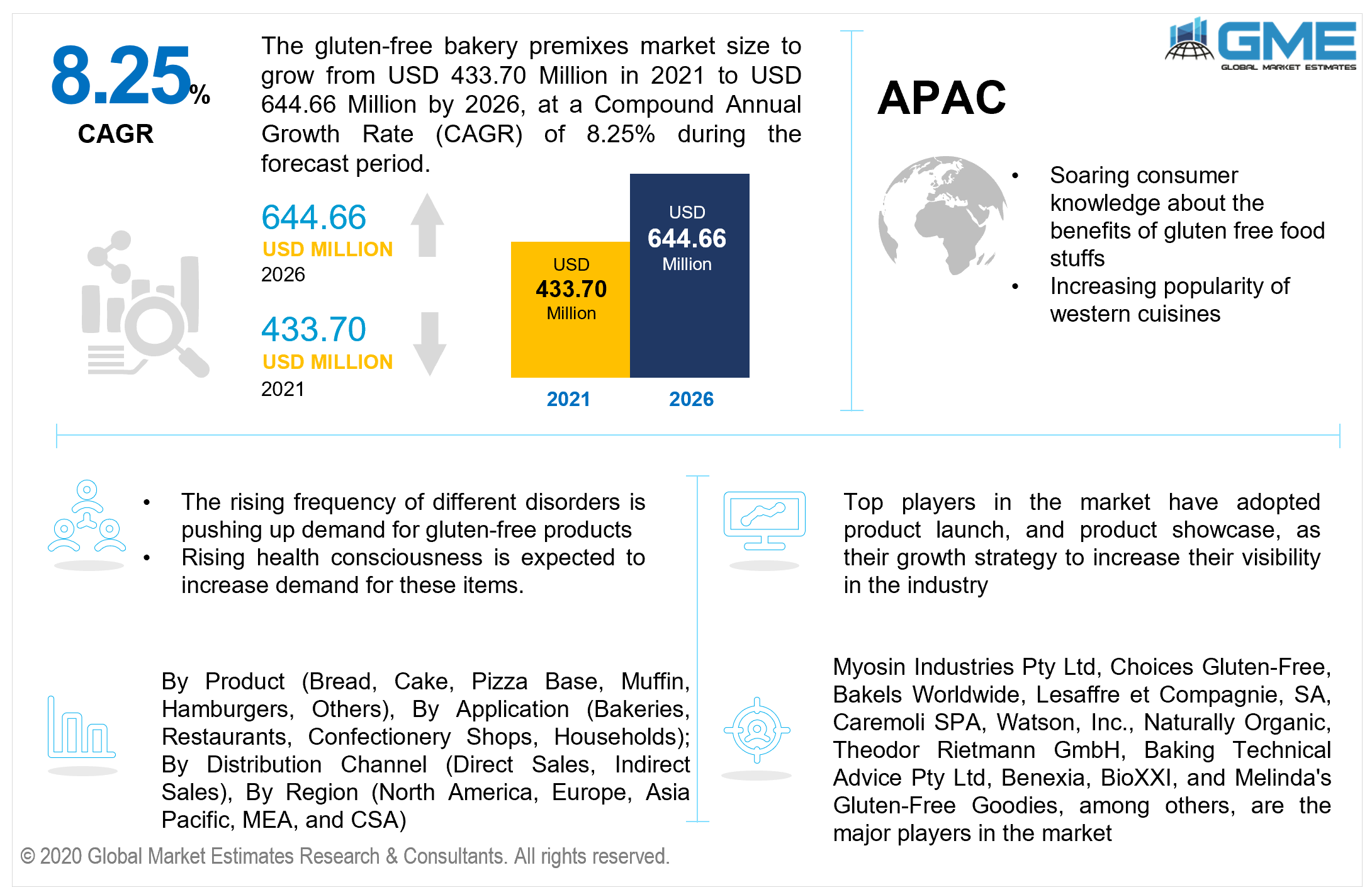

Global Gluten-free Bakery Premixes Market Size, Trends & Analysis - Forecasts to 2026 By Product (Bread, Cake, Pizza Base, Muffin, Hamburgers, Others), By Application (Bakeries, Restaurants, Confectionery Shops, Households); By Distribution Channel (Direct Sales, Indirect Sales), By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Vendor Landscape, and Company Market Share Analysis and Competitor Analysis.

The global gluten-free bakery premixes market is estimated to be valued at USD 433.70 million in 2021 and is projected to reach USD 644.66 million by 2026 at a CAGR of 8.25%. Consumer desire for gluten-free and ready-to-eat items is presumed to increase bakery product demand. Gluten in food can cause celiac disease, which damages the small intestine and raises the risk of long-term health consequences. Gluten-free bakery premixes improve product uniformity, lengthen shelf life, and provide a healthier choice, which is the market's primary driving reason. Rising consumer health consciousness, along with an increase in gluten sensitivity, is expected to drive product demand.

Bread is an important element of the daily diet and is utilized as an ingredient in the creation of a variety of bakery items such as muffins and sandwiches due to its nutritional advantages. With the soaring intake of bread due to the myriad of options available, the overall market is foreseen to witness advancement. Consumer understanding has transitioned, increasing demand for good-tasting, customized, wholesome gluten-free baked goods. This requirement, combined with the cost-effectiveness of bakery premixes, is anticipated to broaden the market's spectrum.

Bakery premixes aid in the uniformity of quality and flavor of baked goods, contribute to convenient storage, and cut manufacturing time, all of which are anticipated to fuel demand for gluten-free bakery premixes. The rising frequency of different disorders is pushing up demand for gluten-free products such as bread premixes. Rising health consciousness is expected to fuel demand further since these products assist avoid a variety of ailments such as obesity, heart disease, several forms of cancer, and metabolic disorders. Gluten-free premixes include extremely little wheat flour, and some products include no wheat flour at all. Baking premixes provide color, flavor, texture, and texture to bakery-based items, including muffins, rolls, and doughnuts flour. Thus, the market is foreseen to gain traction in the coming years.

The growing consumer preference for low-carb, high-fiber foods has created a need for nutritious, gluten-free bread. Increasing health concerns about gluten and carbohydrate intake, as well as growing knowledge about the benefits of gluten-free baked goods, will drive demand for such premixes. The gluten-free muffin market is expected to develop due to rapid expansion in the bakery sector and rising demand for healthy baked snacks.

Gluten sensitivity from bakery items may wreak havoc on digestive health and contribute to nutritional deficiencies as the digestive tract loses its capacity to properly absorb nutrients from meals. The use of such premixes in muffins minimizes inflammatory risk and promotes a healthier lifestyle. According to the United States Census Bureau and the Simmons National Consumer Survey (NHCS), more than 96 million Americans consumed boxed muffins in 2019. Thus, these aforementioned aspects are presumed to boost growth in the market.

Based on the products in the market, they are categorized into bread, cake, pizza base, muffins, hamburgers, and others. Bread is presumed to hold the largest market share. The world's population is increasing, yet animal protein sources are becoming more limited. One of the primary societal problems is providing nutritious and sustainable food for the globe. Thus, bread is becoming more popular as a plant-based protein source gains momentum. Increased overseas travel is also expected to boost bread consumption.

Over the forecast period, hamburgers are predicted to grow at the highest CAGR. The growing desire for ready-to-eat meals as a result of hectic work schedules is expected to drive market development. Furthermore, producers are emphasizing the use of gluten-free premixes in burgers to keep them fresh and healthful in various food chains.

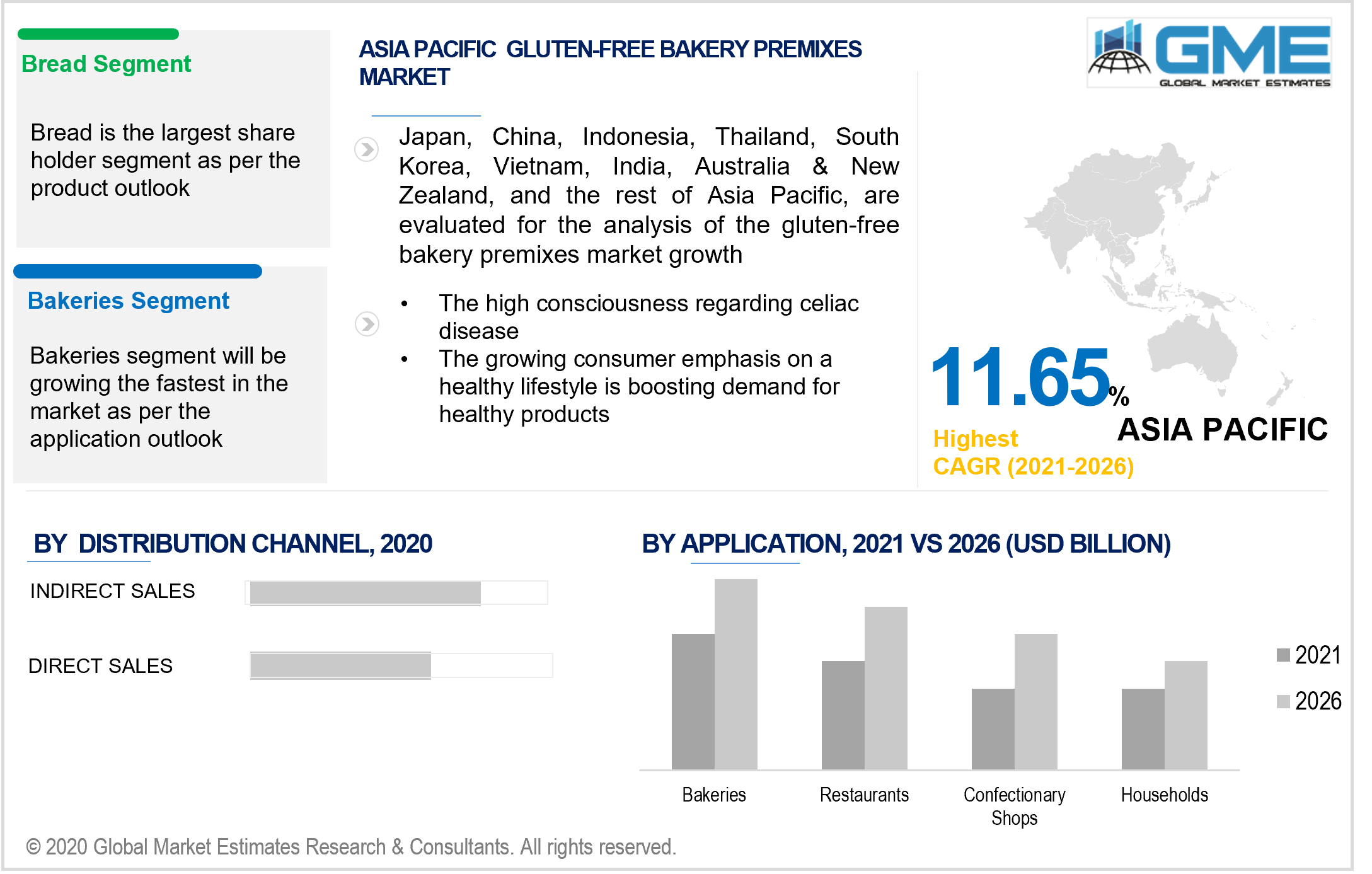

Based on the type of application, the market is categorized as bakeries, restaurants, confectionery shops, and households. Due to increased product sales, bakeries maintained the highest market share. North America and Europe are expected to have the most bakery establishments and manufacturers in the globe. Furthermore, the existence of significant bread product producers is projected to propel market expansion in the coming years.

Over the forecast period, the restaurant category is expected to grow at the highest CAGR. Globally, the soaring level of travel and tourism is expected to drive the consumption of baked goods and associated foodstuffs in restaurants, which will eventually boost the growth of this segment in the foreseeable future.

Based on the type of distribution channel, the market is categorized as direct sales and indirect sales. The indirect sales segment is foreseen to predominate. This category encompasses supermarkets, convenience stores, specialty stores, and online retailers, amongst others. Because of the accelerated evolution of conventional grocery stores into supermarkets, the supermarket sub-segment is dominating the market. Due to the extremely growing multitude of autonomous organic or wellness food stores, the grocery store segment is expected to expand rapidly. Grocery stores offer convenient access to a wide variety of commodities under one roof.

Indirect sales are also presumed to witness the highest CAGR. The prevalence of a constantly evolving retail environment and a large number of supermarkets around the world are presumed to propel bakery sales volume. Besides that, the growing proportion of cafes around the world is foreseen to increase product consumption via the foodservice distribution network.

Soaring customer consciousness, consideration concerning health and wellbeing, reduced meal preparation duration, and the provision of allergen-free meal options have all contributed to a spike in gluten-free product intake. Over the forecast period, this is foreseen to propel the indirect sales segment.

As per the geographical analysis, the market can be classified into North America, Asia Pacific, Europe, Middle East & Africa, and Central & South America.

Due to its elevated understanding and purchasing power, North America is presumed to hold the largest market share of the global market throughout the forecast period. Customers in these industrialized countries are accustomed to a variety of eating events and, as a result, prefer foodstuffs that are customized with supplemental nutritional and wellness rewards. Over the forecast period, the soaring requirement for hygienic labels and gluten-free product lines is assumed to have an impact on the market in the area.

The growing consumer focus on a healthy lifestyle is fueling the demand for gluten-free food items. Increasing awareness of the potential effects of gluten on health is also anticipated to retain the native momentum. The high prevalence of celiac disease in the United States is propelling awareness, which is assumed to portend well for regional advancement over the forecast period.

APAC is estimated to witness the highest CAGR during the forecast period. There are large amounts of investments being made in the food services and manufacturing industries, which will drive the market for different F&B sectors. Due to the increased consumption of gluten-free goods, the APAC region will report robust growth. The growing consumer emphasis on a healthy lifestyle is boosting demand for healthy products.

Rising concern about the potential negative health impacts of gluten is also expected to drive regional demand. The high consciousness regarding celiac disease in the APAC region is propelling growth. Moreover, the increased consumer knowledge and the soaring popularity of western cuisines are foreseen to boost regional market sales.

Myosin Industries Pty Ltd, Choices Gluten-Free, Bakels Worldwide, Lesaffre et Compagnie, SA, Caremoli SPA, Watson, Inc., Naturally Organic, Theodor Rietmann GmbH, Baking Technical Advice Pty Ltd, Benexia, BioXXI, and Melinda's Gluten-Free Goodies, among others, are the major players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Gluten-free Bakery Premixes Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Product Overview

2.1.3 Application Overview

2.1.4 Distribution Channel Overview

2.1.5 Regional Overview

Chapter 3 Gluten-free Bakery Premixes Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising Awareness Regarding Health Benefits Of Gluten-Free Products

3.3.1.2 Introduction Of Various Flavors And Increasing Popularity Of Bakery Products

3.3.2 Industry Challenges

3.3.2.1 High Costs Of Gluten-Free Products

3.4 Prospective Growth Scenario

3.4.1 Product Growth Scenario

3.4.2 Application Growth Scenario

3.4.3 Distribution Channel Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.7 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Gluten-free Bakery Premixes Market, By Product

4.1 Product Outlook

4.2 Bread

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Cake

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

4.4 Pizza Base

4.4.1 Market Size, By Region, 2019-2026 (USD Million)

4.5 Muffin

4.5.1 Market Size, By Region, 2019-2026 (USD Million)

4.6 Hamburgers

4.6.1 Market Size, By Region, 2019-2026 (USD Million)

4.7 Others

4.7.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Gluten-free Bakery Premixes Market, By Application

5.1 Application Outlook

5.2 Bakeries

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 Restaurants

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

5.4 Confectionery Shops

5.4.1 Market Size, By Region, 2019-2026 (USD Million)

5.5 Households

5.5.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Gluten-free Bakery Premixes Market, By Distribution Channel

6.1 Distribution Channel Outlook

6.2 Direct Sales

6.2.1 Market Size, By Region, 2019-2026 (USD Million)

6.3 Indirect Sales

6.3.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 7 Gluten-free Bakery Premixes Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2019-2026 (USD Million)

7.2.2 Market Size, By Product, 2019-2026 (USD Million)

7.2.3 Market Size, By Application, 2019-2026 (USD Million)

7.2.4 Market Size, By Distribution Channel, 2019-2026 (USD Million)

7.2.5 U.S.

7.2.5.1 Market Size, By Product, 2019-2026 (USD Million)

7.2.5.2 Market Size, By Application, 2019-2026 (USD Million)

7.2.5.3 Market Size, By Distribution Channel, 2019-2026 (USD Million)

7.2.6 Canada

7.2.6.1 Market Size, By Product, 2019-2026 (USD Million)

7.2.6.2 Market Size, By Application, 2019-2026 (USD Million)

7.2.6.3 Market Size, By Distribution Channel, 2019-2026 (USD Million)

7.3 Europe

7.3.1 Market Size, By Country 2019-2026 (USD Million)

7.3.2 Market Size, By Product, 2019-2026 (USD Million)

7.3.3 Market Size, By Application, 2019-2026 (USD Million)

7.3.4 Market Size, By Distribution Channel, 2019-2026 (USD Million)

7.3.5 Germany

7.3.5.1 Market Size, By Product, 2019-2026 (USD Million)

7.3.5.2 Market Size, By Application, 2019-2026 (USD Million)

7.3.5.3 Market Size, By Distribution Channel, 2019-2026 (USD Million)

7.3.6 UK

7.3.6.1 Market Size, By Product, 2019-2026 (USD Million)

7.3.6.2 Market Size, By Application, 2019-2026 (USD Million)

7.3.6.3 Market Size, By Distribution Channel, 2019-2026 (USD Million)

7.3.7 France

7.3.7.1 Market Size, By Product, 2019-2026 (USD Million)

7.3.7.2 Market Size, By Application, 2019-2026 (USD Million)

7.3.7.3 Market Size, By Distribution Channel, 2019-2026 (USD Million)

7.3.8 Italy

7.3.8.1 Market Size, By Product, 2019-2026 (USD Million)

7.3.8.2 Market Size, By Application, 2019-2026 (USD Million)

7.3.8.3 Market Size, By Distribution Channel, 2019-2026 (USD Million)

7.3.9 Spain

7.3.9.1 Market Size, By Product, 2019-2026 (USD Million)

7.3.9.2 Market Size, By Application, 2019-2026 (USD Million)

7.3.9.3 Market Size, By Distribution Channel, 2019-2026 (USD Million)

7.3.10 Russia

7.3.10.1 Market Size, By Product, 2019-2026 (USD Million)

7.3.10.2 Market Size, By Application, 2019-2026 (USD Million)

7.3.10.3 Market Size, By Distribution Channel, 2019-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2019-2026 (USD Million)

7.4.2 Market Size, By Product, 2019-2026 (USD Million)

7.4.3 Market Size, By Application, 2019-2026 (USD Million)

7.4.4 Market Size, By Distribution Channel, 2019-2026 (USD Million)

7.4.5 China

7.4.5.1 Market Size, By Product, 2019-2026 (USD Million)

7.4.5.2 Market Size, By Application, 2019-2026 (USD Million)

7.4.5.3 Market Size, By Distribution Channel, 2019-2026 (USD Million)

7.4.6 India

7.4.6.1 Market Size, By Product, 2019-2026 (USD Million)

7.4.6.2 Market Size, By Application, 2019-2026 (USD Million)

7.4.6.3 Market Size, By Distribution Channel, 2019-2026 (USD Million)

7.4.7 Japan

7.4.7.1 Market Size, By Product, 2019-2026 (USD Million)

7.4.7.2 Market Size, By Application, 2019-2026 (USD Million)

7.4.7.3 Market Size, By Distribution Channel, 2019-2026 (USD Million)

7.4.8 Australia

7.4.8.1 Market Size, By Product, 2019-2026 (USD Million)

7.4.8.2 Market size, By Application, 2019-2026 (USD Million)

7.4.8.3 Market Size, By Distribution Channel, 2019-2026 (USD Million)

7.4.9 South Korea

7.4.9.1 Market Size, By Product, 2019-2026 (USD Million)

7.4.9.2 Market Size, By Application, 2019-2026 (USD Million)

7.4.9.3 Market Size, By Distribution Channel, 2019-2026 (USD Million)

7.5 Latin America

7.5.1 Market Size, By Country 2019-2026 (USD Million)

7.5.2 Market Size, By Product, 2019-2026 (USD Million)

7.5.3 Market Size, By Application, 2019-2026 (USD Million)

7.5.4 Market Size, By Distribution Channel, 2019-2026 (USD Million)

7.5.5 Brazil

7.5.5.1 Market Size, By Product, 2019-2026 (USD Million)

7.5.5.2 Market Size, By Application, 2019-2026 (USD Million)

7.5.5.3 Market Size, By Distribution Channel, 2019-2026 (USD Million)

7.5.6 Mexico

7.5.6.1 Market Size, By Product, 2019-2026 (USD Million)

7.5.6.2 Market Size, By Application, 2019-2026 (USD Million)

7.5.6.3 Market Size, By Distribution Channel, 2019-2026 (USD Million)

7.5.7 Argentina

7.5.7.1 Market Size, By Product, 2019-2026 (USD Million)

7.5.7.2 Market Size, By Application, 2019-2026 (USD Million)

7.5.7.3 Market Size, By Distribution Channel, 2019-2026 (USD Million)

7.7 MEA

7.7.1 Market Size, By Country 2019-2026 (USD Million)

7.7.2 Market Size, By Product, 2019-2026 (USD Million)

7.7.3 Market Size, By Application, 2019-2026 (USD Million)

7.7.4 Market Size, By Distribution Channel, 2019-2026 (USD Million)

7.7.5 Saudi Arabia

7.7.5.1 Market Size, By Product, 2019-2026 (USD Million)

7.7.5.2 Market Size, By Application, 2019-2026 (USD Million)

7.7.5.3 Market Size, By Distribution Channel, 2019-2026 (USD Million)

7.7.6 UAE

7.7.6.1 Market Size, By Product, 2019-2026 (USD Million)

7.7.6.2 Market Size, By Application, 2019-2026 (USD Million)

7.7.6.3 Market Size, By Distribution Channel, 2019-2026 (USD Million)

7.7.7 South Africa

7.7.7.1 Market Size, By Product, 2019-2026 (USD Million)

7.7.7.2 Market Size, By Application, 2019-2026 (USD Million)

7.7.7.3 Market Size, By Distribution Channel, 2019-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Myosin Industries Pty Ltd

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 Choices Gluten-Free

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Bakels Worldwide

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Lesaffre et Compagnie,SA

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Caremoli SPA

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Watson, Inc.

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Naturally Organic

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Theodor Rietmann GmbH

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info Graphic Analysis

8.10 Baking Technical Advice Pty Ltd

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Benexia

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

8.12 BioXXI

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info Graphic Analysis

8.13 Melinda's Gluten-Free Goodies

8.13.1 Company Overview

8.13.2 Financial Analysis

8.13.3 Strategic Positioning

8.13.4 Info Graphic Analysis

8.14 Other Companies

8.14.1 Company Overview

8.14.2 Financial Analysis

8.14.3 Strategic Positioning

8.14.4 Info Graphic Analysis

The Global Gluten-free Bakery Premixes Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Gluten-free Bakery Premixes Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS