Global Wireless In-Flight Entertainment Market Size, Trends & Analysis - Forecasts to 2026 By Aircraft Type (Narrow-Body, Wide-Body, Regional Jet), By Fitment Type (Retrofit, Line Fit), By Hardware (Antennas, WAPs, Modems, Others), By Technology (ATG, Ku-Band, L-Band, Ka-Band), By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Company Market Share Analysis & Competitor Analysis

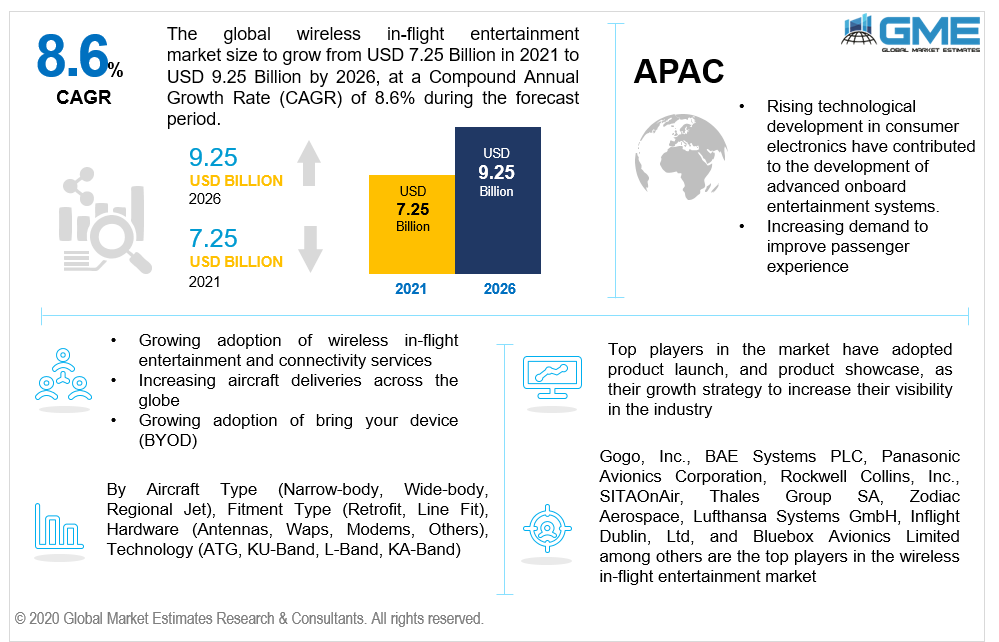

The wireless in-flight entertainment market will reach USD 7.25 billion in 2021 and is projected to reach USD 9.25 billion by 2026 at a CAGR of 8.6%. The major factors which contribute to the wireless in-flight entertainment market growth are the rising popularity of wireless networking in the entertainment industry, growing adoption of personal electronic devices, the rising trend of bring your laptop, increasing demand for high-end travel passenger experience, and growing demand for inflight networking.

Airlines' dependency on in-flight entertainment is a major source of revenue in the market. The implementation of Wi-Fi systems in planes has benefited both airline companies and passengers in terms of revenue generation and entertainment. These systems aid airlines in increasing their sales and revenue growth and thus help the market grow rapidly from 2021-2026.

Inflight entertainment (IFE) refers to the entertainment available for aircraft passengers which uses wireless IFE systems and Small LED TVs that provides entertainment such as computer games, movie and film video, and audio clips, etc. These products work on a Wi-Fi-activated computer. The airline industry is significantly improvising its onboard connectivity through wireless in-flight entertainment to improve the passenger travel experience. This will positively affect the market during the forecast period.

Furthermore, there has been an increase in demand for onboard connectivity solutions that lets passengers share data in real-time data mode while traveling. Also, the political and regulatory climate information is critical to the airline industry. Hence, these factors are leading to increasing demand for IFE and ultimately helping the market grow rapidly. Many countries, like India, have made it illegal to use PEDs in transmitting mode at any time during the flight. Even though the Indian civil aviation authority has banned in-flight voice communication, several European airlines enable customers to make phone calls using satellite-based technology. The public's growing acceptance of the Bring Your Device (BYOD) trend can be attributed to the growing popularity of wireless communication.

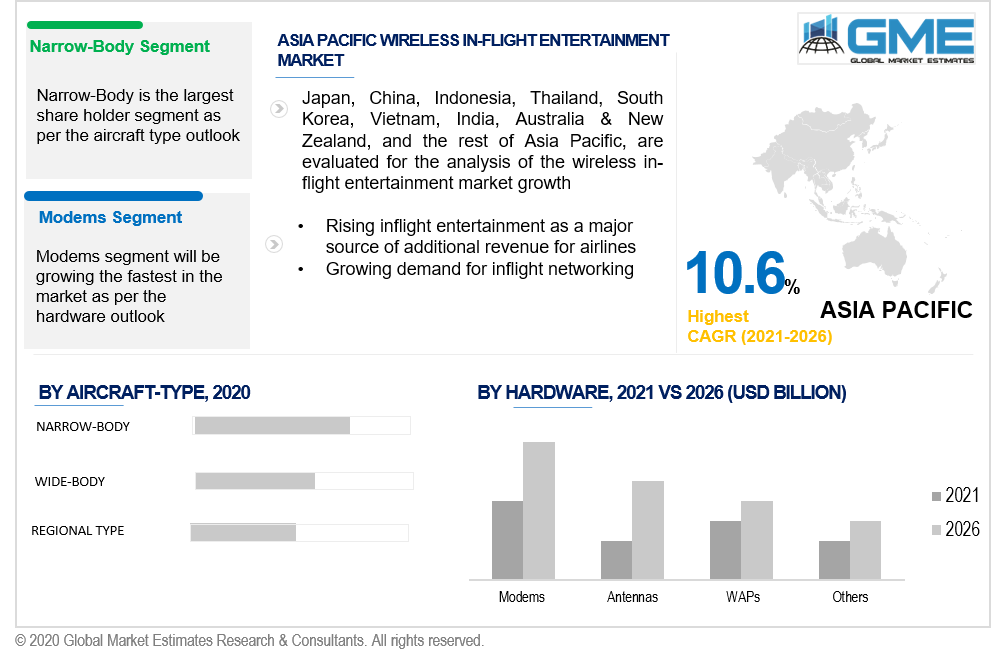

Based on aircraft type, the market is segmented into narrow-body, wide-body, and regional jet. The narrow-body aircraft type segment is expected to hold the largest market share over the forecast period. This is attributed to the increasing demand for narrow-body aircraft on short-haul flights. The rising use of W-IFE systems in single-aisle and twin-aisle aircraft is helping the market segment grow rapidly.

During the forecast period, regional jets are predicted to be the fastest-growing segment. The introduction of wireless in-flight connectivity (W-IFEC) and PED entertainment systems in regional airplane flights is propelling the growth of this segment.

Based on fitment type, the market is segmented into retrofit, and line fit. During the forecast period, retrofit is expected to become the dominant segment. Airline companies are installing retrofit wireless in-flight technologies to reduce the total weight of the plane and improve customer comfort, and boost per-flight profit margins.

Based on hardware, the market is segmented into antennas, WAPs, and modems, among others. Because of the advent of next-generation airborne internet and airborne network systems, modems are projected to be the fastest-growing segment over the forecast period. Airborne Internet (AI) and Airborne Network (AN) systems are two types of airborne internet and network technologies. ViaSat, Inc. recently unveiled a unique Ka/Ku antenna that is expected to provide uninterrupted coverage across Europe and North America. This will help the market segment grow rapidly.

Based on technology, the market is segmented into ATG, Ku-Band, L-Band, and Ka-Band. As a result of the positive impact of W-IFEC technology in the airline industry, as well as the growing economy in various regions, the segment of ATG will be growing the fastest in the market from 2021 to 2026.

As per the geographical analysis, the market can be classified into North America (the US, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, South Korea, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, UAE, and Rest of the Middle East & Africa, and Central & South America (Brazil, Argentina, Peru, and Rest of South America). North America is estimated to hold the largest share of the market and is also expected to continue to be the dominant segment during the forecast period of 2021-2026. The increasing spending power of passengers on air travel, and rising demand for audio or video format for entertainment purpose in flights has helped the North American region be the dominant regional segment in the market.

The Asia Pacific is expected to expand significantly over the forecast period, as it is a huge market for the airline industry, and has the potential to be a promising market for PEDs that complement the BYOD trend on planes. Furthermore, due to increased aircraft deliveries and passenger traffic in this region the Asian market is anticipated to grow the fastest. China is expected to be the region's largest market, thanks to legislative and policy reforms, innovative business models, and the development of aircraft with cutting-edge technology for entertainment purposes. A rise in business travellers is also helping the market grow rapidly.

Gogo, Inc., BAE Systems PLC, Panasonic Avionics Corporation, Rockwell Collins, Inc., SITAOnAir, Thales Group SA, Zodiac Aerospace, Lufthansa Systems GmbH, Inflight Dublin, Ltd, and Bluebox Avionics Limited, among others are the top players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

In June 2020, the US Navy awarded BAE Systems with a USD 90.2 million contract to maintain and modernize the amphibious transport dock of USS San Diego.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Wireless In-Flight Entertainment Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Technology Growth Scenario

2.1.3 Hardware Growth Scenario

2.1.4 Fitment Type Growth Scenario

2.1.5 Aircraft Type Growth Scenario

2.1.6 Regional Overview

Chapter 3 Global Wireless In-Flight Entertainment Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising technological advancements

3.3.1.2 Increasing need to enhance passenger experience

3.3.2 Industry Challenges

3.3.2.1 Cyber-threats

3.4 Prospective Growth Scenario

3.4.1 Technology Growth Scenario

3.4.2 Hardware Growth Scenario

3.4.3 Fitment Type Growth Scenario

3.4.4 Aircraft Type Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Wireless In-Flight Entertainment Market, By Hardware

4.1 Hardware Outlook

4.2 Antennas

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 WAPs

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Modems

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

4.5 Others

4.5.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Global Wireless In-Flight Entertainment Market, By Technology

5.1 Technology Outlook

5.2 ATG

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Ku-Band

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 L-Band

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

5.5 Ka-Band

5.5.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Global Wireless In-Flight Entertainment Market, By Fitment Type

6.1 Fitment Type Outlook

6.2 Retrofit

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

6.3 Line-Fit

6.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Global Wireless In-Flight Entertainment Market, By Aircraft Type

7.1 Aircraft Type Outlook

7.2 Narrow-Body

7.2.1 Market Size, By Region, 2020-2026 (USD Billion)

7.3 Wide-Body

7.3.1 Market Size, By Region, 2020-2026 (USD Billion)

7.4 Regional Jet

7.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Global Wireless In-Flight Entertainment Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2020-2026 (USD Billion)

8.2.2 Market Size, By Hardware, 2020-2026 (USD Billion)

8.2.3 Market Size, By Technology, 2020-2026 (USD Billion)

8.2.4 Market Size, By Fitment Type, 2020-2026 (USD Billion)

8.2.5 Market Size, By Aircraft Type, 2020-2026 (USD Billion)

8.2.6 U.S.

8.2.6.1 Market Size, By Hardware, 2020-2026 (USD Billion)

8.2.6.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.2.6.3 Market Size, By Fitment Type, 2020-2026 (USD Billion)

8.2.6.4 Market Size, By Aircraft Type, 2020-2026 (USD Billion)

8.2.7 Canada

8.2.7.1 Market Size, By Hardware, 2020-2026 (USD Billion)

8.2.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.2.7.3 Market Size, By Fitment Type, 2020-2026 (USD Billion)

8.2.7.4 Market Size, By Aircraft Type, 2020-2026 (USD Billion)

8.3 Europe

8.3.1 Market Size, By Country 2020-2026 (USD Billion)

8.3.2 Market Size, By Hardware, 2020-2026 (USD Billion)

8.3.3 Market Size, By Technology, 2020-2026 (USD Billion)

8.3.4 Market Size, By Fitment Type, 2020-2026 (USD Billion)

8.3.5 Market Size, By Aircraft Type, 2020-2026 (USD Billion)

8.3.6 Germany

8.3.6.1 Market Size, By Hardware, 2020-2026 (USD Billion)

8.3.6.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.3.6.3 Market Size, By Fitment Type, 2020-2026 (USD Billion)

8.3.6.4 Market Size, By Aircraft Type, 2020-2026 (USD Billion)

8.3.7 UK

8.3.7.1 Market Size, By Hardware, 2020-2026 (USD Billion)

8.3.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.3.7.3 Market Size, By Fitment Type, 2020-2026 (USD Billion)

8.3.7.4 Market Size, By Aircraft Type, 2020-2026 (USD Billion)

8.3.8 France

8.3.8.1 Market Size, By Hardware, 2020-2026 (USD Billion)

8.3.8.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.3.8.3 Market Size, By Fitment Type, 2020-2026 (USD Billion)

8.3.8.4 Market Size, By Aircraft Type, 2020-2026 (USD Billion)

8.3.9 Italy

8.3.9.1 Market Size, By Hardware, 2020-2026 (USD Billion)

8.3.9.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.3.9.3 Market Size, By Fitment Type, 2020-2026 (USD Billion)

8.3.9.4 Market Size, By Aircraft Type, 2020-2026 (USD Billion)

8.3.10 Spain

8.3.10.1 Market Size, By Hardware, 2020-2026 (USD Billion)

8.3.10.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.3.10.3 Market Size, By Fitment Type, 2020-2026 (USD Billion)

8.3.10.4 Market Size, By Aircraft Type, 2020-2026 (USD Billion)

8.3.11 Russia

8.3.11.1 Market Size, By Hardware, 2020-2026 (USD Billion)

8.3.11.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.3.11.3 Market Size, By Fitment Type, 2020-2026 (USD Billion)

8.3.11.4 Market Size, By Aircraft Type, 2020-2026 (USD Billion)

8.4 Asia Pacific

8.4.1 Market Size, By Country 2020-2026 (USD Billion)

8.4.2 Market Size, By Hardware, 2020-2026 (USD Billion)

8.4.3 Market Size, By Technology, 2020-2026 (USD Billion)

8.4.4 Market Size, By Fitment Type, 2020-2026 (USD Billion)

8.4.5 Market Size, By Aircraft Type, 2020-2026 (USD Billion)

8.4.6 China

8.4.6.1 Market Size, By Hardware, 2020-2026 (USD Billion)

8.4.6.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.4.6.3 Market Size, By Fitment Type, 2020-2026 (USD Billion)

8.4.6.4 Market Size, By Aircraft Type, 2020-2026 (USD Billion)

8.4.7 India

8.4.7.1 Market Size, By Hardware, 2020-2026 (USD Billion)

8.4.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.4.7.3 Market Size, By Fitment Type, 2020-2026 (USD Billion)

8.4.7.4 Market Size, By Aircraft Type, 2020-2026 (USD Billion)

8.4.8 Japan

8.4.8.1 Market Size, By Hardware, 2020-2026 (USD Billion)

8.4.8.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.4.8.3 Market Size, By Fitment Type, 2020-2026 (USD Billion)

8.4.8.4 Market Size, By Aircraft Type, 2020-2026 (USD Billion)

8.4.9 Australia

8.4.9.1 Market Size, By Hardware, 2020-2026 (USD Billion)

8.4.9.2 Market size, By Technology, 2020-2026 (USD Billion)

8.4.9.3 Market Size, By Fitment Type, 2020-2026 (USD Billion)

8.4.9.4 Market Size, By Aircraft Type, 2020-2026 (USD Billion)

8.4.10 South Korea

8.4.10.1 Market Size, By Hardware, 2020-2026 (USD Billion)

8.4.10.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.4.10.3 Market Size, By Fitment Type, 2020-2026 (USD Billion)

8.4.10.4 Market Size, By Aircraft Type, 2020-2026 (USD Billion)

8.5 Latin America

8.5.1 Market Size, By Country 2020-2026 (USD Billion)

8.5.2 Market Size, By Hardware, 2020-2026 (USD Billion)

8.5.3 Market Size, By Technology, 2020-2026 (USD Billion)

8.5.4 Market Size, By Fitment Type, 2020-2026 (USD Billion)

8.5.5 Market Size, By Aircraft Type, 2020-2026 (USD Billion)

8.5.6 Brazil

8.5.6.1 Market Size, By Hardware, 2020-2026 (USD Billion)

8.5.6.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.5.6.3 Market Size, By Fitment Type, 2020-2026 (USD Billion)

8.5.6.4 Market Size, By Aircraft Type, 2020-2026 (USD Billion)

8.5.7 Mexico

8.5.7.1 Market Size, By Hardware, 2020-2026 (USD Billion)

8.5.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.5.7.3 Market Size, By Fitment Type, 2020-2026 (USD Billion)

8.5.7.4 Market Size, By Aircraft Type, 2020-2026 (USD Billion)

8.5.8 Argentina

8.5.8.1 Market Size, By Hardware, 2020-2026 (USD Billion)

8.5.8.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.5.8.3 Market Size, By Fitment Type, 2020-2026 (USD Billion)

8.5.8.4 Market Size, By Aircraft Type, 2020-2026 (USD Billion)

8.6 MEA

8.6.1 Market Size, By Country 2020-2026 (USD Billion)

8.6.2 Market Size, By Hardware, 2020-2026 (USD Billion)

8.6.3 Market Size, By Technology, 2020-2026 (USD Billion)

8.6.4 Market Size, By Fitment Type, 2020-2026 (USD Billion)

8.6.5 Market Size, By Aircraft Type, 2020-2026 (USD Billion)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Hardware, 2020-2026 (USD Billion)

8.6.6.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.6.6.3 Market Size, By Fitment Type, 2020-2026 (USD Billion)

8.6.6.4 Market Size, By Aircraft Type, 2020-2026 (USD Billion)

8.6.7 UAE

8.6.7.1 Market Size, By Hardware, 2020-2026 (USD Billion)

8.6.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.6.7.3 Market Size, By Fitment Type, 2020-2026 (USD Billion)

8.6.7.4 Market Size, By Aircraft Type, 2020-2026 (USD Billion)

8.6.8 South Africa

8.6.8.1 Market Size, By Hardware, 2020-2026 (USD Billion)

8.6.8.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.6.8.3 Market Size, By Fitment Type, 2020-2026 (USD Billion)

8.6.8.4 Market Size, By Aircraft Type, 2020-2026 (USD Billion)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 BAE Systems PLC

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info-Graphic Analysis

9.3 Bluebox Avionics Ltd

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info-Graphic Analysis

9.4 Gogo Inc

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info-Graphic Analysis

9.5 Inflight Dublin, Ltd

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info-Graphic Analysis

9.6 Lufthansa Systems GmbH

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info-Graphic Analysis

9.7 Panasonic Corporation

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info-Graphic Analysis

9.8 Rockwell Collins Inc.

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info-Graphic Analysis

9.9 SITA OnAir

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info-Graphic Analysis

9.10 Thales Group S.A.

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info-Graphic Analysis

9.11 Zodiac Aerospace SA

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info-Graphic Analysis

9.12 Other Companies

9.12.1 Company Overview

9.12.2 Financial Analysis

9.12.3 Strategic Positioning

9.12.4 Info-Graphic Analysis

The Global Wireless In-Flight Entertainment Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Wireless In-Flight Entertainment Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS