Global Veterinary X-Ray Market Size, Trends & Analysis - Forecasts to 2026 By Type (Digital X-Ray Systems, Analog X-Ray Systems), By Technology (Computed Radiography Systems, Direct Radiography Systems, Film-Based Radiography Systems), By Modality (Stationary X-Ray Systems, Portable X-Ray Systems), By Animal Type (Small Companion Animals, Large Animals), By Application (Orthopedics and Traumatology, Oncology, Cardiology, Neurology, Dental Applications, Others (Ophthalmology, Urology, etc.)), By End-User (Hospitals & Clinics, Reference Laboratories, Others), By Region (By Region (North America, Asia Pacific, Central & South America, Europe, and the Middle East and Africa), Company Market Share Analysis, and Competitor Analysis

The global veterinary x-ray market is projected to grow from USD 1.65 billion in 2021 and is expected to reach USD 2.70 billion by 2026 at a CAGR of 6.6% from 2021 to 2026.

The rising demand for pet insurance, coupled with higher pet healthcare costs, is one of the key drivers driving the rise and demand for veterinary x-rays. Additionally, the rapid increase in the number of veterinarians and the rise in disposable income in developed economies are both contributing to the worldwide market's growth throughout the forecast period.

The market's growth is further aided by the expanding population of household pets and substantial advancement of technologies in animal care, such as effective amalgamation of radiological information management and teleradiology. Similarly, the growing demand for diagnostics and widespread adoption of radiography in veterinarian dentistry, as well as the rapid spike in the number of animal lovers who are concerned about their companions' wellness, are driving the veterinary x-ray market forward.

The rising prevalence of orthopedic illnesses is also a factor contributing to the growth of the veterinary x-ray market. As per the Equine Veterinary Journal (EVJ), orodental illnesses were discovered to be more prevalent in nations such as Egypt in 2017. Also, MyVet Imaging indicates that since the usage of digital x-ray technology in veterinary treatment began in 2016, the cost of the equipment has dropped significantly, rendering the technique more economical for veterinarians.

The most frequent type of imaging utilized by veterinarians is x-rays, often known as a radiograph. An x-ray includes exposing an animal to x-ray radiation and photographing the dispersion of the rays as they pass through. They are very effective in the diagnosis of fractures, arthritis, and infections. Nevertheless, not all illnesses and ailments are visible using x-rays, hence a veterinarian may propose other methods of imaging. In terms of radiation, the quantity of radioactivity exposed to an animal during x-rays is minor and nontoxic. Typically, x-ray technicians wear protective clothing merely as a precaution against inadvertent exposure to oneself.

COVID-19 has caused havoc in a variety of businesses around the world. The veterinary industry has taken a significant hit. The pandemic has hampered the supply chain and increased the financial burden on many businesses. As a result, during COVID-19, many did not adopt pets and were hesitant to bring pets to clinics. Furthermore, as a result of the epidemic, nearly all veterinary facilities worldwide have developed new regulations and procedures and the most popular are the use of personal protective equipment (PPE) and measures aimed to restrict footfall.

Nonetheless, rising pet care expenditures, as well as the expensive demand for instruments and procedures, may limit the expansion of the veterinary x-ray market, while a shortage of veterinarians and an absence of animal healthcare consciousness in emerging economies may pose a hurdle to the market's growth.

Based on type, the market is segmented into digital x-ray systems and analog x-ray systems. The market for the digital x-ray system segment is expected to have the largest share during the forecast period owing to low labor expenses, quicker acquisition duration, and significant profit margin for market players. Furthermore, this technology allows for the creation of photographs within a few seconds of exposure, reducing direct radiation exposure. Such reasons contribute to the promising growth prospects for digital radiography.

Based on technology, the market is segmented into computed radiography systems, direct radiography systems, and film-based radiography systems. The market for computed radiography systems segment has the largest share in the market during the forecast period attributable to expanding electronic scanning technology, research conducted with 3D representations, increased funding in healthcare institutions. Further, the growing impact of increased flexibility, low electrical x-ray gear, and the merits of CR systems over traditional x-ray systems are some of the key drivers propelling the market growth.

Direct radiography systems are also estimated to grow rapidly during the forecast period, attributed to advantages such as improved imagery, easy accessibility, chemical-free removal, and digital storage. Further, wireless setup radiographs, which is particularly useful for horse or large mammals, is likely to drive market demand during the projection period.

Based on modality, the market is segmented into stationary x-ray systems and portable x-ray systems. The market for portable x-ray systems segment is expected to have the lion’s share in the market during the forecast period. Diseases such as cancer and other infectious diseases have raised awareness among pet owners. The soaring number of accidents and the overwhelming amount of orthopedic cases have contributed to the large demand for portable x-rays. Also, as they are tightly compacted and light-weighted, synchronization with digital devices is propelling the market's growth further.

Based on animal type, the market is segmented into small companion animals and large animals. The market for the small companion animals segment is estimated to have the largest share in the market owing to increased pet adoptions, enhanced treatment, compassion, and concern for animals, and the growing preference for minimally invasive surgical procedures for diagnostics.

Deployment of veterinary x-rays in large animals, on the other hand, is predicted to develop rapidly resulting in an increase in implementation of noninvasive diagnostic imaging equipment coupled with improved use of modern radiography equipment, projections, and film-screen combinations used by veterinarians which are contributing to expected to provide lucrative opportunities.

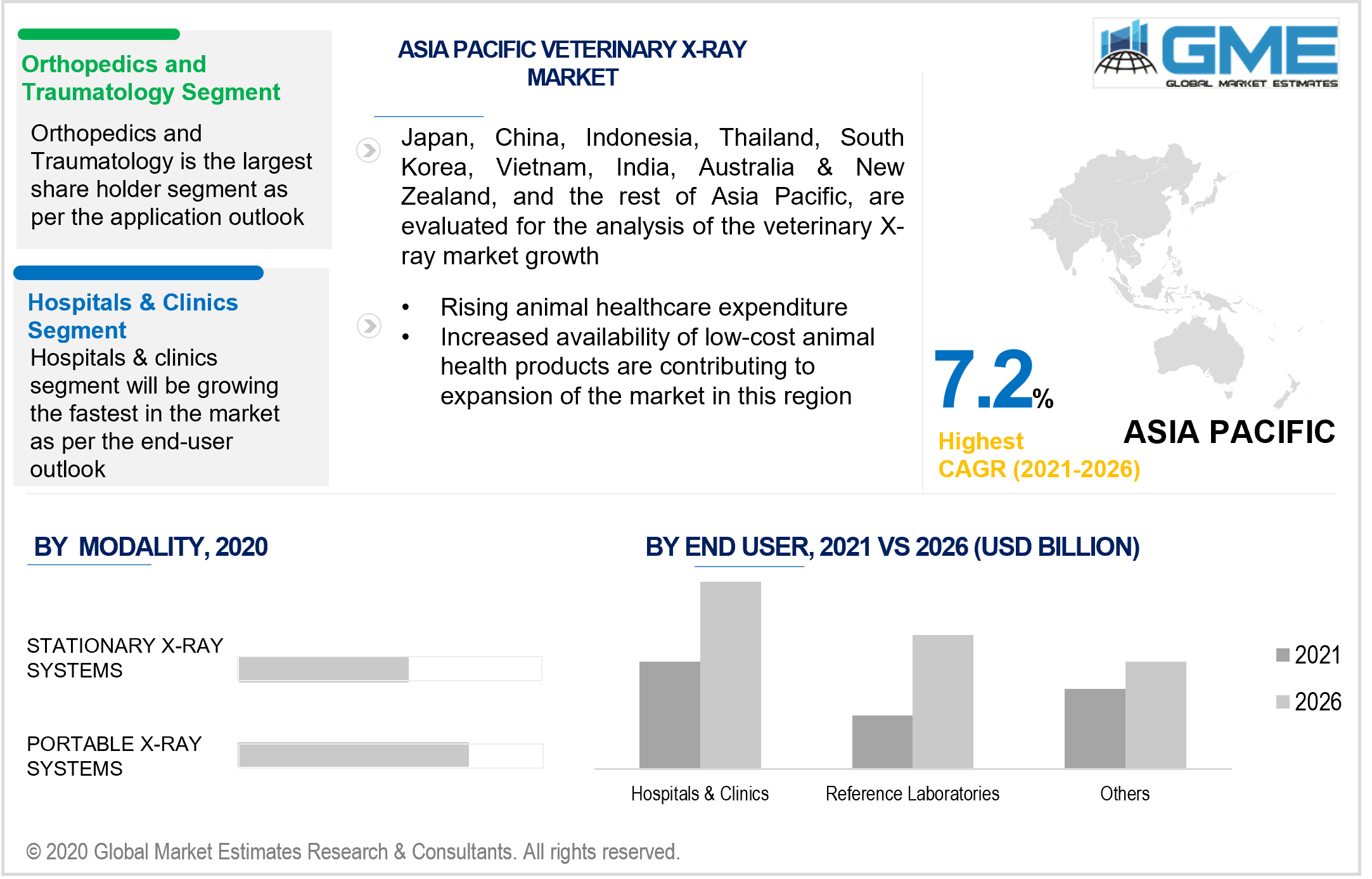

Based on application, the market is segmented into orthopedics and traumatology, oncology, cardiology, neurology, dental applications, and others. The market for orthopedics and traumatology segment is anticipated to have the largest share in the market during the forecast period owing to a spike in the volume of animal traumas, a considerable need for accurate diagnoses, and a growth in the number of pet healthcare settings.

The oncology segment is also expected to grow rapidly during the forecast period, owing to increased oncology scientific research, soaring regulatory reforms to support innovative activities, and the rapidly increasing pet owner expenditure on animal health insurance.

Based on end-user, the market is segmented into hospitals & clinics, reference laboratories, and others. The market for hospitals & clinics segment is predicted to have the largest share in the market during the forecast period owing to the availability of innovative equipment and technology, as well as the presence of trained and skilled healthcare personnel. Furthermore, as the prevalence of diseases such as cancer has increased, so has healthcare spending and health consciousness. As veterinary hospitals and clinics ensure the safety and well-being of animals, there is growing pressure for animal outpatient facilities, as well as an increase in the number of veterinary surgeries.

As per the geographical analysis, the market can be classified into North America (the U.S., Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa and Central South America.

The North American region is expected to hold the lion’s share of the global revenue generated in the market. Rising pet adoption, superior healthcare facilities, compassion and care for animals, escalating diseases, and accidents can all be attributable to growth. In addition, numerous new product launches and collaborations are paving the road for expansion in this region.

The Asia Pacific region is anticipated to be the fastest-growing region in the market owing to rising demand and investments for veterinary products, along with an increase in animal healthcare expenditure, and the availability of low-cost animal health products are all factors that contribute to the expansion of the market in this region.

Konica Minolta Healthcare Americas, Inc., Avante Health Solutions company, IDEXX Laboratories, Inc, Fujifilm holdings America Corporation, Sedecal, Agfa-Gevaert (Sound Technologies), Examion, DRE Veterinary, Heska Corporation, HiTech International Group, Inc, Control-X Medical, among others are the top players in veterinary x-ray market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Veterinary X-Ray Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Technology Overview

2.1.4 Modality Overview

2.1.5 Animal Type Overview

2.1.6 Application Overview

2.1.7 End-User Overview

2.1.8 Regional Overview

Chapter 3 Veterinary X-Ray Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising demand for pet insurance

3.3.2 Restraints

3.3.2.1 Increasing pet care expenditures such as expensive instruments and procedures

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Technology Growth Scenario

3.4.3 Modality Growth Scenario

3.4.4 Animal Type Growth Scenario

3.4.5 Application Overview

3.4.6 End-User Overview

3.4.7 Regional Overview

3.5 COVID-19 Influence over Industry Growth

3.7 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Veterinary X-Ray Market, By Type

4.1 Type Outlook

4.2 Digital X-Ray Systems

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Analog X-Ray Systems

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Veterinary X-Ray Market, By Technology

5.1 Technology Outlook

5.2 Computed Radiography Systems

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Direct Radiography Systems

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Film-Based Radiography Systems

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Veterinary X-Ray Market, By Modality

6.1 Modality Outlook

6.2 Stationary X-Ray Systems

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

6.3 Portable X-Ray Systems

6.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Veterinary X-Ray Market, Animal Types

7.1 Animal Types Outlook

7.2 Small Companion Animals

7.2.1 Market Size, By Region, 2020-2026 (USD Billion)

7.3 Large Animals

7.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 8 Veterinary X-Ray Market, By Application

8.1 Application Outlook

8.2 Orthopedics and Traumatology

8.2.1 Market Size, By Region, 2020-2026 (USD Billion)

8.3 Oncology

8.3.1 Market Size, By Region, 2020-2026 (USD Billion)

8.4 Cardiology

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

5.5 Neurology

8.5.1 Market Size, By Region, 2020-2026 (USD Billion)

8.6 Dental Applications

8.6.1 Market Size, By Region, 2020-2026 (USD Billion)

8.7 Others (Ophthalmology, Urology, etc.)

8.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 9 Veterinary X-Ray Market, By End-User

9.1 End-User Outlook

9.2 Hospitals & Clinics

9.2.1 Market Size, By Region, 2020-2026 (USD Billion)

9.3 Reference Laboratories

9.3.1 Market Size, By Region, 2020-2026 (USD Billion)

9.4 Others

9.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 10 Veterinary X-Ray Market, By Region

10.1 Regional outlook

10.2 North America

10.2.1 Market Size, By Country 20110-20210 (USD Billion)

10.2.2 Market Size, By Type, 20110-20210 (USD Billion)

10.2.3 Market Size, By Technology, 20110-20210 (USD Billion)

10.2.4 Market Size, By Modality, 20110-20210 (USD Billion)

10.2.5 Market Size, By Animal Type, 20110-2026 (USD Billion)

10.2.6 Market Size, By Application, 20110-2026 (USD Billion)

10.2.7 Market Size, By End-User, 20110-2026 (USD Billion)

10.2.8 U.S.

10.2.8.1 Market Size, By Type, 20110-20210 (USD Billion)

10.2.8.2 Market Size, By Technology, 20110-20210 (USD Billion)

10.2.8.3 Market Size, By Modality, 20110-20210 (USD Billion)

10.2.8.4 Market Size, By Animal Type, 20110-2026 (USD Billion)

10.2.8.5 Market Size, By Application, 20110-2026 (USD Billion)

10.2.8.6 Market Size, By End-User, 20110-2026 (USD Billion)

10.2.9 Canada

10.2.9.1 Market Size, By Type, 20110-20210 (USD Billion)

10.2.9.2 Market Size, By Technology, 20110-20210 (USD Billion)

10.2.9.3 Market Size, By Modality, 20110-20210 (USD Billion)

10.2.9.4 Market Size, By Animal Type, 20110-2026 (USD Billion)

10.2.8.5 Market Size, By Application, 20110-2026 (USD Billion)

10.2.8.6 Market Size, By End-User, 20110-2026 (USD Billion)

10.3 Europe

10.3.1 Market Size, By Country 20110-20210 (USD Billion)

10.3.2 Market Size, By Type, 20110-20210 (USD Billion)

10.3.3 Market Size, By Technology, 20110-20210 (USD Billion)

10.3.4 Market Size, By Modality, 20110-20210 (USD Billion)

10.3.5 Market Size, By Animal Type, 20110-2026 (USD Billion)

10.3.6 Market Size, By Application, 20110-2026 (USD Billion)

10.3.7 Market Size, By End-User, 20110-2026 (USD Billion)

10.3.8 Germany

10.3.8.1 Market Size, By Type, 20110-20210 (USD Billion)

10.3.8.2 Market Size, By Technology, 20110-20210 (USD Billion)

10.3.8.3 Market Size, By Modality, 20110-20210 (USD Billion)

10.3.8.4 Market Size, By Animal Type, 20110-2026 (USD Billion)

10.3.8.5 Market Size, By Application, 20110-2026 (USD Billion)

10.3.8.6 Market Size, By End-User, 20110-2026 (USD Billion)

10.3.9 UK

10.3.9.1 Market Size, By Type, 20110-20210 (USD Billion)

10.3.9.2 Market Size, By Technology, 20110-20210 (USD Billion)

10.3.9.3 Market Size, By Modality, 20110-20210 (USD Billion)

10.3.9.4 Market Size, By Animal Type, 20110-2026 (USD Billion)

10.3.9.5 Market Size, By Application, 20110-2026 (USD Billion)

10.3.9.6 Market Size, By End-User, 20110-2026 (USD Billion)

10.3.10 France

10.3.10.1 Market Size, By Type, 20110-20210 (USD Billion)

10.3.10.2 Market Size, By Technology,20110-20210(USD Billion)

10.3.10.3 Market Size, By Modality, 20110-20210 (USD Billion)

10.3.10.4 Market Size, By Animal Type, 20110-2026 (USD Billion)

10.3.10.5 Market Size, By Application, 20110-2026 (USD Billion)

10.3.10.6 Market Size, By End-User, 20110-2026 (USD Billion)

10.3.11 Italy

10.3.11.1 Market Size, By Type, 20110-20210 (USD Billion)

10.3.11.2 Market Size, By Technology, 20110-20210 (USD Billion)

10.3.11.3 Market Size, By Modality, 20110-20210 (USD Billion)

10.3.11.4 Market Size, By Animal Type, 20110-2026 (USD Billion)

10.3.11.5 Market Size, By Application, 20110-2026 (USD Billion)

10.3.11.6 Market Size, By End-User, 20110-2026 (USD Billion)

10.3.12 Spain

10.3.12.1 Market Size, By Type, 20110-20210 (USD Billion)

10.3.12.2 Market Size, By Technology, 20110-20210 (USD Billion)

10.3.12.3 Market Size, By Modality, 20110-20210 (USD Billion)

10.3.12.4 Market Size, By Animal Type, 20110-2026 (USD Billion)

10.3.12.5 Market Size, By Application, 20110-2026 (USD Billion)

10.3.12.6 Market Size, By End-User, 20110-2026 (USD Billion)

10.3.13 Russia

10.3.13.1 Market Size, By Type, 20110-20210 (USD Billion)

10.3.13.2 Market Size, By Technology, 20110-20210(USD Billion)

10.3.13.3 Market Size, By Modality, 20110-20210 (USD Billion)

10.3.13.4 Market Size, By Animal Type, 20110-2026 (USD Billion)

10.3.13.5 Market Size, By Application, 20110-2026 (USD Billion)

10.3.13.6 Market Size, By End-User, 20110-2026 (USD Billion)

10.4 Asia Pacific

10.4.1 Market Size, By Country 20110-20210 (USD Billion)

10.4.2 Market Size, By Type, 20110-20210 (USD Billion)

10.4.3 Market Size, By Technology, 20110-20210 (USD Billion)

10.4.4 Market Size, By Modality, 20110-20210 (USD Billion)

10.4.5 Market Size, By Animal Type, 20110-2026 (USD Billion)

10.4.6 Market Size, By Application, 20110-2026 (USD Billion)

10.4.7 Market Size, By End-User, 20110-2026 (USD Billion)

10.4.8 China

10.4.8.1 Market Size, By Type, 20110-20210 (USD Billion)

10.4.8.2 Market Size, By Technology, 20110-20210 (USD Billion)

10.4.8.3 Market Size, By Modality, 20110-20210 (USD Billion)

10.4.8.4 Market Size, By Animal Type, 20110-2026 (USD Billion)

10.4.8.5 Market Size, By Application, 20110-2026 (USD Billion)

10.4.8.6 Market Size, By End-User, 20110-2026 (USD Billion)

10.4.9 India

10.4.9.1 Market Size, By Type, 20110-20210 (USD Billion)

10.4.9.2 Market Size, By Technology, 20110-20210 (USD Billion)

10.4.9.3 Market Size, By Modality, 20110-20210 (USD Billion)

10.4.9.4 Market Size, By Animal Type, 20110-2026 (USD Billion)

10.2.9.5 Market Size, By Application, 20110-2026 (USD Billion)

10.2.9.6 Market Size, By End-User, 20110-2026 (USD Billion)

10.4.10 Japan

10.4.10.1 Market Size, By Type, 20110-20210 (USD Billion)

10.4.10.2 Market Size, By Technology, 20110-20210 (USD Billion)

10.4.10.3 Market Size, By Modality, 20110-20210 (USD Billion)

10.4.10.4 Market Size, By Animal Type, 20110-2026 (USD Billion)

10.4.10.5 Market Size, By Application, 20110-2026 (USD Billion)

10.4.10.6 Market Size, By End-User, 20110-2026 (USD Billion)

10.4.11 Australia

10.4.11.1 Market Size, By Type, 20110-20210 (USD Billion)

10.4.11.2 Market size, By Technology, 20110-20210 (USD Billion)

10.4.11.3 Market Size, By Modality, 20110-20210 (USD Billion)

10.4.11.4 Market Size, By Animal Type, 20110-2026 (USD Billion)

10.4.11.5 Market Size, By Application, 20110-2026 (USD Billion)

10.4.11.6 Market Size, By End-User, 20110-2026 (USD Billion)

10.4.12 South Korea

10.4.12.1 Market Size, By Type, 20110-20210 (USD Billion)

10.4.12.2 Market Size, By Technology, 20110-20210 (USD Billion)

10.4.12.3 Market Size, By Modality, 20110-20210 (USD Billion)

10.4.12.4 Market Size, By Animal Type, 20110-2026 (USD Billion)

10.4.12.5 Market Size, By Application, 20110-2026 (USD Billion)

10.4.12.6 Market Size, By End-User, 20110-2026 (USD Billion)

10.5 Latin America

10.5.1 Market Size, By Country 20110-20210 (USD Billion)

10.5.2 Market Size, By Type, 20110-20210 (USD Billion)

10.5.3 Market Size, By Technology, 20110-20210 (USD Billion)

10.5.4 Market Size, By Modality, 20110-20210 (USD Billion)

10.5.5 Market Size, By Animal Type, 20110-2026 (USD Billion)

10.5.6 Market Size, By Application, 20110-2026 (USD Billion)

10.5.7 Market Size, By End-User, 20110-2026 (USD Billion)

10.5.8 Brazil

10.5.8.1 Market Size, By Type, 20110-20210 (USD Billion)

10.5.8.2 Market Size, By Technology, 20110-20210 (USD Billion)

10.5.8.3 Market Size, By Modality, 20110-20210 (USD Billion)

10.5.8.4 Market Size, By Animal Type, 20110-2026 (USD Billion)

10.5.8.5 Market Size, By Application, 20110-2026 (USD Billion)

10.5.8.6 Market Size, By End-User, 20110-2026 (USD Billion)

10.5.9 Mexico

10.5.9.1 Market Size, By Type, 20110-20210 (USD Billion)

10.5.9.2 Market Size, By Technology, 20110-20210 (USD Billion)

10.5.9.3 Market Size, By Modality, 20110-20210 (USD Billion)

10.5.9.4 Market Size, By Animal Type, 20110-2026 (USD Billion)

10.5.9.5 Market Size, By Application, 20110-2026 (USD Billion)

10.5.9.6 Market Size, By End-User, 20110-2026 (USD Billion)

10.5.10 Argentina

10.5.10.1 Market Size, By Type, 20110-20210 (USD Billion)

10.5.10.2 Market Size, By Technology 20110-20210 (USD Billion)

10.5.10.3 Market Size, By Modality, 20110-20210 (USD Billion)

10.5.10.4 Market Size, By Animal Type, 20110-2026 (USD Billion)

10.5.10.5 Market Size, By Application, 20110-2026 (USD Billion)

10.5.10.6 Market Size, By End-User, 20110-2026 (USD Billion)

10.6 MEA

10.6.1 Market Size, By Country 20110-20210 (USD Billion)

10.6.2 Market Size, By Type, 20110-20210 (USD Billion)

10.6.3 Market Size, By Technology, 20110-20210 (USD Billion)

10.6.4 Market Size, By Modality, 20110-20210 (USD Billion)

10.6.5 Market Size, By Animal Type, 20110-2026 (USD Billion)

10.6.6 Market Size, By Application, 20110-2026 (USD Billion)

10.6.7 Market Size, By End-User, 20110-2026 (USD Billion)

10.6.8 Saudi Arabia

10.6.8.1 Market Size, By Type, 20110-20210 (USD Billion)

10.6.8.2 Market Size, By Technology, 20110-20210 (USD Billion)

10.6.8.3 Market Size, By Modality, 20110-20210 (USD Billion)

10.6.8.4 Market Size, By Animal Type, 20110-2026 (USD Billion)

10.6.8.5 Market Size, By Application, 20110-2026 (USD Billion)

10.6.8.6 Market Size, By End-User, 20110-2026 (USD Billion)

10.6.9 UAE

10.6.9.1 Market Size, By Type, 20110-20210 (USD Billion)

10.6.9.2 Market Size, By Technology, 20110-20210 (USD Billion)

10.6.9.3 Market Size, By Modality, 20110-20210 (USD Billion)

10.6.9.4 Market Size, By Animal Type, 20110-2026 (USD Billion)

10.6.9.5 Market Size, By Application, 20110-2026 (USD Billion)

10.6.9.6 Market Size, By End-User, 20110-2026 (USD Billion)

10.6.10 South Africa

10.6.10.1 Market Size, By Type, 20110-20210 (USD Billion)

10.6.10.2 Market Size, By Technology, 20110-20210 (USD Billion)

10.6.10.3 Market Size, By Modality, 20110-20210 (USD Billion)

10.6.10.4 Market Size, By Modality, 20110-20210 (USD Billion)

10.6.10.5 Market Size, By Application, 20110-2026 (USD Billion)

10.6.10.6 Market Size, By End-User, 20110-2026 (USD Billion)

Chapter 11 Company Landscape

11.1 Competitive Analysis, 2020

11.2 IDEXX

11.2.1 Company Overview

11.2.2 Financial Analysis

11.2.3 Strategic Positioning

11.2.4 Info Graphic Analysis

11.3 Fujifilm Holding Corporation

11.3.1 Company Overview

11.3.2 Financial Analysis

11.3.3 Strategic Positioning

11.3.4 Info Graphic Analysis

11.4 Onex Corporation

11.4.1 Company Overview

11.4.2 Financial Analysis

11.4.3 Strategic Positioning

11.4.4 Info Graphic Analysis

11.5 Sedecal

11.5.1 Company Overview

11.5.2 Financial Analysis

11.5.3 Strategic Positioning

11.5.4 Info Graphic Analysis

11.6 Agfa-Gevaert and Sound Technologies

11.6.1 Company Overview

11.6.2 Financial Analysis

11.6.3 Strategic Positioning

11.6.4 Info Graphic Analysis

11.7 Canon, Inc

11.7.1 Company Overview

11.7.2 Financial Analysis

11.7.3 Strategic Positioning

11.7.4 Info Graphic Analysis

11.8 Examion

11.8.1 Company Overview

11.8.2 Financial Analysis

11.8.3 Strategic Positioning

11.8.4 Info Graphic Analysis

11.9 Konica Minolta

11.9.1 Company Overview

11.9.2 Financial Analysis

11.9.3 Strategic Positioning

11.9.4 Info Graphic Analysis

11.10 DRE Veterinary

11.10.1 Company Overview

11.10.2 Financial Analysis

11.10.3 Strategic Positioning

11.10.4 Info Graphic Analysis

11.11 Heska Corporation

11.11.1 Company Overview

11.11.2 Financial Analysis

11.11.3 Strategic Positioning

11.11.4 Info Graphic Analysis

11.12 Other Companies

11.12.1 Company Overview

11.12.2 Financial Analysis

11.12.3 Strategic Positioning

11.12.4 Info Graphic Analysis

The Global Veterinary X-Ray Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Veterinary X-Ray Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS