Global Hydrometallurgy Recycling Market Size, Trends & Analysis - Forecasts to 2028 By Battery Chemistry (Lithium-nickel Manganese Cobalt, Lithium-iron Phosphate, Lithium-manganese Oxide, Lithium-titanate Oxide, and Lithium-nickel Cobalt Aluminum Oxide), By End-user (Automotive, Industrial, Power, and Marine), By Region (North America, Asia Pacific, Central & South America, Europe, the Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

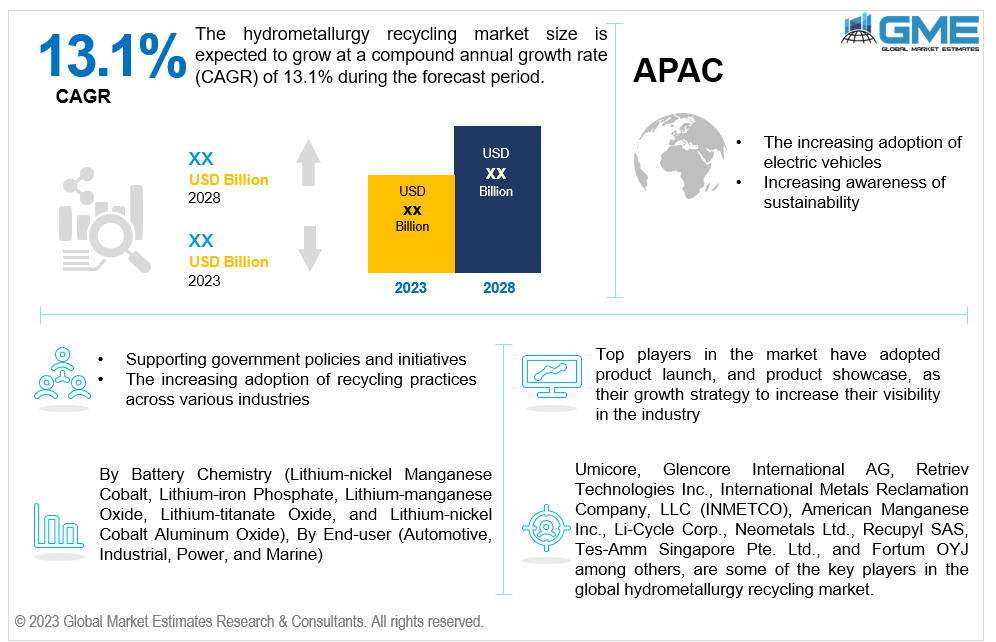

The global hydrometallurgy recycling market is projected to grow at a CAGR of 13.1% from 2023 to 2028.

Hydrometallurgy recycling is a recycling process that involves the use of aqueous solutions and chemical reactions to extract and recover metals from various waste materials. Unlike pyrometallurgy, which relies on high temperatures, hydrometallurgy utilizes leaching, precipitation, solvent extraction, and other techniques to separate and recover metals from the input materials. In hydrometallurgical recycling, the waste materials are treated with specific chemical solutions that selectively dissolve the target metals, leaving behind the non-metallic components. The dissolved metals are then separated from the solution through precipitation or solvent extraction methods. These recovered metals can be further processed, refined, and reused in the production of new products, reducing the need for primary metal extraction. Hydrometallurgy recycling has several advantages, including its ability to handle a wide range of waste materials, high metal recovery rates, and relatively lower energy consumption compared to pyrometallurgy. It is particularly effective in extracting precious metals, such as gold, silver, and platinum, from electronic waste and other sources.

The increasing adoption of electric vehicles, increasing awareness of sustainability, and supporting government policies and initiatives are expected to support the growth of the market during the forecast period. Moreover, the increasing adoption of recycling practices across various industries, the rapid expansion of renewable energy systems, and technological advancements are propelling the growth of the market.

Due to the emphasis on sustainability and the concepts of the circular economy, there is an increasing demand for recycled materials across all industries. Hydrometallurgy recycling offers a reliable and efficient method to recover valuable metals from waste streams, which satisfies the rising need for recovered materials in industries including electronics, automotive, construction, and renewable energy. However, the lack of awareness regarding recycling practices and the requirement for significant investments in infrastructure, equipment, and specialized skills are predicted to impede the market's growth.

The efficiency and efficacy of recovering metal from waste materials are improved by ongoing developments in hydrometallurgical processes, including innovations in leaching procedures, selective extraction techniques, and recovery technologies. These technical developments increase metal recovery rates, lower processing costs, and broaden the spectrum of materials that may be recycled, which all help to fuel the expansion of the hydrometallurgy recycling market.

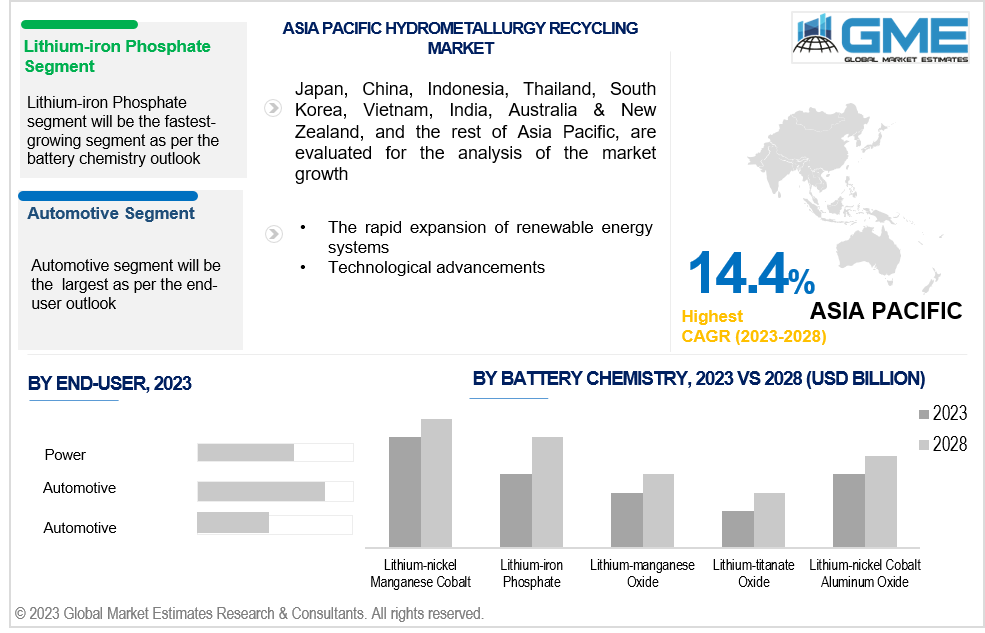

The lithium-iron phosphate segment is expected to be the fastest-growing segment in the market from 2023-2028. This can be attributed to the increasing demand for lithium-ion batteries used in various applications, including electric vehicles, energy storage systems, and portable electronic devices. As these batteries reach their end-of-life, there is a growing need for efficient recycling methods to recover valuable metals like lithium, iron, and phosphate. Hydrometallurgical recycling offers an effective solution by employing chemical processes to leach and extract these metals from the spent batteries.

The lithium-nickel manganese cobalt segment holds the largest share of the market. This can be attributed to the widespread use of lithium-ion batteries containing NMC cathodes in various industries, including electric vehicles, consumer electronics, and grid energy storage systems. As these batteries reach their end-of-life, there is a growing need for efficient recycling methods to recover valuable metals like lithium, nickel, manganese, and cobalt. Hydrometallurgical recycling offers an effective solution by utilizing chemical processes to leach and extract these metals from the spent batteries.

The power segment is anticipated to be the fastest-growing segment in the market from 2023-2028. This can be attributed to the increasing demand for efficient and sustainable energy storage solutions, such as batteries, in the power sector. As renewable energy sources gain prominence, the need for energy storage to mitigate intermittency issues becomes crucial. Hydrometallurgical recycling plays a significant role in the recycling of spent batteries, enabling the recovery of valuable metals like lithium, cobalt, and nickel.

The automotive segment holds the largest share of the market. This can be attributed to the increasing production and demand for electric vehicles (EVs) globally. As EVs gain popularity, there is a growing need for recycling methods to recover valuable metals like lithium, cobalt, nickel, and rare earth elements from spent batteries. Hydrometallurgical recycling offers an efficient solution by using chemical processes to extract and separate these metals from automotive batteries.

The North American segment is expected to be the largest segment in the market. This can be attributed to several factors, including the region's well-developed recycling infrastructure, stringent environmental regulations, and increasing emphasis on sustainability practices. North America has a high volume of waste generation, including electronic waste and end-of-life batteries, creating a significant need for efficient recycling methods. Hydrometallurgical recycling offers an effective solution for recovering valuable metals from these waste streams. Additionally, the region's robust manufacturing sector, particularly in automotive and electronics, drives the demand for recycled metals. The presence of major players and technological advancements in hydrometallurgical recycling further contribute to North America's dominance in the market.

The Asia Pacific segment is projected to be the fastest-growing segment in the Hydrometallurgy Recycling Market. This can be attributed to several factors driving the region's rapid growth. Firstly, the increasing industrialization and urbanization in countries like China and India have led to significant waste generation, including electronic waste and spent batteries, creating a demand for efficient recycling methods. Secondly, the growing awareness and adoption of sustainable practices, coupled with stringent environmental regulations, encourage the implementation of hydrometallurgical recycling processes. Thirdly, the rising demand for metals, especially in the automotive and electronics sectors, drives the need for recycled materials. Additionally, advancements in technology and infrastructure development in the Asia Pacific region support the growth of the hydrometallurgy recycling market.

Umicore, Glencore International AG, Retriev Technologies Inc., International Metals Reclamation Company, LLC (INMETCO), American Manganese Inc., Li-Cycle Corp., Neometals Ltd., Recupyl SAS, Tes-Amm Singapore Pte. Ltd., and Fortum OYJ among others, are some of the key players in the global hydrometallurgy recycling market.

Please note: This is not an exhaustive list of companies profiled in the report.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

2.4 Data Metrics

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

4 GLOBAL HYDROMETALLURGY RECYCLING MARKET, BY BATTERY CHEMISTRY

4.2 Hydrometallurgy Recycling Market: Battery Chemistry Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4 Lithium-nickel Manganese Cobalt

4.4.1 Lithium-nickel Manganese Cobalt Market Estimates and Forecast, 2020-2028 (USD Million)

4.5.1 Lithium-iron Phosphate Market Estimates and Forecast, 2020-2028 (USD Million)

4.6.1 Lithium-manganese Oxide Market Estimates and Forecast, 2020-2028 (USD Million)

4.7.1 Lithium-titanate Oxide Market Estimates and Forecast, 2020-2028 (USD Million)

4.8 Lithium-nickel Cobalt Aluminum Oxide

4.8.1 Lithium-nickel Cobalt Aluminum Oxide Market Estimates and Forecast, 2020-2028 (USD Million)

5 GLOBAL HYDROMETALLURGY RECYCLING MARKET, BY END-USER

5.2 Hydrometallurgy Recycling Market: End-user Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4.1 Automotive Market Estimates and Forecast, 2020-2028 (USD Million)

5.5.1 Industrial Market Estimates and Forecast, 2020-2028 (USD Million)

5.6.1 Power Market Estimates and Forecast, 2020-2028 (USD Million)

5.7.1 Marine Market Estimates and Forecast, 2020-2028 (USD Million)

6 GLOBAL HYDROMETALLURGY RECYCLING MARKET, BY REGION

6.2 North America Hydrometallurgy Recycling Market Estimates and Forecast, 2020-2028 (USD Million)

6.2.3.1 U.S. Hydrometallurgy Recycling Market Estimates and Forecast, 2020-2028 (USD Million)

6.2.3.1.1 By Battery Chemistry

6.2.3.2 Canada Hydrometallurgy Recycling Market Estimates and Forecast, 2020-2028 (USD Million)

6.2.3.2.1 By Battery Chemistry

6.2.3.3 Mexico Hydrometallurgy Recycling Market Estimates and Forecast, 2020-2028 (USD Million)

6.2.3.3.1 By Battery Chemistry

6.3 Europe Hydrometallurgy Recycling Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.1 Germany Hydrometallurgy Recycling Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.1.1 By Battery Chemistry

6.3.3.2 U.K. Hydrometallurgy Recycling Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.2.1 By Battery Chemistry

6.3.3.3 France Hydrometallurgy Recycling Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.3.1 By Battery Chemistry

6.3.3.4 Italy Hydrometallurgy Recycling Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.4.1 By Battery Chemistry

6.3.3.5 Spain Hydrometallurgy Recycling Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.5.1 By Battery Chemistry

6.3.3.6 Netherlands Hydrometallurgy Recycling Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.6.1 By Battery Chemistry

6.3.3.6.1 By Battery Chemistry

6.4 Asia Pacific Hydrometallurgy Recycling Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.1 China Hydrometallurgy Recycling Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.1.1 By Battery Chemistry

6.4.3.2 Japan Hydrometallurgy Recycling Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.2.1 By Battery Chemistry

6.4.3.3 India Hydrometallurgy Recycling Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.3.1 By Battery Chemistry

6.4.3.4 South Korea Hydrometallurgy Recycling Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.4.1 By Battery Chemistry

6.4.3.5 Singapore Hydrometallurgy Recycling Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.5.1 By Battery Chemistry

6.4.3.6 Malaysia Hydrometallurgy Recycling Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.6.1 By Battery Chemistry

6.4.3.7 Thailand Hydrometallurgy Recycling Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.6.1 By Battery Chemistry

6.4.3.8 Indonesia Hydrometallurgy Recycling Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.7.1 By Battery Chemistry

6.4.3.9 Vietnam Hydrometallurgy Recycling Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.8.1 By Battery Chemistry

6.4.3.10 Taiwan Hydrometallurgy Recycling Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.10.1 By Battery Chemistry

6.4.3.11.1 By Battery Chemistry

6.5.3.1.1 By Battery Chemistry

6.5.3.2 U.A.E. Hydrometallurgy Recycling Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.2.1 By Battery Chemistry

6.5.3.3 Israel Hydrometallurgy Recycling Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.3.1 By Battery Chemistry

6.5.3.4.1 By Battery Chemistry

6.5.3.5.1 By Battery Chemistry

6.6.3.1 Brazil Hydrometallurgy Recycling Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.3.1.1 By Battery Chemistry

6.6.3.2 Argentina Hydrometallurgy Recycling Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.3.2.1 By Battery Chemistry

6.6.3.3 Chile Hydrometallurgy Recycling Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.3.3.1 By Battery Chemistry

6.6.3.3.1 By Battery Chemistry

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.4.1.1 Business Description & Financial Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Glencore International AG

7.4.2.1 Business Description & Financial Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 Retriev Technologies Inc.

7.4.3.1 Business Description & Financial Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 International Metals Reclamation Company, LLC (INMETCO)

7.4.4.1 Business Description & Financial Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5.1 Business Description & Financial Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6.1 Business Description & Financial Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7.1 Business Description & Financial Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8.1 Business Description & Financial Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 Tes-Amm Singapore Pte. Ltd.

7.4.9.1 Business Description & Financial Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10.1 Business Description & Financial Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11.1 Business Description & Financial Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8.1.2 Market Scope & Segmentation

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2.1 Various End-user of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.4 Discussion Guide for Primary Participants

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

LIST OF TABLES

1 Global Hydrometallurgy Recycling Market, By Battery Chemistry, 2020-2028 (USD Mllion)

2 Lithium-nickel Manganese Cobalt Market, By Region, 2020-2028 (USD Mllion)

3 Lithium-iron Phosphate Market, By Region, 2020-2028 (USD Mllion)

4 Lithium-manganese Oxide Market, By Region, 2020-2028 (USD Mllion)

5 Lithium-titanate Oxide Market, By Region, 2020-2028 (USD Mllion)

6 Lithium-nickel Cobalt Aluminum Oxide Market, By Region, 2020-2028 (USD Mllion)

7 Global Hydrometallurgy Recycling Market, By End-user, 2020-2028 (USD Mllion)

8 Automotive Market, By Region, 2020-2028 (USD Mllion)

9 Industrial Market, By Region, 2020-2028 (USD Mllion)

10 Power Market, By Region, 2020-2028 (USD Mllion)

11 Marine Market, By Region, 2020-2028 (USD Mllion)

12 Regional Analysis, 2020-2028 (USD Mllion)

13 North America Hydrometallurgy Recycling Market, By Battery Chemistry, 2020-2028 (USD Mllion)

14 North America Hydrometallurgy Recycling Market, By End-user, 2020-2028 (USD Mllion)

15 U.S. Hydrometallurgy Recycling Market, By Battery Chemistry, 2020-2028 (USD Mllion)

16 U.S. Hydrometallurgy Recycling Market, By End-user, 2020-2028 (USD Mllion)

17 Canada Hydrometallurgy Recycling Market, By Battery Chemistry, 2020-2028 (USD Mllion)

18 Canada Hydrometallurgy Recycling Market, By End-user, 2020-2028 (USD Mllion)

19 Mexico Hydrometallurgy Recycling Market, By Battery Chemistry, 2020-2028 (USD Mllion)

20 Mexico Hydrometallurgy Recycling Market, By End-user, 2020-2028 (USD Mllion)

21 Europe Hydrometallurgy Recycling Market, By Battery Chemistry, 2020-2028 (USD Mllion)

22 Europe Hydrometallurgy Recycling Market, By End-user, 2020-2028 (USD Mllion)

23 Germany Hydrometallurgy Recycling Market, By Battery Chemistry, 2020-2028 (USD Mllion)

24 Germany Hydrometallurgy Recycling Market, By End-user, 2020-2028 (USD Mllion)

25 U.K. Hydrometallurgy Recycling Market, By Battery Chemistry, 2020-2028 (USD Mllion)

26 U.K. Hydrometallurgy Recycling Market, By End-user, 2020-2028 (USD Mllion)

27 France Hydrometallurgy Recycling Market, By Battery Chemistry, 2020-2028 (USD Mllion)

28 France Hydrometallurgy Recycling Market, By End-user, 2020-2028 (USD Mllion)

29 Italy Hydrometallurgy Recycling Market, By Battery Chemistry, 2020-2028 (USD Mllion)

30 Italy Hydrometallurgy Recycling Market, By End-user, 2020-2028 (USD Mllion)

31 Spain Hydrometallurgy Recycling Market, By Battery Chemistry, 2020-2028 (USD Mllion)

32 Spain Hydrometallurgy Recycling Market, By End-user, 2020-2028 (USD Mllion)

33 Netherlands Hydrometallurgy Recycling Market, By Battery Chemistry, 2020-2028 (USD Mllion)

34 Netherlands Hydrometallurgy Recycling Market, By End-user, 2020-2028 (USD Mllion)

35 Rest Of Europe Hydrometallurgy Recycling Market, By Battery Chemistry, 2020-2028 (USD Mllion)

36 Rest Of Europe Hydrometallurgy Recycling Market, By End-user, 2020-2028 (USD Mllion)

37 Asia Pacific Hydrometallurgy Recycling Market, By Battery Chemistry, 2020-2028 (USD Mllion)

38 Asia Pacific Hydrometallurgy Recycling Market, By End-user, 2020-2028 (USD Mllion)

39 China Hydrometallurgy Recycling Market, By Battery Chemistry, 2020-2028 (USD Mllion)

40 China Hydrometallurgy Recycling Market, By End-user, 2020-2028 (USD Mllion)

41 Japan Hydrometallurgy Recycling Market, By Battery Chemistry, 2020-2028 (USD Mllion)

42 Japan Hydrometallurgy Recycling Market, By End-user, 2020-2028 (USD Mllion)

43 India Hydrometallurgy Recycling Market, By Battery Chemistry, 2020-2028 (USD Mllion)

44 India Hydrometallurgy Recycling Market, By End-user, 2020-2028 (USD Mllion)

45 South Korea Hydrometallurgy Recycling Market, By Battery Chemistry, 2020-2028 (USD Mllion)

46 South Korea Hydrometallurgy Recycling Market, By End-user, 2020-2028 (USD Mllion)

47 Singapore Hydrometallurgy Recycling Market, By Battery Chemistry, 2020-2028 (USD Mllion)

48 Singapore Hydrometallurgy Recycling Market, By End-user, 2020-2028 (USD Mllion)

49 Thailand Hydrometallurgy Recycling Market, By Battery Chemistry, 2020-2028 (USD Mllion)

50 Thailand Hydrometallurgy Recycling Market, By End-user, 2020-2028 (USD Mllion)

51 Malaysia Hydrometallurgy Recycling Market, By Battery Chemistry, 2020-2028 (USD Mllion)

52 Malaysia Hydrometallurgy Recycling Market, By End-user, 2020-2028 (USD Mllion)

53 Indonesia Hydrometallurgy Recycling Market, By Battery Chemistry, 2020-2028 (USD Mllion)

54 Indonesia Hydrometallurgy Recycling Market, By End-user, 2020-2028 (USD Mllion)

55 Vietnam Hydrometallurgy Recycling Market, By Battery Chemistry, 2020-2028 (USD Mllion)

56 Vietnam Hydrometallurgy Recycling Market, By End-user, 2020-2028 (USD Mllion)

57 Taiwan Hydrometallurgy Recycling Market, By Battery Chemistry, 2020-2028 (USD Mllion)

58 Taiwan Hydrometallurgy Recycling Market, By End-user, 2020-2028 (USD Mllion)

59 Rest of APAC Hydrometallurgy Recycling Market, By Battery Chemistry, 2020-2028 (USD Mllion)

60 Rest of APAC Hydrometallurgy Recycling Market, By End-user, 2020-2028 (USD Mllion)

61 Middle East & Africa Hydrometallurgy Recycling Market, By Battery Chemistry, 2020-2028 (USD Mllion)

62 Middle East & Africa Hydrometallurgy Recycling Market, By End-user, 2020-2028 (USD Mllion)

63 Saudi Arabia Hydrometallurgy Recycling Market, By Battery Chemistry, 2020-2028 (USD Mllion)

64 Saudi Arabia Hydrometallurgy Recycling Market, By End-user, 2020-2028 (USD Mllion)

65 UAE Hydrometallurgy Recycling Market, By Battery Chemistry, 2020-2028 (USD Mllion)

66 UAE Hydrometallurgy Recycling Market, By End-user, 2020-2028 (USD Mllion)

67 Israel Hydrometallurgy Recycling Market, By Battery Chemistry, 2020-2028 (USD Mllion)

68 Israel Hydrometallurgy Recycling Market, By End-user, 2020-2028 (USD Mllion)

69 South Africa Hydrometallurgy Recycling Market, By Battery Chemistry, 2020-2028 (USD Mllion)

70 South Africa Hydrometallurgy Recycling Market, By End-user, 2020-2028 (USD Mllion)

71 Rest Of Middle East & Africa Hydrometallurgy Recycling Market, By Battery Chemistry, 2020-2028 (USD Mllion)

72 Rest Of Middle East & Africa Hydrometallurgy Recycling Market, By End-user, 2020-2028 (USD Mllion)

73 Central & South America Hydrometallurgy Recycling Market, By Battery Chemistry, 2020-2028 (USD Mllion)

74 Central & South America Hydrometallurgy Recycling Market, By End-user, 2020-2028 (USD Mllion)

75 Brazil Hydrometallurgy Recycling Market, By Battery Chemistry, 2020-2028 (USD Mllion)

76 Brazil Hydrometallurgy Recycling Market, By End-user, 2020-2028 (USD Mllion)

77 Chile Hydrometallurgy Recycling Market, By Battery Chemistry, 2020-2028 (USD Mllion)

78 Chile Hydrometallurgy Recycling Market, By End-user, 2020-2028 (USD Mllion)

79 Argentina Hydrometallurgy Recycling Market, By Battery Chemistry, 2020-2028 (USD Mllion)

80 Argentina Hydrometallurgy Recycling Market, By End-user, 2020-2028 (USD Mllion)

81 Rest Of Central & South America Hydrometallurgy Recycling Market, By Battery Chemistry, 2020-2028 (USD Mllion)

82 Rest Of Central & South America Hydrometallurgy Recycling Market, By End-user, 2020-2028 (USD Mllion)

83 Umicore: Products & Services Offering

84 Glencore International AG: Products & Services Offering

85 Retriev Technologies Inc.: Products & Services Offering

86 International Metals Reclamation Company, LLC (INMETCO): Products & Services Offering

87 American Manganese Inc.: Products & Services Offering

88 LI-CYCLE CORP.: Products & Services Offering

89 Neometals Ltd. : Products & Services Offering

90 Recupyl SAS: Products & Services Offering

91 Tes-Amm Singapore Pte. Ltd., Inc: Products & Services Offering

92 Auroboros: Products & Services Offering

93 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Hydrometallurgy Recycling Market Overview

2 Global Hydrometallurgy Recycling Market Value From 2020-2028 (USD Mllion)

3 Global Hydrometallurgy Recycling Market Share, By Battery Chemistry (2022)

4 Global Hydrometallurgy Recycling Market Share, By End-user (2022)

5 Global Hydrometallurgy Recycling Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Hydrometallurgy Recycling Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Hydrometallurgy Recycling Market

10 Impact Of Challenges On The Global Hydrometallurgy Recycling Market

11 Porter’s Five Forces Analysis

12 Global Hydrometallurgy Recycling Market: By Battery Chemistry Scope Key Takeaways

13 Global Hydrometallurgy Recycling Market, By Battery Chemistry Segment: Revenue Growth Analysis

14 Lithium-nickel Manganese Cobalt Market, By Region, 2020-2028 (USD Mllion)

15 Lithium-iron Phosphate Market, By Region, 2020-2028 (USD Mllion)

16 Lithium-manganese Oxide Market, By Region, 2020-2028 (USD Mllion)

17 Lithium-titanate Oxide Market, By Region, 2020-2028 (USD Mllion)

18 Lithium-nickel Cobalt Aluminum Oxide Market, By Region, 2020-2028 (USD Mllion)

19 Global Hydrometallurgy Recycling Market: By End-user Scope Key Takeaways

20 Global Hydrometallurgy Recycling Market, By End-user Segment: Revenue Growth Analysis

21 Automotive Market, By Region, 2020-2028 (USD Mllion)

22 Industrial Market, By Region, 2020-2028 (USD Mllion)

23 Power Market, By Region, 2020-2028 (USD Mllion)

24 Marine Market, By Region, 2020-2028 (USD Mllion)

25 Regional Segment: Revenue Growth Analysis

26 Global Hydrometallurgy Recycling Market: Regional Analysis

27 North America Hydrometallurgy Recycling Market Overview

28 North America Hydrometallurgy Recycling Market, By Battery Chemistry

29 North America Hydrometallurgy Recycling Market, By End-user

30 North America Hydrometallurgy Recycling Market, By Country

31 U.S. Hydrometallurgy Recycling Market, By Battery Chemistry

32 U.S. Hydrometallurgy Recycling Market, By End-user

33 Canada Hydrometallurgy Recycling Market, By Battery Chemistry

34 Canada Hydrometallurgy Recycling Market, By End-user

35 Mexico Hydrometallurgy Recycling Market, By Battery Chemistry

36 Mexico Hydrometallurgy Recycling Market, By End-user

37 Four Quadrant Positioning Matrix

38 Company Market Share Analysis

39 Umicore: Company Snapshot

40 Umicore: SWOT Analysis

41 Umicore: Geographic Presence

42 Glencore International AG: Company Snapshot

43 Glencore International AG: SWOT Analysis

44 Glencore International AG: Geographic Presence

45 Retriev Technologies Inc.: Company Snapshot

46 Retriev Technologies Inc.: SWOT Analysis

47 Retriev Technologies Inc.: Geographic Presence

48 International Metals Reclamation Company, LLC (INMETCO): Company Snapshot

49 International Metals Reclamation Company, LLC (INMETCO): Swot Analysis

50 International Metals Reclamation Company, LLC (INMETCO): Geographic Presence

51 American Manganese Inc.: Company Snapshot

52 American Manganese Inc.: SWOT Analysis

53 American Manganese Inc.: Geographic Presence

54 LI-CYCLE CORP.: Company Snapshot

55 LI-CYCLE CORP.: SWOT Analysis

56 LI-CYCLE CORP.: Geographic Presence

57 Neometals Ltd. : Company Snapshot

58 Neometals Ltd. : SWOT Analysis

59 Neometals Ltd. : Geographic Presence

60 Recupyl SAS: Company Snapshot

61 Recupyl SAS: SWOT Analysis

62 Recupyl SAS: Geographic Presence

63 Tes-Amm Singapore Pte. Ltd., Inc.: Company Snapshot

64 Tes-Amm Singapore Pte. Ltd., Inc.: SWOT Analysis

65 Tes-Amm Singapore Pte. Ltd., Inc.: Geographic Presence

66 Auroboros: Company Snapshot

67 Auroboros: SWOT Analysis

68 Auroboros: Geographic Presence

69 Other Companies: Company Snapshot

70 Other Companies: SWOT Analysis

71 Other Companies: Geographic Presence

The Global Hydrometallurgy Recycling Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Hydrometallurgy Recycling Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS