Global Granite Paint & Coating Market Size, Trends & Analysis - Forecasts to 2026 By Application (Kitchen, Floor, Stair, Building Exterior), By End-Use (Commercial Spaces [New, Remodeling], Residential Spaces [New, Remodeling]), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa); End-User Landscape, Company Market Share Analysis, and Competitor Analysis

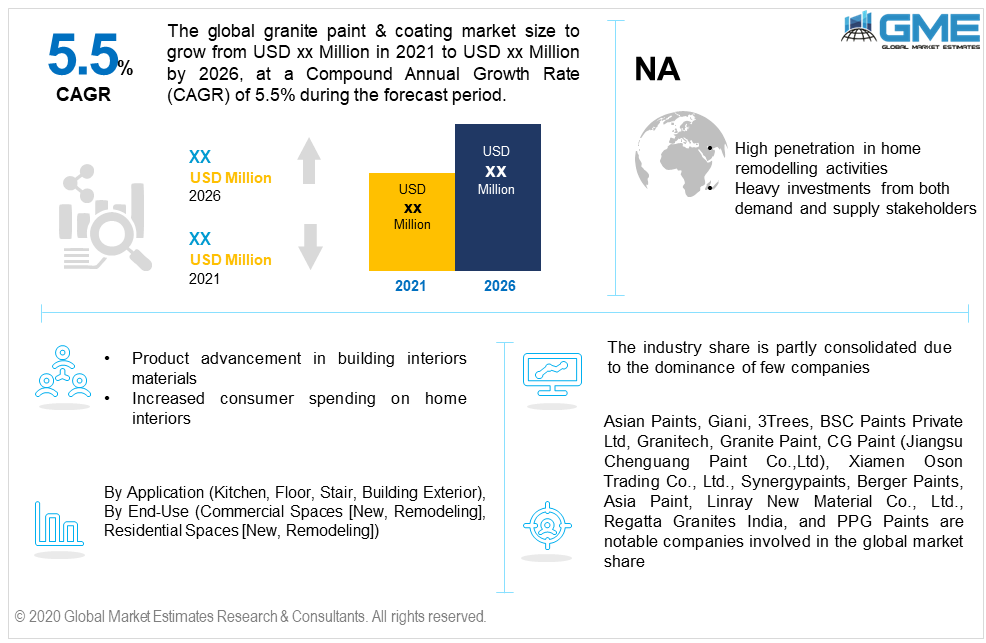

Increased consumer spending on home interiors along with the commercialization of cost-effective and long-term suitable materials have instigated the granite paint & coating demand. High performance, stain resistance, and longevity are the prime properties of these finishes. The global granite paint & coating market size will witness more than 5.5% CAGR from 2021 to 2026, with the Asia Pacific leading the regional demand.

Offering advantages such as appealing texture, aesthetic appeal, and easy maintenance have positively influenced global industry growth. These products also provide a vast number of choices in terms of color and design as per the customer's requirement and purpose. The rising trend of fine finishes in the kitchen countertop, slab, and tabletops has instigated the demand for these product types.

Construction industry expansion owing to rapid industrialization along with rising consumer preference for new product varieties to attain different styles will support product adoption. Hotel industries are also investing in products that are color resistant and have a long life.

Giani is an Italian-based company and is a major market player in the industry. The company provides a self-use kit, which includes mineral coats, applicator, and instruction manual to transform the normal laminated or stone countertop to a granite look-alike countertop. These products are cost-effective solutions to traditional products. Remodeling is the major application of these product kits.

The application segment is categorized into the kitchen, floor, stair, and building exterior. Different applications can use these products according to their purpose. The highest demand is witnessed from kitchen applications. These products provide high-end finishing and appearance which makes the space eye-catching. Many consumers are investing in these products for their kitchen due to their high aesthetic appeal.

The other application which is gaining high popularity is flooring. The floors will foresee the highest gains during the forecast period. High-quality finish, appealing looks, and economics are major factors to drive penetration in this segment.

Commercial spaces and residential spaces are the key end-users in the industry. Later, these two end-users are sub-categorized in new construction and remodeling. The residential spaces dominated the overall demand and held for more than 60% of the market share. Under the residential sector, the remodeling activities will witness the highest CAGR from 2021 to 2026. Increased consumer spending along with rising interest to refurbish their kitchen and building exterior were the major success factors to induce demand in this segment.

The residential spaces will observe significant gains in the coming years. The increased demand for BnB and other short-term rental flats has resulted in the refurbishment of the house interiors. As of now, the hotel industry is also investing in economical and attractive building products and materials.

The Asia Pacific dominated the regional revenue share and held more than 30% of the market share in 2019. The larger scope of construction activities related to new construction and remodeling will drive the regional demand. Another important factor is the presence of numerous suppliers in the region which makes the product widely accessible at economical pricing. China, India, and Japan are among the key countries due to their high contribution to the construction industry.

The North American market is likely to observe the highest gains from 2021 to 2026. Increased remodeling activities along with rising demand for new product design and appearance will support the regional demand.

The European market will witness high demand for remodeling applications. The region holds high potential in the refurbishment segment. A large group of consumers is spending on new product varieties in residential and commercial spaces. Germany, the UK, Italy, and France will be the leading revenue generators in the coming years.

Asian Paints, Giani, 3Trees, BSC Paints Private Ltd, Granitech, Granite Paint, CG Paint (Jiangsu Chenguang Paint Co.,Ltd), Xiamen Oson Trading Co., Ltd., Synergypaints, Berger Paints, Linray New Material Co., Ltd., Regatta Granites India, and PPG Paints are notable companies involved in the global market share.

The industry share is partly consolidated due to the dominance of few companies. However, the large presence of Chinese suppliers and their reach across the globe makes the market competitive and fragmented. Product development and improved performance are the prime activities witnessed in the industry.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market scope & definitions

1.2 Estimates & forecast calculation

1.3 Historical data overview and validation

1.4 Data sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Granite Paint & Coating industry overview, 2019-2026

2.1.1 Industry overview

2.1.2 Application overview

2.1.3 End-use overview

2.1.4 Regional overview

Chapter 3 Granite Paint & Coating Market Trends

3.1 Market segmentation

3.2 Industry background, 2019-2026

3.3 Market key trends

3.3.1 Positive trends

3.3.2 Industry challenges

3.4 Prospective growth scenario

3.4.1 Product growth scenario

3.5 Industry influence over product growth

3.6 Porter’s analysis

3.7 PESTEL analysis

3.8 Value chain & supply chain analysis

3.9 Regulatory framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology overview

3.11 Market share analysis, 2020

3.11.1 Company positioning overview, 2020

Chapter 4 Granite Paint & Coating Market, By Application

4.1 Application Outlook

4.2 Kitchen

4.2.1 Market size, by region, 2019-2026 (USD Million)

4.3 Floor

4.3.1 Market size, by region, 2019-2026 (USD Million)

4.4 Stair

4.4.1 Market size, by region, 2019-2026 (USD Million)

4.5 Building exterior

4.5.1 Market size, by region, 2019-2026 (USD Million)

Chapter 5 Granite Paint & Coating Market, By End-Use

5.1 End-Use Outlook

5.2 Residential Space

5.2.1 Market size, by region, 2019-2026 (USD Million)

5.2.2 New

5.2.2.1 Market size, by region, 2019-2026 (USD Million)

5.2.3 Remodelling

5.2.3.1 Market size, by region, 2019-2026 (USD Million)

5.3 Commercial Space

5.3.1 Market size, by region, 2019-2026 (USD Million)

5.3.2 New

5.3.2.1 Market size, by region, 2019-2026 (USD Million)

5.3.3 Remodelling

5.3.3.1 Market size, by region, 2019-2026 (USD Million)

Chapter 6 Granite Paint & Coating Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market size, by country 2019-2026 (USD Million)

6.2.2 Market size, by application, 2019-2026 (USD Million)

6.2.3 Market size, by end-use, 2019-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market size, by application, 2019-2026 (USD Million)

6.2.4.2 Market size, by end-use, 2019-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market size, by application, 2019-2026 (USD Million)

6.2.5.2 Market size, by end-use, 2019-2026 (USD Million)

6.3 Europe

6.3.1 Market size, by country 2019-2026 (USD Million)

6.3.2 Market size, by application, 2019-2026 (USD Million)

6.3.3 Market size, by end-use, 2019-2026 (USD Million)

6.3.4 Germany

6.2.4.1 Market size, by application, 2019-2026 (USD Million)

6.2.4.2 Market size, by end-use, 2019-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market size, by application, 2019-2026 (USD Million)

6.3.5.2 Market size, by end-use, 2019-2026 (USD Million)

6.3.6 France

6.3.6.1 Market size, by application, 2019-2026 (USD Million)

6.3.6.2 Market size, by end-use, 2019-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market size, by application, 2019-2026 (USD Million)

6.3.7.2 Market size, by end-use, 2019-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market size, by application, 2019-2026 (USD Million)

6.3.8.2 Market size, by end-use, 2019-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market size, by application, 2019-2026 (USD Million)

6.3.9.2 Market size, by end-use, 2019-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market size, by country 2019-2026 (USD Million)

6.4.2 Market size, by application, 2019-2026 (USD Million)

6.4.3 Market size, by end-use, 2019-2026 (USD Million)

6.4.4 China

6.4.4.1 Market size, by application, 2019-2026 (USD Million)

6.4.4.2 Market size, by end-use, 2019-2026 (USD Million)

6.4.5 Japan

6.4.5.1 Market size, by application, 2019-2026 (USD Million)

6.4.5.2 Market size, by end-use, 2019-2026 (USD Million)

6.4.6 Australia

6.4.6.1 Market size, by application, 2019-2026 (USD Million)

6.4.6.2 Market size, by end-use, 2019-2026 (USD Million)

6.4.7 India

6.4.7.1 Market size, by application, 2019-2026 (USD Million)

6.4.7.2 Market size, by end-use, 2019-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market size, by application, 2019-2026 (USD Million)

6.4.8.2 Market size, by end-use, 2019-2026 (USD Million)

6.5 Latin America

6.5.1 Market size, by country 2019-2026 (USD Million)

6.5.2 Market size, by application, 2019-2026 (USD Million)

6.5.3 Market size, by end-use, 2019-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market size, by application, 2019-2026 (USD Million)

6.5.4.2 Market size, by end-use, 2019-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market size, by application, 2019-2026 (USD Million)

6.5.5.2 Market size, by end-use, 2019-2026 (USD Million)

6.6 MEA

6.6.1 Market size, by country 2019-2026 (USD Million)

6.6.2 Market size, by application, 2019-2026 (USD Million)

6.6.3 Market size, by end-use, 2019-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market size, by application, 2019-2026 (USD Million)

6.6.4.2 Market size, by end-use, 2019-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market size, by application, 2019-2026 (USD Million)

6.6.5.2 Market size, by end-use, 2019-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive analysis, 2020

7.2 Asian Paints

7.2.1 Company overview

7.2.2 Financial analysis

7.2.3 Strategic positioning

7.2.4 Info graphic analysis

7.3 Giani, Inc.

7.3.1 Company overview

7.3.2 Financial analysis

7.3.3 Strategic positioning

7.3.4 Info graphic analysis

7.4 3Trees

7.4.1 Company overview

7.4.2 Financial analysis

7.4.3 Strategic positioning

7.4.4 Info graphic analysis

7.5 BSC Paints Private Limited

7.5.1 Company overview

7.5.2 Financial analysis

7.5.3 Strategic positioning

7.5.4 Info graphic analysis

7.6 Granitech

7.6.1 Company overview

7.6.2 Financial analysis

7.6.3 Strategic positioning

7.6.4 Info graphic analysis

7.7 Granite Paint

7.7.1 Company overview

7.7.2 Financial analysis

7.7.3 Strategic positioning

7.7.4 Info graphic analysis

7.8 CG Paint (Jiangsu Chenguang Paint Co.,Ltd)

7.8.1 Company overview

7.8.2 Financial analysis

7.8.3 Strategic positioning

7.8.4 Info graphic analysis

7.9 Xiamen Oson Trading Co., Ltd.

7.9.1 Company overview

7.9.2 Financial analysis

7.9.3 Strategic positioning

7.9.4 Info graphic analysis

7.10 Synergypaints

7.10.1 Company overview

7.10.2 Financial analysis

7.10.3 Strategic positioning

7.10.4 Info graphic analysis

7.11 Berger Paints

7.11.1 Company overview

7.11.2 Financial analysis

7.11.3 Strategic positioning

7.11.4 Info graphic analysis

7.12 Giani Granite

7.12.1 Company overview

7.12.2 Financial analysis

7.12.3 Strategic positioning

7.12.4 Info graphic analysis

7.13 Linray New Material Co., Ltd.

7.13.1 Company overview

7.13.2 Financial analysis

7.13.3 Strategic positioning

7.13.4 Info graphic analysis

7.14 Regatta Granites India

7.14.1 Company overview

7.14.2 Financial analysis

7.14.3 Strategic positioning

7.14.4 Info graphic analysis

7.15 PPG Paints

7.15.1 Company overview

7.15.2 Financial analysis

7.15.3 Strategic positioning

7.15.4 Info graphic analysis

The Global Granite Paint & Coating Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Granite Paint & Coating Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS