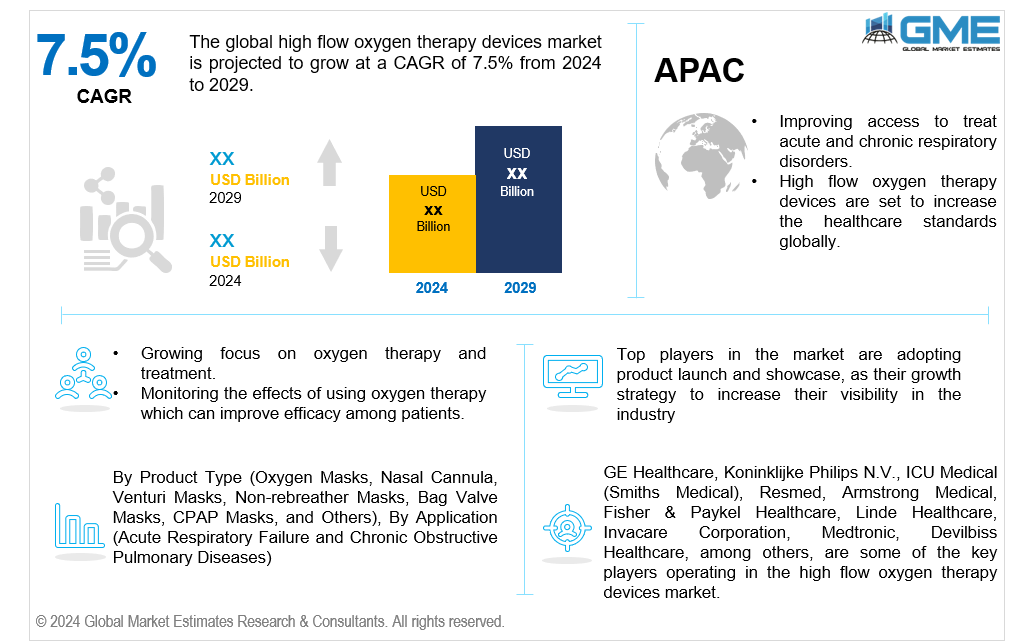

Global High Flow Oxygen Therapy Devices Market Size, Trends & Analysis - Forecasts to 2029 By Product Type (Oxygen Masks, Nasal Cannula, Venturi Masks, Non-rebreather Masks, Bag Valve Masks, CPAP Masks, and Others), By Application (Acute Respiratory Failure and Chronic Obstructive Pulmonary Diseases), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

The high flow oxygen therapy devices market is projected to grow at a CAGR of 7.5% from 2024 to 2029.

High flow oxygen therapy devices are innovative medical equipment that supply oxygen at higher flow rates than conventional oxygen therapy. These devices provide heated, humidified oxygen through a nasal cannula, improving patient comfort and enhancing oxygen delivery efficiency. They help reduce the work of breathing, improve oxygenation, and support better patient outcomes by preventing the need for mechanical ventilation. This therapy is particularly beneficial in reducing hospital readmissions and enhancing the quality of life for patients with severe respiratory insufficiency.

Diseases requiring regular oxygen therapy equipment, such as chronic obstructive pulmonary disease (COPD), idiopathic pulmonary fibrosis (IPF), and acute respiratory failure (ARF), significantly drive the market for high-flow oxygen therapy devices. The oxygen therapy device market analysis offers considerable potential opportunities, led by a growing number of respiratory disorders and the growing elderly population. Globally, COPD affects over 200 million people, and its incidence is projected to rise due to factors such as increasing pollution and smoking rates. This demographic shift necessitates a higher demand for advanced oxygen therapy devices, as older adults are more prone to respiratory conditions requiring consistent oxygen supplementation.

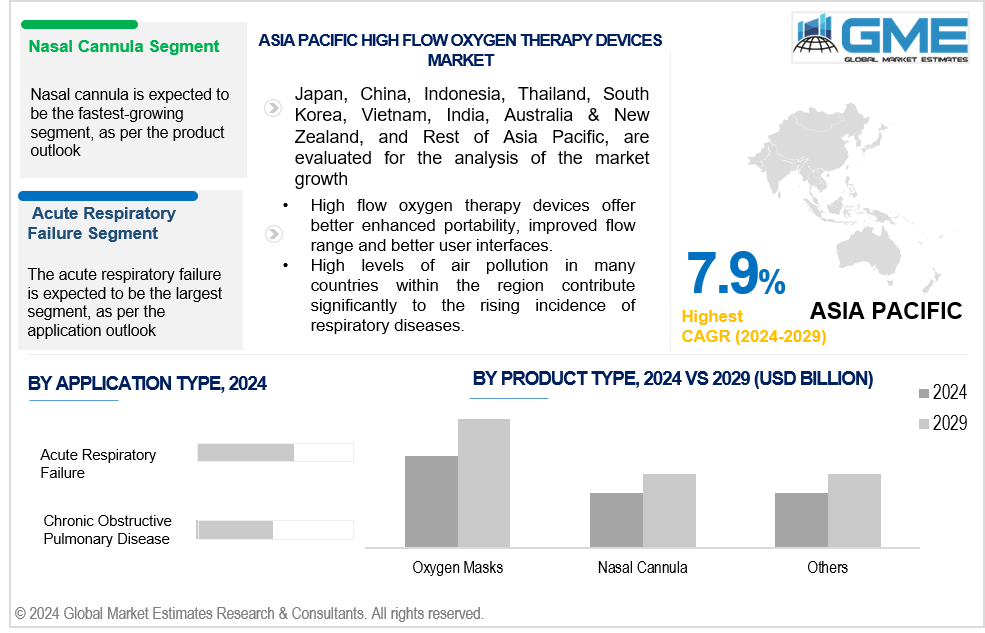

High-flow oxygen therapy uses clinical respiratory support systems that use controlled air pressure and humidity to supply oxygen to patients at higher rates than regular requirements. Oxygen therapy device innovation in the high-flow oxygen therapy sector is crucial for substantially impacting the current market scenario. Traditional oxygen therapy devices, while effective, often lack the advanced features found in newer technologies, such as enhanced portability, improved flow range, and better user interfaces. High-flow oxygen therapy costs might vary depending on the equipment utilized, the length of therapy required, and regional healthcare rates. These improvements in treatment not only benefit patient care but also contribute to a more efficient medical system.

The oxygen masks segment is expected to hold the largest share of the market. This device emphasizes versatility and plays a critical role in patient care. Oxygen masks are known for their ability to deliver a controlled and precise oxygen concentration to patients experiencing respiratory distress or requiring supplemental oxygen. Oxygen therapy in critical care using oxygen masks is vital for maintaining adequate oxygen levels in patients suffering from severe respiratory diseases, guaranteeing optimal oxygenation, and improving patient outcomes. However, oxygen masks remain crucial for situations where high-flow systems are not available or suitable.

The nasal cannula, also called as the high flow nasal cannula (HFNC) segment, is expected to be the fastest-growing segment in the market from 2024 to 2029. It offers flexibility, ease, and efficiency in providing high amounts of oxygen to patients in the form of non-invasive oxygen therapy. Unlike oxygen masks or venturi masks, nasal cannulas allow patients to eat, speak, and move more freely, enhancing overall comfort and adherence to therapy. The increase in chronic respiratory conditions, such as COPD and asthma, has driven the demand for high-flow nasal cannulas, as they are particularly effective in managing these conditions by reducing the work of breathing and improving oxygenation. In neonatal intensive care unit (NICU) high-flow oxygen therapy for infants is typically delivered using specialized nasal cannulas rather than traditional oxygen masks.

The acute respiratory failure (ARF) segment is analyzed to hold the largest market share of the market from 2024 to 2029. In many cases of intensive care admission, oxygen therapy for respiratory patients ensures adequate oxygen levels in the blood, allowing them to breathe more comfortably, and increasing general respiratory function, all of which are critical for recovery from serious respiratory diseases. The increasing prevalence of respiratory conditions and pollution can further exacerbate the incidence of ARF. High flow oxygen therapy provides direct access to the user with compressed air and humidity, providing faster relief, which could not be done normally.

Chronic obstructive pulmonary disease (COPD) segment is analysed to be the fastest-growing segment in the market from 2024 to 2029. Several factors contribute to the increasing global prevalence of chronic obstructive pulmonary disease (COPD). Increased smoking rates continue to be a major factor, as extended exposure to tobacco smoke harms lung tissue and decreases respiratory function. Occupational dangers, such as exposure to dust, chemicals, and fumes in various sectors, can contribute significantly to the development of COPD by irritating and inflaming the airways on a constant basis. Oxygen therapy for COPD patients helps maintain adequate oxygen levels in the blood, reducing symptoms of breathlessness and improving overall quality of life.

North America is expected to be the largest region in the global market. The market growth is due to the region’s robust healthcare infrastructure coupled with high incidence of respiratory disorders rising owing to various occupational hazards, and significant healthcare spending have fuelled demand for improved oxygen therapies. The region also benefits from strong regulatory systems that ensure oxygen therapy device safety and efficacy, which promotes adoption. Furthermore, high healthcare spending and widespread awareness of the high flow oxygen therapy benefits contribute to the region's market dominance.

Asia Pacific is predicted to witness rapid growth during the forecast period. The oxygen therapy market trends show the region has a rapidly growing aging population, which is more susceptible to chronic respiratory conditions such as chronic obstructive pulmonary disease (COPD) and asthma. High levels of air pollution in many countries within the region contribute to the rising incidence of respiratory diseases. Economic growth across the Asia Pacific region has significantly increased healthcare expenditure, including on high-flow oxygen delivery systems. Additionally, the integration of high-flow oxygen therapy technology into healthcare systems in this region has been driven by substantial investments in healthcare infrastructure and continuous innovation in oxygen therapy devices. According to WHO, there is a rising demand for oxygen therapy for pneumonia in the Asia Pacific region.

GE Healthcare, Koninklijke Philips N.V., ICU Medical (Smiths Medical), Resmed, Armstrong Medical, Fisher & Paykel Healthcare, Linde Healthcare, Invacare Corporation, Medtronic, and Devilbiss Healthcare, among others, are some of the key players operating in the high flow oxygen therapy devices market.

Please note: This is not an exhaustive list of companies profiled in the report.

In October 2023, The United States Food and Drug Administration (FDA) approved Telesair Inc’s Bonhawa high-flow oxygen therapy system, designed to enhance the treatment of patients with respiratory insufficiency. It is a lightweight oxygen therapy system that gives healthcare providers and their patients an extended flow range, a streamlined disinfection process, and an intuitive touchscreen, offering greater capabilities and efficiencies, according to a release from the Southern California-based company.

In February 2023, React Health, a medical device developer, oxygen therapy device manufacturer, and distributor for the treatment of sleep-disordered breathing and oxygen therapy, completed the acquisition of Invacare’s Respiratory line. This acquisition includes various products that collectively support a wide range of oxygen therapy needs, from high-flow stationary systems to portable oxygen therapy device solutions and essential accessories for maintenance and monitoring.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL HIGH FLOW OXYGEN THERAPY DEVICES MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL HIGH FLOW OXYGEN THERAPY DEVICES MARKET, BY PRODUCT TYPE

4.1 Introduction

4.2 High Flow Oxygen Therapy Devices Market: Product Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Oxygen Masks

4.4.1 Oxygen Masks Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Nasal Cannula

4.5.1 Nasal Cannula Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Venturi Masks

4.6.1 Venturi Masks Market Estimates and Forecast, 2021-2029 (USD Million)

4.7 Non-rebreather Masks

4.7.1 Non-rebreather Masks Market Estimates and Forecast, 2021-2029 (USD Million)

4.8 Bag Valve Masks

4.8.1 Bag Valve Masks Market Estimates and Forecast, 2021-2029 (USD Million)

4.9 CPAP Masks

4.9.1 CPAP Masks Market Estimates and Forecast, 2021-2029 (USD Million)

4.10 Others

4.10.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL HIGH FLOW OXYGEN THERAPY DEVICES MARKET, BY APPLICATION

5.1 Introduction

5.2 High Flow Oxygen Therapy Devices Market: Application Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Acute Respiratory Failure

5.4.1 Acute Respiratory Failure Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Chronic Obstructive Pulmonary Disease

5.5.1 Chronic Obstructive Pulmonary Disease Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL HIGH FLOW OXYGEN THERAPY DEVICES MARKET, BY REGION

6.1 Introduction

6.2 North America High Flow Oxygen Therapy Devices Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.1 By Product Type

6.2.2 By Application

6.2.3 By Country

6.2.3.1 U.S. High Flow Oxygen Therapy Devices Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.1.1 By Product Type

6.2.3.1.2 By Application

6.2.3.2 Canada High Flow Oxygen Therapy Devices Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.2.1 By Product Type

6.2.3.2.2 By Application

6.2.3.3 Mexico High Flow Oxygen Therapy Devices Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.3.1 By Product Type

6.2.3.3.2 By Application

6.3 Europe High Flow Oxygen Therapy Devices Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.1 By Product Type

6.3.2 By Application

6.3.3 By Country

6.3.3.1 Germany High Flow Oxygen Therapy Devices Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.1.1 By Product Type

6.3.3.1.2 By Application

6.3.3.2 U.K. High Flow Oxygen Therapy Devices Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.2.1 By Product Type

6.3.3.2.2 By Application

6.3.3.3 France High Flow Oxygen Therapy Devices Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.3.1 By Product Type

6.3.3.3.2 By Application

6.3.3.4 Italy High Flow Oxygen Therapy Devices Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.4.1 By Product Type

6.3.3.4.2 By Application

6.3.3.5 Spain High Flow Oxygen Therapy Devices Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.5.1 By Product Type

6.3.3.5.2 By Application

6.3.3.6 Netherlands High Flow Oxygen Therapy Devices Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Product Type

6.3.3.6.2 By Application

6.3.3.7 Rest of Europe High Flow Oxygen Therapy Devices Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Product Type

6.3.3.6.2 By Application

6.4 Asia Pacific High Flow Oxygen Therapy Devices Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.1 By Product Type

6.4.2 By Application

6.4.3 By Country

6.4.3.1 China High Flow Oxygen Therapy Devices Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.1.1 By Product Type

6.4.3.1.2 By Application

6.4.3.2 Japan High Flow Oxygen Therapy Devices Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.2.1 By Product Type

6.4.3.2.2 By Application

6.4.3.3 India High Flow Oxygen Therapy Devices Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.3.1 By Product Type

6.4.3.3.2 By Application

6.4.3.4 South Korea High Flow Oxygen Therapy Devices Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.4.1 By Product Type

6.4.3.4.2 By Application

6.4.3.5 Singapore High Flow Oxygen Therapy Devices Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.5.1 By Product Type

6.4.3.5.2 By Application

6.4.3.6 Malaysia High Flow Oxygen Therapy Devices Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Product Type

6.4.3.6.2 By Application

6.4.3.7 Thailand High Flow Oxygen Therapy Devices Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Product Type

6.4.3.6.2 By Application

6.4.3.8 Indonesia High Flow Oxygen Therapy Devices Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.7.1 By Product Type

6.4.3.7.2 By Application

6.4.3.9 Vietnam High Flow Oxygen Therapy Devices Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.8.1 By Product Type

6.4.3.8.2 By Application

6.4.3.10 Taiwan High Flow Oxygen Therapy Devices Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.10.1 By Product Type

6.4.3.10.2 By Application

6.4.3.11 Rest of Asia Pacific High Flow Oxygen Therapy Devices Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.11.1 By Product Type

6.4.3.11.2 By Application

6.5 Middle East and Africa High Flow Oxygen Therapy Devices Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.1 By Product Type

6.5.2 By Application

6.5.3 By Country

6.5.3.1 Saudi Arabia High Flow Oxygen Therapy Devices Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.1.1 By Product Type

6.5.3.1.2 By Application

6.5.3.2 U.A.E. High Flow Oxygen Therapy Devices Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.2.1 By Product Type

6.5.3.2.2 By Application

6.5.3.3 Israel High Flow Oxygen Therapy Devices Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.3.1 By Product Type

6.5.3.3.2 By Application

6.5.3.4 South Africa High Flow Oxygen Therapy Devices Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.4.1 By Product Type

6.5.3.4.2 By Application

6.5.3.5 Rest of Middle East and Africa High Flow Oxygen Therapy Devices Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.5.1 By Product Type

6.5.3.5.2 By Application

6.6 Central and South America High Flow Oxygen Therapy Devices Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.1 By Product Type

6.6.2 By Application

6.6.3 By Country

6.6.3.1 Brazil High Flow Oxygen Therapy Devices Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.1.1 By Product Type

6.6.3.1.2 By Application

6.6.3.2 Argentina High Flow Oxygen Therapy Devices Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.2.1 By Product Type

6.6.3.2.2 By Application

6.6.3.3 Chile High Flow Oxygen Therapy Devices Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Product Type

6.6.3.3.2 By Application

6.6.3.3 Rest of Central and South America High Flow Oxygen Therapy Devices Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Product Type

6.6.3.3.2 By Application

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 North America

7.3.2 Europe

7.3.3 Asia Pacific

7.3.4 Rest of the World

7.4 Company Profiles

7.4.1 GE Healthcare

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Koninklijke Philips N.V.

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 ICU Medical (Smiths Medical)

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 ResMed

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 Armstrong Medical

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 FISHER & PAYKEL HEALTHCARE

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 Linde Healthcare

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 Invacare Corporation

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 Medtronic

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 DeVilbiss Healthcare

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 Global High Flow Oxygen Therapy Devices Market, By Product Type, 2021-2029 (USD Mllion)

2 Oxygen Masks Market, By Region, 2021-2029 (USD Mllion)

3 Nasal Cannula Market, By Region, 2021-2029 (USD Mllion)

4 Venturi Masks Market, By Region, 2021-2029 (USD Mllion)

5 Non-rebreather Masks Market, By Region, 2021-2029 (USD Mllion)

6 Bag Valve Masks Market, By Region, 2021-2029 (USD Mllion)

7 CPAP Masks Market, By Region, 2021-2029 (USD Mllion)

8 Others Market, By Region, 2021-2029 (USD Mllion)

9 Global High Flow Oxygen Therapy Devices Market, By Application, 2021-2029 (USD Mllion)

10 Acute Respiratory Failure Market, By Region, 2021-2029 (USD Mllion)

11 Chronic Obstructive Pulmonary Disease Market, By Region, 2021-2029 (USD Mllion)

12 Regional Analysis, 2021-2029 (USD Mllion)

13 North America High Flow Oxygen Therapy Devices Market, By Product Type, 2021-2029 (USD Mllion)

14 North America High Flow Oxygen Therapy Devices Market, By Application, 2021-2029 (USD Mllion)

15 North America High Flow Oxygen Therapy Devices Market, By COUNTRY, 2021-2029 (USD Mllion)

16 U.S. High Flow Oxygen Therapy Devices Market, By Product Type, 2021-2029 (USD Mllion)

17 U.S. High Flow Oxygen Therapy Devices Market, By Application, 2021-2029 (USD Mllion)

18 Canada High Flow Oxygen Therapy Devices Market, By Product Type, 2021-2029 (USD Mllion)

19 Canada High Flow Oxygen Therapy Devices Market, By Application, 2021-2029 (USD Mllion)

20 Mexico High Flow Oxygen Therapy Devices Market, By Product Type, 2021-2029 (USD Mllion)

21 Mexico High Flow Oxygen Therapy Devices Market, By Application, 2021-2029 (USD Mllion)

22 Europe High Flow Oxygen Therapy Devices Market, By Product Type, 2021-2029 (USD Mllion)

23 Europe High Flow Oxygen Therapy Devices Market, By Application, 2021-2029 (USD Mllion)

24 Europe High Flow Oxygen Therapy Devices Market, By Country, 2021-2029 (USD Mllion)

25 Germany High Flow Oxygen Therapy Devices Market, By Product Type, 2021-2029 (USD Mllion)

26 Germany High Flow Oxygen Therapy Devices Market, By Application, 2021-2029 (USD Mllion)

27 U.K. High Flow Oxygen Therapy Devices Market, By Product Type, 2021-2029 (USD Mllion)

28 U.K. High Flow Oxygen Therapy Devices Market, By Application, 2021-2029 (USD Mllion)

29 France High Flow Oxygen Therapy Devices Market, By Product Type, 2021-2029 (USD Mllion)

30 France High Flow Oxygen Therapy Devices Market, By Application, 2021-2029 (USD Mllion)

31 Italy High Flow Oxygen Therapy Devices Market, By Product Type, 2021-2029 (USD Mllion)

32 Italy High Flow Oxygen Therapy Devices Market, By Application, 2021-2029 (USD Mllion)

33 Spain High Flow Oxygen Therapy Devices Market, By Product Type, 2021-2029 (USD Mllion)

34 Spain High Flow Oxygen Therapy Devices Market, By Application, 2021-2029 (USD Mllion)

35 Netherlands High Flow Oxygen Therapy Devices Market, By Product Type, 2021-2029 (USD Mllion)

36 Netherlands High Flow Oxygen Therapy Devices Market, By Application, 2021-2029 (USD Mllion)

37 Rest Of Europe High Flow Oxygen Therapy Devices Market, By Product Type, 2021-2029 (USD Mllion)

38 Rest Of Europe High Flow Oxygen Therapy Devices Market, By Application, 2021-2029 (USD Mllion)

39 Asia Pacific High Flow Oxygen Therapy Devices Market, By Product Type, 2021-2029 (USD Mllion)

40 Asia Pacific High Flow Oxygen Therapy Devices Market, By Application, 2021-2029 (USD Mllion)

41 Asia Pacific High Flow Oxygen Therapy Devices Market, By Country, 2021-2029 (USD Mllion)

42 China High Flow Oxygen Therapy Devices Market, By Product Type, 2021-2029 (USD Mllion)

43 China High Flow Oxygen Therapy Devices Market, By Application, 2021-2029 (USD Mllion)

44 Japan High Flow Oxygen Therapy Devices Market, By Product Type, 2021-2029 (USD Mllion)

45 Japan High Flow Oxygen Therapy Devices Market, By Application, 2021-2029 (USD Mllion)

46 India High Flow Oxygen Therapy Devices Market, By Product Type, 2021-2029 (USD Mllion)

47 India High Flow Oxygen Therapy Devices Market, By Application, 2021-2029 (USD Mllion)

48 South Korea High Flow Oxygen Therapy Devices Market, By Product Type, 2021-2029 (USD Mllion)

49 South Korea High Flow Oxygen Therapy Devices Market, By Application, 2021-2029 (USD Mllion)

50 Singapore High Flow Oxygen Therapy Devices Market, By Product Type, 2021-2029 (USD Mllion)

51 Singapore High Flow Oxygen Therapy Devices Market, By Application, 2021-2029 (USD Mllion)

52 Thailand High Flow Oxygen Therapy Devices Market, By Product Type, 2021-2029 (USD Mllion)

53 Thailand High Flow Oxygen Therapy Devices Market, By Application, 2021-2029 (USD Mllion)

54 Malaysia High Flow Oxygen Therapy Devices Market, By Product Type, 2021-2029 (USD Mllion)

55 Malaysia High Flow Oxygen Therapy Devices Market, By Application, 2021-2029 (USD Mllion)

56 Indonesia High Flow Oxygen Therapy Devices Market, By Product Type, 2021-2029 (USD Mllion)

57 Indonesia High Flow Oxygen Therapy Devices Market, By Application, 2021-2029 (USD Mllion)

58 Vietnam High Flow Oxygen Therapy Devices Market, By Product Type, 2021-2029 (USD Mllion)

59 Vietnam High Flow Oxygen Therapy Devices Market, By Application, 2021-2029 (USD Mllion)

60 Taiwan High Flow Oxygen Therapy Devices Market, By Product Type, 2021-2029 (USD Mllion)

61 Taiwan High Flow Oxygen Therapy Devices Market, By Application, 2021-2029 (USD Mllion)

62 Rest of APAC High Flow Oxygen Therapy Devices Market, By Product Type, 2021-2029 (USD Mllion)

63 Rest of APAC High Flow Oxygen Therapy Devices Market, By Application, 2021-2029 (USD Mllion)

64 Middle East and Africa High Flow Oxygen Therapy Devices Market, By Product Type, 2021-2029 (USD Mllion)

65 Middle East and Africa High Flow Oxygen Therapy Devices Market, By Application, 2021-2029 (USD Mllion)

66 Middle East and Africa High Flow Oxygen Therapy Devices Market, By Country, 2021-2029 (USD Mllion)

67 Saudi Arabia High Flow Oxygen Therapy Devices Market, By Product Type, 2021-2029 (USD Mllion)

68 Saudi Arabia High Flow Oxygen Therapy Devices Market, By Application, 2021-2029 (USD Mllion)

69 UAE High Flow Oxygen Therapy Devices Market, By Product Type, 2021-2029 (USD Mllion)

70 UAE High Flow Oxygen Therapy Devices Market, By Application, 2021-2029 (USD Mllion)

71 Israel High Flow Oxygen Therapy Devices Market, By Product Type, 2021-2029 (USD Mllion)

72 Israel High Flow Oxygen Therapy Devices Market, By Application, 2021-2029 (USD Mllion)

73 South Africa High Flow Oxygen Therapy Devices Market, By Product Type, 2021-2029 (USD Mllion)

74 South Africa High Flow Oxygen Therapy Devices Market, By Application, 2021-2029 (USD Mllion)

75 Rest Of Middle East and Africa High Flow Oxygen Therapy Devices Market, By Product Type, 2021-2029 (USD Mllion)

76 Rest Of Middle East and Africa High Flow Oxygen Therapy Devices Market, By Application, 2021-2029 (USD Mllion)

77 Central and South America High Flow Oxygen Therapy Devices Market, By Product Type, 2021-2029 (USD Mllion)

78 Central and South America High Flow Oxygen Therapy Devices Market, By Application, 2021-2029 (USD Mllion)

79 Central and South America High Flow Oxygen Therapy Devices Market, By Country, 2021-2029 (USD Mllion)

80 Brazil High Flow Oxygen Therapy Devices Market, By Product Type, 2021-2029 (USD Mllion)

81 Brazil High Flow Oxygen Therapy Devices Market, By Application, 2021-2029 (USD Mllion)

82 Chile High Flow Oxygen Therapy Devices Market, By Product Type, 2021-2029 (USD Mllion)

83 Chile High Flow Oxygen Therapy Devices Market, By Application, 2021-2029 (USD Mllion)

84 Argentina High Flow Oxygen Therapy Devices Market, By Product Type, 2021-2029 (USD Mllion)

85 Argentina High Flow Oxygen Therapy Devices Market, By Application, 2021-2029 (USD Mllion)

86 Rest Of Central and South America High Flow Oxygen Therapy Devices Market, By Product Type, 2021-2029 (USD Mllion)

87 Rest Of Central and South America High Flow Oxygen Therapy Devices Market, By Application, 2021-2029 (USD Mllion)

88 GE Healthcare: Products & Services Offering

89 Koninklijke Philips N.V.: Products & Services Offering

90 ICU Medical (Smiths Medical): Products & Services Offering

91 ResMed: Products & Services Offering

92 Armstrong Medical: Products & Services Offering

93 FISHER & PAYKEL HEALTHCARE: Products & Services Offering

94 Linde Healthcare : Products & Services Offering

95 Invacare Corporation: Products & Services Offering

96 Medtronic: Products & Services Offering

97 DeVilbiss Healthcare: Products & Services Offering

98 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global High Flow Oxygen Therapy Devices Market Overview

2 Global High Flow Oxygen Therapy Devices Market Value From 2021-2029 (USD Mllion)

3 Global High Flow Oxygen Therapy Devices Market Share, By Product Type (2023)

4 Global High Flow Oxygen Therapy Devices Market Share, By Application (2023)

5 Global High Flow Oxygen Therapy Devices Market, By Region (Asia Pacific Market)

6 Technological Trends In Global High Flow Oxygen Therapy Devices Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global High Flow Oxygen Therapy Devices Market

10 Impact Of Challenges On The Global High Flow Oxygen Therapy Devices Market

11 Porter’s Five Forces Analysis

12 Global High Flow Oxygen Therapy Devices Market: By Product Type Scope Key Takeaways

13 Global High Flow Oxygen Therapy Devices Market, By Product Type Segment: Revenue Growth Analysis

14 Oxygen Masks Market, By Region, 2021-2029 (USD Mllion)

15 Nasal Cannula Market, By Region, 2021-2029 (USD Mllion)

16 Venturi Masks Market, By Region, 2021-2029 (USD Mllion)

17 Non-rebreather Masks Market, By Region, 2021-2029 (USD Mllion)

18 Bag Valve Masks Market, By Region, 2021-2029 (USD Mllion)

19 CPAP Masks Market, By Region, 2021-2029 (USD Mllion)

20 Others Market, By Region, 2021-2029 (USD Mllion)

21 Global High Flow Oxygen Therapy Devices Market: By Application Scope Key Takeaways

22 Global High Flow Oxygen Therapy Devices Market, By Application Segment: Revenue Growth Analysis

23 Acute Respiratory Failure Market, By Region, 2021-2029 (USD Mllion)

24 Chronic Obstructive Pulmonary Disease Market, By Region, 2021-2029 (USD Mllion)

25 Regional Segment: Revenue Growth Analysis

26 Global High Flow Oxygen Therapy Devices Market: Regional Analysis

27 North America High Flow Oxygen Therapy Devices Market Overview

28 North America High Flow Oxygen Therapy Devices Market, By Product Type

29 North America High Flow Oxygen Therapy Devices Market, By Application

30 North America High Flow Oxygen Therapy Devices Market, By Country

31 U.S. High Flow Oxygen Therapy Devices Market, By Product Type

32 U.S. High Flow Oxygen Therapy Devices Market, By Application

33 Canada High Flow Oxygen Therapy Devices Market, By Product Type

34 Canada High Flow Oxygen Therapy Devices Market, By Application

35 Mexico High Flow Oxygen Therapy Devices Market, By Product Type

36 Mexico High Flow Oxygen Therapy Devices Market, By Application

37 Four Quadrant Positioning Matrix

38 Company Market Share Analysis

39 GE Healthcare: Company Snapshot

40 GE Healthcare: SWOT Analysis

41 GE Healthcare: Geographic Presence

42 Koninklijke Philips N.V.: Company Snapshot

43 Koninklijke Philips N.V.: SWOT Analysis

44 Koninklijke Philips N.V.: Geographic Presence

45 ICU Medical (Smiths Medical): Company Snapshot

46 ICU Medical (Smiths Medical): SWOT Analysis

47 ICU Medical (Smiths Medical): Geographic Presence

48 ResMed: Company Snapshot

49 ResMed: Swot Analysis

50 ResMed: Geographic Presence

51 Armstrong Medical: Company Snapshot

52 Armstrong Medical: SWOT Analysis

53 Armstrong Medical: Geographic Presence

54 FISHER & PAYKEL HEALTHCARE: Company Snapshot

55 FISHER & PAYKEL HEALTHCARE: SWOT Analysis

56 FISHER & PAYKEL HEALTHCARE: Geographic Presence

57 Linde Healthcare : Company Snapshot

58 Linde Healthcare : SWOT Analysis

59 Linde Healthcare : Geographic Presence

60 Invacare Corporation: Company Snapshot

61 Invacare Corporation: SWOT Analysis

62 Invacare Corporation: Geographic Presence

63 Medtronic: Company Snapshot

64 Medtronic: SWOT Analysis

65 Medtronic: Geographic Presence

66 DeVilbiss Healthcare: Company Snapshot

67 DeVilbiss Healthcare: SWOT Analysis

68 DeVilbiss Healthcare: Geographic Presence

69 Other Companies: Company Snapshot

70 Other Companies: SWOT Analysis

71 Other Companies: Geographic Presence

The Global High Flow Oxygen Therapy Devices Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the High Flow Oxygen Therapy Devices Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS