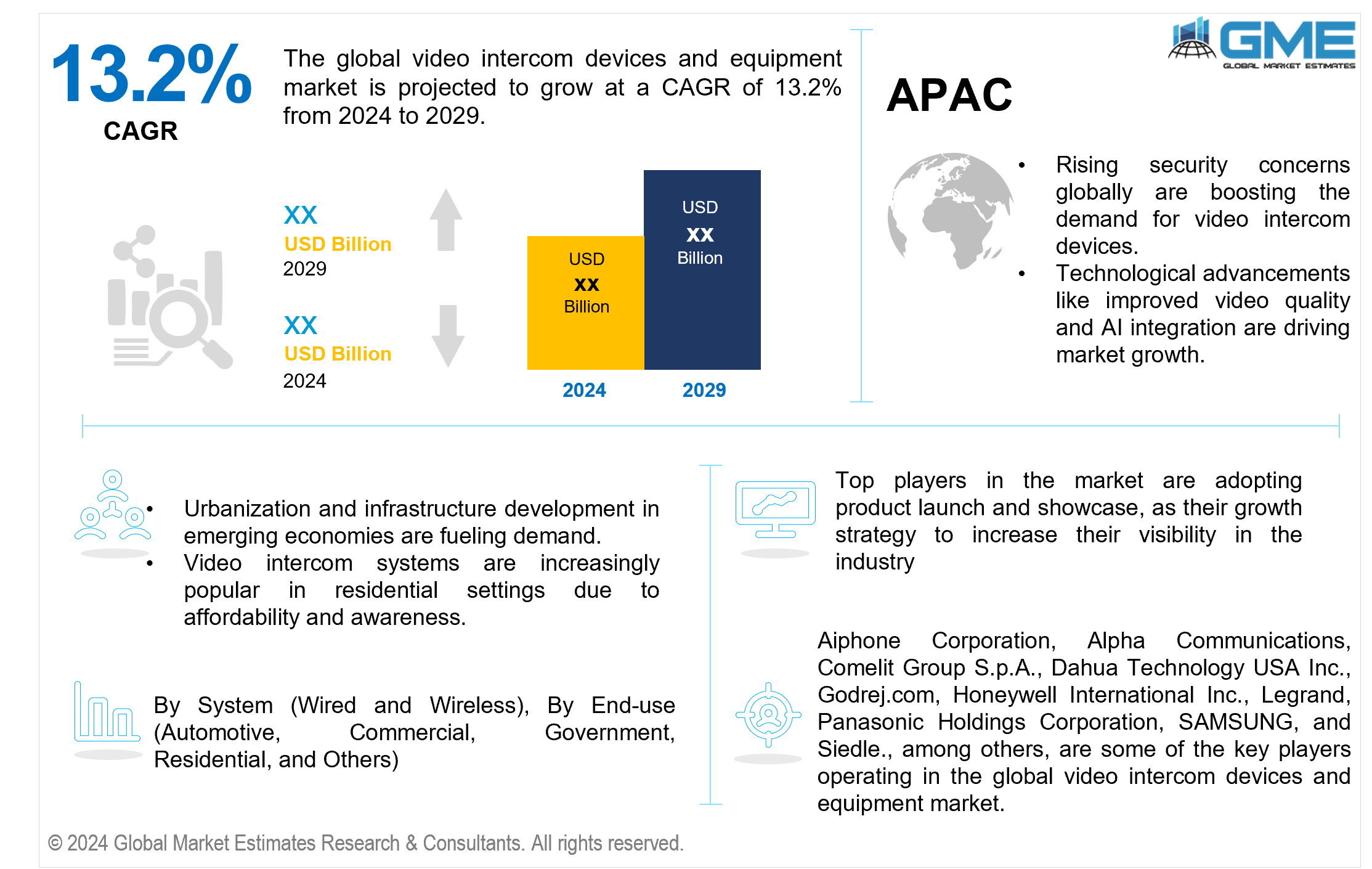

Global Video Intercom Devices and Equipment Market Size, Trends & Analysis - Forecasts to 2029 By System (Wired and Wireless), By End-use (Automotive, Commercial, Government, Residential, and Others), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

The global video intercom devices and equipment market is projected to grow at a CAGR of 13.2% from 2024 to 2029.

The incorporation of modern video intercom technology into various systems, including wireless video intercom and IP video intercom systems, is contributing to the market growth. These advancements offer seamless communication and better security features, making them ideal for both residential and business intercom systems. Furthermore, the introduction of smart video intercom and touchscreen intercom devices has boosted the industry by meeting the consumer's need for sophisticated and user-friendly interfaces.

Another key element driving market expansion is the increasing deployment of video door entry systems and doorbell cameras, which is also contributing to the doorbell camera market growth. As more homeowners and companies value security, the demand for effective door access control systems and video door phone market solutions increases. These devices support two-way video communication, allowing users to visually verify guests before authorizing access, which improves overall security. These video intercom solutions have been popular in both the home and commercial sectors due to the ease and safety they give.

Video intercom market trends show an increasing preference for video intercom integration with other smart home and workplace technology. This trend is especially noticeable in the residential intercom devices industry, where customers are increasingly seeking integrated systems that provide comprehensive security and automation solutions. Furthermore, the commercial intercom equipment market is evolving to meet the needs of modern enterprises, which require dependable and scalable communication and security systems. The ability to integrate video intercom systems with existing infrastructure and security equipment is a key driver of market growth.

Intercom device manufacturers are constantly developing to create more efficient, dependable, and affordable video intercom systems. Business are broadening their product offerings to include a diverse variety of devices, from basic video intercoms to modern IP video intercom systems with high-definition video capability. The competition among manufacturers has resulted in the emergence of high-quality items at competitive rates, improving market accessibility and adoption.

The availability of video intercom installation services and the skills necessary for video intercom integration are critical drivers of market growth. Professional installation guarantees that systems are properly configured and optimized for performance, whereas integration services enable the seamless integration of video intercom devices into existing security frameworks.

The video intercom devices and equipment market has a high initial installation cost. Despite technical developments and rising demand, the significant upfront investment necessary for high-quality systems, such as IP video intercoms and integrated smart solutions, might put off potential customers, especially in the cost-sensitive residential and small business segments. These above-mentioned factors may hinder the market growth over the forecast period.

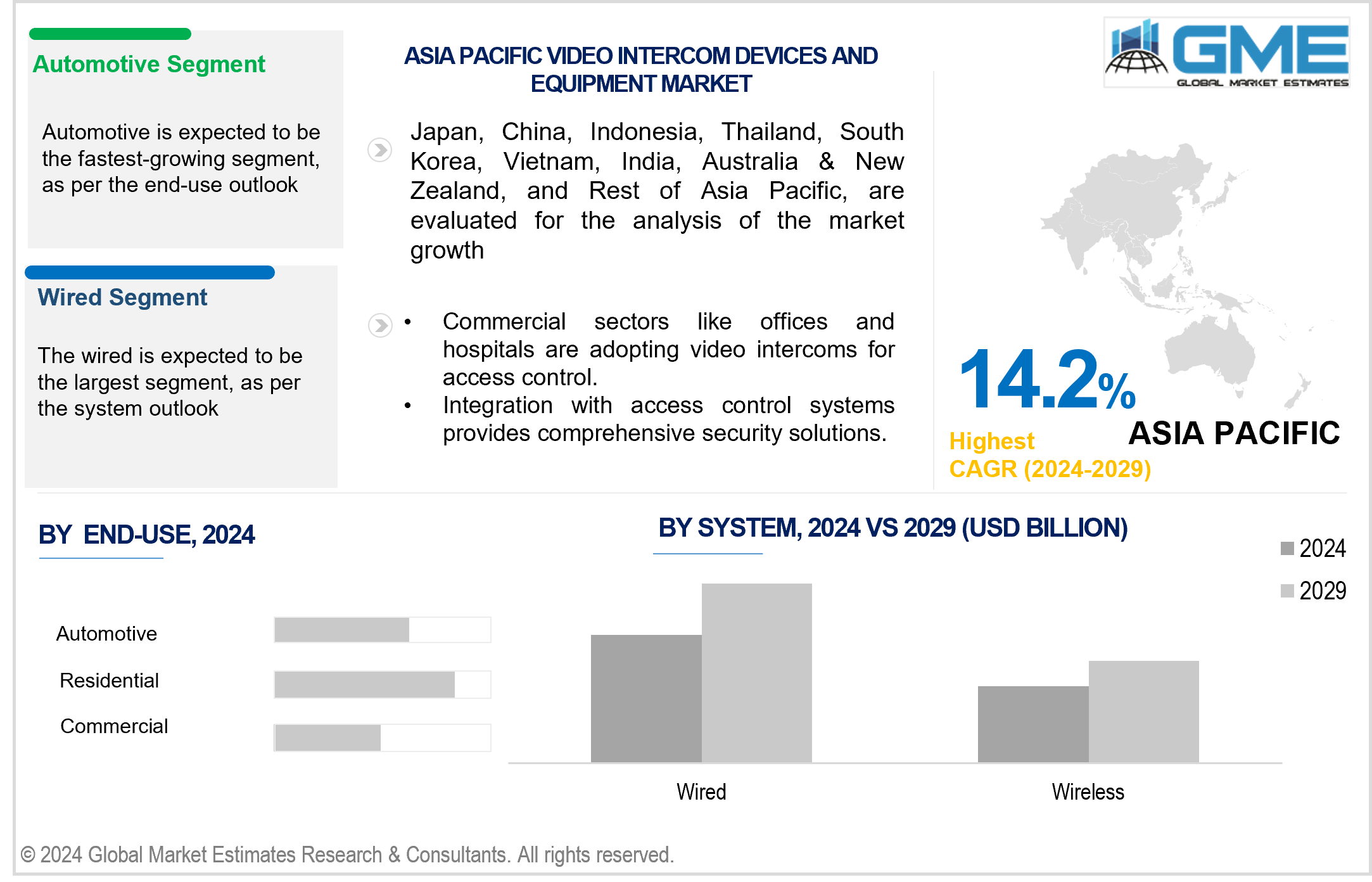

The wired segment is expected to hold the largest share of the market. Its growth is due to its greater durability and stability. Wired video intercom systems are less likely to interfere, resulting in consistent performance and clear communication. They are especially popular in commercial and high-security residential environments, where consistent connectivity is critical.

The wireless segment is expected to be the fastest-growing segment in the market from 2024-2029. The growth is attributed to its ease of installation, versatility, and cost-effectiveness. Wireless video intercom systems do not require substantial cabling, making them perfect for retrofit projects and modern smart homes. Wireless technological advancements and an increasing customer appetite for mobile-accessible, integrated security solutions are driving this segment's rapid adoption and growth.

The automotive segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. This growth is due to improved communication and security technologies being increasingly integrated into vehicles. As automobile manufacturers focus on improving in-car connections and passenger safety, the demand for advanced video intercom systems grows. These technologies improve communication between drivers and passengers while also increasing vehicle security.

The residential segment is expected to hold the largest share of the market. The segment's growth is due to rising demand for home security and convenience. Homeowners are investing more in video intercom systems to improve security, monitor visitors, and integrate with smart home devices. The growing popularity of smart homes, as well as the necessity for greater access control in residential structures, all contribute to this segment's domination.

North America is expected to be the largest region in the market. The primary reasons boosting the market growth in this region include strong technical infrastructure, high adoption of smart home and security systems, and considerable R&D investments. The region's strong economic position, combined with a greater emphasis on security and the presence of significant market participants, fuels demand for advanced video intercom solutions in both the residential and commercial sectors.

Asia Pacific is predicted to witness rapid growth during the forecast period. The regional market growth is attributed to urbanization, rising disposable incomes, and increasing smart city efforts. The region's burgeoning construction industry and growing middle-class population fuel demand for modern security solutions such as video intercom systems. Furthermore, the proliferation of low-cost technology, increased awareness of security requirements, and considerable expenditures in infrastructure development all contribute to the rapid adoption of video intercom devices in countries such as China, India, and Japan.

Aiphone Corporation, Alpha Communications, Comelit Group S.p.A., Dahua Technology USA Inc., Godrej.com, Honeywell International Inc., Legrand, Panasonic Holdings Corporation, SAMSUNG, and Siedle., among others, are some of the key players operating in the global video intercom devices and equipment market.

Please note: This is not an exhaustive list of companies profiled in the report.

In April 2023, Aiphone, a manufacturer of intercom and security communication products, announced the addition of its IX Series kit. The kit is a pre-programmed box set complete with a video intercom system that is ready to install right out of the box.

In February 2024, Dahua Technology, a leading provider of video-centric AIoT solutions, launched its "5E" initiative to enhance customer experience. This initiative, themed "Elevating Efficiency, Embracing Innovation," focuses on user-centered design, aiming to simplify installation, connection, configuration, usage, and maintenance of their products.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL VIDEO INTERCOM DEVICES AND EQUIPMENT MARKET, BY SYSTEM

4.1 Introduction

4.2 Video Intercom Devices and Equipment Market: System Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Wired

4.4.1 Wired Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Wireless

4.5.1 Wireless Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL VIDEO INTERCOM DEVICES AND EQUIPMENT MARKET, BY END-USE

5.1 Introduction

5.2 Video Intercom Devices and Equipment Market: End-use Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Automotive

5.4.1 Automotive Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Commercial

5.5.1 Commercial Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Government

5.6.1 Government Market Estimates and Forecast, 2021-2029 (USD Million)

5.7 Residential

5.7.1 Residential Market Estimates and Forecast, 2021-2029 (USD Million)

5.8 Others

5.8.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL VIDEO INTERCOM DEVICES AND EQUIPMENT MARKET, BY REGION

6.1 Introduction

6.2 North America Video Intercom Devices and Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.1 By System

6.2.2 By End-use

6.2.3 By Country

6.2.3.1 U.S. Video Intercom Devices and Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.1.1 By System

6.2.3.1.2 By End-use

6.2.3.2 Canada Video Intercom Devices and Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.2.1 By System

6.2.3.2.2 By End-use

6.2.3.3 Mexico Video Intercom Devices and Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.3.1 By System

6.2.3.3.2 By End-use

6.3 Europe Video Intercom Devices and Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.1 By System

6.3.2 By End-use

6.3.3 By Country

6.3.3.1 Germany Video Intercom Devices and Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.1.1 By System

6.3.3.1.2 By End-use

6.3.3.2 U.K. Video Intercom Devices and Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.2.1 By System

6.3.3.2.2 By End-use

6.3.3.3 France Video Intercom Devices and Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.3.1 By System

6.3.3.3.2 By End-use

6.3.3.4 Italy Video Intercom Devices and Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.4.1 By System

6.3.3.4.2 By End-use

6.3.3.5 Spain Video Intercom Devices and Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.5.1 By System

6.3.3.5.2 By End-use

6.3.3.6 Netherlands Video Intercom Devices and Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By System

6.3.3.6.2 By End-use

6.3.3.7 Rest of Europe Video Intercom Devices and Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By System

6.3.3.6.2 By End-use

6.4 Asia Pacific Video Intercom Devices and Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.1 By System

6.4.2 By End-use

6.4.3 By Country

6.4.3.1 China Video Intercom Devices and Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.1.1 By System

6.4.3.1.2 By End-use

6.4.3.2 Japan Video Intercom Devices and Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.2.1 By System

6.4.3.2.2 By End-use

6.4.3.3 India Video Intercom Devices and Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.3.1 By System

6.4.3.3.2 By End-use

6.4.3.4 South Korea Video Intercom Devices and Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.4.1 By System

6.4.3.4.2 By End-use

6.4.3.5 Singapore Video Intercom Devices and Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.5.1 By System

6.4.3.5.2 By End-use

6.4.3.6 Malaysia Video Intercom Devices and Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By System

6.4.3.6.2 By End-use

6.4.3.7 Thailand Video Intercom Devices and Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By System

6.4.3.6.2 By End-use

6.4.3.8 Indonesia Video Intercom Devices and Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.7.1 By System

6.4.3.7.2 By End-use

6.4.3.9 Vietnam Video Intercom Devices and Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.8.1 By System

6.4.3.8.2 By End-use

6.4.3.10 Taiwan Video Intercom Devices and Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.10.1 By System

6.4.3.10.2 By End-use

6.4.3.11 Rest of Asia Pacific Video Intercom Devices and Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.11.1 By System

6.4.3.11.2 By End-use

6.5 Middle East and Africa Video Intercom Devices and Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.1 By System

6.5.2 By End-use

6.5.3 By Country

6.5.3.1 Saudi Arabia Video Intercom Devices and Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.1.1 By System

6.5.3.1.2 By End-use

6.5.3.2 U.A.E. Video Intercom Devices and Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.2.1 By System

6.5.3.2.2 By End-use

6.5.3.3 Israel Video Intercom Devices and Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.3.1 By System

6.5.3.3.2 By End-use

6.5.3.4 South Africa Video Intercom Devices and Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.4.1 By System

6.5.3.4.2 By End-use

6.5.3.5 Rest of Middle East and Africa Video Intercom Devices and Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.5.1 By System

6.5.3.5.2 By End-use

6.6 Central and South America Video Intercom Devices and Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.1 By System

6.6.2 By End-use

6.6.3 By Country

6.6.3.1 Brazil Video Intercom Devices and Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.1.1 By System

6.6.3.1.2 By End-use

6.6.3.2 Argentina Video Intercom Devices and Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.2.1 By System

6.6.3.2.2 By End-use

6.6.3.3 Chile Video Intercom Devices and Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By System

6.6.3.3.2 By End-use

6.6.3.3 Rest of Central and South America Video Intercom Devices and Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By System

6.6.3.3.2 By End-use

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 North America

7.3.2 Europe

7.3.3 Asia Pacific

7.3.4 Rest of the World

7.4 Company Profiles

7.4.1 Aiphone Corporation

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Alpha Communications

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 Comelit Group S.p.A.

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 Dahua Technology USA Inc.

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 Godrej.com

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 SAMSUNG

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 Honeywell International Inc.

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 Legrand

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 Panasonic Holdings Corporation

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 Siedle

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 Global Video Intercom Devices and Equipment Market, By System, 2021-2029 (USD Mllion)

2 Wired Market, By Region, 2021-2029 (USD Mllion)

3 Wireless Market, By Region, 2021-2029 (USD Mllion)

4 Global Video Intercom Devices and Equipment Market, By End-use, 2021-2029 (USD Mllion)

5 Automotive Market, By Region, 2021-2029 (USD Mllion)

6 Commercial Market, By Region, 2021-2029 (USD Mllion)

7 Government Market, By Region, 2021-2029 (USD Mllion)

8 Residential Market, By Region, 2021-2029 (USD Mllion)

9 Others Market, By Region, 2021-2029 (USD Mllion)

10 Regional Analysis, 2021-2029 (USD Mllion)

11 North America Video Intercom Devices and Equipment Market, By System, 2021-2029 (USD Mllion)

12 North America Video Intercom Devices and Equipment Market, By End-use, 2021-2029 (USD Mllion)

13 North America Video Intercom Devices and Equipment Market, By COUNTRY, 2021-2029 (USD Mllion)

14 U.S. Video Intercom Devices and Equipment Market, By System, 2021-2029 (USD Mllion)

15 U.S. Video Intercom Devices and Equipment Market, By End-use, 2021-2029 (USD Mllion)

16 Canada Video Intercom Devices and Equipment Market, By System, 2021-2029 (USD Mllion)

17 Canada Video Intercom Devices and Equipment Market, By End-use, 2021-2029 (USD Mllion)

18 Mexico Video Intercom Devices and Equipment Market, By System, 2021-2029 (USD Mllion)

19 Mexico Video Intercom Devices and Equipment Market, By End-use, 2021-2029 (USD Mllion)

20 Europe Video Intercom Devices and Equipment Market, By System, 2021-2029 (USD Mllion)

21 Europe Video Intercom Devices and Equipment Market, By End-use, 2021-2029 (USD Mllion)

22 Europe Video Intercom Devices and Equipment Market, By Country, 2021-2029 (USD Mllion)

23 Germany Video Intercom Devices and Equipment Market, By System, 2021-2029 (USD Mllion)

24 Germany Video Intercom Devices and Equipment Market, By End-use, 2021-2029 (USD Mllion)

25 U.K. Video Intercom Devices and Equipment Market, By System, 2021-2029 (USD Mllion)

26 U.K. Video Intercom Devices and Equipment Market, By End-use, 2021-2029 (USD Mllion)

27 France Video Intercom Devices and Equipment Market, By System, 2021-2029 (USD Mllion)

28 France Video Intercom Devices and Equipment Market, By End-use, 2021-2029 (USD Mllion)

29 Italy Video Intercom Devices and Equipment Market, By System, 2021-2029 (USD Mllion)

30 Italy Video Intercom Devices and Equipment Market, By End-use, 2021-2029 (USD Mllion)

31 Spain Video Intercom Devices and Equipment Market, By System, 2021-2029 (USD Mllion)

32 Spain Video Intercom Devices and Equipment Market, By End-use, 2021-2029 (USD Mllion)

33 Netherlands Video Intercom Devices and Equipment Market, By System, 2021-2029 (USD Mllion)

34 Netherlands Video Intercom Devices and Equipment Market, By End-use, 2021-2029 (USD Mllion)

35 Rest Of Europe Video Intercom Devices and Equipment Market, By System, 2021-2029 (USD Mllion)

36 Rest Of Europe Video Intercom Devices and Equipment Market, By End-use, 2021-2029 (USD Mllion)

37 Asia Pacific Video Intercom Devices and Equipment Market, By System, 2021-2029 (USD Mllion)

38 Asia Pacific Video Intercom Devices and Equipment Market, By End-use, 2021-2029 (USD Mllion)

39 Asia Pacific Video Intercom Devices and Equipment Market, By Country, 2021-2029 (USD Mllion)

40 China Video Intercom Devices and Equipment Market, By System, 2021-2029 (USD Mllion)

41 China Video Intercom Devices and Equipment Market, By End-use, 2021-2029 (USD Mllion)

42 Japan Video Intercom Devices and Equipment Market, By System, 2021-2029 (USD Mllion)

43 Japan Video Intercom Devices and Equipment Market, By End-use, 2021-2029 (USD Mllion)

44 India Video Intercom Devices and Equipment Market, By System, 2021-2029 (USD Mllion)

45 India Video Intercom Devices and Equipment Market, By End-use, 2021-2029 (USD Mllion)

46 South Korea Video Intercom Devices and Equipment Market, By System, 2021-2029 (USD Mllion)

47 South Korea Video Intercom Devices and Equipment Market, By End-use, 2021-2029 (USD Mllion)

48 Singapore Video Intercom Devices and Equipment Market, By System, 2021-2029 (USD Mllion)

49 Singapore Video Intercom Devices and Equipment Market, By End-use, 2021-2029 (USD Mllion)

50 Thailand Video Intercom Devices and Equipment Market, By System, 2021-2029 (USD Mllion)

51 Thailand Video Intercom Devices and Equipment Market, By End-use, 2021-2029 (USD Mllion)

52 Malaysia Video Intercom Devices and Equipment Market, By System, 2021-2029 (USD Mllion)

53 Malaysia Video Intercom Devices and Equipment Market, By End-use, 2021-2029 (USD Mllion)

54 Indonesia Video Intercom Devices and Equipment Market, By System, 2021-2029 (USD Mllion)

55 Indonesia Video Intercom Devices and Equipment Market, By End-use, 2021-2029 (USD Mllion)

56 Vietnam Video Intercom Devices and Equipment Market, By System, 2021-2029 (USD Mllion)

57 Vietnam Video Intercom Devices and Equipment Market, By End-use, 2021-2029 (USD Mllion)

58 Taiwan Video Intercom Devices and Equipment Market, By System, 2021-2029 (USD Mllion)

59 Taiwan Video Intercom Devices and Equipment Market, By End-use, 2021-2029 (USD Mllion)

60 Rest of APAC Video Intercom Devices and Equipment Market, By System, 2021-2029 (USD Mllion)

61 Rest of APAC Video Intercom Devices and Equipment Market, By End-use, 2021-2029 (USD Mllion)

62 Middle East and Africa Video Intercom Devices and Equipment Market, By System, 2021-2029 (USD Mllion)

63 Middle East and Africa Video Intercom Devices and Equipment Market, By End-use, 2021-2029 (USD Mllion)

64 Middle East and Africa Video Intercom Devices and Equipment Market, By Country, 2021-2029 (USD Mllion)

65 Saudi Arabia Video Intercom Devices and Equipment Market, By System, 2021-2029 (USD Mllion)

66 Saudi Arabia Video Intercom Devices and Equipment Market, By End-use, 2021-2029 (USD Mllion)

67 UAE Video Intercom Devices and Equipment Market, By System, 2021-2029 (USD Mllion)

68 UAE Video Intercom Devices and Equipment Market, By End-use, 2021-2029 (USD Mllion)

69 Israel Video Intercom Devices and Equipment Market, By System, 2021-2029 (USD Mllion)

70 Israel Video Intercom Devices and Equipment Market, By End-use, 2021-2029 (USD Mllion)

71 South Africa Video Intercom Devices and Equipment Market, By System, 2021-2029 (USD Mllion)

72 South Africa Video Intercom Devices and Equipment Market, By End-use, 2021-2029 (USD Mllion)

73 Rest Of Middle East and Africa Video Intercom Devices and Equipment Market, By System, 2021-2029 (USD Mllion)

74 Rest Of Middle East and Africa Video Intercom Devices and Equipment Market, By End-use, 2021-2029 (USD Mllion)

75 Central and South America Video Intercom Devices and Equipment Market, By System, 2021-2029 (USD Mllion)

76 Central and South America Video Intercom Devices and Equipment Market, By End-use, 2021-2029 (USD Mllion)

77 Central and South America Video Intercom Devices and Equipment Market, By Country, 2021-2029 (USD Mllion)

78 Brazil Video Intercom Devices and Equipment Market, By System, 2021-2029 (USD Mllion)

79 Brazil Video Intercom Devices and Equipment Market, By End-use, 2021-2029 (USD Mllion)

80 Chile Video Intercom Devices and Equipment Market, By System, 2021-2029 (USD Mllion)

81 Chile Video Intercom Devices and Equipment Market, By End-use, 2021-2029 (USD Mllion)

82 Argentina Video Intercom Devices and Equipment Market, By System, 2021-2029 (USD Mllion)

83 Argentina Video Intercom Devices and Equipment Market, By End-use, 2021-2029 (USD Mllion)

84 Rest Of Central and South America Video Intercom Devices and Equipment Market, By System, 2021-2029 (USD Mllion)

85 Rest Of Central and South America Video Intercom Devices and Equipment Market, By End-use, 2021-2029 (USD Mllion)

86 Aiphone Corporation: Products & Services Offering

87 Alpha Communications: Products & Services Offering

88 Comelit Group S.p.A.: Products & Services Offering

89 Dahua Technology USA Inc.: Products & Services Offering

90 Godrej.com: Products & Services Offering

91 SAMSUNG: Products & Services Offering

92 Honeywell International Inc. : Products & Services Offering

93 Legrand: Products & Services Offering

94 Panasonic Holdings Corporation, Inc: Products & Services Offering

95 Siedle: Products & Services Offering

96 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Video Intercom Devices and Equipment Market Overview

2 Global Video Intercom Devices and Equipment Market Value From 2021-2029 (USD Mllion)

3 Global Video Intercom Devices and Equipment Market Share, By System (2023)

4 Global Video Intercom Devices and Equipment Market Share, By End-use (2023)

5 Global Video Intercom Devices and Equipment Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Video Intercom Devices and Equipment Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Video Intercom Devices and Equipment Market

10 Impact Of Challenges On The Global Video Intercom Devices and Equipment Market

11 Porter’s Five Forces Analysis

12 Global Video Intercom Devices and Equipment Market: By System Scope Key Takeaways

13 Global Video Intercom Devices and Equipment Market, By System Segment: Revenue Growth Analysis

14 Wired Market, By Region, 2021-2029 (USD Mllion)

15 Wireless Market, By Region, 2021-2029 (USD Mllion)

16 Global Video Intercom Devices and Equipment Market: By End-use Scope Key Takeaways

17 Global Video Intercom Devices and Equipment Market, By End-use Segment: Revenue Growth Analysis

18 Automotive Market, By Region, 2021-2029 (USD Mllion)

19 Commercial Market, By Region, 2021-2029 (USD Mllion)

20 Government Market, By Region, 2021-2029 (USD Mllion)

21 Residential Market, By Region, 2021-2029 (USD Mllion)

22 Others Market, By Region, 2021-2029 (USD Mllion)

23 Regional Segment: Revenue Growth Analysis

24 Global Video Intercom Devices and Equipment Market: Regional Analysis

25 North America Video Intercom Devices and Equipment Market Overview

26 North America Video Intercom Devices and Equipment Market, By System

27 North America Video Intercom Devices and Equipment Market, By End-use

28 North America Video Intercom Devices and Equipment Market, By Country

29 U.S. Video Intercom Devices and Equipment Market, By System

30 U.S. Video Intercom Devices and Equipment Market, By End-use

31 Canada Video Intercom Devices and Equipment Market, By System

32 Canada Video Intercom Devices and Equipment Market, By End-use

33 Mexico Video Intercom Devices and Equipment Market, By System

34 Mexico Video Intercom Devices and Equipment Market, By End-use

35 Four Quadrant Positioning Matrix

36 Company Market Share Analysis

37 Aiphone Corporation: Company Snapshot

38 Aiphone Corporation: SWOT Analysis

39 Aiphone Corporation: Geographic Presence

40 Alpha Communications: Company Snapshot

41 Alpha Communications: SWOT Analysis

42 Alpha Communications: Geographic Presence

43 Comelit Group S.p.A.: Company Snapshot

44 Comelit Group S.p.A.: SWOT Analysis

45 Comelit Group S.p.A.: Geographic Presence

46 Dahua Technology USA Inc.: Company Snapshot

47 Dahua Technology USA Inc.: Swot Analysis

48 Dahua Technology USA Inc.: Geographic Presence

49 Godrej.com: Company Snapshot

50 Godrej.com: SWOT Analysis

51 Godrej.com: Geographic Presence

52 SAMSUNG: Company Snapshot

53 SAMSUNG: SWOT Analysis

54 SAMSUNG: Geographic Presence

55 Honeywell International Inc. : Company Snapshot

56 Honeywell International Inc. : SWOT Analysis

57 Honeywell International Inc. : Geographic Presence

58 Legrand: Company Snapshot

59 Legrand: SWOT Analysis

60 Legrand: Geographic Presence

61 Panasonic Holdings Corporation, Inc.: Company Snapshot

62 Panasonic Holdings Corporation, Inc.: SWOT Analysis

63 Panasonic Holdings Corporation, Inc.: Geographic Presence

64 Siedle: Company Snapshot

65 Siedle: SWOT Analysis

66 Siedle: Geographic Presence

67 Other Companies: Company Snapshot

68 Other Companies: SWOT Analysis

69 Other Companies: Geographic Presence

The Global Video Intercom Devices and Equipment Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Video Intercom Devices and Equipment Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS