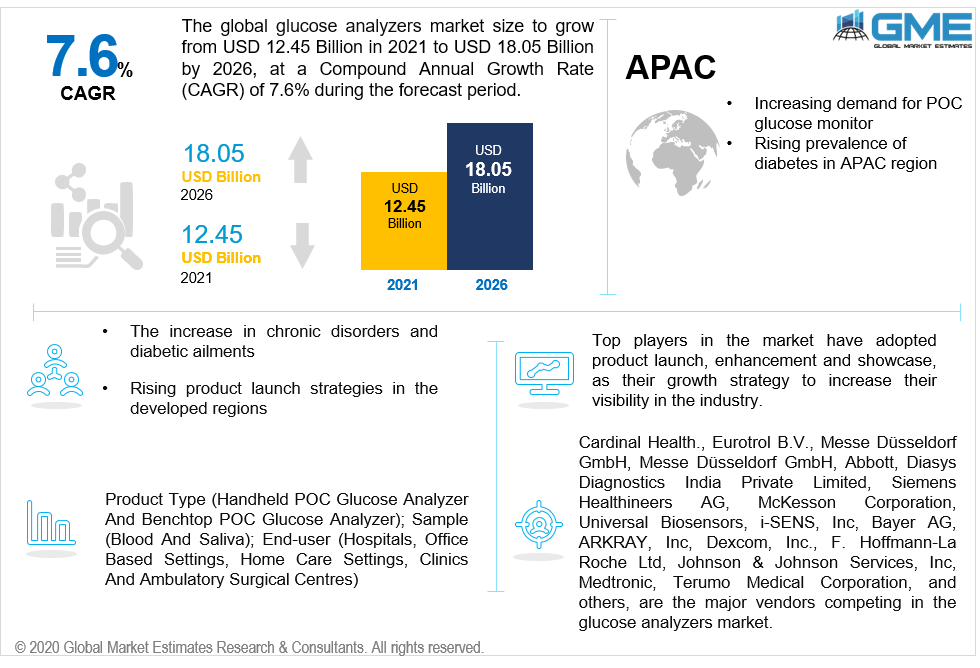

Global Glucose Analyzers Market Size, Trends & Analysis - Forecasts to 2026 By Product Type (Handheld POC Glucose Analyzer and Benchtop POC Glucose Analyzer); By Sample (Blood and Saliva); By End-User (Hospitals, Office based Settings, Home Care Settings, Clinics and Ambulatory Surgical Centres); By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Vendor Landscape, and Company Market Share Analysis and Competitor Analysis

The global glucose analyzers market is expected to grow from USD 12.45 billion in 2021 to USD 18.05 billion in 2026 at a CAGR of 7.6% during the forecast period.

The glucose analyzers market will grow rapidly mainly due to the rising demand for home-based glucose testing devices and the rising adoption of innovative technologies by hospitals and diagnostic laboratories. The smart or POC glucose analyzers help to not only detect the blood glucose level but also store patient-related information and data very effectively in a systematic manner and hence have witnessed an increase in demand since its augmentation. The rising investment in the health care industry and owing to rise in diabetes prevalence will also support the market growth.

On the other hand, the imposition of lockdowns across various countries has driven the demand for home based and smart, and handy sugar reading devices which can check patient’s sugar levels without the assistance of a doctor and cuts down the doctor visits too. Due to changes in eating patterns, physical activities, and sedentary behaviors, etc. the market is experiencing a high prevalence of sugar-related health issues globally. POC solutions have helped to measure diabetes levels at early stages. Hence this factor is, in turn, helping to drive the market as it's one of the first devices used for the initial screening process. The other factors supporting the growth of the analyzers market are rising anemia, blood disorders, and common infections, among others, rising geriatric patient pool, particularly in emerging regions, and increasing blood donation activities.

The data obtained from a point-of-care glucose analyzer can be used immediately in the management of patient clinical care because the observations are provided in 10-30 minutes. Although diabetes mellitus management and diagnosis are mostly transferred to the outpatient setting, point-of-care glucose analyzers can be quite beneficial in outpatient settings. Moreover, government organizations are increasing their support in the form of research grants to launch analyzers in third-world countries. Furthermore, the successful launch of FDA-approved devices in the market has also contributed to the growth.

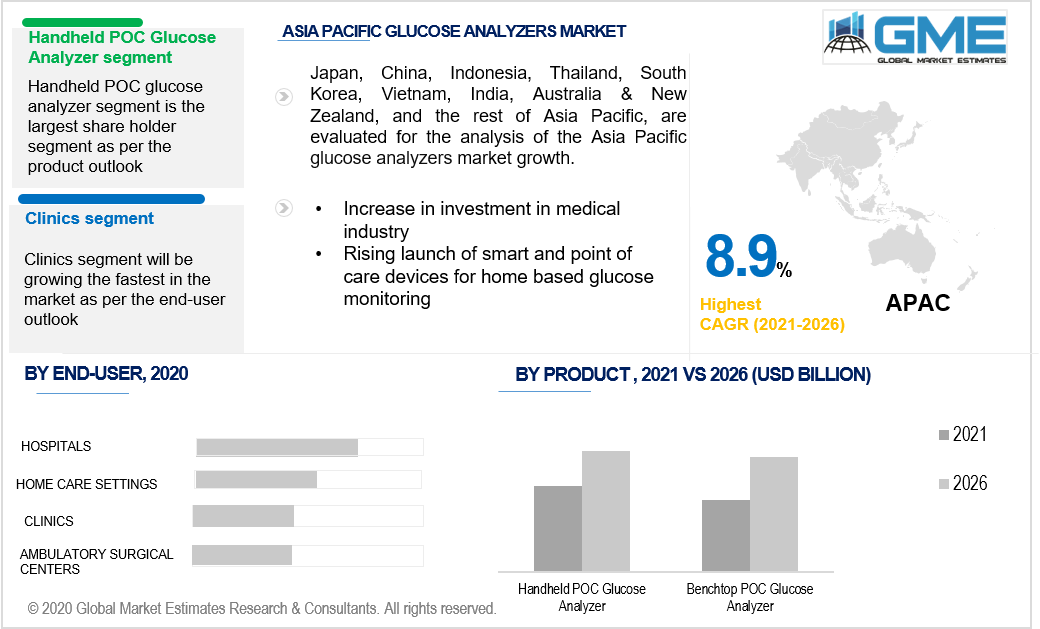

Based on the product type, the market is segmented into handheld POC glucose analyzer and benchtop POC glucose analyzer. The handheld POC glucose analyzer is expected to hold the largest share of the market during the forecast period. The conventional handheld short-term glucose treatment has led to making diabetic detection very easy and effective. The aim of improving the patient's medication care services and making them convenient for patients' use is supporting the growth of this segment.

Based on the sample type, the market comprises blood and saliva. Blood glucose monitoring holds a major share of the market globally. With time the focus has been to improve the patient's medication care services making it convenient for patients to use. The increasing use of blood glucose monitoring has helped the patients to fulfill the frequent requirement of measuring blood sugar levels and including various medication dispensing systems. The glucose analyzers and blood components are set to experience the fastest growth. The rising glucose analysis through blood is one of the major drivers for the market.

Based on the end-user segment, the market is segmented into hospitals, office-based settings, home care settings, clinics, and ambulatory surgical centers. The hospital segment of the market accounts to hold the largest share of the market. This is majorly attributed to the rising demand for analyzers from multi-specialty hospitals and clinics.

As per the geographical analysis, the glucose analyzers market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America.

The North American region is analyzed to be the top segment in the glucose analyzers market. The growth is attributed to the extensive adoption and application of advanced technological medical procedures over conventional practices. The rising prevalence of obesity, high cost of treatments, technological investments and new product launch strategies have helped to drive the North American blood glucose analyzers market.

The glucose analyzers market for APAC will be the fastest growing from 2021 to 2026. The rising prevalence of diabetes is the major driving factor for regional growth. The European region is also expected to grow the fastest during the forecast period owing to the rising investments and expenditure for medical IT solutions, accompanied by the increasing prevalence of infectious disease, and geriatric patient population. The main reason for market growth in recent years has been the increasing population suffering from diabetes and rising demand for quality care and rising need for the up-gradation of healthcare infrastructure.

Cardinal Health, Eurotrol B.V., Messe Düsseldorf GmbH, Abbott, Diasys Diagnostics India Private Limited, Siemens Healthineers AG, McKesson Corporation, Universal Biosensors, i-SENS, Inc, Bayer AG, ARKRAY, Inc, Dexcom, Inc., F. Hoffmann-La Roche Ltd, Johnson & Johnson Services, Inc, Medtronic, Terumo Medical Corporation, and others, are the major players competing in the glucose analyzers market.

Please note: This is not an exhaustive list of companies profiled in the report.

In August 2020, Cardinal Health announced its service delivery customized with high-speed prescription filing solutions for various pharmacies, hospitals, wholesalers, and central fill operations. The companies delivered quick, reliable, automated, and compact automated systems. This led to strengthening their existing lineup for pharmacy technology. This strategy also helped Cardinal Health to increase and enhance its market visibility and help expand its customer base.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Glucose Analyzers Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 End-User Overview

2.1.3 Type Overview

2.1.4 Sample Overview

2.1.5 Regional Overview

Chapter 3 Global Glucose Analyzers Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising prevalence of diabetes around the globe

3.3.1.2 Increasing awareness regarding diabetes management monitoring detection device

3.3.2 Industry Challenges

3.3.2.1 Unfavourable reimbursement policies and standardization issues

3.4 Prospective Growth Scenario

3.4.1 End-User Growth Scenario

3.4.2 Type Growth Scenario

3.4.3 Sample Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Glucose Analyzers Market, By End-User

4.1 End-User Outlook

4.2 Hospitals

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Office Based Settings

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Home Care Settings

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

4.5 Clinics

4.5.1 Market Size, By Region, 2020-2026 (USD Billion)

4.6 Ambulatory Surgical Centres

4.6.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Global Glucose Analyzers Market, By Product Type

5.1 Type Outlook

5.2 Handheld POC Glucose Analyzer

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Benchtop POC Glucose Analyzer

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Glucose Analyzers Market, By Sample

6.1 Sample Outlook

6.2 Blood

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

6.3 Saliva

6.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Glucose Analyzers Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2020-2026 (USD Billion)

7.2.2 Market Size, By End-User, 2020-2026 (USD Billion)

7.2.3 Market Size, By Product Type, 2020-2026 (USD Billion)

7.2.4 Market Size, By Sample, 2020-2026 (USD Billion)

7.2.5 U.S.

7.2.5.1 Market Size, By End-User, 2020-2026 (USD Billion)

7.2.5.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.2.5.3 Market Size, By Sample, 2020-2026 (USD Billion)

7.2.6 Canada

7.2.6.1 Market Size, By End-User, 2020-2026 (USD Billion)

7.2.6.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.2.6.3 Market Size, By Sample, 2020-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2020-2026 (USD Billion)

7.3.2 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.3 Market Size, By Product Type, 2020-2026 (USD Billion)

7.3.4 Market Size, By Sample, 2020-2026 (USD Billion)

7.3.5 Germany

7.3.5.1 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.5.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.3.5.3 Market Size, By Sample, 2020-2026 (USD Billion)

7.3.6 UK

7.3.6.1 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.6.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.3.6.3 Market Size, By Sample, 2020-2026 (USD Billion)

7.3.7 France

7.3.7.1 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By Sample, 2020-2026 (USD Billion)

7.3.8 Italy

7.3.8.1 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.8.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.3.8.3 Market Size, By Sample, 2020-2026 (USD Billion)

7.3.9 Spain

7.3.9.1 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.9.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.3.9.3 Market Size, By Sample, 2020-2026 (USD Billion)

7.3.10 Russia

7.3.10.1 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.10.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.3.10.3 Market Size, By Sample, 2020-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country,2020-2026 (USD Billion)

7.4.2 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.3 Market Size, By Product Type, 2020-2026 (USD Billion)

7.4.4 Market Size, By Sample, 2020-2026 (USD Billion)

7.4.5 China

7.4.5.1 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.5.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.4.5.3 Market Size, By Sample, 2020-2026 (USD Billion)

7.4.6 India

7.4.6.1 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.6.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.4.6.3 Market Size, By Sample, 2020-2026 (USD Billion)

7.4.7 Japan

7.4.7.1 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By Sample, 2020-2026 (USD Billion)

7.4.8 Australia

7.4.8.1 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.8.2 Market size, By Product Type, 2020-2026 (USD Billion)

7.4.8.3 Market Size, By Sample, 2020-2026 (USD Billion)

7.4.9 South Korea

7.4.9.1 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.9.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.4.9.3 Market Size, By Sample, 2020-2026 (USD Billion)

7.6.5 Latin America

7.5.1 Market Size, By Country 2020-2026 (USD Billion)

7.5.2 Market Size, By End-User, 2020-2026 (USD Billion)

7.5.3 Market Size, By Product Type, 2020-2026 (USD Billion)

7.5.4 Market Size, By Sample, 2020-2026 (USD Billion)

7.5.5 Brazil

7.5.5.1 Market Size, By End-User, 2020-2026 (USD Billion)

7.5.5.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.5.5.3 Market Size, By Sample, 2020-2026 (USD Billion)

7.5.6 Mexico

7.5.6.1 Market Size, By End-User, 2020-2026 (USD Billion)

7.5.6.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.5.6.3 Market Size, By Sample, 2020-2026 (USD Billion)

7.5.7 Argentina

7.5.7.1 Market Size, By End-User, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By Sample, 2020-2026 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2020-2026 (USD Billion)

7.6.2 Market Size, By End-User, 2020-2026 (USD Billion)

7.6.3 Market Size, By Product Type, 2020-2026 (USD Billion)

7.6.4 Market Size, By Sample, 2020-2026 (USD Billion)

7.6.5 Saudi Arabia

7.6.5.1 Market Size, By End-User, 2020-2026 (USD Billion)

7.6.5.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.6.5.3 Market Size, By Sample, 2020-2026 (USD Billion)

7.6.6 UAE

7.6.6.1 Market Size, By End-User, 2020-2026 (USD Billion)

7.6.6.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.6.6.3 Market Size, By Sample, 2020-2026 (USD Billion)

7.6.7 South Africa

7.6.7.1 Market Size, By End-User, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By Sample, 2020-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Cardinal Health

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.3 Eurotrol B.V.

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Abbott Laboratories

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 McKesson Corporation

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Siemens Healthineers

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 F. Hoffmann-La Roche Ltd

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Dexcom, Inc.

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info Graphic Analysis

8.10 Medtronic

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Bayer AG

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

8.12 Other Companies

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info Graphic Analysis

The Global Glucose Analyzers Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Glucose Analyzers Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS