Global Green Finance Market Size, Trends & Analysis - Forecasts to 2029 By Investment Type (Equity, Fixed Income, and Mixed Allocation), By Transaction Type (Green Bond, Social Bond, and Mixed-sustainability Bond), By Industry Verticals (Utilities, Transport and Logistics, Chemicals, Food and Beverage, Government, and Others), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

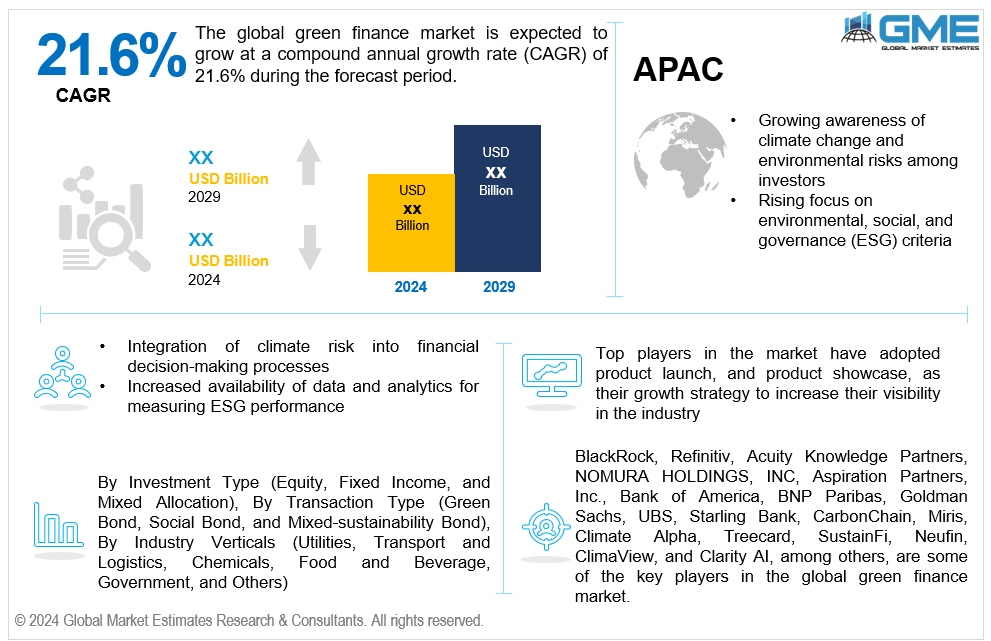

The global green finance market is estimated to exhibit a CAGR of 21.6% from 2024 to 2029.

The primary factors propelling the market growth are the growing awareness of climate change and environmental risks among investors and the rising focus on environmental, social, and governance (ESG) criteria. Investors are more aware of the concrete effects of climate change, such as extreme weather events, rising sea levels, and biodiversity loss. They are more likely to select investments that reduce these risks. This shift in mentality is motivated by the realization that traditional investments can turn into stranded assets in a fast-decarbonizing economy. As a result, there is a greater demand for green financial instruments, such as green bonds, sustainable funds, and ESG-linked loans, which provide both financial rewards and environmental benefits. Additionally, investors are becoming more aware of the long-term financial benefits of sustainable investing, such as increased resilience and regulatory compliance. For instance, according to a 2022 survey by asset management firm Capital Group, 89% of global investors incorporate ESG considerations into their investment strategy.

The integration of climate risk into financial decision-making processes and the increased availability of data and analytics to measure ESG performance are expected to support market growth. Financial institutions are increasingly aware that climate-related risks can significantly influence asset prices, investment returns, and economic stability. Investors and lenders can better manage possible risks from climate-related disasters by including climate risk assessments into their strategy. This integration encourages capital investment in sustainable projects such as renewable energy and green infrastructure, which are intended to mitigate climate risks. Sustainable finance frameworks and disclosure requirements, such as the Task Force on Climate-related Financial Disclosures (TCFD), are also encouraging this trend by requiring greater openness on how climate risks are handled.

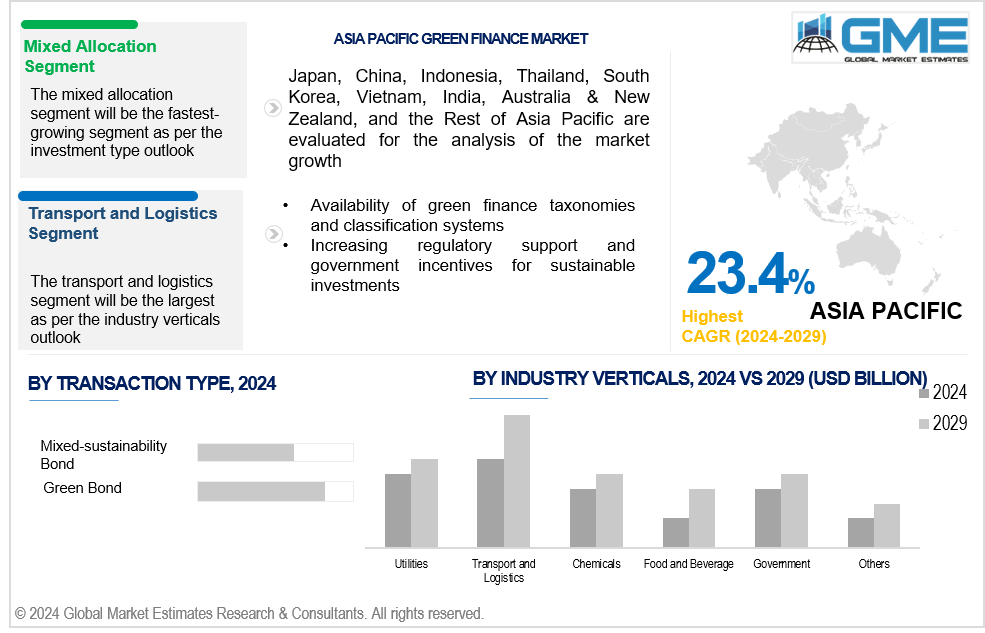

The availability of green finance taxonomies and classification systems and increasing regulatory support and government incentives for sustainable investments propel market growth. Governments worldwide enact green finance regulations and laws to stimulate investment in sustainable projects, such as subsidies, tax incentives, and favorable loan conditions for green initiatives. Regulatory frameworks such as the European Union's Sustainable Finance Disclosure Regulation (SFDR) and the U.S. Securities and Exchange Commission's climate risk disclosure requirements require financial institutions to be more transparent and accountable in their environmental risk and opportunity management. These steps not only mitigate the financial risks associated with unsustainable activities but they also increase the appeal of green investments.

Renewable energy investments in solar, wind, and other sources, which give long-term rewards and contribute to lowering carbon footprints, create market opportunities. Moreover, eco-friendly investments in the green infrastructure projects, including green buildings, smart grids, and sustainable urban transportation systems, creates profitable prospects.

Climate finance initiatives are spearheading the shift, channelling investments towards projects with positive environmental impacts. Carbon credits trading mechanisms are gaining traction, offering incentives for emission reductions. Socially responsible investing principles are guiding the allocation of funds towards companies with ethical practices. Green banking and green loan programs play a major role in facilitating the financing of eco-friendly initiatives. Environmental impact investing, particularly in clean energy financing, is on the rise, paving the way for a transition towards a low-carbon economy supported by green investment funds.

However, the absence of universally accepted standards and insufficient financial products tailored to green investments may impede market growth over the forecast period.

The equity segment is expected to hold the largest share of the market over the forecast period. Equity investments in green finance, such as green stocks and shares in environmentally conscious companies, are becoming more appealing to investors. This is due to increased awareness and concern about environmental sustainability and climate change, which drives demand for investments that help to build a greener economy.

The mixed allocation segment is expected to be the fastest-growing segment in the market from 2024 to 2029. Mixed allocation investments mix a variety of asset classes, including stocks, bonds, and alternative assets, in a single portfolio. This diversity minimizes risk and volatility when compared to investing in a single asset class, making it appealing to investors looking for balanced exposure to green finance.

The green bond segment is expected to hold the largest share of the market over the forecast period. Institutional and individual investors are increasingly seeking fixed-income securities that meet environmental, social, and governance (ESG) metrics. Green bonds address this desire by providing investment possibilities that support environmentally good initiatives while giving consistent returns.

The mixed-sustainability bond segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. Mixed-sustainability bonds, including environmental and social criteria, appeal to a larger spectrum of investors interested in backing full ESG activities. This simultaneous emphasis on environmental and social advantages makes these bonds very appealing to investors looking to maximize their positive impact.

The transport and logistics segment is expected to hold the largest share of the market over the forecast period. The transport and logistics industry is a major contributor to greenhouse gas emissions and environmental damage. Given its large carbon footprint, there is a tremendous incentive to decarbonize and implement sustainable practices, resulting in major green financing investments.

The food and beverage segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. There is a rising global focus on agricultural sustainability and food security. Investments in sustainable agricultural techniques, organic agriculture, and resilient food systems are critical to achieving these objectives. Green finance is essential for supporting these sustainable agriculture projects.

North America is expected to be the largest region in the global market. Government policies and regulations to reduce carbon emissions and support sustainable practices are key drivers of the North American green finance market growth. Policies like carbon pricing, renewable energy mandates, and green bond rules encourage investments in ecologically beneficial initiatives.

Asia Pacific is anticipated to witness rapid growth during the forecast period. Asia Pacific is home to some of the world's most prominent technological hubs and inventors. Technological advancements such as renewable energy technologies, energy storage, smart grids, and digital finance solutions are propelling the creation of innovative green finance products and services, making it simpler to fund sustainable projects and manage environmental risks.

BlackRock, Refinitiv, Acuity Knowledge Partners, NOMURA HOLDINGS, INC, Aspiration Partners, Inc., Bank of America, BNP Paribas, Goldman Sachs, HSBC Group, KPMG International, South Pole, Deutsche Bank AG, Stripe, Inc., Tred Earth Limited, Triodos Bank UK Ltd., UBS, Starling Bank, CarbonChain, Miris, Climate Alpha, Treecard, SustainFi, Neufin, ClimaView, and Clarity AI, among others, are some of the key players in the global green finance market.

Please note: This is not an exhaustive list of companies profiled in the report.

In July 2023, Goldman Sachs Asset Management (GSAM) announced the launch of two new sustainable bond funds, the Goldman Sachs Global Impact Corporate Bond Fund and the Goldman Sachs USD Green Bond Fund. The company mentions that these funds aim to enable investors to enhance their portfolios' sustainability profiles through an allocation to green, social, and sustainability bonds.

In January 2023, BlackRock, the world's largest asset manager, stated that it would transfer USD 500 billion of its assets to sustainable investments by 2025.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL GREEN FINANCE MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL GREEN FINANCE MARKET, BY INVESTMENT TYPE

4.1 Introduction

4.2 Green Finance Market: Investment Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Equity

4.4.1 Equity Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Fixed Income

4.5.1 Fixed Income Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Mixed Allocation

4.6.1 Mixed Allocation Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL GREEN FINANCE MARKET, BY INDUSTRY VERTICALS

5.1 Introduction

5.2 Green Finance Market: Industry Verticals Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Utilities

5.4.1 Utilities Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Transport and Logistics

5.5.1 Transport and Logistics Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Chemicals

5.6.1 Chemicals Market Estimates and Forecast, 2021-2029 (USD Million)

5.7 Food and Beverage

5.7.1 Food and Beverage Market Estimates and Forecast, 2021-2029 (USD Million)

5.8 Government

5.8.1 Government Market Estimates and Forecast, 2021-2029 (USD Million)

5.9 Others

5.9.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL GREEN FINANCE MARKET, BY TRANSACTION TYPE

6.1 Introduction

6.2 Green Finance Market: Transaction Type Scope Key Takeaways

6.3 Revenue Growth Analysis, 2023 & 2029

6.4 Green Bond

6.4.1 Green Bond Market Estimates and Forecast, 2021-2029 (USD Million)

6.5 Social Bond

6.5.1 Social Bond Market Estimates and Forecast, 2021-2029 (USD Million)

6.6 Mixed-sustainability Bond

6.6.1 Mixed-sustainability Bond Market Estimates and Forecast, 2021-2029 (USD Million)

7 GLOBAL GREEN FINANCE MARKET, BY REGION

7.1 Introduction

7.2 North America Green Finance Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.1 By Investment Type

7.2.2 By Industry Verticals

7.2.3 By Transaction Type

7.2.4 By Country

7.2.4.1 U.S. Green Finance Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.1.1 By Investment Type

7.2.4.1.2 By Industry Verticals

7.2.4.1.3 By Transaction Type

7.2.4.2 Canada Green Finance Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.2.1 By Investment Type

7.2.4.2.2 By Industry Verticals

7.2.4.2.3 By Transaction Type

7.2.4.3 Mexico Green Finance Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.3.1 By Investment Type

7.2.4.3.2 By Industry Verticals

7.2.4.3.3 By Transaction Type

7.3 Europe Green Finance Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.1 By Investment Type

7.3.2 By Industry Verticals

7.3.3 By Transaction Type

7.3.4 By Country

7.3.4.1 Germany Green Finance Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.1.1 By Investment Type

7.3.4.1.2 By Industry Verticals

7.3.4.1.3 By Transaction Type

7.3.4.2 U.K. Green Finance Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.2.1 By Investment Type

7.3.4.2.2 By Industry Verticals

7.3.4.2.3 By Transaction Type

7.3.4.3 France Green Finance Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.3.1 By Investment Type

7.3.4.3.2 By Industry Verticals

7.3.4.3.3 By Transaction Type

7.3.4.4 Italy Green Finance Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.4.1 By Investment Type

7.3.4.4.2 By Industry Verticals

7.2.4.4.3 By Transaction Type

7.3.4.5 Spain Green Finance Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.5.1 By Investment Type

7.3.4.5.2 By Industry Verticals

7.2.4.5.3 By Transaction Type

7.3.4.6 Netherlands Green Finance Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.6.1 By Investment Type

7.3.4.6.2 By Industry Verticals

7.2.4.6.3 By Transaction Type

7.3.4.7 Rest of Europe Green Finance Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.7.1 By Investment Type

7.3.4.7.2 By Industry Verticals

7.2.4.7.3 By Transaction Type

7.4 Asia Pacific Green Finance Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.1 By Investment Type

7.4.2 By Industry Verticals

7.4.3 By Transaction Type

7.4.4 By Country

7.4.4.1 China Green Finance Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.1.1 By Investment Type

7.4.4.1.2 By Industry Verticals

7.4.4.1.3 By Transaction Type

7.4.4.2 Japan Green Finance Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.2.1 By Investment Type

7.4.4.2.2 By Industry Verticals

7.4.4.2.3 By Transaction Type

7.4.4.3 India Green Finance Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.3.1 By Investment Type

7.4.4.3.2 By Industry Verticals

7.4.4.3.3 By Transaction Type

7.4.4.4 South Korea Green Finance Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.4.1 By Investment Type

7.4.4.4.2 By Industry Verticals

7.4.4.4.3 By Transaction Type

7.4.4.5 Singapore Green Finance Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.5.1 By Investment Type

7.4.4.5.2 By Industry Verticals

7.4.4.5.3 By Transaction Type

7.4.4.6 Malaysia Green Finance Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.6.1 By Investment Type

7.4.4.6.2 By Industry Verticals

7.4.4.6.3 By Transaction Type

7.4.4.7 Thailand Green Finance Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.7.1 By Investment Type

7.4.4.7.2 By Industry Verticals

7.4.4.7.3 By Transaction Type

7.4.4.8 Indonesia Green Finance Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.8.1 By Investment Type

7.4.4.8.2 By Industry Verticals

7.4.4.8.3 By Transaction Type

7.4.4.9 Vietnam Green Finance Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.9.1 By Investment Type

7.4.4.9.2 By Industry Verticals

7.4.4.9.3 By Transaction Type

7.4.4.10 Taiwan Green Finance Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.10.1 By Investment Type

7.4.4.10.2 By Industry Verticals

7.4.4.10.3 By Transaction Type

7.4.4.11 Rest of Asia Pacific Green Finance Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.11.1 By Investment Type

7.4.4.11.2 By Industry Verticals

7.4.4.11.3 By Transaction Type

7.5 Middle East and Africa Green Finance Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.1 By Investment Type

7.5.2 By Industry Verticals

7.5.3 By Transaction Type

7.5.4 By Country

7.5.4.1 Saudi Arabia Green Finance Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.1.1 By Investment Type

7.5.4.1.2 By Industry Verticals

7.5.4.1.3 By Transaction Type

7.5.4.2 U.A.E. Green Finance Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.2.1 By Investment Type

7.5.4.2.2 By Industry Verticals

7.5.4.2.3 By Transaction Type

7.5.4.3 Israel Green Finance Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.3.1 By Investment Type

7.5.4.3.2 By Industry Verticals

7.5.4.3.3 By Transaction Type

7.5.4.4 South Africa Green Finance Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.4.1 By Investment Type

7.5.4.4.2 By Industry Verticals

7.5.4.4.3 By Transaction Type

7.5.4.5 Rest of Middle East and Africa Green Finance Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.5.1 By Investment Type

7.5.4.5.2 By Industry Verticals

7.5.4.5.2 By Transaction Type

7.6 Central and South America Green Finance Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.1 By Investment Type

7.6.2 By Industry Verticals

7.6.3 By Transaction Type

7.6.4 By Country

7.6.4.1 Brazil Green Finance Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.1.1 By Investment Type

7.6.4.1.2 By Industry Verticals

7.6.4.1.3 By Transaction Type

7.6.4.2 Argentina Green Finance Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.2.1 By Investment Type

7.6.4.2.2 By Industry Verticals

7.6.4.2.3 By Transaction Type

7.6.4.3 Chile Green Finance Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.3.1 By Investment Type

7.6.4.3.2 By Industry Verticals

7.6.4.3.3 By Transaction Type

7.6.4.4 Rest of Central and South America Green Finance Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.4.1 By Investment Type

7.6.4.4.2 By Industry Verticals

7.6.4.4.3 By Transaction Type

8 COMPETITIVE LANDCAPE

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.2.1 Market Leaders

8.2.2 Market Visionaries

8.2.3 Market Challengers

8.2.4 Niche Market Players

8.3 Vendor Landscape

8.3.1 North America

8.3.2 Europe

8.3.3 Asia Pacific

8.3.4 Rest of the World

8.4 Company Profiles

8.4.1 BlackRock

8.4.1.1 Business Description & Financial Analysis

8.4.1.2 SWOT Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2 Refinitiv

8.4.2.1 Business Description & Financial Analysis

8.4.2.2 SWOT Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3 Acuity Knowledge Partners

8.4.3.1 Business Description & Financial Analysis

8.4.3.2 SWOT Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4 NOMURA HOLDINGS, INC

8.4.4.1 Business Description & Financial Analysis

8.4.4.2 SWOT Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5 Aspiration Partners, Inc.

8.4.5.1 Business Description & Financial Analysis

8.4.5.2 SWOT Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6 Bank of America

8.4.6.1 Business Description & Financial Analysis

8.4.6.2 SWOT Analysis

8.4.6.3 Products & Services Offered

8.4.6.4 Strategic Alliances between Business Partners

8.4.7 BNP Paribas

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8 Goldman Sachs

8.4.8.1 Business Description & Financial Analysis

8.4.8.2 SWOT Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9 HSBC Group

8.4.9.1 Business Description & Financial Analysis

8.4.9.2 SWOT Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10 KPMG International

8.4.10.1 Business Description & Financial Analysis

8.4.10.2 SWOT Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

8.4.11 South Pole

8.4.11.1 Business Description & Financial Analysis

8.4.11.2 SWOT Analysis

8.4.11.3 Products & Services Offered

8.4.11.4 Strategic Alliances between Business Partners

8.4.12 Deutsche Bank AG

8.4.12.1 Business Description & Financial Analysis

8.4.12.2 SWOT Analysis

8.4.12.3 Products & Services Offered

8.4.12.4 Strategic Alliances between Business Partners

8.4.13 Stripe, Inc.

8.4.13.1 Business Description & Financial Analysis

8.4.13.2 SWOT Analysis

8.4.13.3 Products & Services Offered

8.4.13.4 Strategic Alliances between Business Partners

8.4.14 Tred Earth Limited

8.4.14.1 Business Description & Financial Analysis

8.4.14.2 SWOT Analysis

8.4.14.3 Products & Services Offered

8.4.14.4 Strategic Alliances between Business Partners

8.4.15 Triodos Bank UK Ltd.

8.4.15.1 Business Description & Financial Analysis

8.4.15.2 SWOT Analysis

8.4.15.3 Products & Services Offered

8.4.15.4 Strategic Alliances between Business Partners

8.4.16 UBS

8.4.16.1 Business Description & Financial Analysis

8.4.16.2 SWOT Analysis

8.4.16.3 Products & Services Offered

8.4.16.4 Strategic Alliances between Business Partners

8.4.17 Starling Bank

8.4.17.1 Business Description & Financial Analysis

8.4.17.2 SWOT Analysis

8.4.17.3 Products & Services Offered

8.4.17.4 Strategic Alliances between Business Partners

8.4.18 CarbonChain

8.4.18.1 Business Description & Financial Analysis

8.4.18.2 SWOT Analysis

8.4.18.3 Products & Services Offered

8.4.18.4 Strategic Alliances between Business Partners

8.4.19 Miris

8.4.19.1 Business Description & Financial Analysis

8.4.19.2 SWOT Analysis

8.4.19.3 Products & Services Offered

8.4.19.4 Strategic Alliances between Business Partners

8.4.20 Climate Alpha

8.4.20.1 Business Description & Financial Analysis

8.4.20.2 SWOT Analysis

8.4.20.3 Products & Services Offered

8.4.20.4 Strategic Alliances between Business Partners

8.4.21 Treecard

8.4.21.1 Business Description & Financial Analysis

8.4.21.2 SWOT Analysis

8.4.21.3 Products & Services Offered

8.4.21.4 Strategic Alliances between Business Partners

8.4.22 SustainFi

8.4.22.1 Business Description & Financial Analysis

8.4.22.2 SWOT Analysis

8.4.22.3 Products & Services Offered

8.4.22.4 Strategic Alliances between Business Partners

8.4.23 Neufin

8.4.23.1 Business Description & Financial Analysis

8.4.23.2 SWOT Analysis

8.4.23.3 Products & Services Offered

8.4.23.4 Strategic Alliances between Business Partners

8.4.24 ClimaView

8.4.24.1 Business Description & Financial Analysis

8.4.24.2 SWOT Analysis

8.4.24.3 Products & Services Offered

8.4.24.4 Strategic Alliances between Business Partners

8.4.25 Clarity AI

8.4.25.1 Business Description & Financial Analysis

8.4.25.2 SWOT Analysis

8.4.25.3 Products & Services Offered

8.4.25.4 Strategic Alliances between Business Partners

8.4.26 Other Companies

8.4.26.1 Business Description & Financial Analysis

8.4.26.2 SWOT Analysis

8.4.26.3 Products & Services Offered

8.4.26.4 Strategic Alliances between Business Partners

9 RESEARCH METHODOLOGY

9.1 Market Introduction

9.1.1 Market Definition

9.1.2 Market Scope & Segmentation

9.2 Information Procurement

9.2.1 Secondary Research

9.2.1.1 Purchased Databases

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2 Primary Research

9.2.2.1 Various Types of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.3 Primary Stakeholders

9.2.2.4 Discussion Guide for Primary Participants

9.2.3 Expert Panels

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4 Paid Local Experts

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3 Market Estimation

9.3.1 Top-Down Approach

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2 Bottom Up Approach

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Product Sales

9.4 Data Triangulation

9.4.1 Data Collection

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.4.3 Cluster Analysis

9.5 Analysis and Output

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

9.7.1 Research Assumptions

9.7.2 Research Limitations

LIST OF TABLES

1 Global Green Finance Market, By Investment Type, 2021-2029 (USD Mllion)

2 Equity Market, By Region, 2021-2029 (USD Mllion)

3 Fixed Income Market, By Region, 2021-2029 (USD Mllion)

4 Mixed Allocation Market, By Region, 2021-2029 (USD Mllion)

5 Global Green Finance Market, By Industry Verticals, 2021-2029 (USD Mllion)

6 Utilities Market, By Region, 2021-2029 (USD Mllion)

7 Transport and Logistics Market, By Region, 2021-2029 (USD Mllion)

8 Food and Beverage Market, By Region, 2021-2029 (USD Mllion)

9 Chemicals Market, By Region, 2021-2029 (USD Mllion)

10 Government Market, By Region, 2021-2029 (USD Mllion)

11 Global Green Finance Market, By Transaction Type, 2021-2029 (USD Mllion)

12 Green Bond Market, By Region, 2021-2029 (USD Mllion)

13 Social Bond Market, By Region, 2021-2029 (USD Mllion)

14 Mixed-sustainability Bond Market, By Region, 2021-2029 (USD Mllion)

15 Regional Analysis, 2021-2029 (USD Mllion)

16 North America Green Finance Market, By Investment Type, 2021-2029 (USD Million)

17 North America Green Finance Market, By Industry Verticals, 2021-2029 (USD Million)

18 North America Green Finance Market, By Transaction Type, 2021-2029 (USD Million)

19 North America Green Finance Market, By Country, 2021-2029 (USD Million)

20 U.S. Green Finance Market, By Investment Type, 2021-2029 (USD Million)

21 U.S. Green Finance Market, By Industry Verticals, 2021-2029 (USD Million)

22 U.S. Green Finance Market, By Transaction Type, 2021-2029 (USD Million)

23 Canada Green Finance Market, By Investment Type, 2021-2029 (USD Million)

24 Canada Green Finance Market, By Industry Verticals, 2021-2029 (USD Million)

25 Canada Green Finance Market, By Transaction Type, 2021-2029 (USD Million)

26 Mexico Green Finance Market, By Investment Type, 2021-2029 (USD Million)

27 Mexico Green Finance Market, By Industry Verticals, 2021-2029 (USD Million)

28 Mexico Green Finance Market, By Transaction Type, 2021-2029 (USD Million)

29 Europe Green Finance Market, By Investment Type, 2021-2029 (USD Million)

30 Europe Green Finance Market, By Industry Verticals, 2021-2029 (USD Million)

31 Europe Green Finance Market, By Transaction Type, 2021-2029 (USD Million)

32 Europe Green Finance Market, By COUNTRY, 2021-2029 (USD Million)

33 Germany Green Finance Market, By Investment Type, 2021-2029 (USD Million)

34 Germany Green Finance Market, By Industry Verticals, 2021-2029 (USD Million)

35 Germany Green Finance Market, By Transaction Type, 2021-2029 (USD Million)

36 U.K. Green Finance Market, By Investment Type, 2021-2029 (USD Million)

37 U.K. Green Finance Market, By Industry Verticals, 2021-2029 (USD Million)

38 U.K. Green Finance Market, By Transaction Type, 2021-2029 (USD Million)

39 France Green Finance Market, By Investment Type, 2021-2029 (USD Million)

40 France Green Finance Market, By Industry Verticals, 2021-2029 (USD Million)

41 France Green Finance Market, By Transaction Type, 2021-2029 (USD Million)

42 Italy Green Finance Market, By Investment Type, 2021-2029 (USD Million)

43 Italy Green Finance Market, By End Use , 2021-2029 (USD Million)

44 Italy Green Finance Market, By Transaction Type, 2021-2029 (USD Million)

45 Spain Green Finance Market, By Investment Type, 2021-2029 (USD Million)

46 Spain Green Finance Market, By Industry Verticals, 2021-2029 (USD Million)

47 Spain Green Finance Market, By Transaction Type, 2021-2029 (USD Million)

48 Rest Of Europe Green Finance Market, By Investment Type, 2021-2029 (USD Million)

49 Rest Of Europe Green Finance Market, By Industry Verticals, 2021-2029 (USD Million)

50 Rest of Europe Green Finance Market, By Transaction Type, 2021-2029 (USD Million)

51 Asia Pacific Green Finance Market, By Investment Type, 2021-2029 (USD Million)

52 Asia Pacific Green Finance Market, By Industry Verticals, 2021-2029 (USD Million)

53 Asia Pacific Green Finance Market, By Transaction Type, 2021-2029 (USD Million)

54 Asia Pacific Green Finance Market, By Country, 2021-2029 (USD Million)

55 China Green Finance Market, By Investment Type, 2021-2029 (USD Million)

56 China Green Finance Market, By Industry Verticals, 2021-2029 (USD Million)

57 China Green Finance Market, By Transaction Type, 2021-2029 (USD Million)

58 India Green Finance Market, By Investment Type, 2021-2029 (USD Million)

59 India Green Finance Market, By Industry Verticals, 2021-2029 (USD Million)

60 India Green Finance Market, By Transaction Type, 2021-2029 (USD Million)

61 Japan Green Finance Market, By Investment Type, 2021-2029 (USD Million)

62 Japan Green Finance Market, By Industry Verticals, 2021-2029 (USD Million)

63 Japan Green Finance Market, By Transaction Type, 2021-2029 (USD Million)

64 South Korea Green Finance Market, By Investment Type, 2021-2029 (USD Million)

65 South Korea Green Finance Market, By Industry Verticals, 2021-2029 (USD Million)

66 South Korea Green Finance Market, By Transaction Type, 2021-2029 (USD Million)

67 Singapore Green Finance Market, By Investment Type, 2021-2029 (USD Million)

68 Singapore Green Finance Market, By Industry Verticals, 2021-2029 (USD Million)

69 Singapore Green Finance Market, By Transaction Type, 2021-2029 (USD Million)

70 Malaysia Green Finance Market, By Investment Type, 2021-2029 (USD Million)

71 Malaysia Green Finance Market, By Industry Verticals, 2021-2029 (USD Million)

72 Malaysia Green Finance Market, By Transaction Type, 2021-2029 (USD Million)

73 Thailand Green Finance Market, By Investment Type, 2021-2029 (USD Million)

74 Thailand Green Finance Market, By Industry Verticals, 2021-2029 (USD Million)

75 Thailand Green Finance Market, By Transaction Type, 2021-2029 (USD Million)

76 Indonesia Green Finance Market, By Investment Type, 2021-2029 (USD Million)

77 Indonesia Green Finance Market, By Industry Verticals, 2021-2029 (USD Million)

78 Indonesia Green Finance Market, By Transaction Type, 2021-2029 (USD Million)

79 Vietnam Green Finance Market, By Investment Type, 2021-2029 (USD Million)

80 Vietnam Green Finance Market, By Industry Verticals, 2021-2029 (USD Million)

81 Vietnam Green Finance Market, By Transaction Type, 2021-2029 (USD Million)

82 Taiwan Green Finance Market, By Investment Type, 2021-2029 (USD Million)

83 Taiwan Green Finance Market, By Industry Verticals, 2021-2029 (USD Million)

84 Taiwan Green Finance Market, By Transaction Type, 2021-2029 (USD Million)

85 Rest of Asia Pacific Green Finance Market, By Investment Type, 2021-2029 (USD Million)

86 Rest of Asia Pacific Green Finance Market, By Industry Verticals, 2021-2029 (USD Million)

87 Rest of Asia Pacific Green Finance Market, By Transaction Type, 2021-2029 (USD Million)

88 Middle East and Africa Green Finance Market, By Investment Type, 2021-2029 (USD Million)

89 Middle East and Africa Green Finance Market, By Industry Verticals, 2021-2029 (USD Million)

90 Middle East and Africa Green Finance Market, By Transaction Type, 2021-2029 (USD Million)

91 Middle East and Africa Green Finance Market, By Country, 2021-2029 (USD Million)

92 Saudi Arabia Green Finance Market, By Investment Type, 2021-2029 (USD Million)

93 Saudi Arabia Green Finance Market, By Industry Verticals, 2021-2029 (USD Million)

94 Saudi Arabia Green Finance Market, By Transaction Type, 2021-2029 (USD Million)

95 UAE Green Finance Market, By Investment Type, 2021-2029 (USD Million)

96 UAE Green Finance Market, By Industry Verticals, 2021-2029 (USD Million)

97 UAE Green Finance Market, By Transaction Type, 2021-2029 (USD Million)

98 Israel Green Finance Market, By Investment Type, 2021-2029 (USD Million)

99 Israel Green Finance Market, By Industry Verticals, 2021-2029 (USD Million)

100 Israel Green Finance Market, By Transaction Type, 2021-2029 (USD Million)

101 South Africa Green Finance Market, By Investment Type, 2021-2029 (USD Million)

102 South Africa Green Finance Market, By Industry Verticals, 2021-2029 (USD Million)

103 South Africa Green Finance Market, By Transaction Type, 2021-2029 (USD Million)

104 Rest of Middle East and Africa Green Finance Market, By Investment Type, 2021-2029 (USD Million)

105 Rest of Middle East and Africa Green Finance Market, By Industry Verticals, 2021-2029 (USD Million)

106 Rest of Middle East and Africa Green Finance Market, By Transaction Type, 2021-2029 (USD Million)

107 Central and South America Green Finance Market, By Investment Type, 2021-2029 (USD Million)

108 Central and South America Green Finance Market, By Industry Verticals, 2021-2029 (USD Million)

109 Central and South America Green Finance Market, By Transaction Type, 2021-2029 (USD Million)

110 Central and South America Green Finance Market, By Country, 2021-2029 (USD Million)

111 Brazil Green Finance Market, By Investment Type, 2021-2029 (USD Million)

112 Brazil Green Finance Market, By Industry Verticals, 2021-2029 (USD Million)

113 Brazil Green Finance Market, By Transaction Type, 2021-2029 (USD Million)

114 Argentina Green Finance Market, By Investment Type, 2021-2029 (USD Million)

115 Argentina Green Finance Market, By Industry Verticals, 2021-2029 (USD Million)

116 Argentina Green Finance Market, By Transaction Type, 2021-2029 (USD Million)

117 Chile Green Finance Market, By Investment Type, 2021-2029 (USD Million)

118 Chile Green Finance Market, By Industry Verticals, 2021-2029 (USD Million)

119 Chile Green Finance Market, By Transaction Type, 2021-2029 (USD Million)

120 Rest of Central and South America Green Finance Market, By Investment Type, 2021-2029 (USD Million)

121 Rest of Central and South America Green Finance Market, By Industry Verticals, 2021-2029 (USD Million)

122 Rest of Central and South America Green Finance Market, By Transaction Type, 2021-2029 (USD Million)

123 BlackRock: Products & Services Offering

124 Refinitiv: Products & Services Offering

125 Acuity Knowledge Partners: Products & Services Offering

126 NOMURA HOLDINGS, INC: Products & Services Offering

127 Aspiration Partners, Inc.: Products & Services Offering

128 ENGIE: Products & Services Offering

129 BNP Paribas : Products & Services Offering

130 Goldman Sachs: Products & Services Offering

131 HSBC Group, Inc: Products & Services Offering

132 KPMG International: Products & Services Offering

133 South Pole: Products & Services Offering

134 Deutsche Bank AG: Products & Services Offering

135 Stripe, Inc.: Products & Services Offering

136 Tred Earth Limited: Products & Services Offering

137 UBS: Products & Services Offering

138 Starling Bank: Products & Services Offering

139 CarbonChain: Products & Services Offering

140 Miris: Products & Services Offering

141 Climate Alpha: Products & Services Offering

142 Triodos Bank UK Ltd.: Products & Services Offering

143 Treecard: Products & Services Offering

144 SustainFi: Products & Services Offering

145 Neufin: Products & Services Offering

146 ClimaView: Products & Services Offering

147 Clarity AI: Products & Services Offering

148 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Green Finance Market Overview

2 Global Green Finance Market Value From 2021-2029 (USD Mllion)

3 Global Green Finance Market Share, By Investment Type (2022)

4 Global Green Finance Market Share, By Industry Verticals (2022)

5 Global Green Finance Market Share, By Transaction Type (2022)

6 Global Green Finance Market, By Region (Asia Pacific Market)

7 Technological Trends In Global Green Finance Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global Green Finance Market

11 Impact Of Challenges On The Global Green Finance Market

12 Porter’s Five Forces Analysis

13 Global Green Finance Market: By Investment Type Scope Key Takeaways

14 Global Green Finance Market, By Investment Type Segment: Revenue Growth Analysis

15 Equity Market, By Region, 2021-2029 (USD Mllion)

16 Fixed Income Market, By Region, 2021-2029 (USD Mllion)

17 Mixed Allocation Market, By Region, 2021-2029 (USD Mllion)

18 Global Green Finance Market: By Industry Verticals Scope Key Takeaways

19 Global Green Finance Market, By Industry Verticals Segment: Revenue Growth Analysis

20 Utilities Market, By Region, 2021-2029 (USD Mllion)

21 Transport and Logistics Market, By Region, 2021-2029 (USD Mllion)

22 Food and Beverage Market, By Region, 2021-2029 (USD Mllion)

23 ChemicalsMarket, By Region, 2021-2029 (USD Mllion)

24 Government Market, By Region, 2021-2029 (USD Mllion)

25 Others Market, By Region, 2021-2029 (USD Mllion)

26 Global Green Finance Market: By Transaction Type Scope Key Takeaways

27 Global Green Finance Market, By Transaction Type Segment: Revenue Growth Analysis

28 Green Bond Market, By Region, 2021-2029 (USD Mllion)

29 Social Bond Market, By Region, 2021-2029 (USD Mllion)

30 Mixed-sustainability Bond Market, By Region, 2021-2029 (USD Mllion)

31 Regional Segment: Revenue Growth Analysis

32 Global Green Finance Market: Regional Analysis

33 North America Green Finance Market Overview

34 North America Green Finance Market, By Investment Type

35 North America Green Finance Market, By Industry Verticals

36 North America Green Finance Market, By Transaction Type

37 North America Green Finance Market, By Country

38 U.S. Green Finance Market, By Investment Type

39 U.S. Green Finance Market, By Industry Verticals

40 U.S. Green Finance Market, By Transaction Type

41 Canada Green Finance Market, By Investment Type

42 Canada Green Finance Market, By Industry Verticals

43 Canada Green Finance Market, By Transaction Type

44 Mexico Green Finance Market, By Investment Type

45 Mexico Green Finance Market, By Industry Verticals

46 Mexico Green Finance Market, By Transaction Type

47 Four Quadrant Positioning Matrix

48 Company Market Share Analysis

49 BlackRock: Company Snapshot

50 BlackRock: SWOT Analysis

51 BlackRock: Geographic Presence

52 Refinitiv: Company Snapshot

53 Refinitiv: SWOT Analysis

54 Refinitiv: Geographic Presence

55 Acuity Knowledge Partners: Company Snapshot

56 Acuity Knowledge Partners: SWOT Analysis

57 Acuity Knowledge Partners: Geographic Presence

58 NOMURA HOLDINGS, INC: Company Snapshot

59 NOMURA HOLDINGS, INC: Swot Analysis

60 NOMURA HOLDINGS, INC: Geographic Presence

61 Aspiration Partners, Inc.: Company Snapshot

62 Aspiration Partners, Inc.: SWOT Analysis

63 Aspiration Partners, Inc.: Geographic Presence

64 Bank of America: Company Snapshot

65 Bank of America: SWOT Analysis

66 Bank of America: Geographic Presence

67 BNP Paribas : Company Snapshot

68 BNP Paribas : SWOT Analysis

69 BNP Paribas : Geographic Presence

70 Goldman Sachs: Company Snapshot

71 Goldman Sachs: SWOT Analysis

72 Goldman Sachs: Geographic Presence

73 HSBC Group, Inc.: Company Snapshot

74 HSBC Group, Inc.: SWOT Analysis

75 HSBC Group, Inc.: Geographic Presence

76 KPMG International: Company Snapshot

77 KPMG International: SWOT Analysis

78 KPMG International: Geographic Presence

79 South Pole: Company Snapshot

80 South Pole: SWOT Analysis

81 South Pole: Geographic Presence

82 Deutsche Bank AG: Company Snapshot

83 Deutsche Bank AG: SWOT Analysis

84 Deutsche Bank AG: Geographic Presence

85 Stripe, Inc.: Company Snapshot

86 Stripe, Inc.: SWOT Analysis

87 Stripe, Inc.: Geographic Presence

88 Tred Earth Limited: Company Snapshot

89 Tred Earth Limited: SWOT Analysis

90 Tred Earth Limited: Geographic Presence

91 UBS: Company Snapshot

92 UBS: SWOT Analysis

93 UBS: Geographic Presence

94 Starling Bank: Company Snapshot

95 Starling Bank: SWOT Analysis

96 Starling Bank: Geographic Presence

97 CarbonChain: Company Snapshot

98 CarbonChain: SWOT Analysis

99 CarbonChain: Geographic Presence

100 Miris: Company Snapshot

101 Miris: SWOT Analysis

102 Miris: Geographic Presence

103 Climate Alpha: Company Snapshot

104 Climate Alpha: SWOT Analysis

105 Climate Alpha: Geographic Presence

106 Triodos Bank UK Ltd.: Company Snapshot

107 Triodos Bank UK Ltd.: SWOT Analysis

108 Triodos Bank UK Ltd.: Geographic Presence

109 Treecard: Company Snapshot

110 Treecard: SWOT Analysis

111 Treecard: Geographic Presence

112 SustainFi: Company Snapshot

113 SustainFi: SWOT Analysis

114 SustainFi: Geographic Presence

115 Neufin: Company Snapshot

116 Neufin: SWOT Analysis

117 Neufin: Geographic Presence

118 ClimaView: Company Snapshot

119 ClimaView: SWOT Analysis

120 ClimaView: Geographic Presence

121 Clarity AI: Company Snapshot

122 Clarity AI: SWOT Analysis

123 Clarity AI: Geographic Presence

124 Other Companies: Company Snapshot

125 Other Companies: SWOT Analysis

126 Other Companies: Geographic Presence

The Global Green Finance Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Green Finance Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS