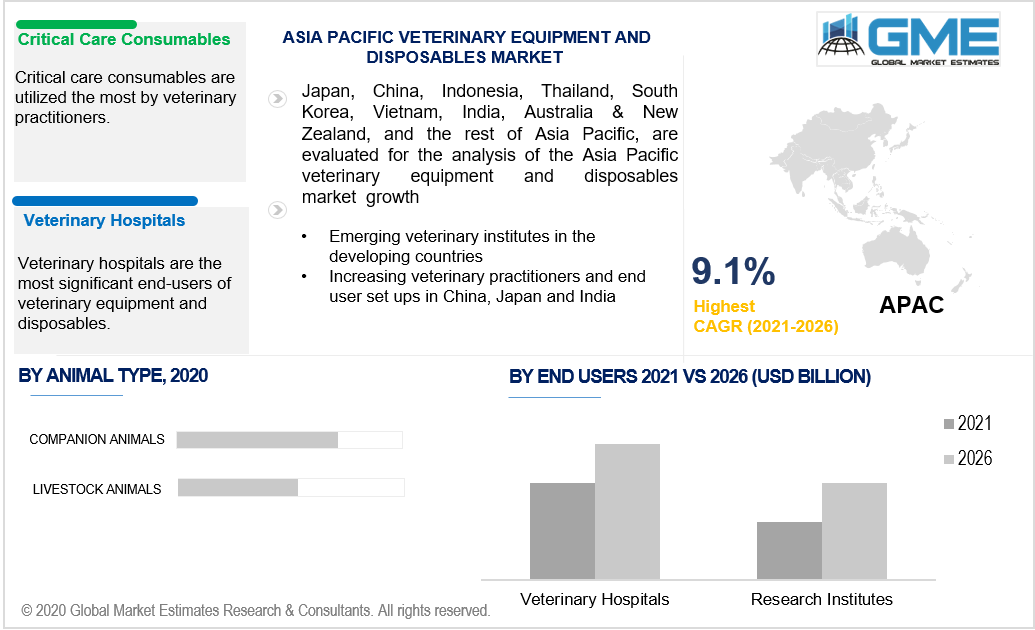

The market based on product type is segmented into critical care consumables, anesthesia equipment, fluid management equipment, temperature management equipment, rescue and resuscitation equipment, research equipment and patient monitoring equipment. Critical care consumables are utilized the most by the veterinary practitioners and hence hold the largest share in the market. These consumables are majorly used for wound management, airway clearing management, Gastroenterology, Fluid Administration, and many other things. Besides the critical care consumables, the demand for anesthesia equipment is also witnessing growth from the end user market due to increasing chronic diseases and the rising need for surgeries and vaccinations.

Companion animal, and livestock animal are the two types in this segment. The ratio of families adopting companion animals is witnessing more significant growth rates into the market and hence this market will have the largest share from 2021 to 2026. The improving lifestyles and high awareness about the animal healthcare are helping this segment grow rapidly.

Veterinary hospitals and research institutes are the major end users of this market, where the veterinary hospitals holds the largest share in the end users segment. As per the latest report released by the American Veterinary Medical Association’s survey shows that as of 2019, there were approximately 28,000 to 32,000 veterinary hospitals or clinics in United States. The report also states that the number is likely to increase rapidly. These veterinary hospitals receive more than 1000 registration of animal imaging on a daily basis and hence, this leads to positive growth of this end user in the market from 2021 to 2026.

North America has the largest share in the market. North American region (United States, Canada, and Mexico) is the biggest promoters of animal welfare where half of the population is indulged in pet adoption and is aware of animal diagnostic imaging importance. Compared to the rest of the world (Middle East & Africa), North America has the most pet ownerships and other adoptions of rescued animals, thus most significantly demanding various kinds of veterinary equipment.

On the other hand, the Asia Pacific region is a very lucrative market and will be the fastest growing segment from 2021 to 2022, with gradually increasing animal and pet owners, gradually increasing awareness about animal welfare and their safety. The countries like India, South Korea, and Japan are also some of the fast growing countries with the citizens adopting animals and having companion animals. These countries are also experiencing growth in emerging veterinary institutes and schools and the increasing number of veterinary practitioners. These increasing pet ownerships and increasing veterinary hospitals in the APAC region are boosting the demand for veterinary equipment and disposables.

B. Braun Vet Care, Smiths Medical, DRE Veterinary, Nonin Medical, Mindray Medical International Limited, Covetrus (Henry Schein), Vetland Medical, Digicare Animal Health, Midmark Corporation, Jorgensen Labs, and Grady Medical are some of the prominent industry players.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Veterinary Equipment and Disposables Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Product Overview

2.1.3 Animal Type Overview

2.1.4 End-User Overview

2.1.6 Regional Overview

Chapter 3 Veterinary Equipment and Disposables Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising number of pet adoption cases and awareness about pet health insurance

3.3.2 Industry Challenges

3.3.2.1 Lack of adequate infrastructure and automated laboratory systems in developing nations for small animals

3.4 Prospective Growth Scenario

3.4.1 Product Growth Scenario

3.4.2 Animal Type Growth Scenario

3.4.3 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Veterinary Equipment and Disposables Market, By Product

4.1 Product Outlook

4.2 Critical Care Consumables

4.2.1 Market Size, By Region, 2020-2026 (USD Million)

4.3 Anesthesia Equipment

4.3.1 Market Size, By Region, 2020-2026 (USD Million)

4.4 Fluid Management Equipment

4.4.1 Market Size, By Region, 2020-2026 (USD Million)

4.5 Temperature Management Equipment

4.5.1 Market Size, By Region, 2020-2026 (USD Million)

4.6 Rescue & Resuscitation Equipment

4.6.1 Market Size, By Region, 2020-2026 (USD Million)

4.7 Research Equipment

4.7.1 Market Size, By Region, 2020-2026 (USD Million)

4.8 Patient Monitoring Equipment

4.8.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 5 Veterinary Equipment and Disposables Market, By Animal Type

5.1 Animal Type Outlook

5.2 Companion Animal

5.2.1 Market Size, By Region, 2020-2026 (USD Million)

5.3 Livestock Animal

5.3.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 6 Veterinary Equipment and Disposables Market, By End-User

6.1 Veterinary Hospitals/Clinics

6.1.1 Market Size, By Region, 2020-2026 (USD Million)

6.2 Research Institutes

6.2.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 7 Veterinary Equipment and Disposables Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2020-2026 (USD Million)

7.2.2 Market Size, By Product, 2020-2026 (USD Million)

7.2.3 Market Size, By Animal Type, 2020-2026 (USD Million)

7.2.4 Market Size, By End-User, 2020-2026 (USD Million)

7.2.5 U.S.

7.2.5.1 Market Size, By Product, 2020-2026 (USD Million)

7.2.5.2 Market Size, By Animal Type, 2020-2026 (USD Million)

7.2.5.3 Market Size, By End-User, 2020-2026 (USD Million)

7.2.6 Canada

7.2.6.1 Market Size, By Product, 2020-2026 (USD Million)

7.2.6.2 Market Size, By Animal Type, 2020-2026 (USD Million)

7.2.6.3 Market Size, By End-User, 2020-2026 (USD Million)

7.3 Europe

7.3.1 Market Size, By Country 2020-2026 (USD Million)

7.3.2 Market Size, By Product, 2020-2026 (USD Million)

7.3.3 Market Size, By Animal Type, 2020-2026 (USD Million)

7.3.4 Market Size, By End-User, 2020-2026 (USD Million)

7.3.5 Germany

7.3.5.1 Market Size, By Product, 2020-2026 (USD Million)

7.3.5.2 Market Size, By Animal Type, 2020-2026 (USD Million)

7.3.5.3 Market Size, By End-User, 2020-2026 (USD Million)

7.3.6 UK

7.3.6.1 Market Size, By Product, 2020-2026 (USD Million)

7.3.6.2 Market Size, By Animal Type, 2020-2026 (USD Million)

7.3.6.3 Market Size, By End-User, 2020-2026 (USD Million)

7.3.9 France

7.3.9.1 Market Size, By Product, 2020-2026 (USD Million)

7.3.9.2 Market Size, By Animal Type, 2020-2026 (USD Million)

7.3.9.3 Market Size, By End-User, 2020-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2020-2026 (USD Million)

7.4.2 Market Size, By Product, 2020-2026 (USD Million)

7.4.3 Market Size, By Animal Type, 2020-2026 (USD Million)

7.4.4 Market Size, By End-User, 2020-2026 (USD Million)

7.4.5 China

7.4.5.1 Market Size, By Product, 2020-2026 (USD Million)

7.4.5.2 Market Size, By Animal Type, 2020-2026 (USD Million)

7.4.5.3 Market Size, By End-User, 2020-2026 (USD Million)

7.4.6 India

7.4.6.1 Market Size, By Product, 2020-2026 (USD Million)

7.4.6.2 Market Size, By Animal Type, 2020-2026 (USD Million)

7.4.6.3 Market Size, By End-User, 2020-2026 (USD Million)

7.4.7 Japan

7.4.7.1 Market Size, By Product, 2020-2026 (USD Million)

7.4.7.2 Market Size, By Animal Type, 2020-2026 (USD Million)

7.4.7.3 Market Size, By End-User, 2020-2026 (USD Million)

7.4.8 Australia

7.4.8.1 Market Size, By Product, 2020-2026 (USD Million)

7.4.8.2 Market size, By Animal Type, 2020-2026 (USD Million)

7.4.8.3 Market Size, By End-User, 2020-2026 (USD Million)

7.5 Latin America

7.5.1 Market Size, By Country 2020-2026 (USD Million)

7.5.2 Market Size, By Product, 2020-2026 (USD Million)

7.5.3 Market Size, By Animal Type, 2020-2026 (USD Million)

7.5.4 Market Size, By End-User, 2020-2026 (USD Million)

7.5.5 Brazil

7.5.5.1 Market Size, By Product, 2020-2026 (USD Million)

7.5.5.2 Market Size, By Animal Type, 2020-2026 (USD Million)

7.5.5.3 Market Size, By End-User, 2020-2026 (USD Million)

7.5.6 Mexico

7.5.6.1 Market Size, By Product, 2020-2026 (USD Million)

7.5.6.2 Market Size, By Animal Type, 2020-2026 (USD Million)

7.5.6.3 Market Size, By End-User, 2020-2026 (USD Million)

7.5.9 Argentina

7.5.9.1 Market Size, By Product, 2020-2026 (USD Million)

7.5.9.2 Market Size, By Animal Type, 2020-2026 (USD Million)

7.5.9.3 Market Size, By End-User, 2020-2026 (USD Million)

7.6 MEA

7.6.1 Market Size, By Country 2020-2026 (USD Million)

7.6.2 Market Size, By Product, 2020-2026 (USD Million)

7.6.3 Market Size, By Animal Type, 2020-2026 (USD Million)

7.6.4 Market Size, By End-User, 2020-2026 (USD Million)

7.6.5 Saudi Arabia

7.6.5.1 Market Size, By Product, 2020-2026 (USD Million)

7.6.5.2 Market Size, By Animal Type, 2020-2026 (USD Million)

7.6.5.3 Market Size, By End-User, 2020-2026 (USD Million)

7.6.6 UAE

7.6.6.1 Market Size, By Product, 2020-2026 (USD Million)

7.6.6.2 Market Size, By Animal Type, 2020-2026 (USD Million)

7.6.6.3 Market Size, By End-User, 2020-2026 (USD Million)

7.6.7 South Africa

7.6.7.1 Market Size, By Product, 2020-2026 (USD Million)

7.6.7.2 Market Size, By Animal Type, 2020-2026 (USD Million)

7.6.7.3 Market Size, By End-User, 2020-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Smith’s Medical

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 B. Braun Vet Care

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 DRE Veterinary

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Mindray Medical International Limited

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Nonin Medical

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Covetrus (Henry Schein)

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Digicare Animal Health

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Vetland Medical

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.10 Midmark Corporation

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Other Companies

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

The Global Veterinary Equipment and Disposables Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Veterinary Equipment and Disposables Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS