Global Hydraulic Breaker Market Size, Trends & Analysis - Forecasts to 2028 By Equipment Size (Small, Medium, and Large), By Type (Premium and Non-premium), By Application (Breaking Oversized Material, Trenching, Demolition, and Others), By End-use Industry (Construction, Mining, and Others), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

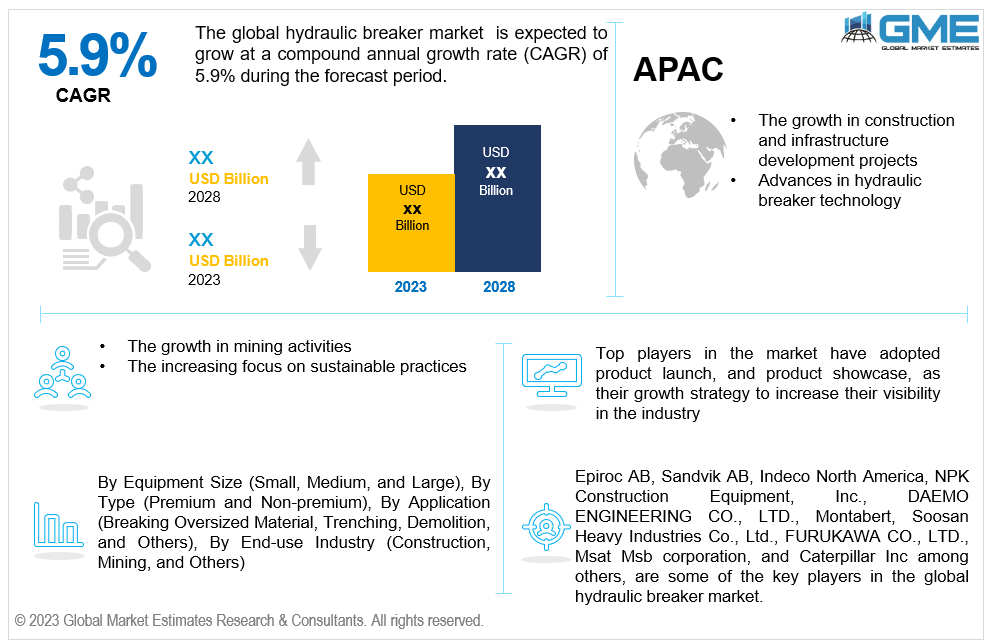

The global hydraulic breaker market is estimated to exhibit a CAGR of 5.9% from 2023 to 2028.

The primary reasons propelling the market growth include rising construction and infrastructure development projects and advances in hydraulic breaker technology. Rocks, concrete, and other materials must be broken and destroyed more frequently as building projects grow and increase. Hydraulic breakers are crucial for operations in the construction industry, including foundation excavation, trenching, and rock breaking. Moreover, hydraulic breakers are necessary for infrastructure projects, including building roads, bridges, tunnels, and utilities. These are often large-scale undertakings, and hydraulic breakers are essential for clearing the site and eliminating obstructions. For instance, according to the Infrastructure Monitor 2022 report, between 2010 and 2021, private infrastructure funding quadrupled from around USD 34 billion in 2010 to USD 129 billion in 2021.

The rising mining activities and the increasing focus on sustainable practices are expected to support the market growth during the forecast period. Mining is the process of removing profitable minerals and ores from the planet. These compounds are frequently covered in solid rock formations. These rocks are broken and excavated using hydraulic breakers, improving mining operations' efficiency. Hydraulic breakers significantly enhance the efficiency and productivity of mining operations. They can more quickly and efficiently shatter and crush rocks than conventional techniques, minimizing downtime and improving total productivity. For instance, according to the International Energy Agency, following a 20% growth in 2021, investment in the extraction of key minerals had another high surge of 30% in 2022.

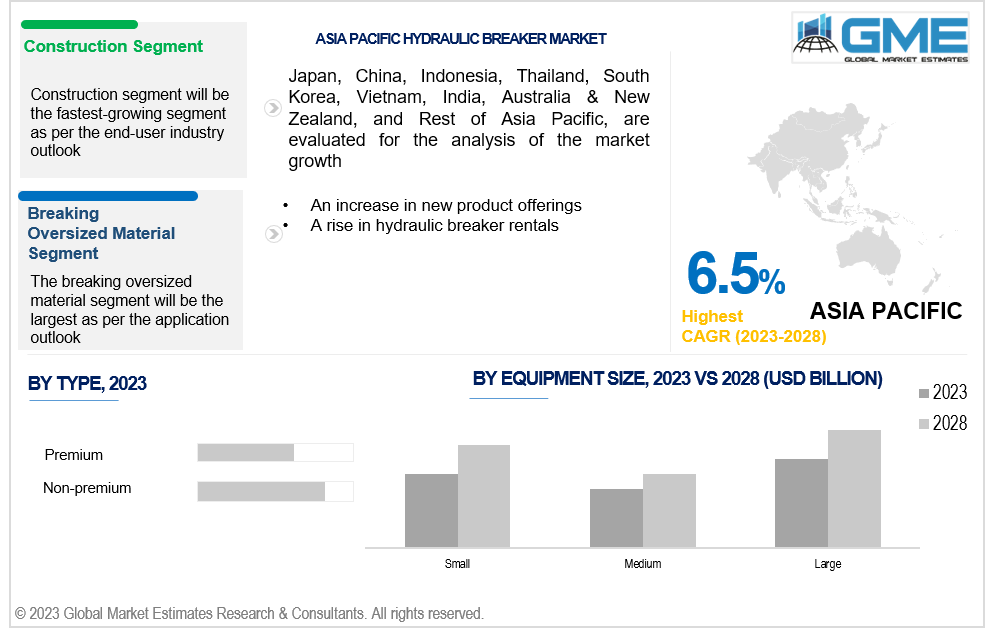

The market is growing due to increased new product offerings and hydraulic breaker rentals. There is an increasing number of product launches, especially in excavator attachments and hydraulic breakers with cutting-edge technology, by manufacturers. These new goods frequently have increased efficiency, less maintenance obligations, improved durability, and more application versatility. Rental businesses often upgrade their fleets with new machinery, such as hydraulic breakers. Since contractors and construction firms prefer to hire the most modern and effective equipment for their projects, the availability of new, sophisticated models can enhance the rental industry. For instance, the Hammer SB 55, also known as a utility breaker, was introduced by Hammer SRL during the Construction & Quarry Machinery Show (CQMS 21) in September 2021. The new hammer has more power, fewer vibrations, requires less upkeep, has a nitrogen charge that lasts longer, has a hushed body, and has a monoblock body without tie rods.

Market players could gain a competitive edge by funding R&D to produce more sophisticated and effective hydraulic breaker models. Innovations in noise reduction, environmental compliance, and energy efficiency may present opportunities in markets where these attributes are prized. Moreover, offering maintenance and servicing solutions for hydraulic breakers can create a lucrative opportunity. Regular upkeep and prompt repairs can extend the useful lives of these machines, minimizing downtime for mining and construction firms. However, a lack of skilled and qualified operators and stricter environmental regulations can hamper the market growth.

The large equipment size segment is expected to hold the largest share of the market over the forecast period. Cost efficiency is a critical factor in favouring large equipment-size hydraulic breakers. Their cost-effectiveness is in accordance with the prevailing hydraulic demolition tools market trends, indicating the emphasis on optimizing expenditures in mining and construction activities. Their capacity to manage significant workloads lowers the total operational expenses in these industries. Moreover, technological advancements developed to tackle heavy-duty tasks appeal to enterprises seeking to improve productivity and reduce downtime, further fueling the market growth of hydraulic breakers, especially in larger machinery.

The small equipment size segment is expected to be the fastest-growing segment in the market from 2023-2028. The compact size of these hydraulic breakers makes them well-suited for urban and residential construction, where space constraints and noise regulations are frequently an issue. In these environments, where urbanization and redevelopment projects are rising, the adaptability of small equipment size hydraulic breakers aligns with the rising trends of construction equipment and hydraulic breakers.

The non-premium segment is expected to hold the largest share of the market. This is due to a combination of factors related to excavator attachments and hydraulic breakers and the influence of hydraulic breaker technology advancements. Manufacturers in this segment have improved their products' durability, effectiveness, and adaptability, making them appropriate for a range of applications. These developments make products more affordable to acquire and maintain, attracting a more comprehensive range of customers.

The premium segment is anticipated to be the fastest-growing segment in the market from 2023-2028. Premium hydraulic breakers frequently include adaptable designs that accommodate different hydraulic systems and accessories. This versatility makes them adaptable to a wide range of applications of hydraulic breakers, such as providing rock and concrete breaking solutions for both building and demolition operations.

The breaking oversized material segment is expected to hold the largest share of the market. Hydraulic breakers are essential for construction projects to destroy massive buildings and enormous materials, in line with demolition and construction industry trends emphasizing reusing existing buildings. Hydraulic breaker attachments for heavy machinery enhance productivity, security, and accuracy when working with large materials. They are essential instruments for the contemporary construction and demolition sector, where the effective handling of enormous materials is of utmost importance, owing to their adaptability and ongoing technical improvements.

The demolition segment is anticipated to be the fastest-growing segment in the market from 2023-2028. This is due to hydraulic breakers' alignment with the growing concern for the environmental impact of hydraulic demolition, the safety considerations in hydraulic breaker operation, the efficiency in large-scale demolition, the versatility in tackling various materials, and compliance with regulatory requirements.

The mining segment is expected to hold the largest share of the market. The mining industry relies heavily on rock-breaking and ore-extraction processes. Hard rock, ore bodies, and other geological materials must be broken down by hydraulic breakers. The mining sector's productivity is significantly increased by its capacity to effectively break and disintegrate these minerals.

The construction segment is anticipated to be the fastest-growing segment in the market from 2023-2028. The rapid pace of urbanization across the globe has led to increased demand for construction activities. New infrastructure, homes, and businesses are increasingly needed as more people relocate to metropolitan regions. In order to satisfy the needs of urbanization, hydraulic breakers are crucial instruments for various building work, such as foundation work, road construction, and demolition.

North America is expected to be the largest region in the global market. The infrastructure and construction sectors have a big impact on the demand for hydraulic breakers. The growing infrastructure and construction sectors significantly impact the demand for hydraulic breakers. The need for hydraulic breakers for demolition and excavation operations rises as North America continues to invest in infrastructure projects, such as roads, bridges, and buildings. For instance, in January 2023, the Federal Highway Administration (FHWA) announced to spend USD 2.1 billion on bridge infrastructure improvements. The national government has committed a sizable amount of money towards rehabilitating highway bridges around the United States, including the USD 2.1 billion initiative.

Asia Pacific is anticipated to witness rapid growth during the forecast period. Asia Pacific is rich in mineral resources, and the mining industry requires hydraulic breakers for tasks such as ore extraction, tunnelling, and rock splitting. Demand for hydraulic breakers is strongly impacted by growth in the mining industry. For instance, according to the United Nations Environment Program (UNEP) (2019), China is the world's largest consumer of minerals and metals. However, it is also the world's largest producer of over 20 minerals and metals.

Epiroc AB, Sandvik AB, Indeco North America, NPK Construction Equipment, Inc., DAEMO ENGINEERING CO., LTD., Montabert, Soosan Heavy Industries Co., Ltd., FURUKAWA CO., LTD., Msat Msb corporation, and Caterpillar Inc among others, are some of the key players in the global hydraulic breaker market.

Please note: This is not an exhaustive list of companies profiled in the report.

Recent Development

In April 2021, Epiroc, a company focused on enhancing productivity and sustainability in the mining and infrastructure sectors, signed an agreement to acquire DandA Heavy Industries, a South Korea-based hydraulic breaker manufacturer.

In February 2022, Montabert, a standalone hydraulic rock breaker business owned by Komatsu, entered into a deal with Tramac to acquire full control of the distributor's U.S. and Canadian operations.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL HYDRAULIC BREAKER MARKET, BY EQUIPMENT SIZE

4.1 Introduction

4.2 Hydraulic Breaker Market: Equipment Size Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4 Small

4.4.1 Small Market Estimates and Forecast, 2020-2028 (USD Billion)

4.5 Medium

4.5.1 Medium Market Estimates and Forecast, 2020-2028 (USD Billion)

4.6 Large

4.6.1 Large Market Estimates and Forecast, 2020-2028 (USD Billion)

5 GLOBAL HYDRAULIC BREAKER MARKET, BY TYPE

5.1 Introduction

5.2 Hydraulic Breaker Market: Type Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4 Premium

5.4.1 Premium Market Estimates and Forecast, 2020-2028 (USD Billion)

5.5 Non-premium

5.5.1 Non-premium Market Estimates and Forecast, 2020-2028 (USD Billion)

6 GLOBAL HYDRAULIC BREAKER MARKET, BY APPLICATION

6.1 Introduction

6.2 Hydraulic Breaker Market: Application Scope Key Takeaways

6.3 Revenue Growth Analysis, 2022 & 2028

6.4 Breaking Oversized Material

6.4.1 Breaking Oversized Material Market Estimates and Forecast, 2020-2028 (USD Billion)

6.5 Trenching

6.5.1 Trenching Market Estimates and Forecast, 2020-2028 (USD Billion)

6.6 Demolition

6.6.1 Demolition Market Estimates and Forecast, 2020-2028 (USD Billion)

6.7 Others

6.7.1 Others Market Estimates and Forecast, 2020-2028 (USD Billion)

7 GLOBAL HYDRAULIC BREAKER MARKET, BY END-USE INDUSTRY

7.1 Introduction

7.2 Hydraulic Breaker Market: End-use Industry Scope Key Takeaways

7.3 Revenue Growth Analysis, 2022 & 2028

7.4 Construction

7.4.1 Construction Market Estimates and Forecast, 2020-2028 (USD Billion)

7.5 Mining

7.5.1 Mining Market Estimates and Forecast, 2020-2028 (USD Billion)

7.6 Others

7.6.1 Others Market Estimates and Forecast, 2020-2028 (USD Billion)

8 GLOBAL HYDRAULIC BREAKER MARKET, BY REGION

8.1 Introduction

8.2 North America Hydraulic Breaker Market Estimates and Forecast, 2020-2028 (USD Billion)

8.2.1 By Equipment Size

8.2.2 By Type

8.2.3 By Application

8.2.4 By End-use Industry

8.2.5 By Country

8.2.5.1 U.S. Hydraulic Breaker Market Estimates and Forecast, 2020-2028 (USD Billion)

8.2.5.1.1 By Equipment Size

8.2.5.1.2 By Type

8.2.5.1.3 By Application

8.2.5.1.4 By End-use Industry

8.2.5.2 Canada Hydraulic Breaker Market Estimates and Forecast, 2020-2028 (USD Billion)

8.2.5.2.1 By Equipment Size

8.2.5.2.2 By Type

8.2.5.2.3 By Application

8.2.5.2.4 By End-use Industry

8.2.5.3 Mexico Hydraulic Breaker Market Estimates and Forecast, 2020-2028 (USD Billion)

8.2.5.3.1 By Equipment Size

8.2.5.3.2 By Type

8.2.5.3.3 By Application

8.2.5.3.4 By End-use Industry

8.3 Europe Hydraulic Breaker Market Estimates and Forecast, 2020-2028 (USD Billion)

8.3.1 By Equipment Size

8.3.2 By Type

8.3.3 By Application

8.3.4 By End-use Industry

8.3.5 By Country

8.3.5.1 Germany Hydraulic Breaker Market Estimates and Forecast, 2020-2028 (USD Billion)

8.3.5.1.1 By Equipment Size

8.3.5.1.2 By Type

8.3.5.1.3 By Application

8.3.5.1.4 By End-use Industry

8.3.5.2 U.K. Presered Flowers Market Estimates and Forecast, 2020-2028 (USD Billion)

8.3.5.2.1 By Equipment Size

8.3.5.2.2 By Type

8.3.5.2.3 By Application

8.3.5.2.4 By End-use Industry

8.3.5.3 France Hydraulic Breaker Market Estimates and Forecast, 2020-2028 (USD Billion)

8.3.5.3.1 By Equipment Size

8.3.5.3.2 By Type

8.3.5.3.3 By Application

8.3.5.3.4 By End-use Industry

8.3.5.4 Italy Hydraulic Breaker Market Estimates and Forecast, 2020-2028 (USD Billion)

8.3.5.4.1 By Equipment Size

8.3.5.4.2 By Type

8.3.5.4.3 By Application

8.3.5.4.4 By End-use Industry

8.3.5.5 Spain Hydraulic Breaker Market Estimates and Forecast, 2020-2028 (USD Billion)

8.3.5.5.1 By Equipment Size

8.3.5.5.2 By Type

8.3.5.5.3 By Application

8.3.5.5.4 By End-use Industry

8.3.5.6 Netherlands Hydraulic Breaker Market Estimates and Forecast, 2020-2028 (USD Billion)

8.3.5.6.1 By Equipment Size

8.3.5.6.2 By Type

8.3.5.6.3 By Application

8.3.5.6.4 By End-use Industry

8.3.5.7 Rest of Europe Hydraulic Breaker Market Estimates and Forecast, 2020-2028 (USD Billion)

8.3.5.7.1 By Equipment Size

8.3.5.7.2 By Type

8.3.5.7.3 By Application

8.3.5.7.4 By End-use Industry

8.4 Asia Pacific Hydraulic Breaker Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.1 By Equipment Size

8.4.2 By Type

8.4.3 By Application

8.4.4 By End-use Industry

8.4.5 By Country

8.4.5.1 China Hydraulic Breaker Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.5.1.1 By Equipment Size

8.4.5.1.2 By Type

8.4.5.1.3 By Application

8.4.5.1.4 By End-use Industry

8.4.5.2 Japan Hydraulic Breaker Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.5.2.1 By Equipment Size

8.4.5.2.2 By Type

8.4.5.2.3 By Application

8.4.5.2.4 By End-use Industry

8.4.5.3 India Hydraulic Breaker Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.5.3.1 By Equipment Size

8.4.5.3.2 By Type

8.4.5.3.3 By Application

8.4.5.3.4 By End-use Industry

8.4.5.4 South Korea Hydraulic Breaker Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.5.4.1 By Equipment Size

8.4.5.4.2 By Type

8.4.5.4.3 By Application

8.4.5.4.4 By End-use Industry

8.4.5.5 Singapore Hydraulic Breaker Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.5.5.1 By Equipment Size

8.4.5.5.2 By Type

8.4.5.5.3 By Application

8.4.5.5.4 By End-use Industry

8.4.5.6 Malaysia Hydraulic Breaker Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.5.6.1 By Equipment Size

8.4.5.6.2 By Type

8.4.5.6.3 By Application

8.4.5.6.4 By End-use Industry

8.4.5.7 Thailand Hydraulic Breaker Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.5.7.1 By Equipment Size

8.4.5.7.2 By Type

8.4.5.7.3 By Application

8.4.5.7.4 By End-use Industry

8.4.5.8 Indonesia Hydraulic Breaker Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.5.8.1 By Equipment Size

8.4.5.8.2 By Type

8.4.5.8.3 By Application

8.4.5.8.4 By End-use Industry

8.4.5.9 Vietnam Hydraulic Breaker Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.5.9.1 By Equipment Size

8.4.5.9.2 By Type

8.4.5.9.3 By Application

8.4.5.9.4 By End-use Industry

8.4.5.10 Taiwan Hydraulic Breaker Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.5.10.1 By Equipment Size

8.4.5.10.2 By Type

8.4.5.10.3 By Application

8.4.5.10.4 By End-use Industry

8.4.5.11 Rest of Asia Pacific Hydraulic Breaker Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.5.11.1 By Equipment Size

8.4.5.11.2 By Type

8.4.5.11.3 By Application

8.4.5.11.4 By End-use Industry

8.5 Middle East and Africa Hydraulic Breaker Market Estimates and Forecast, 2020-2028 (USD Billion)

8.5.1 By Equipment Size

8.5.2 By Type

8.5.3 By Application

8.5.4 By End-use Industry

8.5.5 By Country

8.5.5.1 Saudi Arabia Hydraulic Breaker Market Estimates and Forecast, 2020-2028 (USD Billion)

8.5.5.1.1 By Equipment Size

8.5.5.1.2 By Type

8.5.5.1.3 By Application

8.5.5.1.4 By End-use Industry

8.5.5.2 U.A.E. Hydraulic Breaker Market Estimates and Forecast, 2020-2028 (USD Billion)

8.5.5.2.1 By Equipment Size

8.5.5.2.2 By Type

8.5.5.2.3 By Application

8.5.5.2.4 By End-use Industry

8.5.5.3 Israel Hydraulic Breaker Market Estimates and Forecast, 2020-2028 (USD Billion)

8.5.4.3.1 By Equipment Size

8.5.4.3.2 By Type

8.5.4.3.3 By Application

8.5.5.3.4 By End-use Industry

8.5.5.4 South Africa Hydraulic Breaker Market Estimates and Forecast, 2020-2028 (USD Billion)

8.5.5.4.1 By Equipment Size

8.5.5.4.2 By Type

8.5.5.4.3 By Application

8.5.5.4.4 By End-use Industry

8.5.5.5 Rest of Middle East and Africa Hydraulic Breaker Market Estimates and Forecast, 2020-2028 (USD Billion)

8.5.5.5.1 By Equipment Size

8.5.5.5.2 By Type

8.5.5.5.2 By Application

8.5.5.5.4 By End-use Industry

8.6 Central & South America Hydraulic Breaker Market Estimates and Forecast, 2020-2028 (USD Billion)

8.6.1 By Equipment Size

8.6.2 By Type

8.6.3 By Application

8.6.4 By End-use Industry

8.6.5 By Country

8.6.5.1 Brazil Hydraulic Breaker Market Estimates and Forecast, 2020-2028 (USD Billion)

8.6.5.1.1 By Equipment Size

8.6.5.1.2 By Type

8.6.5.1.3 By Application

8.6.5.1.4 By End-use Industry

8.6.5.2 Argentina Hydraulic Breaker Market Estimates and Forecast, 2020-2028 (USD Billion)

8.6.5.2.1 By Equipment Size

8.6.5.2.2 By Type

8.6.5.2.3 By Application

8.6.5.2.4 By End-use Industry

8.6.5.3 Chile Hydraulic Breaker Market Estimates and Forecast, 2020-2028 (USD Billion)

8.6.5.3.1 By Equipment Size

8.6.5.3.2 By Type

8.6.5.3.3 By Application

8.6.5.5.4 By End-use Industry

8.6.5.4 Rest of Central & South America Hydraulic Breaker Market Estimates and Forecast, 2020-2028 (USD Billion)

8.6.5.4.1 By Equipment Size

8.6.5.4.2 By Type

8.6.5.4.3 By Application

8.6.5.4.4 By End-use Industry

9 COMPETITIVE LANDCAPE

9.1 Company Market Share Analysis

9.2 Four Quadrant Positioning Matrix

9.2.1 Market Leaders

9.2.2 Market Visionaries

9.2.3 Market Challengers

9.2.4 Niche Market Players

9.3 Vendor Landscape

9.3.1 North America

9.3.2 Europe

9.3.3 Asia Pacific

9.3.4 Rest of the World

9.4 Company Profiles

9.4.1 Epiroc AB

9.4.1.1 Business Description & Financial Analysis

9.4.1.2 SWOT Analysis

9.4.1.3 Products & Services Offered

9.4.1.4 Strategic Alliances between Business Partners

9.4.2 Sandvik AB

9.4.2.1 Business Description & Financial Analysis

9.4.2.2 SWOT Analysis

9.4.2.3 Products & Services Offered

9.4.2.4 Strategic Alliances between Business Partners

9.4.3 Indeco North America

9.4.3.1 Business Description & Financial Analysis

9.4.3.2 SWOT Analysis

9.4.3.3 Products & Services Offered

9.4.3.4 Strategic Alliances between Business Partners

9.4.4 NPK Construction Equipment, Inc.

9.4.4.1 Business Description & Financial Analysis

9.4.4.2 SWOT Analysis

9.4.4.3 Products & Services Offered

9.4.4.4 Strategic Alliances between Business Partners

9.4.5 DAEMO ENGINEERING CO., LTD.

9.4.5.1 Business Description & Financial Analysis

9.4.5.2 SWOT Analysis

9.4.5.3 Products & Services Offered

9.4.5.4 Strategic Alliances between Business Partners

9.4.6 MONTABERT

9.4.6.1 Business Description & Financial Analysis

9.4.6.2 SWOT Analysis

9.4.6.3 Products & Services Offered

9.4.6.4 Strategic Alliances between Business Partners

9.4.7 Soosan Heavy Industries Co., Ltd.

9.4.7.1 Business Description & Financial Analysis

9.4.7.2 SWOT Analysis

9.4.7.3 Products & Services Offered

9.4.8.4 Strategic Alliances between Business Partners

9.4.8 FURUKAWA CO., LTD.

9.4.8.1 Business Description & Financial Analysis

9.4.8.2 SWOT Analysis

9.4.8.3 Products & Services Offered

9.4.8.4 Strategic Alliances between Business Partners

9.4.9 Msat Msb corporation

9.4.9.1 Business Description & Financial Analysis

9.4.9.2 SWOT Analysis

9.4.9.3 Products & Services Offered

9.4.9.4 Strategic Alliances between Business Partners

9.4.10 Caterpillar Inc

9.4.10.1 Business Description & Financial Analysis

9.4.10.2 SWOT Analysis

9.4.10.3 Products & Services Offered

9.4.10.4 Strategic Alliances between Business Partners

9.4.11 Other Companies

9.4.11.1 Business Description & Financial Analysis

9.4.11.2 SWOT Analysis

9.4.11.3 Products & Services Offered

9.4.11.4 Strategic Alliances between Business Partners

10 RESEARCH METHODOLOGY

10.1 Market Introduction

10.1.1 Market Definition

10.1.2 Market Scope & Segmentation

10.2 Information Procurement

10.2.1 Secondary Research

10.2.1.1 Purchased Databases

10.2.1.2 GMEs Internal Data Repository

10.2.1.3 Secondary Resources & Third Party Perspectives

10.2.1.4 Company Information Sources

10.2.2 Primary Research

10.2.2.1 Various Types of Respondents for Primary Interviews

10.2.2.2 Number of Interviews Conducted throughout the Research Process

10.2.2.3 Primary Stakeholders

10.2.2.4 Discussion Guide for Primary Participants

10.2.3 Expert Panels

10.2.3.1 Expert Panels Across 30+ Industry

10.2.4 Paid Local Experts

10.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

10.3 Market Estimation

10.3.1 Top-Down Approach

10.3.1.1 Macro-Economic Indicators Considered

10.3.1.2 Micro-Economic Indicators Considered

10.3.2 Bottom Up Approach

10.3.2.1 Company Share Analysis Approach

10.3.2.2 Estimation of Potential Product Sales

10.4 Data Triangulation

10.4.1 Data Collection

10.4.2 Time Series, Cross Sectional & Panel Data Analysis

10.4.3 Cluster Analysis

10.5 Analysis and Output

10.5.1 Inhouse AI Based Real Time Analytics Tool

10.5.2 Output From Desk & Primary Research

10.6 Research Assumptions & Limitations

10.7.1 Research Assumptions

10.7.2 Research Limitations

LIST OF TABLES

1 Global Hydraulic Breaker Market, By Equipment Size, 2020-2028 (USD Billion)

2 Small Market, By Region, 2020-2028 (USD Billion)

3 Medium Market, By Region, 2020-2028 (USD Billion)

4 Large Market, By Region, 2020-2028 (USD Billion)

5 Global Hydraulic Breaker Market, By Type, 2020-2028 (USD Billion)

6 Premium Market, By Region, 2020-2028 (USD Billion)

7 Non-premium Market, By Region, 2020-2028 (USD Billion)

8 Global Hydraulic Breaker Market, By Application, 2020-2028 (USD Billion)

9 Breaking Oversized Material Market, By Region, 2020-2028 (USD Billion)

10 Trenching Market, By Region, 2020-2028 (USD Billion)

11 Demolition Market, By Region, 2020-2028 (USD Billion)

12 Others Market, By Region, 2020-2028 (USD Billion)

13 Global Hydraulic Breaker Market, By END-USE INDUSTRY, 2020-2028 (USD Billion)

14 Construction Market, By Region, 2020-2028 (USD Billion)

15 Mining Market, By Region, 2020-2028 (USD Billion)

16 Others Market, By Region, 2020-2028 (USD Billion)

17 Regional Analysis, 2020-2028 (USD Billion)

18 North America Hydraulic Breaker Market, By Equipment Size, 2020-2028 (USD Billion)

19 North America Hydraulic Breaker Market, By Type, 2020-2028 (USD Billion)

20 North America Hydraulic Breaker Market, By Application, 2020-2028 (USD Billion)

21 North America Hydraulic Breaker Market, By End-use Industry, 2020-2028 (USD Billion)

22 North America Hydraulic Breaker Market, By Country, 2020-2028 (USD Billion)

23 U.S Hydraulic Breaker Market, By Equipment Size, 2020-2028 (USD Billion)

24 U.S Hydraulic Breaker Market, By Type, 2020-2028 (USD Billion)

25 U.S Hydraulic Breaker Market, By Application, 2020-2028 (USD Billion)

26 U.S Hydraulic Breaker Market, By End-use Industry, 2020-2028 (USD Billion)

27 Canada Hydraulic Breaker Market, By Equipment Size, 2020-2028 (USD Billion)

28 Canada Hydraulic Breaker Market, By Type, 2020-2028 (USD Billion)

29 Canada Hydraulic Breaker Market, By Application, 2020-2028 (USD Billion)

30 CANADA Hydraulic Breaker Market, By End-use Industry, 2020-2028 (USD Billion)

31 Mexico Hydraulic Breaker Market, By Equipment Size, 2020-2028 (USD Billion)

32 Mexico Hydraulic Breaker Market, By Type, 2020-2028 (USD Billion)

33 Mexico Hydraulic Breaker Market, By Application, 2020-2028 (USD Billion)

34 mexico Hydraulic Breaker Market, By End-use Industry, 2020-2028 (USD Billion)

35 Europe Hydraulic Breaker Market, By Equipment Size, 2020-2028 (USD Billion)

36 Europe Hydraulic Breaker Market, By Type, 2020-2028 (USD Billion)

37 Europe Hydraulic Breaker Market, By Application, 2020-2028 (USD Billion)

38 europe Hydraulic Breaker Market, By End-use Industry, 2020-2028 (USD Billion)

39 Germany Hydraulic Breaker Market, By Equipment Size, 2020-2028 (USD Billion)

40 Germany Hydraulic Breaker Market, By Type, 2020-2028 (USD Billion)

41 Germany Hydraulic Breaker Market, By Application, 2020-2028 (USD Billion)

42 germany Hydraulic Breaker Market, By End-use Industry, 2020-2028 (USD Billion)

43 UK Hydraulic Breaker Market, By Equipment Size, 2020-2028 (USD Billion)

44 UK Hydraulic Breaker Market, By Type, 2020-2028 (USD Billion)

45 UK Hydraulic Breaker Market, By Application, 2020-2028 (USD Billion)

46 U.kHydraulic Breaker Market, By End-use Industry, 2020-2028 (USD Billion)

47 France Hydraulic Breaker Market, By Equipment Size, 2020-2028 (USD Billion)

48 France Hydraulic Breaker Market, By Type, 2020-2028 (USD Billion)

49 France Hydraulic Breaker Market, By Application, 2020-2028 (USD Billion)

50 france Hydraulic Breaker Market, By End-use Industry, 2020-2028 (USD Billion)

51 Italy Hydraulic Breaker Market, By Equipment Size, 2020-2028 (USD Billion)

52 Italy Hydraulic Breaker Market, By T Type Type, 2020-2028 (USD Billion)

53 Italy Hydraulic Breaker Market, By Application, 2020-2028 (USD Billion)

54 italy Hydraulic Breaker Market, By End-use Industry, 2020-2028 (USD Billion)

55 Spain Hydraulic Breaker Market, By Equipment Size, 2020-2028 (USD Billion)

56 Spain Hydraulic Breaker Market, By Type, 2020-2028 (USD Billion)

57 Spain Hydraulic Breaker Market, By Application, 2020-2028 (USD Billion)

58 spain Hydraulic Breaker Market, By End-use Industry, 2020-2028 (USD Billion)

59 Rest Of Europe Hydraulic Breaker Market, By Equipment Size, 2020-2028 (USD Billion)

60 Rest Of Europe Hydraulic Breaker Market, By Type, 2020-2028 (USD Billion)

61 Rest of Europe Hydraulic Breaker Market, By Application, 2020-2028 (USD Billion)

62 REST OF EUROPE Hydraulic Breaker Market, By End-use Industry, 2020-2028 (USD Billion)

63 Asia Pacific Hydraulic Breaker Market, By Equipment Size, 2020-2028 (USD Billion)

64 Asia Pacific Hydraulic Breaker Market, By Type, 2020-2028 (USD Billion)

65 Asia Pacific Hydraulic Breaker Market, By Application, 2020-2028 (USD Billion)

66 asia Hydraulic Breaker Market, By End-use Industry, 2020-2028 (USD Billion)

67 Asia Pacific Hydraulic Breaker Market, By Country, 2020-2028 (USD Billion)

68 China Hydraulic Breaker Market, By Equipment Size, 2020-2028 (USD Billion)

69 China Hydraulic Breaker Market, By Type, 2020-2028 (USD Billion)

70 China Hydraulic Breaker Market, By Application, 2020-2028 (USD Billion)

71 china Hydraulic Breaker Market, By End-use Industry, 2020-2028 (USD Billion)

72 India Hydraulic Breaker Market, By Equipment Size, 2020-2028 (USD Billion)

73 India Hydraulic Breaker Market, By Type, 2020-2028 (USD Billion)

74 India Hydraulic Breaker Market, By Application, 2020-2028 (USD Billion)

75 india Hydraulic Breaker Market, By End-use Industry, 2020-2028 (USD Billion)

76 Japan Hydraulic Breaker Market, By Equipment Size, 2020-2028 (USD Billion)

77 Japan Hydraulic Breaker Market, By Type, 2020-2028 (USD Billion)

78 Japan Hydraulic Breaker Market, By Application, 2020-2028 (USD Billion)

79 japan Hydraulic Breaker Market, By End-use Industry, 2020-2028 (USD Billion)

80 South Korea Hydraulic Breaker Market, By Equipment Size, 2020-2028 (USD Billion)

81 South Korea Hydraulic Breaker Market, By Type, 2020-2028 (USD Billion)

82 South Korea Hydraulic Breaker Market, By Application, 2020-2028 (USD Billion)

83 south korea Hydraulic Breaker Market, By End-use Industry, 2020-2028 (USD Billion)

84 Middle East and Africa Hydraulic Breaker Market, By Equipment Size, 2020-2028 (USD Billion)

85 Middle East and Africa Hydraulic Breaker Market, By Type, 2020-2028 (USD Billion)

86 Middle East and Africa Hydraulic Breaker Market, By Application, 2020-2028 (USD Billion)

87 MIDDLE EAST AND AFRICA Hydraulic Breaker Market, By End-use Industry, 2020-2028 (USD Billion)

88 Middle East and Africa Hydraulic Breaker Market, By Country, 2020-2028 (USD Billion)

89 Saudi Arabia Hydraulic Breaker Market, By Equipment Size, 2020-2028 (USD Billion)

90 Saudi Arabia Hydraulic Breaker Market, By Type, 2020-2028 (USD Billion)

91 Saudi Arabia Hydraulic Breaker Market, By Application, 2020-2028 (USD Billion)

92 saudi arabia Hydraulic Breaker Market, By End-use Industry, 2020-2028 (USD Billion)

93 UAE Hydraulic Breaker Market, By Equipment Size, 2020-2028 (USD Billion)

94 UAE Hydraulic Breaker Market, By Type, 2020-2028 (USD Billion)

95 UAE Hydraulic Breaker Market, By Application, 2020-2028 (USD Billion)

96 uae Hydraulic Breaker Market, By End-use Industry, 2020-2028 (USD Billion)

97 Central & South America Hydraulic Breaker Market, By Equipment Size, 2020-2028 (USD Billion)

98 Central & South America Hydraulic Breaker Market, By Type, 2020-2028 (USD Billion)

99 Central & South America Hydraulic Breaker Market, By Application, 2020-2028 (USD Billion)

100 CENTRAL & SOUTH AMERICA Hydraulic Breaker Market, By End-use Industry, 2020-2028 (USD Billion)

101 Central & South America Hydraulic Breaker Market, By Country, 2020-2028 (USD Billion)

102 Brazil Hydraulic Breaker Market, By Equipment Size, 2020-2028 (USD Billion)

103 Brazil Hydraulic Breaker Market, By Type, 2020-2028 (USD Billion)

104 Brazil Hydraulic Breaker Market, By Application, 2020-2028 (USD Billion)

105 brazil Hydraulic Breaker Market, By End-use Industry, 2020-2028 (USD Billion)

106 Epiroc AB: Products & Services Offering

107 Sandvik AB: Products & Services Offering

108 Indeco North America: Products & Services Offering

109 NPK Construction Equipment, Inc.: Products & Services Offering

110 DAEMO ENGINEERING CO., LTD.: Products & Services Offering

111 MONTABERT: Products & Services Offering

112 Soosan Heavy Industries Co., Ltd. : Products & Services Offering

113 FURUKAWA CO., LTD.: Products & Services Offering

114 Msat Msb corporation, Inc: Products & Services Offering

115 Caterpillar Inc: Products & Services Offering

116 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Hydraulic Breaker Market Overview

2 Global Hydraulic Breaker Market Value From 2020-2028 (USD Billion)

3 Global Hydraulic Breaker Market Share, By Equipment Size (2022)

4 Global Hydraulic Breaker Market Share, By Type (2022)

5 Global Hydraulic Breaker Market Share, By Application (2022)

6 Global Hydraulic Breaker Market Share, By End-use Industry (2022)

7 Global Hydraulic Breaker Market, By Region (Asia Pacific Market)

8 Technological Trends In Global Hydraulic Breaker Market

9 Four Quadrant Competitor Positioning Matrix

10 Impact Of Macro & Micro Indicators On The Market

11 Impact Of Key Drivers On The Global Hydraulic Breaker Market

12 Impact Of Challenges On The Global Hydraulic Breaker Market

13 Porter’s Five Forces Analysis

14 Global Hydraulic Breaker Market: By Equipment Size Scope Key Takeaways

15 Global Hydraulic Breaker Market, By Equipment Size Segment: Revenue Growth Analysis

16 Small Market, By Region, 2020-2028 (USD Billion)

17 Medium Market, By Region, 2020-2028 (USD Billion)

18 Large Market, By Region, 2020-2028 (USD Billion)

19 Global Hydraulic Breaker Market: By Type Scope Key Takeaways

20 Global Hydraulic Breaker Market, By Type Segment: Revenue Growth Analysis

21 Premium Market, By Region, 2020-2028 (USD Billion)

22 Non-premium Market, By Region, 2020-2028 (USD Billion)

23 Global Hydraulic Breaker Market: By Application Scope Key Takeaways

24 Global Hydraulic Breaker Market, By Application Segment: Revenue Growth Analysis

25 Breaking Oversized Material Market, By Region, 2020-2028 (USD Billion)

26 Trenching Market, By Region, 2020-2028 (USD Billion)

27 Demolition Market, By Region, 2020-2028 (USD Billion)

28 Others Market, By Region, 2020-2028 (USD Billion)

29 Global Hydraulic Breaker Market: By End-use Industry Scope Key Takeaways

30 Global Hydraulic Breaker Market, By End-use Industry Segment: Revenue Growth Analysis

31 Construction Market, By Region, 2020-2028 (USD Billion)

32 Mining Market, By Region, 2020-2028 (USD Billion)

33 Others Market, By Region, 2020-2028 (USD Billion)

34 Regional Segment: Revenue Growth Analysis

35 Global Hydraulic Breaker Market: Regional Analysis

36 North America Hydraulic Breaker Market Overview

37 North America Hydraulic Breaker Market, By Equipment Size

38 North America Hydraulic Breaker Market, By Type

39 North America Hydraulic Breaker Market, By Application

40 North America Hydraulic Breaker Market, By End-use Industry

41 North America Hydraulic Breaker Market, By Country

42 U.S. Hydraulic Breaker Market, By Equipment Size

43 U.S. Hydraulic Breaker Market, By Type

44 U.S. Hydraulic Breaker Market, By Application

45 U.S. Hydraulic Breaker Market, By End-use Industry

46 Canada Hydraulic Breaker Market, By Equipment Size

47 Canada Hydraulic Breaker Market, By Type

48 Canada Hydraulic Breaker Market, By Application

49 Canada Hydraulic Breaker Market, By End-use Industry

50 Mexico Hydraulic Breaker Market, By Equipment Size

51 Mexico Hydraulic Breaker Market, By Type

52 Mexico Hydraulic Breaker Market, By Application

53 Mexico Hydraulic Breaker Market, By End-use Industry

54 Four Quadrant Positioning Matrix

55 Company Market Share Analysis

56 Epiroc AB: Company Snapshot

57 Epiroc AB: SWOT Analysis

58 Epiroc AB: Geographic Presence

59 Sandvik AB: Company Snapshot

60 Sandvik AB: SWOT Analysis

61 Sandvik AB: Geographic Presence

62 Indeco North America: Company Snapshot

63 Indeco North America: SWOT Analysis

64 Indeco North America: Geographic Presence

65 NPK Construction Equipment, Inc.: Company Snapshot

66 NPK Construction Equipment, Inc.: Swot Analysis

67 NPK Construction Equipment, Inc.: Geographic Presence

68 DAEMO ENGINEERING CO., LTD.: Company Snapshot

69 DAEMO ENGINEERING CO., LTD.: SWOT Analysis

70 DAEMO ENGINEERING CO., LTD.: Geographic Presence

71 MONTABERT: Company Snapshot

72 MONTABERT: SWOT Analysis

73 MONTABERT: Geographic Presence

74 Soosan Heavy Industries Co., Ltd. : Company Snapshot

75 Soosan Heavy Industries Co., Ltd. : SWOT Analysis

76 Soosan Heavy Industries Co., Ltd. : Geographic Presence

77 FURUKAWA CO., LTD.: Company Snapshot

78 FURUKAWA CO., LTD.: SWOT Analysis

79 FURUKAWA CO., LTD.: Geographic Presence

80 Msat Msb corporation, Inc.: Company Snapshot

81 Msat Msb corporation, Inc.: SWOT Analysis

82 Msat Msb corporation, Inc.: Geographic Presence

83 Caterpillar Inc: Company Snapshot

84 Caterpillar Inc: SWOT Analysis

85 Caterpillar Inc: Geographic Presence

86 Other Companies: Company Snapshot

87 Other Companies: SWOT Analysis

88 Other Companies: Geographic Presence

The Global Hydraulic Breaker Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Hydraulic Breaker Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS