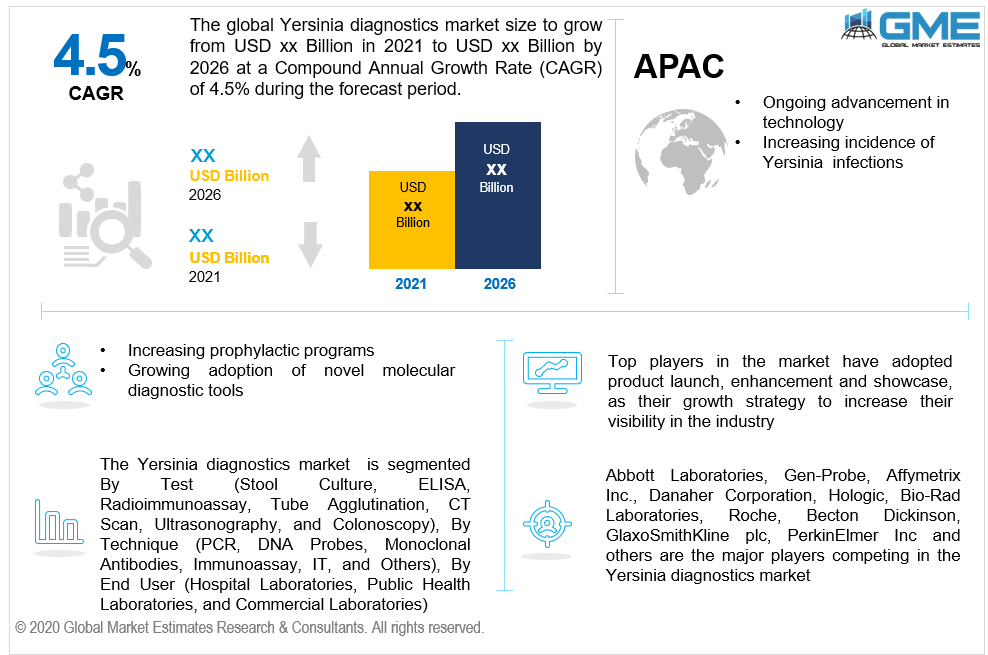

Global Yersinia Diagnostics Market Size, Trends, and Analysis - Forecasts To 2026 By Test (Stool Culture, ELISA, Radioimmunoassay, Tube Agglutination, CT Scan, Ultrasonography, and Colonoscopy), By Technique (PCR, DNA Probes, Monoclonal Antibodies, Immunoassay, IT, and Others), By End User (Hospital Laboratories, Public Health Laboratories, and Commercial Laboratories), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

The Enterobacteriaceae family includes Yersinia, a gram-positive rod-shaped type of bacteria. Yersinia pseudotuberculosis, Yersinia enterocolitica, and Yersinia pestis are all pathogenic Yersinia bacteria. This bacterium's Yersinia pestis species triggers Bubonic plague and is spread by infective fleas and mice. Human-to-human transmission, infective flea-to-human (direct contact), and rodent-to-human (direct contact) are among the modes of transmission for these bacteria (via pneumonic droplets). Yersinia pseudotuberculosis and Yersinia enterocolitica, on the other hand, are the bacteria that cause gastroenteritis.

Terminal ileitis, acute diarrhea, mesenteric lymphadenitis, and enterocolitis are all caused by Yersinia pestis. Due to the essence of Yersiniosis, it is often misdiagnosed as appendicitis or Crohn's disease. Normally, Yersinia infection is characterized by fever, dyspnea, chest pain, swelling of lymph nodes, and hemoptysis, among other signs. Yersinia is mainly acquired through the bites of infected fleas or by consumption of contaminated water, and food.

Technological advances, increased health consciousness in emerging countries, increased use of revolutionary molecular testing instruments, and growth in the proportion of patients are all expected to drive the Yersinia diagnostics market. Nevertheless, forces such as strong rivalry between existing Yersinia diagnostics producers, federal regulations aimed at lowering overall health prices, and an increase in volume purchases from group purchasing organizations (GPOs) are expected to stymie the yersinia diagnostics market. Furthermore, in this Yersinia diagnostics market, the creation of relatively adaptive, reliable, and yet easy effective diagnostic solutions that can be used for primary and secondary diagnosis persists as a barrier.

The comparatively greater incidence of Bubonic plague in the United States (according to the United States Centres for Disease Control and Prevention, nearly 80 percent of plague outbreaks in the United States were identified as Bubonic plague) and the significantly higher incidence of Yersiniosis in Japan, Scandinavian nations, and Northern Europe are among the industry's massive growth factors. Furthermore, the advent of enhanced diagnostic technology such as molecular diagnostics, as well as rising patient knowledge levels around the world, will operate as triggers for the global yersinia diagnostics market. Furthermore, the yersinia diagnostics industry is projected to benefit from unexploited opportunities in developing Asian nations, increased research grants, and an emphasis on research.

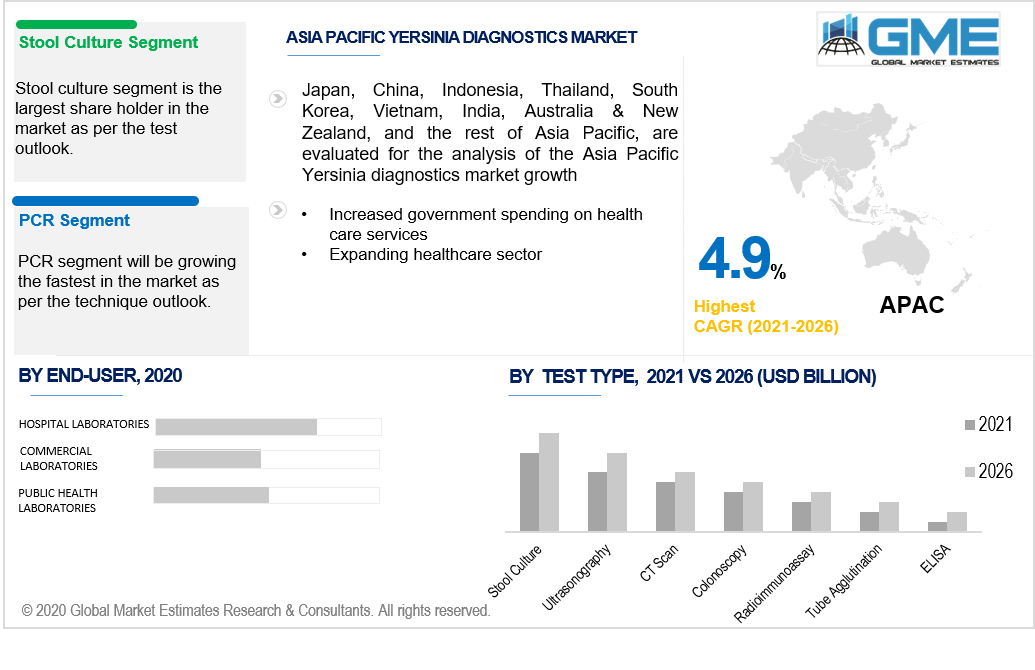

Depending on the test type the market is categorized as, tube agglutination, ELISA, ultrasonography, radioimmunoassay, CT scan, stool culture, and colonoscopy. The leader in this segment is stool culture. Close to appendicitis, Yersinia pseudotuberculosis triggers belly (abdominal) pain. The bacteria Yersinia pestis induces the plague. To diagnose Y. pseudotuberculosis and, in some cases, Y enterocolitis, a stool culture is tested which is the most reliable way to validate a Y enterocolitis diagnosis. Thus, stool culture is the perfect way to identify the Yersinia.

Depending on the testing technique the market is categorized as, PCR, DNA probes, monoclonal antibodies, immunoassay, IT, and others. The leader in this segment is PCR. The domination of the PCR segment is due to technical advances in the domain of genetic engineering and significant spending in the R&D. The PCR segment has a sizable market share owing to the related advantages and diverse implementations of multiplex PCR over traditional PCR approaches. Monoclonal antibodies are used in several procedures, including PCR, to detect pathogens. For the identification of Yersinia pseudotuberculosis and Yersinia pestis, a multiplex real-time polymerase chain reaction (PCR) assay was produced thus, the PCR test is more accurate and to have faster outcomes. The expanded use of high-throughput PCR technology to detect Yersinia is expected to fuel demand. Increased precision and sensitivity, the ability to automate, and widespread use of genotyping and gene expression analysis as a validation method are all factors that support the growth of this segment. Additionally, over the forecast period, the advancement and introduction of new technology in this category are projected to increase the overall market growth. This advancement includes plasmonic PCR, a reduced-cost method for detecting pathogens and infections quickly than current PCR techniques.

Depending on the end-user the market is categorized as, hospital laboratories, public health laboratories, and commercial laboratories. As deluxe charges and services are provided to diagnostic testing for in-patients, the hospital laboratories segment is predicted to retain a large share of the yersinia diagnostics market. With the growing incidence of contagious and non-contagious diseases in emerging and industrialized nations, the increased rate of hospital-acquired infections (HAIs), an increasing proportion of patients being treated in the hospitals, and the increasing elderly population, hospitals have emerged as a market leader in the global yersinia diagnostics market. Diagnosing centers often collaborate with hospitals; as a result, hospitals always have a diagnostic system. Moreover, rapid advancements in healthcare infrastructure construction are expected to improve modern hospital services. As a result, the demand for Yersinia diagnostics tests performed in hospitals is growing.

As per the geographical analysis, the market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central South America (Brazil, Argentina, and Rest of Central and South America). The regional analysis has estimated the dominance of the North American region. North America (the United States and Canada), with its advanced healthcare system and increased prophylactic programs pursued by their elected representatives, can hold a dominant position in the Yersinia diagnostics market. The increasing prevalence of infections in major countries of this region is also acting as a key driver. This is partly attributed to the expanding healthcare sector and an elderly population, which would result in a rise in the population of patients in these nations.

Owing to the existence of unexploited resources and the increasing incidence of infections in nations such as Japan and India, the Asia Pacific region is presumed to be a rapidly-growing region. Due to the increased government spending on health care services, and emerging economies are considered to be the major growth driving factors for the Asia Pacific’s Yersinia diagnostic market.

Abbott Laboratories, Gen-Probe, Affymetrix Inc., Danaher Corporation, Hologic, Bio-Rad Laboratories, Roche, Becton Dickinson, GlaxoSmithKline plc, PerkinElmer Inc and others are the major players competing in the Yersinia diagnostics market.

Please note: This is not an exhaustive list of companies profiled in the report.

CerTest released new kits for the detection of pathogens in humans in July 2018. CerTest's VIASURE Real-Time PCR Detection kits aid in the identification of pathogen levels at any time. The kit also has other pathogens, but it is mostly used in hospitals.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Yersinia Diagnostics Market Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Test Overview

2.1.3 Technique Overview

2.1.4 End-User Overview

2.1.5 Regional Overview

Chapter 3 Yersinia Diagnostics Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Adoption of molecular diagnostic tools

3.3.1.2 Rising awareness about health

3.3.2 Industry Challenges

3.3.2.1 Bulk purchase by various group purchasing organizations

3.4 Prospective Growth Scenario

3.4.1 Test Growth Scenario

3.4.2 Technique Growth Scenario

3.4.3 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Yersinia Diagnostics Market, By Test

4.1 Test Outlook

4.2 Stool Culture

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 ELISA

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

4.4 Radioimmunoassay

4.4.1 Market Size, By Region, 2019-2026 (USD Million)

4.5 Tube Agglutination

4.5.1 Market Size, By Region, 2019-2026 (USD Million)

4.6 CT Scan

4.6.1 Market Size, By Region, 2019-2026 (USD Million)

4.7 Ultrasonography

4.4.1 Market Size, By Region, 2019-2026 (USD Million)

4.8 Colonoscopy

4.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Yersinia Diagnostics Market, By Technique

5.2 PCR

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 DNA

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

5.4 Probes

5.4.1 Market Size, By Region, 2019-2026 (USD Million)

5.5 Monoclonal Antibodies

5.5.1 Market Size, By Region, 2019-2026 (USD Million)

5.6 Immunoassay

5.6.1 Market Size, By Region, 2019-2026 (USD Million)

5.7 IT

5.7.1 Market Size, By Region, 2019-2026 (USD Million)

5.8 Others

5.8.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Yersinia Diagnostics Market, By End-User

6.1 End-User Outlook

6.2 Hospital Laboratories

6.2.1 Market Size, By Region, 2019-2026 (USD Million)

6.3 Public Health Laboratories

6.3.1 Market Size, By Region, 2019-2026 (USD Million)

6.4 Commercial Laboratories

6.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 7 Yersinia Diagnostics Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2019-2026 (USD Million)

7.2.2 Market Size, By Test, 2019-2026 (USD Million)

7.2.3 Market Size, By Technique, 2019-2026 (USD Million)

7.2.4 Market Size, By End-User, 2019-2026 (USD Million)

7.2.5 U.S.

7.2.5.1 Market Size, By Test, 2019-2026 (USD Million)

7.2.5.2 Market Size, By Technique, 2019-2026 (USD Million)

7.2.5.3 Market Size, By End-User, 2019-2026 (USD Million)

7.2.6 Canada

7.2.6.1 Market Size, By Test, 2019-2026 (USD Million)

7.2.6.2 Market Size, By Technique, 2019-2026 (USD Million)

7.2.6.3 Market Size, By End-User, 2019-2026 (USD Million)

7.3 Europe

7.3.1 Market Size, By Country 2019-2026 (USD Million)

7.3.2 Market Size, By Test, 2019-2026 (USD Million)

7.3.3 Market Size, By Technique, 2019-2026 (USD Million)

7.3.4 Market Size, By End-User, 2019-2026 (USD Million)

7.3.5 Germany

7.3.5.1 Market Size, By Test, 2019-2026 (USD Million)

7.3.5.2 Market Size, By Technique, 2019-2026 (USD Million)

7.3.5.3 Market Size, By End-User, 2019-2026 (USD Million)

7.3.6 UK

7.3.6.1 Market Size, By Test, 2019-2026 (USD Million)

7.3.6.2 Market Size, By Technique, 2019-2026 (USD Million)

7.3.6.3 Market Size, By End-User, 2019-2026 (USD Million)

7.3.7 France

7.3.7.1 Market Size, By Test, 2019-2026 (USD Million)

7.3.7.2 Market Size, By Technique, 2019-2026 (USD Million)

7.3.7.3 Market Size, By End-User, 2019-2026 (USD Million)

7.3.8 Italy

7.3.8.1 Market Size, By Test, 2019-2026 (USD Million)

7.3.8.2 Market Size, By Technique, 2019-2026 (USD Million)

7.3.8.3 Market Size, By End-User, 2019-2026 (USD Million)

7.3.9 Spain

7.3.9.1 Market Size, By Test, 2019-2026 (USD Million)

7.3.9.2 Market Size, By Technique, 2019-2026 (USD Million)

7.3.9.2 Market Size, By End-User, 2019-2026 (USD Million)

7.3.10 Russia

7.3.10.1 Market Size, By Test, 2019-2026 (USD Million)

7.3.10.2 Market Size, By Technique, 2019-2026 (USD Million)

7.3.10.3 Market Size, By End-User, 2019-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2019-2026 (USD Million)

7.4.2 Market Size, By Test, 2019-2026 (USD Million)

7.4.3 Market Size, By Technique, 2019-2026 (USD Million)

7.4.4 Market Size, By End-User, 2019-2026 (USD Million)

7.4.5 China

7.4.5.1 Market Size, By Test, 2019-2026 (USD Million)

7.4.5.2 Market Size, By Technique, 2019-2026 (USD Million)

7.4.5.3 Market Size, By End-User, 2019-2026 (USD Million)

7.4.6 India

7.4.6.1 Market Size, By Test, 2019-2026 (USD Million)

7.4.6.2 Market Size, By Technique, 2019-2026 (USD Million)

7.4.6.3 Market Size, By End-User, 2019-2026 (USD Million)

7.4.7 Japan

7.4.7.1 Market Size, By Test, 2019-2026 (USD Million)

7.4.7.2 Market Size, By Technique, 2019-2026 (USD Million)

7.4.7.3 Market Size, By End-User, 2019-2026 (USD Million)

7.4.8 Australia

7.4.8.1 Market Size, By Test, 2019-2026 (USD Million)

7.4.8.2 Market size, By Technique, 2019-2026 (USD Million)

7.4.8.3 Market size, By End-User, 2019-2026 (USD Million)

7.4.9 South Korea

7.4.9.1 Market Size, By Test, 2019-2026 (USD Million)

7.4.9.2 Market Size, By Technique, 2019-2026 (USD Million)

7.4.9.3 Market Size, By End-User, 2019-2026 (USD Million)

7.5 Latin America

7.5.1 Market Size, By Country 2019-2026 (USD Million)

7.5.2 Market Size, By Test, 2019-2026 (USD Million)

7.5.3 Market Size, By Technique, 2019-2026 (USD Million)

7.5.4 Market Size, By End-User, 2019-2026 (USD Million)

7.5.4 Brazil

7.5.5.1 Market Size, By Test, 2019-2026 (USD Million)

7.5.5.2 Market Size, By Technique, 2019-2026 (USD Million)

7.5.5.3 Market Size, By End-User, 2019-2026 (USD Million)

7.5.6 Mexico

7.5.6.1 Market Size, By Test, 2019-2026 (USD Million)

7.5.6.2 Market Size, By Technique, 2019-2026 (USD Million)

7.5.6.3 Market Size, By End-User, 2019-2026 (USD Million)

7.5.7 Argentina

7.5.7.1 Market Size, By Test, 2019-2026 (USD Million)

7.5.7.2 Market Size, By Technique, 2019-2026 (USD Million)

7.5.7.3 Market Size, By End-User, 2019-2026 (USD Million)

7.6 MEA

7.6.1 Market Size, By Country 2019-2026 (USD Million)

7.6.2 Market Size, By Test, 2019-2026 (USD Million)

7.6.3 Market Size, By Technique, 2019-2026 (USD Million)

7.6.4 Market Size, By End-User, 2019-2026 (USD Million)

7.6.5 Saudi Arabia

7.6.5.1 Market Size, By Test, 2019-2026 (USD Million)

7.6.5.2 Market Size, By Technique, 2019-2026 (USD Million)

7.6.5.3 Market Size, By End-User, 2019-2026 (USD Million)

7.6.6 UAE

7.6.6.1 Market Size, By Test, 2019-2026 (USD Million)

7.6.6.2 Market Size, By Technique, 2019-2026 (USD Million)

7.6.6.3 Market Size, By End-User, 2019-2026 (USD Million)

7.6.7 South Africa

7.6.7.1 Market Size, By Test, 2019-2026 (USD Million)

7.6.7.2 Market Size, By Technique, 2019-2026 (USD Million)

7.6.7.3 Market Size, By End-User, 2019-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Abbott Laboratories

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 Gen-Probe

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Affymetrix Inc.

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Danaher Corporation

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Hologic

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Bio-Rad Laboratories

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Roche

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Becton Dickinson

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info Graphic Analysis

8.10 GlaxoSmithKline plc

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 PerkinElmer Inc.

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

The Global Yersinia Diagnostics Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Yersinia Diagnostics Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS