Global Human Papilloma Virus Testing Market Size, Trends, and Analysis - Forecasts To 2026 By Type (High-Risk Human Papilloma Virus, Low-Risk Human Papilloma Virus), By Applications (Immunoassays, Monoclonal And Polyclonal Antibodies, Microarrays, Molecular Diagnostics, Chromosome Analysis, Flow Cytometry, Artificial Intelligence, Microcomputers, and Biosensors), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

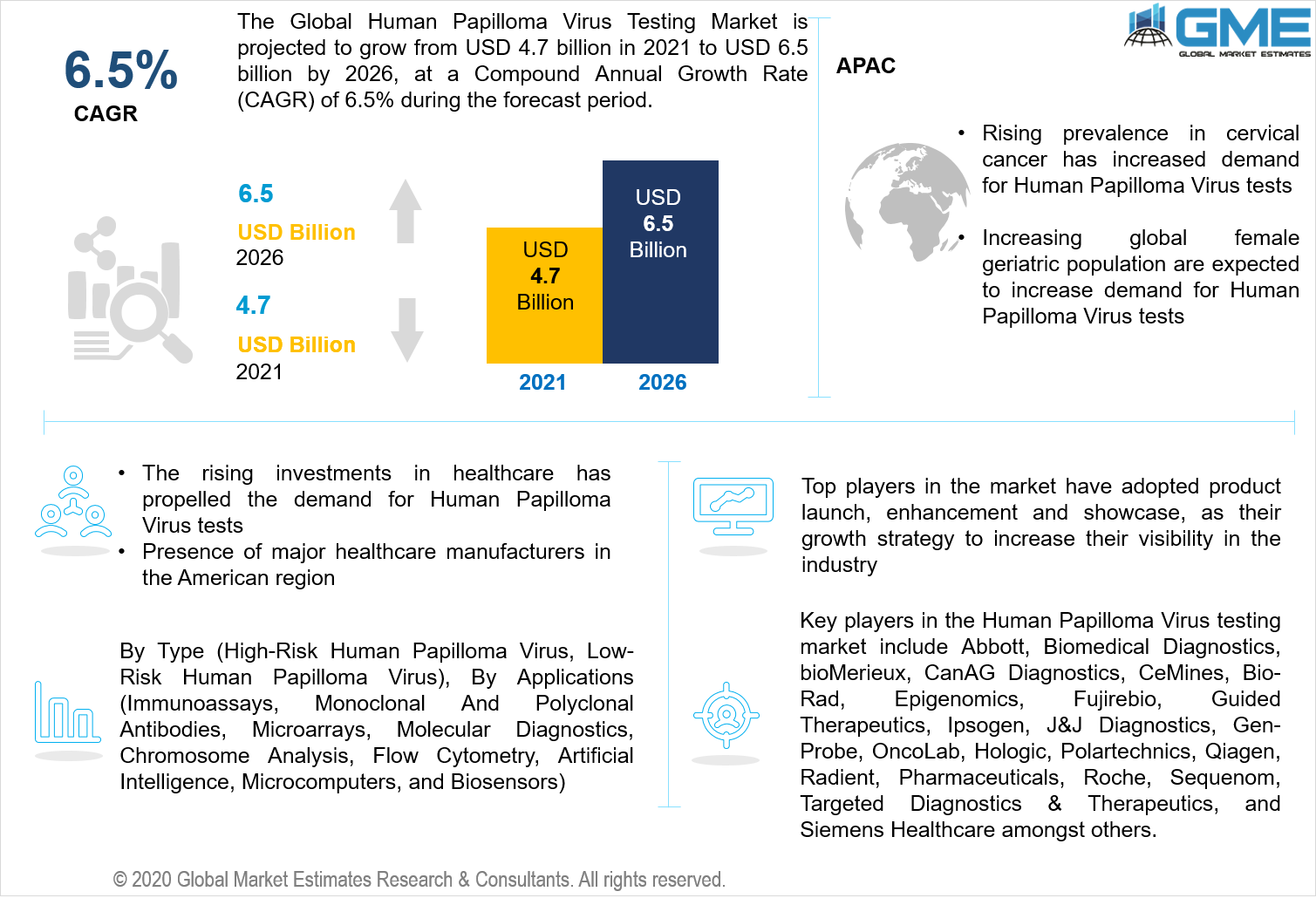

The global human papilloma virus testing market is projected to grow from USD 4.7 billion in 2021 to USD 6.5 billion by 2026 at a CAGR value of 6.5% from 2021 to 2026.

Cervical and breast cancer are the most prevalent cancer type amongst women population across the globe. Also, HPV, which is a sexually transmitted virus, has been clinically proven to be the primary cause of cervical cancer. HPV contributes to around 90% of all anal and cervical cancers and 70% of vaginal and vulvar cancers. Pap tests are the most preferred tests to detect cervical cancer. These tests include microscopic observation of specimens. However, these tests are unable to detect all the genotypes causing HPV infections and might also lead to a significant number of false negative results. Owing to these challenges posed by Pap tests, HPV diagnostic tests were introduced as effective molecular diagnostic tests.

Hence, rising cases of cervical and breast cancer, increasing demand for pre-disease diagnostic tools, rising awareness regarding advanced HPV diagnostic tests, increasing research and development activities and presence of prime market players in the developing regions are some of the factors driving the growth of the market.

Human papillomavirus (HPV) is very commonly known as a sexually transmitted infection (STI). An ideal preventive measure for HPV is to get vaccinated.

However, if not vaccinated, the patient may get severely infected with HPV and can ultimately lead to cancer. Some types of genital HPV can cause cancer to the lower part of the uterus that connects to the vagina. The HPV infection is often transmitted sexually or through skin-to-skin contact with other people.

COVID-19 pandemic has drastically affected the HPV testing market. With the rising cases of communicable infectious disease, and the awareness about pre-symptomatic diagnostic tests, the market for HPV testing played fairly well both in developed and developing regions. However, the market is expected to further grow exponentially post the initial stages of COVID-19 pandemic.

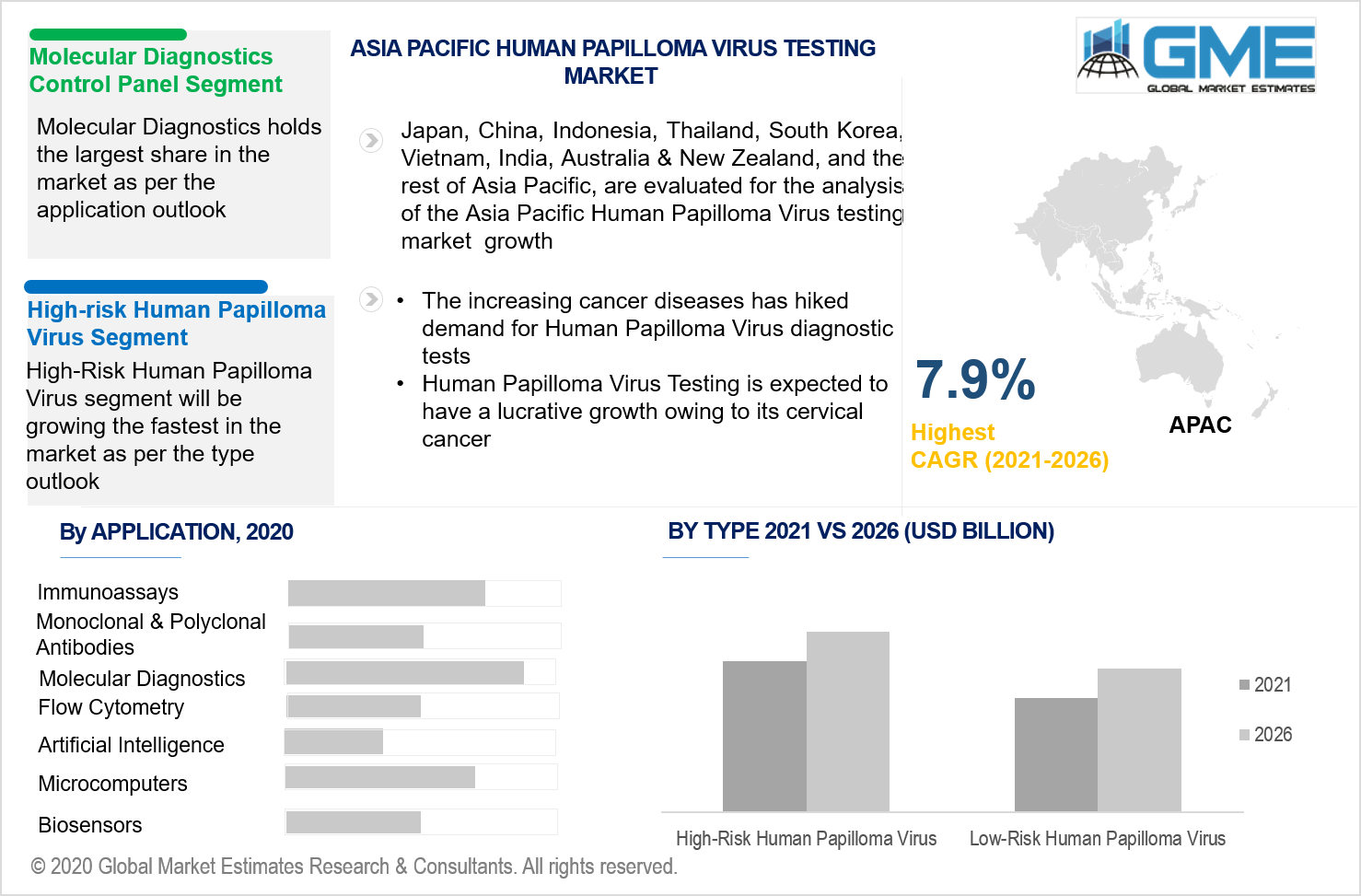

The market for the Human Papilloma Virus testing market is segmented into High-Risk Human Papilloma Virus and Low-Risk Human Papilloma Virus. The Human Papilloma Virus Testing market segment is dominated by High-Risk Human Papilloma Virus.

HR-HPV is a type of human papillomavirus (HPV) that can cause cervical cancer, and also cause infection of bones or soft tissues, anus, penis, vagina, or the vulva and back of the throat.

Chronic infection with high-risk human papillomavirus at some point can lead to cell damage that, if not treated, may become cancerous. Most people never know they have the virus and hence, a dignositc approach is strongly recommended for the same. Hence, rising awareness regarding pre-symptomatic diagnostic tests is the major reason for this segment to grow rapidly.

The market for the Human Papilloma Virus testing is segmented into immunoassays, monoclonal and polyclonal antibodies, microarrays, molecular diagnostics, chromosome analysis, flow cytometry, artificial intelligence, microcomputers, and biosensors. The molecular diagnostics segment is expected to dominate the market during the forecast period of 2021 to 2026.

Molecular diagnostic is a collection of tests used to analyze cells and understand gene expression, protein synthesis procedure and level of cell damage. By analyzing the specific symptoms of the patient’s disease, molecular diagnostics offers the prospect of personalized medicine.

Hence, rising need for personalized medicines and diagnostic approach, increased research and development activities related to launching advanced dianogstic tools, and rising awareness regarding cervical cancer are some of the driver supporting the growth of the molecular diangositc segment in the Human Papilloma Virus testing market.

These tests are useful in a range of medical specialties, such as infectious disease, oncology, human leucocyte antigen typing (which investigates and predicts immune function), coagulation, and pharmacogenomics (the genetic prediction of which drugs will work best). Diagnostic tests demonstrate the presence or absence of an infectious agent. Early and better diagnosis has helped in limiting fatalities due to highly infectious and contagious diseases in the past. Diagnosis has an empirical role in such diseases that are caused by any novel pathogen for which the population is not pre-immune. COVID-19 is one of such infectious diseases, highly contagious and deadly. Hence, the impact of pandemic on novel disease diagnosis has been very high.

According to regional analysis, the Human Papilloma Virus testing market is bifurcated into North America, Europe, Asia Pacific, Latin America, and the Middle East. North American region is estimated to be the largest regional segment in the market.

Rising geriatric patient population, increased awareness regarding advance diagnostic procedures, high prevlance of infectious disease and presence of major players in the US has helped the North American region to be the dominant region in the market. The findings show that at a given point in time 11.7% of women with normal cervical cytological findings had a detectable cervical HPV infection. The American Social Health Association estimates that about 75–80% of sexually active Americans will be infected with HPV at some point in their lifetime.

However, African, Asian and Latin American regions showed higher average HPV prevalence estimates than European, and Northern American regions. Hence, the APAC, MEA and CSA regions are analyzed to be the fastest growing segments in the market.

Key players in the Human Papilloma Virus testing market include Abbott, Biomedical Diagnostics, bioMerieux, CanAG Diagnostics, CeMines, Bio-Rad, Epigenomics, Fujirebio, Guided Therapeutics, Ipsogen, J&J Diagnostics, Gen-Probe, OncoLab, Hologic, Polartechnics, Qiagen, Radient, Pharmaceuticals, Roche, Sequenom, Targeted Diagnostics & Therapeutics, and Siemens Healthcare amongst others.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Human Papilloma Virus Testing Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Application Overview

2.1.4 Regional Overview

Chapter 3 Human Papilloma Virus Testing Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Research advancement in Human Papilloma Virus testing and diagnosis

3.3.2 Industry Challenges

3.3.2.1 Rise in testing prices and dearth of qualified professionals

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Application Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Human Papilloma Virus Testing Market, By Type

4.1 Type Outlook

4.2 High-Risk Human Papilloma Virus

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Low-Risk Human Papilloma Virus

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Human Papilloma Virus Testing Market, By Application

5.1 Application Outlook

5.2 Immunoassays

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Monoclonal & Polyclonal Antibodies

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Microarrays

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

5.5 Molecular Diagnostics

5.5.1 Market Size, By Region, 2020-2026 (USD Billion)

5.6 Chromosome Analysis

5.6.1 Market Size, By Region, 2020-2026 (USD Billion)

5.7 Flow Cytometry

5.7.1 Market Size, By Region, 2020-2026 (USD Billion)

5.8 Artificial Intelligence

5.8.1 Market Size, By Region, 2020-2026 (USD Billion)

5.9 Microcomputers

5.9.1 Market Size, By Region, 2020-2026 (USD Billion)

5.10 Biosensors

5.10.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Human Papilloma Virus Testing Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2020-2026 (USD Billion)

6.2.2 Market Size, By Type, 2020-2026 (USD Billion)

6.2.3 Market Size, By Application, 2020-2026 (USD Billion)

6.2.4 U.S.

6.2.4.1 Market Size, By Type, 2020-2026 (USD Billion)

6.2.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.2.5 Canada

6.2.5.1 Market Size, By Type, 2020-2026 (USD Billion)

6.2.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3 Europe

6.3.1 Market Size, By Country 2020-2026 (USD Billion)

6.3.2 Market Size, By Type, 2020-2026 (USD Billion)

6.3.3 Market Size, By Application, 2020-2026 (USD Billion)

6.3.4 Germany

6.3.4.1 Market Size, By Type, 2020-2026 (USD Billion)

6.3.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.5 UK

6.3.5.1 Market Size, By Type, 2020-2026 (USD Billion)

6.3.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.6 France

6.3.6.1 Market Size, By Type, 2020-2026 (USD Billion)

6.3.6.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.7 Italy

6.3.7.1 Market Size, By Type, 2020-2026 (USD Billion)

6.3.7.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.8 Spain

6.3.8.1 Market Size, By Type, 2020-2026 (USD Billion)

6.3.8.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.9 Russia

6.3.9.1 Market Size, By Type, 2020-2026 (USD Billion)

6.3.9.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2020-2026 (USD Billion)

6.4.2 Market Size, By Type, 2020-2026 (USD Billion)

6.4.3 Market Size, By Application, 2020-2026 (USD Billion)

6.4.4 China

6.4.4.1 Market Size, By Type, 2020-2026 (USD Billion)

6.4.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4.5 India

6.4.5.1 Market Size, By Type, 2020-2026 (USD Billion)

6.4.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4.6 Japan

6.4.6.1 Market Size, By Type, 2020-2026 (USD Billion)

6.4.6.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4.7 Australia

6.4.7.1 Market Size, By Type, 2020-2026 (USD Billion)

6.4.7.2 Market size, By Application, 2020-2026 (USD Billion)

6.4.8 South Korea

6.4.8.1 Market Size, By Type, 2020-2026 (USD Billion)

6.4.8.2 Market Size, By Application, 2020-2026 (USD Billion)

6.5 Latin America

6.5.1 Market Size, By Country 2020-2026 (USD Billion)

6.5.2 Market Size, By Type, 2020-2026 (USD Billion)

6.5.3 Market Size, By Application, 2020-2026 (USD Billion)

6.5.4 Brazil

6.5.4.1 Market Size, By Type, 2020-2026 (USD Billion)

6.5.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.5.5 Mexico

6.5.5.1 Market Size, By Type, 2020-2026 (USD Billion)

6.5.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.5.6 Argentina

6.5.6.1 Market Size, By Type, 2020-2026 (USD Billion)

6.5.6.2 Market Size, By Application, 2020-2026 (USD Billion)

6.6 MEA

6.6.1 Market Size, By Country 2020-2026 (USD Billion)

6.6.2 Market Size, By Type, 2020-2026 (USD Billion)

6.6.3 Market Size, By Application, 2020-2026 (USD Billion)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Type, 2020-2026 (USD Billion)

6.6.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.6.5 UAE

6.6.5.1 Market Size, By Type, 2020-2026 (USD Billion)

6.6.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.6.6 South Africa

6.6.6.1 Market Size, By Type, 2020-2026 (USD Billion)

6.6.6.2 Market Size, By Application, 2020-2026 (USD Billion)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Abbott

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Biomedical Diagnostics

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 bioMerieux

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 CanAG Diagnostics

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 CeMines

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Bio-Rad

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Epigenomics

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Fujirebio

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Other Companies

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

The Global Human Papilloma Virus Testing Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Human Papilloma Virus Testing Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS