Global Greenfield Manufacturing for Electric Vehicles Market Size, Trends & Analysis - Forecasts to 2029 By Vehicle Type (Electric Two-Wheeler and Electric Three and Four-Wheeler), By Manufacturing Stage (Assembly Plants, Battery Manufacturing Facilities, Component Manufacturing Plants, and Complete Vehicle Manufacturing Plants), By End User (Consumer & Commercial Vehicles, Public Transportation, and Industrial Applications), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

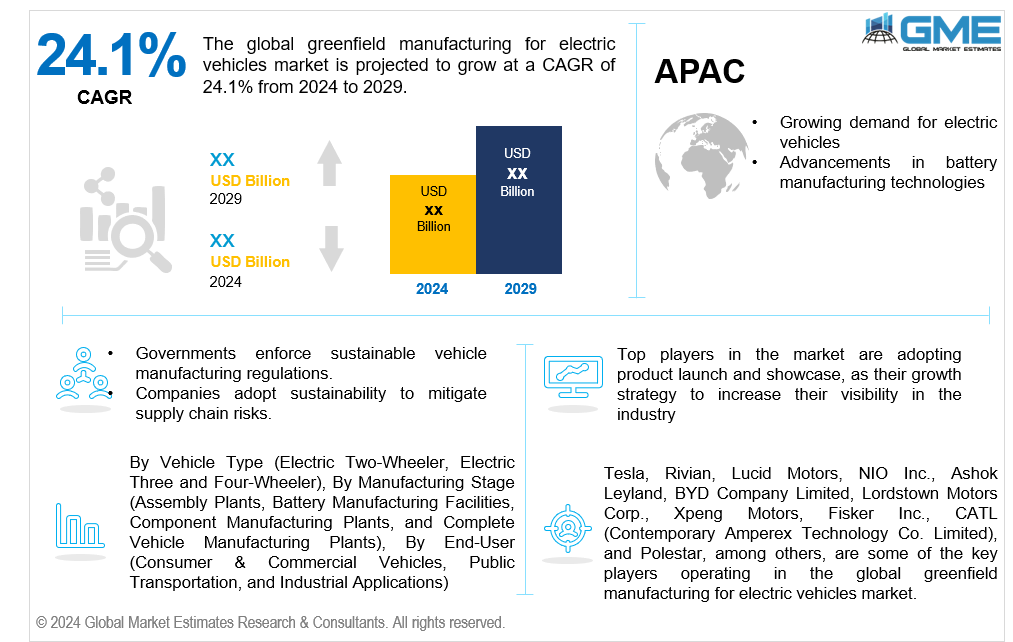

The global greenfield manufacturing for electric vehicles market is projected to grow at a CAGR of 24.1% from 2024 to 2029.

The greenfield manufacturing for electric vehicles market is expanding rapidly as the global automobile industry is shifting significantly towards environmentally friendly and sustainable mobility solutions. The term "greenfield manufacturing" describes the construction of brand-new manufacturing facilities emphasizing integrating cutting-edge technologies and ecologically friendly procedures. This means building factories specifically for producing electric automobiles, batteries, charging infrastructure, and other parts in the context of electric vehicles (EVs).

The growing global demand for electric vehicles is one of the main factors driving the greenfield manufacturing for electric vehicles market. To lessen carbon emissions and fight climate change, governments and regulatory agencies worldwide are enacting stringent emission standards and offering incentives to promote the use of electric vehicles. In response to the global imperative to address climate change, governments worldwide are adopting measures such as the Energy Conservation (Amendment) Act 2022 in India, which took effect on January 1, 2023. This amendment, approved by both houses of Parliament, allows the central government to specify a carbon credit trading scheme, aligning with the broader effort to reduce carbon emissions. Simultaneously, other countries are focusing on promoting electric vehicles, supported by strict emission standards and incentives, to combat climate change and contribute to a sustainable future.

Furthermore, due to the above trend of government support for carbon emission control, automakers are spending more on new and sustainable construction to accommodate the rising demand for electric cars and advance sustainable mobility.

The development of batteries is another factor driving the shift to electric vehicles. Greenfield manufacturing plants aim to provide cutting-edge batteries with increased energy density, quicker charging times, and longer lifespans. This focus on battery research is essential for resolving two of the main issues with electric vehicles: their short range and inadequate infrastructure for charging. Greenfield manufacturing facilities are integral to increasing battery production to fulfill the growing demand for electric vehicles, which propels the growth of the market as a whole.

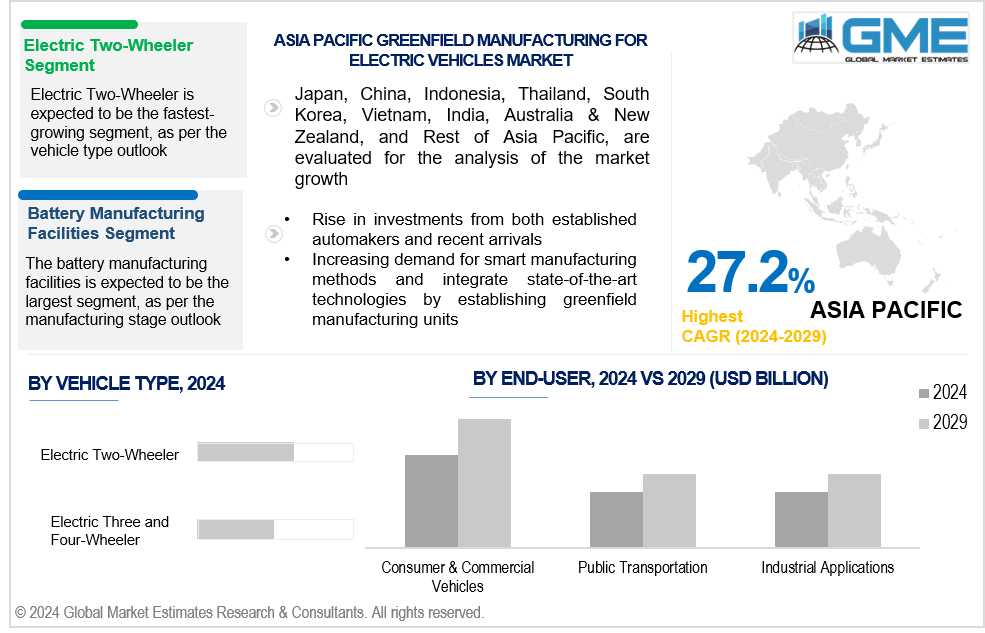

A rise in investments from established automakers also distinguishes the market for greenfield manufacturing of electric vehicles. In order to stay competitive in the rapidly changing automotive industry and make the shift to electric mobility, well-established manufacturers are proactively building greenfield facilities.

Investments in greenfield manufacturing are increasing due to start-ups and tech companies entering the market simultaneously and concentrating on disruptive technologies like connected electric vehicles and autonomous driving.

Companies can apply smart manufacturing methods and integrate state-of-the-art technologies by establishing greenfield manufacturing units. These cutting-edge, technologically advanced facilities use automation, AI, and the Internet of Things (IoT) to maximize production efficiency, minimize expenses, and guarantee the highest quality standards. The total competitiveness of electric vehicles in the automotive market is boosted by the incorporation of Industry 4.0 principles in greenfield manufacturing.

Moreover, the global trend towards sustainable practices impacts the greenfield manufacturing market for electric vehicles. Governments and environmental organizations are pushing for using electric vehicles as a primary solution and reducing greenhouse gas emissions. By using eco-friendly production techniques, integrating renewable energy sources, and putting waste reduction strategies in place, greenfield manufacturing facilities are supporting the production of electric vehicles in an environmentally responsible manner.

In summary, the growing demand for electric vehicles, developments in battery technology, investments from the automotive industry, and a dedication to environmentally friendly manufacturing processes are the main factors driving the greenfield manufacturing for electric vehicles market. The construction of greenfield manufacturing facilities is essential to determining the direction of electric mobility and fostering a more sustainable and environmentally friendly automotive sector.

The electric two-wheeler segment is expected to hold the largest share of the market over the forecast period. This projection depends on a number of variables that have an increasing impact on the market share of electric two-wheelers. The segment is witnessing growth primarily due to the growing emphasis on environmentally friendly and sustainable transportation options worldwide, particularly in urban areas where traffic and environmental concerns are significant. The increasing popularity of electric two-wheelers, including motorbikes and scooters, can be attributed to their environmental friendliness, affordability, and suitability for short-distance transportation compared to their conventional internal combustion engine equivalents.

The electric three and four-wheeler segment is expected to be the fastest-growing segment in the market from 2024 to 2029. The segment growth is attributed to the trend toward electric transportation solutions that has intensified due to growing awareness of environmental sustainability and the need to cut carbon emissions. Worldwide governments and regulatory agencies are insistently pushing the use of electric vehicles, emphasizing three- and four-wheelers in particular due to their capacity to carry higher passenger and cargo loads.

The battery manufacturing facilities segment is anticipated to be the fastest-growing category in the global greenfield manufacturing for electric vehicles market from 2024 to 2029. The vital role of battery technology in the electric vehicle (EV) ecosystem drives the segment's predicted growth. The need for high-performing and reasonably priced batteries is growing as the demand for electric vehicles is increasing globally. The continuous development of energy storage technologies is the main factor propelling the expansion of battery production plants. Advanced battery development is critical as electric vehicles aim for increased efficiency, driving range, and overall performance. Moreover, improving battery chemistries, boosting energy density, and lengthening battery lifespans are important variables influencing consumer adoption, for which manufacturers are making significant investments in R&D.

The complete vehicle manufacturing plants segment is expected to hold the largest share of the market during the forecast period. Several variables that emphasize these manufacturing facilities' critical role in the assembly and manufacture of electric vehicles (EVs) are responsible for their dominance. Global demand for electric vehicles (EVs) is growing, which makes large-scale car production plants more important.

The comprehensive approach that all car manufacturing plants provide to the production of electric vehicles is a significant factor in their retained dominance. These plants handle every production stage, from assembling individual parts to producing whole electric cars. The production cycle is streamlined by the integration of different processes, such as body assembly, battery integration, and final vehicle assembly, which improves operational efficiency and quality control.

The consumer & commercial vehicles segment is anticipated to be the fastest-growing segment in the market from 2024-2029. The growth is supported by several important variables demonstrating the rising demand for and revolutionary effects of electric vehicles (EVs) in the consumer and business markets. The drive for electrification in the commercial vehicle industry is solid because of the focus on lowering carbon emissions in transportation and logistics. The benefits of electric commercial vehicles, such as cheaper operating costs, less of an impact on the environment, and compliance with stringent emission rules, are increasingly recognized by fleet operators. The market for consumer and commercial cars is growing as a result of the growing trend toward sustainable practices and green logistics, which increases demand for electric commercial vehicles.

The public transportation segment is expected to hold the largest share of the market during the forecast period. This dominance is supported by several important criteria that demonstrate how vital electric cars (EVs) will be in determining how public transportation networks will develop globally in the future.

There has been a sharp increase in investments and activities toward the electrification of public transportation due to the growing emphasis on decarbonization and minimizing the effects of climate change. Governments are establishing aggressive goals to replace their fleets of conventional fossil fuel vehicles with electric vehicles for public transportation. The expansion of this segment is primarily due to government grants, subsidies, and other financial incentives that encourage public transportation companies to deploy electric buses and other electric vehicles.

North America is anticipated to emerge as the largest region in the market, showcasing a robust and influential presence throughout the forecast period. Several key factors contribute to North America's prominence in shaping the landscape of greenfield manufacturing for electric vehicles, reflecting the region's commitment to sustainable mobility and technological leadership. The financial support and incentives offered by North American governments have greatly enhanced the ecology of greenfield manufacturing for electric vehicles. Requirements for manufacturing excellence and innovation in the electric car sector are facilitated by favorable regulatory frameworks and significant investments in research and development. Manufacturers have been greatly aided in establishing and growing their greenfield manufacturing facilities in the region by incentives like tax credits, rebates, and subsidies.

Asia Pacific is anticipated to witness the fastest growth in the global greenfield manufacturing for electric vehicles market throughout the forecast period. The region's dynamic and evolving landscape, characterized by a combination of factors, positions it as a pivotal contributor to the burgeoning electric vehicle manufacturing sector. Asia Pacific's growth trajectory in greenfield electric car production is further aided by the presence of established and growing economies in the area. Large economies are pivotal in the global automotive and technology sectors. These include China, Japan, South Korea, and India, which make calculated investments in infrastructure, R&D, and production capacity to establish themselves as industry leaders in electric vehicles. Being the world's largest market for electric vehicles and a center for electric car production, China stands out as a leader in this regard.

Tesla, Rivian, Lucid Motors, NIO Inc., Ashok Leyland, BYD Company Limited, Lordstown Motors Corp., Xpeng Motors, Fisker Inc., CATL (Contemporary Amperex Technology Co. Limited), and Polestar, among others, are some of the key players operating in the global greenfield manufacturing for electric vehicles market.

Please note: This is not an exhaustive list of companies profiled in the report.

In February 2024, Ashok Leyland, the commercial vehicle manufacturing arm of the Hinduja Group, announced its new integrated commercial vehicle green manufacturing plant in Uttar Pradesh, India. The launch marked the initiation of construction for the state-of-the-art facility, situated at Kanpur Road in Lucknow. This new plant becomes Ashok Leyland's seventh vehicle manufacturing facility in the country. Spanning 70 acres, the greenfield manufacturing unit will be dedicated to producing electric buses, with the added capability to manufacture vehicles powered by various alternate fuels, aligning with the company's commitment to green mobility.

In December 2020, Lucid Motors announced that they had achieved a milestone in advancing sustainable mobility by completing the initial construction phase of its Lucid AMP-1 (Advanced Manufacturing Plant) factory in Arizona, U.S. The production equipment and processes have been commissioned as the company prepares for the production launch of Lucid Air in Spring 2021. Recognized as the first dedicated electric vehicle greenfield factory built from scratch in North America, Lucid's innovative AMP-1 is future-ready, designed for additional expansion phases.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL GREENFIELD MANUFACTURING FOR ELECTRIC VEHICLES MARKET MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL GREENFIELD MANUFACTURING FOR ELECTRIC VEHICLES MARKET, BY MANUFACTURING STAGE

4.1 Introduction

4.2 Greenfield Manufacturing for Electric Vehicles Market: Manufacturing Stage Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Assembly Plants

4.4.1 Assembly Plants Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Battery Manufacturing Facilities

4.5.1 Battery Manufacturing Facilities Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Component Manufacturing Plants

4.6.1 Component Manufacturing Plants Market Estimates and Forecast, 2021-2029 (USD Million)

4.7 Complete Vehicle Manufacturing Plants

4.7.1 Complete Vehicle Manufacturing Plants Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL GREENFIELD MANUFACTURING FOR ELECTRIC VEHICLES MARKET, BY VEHICLE TYPE

5.1 Introduction

5.2 Greenfield Manufacturing for Electric Vehicles Market: Vehicle Type Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Electric Two-Wheeler

5.4.1 Electric Two-Wheeler Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Electric Three and Four-Wheeler

5.5.1 Electric Three and Four-Wheeler Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL GREENFIELD MANUFACTURING FOR ELECTRIC VEHICLES MARKET, BY END-USER

6.1 Introduction

6.2 Greenfield Manufacturing for Electric Vehicles Market: End-User Scope Key Takeaways

6.3 Revenue Growth Analysis, 2023 & 2029

6.4 Consumer & Commercial Vehicles

6.4.1 Consumer & Commercial Vehicles Market Estimates and Forecast, 2021-2029 (USD Million)

6.5 Public Transportation

6.5.1 Public Transportation Market Estimates and Forecast, 2021-2029 (USD Million)

6.6 Industrial Applications

6.6.1 Industrial Applications Market Estimates and Forecast, 2021-2029 (USD Million)

7 GLOBAL GREENFIELD MANUFACTURING FOR ELECTRIC VEHICLES MARKET, BY REGION

7.1 Introduction

7.2 North America Greenfield Manufacturing for Electric Vehicles Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.1 By Manufacturing Stage

7.2.2 By Vehicle Type

7.2.3 By End-User

7.2.4 By Country

7.2.4.1 U.S. Greenfield Manufacturing for Electric Vehicles Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.1.1 By Manufacturing Stage

7.2.4.1.2 By Vehicle Type

7.2.4.1.3 By End-User

7.2.4.2 Canada Greenfield Manufacturing for Electric Vehicles Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.2.1 By Manufacturing Stage

7.2.4.2.2 By Vehicle Type

7.2.4.2.3 By End-User

7.2.4.3 Mexico Greenfield Manufacturing for Electric Vehicles Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.3.1 By Manufacturing Stage

7.2.4.3.2 By Vehicle Type

7.2.4.3.3 By End-User

7.3 Europe Greenfield Manufacturing for Electric Vehicles Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.1 By Manufacturing Stage

7.3.2 By Vehicle Type

7.3.3 By End-User

7.3.4 By Country

7.3.4.1 Germany Greenfield Manufacturing for Electric Vehicles Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.1.1 By Manufacturing Stage

7.3.4.1.2 By Vehicle Type

7.3.4.1.3 By End-User

7.3.4.2 U.K. Greenfield Manufacturing for Electric Vehicles Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.2.1 By Manufacturing Stage

7.3.4.2.2 By Vehicle Type

7.3.4.2.3 By End-User

7.3.4.3 France Greenfield Manufacturing for Electric Vehicles Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.3.1 By Manufacturing Stage

7.3.4.3.2 By Vehicle Type

7.3.4.3.3 By End-User

7.3.4.4 Italy Greenfield Manufacturing for Electric Vehicles Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.4.1 By Manufacturing Stage

7.3.4.4.2 By Vehicle Type

7.2.4.4.3 By End-User

7.3.4.5 Spain Greenfield Manufacturing for Electric Vehicles Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.5.1 By Manufacturing Stage

7.3.4.5.2 By Vehicle Type

7.2.4.5.3 By End-User

7.3.4.6 Netherlands Greenfield Manufacturing for Electric Vehicles Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.6.1 By Manufacturing Stage

7.3.4.6.2 By Vehicle Type

7.2.4.6.3 By End-User

7.3.4.7 Rest of Europe Greenfield Manufacturing for Electric Vehicles Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.7.1 By Manufacturing Stage

7.3.4.7.2 By Vehicle Type

7.2.4.7.3 By End-User

7.4 Asia Pacific Greenfield Manufacturing for Electric Vehicles Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.1 By Manufacturing Stage

7.4.2 By Vehicle Type

7.4.3 By End-User

7.4.4 By Country

7.4.4.1 China Greenfield Manufacturing for Electric Vehicles Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.1.1 By Manufacturing Stage

7.4.4.1.2 By Vehicle Type

7.4.4.1.3 By End-User

7.4.4.2 Japan Greenfield Manufacturing for Electric Vehicles Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.2.1 By Manufacturing Stage

7.4.4.2.2 By Vehicle Type

7.4.4.2.3 By End-User

7.4.4.3 India Greenfield Manufacturing for Electric Vehicles Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.3.1 By Manufacturing Stage

7.4.4.3.2 By Vehicle Type

7.4.4.3.3 By End-User

7.4.4.4 South Korea Greenfield Manufacturing for Electric Vehicles Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.4.1 By Manufacturing Stage

7.4.4.4.2 By Vehicle Type

7.4.4.4.3 By End-User

7.4.4.5 Singapore Greenfield Manufacturing for Electric Vehicles Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.5.1 By Manufacturing Stage

7.4.4.5.2 By Vehicle Type

7.4.4.5.3 By End-User

7.4.4.6 Malaysia Greenfield Manufacturing for Electric Vehicles Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.6.1 By Manufacturing Stage

7.4.4.6.2 By Vehicle Type

7.4.4.6.3 By End-User

7.4.4.7 Thailand Greenfield Manufacturing for Electric Vehicles Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.7.1 By Manufacturing Stage

7.4.4.7.2 By Vehicle Type

7.4.4.7.3 By End-User

7.4.4.8 Indonesia Greenfield Manufacturing for Electric Vehicles Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.8.1 By Manufacturing Stage

7.4.4.8.2 By Vehicle Type

7.4.4.8.3 By End-User

7.4.4.9 Vietnam Greenfield Manufacturing for Electric Vehicles Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.9.1 By Manufacturing Stage

7.4.4.9.2 By Vehicle Type

7.4.4.9.3 By End-User

7.4.4.10 Australia Greenfield Manufacturing for Electric Vehicles Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.10.1 By Manufacturing Stage

7.4.4.10.2 By Vehicle Type

7.4.4.10.3 By End-User

7.4.4.11 Rest of Asia Pacific Greenfield Manufacturing for Electric Vehicles Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.11.1 By Manufacturing Stage

7.4.4.11.2 By Vehicle Type

7.4.4.11.3 By End-User

7.5 Middle East and Africa Greenfield Manufacturing for Electric Vehicles Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.1 By Manufacturing Stage

7.5.2 By Vehicle Type

7.5.3 By End-User

7.5.4 By Country

7.5.4.1 Saudi Arabia Greenfield Manufacturing for Electric Vehicles Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.1.1 By Manufacturing Stage

7.5.4.1.2 By Vehicle Type

7.5.4.1.3 By End-User

7.5.4.2 U.A.E. Greenfield Manufacturing for Electric Vehicles Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.2.1 By Manufacturing Stage

7.5.4.2.2 By Vehicle Type

7.5.4.2.3 By End-User

7.5.4.3 Israel Greenfield Manufacturing for Electric Vehicles Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.3.1 By Manufacturing Stage

7.5.4.3.2 By Vehicle Type

7.5.4.3.3 By End-User

7.5.4.4 South Africa Greenfield Manufacturing for Electric Vehicles Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.4.1 By Manufacturing Stage

7.5.4.4.2 By Vehicle Type

7.5.4.4.3 By End-User

7.5.4.5 Rest of Middle East and Africa Greenfield Manufacturing for Electric Vehicles Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.5.1 By Manufacturing Stage

7.5.4.5.2 By Vehicle Type

7.5.4.5.2 By End-User

7.6 Central and South America Greenfield Manufacturing for Electric Vehicles Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.1 By Manufacturing Stage

7.6.2 By Vehicle Type

7.6.3 By End-User

7.6.4 By Country

7.6.4.1 Brazil Greenfield Manufacturing for Electric Vehicles Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.1.1 By Manufacturing Stage

7.6.4.1.2 By Vehicle Type

7.6.4.1.3 By End-User

7.6.4.2 Argentina Greenfield Manufacturing for Electric Vehicles Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.2.1 By Manufacturing Stage

7.6.4.2.2 By Vehicle Type

7.6.4.2.3 By End-User

7.6.4.3 Chile Greenfield Manufacturing for Electric Vehicles Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.3.1 By Manufacturing Stage

7.6.4.3.2 By Vehicle Type

7.6.4.3.3 By End-User

7.6.4.4 Rest of Central and South America Greenfield Manufacturing for Electric Vehicles Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.4.1 By Manufacturing Stage

7.6.4.4.2 By Vehicle Type

7.6.4.4.3 By End-User

8 COMPETITIVE LANDCAPE

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.2.1 Market Leaders

8.2.2 Market Visionaries

8.2.3 Market Challengers

8.2.4 Niche Market Players

8.3 Vendor Landscape

8.3.1 North America

8.3.2 Europe

8.3.3 Asia Pacific

8.3.4 Rest of the World

8.4 Company Profiles

8.4.1 Tesla

8.4.1.1 Business Description & Financial Analysis

8.4.1.2 SWOT Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2 Ashok Leyland

8.4.2.1 Business Description & Financial Analysis

8.4.2.2 SWOT Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3 Lucid Motors

8.4.3.1 Business Description & Financial Analysis

8.4.3.2 SWOT Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4 Rivian

8.4.4.1 Business Description & Financial Analysis

8.4.4.2 SWOT Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5 NIO Inc.

8.4.5.1 Business Description & Financial Analysis

8.4.5.2 SWOT Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6 BYD Company Limited

8.4.6.1 Business Description & Financial Analysis

8.4.6.2 SWOT Analysis

8.4.6.3 Products & Services Offered

8.4.6.4 Strategic Alliances between Business Partners

8.4.7 CATL (Contemporary Amperex Technology Co. Limited)

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8 Lordstown Motors Corp.

8.4.8.1 Business Description & Financial Analysis

8.4.8.2 SWOT Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9 Fisker Inc.

8.4.9.1 Business Description & Financial Analysis

8.4.9.2 SWOT Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10 Polestar

8.4.10.1 Business Description & Financial Analysis

8.4.10.2 SWOT Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

8.4.11 Other Companies

8.4.11.1 Business Description & Financial Analysis

8.4.11.2 SWOT Analysis

8.4.11.3 Products & Services Offered

8.4.11.4 Strategic Alliances between Business Partners

9 RESEARCH METHODOLOGY

9.1 Market Introduction

9.1.1 Market Definition

9.1.2 Market Scope & Segmentation

9.2 Information Procurement

9.2.1 Secondary Research

9.2.1.1 Purchased Databases

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2 Primary Research

9.2.2.1 Various Types of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.3 Primary Stakeholders

9.2.2.4 Discussion Guide for Primary Participants

9.2.3 Expert Panels

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4 Paid Local Experts

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3 Market Estimation

9.3.1 Top-Down Approach

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2 Bottom Up Approach

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Product Sales

9.4 Data Triangulation

9.4.1 Data Collection

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.4.3 Cluster Analysis

9.5 Analysis and Output

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

9.7.1 Research Assumptions

9.7.2 Research Limitations

LIST OF TABLES

1 Global Greenfield Manufacturing for Electric Vehicles Market, By Manufacturing Stage, 2021-2029 (USD Mllion)

2 Assembly Plants Market, By Region, 2021-2029 (USD Mllion)

3 Battery Manufacturing Facilities Market, By Region, 2021-2029 (USD Mllion)

4 Component Manufacturing Plants Market, By Region, 2021-2029 (USD Mllion)

5 Complete Vehicle Manufacturing Plants Market, By Region, 2021-2029 (USD Mllion)

6 Global Greenfield Manufacturing for Electric Vehicles Market, By Vehicle Type, 2021-2029 (USD Mllion)

7 Electric Two-Wheeler Market, By Region, 2021-2029 (USD Mllion)

8 Electric Three and Four-Wheeler Market, By Region, 2021-2029 (USD Mllion)

9 Global Greenfield Manufacturing for Electric Vehicles Market, By End-User, 2021-2029 (USD Mllion)

10 Consumer & Commercial Vehicles Market, By Region, 2021-2029 (USD Mllion)

11 Public Transportation Market, By Region, 2021-2029 (USD Mllion)

12 iNDUSTRIAL APPLICATIONS Market, By Region, 2021-2029 (USD Mllion)

13 Regional Analysis, 2021-2029 (USD Mllion)

14 North America Greenfield Manufacturing for Electric Vehicles Market, By Manufacturing Stage, 2021-2029 (USD Million)

15 North America Greenfield Manufacturing for Electric Vehicles Market, By Vehicle Type, 2021-2029 (USD Million)

16 North America Greenfield Manufacturing for Electric Vehicles Market, By End-User, 2021-2029 (USD Million)

17 North America Greenfield Manufacturing for Electric Vehicles Market, By Country, 2021-2029 (USD Million)

18 U.S Greenfield Manufacturing for Electric Vehicles Market, By Manufacturing Stage, 2021-2029 (USD Million)

19 U.S Greenfield Manufacturing for Electric Vehicles Market, By Vehicle Type, 2021-2029 (USD Million)

20 U.S Greenfield Manufacturing for Electric Vehicles Market, By End-User, 2021-2029 (USD Million)

21 Canada Greenfield Manufacturing for Electric Vehicles Market, By Manufacturing Stage, 2021-2029 (USD Million)

22 Canada Greenfield Manufacturing for Electric Vehicles Market, By Vehicle Type, 2021-2029 (USD Million)

23 Canada Greenfield Manufacturing for Electric Vehicles Market, By End-User, 2021-2029 (USD Million)

24 Mexico Greenfield Manufacturing for Electric Vehicles Market, By Manufacturing Stage, 2021-2029 (USD Million)

25 Mexico Greenfield Manufacturing for Electric Vehicles Market, By Vehicle Type, 2021-2029 (USD Million)

26 Mexico Greenfield Manufacturing for Electric Vehicles Market, By End-User, 2021-2029 (USD Million)

27 Europe Greenfield Manufacturing for Electric Vehicles Market, By Manufacturing Stage, 2021-2029 (USD Million)

28 Europe Greenfield Manufacturing for Electric Vehicles Market, By Vehicle Type, 2021-2029 (USD Million)

29 Europe Greenfield Manufacturing for Electric Vehicles Market, By End-User, 2021-2029 (USD Million)

30 Europe Greenfield Manufacturing for Electric Vehicles Market, By COUNTRY, 2021-2029 (USD Million)

31 Germany Greenfield Manufacturing for Electric Vehicles Market, By Manufacturing Stage, 2021-2029 (USD Million)

32 Germany Greenfield Manufacturing for Electric Vehicles Market, By Vehicle Type, 2021-2029 (USD Million)

33 Germany Greenfield Manufacturing for Electric Vehicles Market, By End-User, 2021-2029 (USD Million)

34 U.K Greenfield Manufacturing for Electric Vehicles Market, By Manufacturing Stage, 2021-2029 (USD Million)

35 U.K Greenfield Manufacturing for Electric Vehicles Market, By Vehicle Type, 2021-2029 (USD Million)

36 U.K Greenfield Manufacturing for Electric Vehicles Market, By End-User, 2021-2029 (USD Million)

37 France Greenfield Manufacturing for Electric Vehicles Market, By Manufacturing Stage, 2021-2029 (USD Million)

38 France Greenfield Manufacturing for Electric Vehicles Market, By Vehicle Type, 2021-2029 (USD Million)

39 France Greenfield Manufacturing for Electric Vehicles Market, By End-User, 2021-2029 (USD Million)

40 Italy Greenfield Manufacturing for Electric Vehicles Market, By Manufacturing Stage, 2021-2029 (USD Million)

41 Italy Greenfield Manufacturing for Electric Vehicles Market, By End Use , 2021-2029 (USD Million)

42 Italy Greenfield Manufacturing for Electric Vehicles Market, By End-User, 2021-2029 (USD Million)

43 Spain Greenfield Manufacturing for Electric Vehicles Market, By Manufacturing Stage, 2021-2029 (USD Million)

44 Spain Greenfield Manufacturing for Electric Vehicles Market, By Vehicle Type, 2021-2029 (USD Million)

45 Spain Greenfield Manufacturing for Electric Vehicles Market, By End-User, 2021-2029 (USD Million)

46 Rest Of Europe Greenfield Manufacturing for Electric Vehicles Market, By Manufacturing Stage, 2021-2029 (USD Million)

47 Rest Of Europe Greenfield Manufacturing for Electric Vehicles Market, By Vehicle Type, 2021-2029 (USD Million)

48 Rest of Europe Greenfield Manufacturing for Electric Vehicles Market, By End-User, 2021-2029 (USD Million)

49 Asia Pacific Greenfield Manufacturing for Electric Vehicles Market, By Manufacturing Stage, 2021-2029 (USD Million)

50 Asia Pacific Greenfield Manufacturing for Electric Vehicles Market, By Vehicle Type, 2021-2029 (USD Million)

51 Asia Pacific Greenfield Manufacturing for Electric Vehicles Market, By End-User, 2021-2029 (USD Million)

52 Asia Pacific Greenfield Manufacturing for Electric Vehicles Market, By Country, 2021-2029 (USD Million)

53 China Greenfield Manufacturing for Electric Vehicles Market, By Manufacturing Stage, 2021-2029 (USD Million)

54 China Greenfield Manufacturing for Electric Vehicles Market, By Vehicle Type, 2021-2029 (USD Million)

55 China Greenfield Manufacturing for Electric Vehicles Market, By End-User, 2021-2029 (USD Million)

56 India Greenfield Manufacturing for Electric Vehicles Market, By Manufacturing Stage, 2021-2029 (USD Million)

57 India Greenfield Manufacturing for Electric Vehicles Market, By Vehicle Type, 2021-2029 (USD Million)

58 India Greenfield Manufacturing for Electric Vehicles Market, By End-User, 2021-2029 (USD Million)

59 Japan Greenfield Manufacturing for Electric Vehicles Market, By Manufacturing Stage, 2021-2029 (USD Million)

60 Japan Greenfield Manufacturing for Electric Vehicles Market, By Vehicle Type, 2021-2029 (USD Million)

61 Japan Greenfield Manufacturing for Electric Vehicles Market, By End-User, 2021-2029 (USD Million)

62 South Korea Greenfield Manufacturing for Electric Vehicles Market, By Manufacturing Stage, 2021-2029 (USD Million)

63 South Korea Greenfield Manufacturing for Electric Vehicles Market, By Vehicle Type, 2021-2029 (USD Million)

64 South Korea Greenfield Manufacturing for Electric Vehicles Market, By End-User, 2021-2029 (USD Million)

65 Singapore Greenfield Manufacturing for Electric Vehicles Market, By Manufacturing Stage, 2021-2029 (USD Million)

66 Singapore Greenfield Manufacturing for Electric Vehicles Market, By Vehicle Type, 2021-2029 (USD Million)

67 Singapore Greenfield Manufacturing for Electric Vehicles Market, By End-User, 2021-2029 (USD Million)

68 Malaysia Greenfield Manufacturing for Electric Vehicles Market, By Manufacturing Stage, 2021-2029 (USD Million)

69 Malaysia Greenfield Manufacturing for Electric Vehicles Market, By Vehicle Type, 2021-2029 (USD Million)

70 Malaysia Greenfield Manufacturing for Electric Vehicles Market, By End-User, 2021-2029 (USD Million)

71 Thailand Greenfield Manufacturing for Electric Vehicles Market, By Manufacturing Stage, 2021-2029 (USD Million)

72 Thailand Greenfield Manufacturing for Electric Vehicles Market, By Vehicle Type, 2021-2029 (USD Million)

73 Thailand Greenfield Manufacturing for Electric Vehicles Market, By End-User, 2021-2029 (USD Million)

74 Indonesia Greenfield Manufacturing for Electric Vehicles Market, By Manufacturing Stage, 2021-2029 (USD Million)

75 Indonesia Greenfield Manufacturing for Electric Vehicles Market, By Vehicle Type, 2021-2029 (USD Million)

76 Indonesia Greenfield Manufacturing for Electric Vehicles Market, By End-User, 2021-2029 (USD Million)

77 Vietnam Greenfield Manufacturing for Electric Vehicles Market, By Manufacturing Stage, 2021-2029 (USD Million)

78 Vietnam Greenfield Manufacturing for Electric Vehicles Market, By Vehicle Type, 2021-2029 (USD Million)

79 Vietnam Greenfield Manufacturing for Electric Vehicles Market, By End-User, 2021-2029 (USD Million)

80 Australia Greenfield Manufacturing for Electric Vehicles Market, By Manufacturing Stage, 2021-2029 (USD Million)

81 Australia Greenfield Manufacturing for Electric Vehicles Market, By Vehicle Type, 2021-2029 (USD Million)

82 Australia Greenfield Manufacturing for Electric Vehicles Market, By End-User, 2021-2029 (USD Million)

83 Rest of Asia Pacific Greenfield Manufacturing for Electric Vehicles Market, By Manufacturing Stage, 2021-2029 (USD Million)

84 Rest of Asia Pacific Greenfield Manufacturing for Electric Vehicles Market, By Vehicle Type, 2021-2029 (USD Million)

85 Rest of Asia Pacific Greenfield Manufacturing for Electric Vehicles Market, By End-User, 2021-2029 (USD Million)

86 Middle East and Africa Greenfield Manufacturing for Electric Vehicles Market, By Manufacturing Stage, 2021-2029 (USD Million)

87 Middle East and Africa Greenfield Manufacturing for Electric Vehicles Market, By Vehicle Type, 2021-2029 (USD Million)

88 Middle East and Africa Greenfield Manufacturing for Electric Vehicles Market, By End-User, 2021-2029 (USD Million)

89 Middle East and Africa Greenfield Manufacturing for Electric Vehicles Market, By Country, 2021-2029 (USD Million)

90 Saudi Arabia Greenfield Manufacturing for Electric Vehicles Market, By Manufacturing Stage, 2021-2029 (USD Million)

91 Saudi Arabia Greenfield Manufacturing for Electric Vehicles Market, By Vehicle Type, 2021-2029 (USD Million)

92 Saudi Arabia Greenfield Manufacturing for Electric Vehicles Market, By End-User, 2021-2029 (USD Million)

93 UAE Greenfield Manufacturing for Electric Vehicles Market, By Manufacturing Stage, 2021-2029 (USD Million)

94 UAE Greenfield Manufacturing for Electric Vehicles Market, By Vehicle Type, 2021-2029 (USD Million)

95 UAE Greenfield Manufacturing for Electric Vehicles Market, By End-User, 2021-2029 (USD Million)

96 Israel Greenfield Manufacturing for Electric Vehicles Market, By Manufacturing Stage, 2021-2029 (USD Million)

97 Israel Greenfield Manufacturing for Electric Vehicles Market, By Vehicle Type, 2021-2029 (USD Million)

98 Israel Greenfield Manufacturing for Electric Vehicles Market, By End-User, 2021-2029 (USD Million)

99 South Africa Greenfield Manufacturing for Electric Vehicles Market, By Manufacturing Stage, 2021-2029 (USD Million)

100 South Africa Greenfield Manufacturing for Electric Vehicles Market, By Vehicle Type, 2021-2029 (USD Million)

101 South Africa Greenfield Manufacturing for Electric Vehicles Market, By End-User, 2021-2029 (USD Million)

102 Rest of Middle East and Africa Greenfield Manufacturing for Electric Vehicles Market, By Manufacturing Stage, 2021-2029 (USD Million)

103 Rest of Middle East and Africa Greenfield Manufacturing for Electric Vehicles Market, By Vehicle Type, 2021-2029 (USD Million)

104 Rest of Middle East and Africa Greenfield Manufacturing for Electric Vehicles Market, By End-User, 2021-2029 (USD Million)

105 Central and South America Greenfield Manufacturing for Electric Vehicles Market, By Manufacturing Stage, 2021-2029 (USD Million)

106 Central and South America Greenfield Manufacturing for Electric Vehicles Market, By Vehicle Type, 2021-2029 (USD Million)

107 Central and South America Greenfield Manufacturing for Electric Vehicles Market, By End-User, 2021-2029 (USD Million)

108 Central and South America Greenfield Manufacturing for Electric Vehicles Market, By Country, 2021-2029 (USD Million)

109 Brazil Greenfield Manufacturing for Electric Vehicles Market, By Manufacturing Stage, 2021-2029 (USD Million)

110 Brazil Greenfield Manufacturing for Electric Vehicles Market, By Vehicle Type, 2021-2029 (USD Million)

111 Brazil Greenfield Manufacturing for Electric Vehicles Market, By End-User, 2021-2029 (USD Million)

112 Argentina Greenfield Manufacturing for Electric Vehicles Market, By Manufacturing Stage, 2021-2029 (USD Million)

113 Argentina Greenfield Manufacturing for Electric Vehicles Market, By Vehicle Type, 2021-2029 (USD Million)

114 Argentina Greenfield Manufacturing for Electric Vehicles Market, By End-User, 2021-2029 (USD Million)

115 Chile Greenfield Manufacturing for Electric Vehicles Market, By Manufacturing Stage, 2021-2029 (USD Million)

116 Chile Greenfield Manufacturing for Electric Vehicles Market, By Vehicle Type, 2021-2029 (USD Million)

117 Chile Greenfield Manufacturing for Electric Vehicles Market, By End-User, 2021-2029 (USD Million)

118 Rest of Central and South America Greenfield Manufacturing for Electric Vehicles Market, By Manufacturing Stage, 2021-2029 (USD Million)

119 Rest of Central and South America Greenfield Manufacturing for Electric Vehicles Market, By Vehicle Type, 2021-2029 (USD Million)

120 Rest of Central and South America Greenfield Manufacturing for Electric Vehicles Market, By End-User, 2021-2029 (USD Million)

121 Tesla: Products & Services Offering

122 Ashok Leyland: Products & Services Offering

123 Lucid Motors: Products & Services Offering

124 Rivian: Products & Services Offering

125 NIO Inc.: Products & Services Offering

126 BYD COMPANY LIMITED: Products & Services Offering

127 CATL (Contemporary Amperex Technology Co. Limited) : Products & Services Offering

128 Lordstown Motors Corp.: Products & Services Offering

129 Fisker Inc., Inc: Products & Services Offering

130 Polestar: Products & Services Offering

131 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Greenfield Manufacturing for Electric Vehicles Market Overview

2 Global Greenfield Manufacturing for Electric Vehicles Market Value From 2021-2029 (USD Mllion)

3 Global Greenfield Manufacturing for Electric Vehicles Market Share, By Manufacturing Stage (2023)

4 Global Greenfield Manufacturing for Electric Vehicles Market Share, By Vehicle Type (2023)

5 Global Greenfield Manufacturing for Electric Vehicles Market Share, By End-User (2023)

6 Global Greenfield Manufacturing for Electric Vehicles Market, By Region (Asia Pacific Market)

7 Technological Trends In Global Greenfield Manufacturing for Electric Vehicles Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global Greenfield Manufacturing for Electric Vehicles Market

11 Impact Of Challenges On The Global Greenfield Manufacturing for Electric Vehicles Market

12 Porter’s Five Forces Analysis

13 Global Greenfield Manufacturing for Electric Vehicles Market: By Manufacturing Stage Scope Key Takeaways

14 Global Greenfield Manufacturing for Electric Vehicles Market, By Manufacturing Stage Segment: Revenue Growth Analysis

15 Assembly Plants Market, By Region, 2021-2029 (USD Mllion)

16 Battery Manufacturing Facilities Market, By Region, 2021-2029 (USD Mllion)

17 Component Manufacturing Plants Market, By Region, 2021-2029 (USD Mllion)

18 Complete Vehicle Manufacturing Plants Market, By Region, 2021-2029 (USD Mllion)

19 Global Greenfield Manufacturing for Electric Vehicles Market: By Vehicle Type Scope Key Takeaways

20 Global Greenfield Manufacturing for Electric Vehicles Market, By Vehicle Type Segment: Revenue Growth Analysis

21 Electric Two-Wheeler Market, By Region, 2021-2029 (USD Mllion)

22 Electric Three and Four-Wheeler Market, By Region, 2021-2029 (USD Mllion)

23 Global Greenfield Manufacturing for Electric Vehicles Market: By End-User Scope Key Takeaways

24 Global Greenfield Manufacturing for Electric Vehicles Market, By End-User Segment: Revenue Growth Analysis

25 Consumer & Commercial Vehicles Market, By Region, 2021-2029 (USD Mllion)

26 Public Transportation Market, By Region, 2021-2029 (USD Mllion)

27 Industrial Application Market, By Region, 2021-2029 (USD Mllion)

28 Regional Segment: Revenue Growth Analysis

29 Global Greenfield Manufacturing for Electric Vehicles Market: Regional Analysis

30 North America Greenfield Manufacturing for Electric Vehicles Market Overview

31 North America Greenfield Manufacturing for Electric Vehicles Market, By Manufacturing Stage

32 North America Greenfield Manufacturing for Electric Vehicles Market, By Vehicle Type

33 North America Greenfield Manufacturing for Electric Vehicles Market, By End-User

34 North America Greenfield Manufacturing for Electric Vehicles Market, By Country

35 U.S. Greenfield Manufacturing for Electric Vehicles Market, By Manufacturing Stage

36 U.S. Greenfield Manufacturing for Electric Vehicles Market, By Vehicle Type

37 U.S. Greenfield Manufacturing for Electric Vehicles Market, By End-User

38 Canada Greenfield Manufacturing for Electric Vehicles Market, By Manufacturing Stage

39 Canada Greenfield Manufacturing for Electric Vehicles Market, By Vehicle Type

40 Canada Greenfield Manufacturing for Electric Vehicles Market, By End-User

41 Mexico Greenfield Manufacturing for Electric Vehicles Market, By Manufacturing Stage

42 Mexico Greenfield Manufacturing for Electric Vehicles Market, By Vehicle Type

43 Mexico Greenfield Manufacturing for Electric Vehicles Market, By End-User

44 Four Quadrant Positioning Matrix

45 Company Market Share Analysis

46 Tesla: Company Snapshot

47 Tesla: SWOT Analysis

48 Tesla: Geographic Presence

49 Ashok Leyland: Company Snapshot

50 Ashok Leyland: SWOT Analysis

51 Ashok Leyland: Geographic Presence

52 Lucid Motors: Company Snapshot

53 Lucid Motors: SWOT Analysis

54 Lucid Motors: Geographic Presence

55 Rivian: Company Snapshot

56 Rivian: Swot Analysis

57 Rivian: Geographic Presence

58 NIO Inc.: Company Snapshot

59 NIO Inc.: SWOT Analysis

60 NIO Inc.: Geographic Presence

61 BYD Company Limited: Company Snapshot

62 BYD Company Limited: SWOT Analysis

63 BYD Company Limited: Geographic Presence

64 CATL (Contemporary Amperex Technology Co. Limited) : Company Snapshot

65 CATL (Contemporary Amperex Technology Co. Limited) : SWOT Analysis

66 CATL (Contemporary Amperex Technology Co. Limited) : Geographic Presence

67 Lordstown Motors Corp.: Company Snapshot

68 Lordstown Motors Corp.: SWOT Analysis

69 Lordstown Motors Corp.: Geographic Presence

70 Fisker Inc., Inc.: Company Snapshot

71 Fisker Inc., Inc.: SWOT Analysis

72 Fisker Inc., Inc.: Geographic Presence

73 Polestar: Company Snapshot

74 Polestar: SWOT Analysis

75 Polestar: Geographic Presence

76 Other Companies: Company Snapshot

77 Other Companies: SWOT Analysis

78 Other Companies: Geographic Presence

The Global Greenfield Manufacturing for Electric Vehicles Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Greenfield Manufacturing for Electric Vehicles Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS