Global Healthcare Asset Recovery Market Size, Trends & Analysis - Forecasts to 2029 By Asset Type (Medical Equipment, IT Hardware, and Software), By Organization Size (Small Clinics, Mid-sized Hospitals, and Large Medical Facilities), By Application (Data Security and Environmentally Sustainable Practices), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

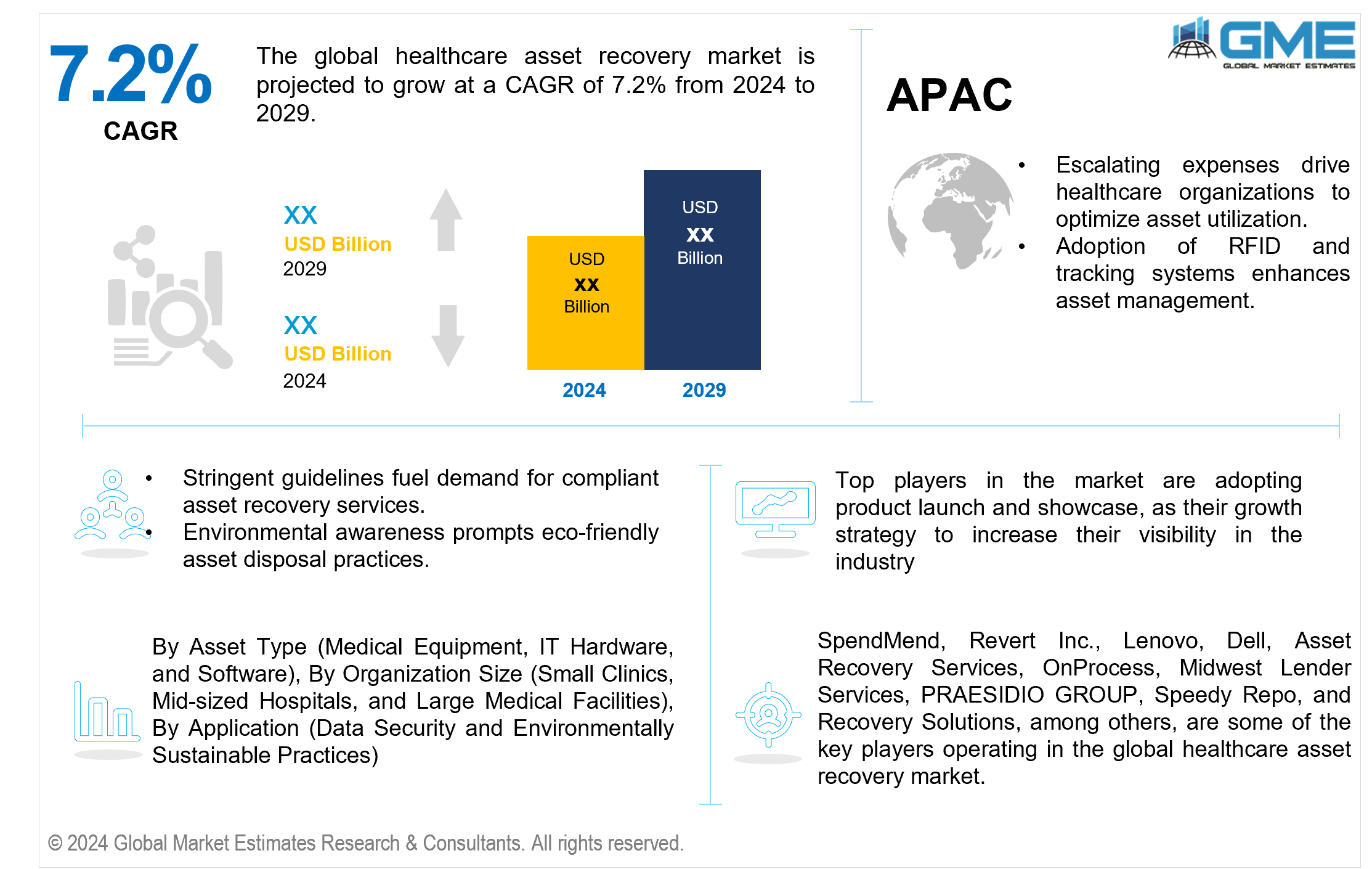

The global healthcare asset recovery market is projected to grow at a CAGR of 7.2% from 2024 to 2029.

The healthcare industry's increasing technological innovation results in the rapid turnover of medical equipment, necessitating asset recovery services. These services are essential for properly disposing of outdated or unused assets as healthcare facilities adopt newer technologies. Asset recovery becomes crucial in handling the strategic disposition of obsolete equipment, ensuring adherence to environmental regulations, and promoting sustainability. This trend underscores the industry's dedication to staying current with healthcare advancements while efficiently managing resources through responsible and cost-effective asset recovery solutions.

Healthcare providers are facing cost pressures, for which asset recovery is a desirable solution. This process enables organizations to reclaim value from assets that are either unused or underutilized, resulting in notable cost savings. By efficiently managing and repurposing these assets, healthcare entities strive to optimize their financial resources, aligning with the imperative to navigate the challenges associated with cost reduction neutrally and strategically.

The global healthcare asset recovery market's expansion may be hindered by complex regional, international, and local regulations governing asset recovery services. These diverse regulations significantly shape operational strategies for market participants, particularly in cross-border transactions. Challenges emerge based on the specific characteristics of healthcare assets being recovered and the unique regulatory environment of the healthcare industry. These limitations include regional barriers that may impact processes related to product identification, redeployment, or divestment within the healthcare sector.

The medical equipment segment is expected to hold the largest share of the market over the forecast period. The anticipated growth of the segment is due to frequent technological advancements, leading to rapid equipment expenses. The constant need for upgrades and replacements in healthcare facilities requires a significant expense, resulting in a substantial volume of retired medical equipment. Asset recovery services cater to the efficient management and disposition of these assets, contributing to market growth.

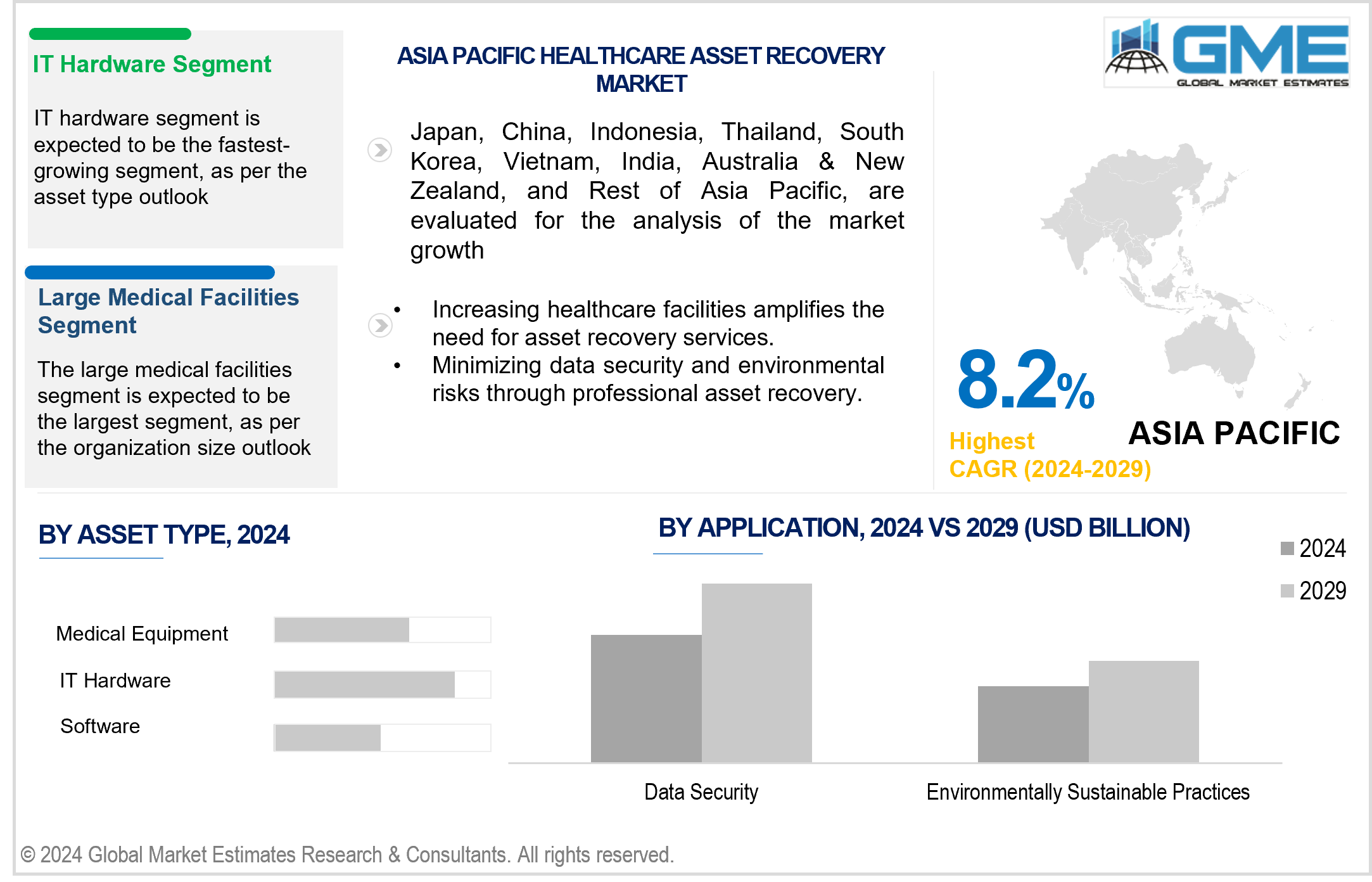

IT hardware is expected to be the fastest-growing segment in the market from 2024-2029. The growth is attributed to the increasing adoption of advanced information technology in the healthcare sector. Advancements in IT infrastructure, such as computers, servers, and networking devices, drive the need for efficient asset recovery services. The increasing digitization of healthcare operations contributes to the IT hardware segment's accelerated growth during this period.

The large medical facilities segment is expected to hold the largest share of the market. This is due to its broad scope of operations and significant expenditures on innovative medical equipment. These facilities frequently upgrade and replace outdated assets, resulting in a continuous demand for asset recovery services. Large medical facilities, because of their sheer size and the requirement for efficient management of various assets, contribute to the market's growth.

The small clinics segment is anticipated to be the fastest-growing segment in the market from 2024-2029. The anticipated growth is due to increased awareness among smaller healthcare institutions about the cost-saving benefits of asset recovery. As these clinics seek to maximize their resources, they are increasingly turning to effective asset management systems. Furthermore, the price and scalability of asset recovery services make them particularly appealing to small clinics, which contributes to the segment's growth.

The data security segment is anticipated to hold the largest share of the market. This growth is attributed to the increasing need to protect sensitive patient information. With increased digitization in healthcare, the secure disposal and management of data-bearing assets has become critical. Organizations prioritize asset recovery services that assure compliance with data erasure and disposal, answering rising concerns about data breaches and privacy legislation. This emphasis on data security sets the segment to make a major contribution to the market's growth.

The environmentally sustainable practices segment is anticipated to be the fastest-growing segment in the market from 2024-2029. The growth is due to rising awareness and regulatory emphasis on eco-friendly techniques. Healthcare businesses increasingly prioritize ecologically responsible asset recovery to reduce electronic waste. This tendency is consistent with increasing environmental consciousness, encouraging services that assure correct disposal, recycling, and sustainable practices, and positioning the segment for rapid expansion.

North America is expected to be the largest region in the market. The primary reasons boosting the market growth in this region include robust healthcare facilities, frequent technological advancements, and strict environmental laws. Large healthcare facilities in North America continue to invest in cutting-edge equipment, boosting the need for effective asset recovery services. Furthermore, a strong emphasis on environmental sustainability contributes to North America's dominance in the market.

Asia Pacific is predicted to witness rapid growth during the forecast period. Increased healthcare investment, rapid technology breakthroughs, and the construction of modern healthcare facilities all contribute to higher revenue for medical assets. As healthcare infrastructure increases in emerging economies, the requirement for effective asset recovery services is thus contributing to the market's growth.

SpendMend, Revert Inc., Lenovo, Dell, Asset Recovery Services, OnProcess, Midwest Lender Services, PRAESIDIO GROUP, Speedy Repo, and Recovery Solutions among others, are some of the key players operating in the global healthcare asset recovery market.

Please note: This is not an exhaustive list of companies profiled in the report.

In February 2022, SpendMend acquired the healthcare division of Moody Associates, P.A., a company that specializes in profit recovery and contract compliance services in the healthcare industry.

In September 2022, Dell Technologies introduced Asset Recovery Services, a solution designed to assist partners in helping their customers retire IT equipment in an environmentally responsible manner.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL HEALTHCARE ASSET RECOVERY MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL HEALTHCARE ASSET RECOVERY MARKET, BY ASSET TYPE

4.1 Introduction

4.2 Healthcare Asset Recovery Market: Asset Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Medical Equipment

4.4.1 Medical Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 IT Hardware

4.5.1 IT Hardware Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Software

4.6.1 Software Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL HEALTHCARE ASSET RECOVERY MARKET, BY ORGANIZATION SIZE

5.1 Introduction

5.2 Healthcare Asset Recovery Market: Organization Size Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Small Clinics

5.4.1 Small Clinics Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Mid-sized Hospitals

5.5.1 Mid-sized Hospitals Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Large Medical Facilities

5.6.1 Large Medical Facilities Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL HEALTHCARE ASSET RECOVERY MARKET, BY APPLICATION

6.1 Introduction

6.2 Healthcare Asset Recovery Market: Application Scope Key Takeaways

6.3 Revenue Growth Analysis, 2023 & 2029

6.4 Data Security

6.4.1 Data Security Market Estimates and Forecast, 2021-2029 (USD Million)

6.5 Environmentally Sustainable Practices

6.5.1 Environmentally Sustainable Practices Market Estimates and Forecast, 2021-2029 (USD Million)

7 GLOBAL HEALTHCARE ASSET RECOVERY MARKET, BY REGION

7.1 Introduction

7.2 North America Healthcare Asset Recovery Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.1 By Asset Type

7.2.2 By Organization Size

7.2.3 By Application

7.2.4 By Country

7.2.4.1 U.S. Healthcare Asset Recovery Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.1.1 By Asset Type

7.2.4.1.2 By Organization Size

7.2.4.1.3 By Application

7.2.4.2 Canada Healthcare Asset Recovery Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.2.1 By Asset Type

7.2.4.2.2 By Organization Size

7.2.4.2.3 By Application

7.2.4.3 Mexico Healthcare Asset Recovery Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.3.1 By Asset Type

7.2.4.3.2 By Organization Size

7.2.4.3.3 By Application

7.3 Europe Healthcare Asset Recovery Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.1 By Asset Type

7.3.2 By Organization Size

7.3.3 By Application

7.3.4 By Country

7.3.4.1 Germany Healthcare Asset Recovery Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.1.1 By Asset Type

7.3.4.1.2 By Organization Size

7.3.4.1.3 By Application

7.3.4.2 U.K. Healthcare Asset Recovery Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.2.1 By Asset Type

7.3.4.2.2 By Organization Size

7.3.4.2.3 By Application

7.3.4.3 France Healthcare Asset Recovery Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.3.1 By Asset Type

7.3.4.3.2 By Organization Size

7.3.4.3.3 By Application

7.3.4.4 Italy Healthcare Asset Recovery Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.4.1 By Asset Type

7.3.4.4.2 By Organization Size

7.2.4.4.3 By Application

7.3.4.5 Spain Healthcare Asset Recovery Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.5.1 By Asset Type

7.3.4.5.2 By Organization Size

7.2.4.5.3 By Application

7.3.4.6 Netherlands Healthcare Asset Recovery Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.6.1 By Asset Type

7.3.4.6.2 By Organization Size

7.2.4.6.3 By Application

7.3.4.7 Rest of Europe Healthcare Asset Recovery Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.7.1 By Asset Type

7.3.4.7.2 By Organization Size

7.2.4.7.3 By Application

7.4 Asia Pacific Healthcare Asset Recovery Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.1 By Asset Type

7.4.2 By Organization Size

7.4.3 By Application

7.4.4 By Country

7.4.4.1 China Healthcare Asset Recovery Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.1.1 By Asset Type

7.4.4.1.2 By Organization Size

7.4.4.1.3 By Application

7.4.4.2 Japan Healthcare Asset Recovery Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.2.1 By Asset Type

7.4.4.2.2 By Organization Size

7.4.4.2.3 By Application

7.4.4.3 India Healthcare Asset Recovery Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.3.1 By Asset Type

7.4.4.3.2 By Organization Size

7.4.4.3.3 By Application

7.4.4.4 South Korea Healthcare Asset Recovery Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.4.1 By Asset Type

7.4.4.4.2 By Organization Size

7.4.4.4.3 By Application

7.4.4.5 Singapore Healthcare Asset Recovery Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.5.1 By Asset Type

7.4.4.5.2 By Organization Size

7.4.4.5.3 By Application

7.4.4.6 Malaysia Healthcare Asset Recovery Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.6.1 By Asset Type

7.4.4.6.2 By Organization Size

7.4.4.6.3 By Application

7.4.4.7 Thailand Healthcare Asset Recovery Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.7.1 By Asset Type

7.4.4.7.2 By Organization Size

7.4.4.7.3 By Application

7.4.4.8 Indonesia Healthcare Asset Recovery Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.8.1 By Asset Type

7.4.4.8.2 By Organization Size

7.4.4.8.3 By Application

7.4.4.9 Vietnam Healthcare Asset Recovery Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.9.1 By Asset Type

7.4.4.9.2 By Organization Size

7.4.4.9.3 By Application

7.4.4.10 Taiwan Healthcare Asset Recovery Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.10.1 By Asset Type

7.4.4.10.2 By Organization Size

7.4.4.10.3 By Application

7.4.4.11 Rest of Asia Pacific Healthcare Asset Recovery Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.11.1 By Asset Type

7.4.4.11.2 By Organization Size

7.4.4.11.3 By Application

7.5 Middle East and Africa Healthcare Asset Recovery Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.1 By Asset Type

7.5.2 By Organization Size

7.5.3 By Application

7.5.4 By Country

7.5.4.1 Saudi Arabia Healthcare Asset Recovery Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.1.1 By Asset Type

7.5.4.1.2 By Organization Size

7.5.4.1.3 By Application

7.5.4.2 U.A.E. Healthcare Asset Recovery Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.2.1 By Asset Type

7.5.4.2.2 By Organization Size

7.5.4.2.3 By Application

7.5.4.3 Israel Healthcare Asset Recovery Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.3.1 By Asset Type

7.5.4.3.2 By Organization Size

7.5.4.3.3 By Application

7.5.4.4 South Africa Healthcare Asset Recovery Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.4.1 By Asset Type

7.5.4.4.2 By Organization Size

7.5.4.4.3 By Application

7.5.4.5 Rest of Middle East and Africa Healthcare Asset Recovery Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.5.1 By Asset Type

7.5.4.5.2 By Organization Size

7.5.4.5.2 By Application

7.6 Central and South America Healthcare Asset Recovery Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.1 By Asset Type

7.6.2 By Organization Size

7.6.3 By Application

7.6.4 By Country

7.6.4.1 Brazil Healthcare Asset Recovery Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.1.1 By Asset Type

7.6.4.1.2 By Organization Size

7.6.4.1.3 By Application

7.6.4.2 Argentina Healthcare Asset Recovery Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.2.1 By Asset Type

7.6.4.2.2 By Organization Size

7.6.4.2.3 By Application

7.6.4.3 Chile Healthcare Asset Recovery Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.3.1 By Asset Type

7.6.4.3.2 By Organization Size

7.6.4.3.3 By Application

7.6.4.4 Rest of Central and South America Healthcare Asset Recovery Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.4.1 By Asset Type

7.6.4.4.2 By Organization Size

7.6.4.4.3 By Application

8 COMPETITIVE LANDCAPE

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.2.1 Market Leaders

8.2.2 Market Visionaries

8.2.3 Market Challengers

8.2.4 Niche Market Players

8.3 Vendor Landscape

8.3.1 North America

8.3.2 Europe

8.3.3 Asia Pacific

8.3.4 Rest of the World

8.4 Company Profiles

8.4.1 SpendMend

8.4.1.1 Business Description & Financial Analysis

8.4.1.2 SWOT Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2 Revert Inc.

8.4.2.1 Business Description & Financial Analysis

8.4.2.2 SWOT Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3 Lenovo

8.4.3.1 Business Description & Financial Analysis

8.4.3.2 SWOT Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4 Dell

8.4.4.1 Business Description & Financial Analysis

8.4.4.2 SWOT Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5 Asset Recovery Services

8.4.5.1 Business Description & Financial Analysis

8.4.5.2 SWOT Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6 OnProcess

8.4.6.1 Business Description & Financial Analysis

8.4.6.2 SWOT Analysis

8.4.6.3 Products & Services Offered

8.4.6.4 Strategic Alliances between Business Partners

8.4.7 Midwest Lender Services

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8 PRAESIDIO GROUP

8.4.8.1 Business Description & Financial Analysis

8.4.8.2 SWOT Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9 Speedy Repo

8.4.9.1 Business Description & Financial Analysis

8.4.9.2 SWOT Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10 Recovery Solutions

8.4.10.1 Business Description & Financial Analysis

8.4.10.2 SWOT Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

8.4.11 Other Companies

8.4.11.1 Business Description & Financial Analysis

8.4.11.2 SWOT Analysis

8.4.11.3 Products & Services Offered

8.4.11.4 Strategic Alliances between Business Partners

9 RESEARCH METHODOLOGY

9.1 Market Introduction

9.1.1 Market Definition

9.1.2 Market Scope & Segmentation

9.2 Information Procurement

9.2.1 Secondary Research

9.2.1.1 Purchased Databases

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2 Primary Research

9.2.2.1 Various Types of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.3 Primary Stakeholders

9.2.2.4 Discussion Guide for Primary Participants

9.2.3 Expert Panels

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4 Paid Local Experts

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3 Market Estimation

9.3.1 Top-Down Approach

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2 Bottom Up Approach

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Product Sales

9.4 Data Triangulation

9.4.1 Data Collection

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.4.3 Cluster Analysis

9.5 Analysis and Output

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

9.7.1 Research Assumptions

9.7.2 Research Limitations

LIST OF TABLES

1 Global Healthcare Asset Recovery Market, By Asset Type, 2021-2029 (USD Mllion)

2 Medical Equipment Market, By Region, 2021-2029 (USD Mllion)

3 IT Hardware Market, By Region, 2021-2029 (USD Mllion)

4 Software Market, By Region, 2021-2029 (USD Mllion)

5 Global Healthcare Asset Recovery Market, By Organization Size, 2021-2029 (USD Mllion)

6 Small Clinics Market, By Region, 2021-2029 (USD Mllion)

7 Mid-sized Hospitals Market, By Region, 2021-2029 (USD Mllion)

8 Large Medical Facilities Market, By Region, 2021-2029 (USD Mllion)

9 Global Healthcare Asset Recovery Market, By Application, 2021-2029 (USD Mllion)

10 Data Security Market, By Region, 2021-2029 (USD Mllion)

11 Environmentally Sustainable Practices Market, By Region, 2021-2029 (USD Mllion)

12 North America Healthcare Asset Recovery Market, By Asset Type, 2021-2029 (USD Million)

13 North America Healthcare Asset Recovery Market, By Organization Size, 2021-2029 (USD Million)

14 North America Healthcare Asset Recovery Market, By Application, 2021-2029 (USD Million)

15 North America Healthcare Asset Recovery Market, By Country, 2021-2029 (USD Million)

16 U.S Healthcare Asset Recovery Market, By Asset Type, 2021-2029 (USD Million)

17 U.S Healthcare Asset Recovery Market, By Organization Size, 2021-2029 (USD Million)

18 U.S Healthcare Asset Recovery Market, By Application, 2021-2029 (USD Million)

19 Canada Healthcare Asset Recovery Market, By Asset Type, 2021-2029 (USD Million)

20 Canada Healthcare Asset Recovery Market, By Organization Size, 2021-2029 (USD Million)

21 Canada Healthcare Asset Recovery Market, By Application, 2021-2029 (USD Million)

22 Mexico Healthcare Asset Recovery Market, By Asset Type, 2021-2029 (USD Million)

23 Mexico Healthcare Asset Recovery Market, By Organization Size, 2021-2029 (USD Million)

24 Mexico Healthcare Asset Recovery Market, By Application, 2021-2029 (USD Million)

25 Europe Healthcare Asset Recovery Market, By Asset Type, 2021-2029 (USD Million)

26 Europe Healthcare Asset Recovery Market, By Organization Size, 2021-2029 (USD Million)

27 Europe Healthcare Asset Recovery Market, By Application, 2021-2029 (USD Million)

28 Europe Healthcare Asset Recovery Market, By COUNTRY, 2021-2029 (USD Million)

29 Germany Healthcare Asset Recovery Market, By Asset Type, 2021-2029 (USD Million)

30 Germany Healthcare Asset Recovery Market, By Organization Size, 2021-2029 (USD Million)

31 Germany Healthcare Asset Recovery Market, By Application, 2021-2029 (USD Million)

32 U.K Healthcare Asset Recovery Market, By Asset Type, 2021-2029 (USD Million)

33 U.K Healthcare Asset Recovery Market, By Organization Size, 2021-2029 (USD Million)

34 U.K Healthcare Asset Recovery Market, By Application, 2021-2029 (USD Million)

35 France Healthcare Asset Recovery Market, By Asset Type, 2021-2029 (USD Million)

36 France Healthcare Asset Recovery Market, By Organization Size, 2021-2029 (USD Million)

37 France Healthcare Asset Recovery Market, By Application, 2021-2029 (USD Million)

38 Italy Healthcare Asset Recovery Market, By Asset Type, 2021-2029 (USD Million)

39 Italy Healthcare Asset Recovery Market, By End Use , 2021-2029 (USD Million)

40 Italy Healthcare Asset Recovery Market, By Application, 2021-2029 (USD Million)

41 Spain Healthcare Asset Recovery Market, By Asset Type, 2021-2029 (USD Million)

42 Spain Healthcare Asset Recovery Market, By Organization Size, 2021-2029 (USD Million)

43 Spain Healthcare Asset Recovery Market, By Application, 2021-2029 (USD Million)

44 Rest Of Europe Healthcare Asset Recovery Market, By Asset Type, 2021-2029 (USD Million)

45 Rest Of Europe Healthcare Asset Recovery Market, By Organization Size, 2021-2029 (USD Million)

46 Rest of Europe Healthcare Asset Recovery Market, By Application, 2021-2029 (USD Million)

47 Asia Pacific Healthcare Asset Recovery Market, By Asset Type, 2021-2029 (USD Million)

48 Asia Pacific Healthcare Asset Recovery Market, By Organization Size, 2021-2029 (USD Million)

49 Asia Pacific Healthcare Asset Recovery Market, By Application, 2021-2029 (USD Million)

50 Asia Pacific Healthcare Asset Recovery Market, By Country, 2021-2029 (USD Million)

51 China Healthcare Asset Recovery Market, By Asset Type, 2021-2029 (USD Million)

52 China Healthcare Asset Recovery Market, By Organization Size, 2021-2029 (USD Million)

53 China Healthcare Asset Recovery Market, By Application, 2021-2029 (USD Million)

54 India Healthcare Asset Recovery Market, By Asset Type, 2021-2029 (USD Million)

55 India Healthcare Asset Recovery Market, By Organization Size, 2021-2029 (USD Million)

56 India Healthcare Asset Recovery Market, By Application, 2021-2029 (USD Million)

57 Japan Healthcare Asset Recovery Market, By Asset Type, 2021-2029 (USD Million)

58 Japan Healthcare Asset Recovery Market, By Organization Size, 2021-2029 (USD Million)

59 Japan Healthcare Asset Recovery Market, By Application, 2021-2029 (USD Million)

60 South Korea Healthcare Asset Recovery Market, By Asset Type, 2021-2029 (USD Million)

61 South Korea Healthcare Asset Recovery Market, By Organization Size, 2021-2029 (USD Million)

62 South Korea Healthcare Asset Recovery Market, By Application, 2021-2029 (USD Million)

63 Singapore Healthcare Asset Recovery Market, By Asset Type, 2021-2029 (USD Million)

64 Singapore Healthcare Asset Recovery Market, By Organization Size, 2021-2029 (USD Million)

65 Singapore Healthcare Asset Recovery Market, By Application, 2021-2029 (USD Million)

66 Malaysia Healthcare Asset Recovery Market, By Asset Type, 2021-2029 (USD Million)

67 Malaysia Healthcare Asset Recovery Market, By Organization Size, 2021-2029 (USD Million)

68 Malaysia Healthcare Asset Recovery Market, By Application, 2021-2029 (USD Million)

69 Thailand Healthcare Asset Recovery Market, By Asset Type, 2021-2029 (USD Million)

70 Thailand Healthcare Asset Recovery Market, By Organization Size, 2021-2029 (USD Million)

71 Thailand Healthcare Asset Recovery Market, By Application, 2021-2029 (USD Million)

72 Indonesia Healthcare Asset Recovery Market, By Asset Type, 2021-2029 (USD Million)

73 Indonesia Healthcare Asset Recovery Market, By Organization Size, 2021-2029 (USD Million)

74 Indonesia Healthcare Asset Recovery Market, By Application, 2021-2029 (USD Million)

75 Vietnam Healthcare Asset Recovery Market, By Asset Type, 2021-2029 (USD Million)

76 Vietnam Healthcare Asset Recovery Market, By Organization Size, 2021-2029 (USD Million)

77 Vietnam Healthcare Asset Recovery Market, By Application, 2021-2029 (USD Million)

78 Taiwan Healthcare Asset Recovery Market, By Asset Type, 2021-2029 (USD Million)

79 Taiwan Healthcare Asset Recovery Market, By Organization Size, 2021-2029 (USD Million)

80 Taiwan Healthcare Asset Recovery Market, By Application, 2021-2029 (USD Million)

81 Rest of Asia Pacific Healthcare Asset Recovery Market, By Asset Type, 2021-2029 (USD Million)

82 Rest of Asia Pacific Healthcare Asset Recovery Market, By Organization Size, 2021-2029 (USD Million)

83 Rest of Asia Pacific Healthcare Asset Recovery Market, By Application, 2021-2029 (USD Million)

84 Middle East and Africa Healthcare Asset Recovery Market, By Asset Type, 2021-2029 (USD Million)

85 Middle East and Africa Healthcare Asset Recovery Market, By Organization Size, 2021-2029 (USD Million)

86 Middle East and Africa Healthcare Asset Recovery Market, By Application, 2021-2029 (USD Million)

87 Middle East and Africa Healthcare Asset Recovery Market, By Country, 2021-2029 (USD Million)

88 Saudi Arabia Healthcare Asset Recovery Market, By Asset Type, 2021-2029 (USD Million)

89 Saudi Arabia Healthcare Asset Recovery Market, By Organization Size, 2021-2029 (USD Million)

90 Saudi Arabia Healthcare Asset Recovery Market, By Application, 2021-2029 (USD Million)

91 UAE Healthcare Asset Recovery Market, By Asset Type, 2021-2029 (USD Million)

92 UAE Healthcare Asset Recovery Market, By Organization Size, 2021-2029 (USD Million)

93 UAE Healthcare Asset Recovery Market, By Application, 2021-2029 (USD Million)

94 Israel Healthcare Asset Recovery Market, By Asset Type, 2021-2029 (USD Million)

95 Israel Healthcare Asset Recovery Market, By Organization Size, 2021-2029 (USD Million)

96 Israel Healthcare Asset Recovery Market, By Application, 2021-2029 (USD Million)

97 South Africa Healthcare Asset Recovery Market, By Asset Type, 2021-2029 (USD Million)

98 South Africa Healthcare Asset Recovery Market, By Organization Size, 2021-2029 (USD Million)

99 South Africa Healthcare Asset Recovery Market, By Application, 2021-2029 (USD Million)

100 Rest of Middle East and Africa Healthcare Asset Recovery Market, By Asset Type, 2021-2029 (USD Million)

101 Rest of Middle East and Africa Healthcare Asset Recovery Market, By Organization Size, 2021-2029 (USD Million)

102 Rest of Middle East and Africa Healthcare Asset Recovery Market, By Application, 2021-2029 (USD Million)

103 Central and South America Healthcare Asset Recovery Market, By Asset Type, 2021-2029 (USD Million)

104 Central and South America Healthcare Asset Recovery Market, By Organization Size, 2021-2029 (USD Million)

105 Central and South America Healthcare Asset Recovery Market, By Application, 2021-2029 (USD Million)

106 Central and South America Healthcare Asset Recovery Market, By Country, 2021-2029 (USD Million)

107 Brazil Healthcare Asset Recovery Market, By Asset Type, 2021-2029 (USD Million)

108 Brazil Healthcare Asset Recovery Market, By Organization Size, 2021-2029 (USD Million)

109 Brazil Healthcare Asset Recovery Market, By Application, 2021-2029 (USD Million)

110 Argentina Healthcare Asset Recovery Market, By Asset Type, 2021-2029 (USD Million)

111 Argentina Healthcare Asset Recovery Market, By Organization Size, 2021-2029 (USD Million)

112 Argentina Healthcare Asset Recovery Market, By Application, 2021-2029 (USD Million)

113 Chile Healthcare Asset Recovery Market, By Asset Type, 2021-2029 (USD Million)

114 Chile Healthcare Asset Recovery Market, By Organization Size, 2021-2029 (USD Million)

115 Chile Healthcare Asset Recovery Market, By Application, 2021-2029 (USD Million)

116 Rest of Central and South America Healthcare Asset Recovery Market, By Asset Type, 2021-2029 (USD Million)

117 Rest of Central and South America Healthcare Asset Recovery Market, By Organization Size, 2021-2029 (USD Million)

118 Rest of Central and South America Healthcare Asset Recovery Market, By Application, 2021-2029 (USD Million)

119 SpendMend: Products & Services Offering

120 Revert Inc.: Products & Services Offering

121 Lenovo: Products & Services Offering

122 Dell: Products & Services Offering

123 Asset Recovery Services: Products & Services Offering

124 ONPROCESS: Products & Services Offering

125 Midwest Lender Services : Products & Services Offering

126 PRAESIDIO GROUP: Products & Services Offering

127 Speedy Repo, Inc: Products & Services Offering

128 Recovery Solutions: Products & Services Offering

129 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Healthcare Asset Recovery Market Overview

2 Global Healthcare Asset Recovery Market Value From 2021-2029 (USD Mllion)

3 Global Healthcare Asset Recovery Market Share, By Asset Type (2023)

4 Global Healthcare Asset Recovery Market Share, By Organization Size (2023)

5 Global Healthcare Asset Recovery Market Share, By Application (2023)

6 Global Healthcare Asset Recovery Market, By Region (Asia Pacific Market)

7 Technological Trends In Global Healthcare Asset Recovery Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global Healthcare Asset Recovery Market

11 Impact Of Challenges On The Global Healthcare Asset Recovery Market

12 Porter’s Five Forces Analysis

13 Global Healthcare Asset Recovery Market: By Asset Type Scope Key Takeaways

14 Global Healthcare Asset Recovery Market, By Asset Type Segment: Revenue Growth Analysis

15 Medical Equipment Market, By Region, 2021-2029 (USD Mllion)

16 IT Hardware Market, By Region, 2021-2029 (USD Mllion)

17 Software Market, By Region, 2021-2029 (USD Mllion)

18 Global Healthcare Asset Recovery Market: By Organization Size Scope Key Takeaways

19 Global Healthcare Asset Recovery Market, By Organization Size Segment: Revenue Growth Analysis

20 Small Clinics Market, By Region, 2021-2029 (USD Mllion)

21 Mid-sized Hospitals Market, By Region, 2021-2029 (USD Mllion)

22 Large Medical Facilities Market, By Region, 2021-2029 (USD Mllion)

23 Global Healthcare Asset Recovery Market: By Application Scope Key Takeaways

24 Global Healthcare Asset Recovery Market, By Application Segment: Revenue Growth Analysis

25 Data Security Market, By Region, 2021-2029 (USD Mllion)

26 Environmentally Sustainable Practices Market, By Region, 2021-2029 (USD Mllion)

27 Regional Segment: Revenue Growth Analysis

28 Global Healthcare Asset Recovery Market: Regional Analysis

29 North America Healthcare Asset Recovery Market Overview

30 North America Healthcare Asset Recovery Market, By Asset Type

31 North America Healthcare Asset Recovery Market, By Organization Size

32 North America Healthcare Asset Recovery Market, By Application

33 North America Healthcare Asset Recovery Market, By Country

34 U.S. Healthcare Asset Recovery Market, By Asset Type

35 U.S. Healthcare Asset Recovery Market, By Organization Size

36 U.S. Healthcare Asset Recovery Market, By Application

37 Canada Healthcare Asset Recovery Market, By Asset Type

38 Canada Healthcare Asset Recovery Market, By Organization Size

39 Canada Healthcare Asset Recovery Market, By Application

40 Mexico Healthcare Asset Recovery Market, By Asset Type

41 Mexico Healthcare Asset Recovery Market, By Organization Size

42 Mexico Healthcare Asset Recovery Market, By Application

43 Four Quadrant Positioning Matrix

44 Company Market Share Analysis

45 SpendMend: Company Snapshot

46 SpendMend: SWOT Analysis

47 SpendMend: Geographic Presence

48 Revert Inc.: Company Snapshot

49 Revert Inc.: SWOT Analysis

50 Revert Inc.: Geographic Presence

51 Lenovo: Company Snapshot

52 Lenovo: SWOT Analysis

53 Lenovo: Geographic Presence

54 Dell: Company Snapshot

55 Dell: Swot Analysis

56 Dell: Geographic Presence

57 Asset Recovery Services: Company Snapshot

58 Asset Recovery Services: SWOT Analysis

59 Asset Recovery Services: Geographic Presence

60 OnProcess: Company Snapshot

61 OnProcess: SWOT Analysis

62 OnProcess: Geographic Presence

63 Midwest Lender Services : Company Snapshot

64 Midwest Lender Services : SWOT Analysis

65 Midwest Lender Services : Geographic Presence

66 PRAESIDIO GROUP: Company Snapshot

67 PRAESIDIO GROUP: SWOT Analysis

68 PRAESIDIO GROUP: Geographic Presence

69 Speedy Repo, Inc.: Company Snapshot

70 Speedy Repo, Inc.: SWOT Analysis

71 Speedy Repo, Inc.: Geographic Presence

72 Recovery Solutions: Company Snapshot

73 Recovery Solutions: SWOT Analysis

74 Recovery Solutions: Geographic Presence

75 Other Companies: Company Snapshot

76 Other Companies: SWOT Analysis

77 Other Companies: Geographic Presence

The Global Healthcare Asset Recovery Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Healthcare Asset Recovery Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS