Global Healthcare Cybersecurity Market Size, Trends & Analysis - Forecasts to 2027 By Threat Type [Ransomware, Distributed Denial-Of-Service (DDoS), Malware & Spyware, Advanced Persistent Threat (Apt), Phishing & Spear Phishing], By Products [Solutions- (Antivirus & Antimalware, Security Information and Event Management (SIEM), Distributed Denial of Service (DDoS), Risk & Compliance Management, Identity & Access Management, Firewall, Unifies Threat Management, Intrusion Detection System/Intrusion Prevention System), Services], By Security Type (Network Security, Endpoint Security, Cloud Security, Application Security), By End-User (Healthcare Providers, Healthcare Players) By Region (North America, Asia Pacific, Central & South America, Europe, and the Middle East and Africa), Company Market Share Analysis, and Competitor Analysis

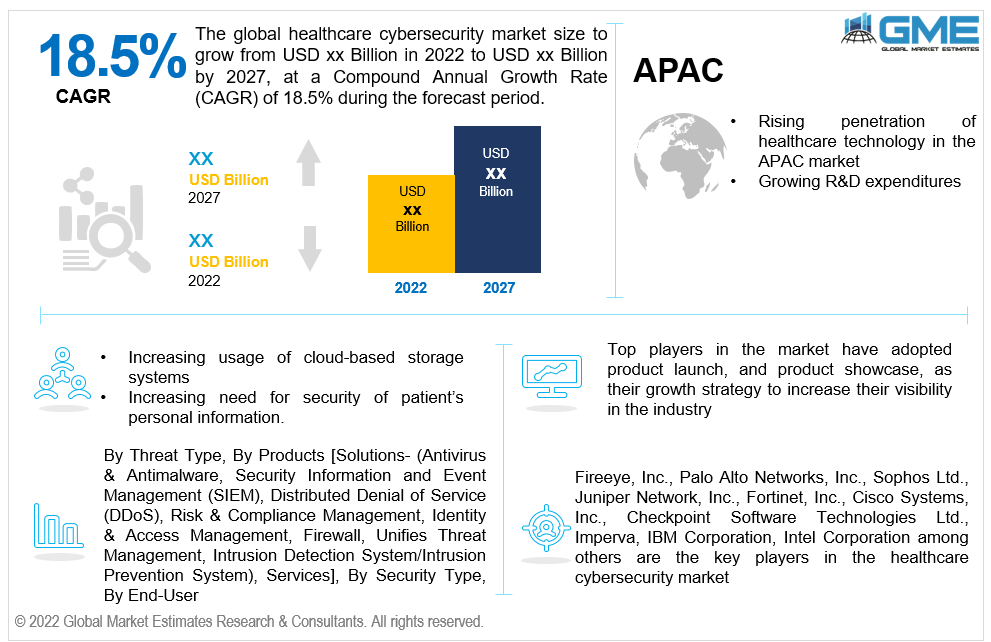

The global healthcare cybersecurity market is projected to grow at a CAGR value of 18.5% from 2022 to 2027.

The healthcare system across the globe gives services to millions of patients. This results in collection of sensitive and confidential health-related information and data. The information comes with the threat of being used illegally and being misused for harmful activities.

Cybersecurity in healthcare help protect vulnerable information like the identity of the patient, sensitive healthcare information, financial details such as credit card number and bank details and health insurance details. Healthcare institutions and providers are making use of cybersecurity in healthcare by conducting vulnerability assessments and security controls in order to provide a safe space for their patient both during care and with respect to their identity and health details.

The healthcare cybersecurity market is expected to grow rapidly due to factors such as the increasing demand for data security systems for medical and personal information, rising cases of cyberattacks on the healthcare data sets, growing demand and usage of cloud-based services for storage of data and rising integration of AI and ML technologies in place of traditional manual methods in the healthcare industry.

Furthermore, the immergence of new sets of rules and norms to regulate patient data in the healthcare industry and government involvement with respect to protecting healthcare data are driving the growth of the healthcare cybersecurity market.

The COVID-19 pandemic has increased the dependence of telemedicine and remote care management, which has resulted in the generation of huge data containing information on the identities of the patients and the health issues they are facing. As per the European Union Agency for Cybersecurity (ENISA), cyberattacks have increased exponentially owing to the strain and vulnerability faced by healthcare organization due to the pandemic situation. Healthcare organizations are finding themselves in tight situations which do not allow security checks and regular cybersecurity related procedures. The pandemic has increased the usage of cybersecurity services and is expected to boost the market significantly.

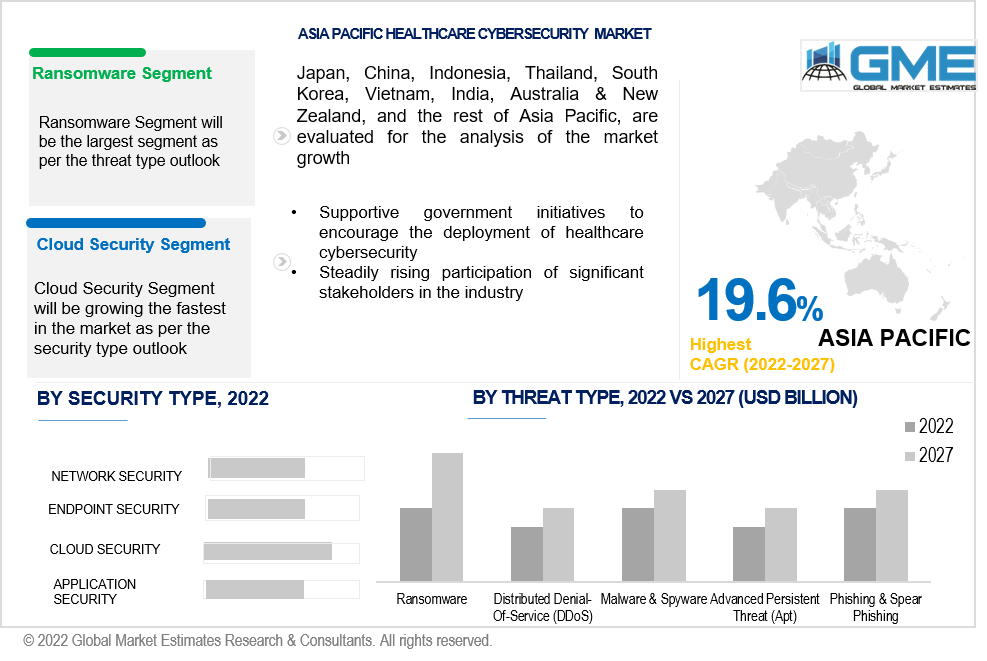

Based on the threat, the healthcare cybersecurity market is divided into ransomware, distributed denial-of-service (DDoS), malware & spyware, advanced persistent threat 9Apt), phishing & spear phishing. The android segment is expected to be the largest segment in the market from 2022 to 2027.

Hackers have conducted ransomware attacks on several healthcare institutions by entering in the computer system, gaining access to confidential information, encrypting the files running it and demanding a ransom from institutions in order to get the decryption key. Ransomware attacks are in general on a rise especially among vulnerable sectors like the healthcare industry.

Based on the products, the healthcare cybersecurity market is divided into solutions and services. The solutions segment is expected to be the largest segment in the market from 2022 to 2027.

The solutions segment includes antivirus and antimalware, security information and event management (SIEM), distributed denial of service (DDoS) mitigation, risk and compliance management, identity and access management, firewall, unified threat management and intrusion detection system/intrusion prevention system. The solutions segment is expected to dominate due to the rising demand for cost-effective and efficient security solutions. Increasing need to comply with the new set of rules and regulations on the healthcare industry and growing concern with respect to data leakage will propel the solution segment from 2022 to 2027.

Based on the security type, the healthcare cybersecurity market is divided into network security, endpoint security, cloud security, application security. The cloud security segment is expected to be the fastest-growing segment in the market from 2022 to 2027.

The growing use of cloud-based technology to store information has given rise to the demand for cloud security. Cloud-based technology are usually cost -effective as opposed to other methods of storing data and hence it has a large number of healthcare organizations and providers as its customers. The increase in demand for cloud-security is due to its rising customer base and low management cost.

Based on the end-user, the healthcare cybersecurity market is divided into healthcare providers and healthcare players. The healthcare providers segment is expected to be the largest segment in the market from 2022 to 2027.

Increasing investments by healthcare providers in data security due to rising need for storing excessive patient data in cloud-based systems and growing security concerns. Healthcare providers are increasing their budgets for cybersecurity in order to safeguard their patients’ information from being misused.

As per the geographical analysis, the healthcare cybersecurity market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico) will have a dominant share in the healthcare cybersecurity market from 2022 to 2027. The major factor driving the growth of the market in the North American region is the increasing cases of cyberattacks in the healthcare industry, mandatory compliance of rules and regulations set up by healthcare organizations with respect to cybersecurity and the presence of fortune 500 healthcare organizations in the region.

Moreover, the Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific) region is expected to be the fastest-growing segment in the Healthcare Cybersecurity market during the forecast period. Rapidly rising incorporation of technology in healthcare industry, increasing collection of patient data and the growing need to protect data will propel the healthcare cybersecurity market in the region.

Fireeye, Inc., Palo Alto Networks, Inc., Sophos Ltd., Juniper Network, Inc., Fortinet, Inc., Cisco Systems, Inc., Checkpoint Software Technologies Ltd.,Imperva, IBM Corporation, Intel Corporation among others are the key players in the healthcare cybersecurity market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Healthcare Cybersecurity Industry Overview, 2022-2027

2.1.1 Industry Overview

2.1.2 Threat Type Overview

2.1.3 Products Overview

2.1.4 Security Type Overview

2.1.5 End-User Overview

2.1.6 Regional Overview

Chapter 3 Healthcare Cybersecurity Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2022-2027

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Advancements in the healthcare cybersecurity technology

3.3.1.2 Growing demand for security of patient data in the healthcare industry

3.3.2 Industry Challenges

3.3.2.1 Increasing installation costs and threat to patient data

3.4 Prospective Growth Scenario

3.4.1 Threat Type Growth Scenario

3.4.2 Products Growth Scenario

3.4.3 Security Type Growth Scenario

3.4.4 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2022

3.11.1 Company Positioning Overview, 2022

Chapter 4 Healthcare Cybersecurity Market, By Threat Type

4.1 Threat Type Outlook

4.2 Ransomware

4.2.1 Market Size, By Region, 2022-2027 (USD Million)

4.3 Distributed-Denial-Of-Service (DDoS)

4.3.1 Market Size, By Region, 2022-2027 (USD Million)

4.4 Malware & Spyware

4.4.1 Market Size, By Region, 2022-2027 (USD Million)

4.5 Advanced Persistent Threat (Apt)

4.5.1 Market Size, By Region, 2022-2027 (USD Million)

4.6 Phishing & Spear Phishing

4.6.1 Market Size, By Region, 2022-2027 (USD Million)

Chapter 5 Healthcare Cybersecurity Market, By Security Type

5.1 Security Type Outlook

5.2 Network Security

5.2.1 Market Size, By Region, 2022-2027 (USD Million)

5.3 Endpoint Security

5.3.1 Market Size, By Region, 2022-2027 (USD Million)

5.4 Cloud Security

5.4.1 Market Size, By Region, 2022-2027 (USD Million)

5.5 Application Security

5.5.1 Market Size, By Region, 2022-2027 (USD Million)

Chapter 6 Healthcare Cybersecurity Market, By Products

6.1 Solutions

6.1.1 Antivirus & Antimalware

6.1.2 Security Information and Event Management (SIEM0

6.1.3 Distributed Denial of Service (DDoS) Mitigation

6.1.4 Risk & Compliance Management

6.1.5 Identity & Access Management

6.1.6 Firewall

6.1.7 Unified Threat Management

6.1.8 Intrusion Detection System/Intrusion Prevention System

6.1.9 Market Size, By Region, 2022-2027 (USD Million)

6.1.10 Market Size, By Region, 2022-2027 (USD Million)

6.2 Services

6.2.1 Market Size, By Region, 2022-2027 (USD Million)

Chapter 7 Healthcare Cybersecurity Market, By End-User

7.1 Healthcare Providers

7.1.1 Market Size, By Region, 2022-2027 (USD Million)

7.2 Healthcare Payers

7.2.1 Market Size, By Region, 2022-2027 (USD Million)

Chapter 8 Healthcare Cybersecurity Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2022-2027 (USD Million)

8.2.2 Market Size, By Threat Type, 2022-2027 (USD Million)

8.2.3 Market Size, By Products, 2022-2027 (USD Million)

8.2.4 Market Size, By Security Type, 2022-2027 (USD Million)

8.2.5 Market Size, By End-User, 2022-2027 (USD Million)

8.2.6 U.S.

8.2.6.1 Market Size, By Threat Type, 2022-2027 (USD Million)

8.2.4.2 Market Size, By Products, 2022-2027 (USD Million)

8.2.4.3 Market Size, By Security Type, 2022-2027 (USD Million)

Market Size, By End-User, 2022-2027 (USD Million)

8.2.7 Canada

8.2.7.1 Market Size, By Threat Type, 2022-2027 (USD Million)

8.2.7.2 Market Size, By Products, 2022-2027 (USD Million)

8.2.7.3 Market Size, By Security Type, 2022-2027 (USD Million)

8.2.7.4 Market Size, By End-User, 2022-2027 (USD Million)

8.3 Europe

8.3.1 Market Size, By Country 2022-2027 (USD Million)

8.3.2 Market Size, By Threat Type, 2022-2027 (USD Million)

8.3.3 Market Size, By Products, 2022-2027 (USD Million)

8.3.4 Market Size, By Security Type, 2022-2027 (USD Million)

8.3.5 Market Size, By End-User, 2022-2027 (USD Million)

8.3.6 Germany

8.3.6.1 Market Size, By Threat Type, 2022-2027 (USD Million)

8.3.6.2 Market Size, By Products, 2022-2027 (USD Million)

8.3.6.3 Market Size, By Security Type, 2022-2027 (USD Million)

8.3.6.4 Market Size, By End-User, 2022-2027 (USD Million)

8.3.7 UK

8.3.7.1 Market Size, By Threat Type, 2022-2027 (USD Million)

8.3.7.2 Market Size, By Products, 2022-2027 (USD Million)

8.3.7.3 Market Size, By Security Type, 2022-2027 (USD Million)

8.3.7.4 Market Size, By End-User, 2022-2027 (USD Million)

8.3.8 France

8.3.8.1 Market Size, By Threat Type, 2022-2027 (USD Million)

8.3.8.2 Market Size, By Products, 2022-2027 (USD Million)

8.3.8.3 Market Size, By Security Type, 2022-2027 (USD Million)

8.3.8.4 Market Size, By End-User, 2022-2027 (USD Million)

8.3.9 Italy

8.3.9.1 Market Size, By Threat Type, 2022-2027 (USD Million)

8.3.9.2 Market Size, By Products, 2022-2027 (USD Million)

8.3.9.3 Market Size, By Security Type, 2022-2027 (USD Million)

8.3.9.4 Market Size, By End-User, 2022-2027 (USD Million)

8.3.10 Spain

8.3.10.1 Market Size, By Threat Type, 2022-2027 (USD Million)

8.3.10.2 Market Size, By Products, 2022-2027 (USD Million)

8.3.10.3 Market Size, By Security Type, 2022-2027 (USD Million)

8.3.10.4 Market Size, By End-User, 2022-2027 (USD Million)

8.3.11 Russia

8.3.11.1 Market Size, By Threat Type, 2022-2027 (USD Million)

8.3.11.2 Market Size, By Products, 2022-2027 (USD Million)

8.3.11.3 Market Size, By Security Type, 2022-2027 (USD Million)

8.3.11.4 Market Size, By End-User, 2022-2027 (USD Million)

8.4 Asia Pacific

8.4.1 Market Size, By Country 2022-2027 (USD Million)

8.4.2 Market Size, By Threat Type, 2022-2027 (USD Million)

8.4.3 Market Size, By Products, 2022-2027 (USD Million)

8.4.4 Market Size, By Security Type, 2022-2027 (USD Million)

8.4.5 Market Size, By End-User, 2022-2027 (USD Million)

8.4.6 China

8.4.6.1 Market Size, By Threat Type, 2022-2027 (USD Million)

8.4.6.2 Market Size, By Products, 2022-2027 (USD Million)

8.4.6.3 Market Size, By Security Type, 2022-2027 (USD Million)

8.4.6.4 Market Size, By End-User, 2022-2027 (USD Million)

8.4.7 India

8.4.7.1 Market Size, By Threat Type, 2022-2027 (USD Million)

8.4.7.2 Market Size, By Products, 2022-2027 (USD Million)

8.4.7.3 Market Size, By Security Type, 2022-2027 (USD Million)

8.4.7.4 Market Size, By End-User, 2022-2027 (USD Million)

8.4.8 Japan

8.4.8.1 Market Size, By Threat Type, 2022-2027 (USD Million)

8.4.8.2 Market Size, By Products, 2022-2027 (USD Million)

8.4.8.3 Market Size, By Security Type, 2022-2027 (USD Million)

8.4.8.4 Market Size, By End-User, 2022-2027 (USD Million)

8.4.9 Australia

8.4.9.1 Market Size, By Threat Type, 2022-2027 (USD Million)

8.4.9.2 Market size, By Products, 2022-2027 (USD Million)

8.4.9.3 Market Size, By Security Type, 2022-2027 (USD Million)

8.4.9.4 Market Size, By End-User, 2022-2027 (USD Million)

8.4.10 South Korea

8.4.10.1 Market Size, By Threat Type, 2022-2027 (USD Million)

8.4.10.2 Market Size, By Products, 2022-2027 (USD Million)

8.4.10.3 Market Size, By Security Type, 2022-2027 (USD Million)

8.4.10.4 Market Size, By End-User, 2022-2027 (USD Million)

8.5 Central and South America

8.5.1 Market Size, By Country 2022-2027 (USD Million)

8.5.2 Market Size, By Threat Type, 2022-2027 (USD Million)

8.5.3 Market Size, By Products, 2022-2027 (USD Million)

8.5.4 Market Size, By Security Type, 2022-2027 (USD Million)

8.5.5 Market Size, By End-User, 2022-2027 (USD Million)

8.5.6 Brazil

8.5.6.1 Market Size, By Threat Type, 2022-2027 (USD Million)

8.5.6.2 Market Size, By Products, 2022-2027 (USD Million)

8.5.6.3 Market Size, By Security Type, 2022-2027 (USD Million)

8.5.6.4 Market Size, By End-User, 2022-2027 (USD Million)

8.5.7 Mexico

8.5.7.1 Market Size, By Threat Type, 2022-2027 (USD Million)

8.5.7.2 Market Size, By Products, 2022-2027 (USD Million)

8.5.7.3 Market Size, By Security Type, 2022-2027 (USD Million)

8.5.7.4 Market Size, By End-User, 2022-2027 (USD Million)

8.5.8 Argentina

8.5.8.1 Market Size, By Threat Type, 2022-2027 (USD Million)

8.5.8.2 Market Size, By Products, 2022-2027 (USD Million)

8.5.8.3 Market Size, By Security Type, 2022-2027 (USD Million)

8.5.8.4 Market Size, By End-User, 2022-2027 (USD Million)

8.6 MEA

8.6.1 Market Size, By Country 2022-2027 (USD Million)

8.6.2 Market Size, By Threat Type, 2022-2027 (USD Million)

8.6.3 Market Size, By Products, 2022-2027 (USD Million)

8.6.4 Market Size, By Security Type, 2022-2027 (USD Million)

8.6.5 Market Size, By End-User, 2022-2027 (USD Million)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Threat Type, 2022-2027 (USD Million)

8.6.6.2 Market Size, By Products, 2022-2027 (USD Million)

8.6.6.3 Market Size, By Security Type, 2022-2027 (USD Million)

8.6.6.4 Market Size, By End-User, 2022-2027 (USD Million)

8.6.7 UAE

8.6.7.1 Market Size, By Threat Type, 2022-2027 (USD Million)

8.6.7.2 Market Size, By Products, 2022-2027 (USD Million)

8.6.7.3 Market Size, By Security Type, 2022-2027 (USD Million)

8.6.7.4 Market Size, By End-User, 2022-2027 (USD Million)

8.6.8 South Africa

8.6.8.1 Market Size, By Threat Type, 2022-2027 (USD Million)

8.6.8.2 Market Size, By Products, 2022-2027 (USD Million)

8.6.8.3 Market Size, By Security Type, 2022-2027 (USD Million)

8.6.8.4 Market Size, By End-User, 2022-2027 (USD Million)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2022

9.2 Fireeye, Inc.

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 Palo Alto Networks, Inc.

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 Sophos Ltd.

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 Juniper Network, Inc.

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 Fortinet, Inc.

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 Cisco Systems, Inc.

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 Checkpoint Software Technologies Ltd.

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 Imperva

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info Graphic Analysis

9.11 Intel Corporation

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info Graphic Analysis

9.10 Others

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info Graphic Analysis

The Global Healthcare Cybersecurity Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Healthcare Cybersecurity Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS