Global Wearable Injectors Market Size, Trends & Analysis - Forecasts to 2026 By Type (On-Body, Off-Body (Infusion Pump Devices)), By Therapy (Immuno-Oncology, Diabetes, Cardiovascular Diseases, Parkinsons Disease, Thalassemia, Primary Immunodeficiency Disease), By Technology (Spring-based, Motor-driven), By End-Use (Hospitals, Clinics, Homecare, Others); Competitive Landscape, Company Market Share Analysis, and Competitor Analysis; By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Company Market Share Analysis & Competitor Analysis

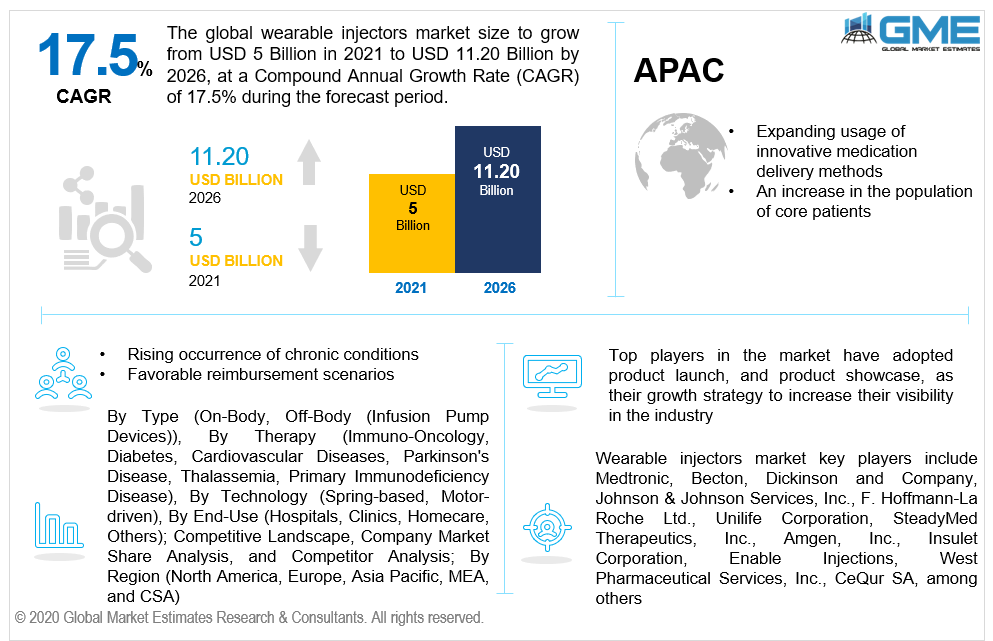

The wearable injectors market is estimated to be valued at USD 5 Billion in 2021 and is projected to reach USD 11.20 Billion by 2026 at a CAGR of 17.5%. Globally, the rising occurrence of chronic conditions such as diabetes and cardiovascular diseases is likely to fuel the global wearable injector market's rise throughout the forecast period. Furthermore, favorable reimbursement scenarios, particularly in developed nations, are likely to drive the target market's expansion throughout the forecast period. An additional aspect likely to assist the target market's expansion throughout the forecast period is producers' deployment of technologically advanced products in order to obtain a competitive advantage.

Patients have been pushed to transition to more cost-effective options because of the expenses and complications connected with conventional setups, resulting in a preference for such injectors. In addition, when contrasted to syringes, these injectors provide benefits including simplicity of delivery, pain control, and decreased inconvenience, all of which contribute to market growth. The possibility of contracting COVID-19 has prompted patients, particularly those with chronic conditions, to choose self-administration of treatment at home. Healthcare professionals are also reserving supplies for acute treatment or individuals affected with COVID-19. Thus, remote care solutions, including wearable injectors, are in high demand. As a result, the wearable injectors market size is foreseen to increase steadily and positively during this time, notwithstanding the COVID-19 epidemic.

Due to their ability to administer a large proportion of viscous compositions, wearable injections are rapidly acquiring market share. In hospital settings, administering medications by intravenous (IV) infusion is costly. Subcutaneous injections that are self-administered are estimated to save 30–70% of expenditure. Furthermore, traditional techniques of delivery carry dangers, including incorrect doses and needle stick accidents. Wearable injectable devices have become more popular as the number of biological medications that are not suited for oral administration has multiplied. The necessity for innovative injection techniques is being emphasized by higher dosage amounts and viscous compositions of these medications.

Nonetheless, the global wearable injector market is foreseen to be hampered by the existence and demand for substitute drug delivery mechanisms. Furthermore, an unfavorable reimbursement environment, particularly in emerging countries, is likely to restrain the global market's growth throughout the forecast period. Since biologics and mAbs must be delivered through the parenteral route, an increasing focus on their usage to cure infections like rheumatoid arthritis, cardiovascular disease, and cancer will create a surge in the wearable injectors market opportunities available globally. According to PhRMA (Pharmaceutical Research and Manufacturers of America), there are 907 biologics in research, and research & development effort in this area is likely to increase significantly in the future years.

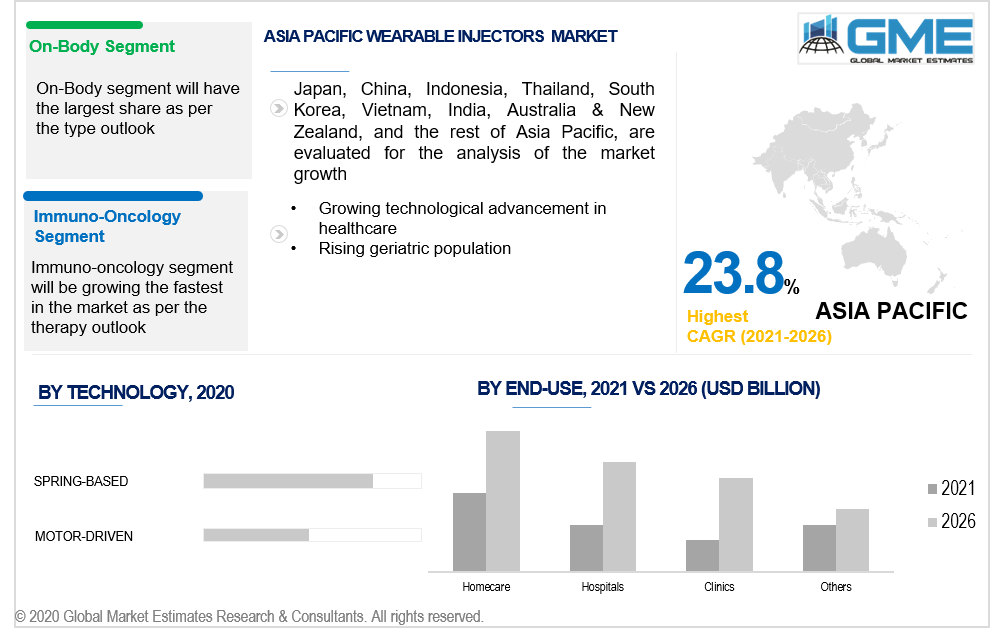

Depending on the type, the market is categorized as on-body and off-body. By type, the on-body segment is likely to take the lead in the global market. These feel great against the skin, especially on the tummy. They're also water-resistant and easy to use in-home care settings. Nevertheless, off-body injectors are expected to rise the most in future years, according to the estimate. Due to the disadvantages of on-body injectors, including uncomfortable withdrawal, contact dermatitis and discomfort, and adhesive compatibility difficulties, off-body injectors have become more popular.

Depending on the therapy, the market is categorized as immuno-oncology, diabetes, cardiovascular diseases, Parkinson’s disease, thalassemia, and primary immunodeficiency disease. Due to the increasing occurrence of cancer and a growing movement towards patient self-administration of drugs, the immuno-oncology category is predicted to contribute to the highest share of the wearable injector market. According to new estimates of Globocan 2020, issued by The International Agency for Research on Cancer (IARC), the global cancer burden has risen to 19.3 million cases and 10 million cancer deaths in 2020.

Depending on the technology, the market is categorized as spring-based and motor-driven. The market is expected to be dominated by spring-based products. This is due to the growing popularity of adhesive patches, which are user-friendly solutions that allow patients to correctly distribute drugs intravenously by pushing one or more keys on the instrument.

Depending on the end-use, the market is categorized as hospitals, clinics, home care, and others. The market is projected to be dominated by the home care segment. This is related to the growing demand for self-medication and the escalating need to reduce healthcare expenses. In particular, the market is foreseen to rise due to the rising demand for technologically advanced drug administration, which reduces hospitalization rates and necessitates little competence.

As per the geographical analysis, the market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America). The market will be dominated by the North American region. Furthermore, throughout the forecast period, North America is expected to grow at a fast pace. The market for such injectors in North America is likely to expand due to considerations, including the increased frequency of chronic diseases, advantageous reimbursement scenarios, and the participation of significant industry participants in the area.

Over the forecast period, Asia Pacific is expected to be the fastest-growing regional market. This might be linked to the area's growing geriatric population, particularly in Japan, as well as a large diabetic demographic in India and China, as well as a spike in the proportion of chronic illnesses. An additional crucial component envisioned to support market expansion in the area over the forecast period is escalating healthcare expenditure and increased usage of innovative medication delivery methods. The growing use of recyclable technology and the introduction of technologically improved medication delivery systems are driving the wearable injector market in the United States and Japan. Convenient accessibility, improved commercialization, effectiveness in long-term doses, and, most importantly, an increase in the population of patients, are likely to fuel wearable injector demand in these areas.

Wearable injectors market key players include Medtronic, Becton, Dickinson and Company, Johnson & Johnson Services, Inc., F. Hoffmann-La Roche Ltd., Unilife Corporation, SteadyMed Therapeutics, Inc., Amgen, Inc., Insulet Corporation, Enable Injections, West Pharmaceutical Services, Inc., CeQur SA, among others.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Wearable Injectors Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Therapy Overview

2.1.4 Technology Overview

2.1.5 End-Use Overview

2.1.6 Regional Overview

Chapter 3 Wearable Injectors Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing Occurrence Of Chronic Conditions

3.3.1.2 Increasing Investments in Research and Development Activities

3.3.2 Industry Challenges

3.3.2.1 Existence And Demand For Substitute Drug Delivery Mechanisms

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Therapy Growth Scenario

3.4.3 Technology Growth Scenario

3.4.4 End-Use Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Wearable Injectors Market, By Type

4.1 Type Outlook

4.2 On-Body

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Off-Body (Infusion Pump Devices)

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Wearable Injectors Market, By Therapy

5.1 Therapy Outlook

5.2 Immuno-Oncology

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 Diabetes

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

5.4 Cardiovascular Diseases

5.4.1 Market Size, By Region, 2019-2026 (USD Million)

5.5 Parkinson's Disease

5.5.1 Market Size, By Region, 2019-2026 (USD Million)

5.6 Thalassemia

5.6.1 Market Size, By Region, 2019-2026 (USD Million)

5.7 Primary Immunodeficiency Disease

5.7.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Wearable Injectors Market, By Technology

6.1 Technology Outlook

6.2 Spring-based

6.2.1 Market Size, By Region, 2019-2026 (USD Million)

6.3 Motor-driven

6.3.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 7 Wearable Injectors Market, By End-Use

7.1 End-Use Outlook

7.2 Hospitals

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

7.4 Clinics

7.4.1 Market Size, By Region, 2019-2026 (USD Million)

7.5 Homecare

7.5.1 Market Size, By Region, 2019-2026 (USD Million)

7.6 Others

7.6.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 8 Wearable Injectors Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country, 2019-2026 (USD Million)

8.2.2 Market Size, By Type, 2019-2026 (USD Million)

8.2.3 Market Size, By Therapy, 2019-2026 (USD Million)

8.2.4 Market Size, By Technology, 2019-2026 (USD Million)

8.2.5 Market Size, By End-Use, 2019-2026 (USD Million)

8.2.6 U.S.

8.2.6.1 Market Size, By Type, 2019-2026 (USD Million)

8.2.6.2 Market Size, By Therapy, 2019-2026 (USD Million)

8.2.6.3 Market Size, By Technology, 2019-2026 (USD Million)

8.2.6.4 Market Size, By End-Use, 2019-2026 (USD Million)

8.2.7 Canada

8.2.7.1 Market Size, By Type, 2019-2026 (USD Million)

8.2.7.2 Market Size, By Therapy, 2019-2026 (USD Million)

8.2.7.3 Market Size, By Technology, 2019-2026 (USD Million)

8.2.7.4 Market Size, By End-Use, 2019-2026 (USD Million)

8.3 Europe

8.3.1 Market Size, By Country, 2019-2026 (USD Million)

8.3.2 Market Size, By Type, 2019-2026 (USD Million)

8.3.3 Market Size, By Therapy, 2019-2026 (USD Million)

8.3.4 Market Size, By Technology, 2019-2026 (USD Million)

8.3.5 Market Size, By End-Use, 2019-2026 (USD Million)

8.3.6 Germany

8.3.6.1 Market Size, By Type, 2019-2026 (USD Million)

8.3.6.2 Market Size, By Therapy, 2019-2026 (USD Million)

8.3.6.3 Market Size, By Technology, 2019-2026 (USD Million)

8.3.6.4 Market Size, By End-Use, 2019-2026 (USD Million)

8.3.7 UK

8.3.7.1 Market Size, By Type, 2019-2026 (USD Million)

8.3.7.2 Market Size, By Therapy, 2019-2026 (USD Million)

8.3.7.3 Market Size, By Technology, 2019-2026 (USD Million)

8.3.7.4 Market Size, By End-Use, 2019-2026 (USD Million)

8.3.8 France

8.3.8.1 Market Size, By Type, 2019-2026 (USD Million)

8.3.8.2 Market Size, By Therapy, 2019-2026 (USD Million)

8.3.8.3 Market Size, By Technology, 2019-2026 (USD Million)

8.3.8.4 Market Size, By End-Use, 2019-2026 (USD Million)

8.3.9 Italy

8.3.9.1 Market Size, By Type, 2019-2026 (USD Million)

8.3.9.2 Market Size, By Therapy, 2019-2026 (USD Million)

8.3.9.3 Market Size, By Technology, 2019-2026 (USD Million)

8.3.9.4 Market Size, By End-Use, 2019-2026 (USD Million)

8.3.10 Spain

8.3.10.1 Market Size, By Type, 2019-2026 (USD Million)

8.3.10.2 Market Size, By Therapy, 2019-2026 (USD Million)

8.3.10.3 Market Size, By Technology, 2019-2026 (USD Million)

8.3.10.4 Market Size, By End-Use, 2019-2026 (USD Million)

8.3.11 Russia

8.3.11.1 Market Size, By Type, 2019-2026 (USD Million)

8.3.11.2 Market Size, By Therapy, 2019-2026 (USD Million)

8.3.11.3 Market Size, By Technology, 2019-2026 (USD Million)

8.3.11.4 Market Size, By End-Use, 2019-2026 (USD Million)

8.4 Asia Pacific

8.4.1 Market Size, By Country, 2019-2026 (USD Million)

8.4.2 Market Size, By Type, 2019-2026 (USD Million)

8.4.3 Market Size, By Therapy, 2019-2026 (USD Million)

8.4.4 Market Size, By Technology, 2019-2026 (USD Million)

8.4.5 Market Size, By End-Use, 2019-2026 (USD Million)

8.4.6 China

8.4.6.1 Market Size, By Type, 2019-2026 (USD Million)

8.4.6.2 Market Size, By Therapy, 2019-2026 (USD Million)

8.4.6.3 Market Size, By Technology, 2019-2026 (USD Million)

8.4.6.4 Market Size, By End-Use, 2019-2026 (USD Million)

8.4.7 India

8.4.7.1 Market Size, By Type, 2019-2026 (USD Million)

8.4.7.2 Market Size, By Therapy, 2019-2026 (USD Million)

8.4.7.3 Market Size, By Technology, 2019-2026 (USD Million)

8.4.7.4 Market Size, By End-Use, 2019-2026 (USD Million)

8.4.8 Japan

8.4.8.1 Market Size, By Type, 2019-2026 (USD Million)

8.4.8.2 Market Size, By Therapy, 2019-2026 (USD Million)

8.4.8.3 Market Size, By Technology, 2019-2026 (USD Million)

8.4.8.4 Market Size, By End-Use, 2019-2026 (USD Million)

8.4.9 Australia

8.4.9.1 Market Size, By Type, 2019-2026 (USD Million)

8.4.9.2 Market size, By Therapy, 2019-2026 (USD Million)

8.4.9.3 Market size, By Technology, 2019-2026 (USD Million)

8.4.9.4 Market size, By End-Use, 2019-2026 (USD Million)

8.4.10 South Korea

8.4.10.1 Market Size, By Type, 2019-2026 (USD Million)

8.4.10.2 Market Size, By Therapy, 2019-2026 (USD Million)

8.4.10.3 Market Size, By Technology, 2019-2026 (USD Million)

8.4.10.4 Market Size, By End-Use, 2019-2026 (USD Million)

8.5 Latin America

8.5.1 Market Size, By Country, 2019-2026 (USD Million)

8.5.2 Market Size, By Type, 2019-2026 (USD Million)

8.5.3 Market Size, By Therapy, 2019-2026 (USD Million)

8.5.4 Market Size, By Technology, 2019-2026 (USD Million)

8.5.5 Market Size, By End-Use, 2019-2026 (USD Million)

8.5.6 Brazil

8.5.6.1 Market Size, By Type, 2019-2026 (USD Million)

8.5.6.2 Market Size, By Therapy, 2019-2026 (USD Million)

8.5.6.3 Market Size, By Technology, 2019-2026 (USD Million)

8.5.6.4 Market Size, By End-Use, 2019-2026 (USD Million)

8.5.7 Mexico

8.5.7.1 Market Size, By Type, 2019-2026 (USD Million)

8.5.7.2 Market Size, By Therapy, 2019-2026 (USD Million)

8.5.7.3 Market Size, By Technology, 2019-2026 (USD Million)

8.5.7.4 Market Size, By End-Use, 2019-2026 (USD Million)

8.5.8 Argentina

8.5.8.1 Market Size, By Type, 2019-2026 (USD Million)

8.5.8.2 Market Size, By Therapy, 2019-2026 (USD Million)

8.5.8.3 Market Size, By Technology, 2019-2026 (USD Million)

8.5.8.4 Market Size, By End-Use, 2019-2026 (USD Million)

8.6 MEA

8.6.1 Market Size, By Country, 2019-2026 (USD Million)

8.6.2 Market Size, By Type, 2019-2026 (USD Million)

8.6.3 Market Size, By Therapy, 2019-2026 (USD Million)

8.6.4 Market Size, By Technology, 2019-2026 (USD Million)

8.6.5 Market Size, By End-Use, 2019-2026 (USD Million)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Type, 2019-2026 (USD Million)

8.6.6.2 Market Size, By Therapy, 2019-2026 (USD Million)

8.6.6.3 Market Size, By Technology, 2019-2026 (USD Million)

8.6.6.4 Market Size, By End-Use, 2019-2026 (USD Million)

8.6.7 UAE

8.6.7.1 Market Size, By Type, 2019-2026 (USD Million)

8.6.7.2 Market Size, By Therapy, 2019-2026 (USD Million)

8.6.7.3 Market Size, By Technology, 2019-2026 (USD Million)

8.6.7.4 Market Size, By End-Use, 2019-2026 (USD Million)

8.6.8 South Africa

8.6.8.1 Market Size, By Type, 2019-2026 (USD Million)

8.6.8.2 Market Size, By Therapy, 2019-2026 (USD Million)

8.6.8.3 Market Size, By Technology, 2019-2026 (USD Million)

8.6.8.4 Market Size, By End-Use, 2019-2026 (USD Million)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 Medtronic

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 Becton, Dickinson and Company

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 Johnson & Johnson Services, Inc.

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 F. Hoffmann-La Roche Ltd.

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 Unilife Corporation

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 SteadyMed Therapeutics, Inc.

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 Amgen, Inc.

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 Insulet Corporation

7.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

9.10 Enable Injections

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info Graphic Analysis

9.11 West Pharmaceutical Services, Inc.

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info Graphic Analysis

9.12 CeQur SA

9.12.1 Company Overview

9.12.2 Financial Analysis

9.12.3 Strategic Positioning

9.12.4 Info Graphic Analysis

9.13 Other Companies

9.13.1 Company Overview

9.13.2 Financial Analysis

9.13.3 Strategic Positioning

9.13.4 Info Graphic Analysis

The Global Wearable Injectors Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Wearable Injectors Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS